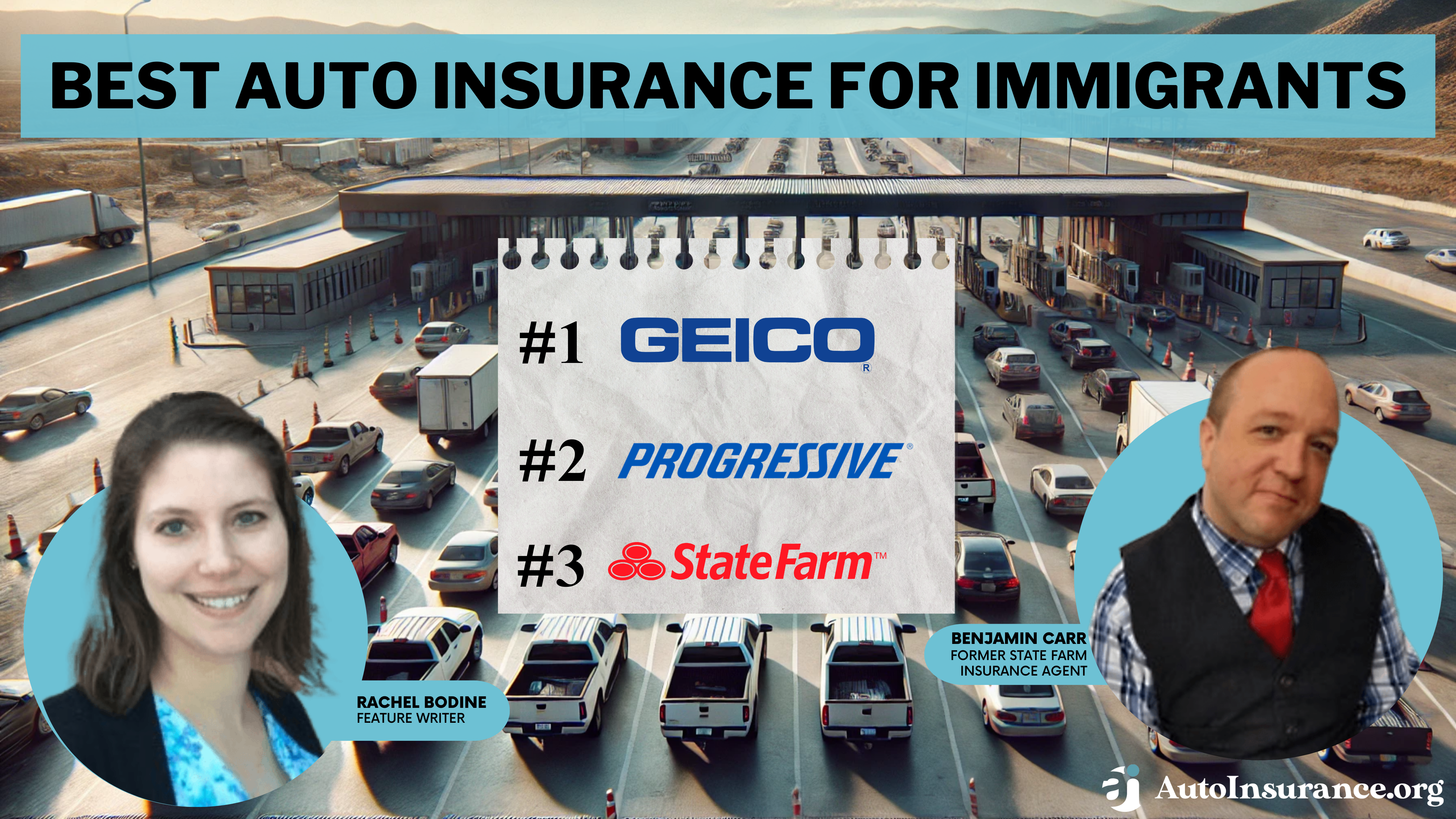

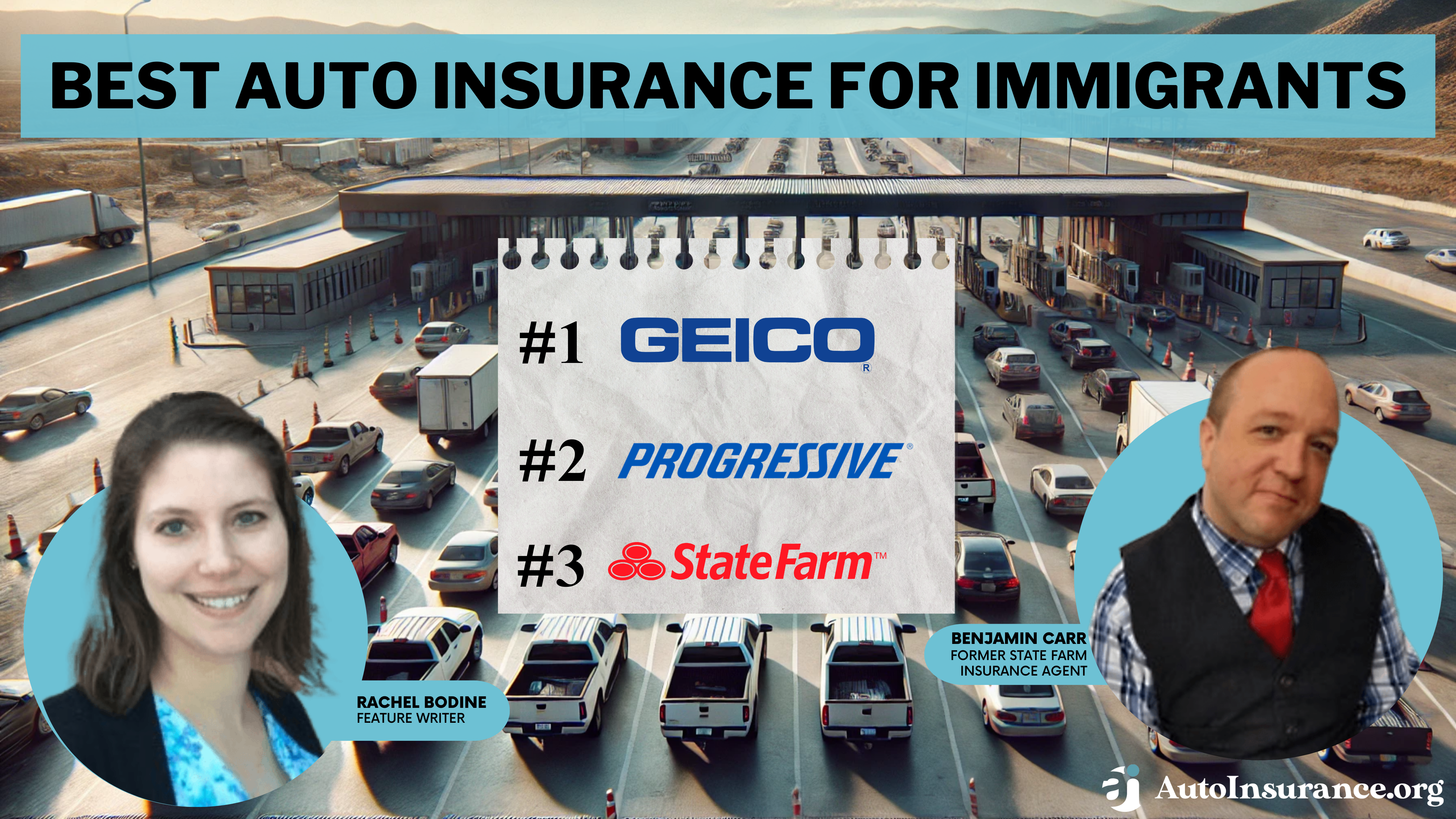

Best Auto Insurance for Immigrants in 2025 (Our Top 10 Picks)

The winners for the best auto insurance for immigrants are Geico, Progressive, and State Farm. Immigrant auto insurance can be found for an affordable minimum coverage rate of $43 per month with Geico. Geico also takes the lead as the best auto insurance for immigrants for multilingual customer service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Immigrants

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Immigrants

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Immigrants

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsGeico, Progressive, and State Farm top the list for best auto insurance for immigrants. Geico stands out with a budget-friendly $30 minimum rate and multilingual customer service.

Most immigrants need a car, but many states make getting a driver’s license difficult without proper documentation. It can be challenging to get auto insurance quotes without a driver’s license, leaving millions of immigrants without vital coverage.

Our Top 10 Company Picks: Best Auto Insurance for Immigrants

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Cheap Rates | Geico | |

| #2 | 30% | A+ | Qualifying Coverage | Progressive | |

| #3 | 30% | B | Many Discounts | State Farm | |

| #4 | 30% | A+ | Customer Service | Allstate | |

| #5 | 30% | A | Family Plans | Farmers | |

| #6 | 40% | A+ | Multi-Policy Discounts | Nationwide |

| #7 | 30% | A | 24/7 Support | Liberty Mutual |

| #8 | 30% | A++ | Bundling Policies | Travelers | |

| #9 | 30% | A+ | Exclusive Benefits | The Hartford |

| #10 | 30% | A | Roadside Assistance | AAA |

Read below to learn how to get auto insurance as an undocumented immigrant, then enter your ZIP into our free rate comparison tool above to get quotes to find out who really has the lowest auto insurance rates.

- Immigrants with a valid driver’s license can easily secure auto insurance

- Undocumented immigrants in license-restricted states face insurance hurdles

- Immigrant auto insurance may cost more due to driving record

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Competitive Rates: Geico is often praised for offering affordable premiums.

- Easy-to-Use Online Tools: Their website and mobile app make managing policies convenient.

- Multilingual Customer Service: They offer support in various languages, catering to immigrants.

Cons

- Limited Agent Interaction: Some customers may prefer more personalized assistance.

- Fewer Discounts: Geico may offer fewer discounts compared to some competitors. You can learn more about Geico’s discounts in our Geico auto insurance review.

#2 – Progressive: Best for Customizable Policies

Pros

- Wide Range of Coverage Options: Progressive offers customizable policies to meet diverse needs. You can learn more in our Progressive auto insurance review.

- Name Your Price Tool: This feature allows customers to find a policy that fits their budget.

- Multilingual Support: They provide assistance in multiple languages.

Cons

- Higher Rates for Some Drivers: Rates may be higher for drivers with certain risk factors.

- Limited Agent Availability: Face-to-face interactions may be less common compared to some competitors.

#3 – State Farm: Best for Extensive Agent Network

Pros

- Extensive Agent Network: State Farm has a large network of local agents offering personalized assistance.

- Diverse Insurance Products: They offer various insurance products besides auto insurance.

- Strong Financial Stability: State Farm is known for its financial strength and reliability. You can learn more in our State Farm auto insurance review.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

- Limited Discounts: State Farm may offer fewer discounts than some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options to suit different needs. You can learn more about Allstate’s coverage options in our Allstate auto insurance review.

- Strong Financial Stability: Allstate is a financially stable company with a solid reputation.

- Multilingual Support: They provide customer service in multiple languages.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some competitors.

- Limited Discounts: Allstate may offer fewer discounts compared to some other insurers.

#5 – Farmers: Best for Personalized Assistance

Pros

- Customizable Policies: Farmers Insurance offers customizable policies to meet individual needs. You can read more in our Farmers auto insurance review.

- Strong Agent Support: They have a network of local agents providing personalized assistance.

- Multilingual Support: Farmers Insurance offers customer service in multiple languages.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

- Limited Online Tools: Online self-service options may be less robust compared to some competitors.

#6 – Nationwide: Best for Strong Financial Stability

Pros

- Variety of Coverage Options: Nationwide offers a wide range of coverage options to meet different needs. You can read more in our Nationwide auto insurance review.

- Strong Financial Stability: Nationwide is a well-established company with a solid financial reputation.

- Multilingual Support: They provide customer service in multiple languages.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

- Limited Discounts: Nationwide may offer fewer discounts compared to some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Multilingual Support

Pros

- Comprehensive Coverage Options: Liberty Mutual offers various coverage options to suit different needs.

- Multilingual Support: They provide customer service in multiple languages.

- Online Tools: Liberty Mutual offers convenient online tools for managing policies and claims.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

- Limited Discounts: Liberty Mutual may offer fewer discounts compared to some competitors. Read more in our Liberty Mutual auto insurance review.

#8 – Travelers: Best for Flexibility

Pros

- Customizable Policies: Travelers offers customizable policies to meet individual needs.

- Strong Financial Stability: Travelers is a financially stable company with a solid reputation.

- Multilingual Support: They provide customer service in multiple languages.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers. Learn more in our Travelers auto insurance review.

- Limited Discounts: Travelers may offer fewer discounts compared to some competitors.

#9 – The Hartford: Best for Specialized Insurance Products

Pros

- Specialized Insurance Products: The Hartford offers specialized insurance products, including options for AARP members. You can learn more in our The Hartford auto insurance review.

- Strong Financial Stability: The Hartford is a financially stable company with a solid reputation.

- Multilingual Support: They provide customer service in multiple languages.

Cons

- Limited Availability: Coverage may not be available in all areas.

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for Roadside Assistance Services

Pros

- Roadside Assistance Services: AAA is renowned for its roadside assistance services, providing peace of mind to drivers in emergencies.

- Competitive Rates for Members: AAA often offers competitive rates for auto insurance to its members, potentially leading to cost savings. Learn more in our AAA auto insurance review.

- Multilingual Support: AAA typically provides customer service in multiple languages to accommodate diverse member needs.

Cons

- Membership Requirement: Access to AAA’s auto insurance policies requires membership in the American Automobile Association, which comes with associated fees.

- Limited Availability: AAA coverage may not be available in all areas, potentially limiting options for some drivers.

Getting Car Insurance for Immigrants

The only thing you need to get car insurance in most cases is a driver’s license. Unfortunately, getting a license as an immigrant can come with its own challenges.

Documented immigrants will have an easier time getting a license, but it still requires paperwork. Requirements vary by state, but you typically need to provide an ID, a social security number, proof of residency in your state, a passport, and a green card.

You’ll also need to pass a written and driving test before you can get a license (learn more: Can you get auto insurance without a license?).

Undocumented immigrants have a harder time getting a license because they can’t provide the necessary documents. Since there are currently more than 11 million undocumented immigrants in America, some states have passed laws that allow everyone to get a license.

Read More: Best Auto Insurance for Undocumented Immigrants

While your quotes will be unique to your circumstances, you can get an idea of what you’ll pay by looking at the average price of insurance below.

Immigrants Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$65 $122

$87 $228

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$61 $161

$53 $248

Of course, you might pay much more or less than the national average. Also, keep in mind that the cheapest car insurance for immigrants isn’t always the best. For example, Allstate is the most expensive on the list, but it has some of the highest satisfaction rates and an extensive list of add-ons.

Securing Car Insurance for Undocumented Immigrants

When it comes to the car insurance for undocumented immigrants, navigating the process can be daunting. However, it’s crucial to know that there are options available. One common question is, can undocumented immigrants get car insurance?

Despite the challenges, there are insurers who understand the unique needs of this demographic and offer car insurance for non-citizens.

Finding the best car insurance for undocumented immigrants involves thorough research and understanding the requirements. Some insurers may cater in regards to car insurance for new immigrants in the US or even offer car insurance for foreign license holders.

While car insurance for illegal immigrants may seem like a difficult prospect, there are policies designed to provide coverage.

For migrants, refugees, and others seeking car insurance for foreigners, it’s essential to explore all available options. Whether you’re looking for migrant car insurance or car insurance for refugees, understanding your rights and available policies is essential.

Providers who specialize in catering to the needs of immigrants and refugees can offer tailored solutions to ensure you have the coverage necessary for peace of mind on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Obtaining Car Insurance with an International Driver’s License

Navigating car insurance as an immigrant with an international driver’s license poses unique challenges. However, it’s crucial to understand that it’s possible to obtain coverage. Many wonder, can immigrants get car insurance in the US with their international license?

Despite complexities, solutions exist, including cheap car insurance for international drivers’ licenses.

As a newcomer, you may be eager to buy a car in the US as an immigrant. Understanding car insurance for newcomers becomes essential. Additionally, immigrants often seek expat auto insurance to cater to their unique circumstances. (Read More: What is auto insurance?)

Exploring US car insurance for foreigners is vital, regardless of your location within the country. Whether you’re in California or elsewhere, many insurers accommodate those with foreign licenses, ensuring access to necessary coverage.

While some states ban non-citizens from getting a license, others have taken another approach to the number of undocumented immigrants within their borders.

When undocumented immigrants can’t attain things like a driver’s license, they pose an unintentional risk to themselves and those around them. You need insurance to drive, and most companies require a license to get coverage, which leaves undocumented immigrants without coverage.

Uninsured motorists usually can’t pay for the damage they cause to other vehicles or property, which leaves people with extra insurance stuck with the bill. According to the Insurance Information Institute, about one in eight drivers is uninsured, and the number is growing. Collisions with uninsured motorists increase the overall insurance price, which is an unfair burden to people with proper coverage.

Learn More: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage

Understanding the toll uninsured motorists have on other drivers, the following states allow undocumented immigrants to obtain a license:

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Illinois

- Maryland

- Nevada

- New Jersey

- New Mexico

- New York

- Oregon

- Utah

- Vermont

- Virginia

- Washington

The requirements to get a license as an undocumented immigrant varies by state, so check with your local DMV’s site to see what you need. You can also check when the license will expire and how to renew it.

Unfortunately, there’s not much you can do if you live in a state that doesn’t let undocumented immigrants get a license.

There are avenues to get coverage without a license, but they don’t cover as much as standard insurance. For example, some companies might sell you a policy if you list someone else as the primary driver.

Regardless, driving without auto insurance or a license is a crime and should be avoided. Even if you can get insurance on your vehicle, driving without a license is not worth the risk. (Read More: What happens if you drive without a license and get stopped by the police?)

The 10 Best States for Obtaining Immigrant Auto Insurance

The states below have immigrant-friendly laws when it comes to driver licensing. We looked at whether the state will allow immigrants to get a driver’s license regardless of their immigration status, as well as whether they require drivers to have an International Driving Permit (IDP).

While we focused on the states that allow immigrants to drive with fewer restrictions, within that group of states we also looked at car insurance rates.

All of the states in the top 10 allow drivers to get a license regardless of their immigration status.Daniel Walker Licensed Auto Insurance Agent

From there, we looked at the requirements for an IDP and rates. The number-one state is therefore the one with the cheapest rates among those states that have the least restrictive laws.

#10 – New Jersey

Although auto insurance in New Jersey isn’t particularly cheap, the state’s laws do make it easier to get on the road legally. Immigrants here can apply for and get a New Jersey driver’s license regardless of their immigration status. (Read More: New Jersey Auto Insurance)

New Jersey is one of 11 states that have sanctuary laws for undocumented immigrants state-wide.

You won’t be required to get an IDP in New Jersey, either unless your driver’s license is not in English. Of course, that applies to a large portion of the world, but if you’re planning to stay in New Jersey, getting a state driver’s license is the better approach anyway.

#9 – Colorado

Colorado law will require foreign drivers to obtain an International Driving Permit if they’re in the state for more than 90 days. If you’re temporarily in the state for more than 90 days (as a student, for example), you’ll need to get that IDP.

If you’re making Colorado your new residence, however, you will want to apply for a driver’s license here. Fortunately, you can do that no matter what your current immigration status. Like New Jersey, Colorado is also a sanctuary state.

#8 – California

Navigating California car insurance for foreigners presents unique challenges but understanding available options is essential for newcomers seeking coverage. According to the Public Policy Institute of California (PPIC), the state is home to about a quarter of the foreign-born population of the entire U.S.

Of those, it’s estimated that 22% are undocumented. Can illegal immigrants get car insurance in California? California does allow immigrants to apply for a special AB-60 driver’s license regardless of their status. With that license, you can qualify for a car insurance policy from a California company. (Read More: California Auto Insurance)

For those new to the state, there’s a 90-day grace period on driving without an IDP. If you’re staying longer but don’t plan to make California your home, the IDP will help you get insured. California joins the previous two states on our list with state-wide sanctuary laws.

#7 – Nevada

Whether you’re on a visa, in the process of a green card application, or any other status (even no status at all) in Nevada, you aren’t required to have an IDP. And you can also apply for a Nevada driver’s license no matter what your status.

Although not a sanctuary state, two Nevada counties have sanctuary laws: Clark and Washoe.

If you plan to live in Nevada, the latter is your best option. Many Nevada auto insurance companies may not be willing to insure a driver with a foreign license. Although there are some non-standard companies that might insure you, the rates will be much higher. (Read More: Nevada Auto Insurance)

#6 – Maryland

Maryland law allows every resident to apply for and obtain a driver’s license regardless of their immigration status. Like most states, you are required to head to the DMV to get a Maryland license shortly after you move to the state. Three Maryland counties as well as the city of Baltimore have sanctuary laws.

If you’re in Maryland temporarily, you don’t need an International Driver’s Permit. Bear in mind that auto insurance in Maryland is required by law, and not all companies are willing to insure a driver with a foreign license. (Read More: Maryland Auto Insurance)

#5 – New York

Once the landing place for waves of immigrants coming across the Atlantic, New York is still a welcoming place for new arrivals. The state allows all residents to apply for a driver’s license no matter what their immigration status might be. There’s also no requirement for an IDP here.

Can illegal immigrants get car insurance in New York? Yes, as long as you’re licensed. Bear in mind that newly licensed drivers tend to pay more for their insurance.

As we head into the second half of this list, the average cost of auto insurance goes down. New York auto insurance rates aren’t the cheapest compared to the entire country, but for states with immigrant-friendly licensing laws, they’re on the lower end. The entire state also has sanctuary laws for undocumented immigrants.

#4 – Utah

Like the other states on the back end of this list, Utah doesn’t require you to prove your immigration status in order to get a driver’s license. The state also has no requirement for an IDL.

Utah is one of the few states on our list where there are no sanctuary laws in any part of the state. However, the state laws regarding driver licensing and the low cost of Utah auto insurance still make it a good bet for getting licensed and insured as an immigrant.

#3 – New Mexico

With an average monthly insurance rate below the $300 mark, New Mexico lands in the top three states for immigrant auto insurance. Immigrants can get a driver’s license regardless of their status in the U.S., and an IDP is not required.

New Mexico is a sanctuary state, which is common to the rest of the top three states on our list as well. While this border state has a lot of controversy regarding immigration, the laws for drivers are immigrant-friendly.

Being a border state also means more access to non-standard auto insurance companies that offer bilingual services and can help drivers with a foreign license. That may include offering auto insurance for undocumented immigrants. (Read More: What do non-standard auto insurance companies offer?)

#2 – Oregon

Oregon is number two on our list as a full sanctuary state that also allows immigrants to get a driver’s license even if they are undocumented. The state has no requirement for an IDP either but may not have as many options for insurance on a foreign license as do states near the Mexican border.

What Oregon does have, however, is affordable auto insurance. That lands it a little higher on our list as a place where it’s both easy and budget-friendly for immigrants to live and drive.

#1 – Illinois

Landing at number one on the list of the best states for immigrants to get licensed and insured in is Illinois. Your immigration status doesn’t affect your ability to get an Illinois driver’s license, nor is an IDP required in the state for those with a foreign license.

Illinois is a sanctuary state, and the city of Chicago also has sanctuary laws of its own.

Illinois just beats out Oregon for the top spot on our list thanks to slightly lower average insurance rates. Of course, rates will vary based on a number of factors like your age, gender, and even ZIP code, so which state winds up having cheaper rates for you really depends on those personal factors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

All States Ranked for Immigrant Licensing and Auto Insurance

Below, you’ll find the licensing laws as well as the average cost of car insurance for each state. Take a look at the map to see the data for each state.

It’s notable that most of the friendliest states for immigrant drivers are found along the west and northeast coasts of the country. Also notable is that among states that border Mexico, only two allow undocumented immigrants to obtain a driver’s license (learn more: Best Auto Insurance When Traveling to Mexico).

Rates are averages, so it’s important to remember that there are a lot of variables involved. The best way to shop for auto insurance as an immigrant is to carefully compare your options.

As long as you have a license, you’ll go through the same process as any other driver. There are a lot of insurance products available, and picking the right policy can feel overwhelming sometimes.

However, you don’t need to stress about buying insurance. Follow the steps below to get the perfect policy for your needs.

Determine Your Coverage Needs

The first step in purchasing a policy is to figure out what you need. For example, you probably need full coverage if you have a car loan or lease. Drivers with older, less valuable cars can get away with less insurance if they’re trying to save money.

To begin, consider the primary types of auto insurance policies:

- Liability Auto Insurance: If you cause an accident, liability coverage will help pay for damage you cause to people and property. Most states require liability coverage. (Read More: Liability Auto Insurance)

- Collision Auto Insurance: After an accident, collision insurance helps pay for repairs to your vehicle. You’ll be eligible to make a claim no matter who is at fault for the collision. (Read More: Collision Auto Insurance)

- Comprehensive Auto Insurance: For damage not caused by an accident, there’s comprehensive coverage. Comprehensive usually covers damage from weather, vandalism, animal contact, theft, and more. (Read More: Comprehensive Auto Insurance Explained)

- Uninsured/Underinsured Motorist Coverage: As stated above, uninsured motorists are a serious problem on the streets. This coverage helps pay for damage caused by drivers with inadequate insurance. (Read More: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage)

- Personal Injury Protection (PIP): If you or your passengers are injured in an accident, PIP will help pay for hospital bills, physical therapy, and even lost wages. (Read More: Personal Injury Protection (PIP) Auto Insurance)

You will need a minimum amount of liability coverage in most states, while uninsured/underinsured motorist coverage is required in about half. If you have a tight budget, the minimum coverage is your cheapest option.

Full coverage auto insurance, which usually includes everything except PIP, is ideal for people who can’t afford to replace their car, don’t own their vehicle outright, or have a valuable car. (Read More: What is full coverage auto insurance?)

In addition to the basic types of insurance, there are several add-ons that increase the value of your policy. Companies offer unique lists, but here are some of the most common you’ll find:

- Roadside assistance coverage

- Guaranteed auto protection (GAP) insurance

- Auto insurance for custom cars

- New car replacement insurance (Read More: What is new car replacement insurance?)

- Windshield repair

- Rental car reimbursement coverage

As you can see, there are plenty of opportunities to increase your policy’s value (and price). Before you sign up for any, make sure you really need the coverage. You can also speak with an insurance agent to get an idea of how much it will cost.

When it comes to insurance, companies treat immigrants the same as anyone else. There are several factors insurance companies use to craft a rate specific to you. Each company uses a different formula, but the most common factors are:

- Age and Gender: The higher the chances are of you filing a claim, the more your insurance will cost. Young people, seniors, and men are statistically more likely to file a claim.

- Location: Insurance companies keep careful track of claims by ZIP code. You can see higher rates one ZIP code over because residents file more claims.

- Driving Record: One of the best indications of your risk to a company is your driving record. Immigrants usually don’t have a driving record, so they typically pay a higher price.

- Vehicle: Like age and gender, some cars are more likely to file claims than others. Another aspect companies look at is how much your car costs to repair.

- Credit Score: An insurance company will consider you a higher risk if you have a low credit score. However, some states have outlawed the use of credit scores for insurance quotes.

This is why it’s so important to compare quotes with as many companies as possible. You can see vastly different prices for the same coverage level by shopping around. Learn how to find auto insurance quotes fast.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find the Best Car Insurance for Immigrants in the U.S.

While getting car insurance for immigrants takes more work, it’s well worth the effort. Insurance can save you thousands of dollars if you’re ever involved in an accident. It also makes sure that you can legally drive on American roads.

Exploring car insurance in the USA for foreigners is crucial, guaranteeing that newcomers attain the appropriate coverage to navigate their journeys with confidence.

Read More: Best Auto Insurance for International Drivers

Since most companies offer immigrant auto insurance, you’ll have a wide selection to compare when you’re ready for a quote. As long as you figure out what coverage you need first, you’ll be ready to find the perfect policy for you.

Enter your ZIP to get auto insurance quotes for the best auto insurance for immigrants coverage.

Frequently Asked Questions

Can an immigrant get car insurance?

Yes, immigrants can typically obtain auto insurance. Insurance companies consider various factors such as driving history, identification documents, and residency status when determining eligibility. Immigrants, including those with work visas, green cards, or student visas, can often secure auto insurance by providing the necessary documentation required by insurance providers.

What documents are needed to get auto insurance as an immigrant?

The documentation requirements can vary depending on the insurance provider and the immigrant’s status. Generally, common documents that may be requested include a valid driver’s license, proof of residency or legal presence in the country, and identification documents such as a passport or visa. It’s important to contact insurance providers directly to understand their specific documentation requirements.

Are there any specific considerations for auto insurance for immigrants?

Immigrants should be aware of any state-specific requirements or laws related to auto insurance. Some states may have different regulations or additional documentation requirements for immigrants. It’s important to understand and comply with the specific rules and regulations of the state where you reside to ensure proper coverage (learn more: Minimum Auto Insurance Requirements by State).

Can immigrants with international driver’s licenses obtain auto insurance?

Immigrants with valid international driver’s licenses may be able to obtain auto insurance, depending on the insurance provider and state regulations. However, some states may require immigrants to obtain a driver’s license from that particular state within a certain period to continue driving legally. It’s advisable to check the specific requirements of the state where you reside.

Will an immigrant’s immigration status be reported to immigration authorities when getting auto insurance?

Insurance companies typically do not report an individual’s immigration status to immigration authorities when providing auto insurance. Their primary concern is assessing the driving record, vehicle information, and other relevant factors to determine premiums and coverage. Immigration status is generally not a factor considered in the insurance underwriting process.

Can immigrants be denied auto insurance coverage based on their immigration status?

Insurance companies cannot typically deny auto insurance coverage based solely on an individual’s immigration status. However, insurance providers may have their own underwriting criteria and eligibility requirements. Immigrants should research and contact insurance companies that are known to provide coverage to individuals with their particular immigration status to ensure they can obtain the necessary coverage (read more: Can you be denied auto insurance?).

What are the best states for immigrant auto insurance?

While insurance rates can vary based on various factors, including location, some states tend to be more immigrant-friendly when it comes to auto insurance. Here are a few states known for offering competitive rates and coverage options for immigrants:

- California: California has a large immigrant population, and the state has implemented laws and regulations to protect the rights of immigrants. Many insurance companies in California offer affordable auto insurance options tailored to meet the needs of immigrants.

- New York: New York is another state with a significant immigrant population. The state has various insurance options available, and its regulations aim to provide fair and accessible coverage for all residents, including immigrants.

- Illinois: Illinois has a diverse population, and insurance companies in the state often provide policies suitable for immigrants. Additionally, Illinois law prohibits discrimination based on national origin, which can benefit immigrants seeking auto insurance.

- New Jersey: New Jersey is known for its diverse communities, and insurance providers in the state offer options specifically designed for immigrants. The state also has laws in place to prevent discrimination against immigrants when it comes to auto insurance.

What other factors should immigrants consider when purchasing auto insurance?

When purchasing auto insurance as an immigrant, consider the following factors:

- Coverage options: Look for policies that offer adequate coverage based on your needs and the requirements of your state. Consider liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Premium rates: Compare premium rates from different insurance companies to find the most affordable option. Factors such as your age, driving history, type of vehicle, and location can influence the premiums you’ll pay.

- Deductibles: Evaluate the deductible amounts offered by insurance providers. A higher deductible can lower your premium but may require you to pay more out of pocket in case of a claim.

- Customer service: Read reviews and consider the reputation of the insurance companies you’re considering. Good customer service is essential for prompt claims handling and overall satisfaction.

- Additional benefits: Some insurance companies may offer additional benefits, such as roadside assistance or accident forgiveness. Consider these extras when comparing policies.

Can immigrants get the same coverage options and discounts as other drivers?

Immigrants can generally access the same coverage options and discounts as other drivers, provided they meet the eligibility criteria set by the insurance provider. Factors such as driving history, vehicle safety features, and bundling multiple policies may still apply to immigrants. It’s advisable to inquire about available coverage options and discounts directly with insurance providers. Learn more in our article: Cheap Full Coverage Auto Insurance.

Can immigrants be listed as drivers on someone else’s auto insurance policy?

Immigrants can often be listed as drivers on someone else’s auto insurance policy, such as a family member or friend. Insurance providers typically allow policyholders to add additional drivers to their policies, including immigrants. However, it’s important to check with the insurance company directly to understand their policies regarding adding drivers with different immigration statuses and any specific documentation requirements that may apply.

Are there any resources or organizations that can assist immigrants with auto insurance?

Yes, several resources and organizations can assist immigrants with auto insurance. Consider the following options:

- Community organizations: Local community organizations, immigrant support centers, or ethnic associations may provide guidance and information on auto insurance options specifically tailored to immigrants.

- State insurance departments: State insurance departments often offer resources and guidance on insurance regulations and consumer rights. They can provide information on insurance companies operating in your state and help address any concerns or complaints.

- Insurance brokers/agents: Insurance brokers or agents who specialize in serving immigrant communities can offer valuable assistance in navigating the insurance landscape and finding suitable coverage options.

How can you get car insurance for immigrants?

You can get car insurance for immigrants by researching insurance providers that offer coverage to individuals without a driver’s license and providing necessary documentation such as a passport. Read more in our article: How to Get Auto Insurance Without a License.

What states allow undocumented immigrants to get a license?

Undocumented immigrants can obtain driver’s licenses in states such as California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, New Jersey, New Mexico, New York, Nevada, Oregon, Utah, Vermont, Virginia, and Washington, along with the District of Columbia.

Can you get car insurance for immigrants if your state doesn’t allow you to get a license?

Yes, it’s possible to get car insurance for immigrants in states where driver’s licenses aren’t available to undocumented immigrants, although requirements and available options may vary depending on the state and the insurance provider.

How do you get the right car insurance for immigrants?

To get the right car insurance for immigrants, individuals should research insurance providers that offer coverage to those without a driver’s license, provide necessary documentation such as a passport, and compare policies to find the best coverage for their needs and circumstances (read more: 10 Cheapest Auto Insurance Companies).

How much does car insurance for immigrants cost?

Geico stands out with a competitive monthly rate of $82, making it an affordable option.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.