Cheap Auto Insurance for Rebuilt or Salvage Title Vehicles in 2025 (10 Affordable Companies)

Geico, State Farm, and Travelers are our top picks for cheap auto insurance for rebuilt or salvage title vehicles. With rates starting at just $32/month, finding affordable salvage title insurance is usually easy with these companies. However, it can be difficult to purchase full coverage for a rebuilt title car.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Feb 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Rebuilt or Salvage Title

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Rebuilt or Salvage Title

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Rebuilt or Salvage Title

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsOur top picks for cheap auto insurance for rebuilt or salvage title vehicles are Geico, State Farm, and Travelers.

Usually, drivers want to choose the cheapest auto insurance companies for rebuilt title insurance because it doesn’t make sense to purchase a lot of coverage for their vehicles. Geico is the cheapest company on average for rebuilt title cars.

Our Top 10 Company Picks: Cheap Auto Insurance for Rebuilt or Salvage Title Vehicles

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A++ | Good Drivers | Geico | |

| #2 | $39 | B | Local Agents | State Farm | |

| #3 | $40 | A++ | Discount Options | Travelers | |

| #4 | $50 | A+ | Organization Discount | The Hartford |

| #5 | $50 | A+ | Loyalty Rewards | Progressive | |

| #6 | $51 | A | Claims Service | American Family | |

| #7 | $53 | A+ | Multi-Policy Savings | Nationwide |

| #8 | $64 | A | Customizable Policies | Farmers | |

| #9 | $67 | A+ | Safe-Driving Discounts | Allstate | |

| #10 | $77 | A | Comprehensive Policies | Liberty Mutual |

Read on to learn more about salvage title insurance costs and how much coverage would be best for your vehicle. Then, enter your ZIP code into our free comparison tool to find the best coverage.

- A rebuilt title means a vehicle has undergone significant damage and been repaired

- Most insurance companies won’t sell full coverage to rebuilt vehicles

- Geico and State Farm have the most affordable coverage for rebuilt cars

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Competitive Rates: If you’re looking for cheap car insurance, Geico generally has lower premiums for high-risk vehicles.

- Customizable Policies: Geico offers flexibility to adjust coverage levels according to your needs. Learn more about Geico’s coverage options in our Geico auto insurance review.

- Online Tools: Not only does Geico offer cheap car insurance for salvage cars, but you’ll also get access to its user-friendly online platform for quotes and policy management.

Cons

- Limited Coverage Options: Some Geico coverage types might not be available for rebuilt or salvage vehicles.

- Claims Process Issues: Many Geico customer reviews report delays and issues with claims handling for vehicles with rebuilt title insurance.

#2 – State Farm: Best Network of Local Agents

Pros

- Agent Support: State Farm maintains a massive network of local agents so you can access personalized guidance.

- Comprehensive Coverage: State Farm has a wide range of coverage options available when you’re insuring a rebuilt title car.

- Excellent Reputation: With a reputation for strong customer satisfaction and reliability, State Farm is always a good bet for salvage title insurance.

Cons

- Digital Experience: State Farm’s online and mobile tools are not as advanced as some competitors.

- Claims Satisfaction: Many of State Farm’s reviews report inconsistent customer service experiences. Read more detailed reviews in our State Farm auto insurance review.

#3 – Travelers: Best for Specialized Rebuilt Title Coverage

Pros

- Specialized Coverage: Travelers offers tailored policies for high-risk vehicles so you can get the best coverage possible.

- Generous Discounts: With 15 available discounts like savings for safe driving and bundling policies, Travelers offers excellent ways to save.

- Financial Stability: Travelers has strong financial ratings from A.M. Best, ensuring that your claims will always be paid. See more ratings in Travelers auto insurance review.

Cons

- Price Variability: Travelers can be more expensive in some regions. If you’re looking for affordable rebuilt insurance costs, make sure to compare rates before you sign up.

- Mobile App: Although Travelers has a mobile app, it could improve in terms of usability and features.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – The Hartford: Best for Older Drivers

Pros

- AARP Partnership: The Hartford partners exclusively with AARP to offer members discounts and benefits. Explore all the benefits AARP members enjoy in our review of The Hartford auto insurance.

- Solid Coverage Options: Whether you’re insuring a salvage car or a luxury vehicle, The Hartford has comprehensive options for every need.

- Customer Service: Generally speaking, The Hartford has high ratings for customer support and claims handling.

Cons

- Eligibility Requirements: The Hartford caters exclusively to AARP members, which might limit availability for others.

- Higher Premiums: Although car insurance quotes vary from driver to driver, The Hartford is often higher than some competitors.

#5 – Progressive: Best Rebuilt Auto Insurance on a Budget

Pros

- Competitive Rates: No matter where you live, Progressive typically offers a lower cost of salvage title insurance for high-risk vehicles.

- Digital Tools: Progressive offers several innovative digital tools, including the Name Your Price tool, which allows for budget-friendly policy selection. Explore all of Progressive’s online options in our Progressive auto insurance review.

- Solid Discount Options: There are numerous Progressive auto insurance discounts available, including multi-car and safe driver discounts.

Cons:

- Customer Loyalty: Progressive struggles with low customer loyalty ratings despite being one of the most affordable insurance companies that cover salvage titles.

- Slow Claims Process: Some customers report delays and issues with Progressive’s claims process.

#6 – American Family: Best for Costco Members

Pros

- Customizable Policies: American Family makes it easy to customize your policy with flexible coverage options for high-risk vehicles.

- Impressive Discounts: With 18 discount options, American Family makes it easy to save on car insurance for salvage titles. Popular options include good driver and multi-policy discounts.

- Costco Policies: American Family writes auto insurance policies for Costco, helping warehouse members save.

Cons

- Limited Availability: American Family sells insurance in just 19 states. See if your state is one of them in our American Family auto insurance review.

- Higher Prices: American Family can be more expensive than other insurance companies that will insure a salvage title vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for UBI Savings

Pros

- Helpful Discounts: Lower your overall Nationwide rates when you insure a rebuilt title with the company’s multiple discounts.

- Coverage Options: Nationwide offers an extensive range of coverage and add-ons. Explore your coverage opportunities in our Nationwide auto insurance review.

- Usage-Based Insurance: Nationwide offers two usage-based insurance (UBI) programs: SmartRide and SmartMiles. SmartMiles is a pay-per-mile plan, while SmartRide offers a discount of up to 40% for your safe driving habits.

Cons

- Above Average Rates: While it’s not usually the most expensive, Nationwide can be higher than some competitors.

- Unimpressive Mobile App: You can start a quote for auto insurance for salvage titles on the Nationwide app, but the platform leaves much to be desired.

#8 – Farmers: Best List of Auto Insurance Discounts

Pros

- Customizable Coverage: Get the perfect insurance for a salvage title with Farmer’s wide range of policy options and term lengths.

- Impressive Discounts: Farmers has one of the largest lists of discounts on the market, with 23 ways to save. See how many you might qualify for in our Farmers auto insurance review.

- Local Agents: There are plenty of Farmers local agents, so it’s never difficult to find personalized service.

Cons

- Often Expensive: Farmers offers some of the best insurance for rebuilt titles, but it usually costs more than the national average.

- Digital Experience: Farmers’ online tools and mobile app are less advanced than some customers might like.

#9 – Allstate: Best for Low-Mileage Drivers

Pros

- Discount Opportunities: There are 12 Allstate discounts to take advantage of, including discounts for being a safe driver and good student.

- Customizable Policies: Flexible coverage options make finding the best full coverage on a salvage title as easy as possible.

- Milewise: Low-mileage drivers can save by enrolling in Allstate’s pay-per-mile program, Milewise. If you’re not a low-mileage driver, consider Drivewise instead.

Cons

- High Average Rates: No matter what type of car you’re insuring, Allstate is almost always one of the more expensive options for auto insurance for salvage vehicles.

- Claims Process: Allstate has mixed reviews regarding claims handling. Learn more about the claims process in our Allstate auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Customizable coverage: Liberty Mutual offers a variety of unique coverage options that can be hard to find elsewhere. Explore what you can add to your policy in our Liberty Mutual auto insurance review.

- Discounts: Lower the cost of your insurance by qualifying for as many of Liberty Mutual’s 17 auto insurance discount options.

- Customer service: While there are some negative reviews, Liberty Mutual customers are typically impressed by the service.

Cons

- Average Rates: Liberty Mutual isn’t typically the priceiest option for car insurance, but it’s also rarely the cheapest.

- Claims Handling: Many Liberty Mutual customers report feeling unsatisfied with the claims processing process.

Understanding Salvage and Rebuilt Titles

Wondering about the meaning of a salvage title? A salvage title simply means that a vehicle has been damaged badly enough that it’s been declared a total loss. You can’t legally drive or buy insurance for a car with a salvage title.

Rebuilt titles are issued after a salvage car has been repaired and passed a DMV test. You can purchase insurance on a car with a rebuilt title because they’re legally allowed to be driven. However, many insurance companies still hesitate to insure a car with a rebuilt title for the following reasons:

- It’s difficult to determine what damage already existed on the vehicle if you need to file a claim.

- Undiscovered damage can make the car unsafe.

- Cars with rebuilt titles are usually worth about 20% less than the same vehicle with a clean title.

Driving a rebuilt car poses a bigger threat than you face from a car with a clean title, so make sure to check before you start driving.

Whether you are a new or experienced driver, these tips can help you keep your vehicle in road-ready condition. Learn more: https://t.co/l2ve7xigyt pic.twitter.com/oUGl5ryAsV

— Travelers (@Travelers) September 6, 2023

A final downside to buying rebuilt title insurance is that you won’t receive a large payout if you make a claim. Rebuilt cars are rarely worth very much, and your insurance company is likely to total your car.

Salvage Title Auto Insurance Rates

Salvage title car insurance is usually affordable, but that’s because most insurance companies won’t sell you a full coverage auto insurance policy for a rebuilt title. Check below to see how much you might pay for your insurance from our top companies.

Auto Insurance Monthly Rates for Rebuilt or Salvage Title Vehicles by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $67 | $176 |

| American Family | $51 | $136 |

| Farmers | $64 | $167 |

| Geico | $32 | $87 |

| Liberty Mutual | $77 | $200 |

| Nationwide | $53 | $137 |

| Progressive | $50 | $136 |

| State Farm | $39 | $103 |

| The Hartford | $50 | $133 |

| Travelers | $40 | $108 |

Other factors play a role in your insurance, but having a salvage title will have a significant impact on your insurance availability and rates.

Although most salvage title cars are safe, it's virtually impossible to know the full extent of damage a car has taken. Insurance companies are usually unwilling to provide too much coverage to a salvage title car because they don't want to pay for damage that was there before your policy started.Jeff Root Licensed Insurance Agent

If you were to find a company that sells full coverage to rebuilt title cars, you’d likely pay much higher rates than you would for a clean title car. Regardless of how much coverage you need, there are plenty of ways to find even lower rates.

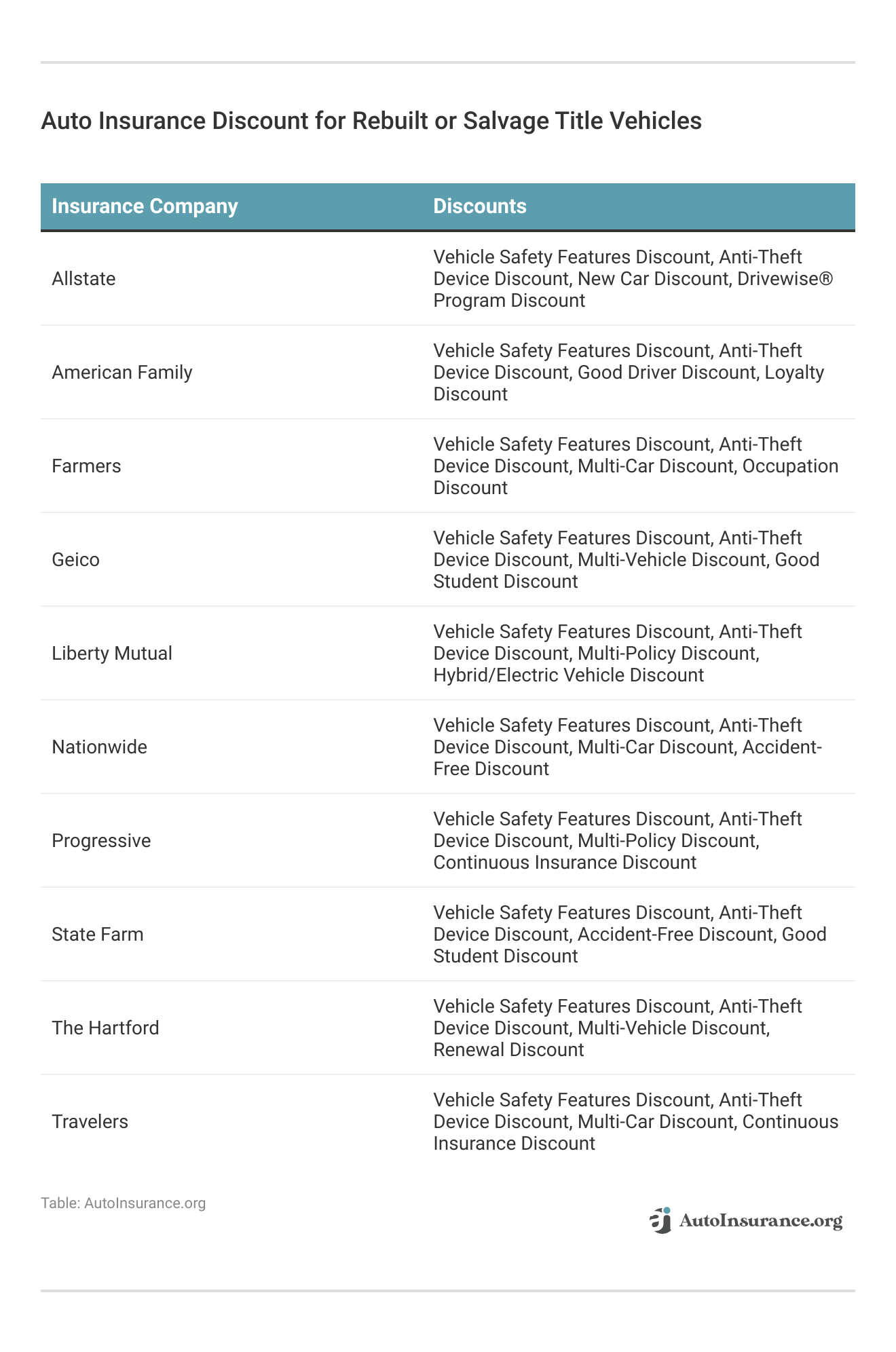

For starters, you should look for as many discounts as you qualify for. Check below to see a selection of discounts offered by our top companies.

You can also save on your insurance by lowering your coverage, raising your deductible, and comparing quotes. Most insurance companies make it easy to get a quote by offering a request form on their website.

You’ll need some basic information to get your quote, like your ZIP code, VIN from your car, and the names of any other drivers you want to add to your policy.

Filling out multiple request forms can be time-consuming. If you’d like to skip the inconvenience of filling out multiple forms, consider using a quote comparison tool.

Why Rebuilt Cars Cost More to Insure

Although insuring a salvage title vehicle isn’t legal in most states, insuring a rebuilt title vehicle can sometimes be more expensive than a vehicle that has never been totaled. It’s also important to remember that obtaining a rebuilt title and insurance for your salvage vehicle first requires ensuring that the vehicle is safe to drive on the road. This process can add additional repair costs and inspection fees.

If you’re interested in insuring a rebuilt title car, learning how to evaluate auto insurance quotes can help you find the lowest coverage possible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find Cheap Auto Insurance for Rebuilt or Salvage Title Vehicles Today

Although you’ll probably be limited in the types of auto insurance you can purchase for a rebuilt car, finding affordable coverage is usually easy. However, you should be cautious about driving a rebuilt title car — having a comprehensive exam done to your car before you drive it is usually recommended.

Now that you know where to buy cheap auto insurance for rebuilt or salvage title vehicles, your next step should be to compare quotes. Enter your ZIP code into our free comparison tool below to see how much you might pay for coverage today.

Frequently Asked Questions

Is it worth it to purchase a salvage title vehicle?

Deciding whether it’s worth buying a salvage title car or truck depends on your circumstances. Because it’s illegal to drive a salvage vehicle, buying one means you’ll need to invest a lot of time, money, and effort into restoring the car to good condition before restoring its title. You should only buy a salvage title vehicle if you have the time and resources to restore its title.

How much are salvage title restoration and inspection fees in California?

Beyond the cost of repairs to restore your totaled vehicle to roadworthiness as the owner of a salvage title vehicle, you will also need to pay additional fees to register and inspect your revived salvage vehicle. Although fees vary, the costs associated with obtaining a revived salvage title and registration include paying a salvage title registration fee, a Salvage/Dismantled Vehicle Inspection fee of $50, a substitute plate fee or a vehicle license fee (if the owner is the same), and a prior history fee. California auto insurance rates are usually affordable, however, so you shouldn’t have to worry about expensive rebuilt insurance costs.

Does insuring a rebuilt title car cost more than a regular new or used vehicle?

Because of concerns about safety and roadworthiness related to your vehicle’s history, insuring a revived salvage title vehicle might cost more than a vehicle that never incurred serious damage. Because rates vary, it’s best to contact an insurance agent to compare quotes.

Is a rebuilt title bad for insurance?

A vehicle with a rebuilt title will be more expensive to insure, and you will likely have limited coverage options. Many companies will only provide liability insurance for rebuilt title cars. If you’re worried about insurance costs, buying the bare minimum coverage to meet auto insurance requirements in your state will help you save.

What is a salvage vehicle?

A salvage vehicle is a car that has been deemed a total loss by an insurance company due to severe damage, typically from an accident, natural disaster, or other significant event. Salvage vehicles are usually sold through salvage auctions or to salvage yards.

Can I get auto insurance for a salvage vehicle?

Yes, it is possible to obtain auto insurance for a salvage vehicle. However, the availability of insurance and coverage options may vary depending on the insurance company and state regulations. Since rates can be high, it’s best that you compare rates before signing up for a policy. Enter your ZIP code into our free comparison tool to see rates in your area.

What type of insurance coverage can I get for a salvage vehicle?

Insurance coverage for salvage vehicles typically includes liability auto insurance, which is required by law in most states. However, comprehensive and collision coverage may be more limited or not available for salvage vehicles. It’s important to discuss the available coverage options with your insurance provider.

Will my salvage vehicle be insured for its pre-accident value?

No, salvage vehicles are generally not insured for their pre-accident value. Since salvage vehicles have been deemed total losses, the insurance coverage is typically based on the current market value of the salvage vehicle, which is typically significantly lower than the pre-accident value.

Which companies have the best auto insurance for rebuilt cars?

The best auto insurance companies for rebuilt title insurance are Geico, State Farm, and Travelers because they offer affordable rates and excellent coverage options.

Can you insure a salvage title car?

Since salvage title cars can’t be driven, most insurance companies won’t sell you an insurance policy. If you are offered coverage for a salvage title car, make sure to check if the company is legitimate before giving them money.

Can you get full coverage on a salvage title?

You can’t get any insurance on a salvage title. For rebuilt titles, it can be very difficult to find a company willing to sell you full coverage insurance. Unless your car is extremely valuable, having full coverage on a rebuilt car is probably not worth the cost of insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.