Best Battle Creek, Michigan Auto Insurance in 2025 (Compare the Top 10 Companies)

State Farm, AAA, and Erie are recognized as offering the best Battle Creek, Michigan auto insurance, starting at $49 monthly. Known as the top options for membership benefits and local representatives, they are ideal for residents who want both a balance of cost-effectiveness and reliability.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Battle Creek Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Battle Creek Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Battle Creek Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews

Top contenders for the best Battle Creek, Michigan auto insurance include State Farm, AAA, and Erie for as low as $49 per month. State Farm stands out for its perfect blend of fair prices, thorough coverage, and contented customers.

Find the best car insurance options in Battle Creek, MI. We’ve laid it all out for you. We’ll cover insurance industry leaders, compare prices, and highlight key features of Michigan auto insurance.

Our Top 10 Company Picks: Best Battle Creek, Michigan Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Local Presence State Farm

#2 10% A Member Benefits AAA

#3 12% A+ Customer Service Erie

#4 14% A Personalized Service American Family

#5 10% A++ Flexible Policies Travelers

#6 20% A Customizable Policies Farmers

#7 15% A Innovative Features Liberty Mutual

#8 10% A+ Strong Coverage Nationwide

#9 12% A+ Competitive Rates Progressive

#10 18% A+ Discount Opportunities Allstate

Discover the way to the cheapest insurance and understand what shapes your rates in Battle Creek. Use our free comparison tool above to see what auto insurance quotes look like in your area.

- State Farm offers the best auto insurance in Battle Creek, MI

- Opt for companies with local expertise for tailored advice

- Know how age, driving record, and credit affect rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Local Expertise Unleashed: State Farm’s extensive Battle Creek agent network provides personalized guidance, ensuring your policy aligns perfectly with local driving conditions and regulations.

- Active Involvement: State Farm in Battle Creek, MI area is dedicated to participating in local events and community initiatives, which helps to establish trust and strengthen its commitment to the residents.

- Bundle and Save: Combine your home and auto policies to unlock substantial savings, a smart move for Battle Creek homeowners looking to optimize their insurance expenses. Learn more information about State Farm auto insurance discounts.

Cons

- Youth Pay Premium: Younger Battle Creek drivers might find State Farm’s rates a bit steep, potentially pushing them to explore more budget-friendly alternatives in the area.

- Limited Flexibility: State Farm’s policy customization options could use expansion to better cater to the diverse needs of Battle Creek’s eclectic driving population.

#2 – AAA: Best for Roadside Assistance

Pros

- Roadside Peace of Mind: AAA’s stellar assistance service proves invaluable during Michigan’s harsh winters, offering Battle Creek drivers reliable help in challenging conditions.

- Membership Perks Galore: AAA members enjoy a treasure trove of local discounts, from hotel stays to car rentals, adding extra value beyond just auto insurance.

- Tailored Coverage Options: From basic protection to comprehensive plans, AAA offers a spectrum of choices to suit various Battle Creek driving scenarios and budgets. Learn more information about AAA auto insurance review.

Cons

- Entry Fee Hurdle: The required AAA membership fee adds an extra expense, potentially deterring budget-conscious Battle Creek residents from accessing their services.

- Youthful Driver Premiums: Younger Battle Creek motorists might face higher-than-average rates with AAA, making it less appealing for new drivers in the area.

#3 – Erie: Best for Claims Satisfaction

Pros

- Smooth Claim Sailing: Erie’s efficient, customer-friendly claim process ensures Battle Creek drivers experience minimal hassle during stressful post-accident periods.

- Safe Driver Haven: Battle Creek’s cautious drivers rejoice at Erie’s competitive rates, rewarding their commitment to road safety with affordable premiums.

- Innovative Coverage Perks: Unique features like Rate Lock protect Battle Creek policyholders from unexpected premium increases, offering financial predictability in uncertain times. Learn more information about Erie auto insurance review.

Cons

- Limited Reach: Erie’s services don’t stretch across all of Battle Creek. Some policyholders might find themselves left out, unable to get their hands on the well-regarded insurance options.

Post-Accident Rate Spike: Battle Creek drivers with recent accidents might face significantly higher premiums, making Erie less attractive for those with imperfect driving records.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Personalized Service

Pros

- Tailored Local Service: American Family’s Battle Creek agents offer personalized attention, ensuring your policy reflects the unique aspects of driving in our community.

- Discount Bonanza: From safe driving to loyalty rewards, American Family provides numerous ways for Battle Creek residents to trim their premium costs.

- Flexible Policy Crafting: Battle Creek drivers appreciate the ability to fine-tune their coverage, creating a policy that perfectly fits their lifestyle and budget. Learn more information about American Family Auto Insurance Review.

Cons

- Coverage Gaps: American Family’s services aren’t available in all Battle Creek areas, potentially leaving some residents without access to their offerings.

- Credit Sensitivity: Battle Creek drivers with less-than-stellar credit might face higher rates, making American Family less competitive for certain segments of our community.

#5 – Travelers: Best for Comprehensive Coverage

Pros

- 24/7 Claims Assistance: Travelers offers round-the-clock claims support, providing Battle Creek policyholders with the ability to file claims and receive assistance at any time. This service ensures timely support and efficient claims handling.

- Discounts Available: Travelers offers unique discounts in Battle Creek, Michigan, including savings for hybrid/electric vehicles and maintaining safe driving habits.

- Good Financial Stability: With a solid financial standing, Travelers is a dependable choice in Battle Creek, Michigan, particularly praised for its efficient claims processing. Learn more information about Travelers auto insurance review.

Cons

- Complex Policy Language: Some customers have found Travelers’ policy documents to be complex, which can make understanding coverage details and exclusions more challenging. This complexity might require extra effort to ensure clarity and comprehension.

- Fewer Local Agents: Compared to competitors, Travelers has a more limited presence of local agents in Battle Creek, Michigan, which could affect in-person service accessibility.

#6 – Farmers: Best for Comprehensive Coverage Options

Pros

- Tailored Protection Palette: Farmers offers Battle Creek drivers a rich array of coverage options, including specialized plans for rideshare drivers and owners of custom vehicles.

- Local Support Network: With a robust presence of knowledgeable agents in Battle Creek, Farmers ensures personalized assistance is always just around the corner.

- Savings Harvest: Battle Creek residents can reap a bounty of discounts, from safe driving rewards to multi-policy bundles, helping to keep premiums manageable. Learn more information about Farmers auto insurance review.

Cons

- Premium Price Tag: Younger Battle Creek drivers might find Farmers’ rates less competitive, potentially steering them towards more budget-friendly alternatives in the area.

- Digital Divide: While excelling in personal service, Farmers’ online tools lag behind some competitors, potentially frustrating tech-savvy Battle Creek policyholders seeking digital convenience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Policy Customization

Pros

- Policy Sculpting: Liberty Mutual empowers Battle Creek motorists to craft bespoke policies, offering unique add-ons like accident forgiveness and new car replacement.

- Discount Diversity: From safe driving to vehicle safety features, Liberty Mutual provides numerous ways for Battle Creek residents to trim their insurance costs.

- Tech-Savvy Solutions: Battle Creek policyholders enjoy Liberty Mutual’s user-friendly digital tools, streamlining everything from policy management to claim filing. Learn more information about Liberty Mutual auto insurance review.

Cons

- Youthful Driver Premiums: Less experienced Battle Creek drivers might face steeper rates with Liberty Mutual, potentially pushing them to explore other local options.

- Service Roulette: Customer experiences in Battle Creek can vary widely, with some reporting inconsistent service quality across different local Liberty Mutual representatives.

#8 – Nationwide: Best for Customer Satisfaction

Pros

- Customer Satisfaction Champion: Nationwide consistently earns high marks from Battle Creek policyholders for its reliable support and overall service quality.

- Vanishing Deductible Perk: Safe Battle Creek drivers rejoice as their deductibles shrink over time, a unique Nationwide feature that rewards careful motoring.

- Coverage Spectrum: From basic protection to premium packages, Nationwide offers Battle Creek drivers a wide range of options to suit various needs and budgets. Learn more information about Nationwide auto insurance review.

Cons

- Premium Price Point: Battle Creek’s younger or less experienced drivers might find Nationwide’s rates higher than average, potentially limiting its appeal to this demographic.

- Agent Scarcity: While service quality is high, Nationwide’s local agent network in Battle Creek is less extensive than some competitors, potentially impacting accessibility.

#9 – Progressive: Best for Affordable Rates

Pros

- Budget-Friendly Beacon: Progressive shines as a cost-effective option for many Battle Creek drivers, especially those with clean records seeking multi-policy discounts.

- Snapshot Savings: Battle Creek’s careful drivers can earn significant discounts through Progressive’s usage-based Snapshot program, rewarding safe driving habits.

- Digital Dexterity: Tech-savvy Battle Creek residents appreciate Progressive’s robust online platform and mobile app, offering seamless policy management and support. Learn more information about Progressive auto insurance review.

Cons

- Limited Local Presence: Progressive’s smaller network of local agents in Battle Creek may disappoint those preferring face-to-face interactions for their insurance needs.

- Post-Claim Rate Jumps: Battle Creek drivers might see significant premium increases following accidents or claims, potentially impacting long-term affordability with Progressive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Innovative Features

Pros

- Coverage Options: Allstate in Battle Creek, provides drivers with a wealth of protection choices. They offer innovative features like Drivewise that reward those who drive with care and caution.

- Neighborhood Expertise: With a robust network of local agents, Allstate ensures Battle Creek residents receive personalized guidance tailored to our community’s unique needs.

- Discount Buffet: From safe driving to new car ownership, Allstate serves up a variety of ways for Battle Creek policyholders to savor savings on their premiums. Learn more information about Allstate auto insurance review.

Cons

- Premium Price Point: Battle Creek drivers, especially those with less-than-perfect records, might find Allstate’s rates a bit steep compared to some local alternatives.

- Claims Rollercoaster: Some Battle Creek policyholders report a bumpy ride during the claims process, with occasional delays and challenges that can test one’s patience.

Minimum vs. Full Coverage Insurance Rates in Battle Creek, MI

Cruising through Cereal City? Don’t let your auto insurance be a flake. Battle Creek, Michigan has rules of the road when it comes to coverage. The state wants you to carry more than just a box of Corn Flakes in your glove compartment – you need at least the minimum auto insurance to keep you rolling legally.

This includes Property Damage Liability with a minimum of $10,000, and Bodily Injury Liability at $20,000 per person and $40,000 per accident.

This table lays out the monthly auto insurance rates in Battle Creek, Michigan, for different levels of coverage from the top providers. Whether you seek the bare minimum or the full deal, this comparison shows you the best price.

Battle Creek, Michigan Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $55 $120

Allstate $57 $122

American Family $53 $125

Erie $52 $110

Farmers $56 $135

Liberty Mutual $58 $140

Nationwide $51 $118

Progressive $49 $105

State Farm $50 $115

Travelers $54 $130

This is your roadmap to cheap car insurance in Battle Creek, MI without sacrificing protection. Compare top providers’ rates across coverage levels to find your sweet spot.

State Farm stands out for its balance of affordability, comprehensive coverage, and customer satisfaction.Jeff Root LICENSED INSURANCE AGENT

We’ll cover factors that affect auto insurance rates, from your driving history to your credit score, helping you secure the best Battle Creek, Michigan auto insurance.

Credit Standing’s Role in Battle Creek Car Insurance Costs

Here’s a breakdown of monthly auto insurance rates in Battle Creek, Michigan, based on credit scores. This table compares how different providers modify their rates for drivers with poor, fair, and excellent credit ratings, thereby illustrating the financial implications of credit scores on insurance expenditures.

Battle Creek, Michigan Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $1,237 | $686 | $530 |

| Farmers | $308 | $203 | $187 |

| Geico | $409 | $300 | $243 |

| Liberty Mutual | $1,177 | $680 | $376 |

| Nationwide | $236 | $179 | $154 |

| Progressive | $232 | $196 | $177 |

| State Farm | $719 | $364 | $248 |

| Travelers | $349 | $338 | $334 |

| USAA | $198 | $114 | $87 |

Understanding how your credit score influences your auto insurance rates can help you make informed decisions when choosing a provider.

If you’re wondering, “What is a good auto insurance score?” Remember, the higher your score, the better your rates are likely to be. Keep this in mind as you explore the different insurance companies in Battle Creek, Michigan, to find the best deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Effect of Age and Gender on Battle Creek Auto Insurance Rates

Some companies, like Allstate and Farmers, don’t charge different prices for males and females. But other companies, like Progressive and USAA, do change their prices based on whether you’re a male and female.

Battle Creek, Michigan Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $1,501 | $1,501 | $626 | $626 | $594 | $594 | $550 | $550 |

| Farmers | $391 | $391 | $199 | $199 | $177 | $177 | $165 | $165 |

| Geico | $617 | $617 | $210 | $210 | $220 | $220 | $223 | $223 |

| Liberty Mutual | $1,308 | $1,308 | $559 | $559 | $559 | $559 | $553 | $553 |

| Nationwide | $352 | $352 | $149 | $149 | $136 | $136 | $121 | $121 |

| Progressive | $434 | $464 | $137 | $128 | $118 | $110 | $104 | $116 |

| State Farm | $944 | $944 | $315 | $315 | $268 | $268 | $248 | $248 |

| Travelers | $689 | $689 | $248 | $248 | $228 | $228 | $196 | $196 |

| USAA | $238 | $226 | $118 | $114 | $97 | $92 | $92 | $87 |

The difference in rates between young and old drivers is clear. Experience changes how we see risk. When thinking about policies, we should ask, “What age group has the most fatal crashes?” Knowing this can help explain why premiums vary by age and show how important it is to drive responsibly, no matter how old you are.

Driving Record Effects on Battle Creek Auto Insurance Rates

Analyzing this comparative table reveals the nuanced impact of driving infractions on Battle Creek car insurance premiums across multiple carriers. The data shows that underwriting practices vary, with DUI convictions typically causing the largest rate hikes, as they indicate a higher risk profile.

Battle Creek, Michigan Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $401 | $534 | $559 | $1,776 |

| Farmers | $196 | $249 | $241 | $246 |

| Geico | $111 | $235 | $206 | $717 |

| Liberty Mutual | $515 | $626 | $663 | $1,173 |

| Nationwide | $163 | $215 | $183 | $197 |

| Progressive | $171 | $224 | $209 | $201 |

| State Farm | $281 | $337 | $422 | $735 |

| Travelers | $231 | $329 | $272 | $529 |

| USAA | $107 | $133 | $117 | $174 |

USAA and Geico demonstrate the most favorable pricing for policyholders maintaining clean driving records, while Allstate’s risk assessment model appears to be particularly stringent regarding DUI incidents.

DUI Impact on Battle Creek Auto Insurance Rates

When motorists are charged with a DUI, car insurance in Battle Creek can experience a marked escalation. This information underscores the disparate effects on insurance costs across various companies, revealing that some insurers impose considerably steeper rate hikes than others.

Battle Creek, Michigan Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $1,776 |

| Farmers | $246 |

| Geico | $717 |

| Liberty Mutual | $1,173 |

| Nationwide | $197 |

| Progressive | $201 |

| State Farm | $735 |

| Travelers | $529 |

| USAA | $174 |

When evaluating coverage options, it’s advisable to discuss drunk driving rates by state with your agent, as this metric can provide valuable context for understanding the actuarial basis behind premium adjustments for alcohol-related violations.

Mileage-Based Pricing for Battle Creek Auto Coverage

Car insurance companies in Battle Creek, MI adjust their rates based on annual mileage, with significant variations depending on how much you drive. USAA consistently provides the lowest premiums for both low and high-mileage drivers.

Battle Creek, Michigan Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $1,635 | $1,832 |

| Farmers | $466 | $672 |

| Geico | $620 | $650 |

| Liberty Mutual | $1,438 | $1,540 |

| Nationwide | $379 | $536 |

| Progressive | $403 | $932 |

| State Farm | $864 | $911 |

| Travelers | $676 | $973 |

| USAA | $263 | $467 |

For those with the most expensive commutes in America, understanding how mileage impacts insurance costs is crucial. Selecting the right provider can help you manage expenses, especially if you frequently drive long distances.

Drivers seeking low mileage auto insurance in Battle Creek can benefit from the noticeable savings offered by several providers. For instance, Nationwide and USAA have great rates for people who drive less than 6,000 miles a year.

On the other hand, Allstate usually charges more for low-mileage drivers, so it might not be the best choice if you don’t drive often. Picking the right insurance company for low mileage can lead to big savings on yearly premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Battle Creek’s Unique Influences on Car Insurance Costs

In Battle Creek, Michigan, the cost of your auto insurance can rise and fall. The ebb and flow depend on many things—traffic snarls and the number of stolen cars among them. Knowing these local quirks can help you steer through and keep a handle on your insurance expenses in this town.

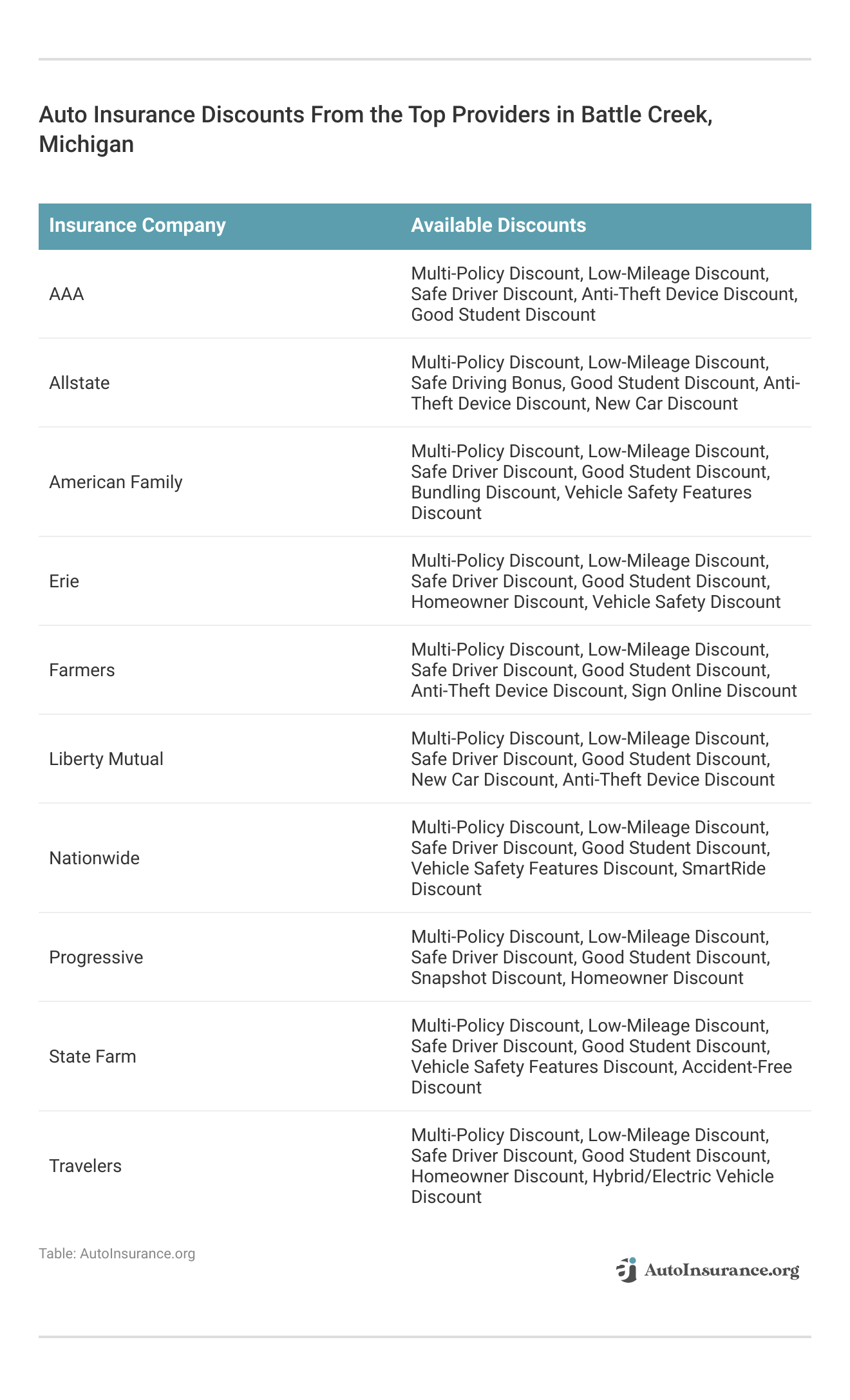

Leading insurers such as State Farm, AAA, and Erie present a comprehensive array of discounts, including those for holding multiple policies, maintaining a safe driving record, and achieving good student status. These represent the premier discount options offered by top-tier insurance companies in Battle Creek.

Vehicle Theft’s Ripple Effect on Battle Creek, MI Insurance Premiums

Increased vehicle thefts directly contribute to higher auto insurance premiums, as insurers adjust rates to cover the growing number of claims. The FBI reports that Battle Creek, Michigan, with its elevated crime rate, experienced 77 auto thefts last year, underscoring the importance of comprehensive coverage in this region.

Given the Battle Creek, Michigan crime rate, residents should be particularly mindful of selecting policies that adequately protect against theft-related losses. So, does auto insurance cover vehicle theft? Yes, but only if you have comprehensive coverage, which is essential in areas with higher crime rates like Battle Creek.

Battle Creek’s Commute-Insurance Link

Battle Creek drivers, your 18-minute average commute isn’t just about traffic – it’s influencing your insurance rates too. More road time can mean higher premiums. Keep this in mind when shopping for the best Battle Creek, Michigan auto insurance to find your perfect coverage-cost balance.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Frequently Asked Questions

Is auto insurance mandatory in Battle Creek, MI?

Yes, auto insurance is mandatory in Battle Creek, MI, as it is throughout the state of Michigan. All drivers are required to carry a minimum level of liability insurance coverage to legally operate a motor vehicle.

What are the minimum auto insurance requirements in Battle Creek, MI?

The minimum auto insurance requirements in Battle Creek, MI, include $20,000 in bodily injury liability coverage per person, $40,000 in bodily injury liability coverage per accident, and $10,000 in property damage liability coverage. These are the minimum limits set by Michigan law to ensure basic financial protection.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Can I choose additional coverage beyond the minimum requirements?

Yes, you can purchase additional coverage beyond the minimum requirements to enhance your protection. Common options include collision coverage, comprehensive auto insurance coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP) coverage. These options provide broader protection against various risks.

What factors can affect auto insurance rates in Battle Creek, MI?

Several factors can influence your auto insurance rates in Battle Creek, MI, including your driving record, age, gender, marital status, credit history, vehicle type, and coverage level. Insurers use these factors to assess the risk of insuring you and set your premium accordingly.

Are there any specific insurance requirements related to weather conditions in Battle Creek, MI?

Battle Creek, MI, experiences various weather conditions, including snow and ice during the winter months. While there are no specific insurance requirements related to weather, it’s advisable to have comprehensive coverage to protect your vehicle from weather-related damages, such as those caused by hail, ice, or falling tree limbs.

Can I qualify for any discounts on auto insurance in Battle Creek, MI?

Yes, many insurance providers offer car insurance discounts that can help reduce your premiums. Common discounts include those for safe driving, good students, bundling multiple policies, and having safety features in your vehicle. Be sure to ask your insurance provider about available discounts and eligibility requirements.

How does my driving record impact my auto insurance rates in Battle Creek, MI?

Your driving record plays a significant role in determining your auto insurance rates. Drivers with a clean record typically enjoy lower rates, while those with traffic violations, accidents, or DUIs may face higher premiums. Maintaining a clean driving record can help keep your insurance costs down.

Can I get auto insurance in Battle Creek, MI if I have a bad credit history?

Yes, you can still obtain auto insurance in Battle Creek, MI, if you have a bad credit history, but you may face higher premiums. Some insurers consider credit history when determining rates, so it’s a good idea to compare quotes from multiple providers to find the most affordable option.

What should I do if I’m involved in an accident in Battle Creek, MI?

If you’re involved in an accident in Battle Creek, MI, the first step is to ensure everyone’s safety and call 911 if necessary. Exchange information with the other driver(s), document the scene with photos, and report the incident to your insurance company as soon as possible to begin the claims process.

Read More: If someone hits my car, do I call my insurance or theirs?

How can I find the best auto insurance rates in Battle Creek, MI?

To find the rates it’s important to compare auto insurance quotes in Battle Creek, MI from multiple insurance providers. Consider factors such as coverage options, discounts, and customer service when evaluating your options. Using online comparison tools can help you quickly identify the most competitive rates for your needs.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.