Best Belleville, Michigan Auto Insurance in 2024 (Your Guide to the Top 10 Companies)

The best Belleville, Michigan auto insurance comes from Geico, USAA, and Progressive, with rates as low as $32/month. Geico offers the cheapest premiums, USAA excels in benefits for military families, and Progressive stands out with flexible coverage options, making them top providers for Belleville drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Belen

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Belen

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Belen

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Belleville, Michigan auto insurance providers are Geico, USAA, and Progressive based on affordability, coverage options, and customer satisfaction.

Geico provides highly competitive rates, particularly for drivers looking for standard insurance coverage. USAA is an excellent option for military members and their families, known for its outstanding service and affordable pricing.

Our Top 10 Company Picks: Best Belleville, Michigan Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 23% | A++ | Affordable Rates | Geico | |

| #2 | 19% | A++ | Military Benefits | USAA | |

| #3 | 20% | A+ | Snapshot® Savings | Progressive | |

| #4 | 17% | A+ | SmartRide® Savings | Nationwide |

| #5 | 22% | A+ | Local Support | Allstate | |

| #6 | 19% | A | Claims Service | American Family | |

| #7 | 20% | A++ | Bundling Policies | Travelers | |

| #8 | 21% | A | Weather Coverage | Farmers | |

| #9 | 20% | B | Local Agents | State Farm | |

| #10 | 15% | A | Add-on Coverages | Liberty Mutual |

Progressive excels with its flexible policies and discounts, making it an ideal option for those seeking the best Belleville, Michigan auto insurance.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code above in our free quote comparison tool.

- Geico offers the top pick for affordable auto insurance in Belleville, Michigan

- The best Belleville, Michigan auto insurance starts at $32/month for basic coverage

- Tailored policies in Belleville, Michigan meet the area’s specific driving needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

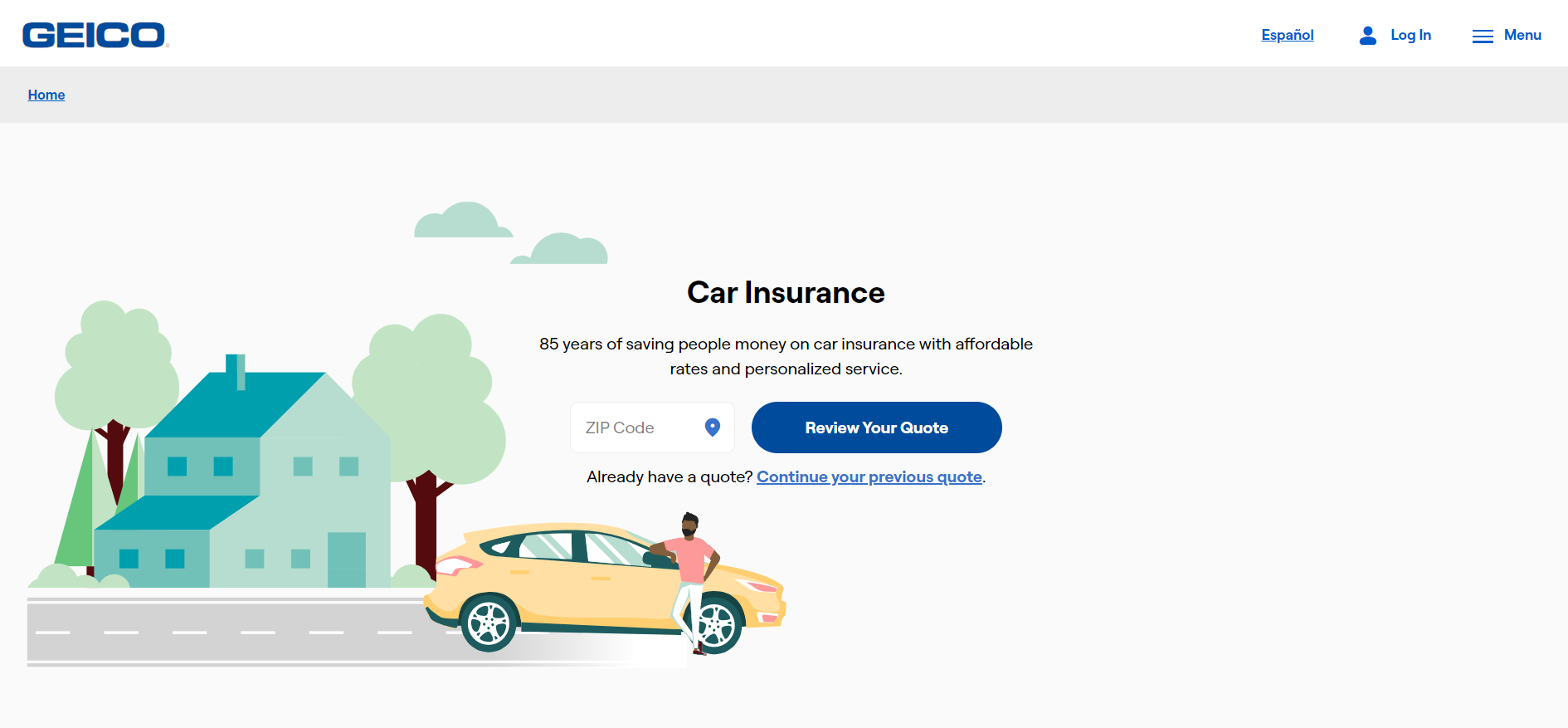

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Our Geico auto insurance review reveals competitive rates, making it a top choice for budget-conscious drivers seeking the best Belleville, Michigan, auto insurance.

- User-Friendly Mobile App: Geico’s app simplifies policy management and claims processing, making it ideal for drivers looking for the top auto insurance in Belleville, Michigan.

- Extensive Discounts: Geico offers discounts for safe drivers and federal employees, helping Belleville, Michigan residents find affordable, high-quality auto insurance.

Cons

- Limited Local Agent Support: Geico’s focus on online services might not meet customers’ preferences who want in-person support for their Belleville, Michigan auto insurance.

- Fewer Specialized Coverage Options: Geico offers fewer specialized coverage options, limiting flexibility for those seeking comprehensive auto insurance in Belleville, Michigan.

#2 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA provides exclusive benefits, including deployment discounts, making it an excellent choice for Belleville, Michigan auto insurance tailored to military members.

- Highly Rated Customer Service: USAA is known for its excellent customer service and top-notch support for residents seeking the best auto insurance in Belleville, Michigan.

- Competitive Rates for Safe Drivers: As outlined by our USAA auto insurance review, they provide competitive rates for safe drivers, facilitating access to the best auto insurance in Belleville, Michigan.

Cons

- Membership Restrictions: USAA restricts its services to military families, which can limit access for some local residents to top-tier auto insurance options in Belleville, Michigan.

- Fewer Local Agents: Fewer in-person branches can be a drawback for Belleville drivers who value a more personalized approach in selecting the best auto insurance coverage.

#3 – Progressive: Best for Snapshot® Savings

Pros

- Snapshot® Savings Program: Progressive’s Snapshot® program rewards safe driving, giving Belleville drivers premium discounts and better access to best auto insurance.

- Flexible Coverage Options: Based on our Progressive auto insurance review, the company offers various coverage options, enabling Belleville residents to customize their policies for the best auto insurance.

- User-Friendly Online Tools: With accessible online tools for policy management and claims, Progressive enhances convenience for Belleville drivers seeking quality auto insurance.

Cons

- Potential Rate Increases: Rates may rise for drivers who do not perform well in the Snapshot® program, affecting their ability to secure the best Belleville, Michigan auto insurance.

- Mixed Customer Service Reviews: Progressive’s customer service feedback varies, which could influence the experience for Belleville residents looking for dependable auto insurance support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for SmartRide® Savings

Pros

- SmartRide® Savings: Nationwide’s SmartRide® program rewards safe driving, helping Belleville drivers get the best auto insurance discounts. Discover more in our Nationwide auto insurance review.

- Comprehensive Coverage Options: Nationwide provides various coverage choices, enabling Belleville, Michigan, residents to find a policy that suits their specific auto insurance needs.

- Personalized Policy Management: With user-friendly tools, Nationwide simplifies policy management, helping Belleville drivers navigate their auto insurance options easily.

Cons

- Higher Initial Rates: Some drivers in Belleville may encounter higher initial premiums with Nationwide, which could restrict their ability to find more affordable auto insurance solutions.

- Limited Local Agent Network: Fewer local agents may hinder Belleville residents from receiving personalized support for their best Belleville, Michigan auto insurance.

#5 – Allstate: Best for Local Support

Pros

- Local Support: Allstate’s local agents help Belleville drivers find the best auto insurance services in Belleville, Michigan. Read more in our Allstate auto insurance review.

- Unique Coverage Options: Allstate offers unique coverage choices, like accident forgiveness, benefiting Belleville residents seeking best auto insurance.

- Strong Claim Support: Allstate is known for effective claims handling, ensuring Belleville drivers have a smooth experience when filing for their best Belleville, Michigan auto insurance.

Cons

- Higher Premiums: Allstate’s rates may be higher than those of competitors, making it less accessible for budget-conscious Belleville drivers.

- Complex Discount Structure: The various discounts can be complicated and potentially confusing for Belleville drivers trying to find the best Belleville, Michigan auto insurance deals.

#6 – American Family: Best for Claims Service

Pros

- Excellent Claims Service: American Family is known for its exceptional claims support, making it easier for Belleville residents to secure top-notch auto insurance.

- Diverse Coverage Options: American Family offers a range of customizable coverage options, allowing drivers in Belleville to personalize their policies for the best auto insurance solutions.

- Innovative Discounts: Our American Family auto insurance review shows that exclusive discounts for certain professions help eligible drivers save on the best Belleville, Michigan, auto insurance.

Cons

- Availability Limitations: American Family is not available in all states, which might limit access for some Belleville residents seeking the best Belleville, Michigan auto insurance.

- Higher Premiums for Some Drivers: Individuals with imperfect driving records could encounter elevated rates, hindering their ability to obtain the most favorable auto insurance in Belleville, Michigan.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Bundling Policies

Pros

- Flexible Coverage Options: Travelers offers various add-on coverages, allowing Belleville drivers to customize their auto insurance policies. Explore further in our Travelers auto insurance review.

- User-Friendly Online Tools: Travelers feature intuitive policy management tools, improving the experience for Belleville residents looking for the area’s best auto insurance options.

- Strong Claims Support: Travelers is recognized for its strong claims handling, offering reliable assistance to Belleville drivers in securing the best auto insurance coverage.

Cons

- Limited Online Tools: Some customers may find Travelers’ online tools less comprehensive than those of competitors, which could make managing their auto insurance in Belleville more challenging.

- Higher Rates for High-Risk Drivers: Travelers often charge higher premiums for drivers with poor driving records, which could impact their access to the best Belleville, Michigan, auto insurance.

#8 – Farmers: Best for Weather Coverage

Pros

- Weather-Specific Coverage: Farmers offers specialized protection for weather-related incidents, making it a strong choice for the best Belleville, Michigan auto insurance against natural disasters

- Innovative Discounts: In line with our Farmers auto insurance review, they offer innovative discounts for eco-friendly vehicles, helping Belleville residents save on auto insurance.

- Strong Customer Service: Farmers is recognized for its outstanding customer support, ensuring that drivers in Belleville receive the assistance they need when managing their auto insurance policies.

Cons

- Higher Premiums: Farmers tends to have higher rates compared to competitors, which may limit access to the best Belleville, Michigan auto insurance for budget-conscious drivers.

- Complex Policy Options: The extensive range of coverage options offered by Farmers might overwhelm some drivers in Belleville who are searching for the most suitable auto insurance.

#9 – State Farm: Best for Local Agents

Pros

- Personalized Service: State Farm’s local agents provide personalized assistance, ensuring Belleville drivers receive tailored support for their best Belleville, Michigan auto insurance.

- Wide Coverage Options: State Farm offers a diverse selection of coverage options to help Belleville residents find auto insurance that best suits their specific needs.

- Good Claims Handling: State Farm offers quick claims processing, providing reliable support for drivers with the best Belleville, Michigan auto insurance. Learn more in our State Farm auto insurance review.

Cons

- Lower Financial Rating: With a B rating from A.M. Best, some drivers may find State Farm less appealing when seeking the best Belleville, Michigan auto insurance from a higher-rated company.

- Higher Rates for Some Drivers: Younger or higher-risk drivers may encounter elevated premiums, complicating their quest for the most suitable auto insurance coverage in Belleville

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Add-on Coverages

Pros

- Flexible Add-On Coverages: Liberty Mutual offers various add-on options, allowing Belleville drivers to customize their best Belleville, Michigan auto insurance policies to suit their needs.

- Innovative Coverage Options: In accordance with our Liberty Mutual auto insurance review, accident forgiveness, and new car replacement improve its best Belleville, Michigan auto insurance.

- Decent Customer Service: Liberty Mutual is known for its strong customer service, which can assist Belleville drivers in effectively managing their auto insurance needs.

Cons

- Higher Rates for New Drivers: New drivers may encounter higher premiums, making it challenging to find the best Belleville, Michigan auto insurance at an affordable price.

- Limited Local Presence: The absence of a substantial local agent network might leave some drivers in Belleville feeling unsupported while searching for the most suitable auto insurance coverage.

Minimum Auto Insurance Coverage Needed in Belleville, Michigan

Auto insurance is considered statutory law, and a driver in Belleville, Michigan, has to purchase minimum auto insurance so a person would be financially responsible for causing an accident.

In fact, the minimum amount of such cover involves bodily injury liability with $20,000 per person and $40,000 per accident, while property damage liability has a minimum limit of $10,000. Drivers have to follow these in order to comply with state laws and also to provide financial security should an accident occur.

Belleville, Michigan Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $41 | $110 | |

| $39 | $108 | |

| $43 | $113 | |

| $32 | $95 | |

| $44 | $115 |

| $36 | $100 |

| $37 | $103 | |

| $38 | $105 | |

| $40 | $109 | |

| $34 | $98 |

Belleville, Michigan, rates follow a line of options for both minimum and full coverage by month. Minimum coverage ranges from $32 to $44, while complete coverage ranges from $95 to $115. This competitiveness in rates lets drivers of Belleville, Michigan, find the best balance between cost and coverage for an auto insurance policy.

Auto Insurance Discounts From the Top Providers in Belleville, Michigan

| Insurance Company | Available Discounts |

|---|---|

| Safe driver, Bundling, Early Signing | |

| KnowYourDrive®, Loyalty, Bundling | |

| Signal®, Good Student, Bundling | |

| Good Driver, Multi-Vehicle, Defensive Driving | |

| Bundling, New Car, Anti-Theft |

| SmartRide®, Accident-Free, Bundling |

| Snapshot®, Bundling, Paperless Billing | |

| Drive Safe & Save™, Bundling | |

| IntelliDrive®, Hybrid Vehicle, Bundling | |

| Military, Safe Driver, Loyalty |

This chart showcases the top auto insurance providers in Belleville, Michigan, along with their discounts. From Allstate’s safe driver and multi-policy deals to Geico’s defensive driving savings, each company highlights unique ways to help drivers save.

Geico offers the best Belleville, Michigan auto insurance with affordable rates, reliable coverage, and excellent customer service.Dani Best Licensed Insurance Producer

Whether through bundling, loyalty perks, or usage-based programs, Belleville residents have plenty of opportunities to reduce their premiums.

How Age, Gender, and Marital Status Influence Your Insurance Rates

Auto insurance premiums in Belleville, Michigan, are influenced by age, gender, and marital status. Insurers consider these variables when determining rates, as they correlate with risk levels.

One of the primary reasons why auto insurance costs more for young drivers is their inexperience behind the wheel. As a result, younger drivers, particularly teenagers, typically encounter significantly higher premiums, whereas older drivers usually benefit from lower rates.

Gender can also play a role, with young male drivers often paying more than their female counterparts. Below is a detailed comparison of how age and gender impact full coverage auto insurance premiums in Belleville.

Belleville, Michigan Full Coverage Auto Insurance Monthly Rates by Age, & Gender

| Insurance Company | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male |

|---|---|---|---|---|---|---|---|---|

| $1,862 | $1,862 | $1,746 | $1,746 | $4,371 | $4,371 | $1,957 | $1,957 | |

| $924 | $924 | $856 | $856 | $2,009 | $2,009 | $1,044 | $1,044 | |

| $370 | $370 | $379 | $379 | $1,044 | $1,044 | $353 | $353 | |

| $1,302 | $1,302 | $1,289 | $1,289 | $3,055 | $3,055 | $1,302 | $1,302 |

| $365 | $365 | $325 | $325 | $961 | $961 | $400 | $400 |

| $275 | $254 | $243 | $273 | $1,009 | $1,069 | $320 | $292 | |

| $764 | $764 | $713 | $713 | $2,727 | $2,727 | $899 | $899 | |

| $622 | $622 | $533 | $533 | $1,887 | $1,887 | $676 | $676 | |

| $222 | $209 | $209 | $197 | $546 | $516 | $270 | $257 |

The table highlights how rates differ across various age groups and genders for several top insurers. Notably, teenage drivers face the highest costs, while middle-aged and senior drivers often receive more affordable premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding Affordable Car Insurance Rates for Teen Drivers

Finding affordable teen auto insurance in Belleville, Michigan will be one of the major concerns for parents or guardians. Since many factors weigh on the rates, options must be investigated to acquire the best coverage for your teen driver without breaking the bank.

The following table outlines the annual teen auto insurance rates in Belleville, Michigan, by provider and gender. This gives families an overview when determining which insurance plan best suits their needs and budget

Belleville, Michigan Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| $4,371 | $4,371 | |

| $2,009 | $2,009 | |

| $1,044 | $1,044 | |

| $3,055 | $3,055 |

| $961 | $961 |

| $1,009 | $1,069 | |

| $2,727 | $2,727 | |

| $1,887 | $1,887 | |

| $546 | $516 |

The following are monthly insurance rates from different providers to give a clear picture of how much it costs to insure teen drivers in Belleville.

It’s important to note that the rates for male and female drivers differ, and this will make a big difference in total expenses. The families should thus take a keen interest in observing these rates in order to identify the most reasonable ways through which coverage for their teen drivers in Belleville can be secured.

Affordable Auto Insurance Options for Senior Drivers

The most affordable options for the best auto insurance for seniors in Belleville, Michigan, can be found; prices vary depending on the insurance company and gender of the driver. Most insurance companies provide special rates for older drivers and can offer a number of ways for seniors to save on their insurance premiums while keeping proper protection.

Belleville, Michigan Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| $1,746 | $1,746 | |

| $856 | $856 | |

| $379 | $379 | |

| $1,289 | $1,289 |

| $325 | $325 |

| $243 | $273 | |

| $713 | $713 | |

| $533 | $533 | |

| $209 | $197 |

This table compares monthly premiums paid by senior drivers aged 60 years based on gender and insurance provider. Rates are considerably different: USAA is the most feasible option for men and women, and Geico and Progressive also provide decent rates.

How Your Driving Record Impacts Your Auto Insurance Rates

Your driving history is an insurance company’s most critical factor in determining your auto insurance rates. The cleaner your record, the less you might pay, while tickets, accidents, and DUIs can significantly raise your rate.

The comparison illustrates how widespread annual auto insurance rates in Belleville, Michigan, can be, depending on driving history.

Belleville, Michigan Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One DUI | One Accident |

|---|---|---|---|---|

| $1,192 | $1,679 | $5,455 | $1,609 | |

| $1,008 | $1,245 | $1,279 | $1,300 | |

| $186 | $347 | $1,215 | $399 | |

| $1,204 | $1,549 | $2,734 | $1,462 |

| $439 | $494 | $533 | $586 |

| $394 | $485 | $468 | $521 | |

| $802 | $1,214 | $2,120 | $967 | |

| $630 | $746 | $1,444 | $899 | |

| $244 | $265 | $399 | $305 |

The table below clearly illustrates how different insurance providers in Belleville modify their monthly rates according to your driving history, helping you grasp the financial consequences of your driving behavior. This information is particularly valuable for identifying the best auto insurance companies for high-risk drivers.

Belleville, Michigan Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A | Low theft rate reduces insurance costs slightly |

| Traffic Density | B | Moderate traffic with average accident risk |

| Weather-Related Risks | C | Severe weather increases claim likelihood |

| Uninsured Drivers Rate | C- | High rate of uninsured drivers raises premiums |

| Average Claim Size | D | High claim size due to Michigan's no-fault laws |

The report card points out the important local factors driving the insurance cost. A low vehicle theft rate generates an “A,” which keeps costs low. A moderate traffic rate generates a “B,” reflecting an average risk of accidents. Harsh weather, a high percentage of uninsured drivers, and large average claim sizes linked to no-fault laws drive the grades down, revealing where premiums are apt to increase.

This table shows how individual conditions in Belleville combine to provide the overall insurance cost of drivers in the area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Rates After a DUI in Belleville, Michigan

If you have been charged with a DUI in Belleville, Michigan, you may wonder how it will affect your auto insurance rates. You’ll find it challenging to shop around for more affordable coverage, as it is usual for the providers to elevate the rates of drivers convicted of DUI.

To make it easier for you to buy your options, we have compiled below a comparative study of the monthly rates after receiving a DUI for full coverage auto insurance.

Below is a summarized table of the providers listed in this article, with their respective monthly premiums; from there, you can determine which company has the best deal for you.

Belleville, Michigan Full Coverage Auto Insurance Monthly Rates After a DUI

| Insurance Company | One DUI |

|---|---|

| $5,455 | |

| $1,279 | |

| $1,215 | |

| $2,734 |

| $533 |

| $468 | |

| $2,120 | |

| $1,444 | |

| $399 |

Understanding various monthly auto insurance after a DUI may help make an individual’s choice very effective. These differing premiums give a fair explanation of the insurer’s risk assessment and pricing for policies for drivers with a DUI conviction. You can find affordable options by comparing these rates and getting the best coverage.

Belleville, Michigan Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 300,000 |

| Total Claims Per Year | 250,000 |

| Average Claim Size | $6,000 |

| Percentage of Uninsured Drivers | 18% |

| Vehicle Theft Rate | 9 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | High |

The table presents key auto accident and insurance claims statistics in Belleville, Michigan. The area reports 300,000 total accidents annually, with 250,000 resulting in claims. The average claim amount is $6,000, while 18% of drivers are uninsured. Nine vehicle thefts occur yearly, there is medium traffic density, and there is a high rate of weather-related incidents.

How Credit History Affects Auto Insurance Rates in Belleville, Michigan

Credit history contributes to auto insurance premiums, with many companies using this as a base in determining risk. With the immense number of credit scores one can have, drivers in Belleville, Michigan, will see a big variation in annual auto insurance rates.

Consumers would make better decisions regarding their insurance coverage by being informed about how these rates change based on their auto insurance score and credit history.

Belleville, Michigan Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $1,546 | $2,090 | $3,816 | |

| $872 | $942 | $1,810 | |

| $412 | $507 | $690 | |

| $876 | $1,587 | $2,748 |

| $412 | $484 | $643 |

| $407 | $453 | $540 | |

| $709 | $1,046 | $2,072 | |

| $912 | $924 | $953 | |

| $197 | $259 | $453 |

The table compares monthly rates for full-coverage auto insurance in Belleville for drivers with different credit scores. As one can clearly see from the table, creditworthiness has a big influence on the cost of premiums, with drivers with good credit receiving considerably cheaper rates. On the other hand, drivers with fair or poor credit experience sharp increases.

This analysis not only emphasizes the financial impact of credit scores on insurance affordability but it will also remind consumers that credit health is one of the main priorities when shopping for auto insurance.

The Impact of ZIP Codes on Auto Insurance Costs

Your ZIP code plays a significant role in determining your auto insurance premiums. In Belleville, Michigan, various factors tied to location, such as population density, crime rates, and local weather conditions, can lead to substantial differences in insurance costs.

| ZIP Code | Rates |

|---|---|

| 48111 | $735 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Impact of Commute Distance on Auto Insurance Rates in Belleville, Michigan

Commute length and annual mileage significantly influence auto insurance rates in Belleville, Michigan. Insurer bases risk on how much and how often you drive. The more you drive, the higher your car insurance rates. See a comparison of average monthly full-coverage auto insurance rates for different levels of annual mileage to find the best option for your commute.

Belleville, Michigan Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $2,484 | $2,484 | |

| $1,208 | $1,208 | |

| $524 | $549 | |

| $1,678 | $1,797 |

| $513 | $513 |

| $467 | $467 | |

| $1,240 | $1,311 | |

| $924 | $935 | |

| $300 | $307 |

This comparison enables you to make an informed decision when selecting auto insurance in Belleville.

By understanding how commute distance impacts your premiums, you can find the best coverage options for your budget and driving habits.

How Coverage Levels Impact Auto Insurance Costs

Choosing the right auto insurance coverage is crucial for protecting yourself and your vehicle but also significantly influences your premiums. In Belleville, Michigan, the level of insurance coverage you select can vary widely in cost, affecting your overall insurance expenses.

Belleville, Michigan Full Coverage Auto Insurance Monthly Rates by Coverage

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| $2,436 | $2,488 | $2,527 | |

| $1,168 | $1,204 | $1,252 | |

| $504 | $532 | $573 | |

| $1,699 | $1,733 | $1,779 |

| $534 | $505 | $499 |

| $453 | $467 | $481 | |

| $1,206 | $1,284 | $1,337 | |

| $921 | $931 | $937 | |

| $293 | $304 | $312 |

This table compares the annual rates for different coverage levels—low, medium, and high—across several major insurance providers. By analyzing this data, you can pick which works best for you, depending on your needs and budget.

Key Factors Influencing Auto Insurance Rates in Belleville, Michigan

Auto insurance rates in Belleville, Michigan, can vary significantly compared to other cities, influenced by various local factors. Understanding these elements can help residents make informed decisions about their insurance policies.

Auto Theft Rates in Belleville

Auto theft is another important factor that can influence auto insurance premiums. As more vehicles get stolen, the number of claims against any given insurance company goes up, which, in turn, raises car owners’ premiums. On the positive side, Belleville has a very good track record, with the FBI recording 0 car thefts in the city.

Low rates of auto thefts have an excellent effect on insurance costs since insurance providers have less risk in the area. As a result of the aforementioned, residents would be interested in whether vehicle theft was included in auto insurance as they tried to seek reasonable coverage.

Belleville Commute Time

Commute times, which determine how much time a driver spends daily on the road, are also factored into auto premiums. Generally speaking, the longer the commute time, the more time spent driving increases, and so does the risk of an accident. According to City Data, the average commute length in Belleville is 27.1 minutes.

This is fair to middle ground but can be a consideration for insurance, especially with other concerns, such as traffic density and the rate of accidents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Choices for Affordable Auto Insurance in Belleville, Michigan

Discover the best Belleville, Michigan auto insurance options focusing on top providers like Geico, USAA, and Progressive. With rates starting at $32 per month, Geico stands out for affordability, while USAA offers exceptional benefits for military families. Progressive is known for its flexible coverage options, making these three insurers ideal for Belleville drivers.

For the best Belleville, Michigan auto insurance, Geico stands out with competitive pricing and comprehensive policy options.Kristen Gryglik Licensed Insurance Agent

Michigan’s minimum coverage requirements are 20/40/10. The best rate and coverage can be determined by comparing the rates of several insurers. The strong factors that affect premiums include age, gender, marital status, driving history, and credit score.

This includes comprehensive tables comparing monthly rates for different coverage levels to help readers make an informed decision and show that better savings can be obtained with the best Belleville, Michigan auto insurance if research is done correctly.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

Which factors influence Belleville, Michigan, auto insurance rates?

Key factors affecting auto insurance rates in Belleville, Michigan, include your driving record, age, gender, marital status, credit score, and vehicle type. Local factors like auto theft rates and commute times also matter.

How can I find the best Belleville, Michigan auto insurance?

Compare quotes from multiple providers to find the best Belleville, Michigan auto insurance. Geico, USAA, and Progressive are top choices due to their affordability, customer satisfaction, and coverage flexibility.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

What coverage options are typically found in top auto insurance policies in Belleville, Michigan?

Belleville, Michigan’s best auto insurance policies generally encompass liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Full coverage auto insurance options are also available from leading providers.

Is getting the best Belleville, Michigan auto insurance with a bad driving record possible?

Yes, it’s possible to locate affordable auto insurance in Belleville, Michigan, even with a poor driving history. While insurers like Progressive might provide higher premiums, exploring multiple options through comparison shopping can lead you to cost-effective coverage.

What can you expect to pay for top auto insurance in Belleville, Michigan?

For premier auto insurance in Belleville, Michigan, the average monthly premium begins at approximately $32 for minimum coverage. If you opt for full coverage, expect to pay between $95 and $115 each month, varying by provider and the extent of coverage chosen.

How do age and gender affect the best Belleville, Michigan auto insurance costs?

Younger drivers and males often face higher premiums when seeking the best Belleville, Michigan auto insurance. Older drivers, particularly those in their 40s and 50s, enjoy lower rates due to their experience. To gain profound insights, consult our extensive guide titled “Why are auto insurance rates higher for males?“

Can I find affordable coverage for teens with Belleville, Michigan’s top auto insurance options?

Belleville, Michigan’s best auto insurance providers offer plans for teen drivers. While rates are often higher for this age group, many insurers provide discounts and tailored coverage to keep costs manageable.

What is the best Belleville, Michigan auto insurance company?

Top auto insurance providers in Belleville, Michigan, are Geico, USAA, and Progressive. Geico is known for its competitive pricing, USAA caters specifically to military families, and Progressive offers a range of flexible coverage options.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

What discounts are available for the best Belleville, Michigan auto insurance?

The top auto insurance options in Belleville, Michigan, provide various auto insurance discounts, including safe driver, multi-policy, defensive driving, and military discounts. Many companies are recognized for offering a wide range of savings opportunities.

How does my credit score impact the best Belleville, Michigan auto insurance rates?

Your credit score is crucial in determining your auto insurance premiums in Belleville, Michigan. Typically, individuals with excellent credit tend to enjoy the most favorable insurance rates in the area, while those with lower credit scores often encounter increased premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.