Best Bellingham, Washington Auto Insurance in 2025 (Compare the Top 10 Companies)

Secure top-notch and best Bellingham, Washington auto insurance, starting at just $27 monthly with the best providers such as Geico, USAA, and State Farm. While car insurance rates in Washington tend to be above average, Geico provides the most affordable options. To find the best coverage, compare quotes online.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Bellingham Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Bellingham Washington

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Bellingham Washington

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Geico, USAA, and State Farm are considered the top options for best Bellingham, Washington auto insurance, with rates beginning at $27 per month.

Compare auto insurance rates in Bellingham with those in Bellevue, Everett, and Federal Way to see how they stack up. This comparison can help explain why it’s so hard to find cheap auto insurance coverage.

Our Top 10 Company Picks: Best Bellingham, Washington Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Affordable Rates Geico

#2 30% A++ Military Members USAA

#3 17% B New Drivers State Farm

#4 20% A+ Broad Coverage Nationwide

#5 5% A+ High-Risk Drivers Progressive

#6 10% A+ New Cars Allstate

#7 15% A Comprehensive Coverage Farmers

#8 23% A Customer Service American Family

#9 13% A++ Electric Cars Travelers

#10 10% A Custom Coverage Liberty Mutual

Before buying, compare rates from multiple companies. Enter your ZIP code above to get free quotes for Bellingham auto insurance.

- Geico is the top provider in Bellingham, Washington

- Factors affecting insurance costs in Bellingham, Washington

- Traffic and theft rates increases auto insurance premiums

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- User-Friendly App: Their highly-rated mobile app enhances the customer experience by allowing easy management of your policy and claims. Geico’s app is frequently cited as one of the best Bellingham, Washington auto insurance tools for tech-savvy users.

- Wide Range of Discounts: Geico offers a variety of discounts, including for good driving and military personnel, which can make it one of the best Bellingham, Washington auto insurance providers for those who qualify. Read more through our Geico auto insurance review.

- Excellent Customer Service: Geico consistently receives high marks for customer service, an essential factor for handling claims and policy issues efficiently. This reputation helps Geico stand out as one of the best Bellingham, Washington auto insurance companies.

Cons

- Limited Local Agent Presence: Geico’s focus on online and phone-based service means fewer local agents are available for face-to-face consultations, which might be a drawback for those preferring in-person support. This limitation affects their standing as the best Bellingham, Washington auto insurance for personal service.

- Coverage Options: Basic coverage plans might lack some specialized protections offered by other providers, potentially leaving gaps for certain needs. This could impact Geico’s ranking as the best Bellingham, Washington auto insurance for comprehensive coverage.

#2 – USAA: Best for Military Members

Pros

- Great for Military Families: USAA offers exclusive benefits and discounts for military members and their families, such as a 30% multi-policy discount. This makes USAA one of the best Bellingham, Washington auto insurance options for those who qualify.

- High Satisfaction Ratings: Known for outstanding customer service, USAA receives top ratings in customer satisfaction and claims handling. This strong reputation contributes to USAA being considered one of the best Bellingham, Washington auto insurance providers.

- Competitive Rates: USAA’s rates are highly competitive, particularly when factoring in their multi-policy discounts. This pricing advantage makes them a standout in the best Bellingham, Washington auto insurance market. Unlock details in our guide titled, USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, which restricts access for the general population. This limitation can affect its standing as the best Bellingham, Washington auto insurance for a broader audience.

- Limited Availability: USAA’s coverage is not available in all states, which might be problematic if you relocate to a region where they do not operate, affecting their ranking as the best Bellingham, Washington auto insurance provider for all locations.

#3 – State Farm: Best for New Drivers

Pros

- Good Student Discounts: Offers significant discounts for students with good grades, making it an attractive option for families with young drivers. This discount helps State Farm stand out as one of the best Bellingham, Washington auto insurance companies for student drivers.

- Accident Forgiveness: Provides accident forgiveness for long-term customers, helping to prevent premium increases after an accident. This feature enhances State Farm’s position as one of the best Bellingham, Washington auto insurance providers for long-term policyholders.

- Wide Range of Coverage Options: Offers diverse policy options and add-ons to tailor coverage according to specific needs, making it one of the best Bellingham, Washington auto insurance choices for comprehensive coverage. Discover insights in our guide titled, State Farm auto insurance review.

Cons

- Higher Premiums for Some Drivers: Drivers with less-than-perfect records may face higher premiums compared to other providers, which can affect State Farm’s ranking as the best Bellingham, Washington auto insurance for all driver profiles.

- Customer Service Variability: The quality of customer service can vary based on the local agent, potentially leading to inconsistent experiences. This variability might impact State Farm’s overall reputation as the best Bellingham, Washington auto insurance provider.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Broad Coverage

Pros

- On Your Side® Review: Provides detailed insurance reviews to ensure optimal coverage for your needs. This personalized approach helps Nationwide stand out as one of the best Bellingham, Washington auto insurance providers for tailored coverage.

- Competitive Rates: Offers competitive rates and maintains strong financial stability with an A+ rating from A.M. Best, enhancing its status as one of the best Bellingham, Washington auto insurance companies. Read up on the Nationwide auto insurance review for more information.

- Good for New Drivers: Nationwide’s comprehensive coverage options are particularly beneficial for new drivers who need extra support and guidance, making it a top choice among the best Bellingham, Washington auto insurance providers.

Cons

- Higher Rates for New Drivers: New drivers might face higher premiums compared to other insurers, affecting Nationwide’s ranking as the best Bellingham, Washington auto insurance for those new to driving.

- Complex Policy Structure: The variety of policy options can make it challenging to navigate and select the right coverage, which might impact its standing as the best Bellingham, Washington auto insurance for those seeking simplicity.

#5 – Progressive: Best for High-Risk Drivers

Pros

- High-Risk Drivers: Known for offering competitive rates and options for high-risk drivers, Progressive’s Snapshot® program helps tailor rates based on driving behavior. This makes Progressive one of the best Bellingham, Washington auto insurance choices for high-risk drivers.

- Flexible Payment Options: Provides a range of payment plans and options to suit various financial situations, enhancing its standing as one of the best Bellingham, Washington auto insurance companies for flexibility.

- Good for High-Risk Drivers: Tailors coverage specifically for high-risk drivers, making it a suitable option among the best Bellingham, Washington auto insurance providers for those with challenging driving histories. Delve into our evaluation of Progressive auto insurance review.

Cons

- Potentially Higher Rates Without Discounts: Rates can be higher for those who do not qualify for discounts, which might affect Progressive’s standing as the best Bellingham, Washington auto insurance for those without qualifying criteria.

- Customer Service Issues: Some customers report difficulties with claims processing and support, which can impact Progressive’s reputation as the best Bellingham, Washington auto insurance provider for service quality.

#6 – Allstate: Best for New Cars

Pros

- New Car Protection: Allstate provides excellent coverage options for new cars, including new car replacement if your vehicle is totaled. This makes Allstate one of the best Bellingham, Washington auto insurance options for new car owners.

- Safe Driving Bonus: Offers rewards for safe driving habits with bonus checks, which helps reduce overall insurance costs. This program contributes to Allstate’s position as one of the best Bellingham, Washington auto insurance providers for safe drivers.

- Strong Local Agent Network: An extensive network of local agents provides personalized service and support, making Allstate one of the best Bellingham, Washington auto insurance providers for local, face-to-face interactions.

Cons

- Higher Premiums for Older Vehicles: Insurance rates for older cars can be higher, which might affect Allstate’s ranking as the best Bellingham, Washington auto insurance for those with older vehicles. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Mixed Customer Service Reviews: Customer service experiences can be inconsistent, with some reports of subpar support, which could impact Allstate’s standing as the best Bellingham, Washington auto insurance provider for service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Farmers offers a range of comprehensive coverage options, including custom parts and equipment. This extensive coverage makes Farmers one of the best Bellingham, Washington auto insurance providers for detailed protection.

- Multiple Discounts: Provides various discounts, including for bundling policies and maintaining a clean driving record. This discount availability helps Farmers stand out as one of the best Bellingham, Washington auto insurance options for cost savings.

- Customizable Policies: Allows extensive customization of policies to fit specific needs, making it one of the best Bellingham, Washington auto insurance providers for personalized coverage.

Cons

- Higher Premiums: Premiums may be higher compared to other providers, which could affect Farmers’ ranking as the best Bellingham, Washington auto insurance for cost efficiency. More information is available in our Farmers auto insurance review.

- Complex Policy Options: The variety of policy options and add-ons can be overwhelming, potentially impacting Farmers’ standing as the best Bellingham, Washington auto insurance provider for simplicity.

#8 – American Family: Best for Customer Service

Pros

- Good Discounts: Offers significant discounts, including a 23% multi-policy discount, which can reduce overall insurance costs. This discount structure contributes to American Family being considered one of the best Bellingham, Washington auto insurance providers.

- Comprehensive Coverage Options: Provides a wide range of coverage options and add-ons to meet various needs, enhancing its status as one of the best Bellingham, Washington auto insurance companies for flexible coverage.

- Strong Community Focus: American Family’s commitment to community initiatives and local involvement adds to its appeal as a trusted insurance provider in Bellingham.

Cons

- Higher Rates for Some Drivers: Rates may be higher for certain driver profiles, which could impact American Family’s standing as the best Bellingham, Washington auto insurance for all drivers.

- Limited Local Presence: Fewer local agents compared to some competitors might affect its accessibility and personal service options in Bellingham. Read more through our American Family auto insurance review.

#9 – Travelers: Best for Electric Cars

Pros

- Specialized Coverage for Electric Cars: Travelers offers coverage tailored specifically for electric vehicles, making it a top choice among the best Bellingham, Washington auto insurance providers for EV owners.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers is known for its financial strength and reliability, contributing to its reputation as one of the best Bellingham, Washington auto insurance companies.

- Customizable Policies: Offers a wide range of customizable coverage options to suit individual needs, making Travelers a strong contender for the best Bellingham, Washington auto insurance provider.

Cons

- Higher Rates for Some Drivers: Certain drivers may experience higher premiums compared to other providers, affecting Travelers’ standing as the best Bellingham, Washington auto insurance for all driver profiles. For more information, read our guide titled, “Travelers Auto Insurance Review.”

- Customer Service Variability: Customer service experiences can vary, with some reports of slower claims processing, which could impact Travelers’ reputation as the best Bellingham, Washington auto insurance provider.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Custom Coverage

Pros

- Custom Coverage Options: Liberty Mutual provides customizable coverage plans to fit various needs, making it one of the best Bellingham, Washington auto insurance providers for personalized protection. Their 10% multi-policy discount further enhances the value.

- Innovative Tools: Provides tools like the RightTrack® program to monitor driving habits and potentially lower rates, which enhances its standing as one of the best Bellingham, Washington auto insurance options for tech-savvy drivers.

- Good Financial Stability: With an A rating from A.M. Best, Liberty Mutual is recognized for its financial stability, which is crucial for ensuring reliable coverage. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Higher Premiums for Some Drivers: Rates may be higher for certain drivers, affecting Liberty Mutual’s standing as the best Bellingham, Washington auto insurance for those seeking lower premiums.

- Complex Policy Details: The extensive range of options can make it difficult to navigate and select the most suitable coverage, potentially impacting Liberty Mutual’s reputation as the best Bellingham, Washington auto insurance provider for straightforward policies.

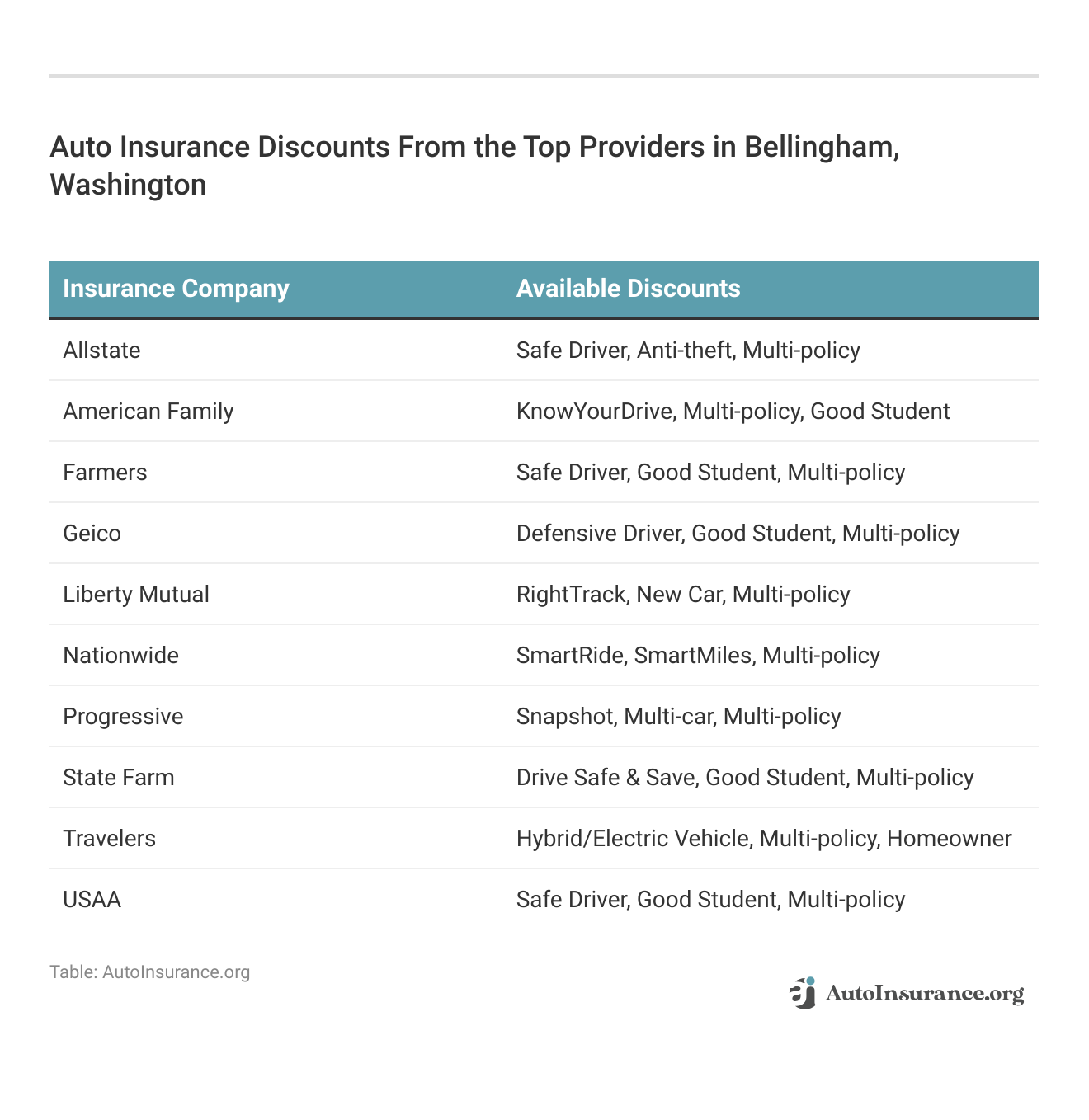

The Most Affordable Auto Insurance Providers in Bellingham, Washington

When seeking affordable auto insurance in Bellingham, Washington, managing your auto insurance policy effectively is key to finding the best rates.

Comparing rates from top providers like State Farm, Geico, and Progressive is crucial. State Farm offers a robust local network and personalized service, which could lead to lower rates for drivers with a clean record.

Bellingham, Washington Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $68 $124

American Family $58 $111

Farmers $79 $162

Geico $38 $79

Liberty Mutual $50 $109

Nationwide $55 $105

Progressive $52 $88

State Farm $40 $87

Travelers $46 $95

USAA $27 $69

Geico stands out for its budget-friendly options and user-friendly online tools, making it ideal for those looking to manage their policy with ease and secure lower premiums.

Ty Stewart

Licensed Insurance Agent

Progressive is noted for its innovative pricing models and discounts for safe driving, beneficial for those with a solid driving history.

To ensure you get the best deal, obtain quotes from these companies, assess their coverage options, discounts, and customer service, and carefully evaluate how each company’s policy management aligns with your needs.

Top Choice by Category for Cheapest Bellingham, Washington Auto Insurance

To find the most cost-effective auto insurance in Bellingham, Washington, especially if you have a bad driving record, it’s essential to compare the cheapest insurance companies across various categories.

Start by evaluating rates based on your specific driving profile, vehicle type, and coverage needs. For instance, look at basic liability coverage versus comprehensive plans to determine which offers the most savings.

Consider also the impact of factors like your driving history, age, and credit score on premium costs. Specifically, searching for “cheap auto insurance for a bad driving record” can help you identify insurance providers that offer lower rates despite a history of violations or accidents.

By thoroughly comparing these elements, you can find the insurance provider that offers the best rates tailored to your individual requirements, ensuring you get optimal coverage without overspending. Enter your ZIP code now to begin.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Basic Auto Insurance Requirements in Bellingham, Washington

Additionally, Washington law requires drivers to have uninsured/underinsured motorist coverage to safeguard against situations where other drivers lack adequate insurance.

By adhering to these legal requirements, drivers in Bellingham can help ensure they are adequately protected and compliant with state regulations.

Compare Auto Insurance Quotes for Bellingham, Washington

Frequently Asked Questions

What is Bellingham, WA auto insurance?

Bellingham, WA auto insurance refers to insurance coverage specifically designed for vehicles registered and operated within the city of Bellingham, Washington.

It provides financial protection against potential losses resulting from accidents, theft, or other damages to your vehicle or property.

Why do I need auto insurance in Bellingham, WA?

Auto insurance is mandatory in Bellingham, WA, as it is in most states across the United States.

The primary purpose of auto insurance is to protect you and other drivers from financial liabilities that may arise due to accidents or damages.

It ensures that you have the means to cover any medical expenses, property damage, or legal costs resulting from an accident. Enter your ZIP code now to begin.

Where can I find more information about auto insurance in Bellingham, WA?

Can I use my Bellingham, WA auto insurance coverage outside of the city or state?

Yes, in most cases, your auto insurance coverage extends beyond Bellingham and Washington state.

However, it’s essential to review your policy or consult with your insurance provider to understand the specific terms and limitations of your coverage when driving outside the area.

What happens if I let someone else drive my car in Bellingham, WA?

Generally, auto insurance follows the vehicle rather than the driver. If you give permission to someone else to drive your car in Bellingham, WA, your insurance coverage should apply in the event of an accident.

However, it’s important to note that if the person driving is not listed on your policy and is a frequent driver of your vehicle, you may need to add them to your policy to ensure adequate coverage. Enter your ZIP code now to begin.

Can my credit score affect my auto insurance rates in Bellingham, WA?

Yes, in most states, including Washington, insurance companies may consider your credit score when determining your auto insurance rates.

Statistically, individuals with lower credit scores tend to file more insurance claims. However, not all insurance companies weigh credit scores equally, so it’s a good idea to shop around and inquire about how your credit score may impact your rates.

Additionally, when discussing your insurance options, ask about auto insurance discounts to ask for—such as those for maintaining a good credit score, which could help you secure better rates or discounts.

What multi-policy discount percentage does Geico offer as one of the best Bellingham, Washington auto insurance providers?

Geico offers a 25% multi-policy discount, making it a top choice for affordable rates in Bellingham, Washington.

This discount contributes to its reputation as one of the best Bellingham, Washington auto insurance providers.

Which insurance provider is recognized for its coverage specifically tailored to military families in Bellingham, Washington?

USAA is recognized for its specialized coverage for military families in Bellingham, Washington.

This focus on military members helps it stand out among the best Bellingham, Washington auto insurance options. Enter your ZIP code now to begin.

What is the A.M. Best rating of Nationwide, and how does it contribute to its status as one of the best Bellingham, Washington auto insurance options?

Nationwide has an A+ rating from A.M. Best, reflecting its strong financial stability and reliability.

This high rating supports its position as one of the best Bellingham, Washington auto insurance providers. When it comes to handling claims, Nationwide is known for its fair approach, including how it manages at-fault accidents.

Their comprehensive coverage options and responsive customer service ensure that policyholders receive the support they need in the event of an at-fault accident, making it a reliable choice for drivers seeking excellent coverage and peace of mind.

How does Progressive’s Snapshot® program benefit high-risk drivers seeking the best Bellingham, Washington auto insurance?

Progressive’s Snapshot® program offers potential discounts for high-risk drivers, making it a favorable choice for those seeking savings.

This feature enhances its standing as a leading provider of the best Bellingham, Washington auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.