Best Audi Q7 Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

For the best Audi Q7 auto insurance, State Farm, Allstate, and Progressive are the best option with rates start at $30 per month. These top providers offer competitive rates and excellent coverage options. Compare Audi Q7 insurance quotes from these companies to find the best deal tailored to your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Audi Q7

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Audi Q7

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Audi Q7

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Allstate, and Progressive offer the best Audi Q7 auto insurance, with rates starting at $30 per month. These top providers deliver exceptional coverage and competitive pricing. State Farm emerges as the top pick overall for optimal affordability and comprehensive protection, helping manage your Audi insurance cost effectively.

The article also delves into strategies for finding cheap auto insurance, highlighting how various discounts and coverage options can lower your premiums.

Our Top 10 Company Picks: Best Audi Q7 Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% B Many Discounts State Farm

#2 12% A+ Add-on Coverages Allstate

#3 15% A+ Online Convenience Progressive

#4 15% A++ Cheap Rates Geico

#5 12% A++ Military Savings USAA

#6 10% A+ Usage Discount Nationwide

#7 11% A Customizable Polices Liberty Mutual

#8 10% A Local Agents Farmers

#9 10% A++ Accident Forgiveness Travelers

#10 10% A Student Savings American Family

It explains how adjusting deductibles and assessing risk factors can significantly impact costs, helping you secure affordable protection tailored to your driving profile. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- State Farm provides top coverage and rates for Audi Q7 insurance

- Get comprehensive policies and low deductibles for your Audi Q7

- Compare Audi insurance quote for affordable coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers competitive rates for Audi Q7 insurance at $95 per month, providing an affordable option for comprehensive coverage without compromising on protection.

- Excellent Customer Service: Known for its high-quality customer service, State Farm ensures that Audi Q7 owners receive prompt and efficient assistance with their insurance needs and claims.

- Comprehensive Coverage Options: As mentioned in our State Farm auto insurance review, State Farm provides a wide range of coverage options specifically for the Audi Q7, including customizable add-ons that enhance protection for your vehicle.

Cons

- Higher Premiums for Newer Models: State Farm’s premiums can increase significantly for newer Audi Q7 models, which may be a drawback for owners of recent model years seeking lower costs.

- Limited Discounts for Safety Features: While competitive, State Farm offers fewer discounts specifically for the advanced safety features of the Audi Q7 compared to some competitors, potentially reducing savings.

#2 – Allstate: Best for Add-on Coverages

Pros

- Robust Coverage: As mentioned in our Allstate auto insurance review, Allstate provides robust coverage options for the Audi Q7, including high limits for comprehensive and collision coverage, ensuring extensive protection for your vehicle.

- Multiple Discounts Available: Allstate offers various discounts, such as bundling multiple policies and safety features discounts, which can help reduce the overall cost of insuring an Audi Q7.

- Strong Claims Satisfaction: With a strong reputation for claims satisfaction, Allstate ensures that Audi Q7 owners experience efficient and fair handling of their insurance claims.

Cons

- Higher Monthly Premiums: At $114 per month, Allstate’s insurance rates for the Audi Q7 are higher compared to some other providers, which might be a disadvantage for those looking for lower premiums.

- Potential for Higher Costs with Advanced Features: Audi Q7 models with advanced features might result in higher insurance costs with Allstate due to the increased value and repair costs associated with these features.

#3 – Progressive: Best for Online Convenience

Pros

- Affordable Rates: As mentioned in Progressive auto insurance review, Progressive offers affordable insurance rates for the Audi Q7 at $140 per month, making it a cost-effective choice for comprehensive auto coverage.

- Usage-Based Discounts: Progressive’s usage-based insurance options can help reduce premiums for Audi Q7 owners who drive less frequently, providing opportunities for additional savings.

- Customizable Coverage: With Progressive, Audi Q7 owners can tailor their coverage to fit specific needs, ensuring they pay only for the protection they require.

Cons

- Higher Base Rates: Despite affordable options, Progressive’s base rates for Audi Q7 insurance can be higher compared to some competitors, which might affect those seeking the lowest possible rates.

- Limited Customer Service Options: Some users report that Progressive’s customer service may not be as responsive or comprehensive, potentially leading to delays in claims processing for Audi Q7 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Cheap Rates

Pros

- Lowest Monthly Premiums: As mentioned in our Geico auto insurance review, Geico offers the lowest monthly premiums for Audi Q7 insurance at $71, making it an excellent option for cost-conscious drivers seeking affordable coverage.

- Good Discount Programs: Geico provides a variety of discount programs, including those for safe driving and anti-theft devices, which can further reduce insurance costs for Audi Q7 owners.

- Efficient Online Services: Geico’s user-friendly online services allow Audi Q7 owners to easily manage their policies, file claims, and get quotes, enhancing convenience and accessibility.

Cons

- Limited High-Value Vehicle Coverage: Geico’s coverage options for high-value vehicles like the Audi Q7 may be less comprehensive compared to other providers, potentially leaving gaps in coverage.

- Customer Service Variability: Geico’s customer service experience can vary, with some users reporting less satisfactory interactions, which might impact Audi Q7 owners’ overall satisfaction with their insurance.

#5 – USAA: Best for Military Savings

Pros

- Competitive Rates for Military Families: USAA offers competitive rates for Audi Q7 insurance at $127 per month, providing excellent value, especially for military families and veterans with special discounts.

- Comprehensive Coverage Options: USAA provides extensive coverage options specifically for the Audi Q7, including comprehensive and collision coverage, ensuring thorough protection for your vehicle.

- High Customer Satisfaction: As outlined in our USAA auto insurance review, USAA consistently scores high in customer satisfaction and claims handling, making it a reliable choice for Audi Q7 owners who value excellent service.

Cons

- Eligibility Restrictions: USAA insurance is available only to military members and their families, which limits access for the general public who own an Audi Q7.

- Higher Premiums for Younger Drivers: Younger drivers may face higher premiums with USAA, which could be a drawback for younger Audi Q7 owners seeking more affordable insurance options.

#6 – Nationwide: Best for Usage Discount

Pros

- Broad Coverage Options: Nationwide offers a wide range of coverage options for the Audi Q7, including customizable plans that allow owners to tailor protection based on their specific needs.

- Multiple Discounts: Nationwide provides various discounts, such as bundling multiple policies and maintaining a clean driving record, which can help reduce insurance costs for Audi Q7 owners.

- Solid Financial Strength: Nationwide’s strong financial stability offers reassurance to Audi Q7 owners that their claims will be handled reliably and efficiently. For more information, read our Nationwide auto insurance review.

Cons

- Higher Rates for High-Performance Models: Audi Q7 models with advanced features or high performance might result in higher premiums with Nationwide, which could be a disadvantage for those seeking lower rates.

- Customer Service Variability: Some customers have reported inconsistent customer service experiences with Nationwide, which might affect overall satisfaction for Audi Q7 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Polices

Pros

- Comprehensive Coverage Options: Liberty Mutual offers extensive coverage for the Audi Q7, including high limits and add-ons that provide thorough protection for various scenarios.

- Discounts for Safety Measures: Liberty Mutual provides discounts for the safety features and anti-theft devices installed in the Audi Q7, helping to lower the overall cost of insurance.

- Flexible Payment Plans: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual offers flexible payment plans, allowing Audi Q7 owners to manage their premiums in a way that suits their financial situation.

Cons

- Higher Monthly Premiums: At $123 per month, Liberty Mutual’s premiums for the Audi Q7 are higher compared to other providers, which might not be ideal for those looking to minimize their insurance expenses.

- Potential for Higher Costs with Claims: Liberty Mutual may have higher costs associated with claims processing, potentially impacting the overall affordability of insurance for Audi Q7 owners.

#8 – Farmers: Best for Local Agents

Pros

- Extensive Coverage Options: Farmers provides a wide range of coverage options for the Audi Q7, including customizable plans that cater to various needs and preferences.

- Strong Customer Support: Known for robust customer support, Farmers ensures that Audi Q7 owners receive effective assistance with their insurance needs and claims.

- Variety of Discounts: As mentioned in our Farmers auto insurance discounts, Farmers offers numerous discounts, including those for safe driving and bundling multiple policies, which can help reduce insurance costs for Audi Q7 owners.

Cons

- High Premiums: At $191 per month, Farmers’ insurance rates for the Audi Q7 are the highest among the listed providers, which may not be suitable for budget-conscious consumers.

- Limited Discounts for Advanced Features: Farmers may offer fewer discounts for the advanced features of the Audi Q7, potentially leading to higher premiums despite the vehicle’s safety enhancements.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Wide Range of Coverage: Travelers offers a broad array of coverage options for the Audi Q7, including high limits and comprehensive plans tailored to protect various aspects of the vehicle.

- Discounts for Safety Measures: Travelers provides discounts for safety features and anti-theft devices installed in the Audi Q7, helping to reduce the overall cost of insurance.

- Strong Financial Stability: As mentioned in our Travelers auto insurance review, Travelers is known for its financial stability, giving Audi Q7 owners confidence that their insurance claims will be handled reliably.

Cons

- Higher Premiums for Newer Models: Travelers may have higher premiums for newer Audi Q7 models, which could be a disadvantage for those with recent vehicle purchases.

- Customer Service Concerns: Some users have reported issues with Travelers’ customer service, which may impact the overall experience for Audi Q7 owners, especially when handling claims or policy adjustments.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Student Savings

Pros

- Affordable Premiums: As outlined in our American Family auto insurance review, American Family offers competitive premiums for Audi Q7 insurance at $109 per month, providing a cost-effective option for those seeking comprehensive coverage without excessive costs.

- Extensive Coverage Options: American Family provides a variety of coverage options specifically tailored for the Audi Q7, including comprehensive and collision coverage that ensures thorough protection for your vehicle.

- Discounts for Safety Features: American Family offers discounts for safety features and advanced technology in the Audi Q7, such as anti-theft devices and advanced driver assistance systems, helping to reduce overall insurance costs.

Cons

- Potential for Higher Costs with Add-Ons: While the base premiums are affordable, adding extra coverage options or add-ons may increase the overall cost of insuring the Audi Q7 with American Family, potentially impacting budget-conscious owners.

- Customer Service Variability: Some customers have reported inconsistencies in American Family’s customer service, which might affect the overall satisfaction of Audi Q7 owners when handling claims or policy issues.

Audi Q7 Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Audi Q7 from various providers.

Audi Q7 Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $37 $114

American Family $35 $109

Farmers $62 $191

Geico $23 $71

Liberty Mutual $40 $123

Nationwide $36 $113

Progressive $46 $140

State Farm $30 $95

Travelers $46 $141

USAA $42 $127

When choosing insurance for your Audi Q7, comparing rates from different providers can help you find the best coverage at an affordable price. Whether you prioritize cost or comprehensive coverage, options like Geico and State Farm offer competitive rates to meet your needs.

Understanding how different deductible levels and risk factors affect your Audi Q7 insurance rates can help you make more informed decisions. Adjusting your deductible and assessing your risk profile can significantly impact your overall insurance costs. For those in high-risk categories, exploring tailored high-risk auto insurance options can also be beneficial in finding suitable coverage at a manageable cost.

Why Audi Q7s Insurance are Expensive

The chart below details how Audi Q7 insurance rates compare to other SUVs like the Toyota Sequoia, Cadillac Escalade ESV, and Volkswagen Touareg.

Audi Q7 Auto Insurance Monthly Rates by Coverage Type

| Type | Rate |

|---|---|

| Average Rate | $139 |

| Discount Rate | $82 |

| High Deductibles | $120 |

| High Risk Driver | $295 |

| Low Deductibles | $175 |

| Teen Driver | $507 |

Audi Q7 insurance costs can be higher compared to other SUVs due to its comprehensive and collision coverage rates. Comparing these rates with similar vehicles can help you understand the factors contributing to its higher insurance expenses.

Read More: Cheap Dodge Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Influencing the Audi Q7 Insurance Cost

The trim and model of your Audi Q7 significantly influence your insurance costs. Higher trims and newer models often come with advanced technology and features, which can increase repair and replacement costs, thereby raising insurance premiums.

More expensive trims might attract higher premiums due to their higher value and the increased risk associated with their enhanced performance and luxury features.Scott W. Johnson LICENSED INSURANCE AGENT

Insurance providers consider these factors when calculating your rates, as they impact the potential cost of claims and the overall risk profile of insuring your vehicle.

Age of the Vehicle

The average Audi Q7 auto insurance rates are higher for newer models. For example, auto insurance for a 2018 Audi Q7 costs $138, while 2010 Audi Q7 insurance costs are $111, a difference of $27.

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $507 | $550 | $580 | $650 |

| Age: 18 | $420 | $460 | $490 | $550 |

| Age: 20 | $314 | $342 | $360 | $405 |

| Age: 30 | $145 | $158 | $170 | $190 |

| Age: 40 | $139 | $151 | $163 | $182 |

| Age: 45 | $133 | $145 | $156 | $175 |

| Age: 50 | $127 | $138 | $149 | $167 |

| Age: 60 | $124 | $135 | $145 | $162 |

Insurance costs for the Audi Q7 generally decrease as the vehicle ages, reflecting lower repair and replacement costs for older models. Understanding these variations can help you budget more effectively and select the appropriate coverage for your Audi Q7 based on its model year.

Driver Age

Driver age can have a significant effect on the cost of Audi Q7 auto insurance. For example, 30-year-old drivers pay approximately $6 more for their Audi Q7 auto insurance than 40-year-old drivers.

Audi Q7 Auto Insurance Monthly Rates by Age

| Age | Rate |

|---|---|

| Age: 16 | $507 |

| Age: 18 | $420 |

| Age: 20 | $314 |

| Age: 30 | $145 |

| Age: 40 | $139 |

| Age: 45 | $133 |

| Age: 50 | $127 |

| Age: 60 | $124 |

Driver age plays a crucial role in determining Audi Q7 insurance rates, with younger drivers often facing significantly higher premiums compared to older, more experienced drivers. By understanding how age impacts insurance costs, you can better plan your budget and explore ways to reduce expenses.

Driver Location

Where you live can have a large impact on Audi Q7 insurance rates. For example, drivers in New York may pay $84 a month more than drivers in Seattle.

Audi Q7 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $183 |

| Columbus, OH | $115 |

| Houston, TX | $217 |

| Indianapolis, IN | $118 |

| Jacksonville, FL | $201 |

| Los Angeles, CA | $237 |

| New York, NY | $219 |

| Philadelphia, PA | $186 |

| Phoenix, AZ | $161 |

| Seattle, WA | $135 |

Your location has a substantial effect on Audi Q7 insurance rates, with significant variations between cities. For instance, residing in high-risk areas like New York can lead to much higher premiums compared to cities with lower risk profiles, such as Seattle.

Read More: Cheap Auto Insurance for Drivers Over 60

Your Driving Record

Your driving record can have an impact on the cost of Audi Q7 auto insurance. Teens and drivers in their 20’s see the highest jump in their Audi Q7 auto insurance rates with violations on their driving record.

Audi Q7 Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $507 | $550 | $580 | $650 |

| Age: 18 | $420 | $460 | $490 | $550 |

| Age: 20 | $314 | $342 | $360 | $405 |

| Age: 30 | $145 | $158 | $170 | $190 |

| Age: 40 | $139 | $151 | $163 | $182 |

| Age: 45 | $133 | $145 | $156 | $175 |

| Age: 50 | $127 | $138 | $149 | $167 |

| Age: 60 | $124 | $135 | $145 | $162 |

A clean driving record can significantly lower your Audi Q7 insurance rates, while violations and accidents, especially for younger drivers, can lead to substantial increases. Maintaining a clean record is crucial for managing and reducing your insurance costs effectively.

Safety Ratings

The insurance rates for your Audi Q7 are closely linked to its safety ratings. Here’s a detailed breakdown of the Audi Q7’s performance in various safety tests.

Audi Q7 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Audi Q7’s strong safety ratings contribute to potentially lower insurance premiums. High ratings in key areas indicate a lower risk for insurers, which can translate into more affordable rates for you.

Crash Test Ratings

The crash test ratings for the Audi Q7 play a crucial role in determining your insurance rates. The following table outlines the safety performance of various model years in key crash categories.

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Audi Q7 SUV AWD | Good | Good | 5 stars | 4 stars |

| 2020 Audi Q7 SUV AWD | N/R | N/R | 5 stars | 4 stars |

| 2019 Audi Q7 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Audi Q7 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Audi Q7 SUV AWD | N/R | N/R | N/R | N/R |

Consistently high crash test ratings can lead to lower insurance premiums for the Audi Q7. Evaluating these ratings helps understand how vehicle safety influences overall insurance costs.

Safety Features

The safety features of the Audi Q7 can impact your Audi Q7 auto insurance rates. The Audi Q7 has the following safety features:

- Comprehensive Air Bag System: Includes driver, passenger, front head, rear head, front side, and rear side air bags for extensive occupant protection.

- Advanced Safety Features: Equipped with 4-wheel ABS, electronic stability control, brake assist, and traction control for enhanced driving stability.

- Convenience and Visibility: Features daytime running lights, auto-leveling headlights, and integrated turn signal mirrors to improve road safety.

- Collision Avoidance Technologies: Includes blind spot monitor, lane departure warning, and cross-traffic alert to help prevent accidents.

- Child and Family Safety: Offers child safety locks to secure young passengers and rear side air bags for additional protection.

The Audi Q7’s robust safety features not only enhance protection but also influence insurance rates. Investing in such advanced technologies can potentially lead to savings on premiums by reducing risk and improving overall safety.

Loss Probability

The lower percentage means lower Audi Q7 auto insurance costs; higher percentages mean higher Audi Q7 auto insurance costs. Compare the following Audi Q7 auto insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury.

Audi Q7 Insurance Loss Probability

| Coverage Category | Loss Rate |

|---|---|

| Bodily Injury | -24% |

| Collision | 62% |

| Comprehensive | 64% |

| Medical Payment | -46% |

| Personal Injury | -47% |

| Property Damage | -4% |

Understanding the loss probability rates for different types of coverage can help you gauge potential insurance costs for your Audi Q7. Lower loss rates generally suggest reduced insurance expenses, while higher rates may lead to increased premiums.

Audi Q7 Finance and Insurance Cost

If you are financing an Audi Q7, most lenders will require you to carry higher Audi Q7 coverage options, including comprehensive coverage. Be sure to shop around and compare Audi Q7 car insurance rates from the best companies using our free tool below. For those looking for cost-effective solutions, finding cheap Audi auto insurance can help balance coverage needs with budget considerations.

5 Ways to Save on Audi Q7 Insurance

There are many ways that you can save on Audi Q7 auto insurance. Below are five actions you can take to find cheap Audi Q7 auto insurance rates.

- Move to an area with better weather.

- Provide your Audi Q7 VIN when requesting Audi Q7 insurance rates.

- Get a plan with only liability coverage if you’re driving an older Audi Q7.

- Work with a direct insurer instead of an insurance broker for your Audi Q7.

- Buy an older Audi Q7.

Read More: Cheapest Liability-Only Auto Insurance

Finding affordable insurance for your Audi Q7 is achievable with these strategies. Implement these tips to lower your premiums and enjoy significant savings.

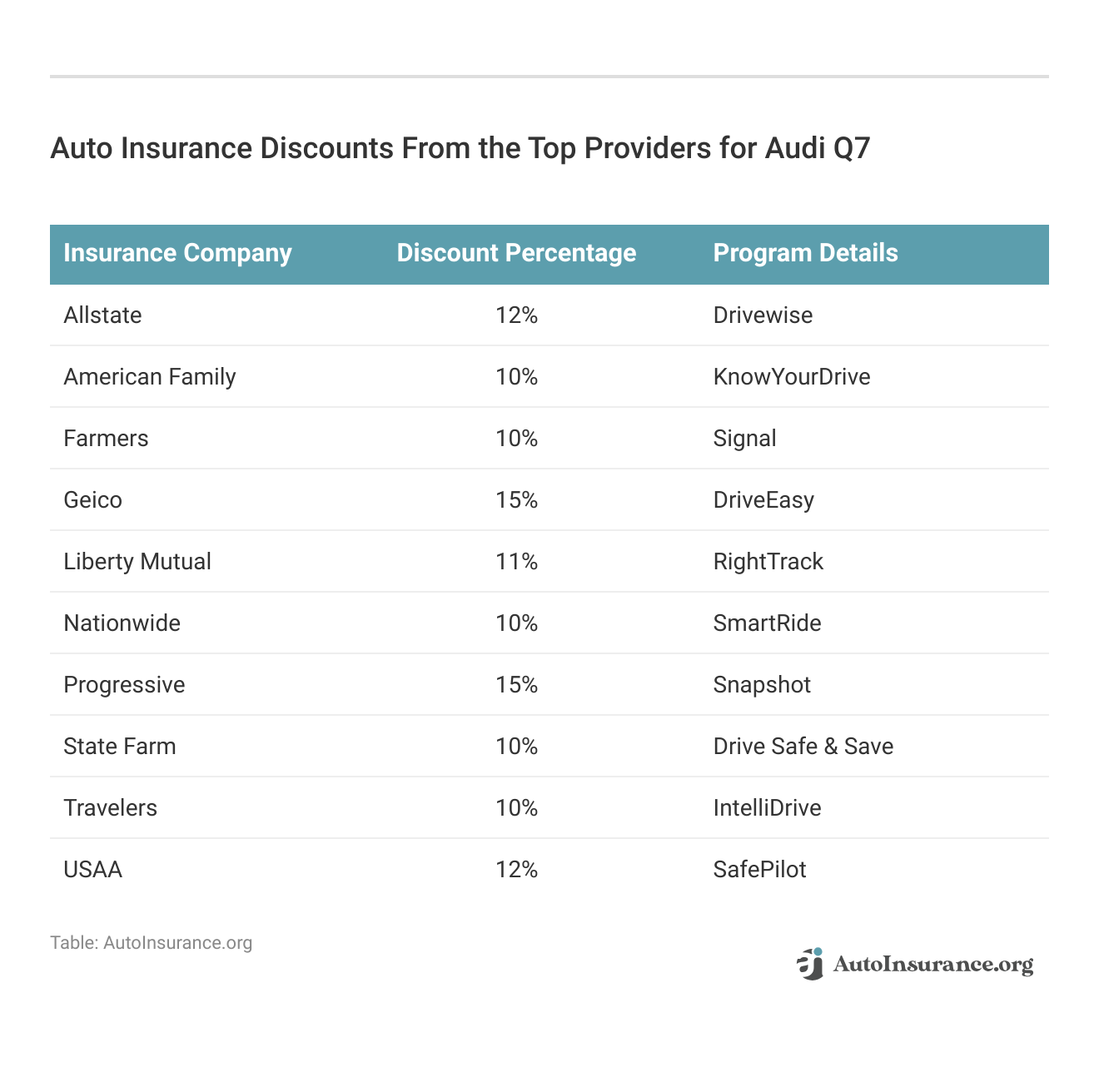

These discounts from top insurance providers for Audi Q7 offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Audi Q7 Insurance Companies

Who are the best auto insurance companies for Audi Q7 insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Audi Q7 auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Audi Q7 offers.

Top Audi Q7 Largest Auto Insurers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Allstate | $39.2 million | 5% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20.0 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

Choosing the right auto insurance company for your Audi Q7 can significantly impact your coverage and rates. Review top providers to find the best fit, considering factors such as market share, discounts, and specific coverage options for your vehicle.

Compare Free Audi Q7 Insurance Quotes Online

Explore the best Audi Q7 auto insurance options by using our free comparison tool. By comparing quotes online, you can easily evaluate different providers and find the most competitive rates for your Audi Q7.

This tool allows you to assess various coverage levels and discounts available, ensuring you get the best protection at the most affordable price. Don’t miss out on potential savings and enhanced coverage—start comparing today to find the best Audi Q7 auto insurance for your needs.

For guidance on where to compare auto insurance rates, use our free comparison tool to make an informed decision. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

What factors can affect the insurance premium for an Audi Q7?

Audi car insurance rates are influenced by several factors including the model of the vehicle, your driving history, location, and the coverage levels you choose. For example, luxury models like the Audi Q7 might have higher rates due to their value and repair costs.

Are Audi Q7 SUVs generally more expensive to insure compared to other vehicles?

SUVs, including the Audi Q7, can often have higher insurance premiums than smaller cars due to factors such as their size, weight, and potential for causing more damage in accidents. However, insurance rates can vary among different models and insurance providers.

How does the Audi Q7’s safety features affect insurance premiums?

The Audi Q7’s advanced safety features can lead to lower Audi Q7 insurance price as they reduce the risk of accidents and potential claims. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

What are some pros of insuring an Audi Q7?

Audi insurance can be beneficial due to its advanced safety features, which may lower premiums. Many insurers offer discounts for luxury vehicles, and the Q7’s strong resale value can help reduce overall insurance costs.

What are some cons of insuring an Audi Q7?

Insuring an Audi Q7 can be costly due to higher repair expenses, increased theft risk, and expensive replacement parts, all of which can lead to higher insurance premiums.

Does gender affect Audi Q7 auto insurance rates?

Yes, gender can influence Audi Q7 auto insurance rates. Generally, younger male drivers might face higher premiums due to statistically higher accident rates. However, rates vary by insurer and individual driving history, so it’s essential to compare quotes to get the best rate.

Read More: Male vs. Female Auto Insurance Rates

How does my driving history impact Audi Q7 insurance rates?

A clean driving history with no accidents or traffic violations generally leads to lower Audi Q7 insurance rates. Conversely, a history of accidents or tickets can increase premiums due to higher perceived risk.

How much does it cost to insure an Audi?

Insuring an Audi generally costs between $100 to $210 per month. Rates vary based on the model, location, and driver profile, with the Audi Q7 typically starting around $30 per month with top insurers like State Farm, Allstate, and Progressive.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Are Audi Q7s reliable?

The Audi Q7 generally scores well for reliability, with robust performance and advanced features. However, like any luxury vehicle, maintenance and repair costs can be higher. Regular upkeep and adhering to service schedules can help maintain its reliability.

Read More: Best Auto Insurance for Luxury Cars

How does a crash test rating affect Audi Q7 insurance rates?

A high crash test rating for the Audi Q7 can positively impact insurance rates. Vehicles with excellent safety ratings are often considered less risky to insure, potentially leading to lower premiums due to their enhanced safety features and lower likelihood of severe accidents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.