Best Auto Insurance After a DUI in Kentucky (Top 10 Companies Ranked for 2025)

Starting at a monthly rate of $47, Progressive, State Farm, and Allstate have the best auto insurance after a DUI in Kentucky. These top providers ensure you get back on the road without breaking the bank, with bundling discounts of up to 20% to help lower Kentucky DUI auto insurance costs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage After a DUI in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage After a DUI in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage After a DUI in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best auto insurance after a DUI in Kentucky comes from Progressive, State Farm, and Allstate, standing out for their comprehensive coverage and exceptional support.

Kentucky might not be one of the best states for affordable DUI auto insurance, but the best insurance companies that accept DUI drivers excel in balancing low rates with reliability and competitive bundling discounts.

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Kentucky

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Flexible Coverage | Progressive | |

| #2 | 15% | B | Strong Support | State Farm | |

| #3 | 12% | A+ | Low-Mileage Drivers | Allstate | |

| #4 | 14% | A | Insurance Discounts | Farmers | |

| #5 | 16% | A | Accident Forgiveness | Liberty Mutual |

| #6 | 13% | A+ | Customer Service | Nationwide |

| #7 | 11% | A++ | Broad Coverage | Travelers | |

| #8 | 12% | A | Young Drivers | American Family | |

| #9 | 20% | A+ | Senior Drivers | The Hartford |

| #10 | 9% | A++ | Personalized Service | Auto-Owners |

Kentucky auto insurance premiums after a DUI will be higher than average costs for safe drivers.

Compare these top companies to get the best DUI insurance rates. Scroll down or enter your ZIP code above to compare cheap auto insurance quotes near you.

- Progressive leads as the top choice for post-DUI auto insurance in Kentucky

- State Farm has the highest DUI insurance claim satisfaction in KY

- Allstate Milewise helps low-mileage drivers save on Kentucky DUI insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Customizable Plans: Progressive excels in offering highly adaptable insurance plans specially crafted for drivers who have experienced a DUI in Kentucky, making it the top choice for the best insurance after DUI charges.

- Competitive Pricing: Progressive emphasizes affordability and provides competitively priced policies that don’t compromise coverage, even after a DUI in Kentucky.

- Snapshot Advantage: Snapshot rewards help mitigate DUI rate increases in Kentucky. Learn more in our Progressive Snapshot review.

Cons

- Limited Bundling Savings: The 10% bundling discount offered by Progressive may seem modest when compared to other Kentucky DUI auto insurance companies.

- Costly Add-Ons: While optional coverages can be beneficial, they might significantly increase the overall policy cost, especially for drivers with a DUI in Kentucky.

#2 – State Farm: Best for Strong Support

Pros

- Generous Bundling Discount: State Farm offers a substantial 15% discount on Kentucky DUI auto insurance when bundling policies. Compare more discounts in our State Farm auto insurance review.

- Extensive Local Agent Network: With a strong presence of local agents, State Farm provides personalized and accessible support with a State Farm DUI policy, which is crucial for navigating the complexities of a DUI in Kentucky.

- High Claims Satisfaction: State Farm is known for its customer-friendly claims process, ensuring efficient and supportive handling after a DUI in Kentucky.

Cons

- Low A.M. Best Ratings: State Farm is one the least dependable KY auto insurance companies on this list, with a B financial rating from A.M. Best.

- Rigid Policy Structure: State Farm’s policies might lack the flexibility required to make adjustments that are often necessary after a DUI in Kentucky.

#3 – Allstate: Best for Low-Mileage Drivers With DUIs

Pros

- Decent Bundling Incentives: Allstate’s 12% bundling discount offers valuable savings, especially for drivers dealing with the financial aftermath of a DUI in Kentucky.

- Milewise Program Rewards: Allstate Milewise sets rates based on monthly mileage, which can reduce high-risk insurance costs in Kentucky. Learn how in our Allstate Milewise Review.

- Wide Range of Coverage: Allstate provides a diverse array of coverage options, making it easier to customize a policy to meet the specific challenges posed by a DUI in Kentucky.

Cons

- Higher Premium Rates: Allstate DUI insurance rates can be higher than expected, particularly for drivers with more than one DUI in Kentucky on their record.

- Limited Discount Options: While the bundling discount is helpful, other discounts may be less available or impactful for those with a DUI in Kentucky.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best for DUI Insurance Discounts

Pros

- Attractive Bundling Savings: Farmers offers a competitive 14% bundling discount, which can be especially beneficial for those looking to reduce their overall costs after a DUI in Kentucky.

- Multiple Discount Opportunities: Farmers provides a variety of discounts that make Kentucky DUI auto insurance more affordable. Get a full list in our Farmers Insurance review.

- User-Friendly Online Tools: Farmers’ digital tools simplify policy management, which is a significant advantage for drivers handling the complexities of a DUI in Kentucky.

Cons

- Premium Rate Concerns: Even with discounts, premiums can still be on the higher side, especially for those dealing with a DUI in Kentucky.

- Limited Coverage Choices: Farmers’ coverage options may not be as extensive, potentially leaving gaps in DUI insurance protection in Kentucky.

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Bundling Savings: Liberty Mutual’s bundling discount is 16%, a significant benefit for drivers looking to save after a DUI in Kentucky.

- Accident Forgiveness Benefits: Accident forgiveness helps protect against large premium increases, an essential feature for those with a DUI in Kentucky.

- Flexible Policy Options: Liberty Mutual provides adaptable DUI insurance coverage options in Kentucky. See what’s available in our Liberty Mutual auto insurance review.

Cons

- Premium Cost Concerns: Even with available discounts, premiums can still be high, particularly for drivers managing the aftermath of a DUI in Kentucky.

- Complex Claims Processing: Liberty Mutual’s claims process can be complex and time-consuming, which might add stress for those with a DUI in Kentucky.

#6 – Nationwide: Best for Customer Service

Pros

- On Your Side Review: This unique feature provides personalized policy reviews, ensuring that drivers with a DUI in Kentucky have the best coverage. Learn how in our Nationwide auto insurance review.

- Few Customer Complaints: Nationwide customer service receives 40% fewer customer complaints than other Kentucky DUI auto insurance companies its size.

- 13% Bundling Discount: Nationwide offers a solid bundling discount, which is helpful for reducing costs after a DUI in Kentucky.

Cons

- Premium Costs: Despite excellent service, Nationwide’s premiums can be relatively high, particularly for drivers with a DUI in Kentucky.

- Agent Availability: Fewer local agents in some areas might reduce accessibility for personalized service regarding Kentucky DUI auto insurance policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Broad Coverage

Pros

- 11% Bundling Discount: Travelers offers a reasonable bundling discount, which can help lower costs for those with a DUI in Kentucky. Learn more by reading our review of Travelers auto insurance.

- Comprehensive Coverage Options: Travelers provides a wide array of coverage choices, making it easier to tailor policies to the specific needs after a DUI in Kentucky.

- Premier Responsible Driver Plan: This program helps reduce rate increases after a DUI in Kentucky, offering drivers more control over their premiums on the best DUI auto insurance.

Cons

- Limited Agent Interaction: Fewer local agents might mean less personalized service for drivers with a DUI in Kentucky.

- Strict Underwriting: Travelers may have stricter underwriting guidelines, making it harder to qualify for certain discounts after a DUI in Kentucky.

#8 – American Family: Best for Young Drivers With DUIs

Pros

- Teen Safe Driver Program: This program offers discounts and safety features, particularly beneficial for young drivers with a DUI in Kentucky.

- DreamSecure Options: American Family’s DreamSecure plans offer additional security and flexibility for DUI insurance in Kentucky. Find out more in our AmFam auto insurance review.

- 12% Bundling Discount: American Family provides a solid discount for bundling, which helps keep premiums lower for drivers with a DUI in Kentucky.

Cons

- Higher Premiums for Risky Drivers: Even with discounts, premiums can still be high for drivers with a DUI in Kentucky.

- Limited Online Features: American Family’s digital tools are less advanced, which may complicate DUI policy management for Kentucky drivers.

#9 – The Hartford: Best for Senior Drivers With DUIs

Pros

- 20% Bundling Discount: The Hartford offers a significant bundling discount, which is particularly advantageous for drivers with a DUI in Kentucky.

- AARP Membership Benefits: Exclusive to AARP members, these benefits include added protections and discounts, beneficial for older drivers who need DUI auto insurance in Kentucky.

- Lifetime Renewability: The Hartford guarantees renewability for policyholders, which is reassuring for those with a DUI in Kentucky. Learn more in The Hartford auto insurance review.

Cons

- Exclusive AARP Membership: Discounts and benefits are tied to AARP membership, which may limit accessibility for younger Kentucky drivers with DUIs.

- Strict Policy Terms: Policy terms might be less flexible, which could disadvantage drivers needing specific coverage adjustments post-DUI in Kentucky.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for Personalized Service

Pros

- Personalized Agent Service: Auto-Owners provide personalized attention for Kentucky drivers with DUIs. Read our review of Auto-Owners auto insurance.

- A++ Financial Strength: With an A++ rating from A.M. Best, Auto-Owners ensures superior financial stability among Kentucky DUI auto insurance companies.

- Comprehensive Coverage Options: Auto-Owners offer a wide range of coverage options, allowing drivers to tailor their policies to meet the specific challenges of a DUI in Kentucky.

Cons

- Lower Bundling Discount: The 9% bundling discount is lower than competitors, which may not provide substantial savings after a DUI in Kentucky.

- Agent Dependency: While personalized, the reliance on agents may limit flexibility for Kentucky drivers with DUIs who prefer managing policies online.

Comparing Auto Insurance Rates After a DUI in Kentucky

A DUI conviction often leads to substantial increases as it signals a higher risk to insurers, especially if you are looking for the best car insurance with a DUI that has the most protection. Younger drivers, in particular, face even steeper premiums due to the combined impact of age and driving history.

The level of coverage selected at companies with the best car insurance after DUI charges also plays a pivotal role. This wide range of rates underscores the need to assess your specific needs and budget when choosing the best car insurance for DUI drivers.

Kentucky DUI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $176 | $483 | |

| $120 | $330 | |

| $86 | $283 | |

| $121 | $334 | |

| $89 | $245 |

| $166 | $459 |

| $63 | $175 | |

| $47 | $129 | |

| $86 | $283 |

| $112 | $306 |

When comparing minimum coverage among the best auto insurance companies for DUI drivers, State Farm stands out with the lowest rate at $47/month, while Allstate tops the scale at $145/month.

State Farm also offers a highly competitive monthly rate of $106 for full coverage car insurance in Kentucky, whereas Allstate’s full coverage peaks at $398 monthly.

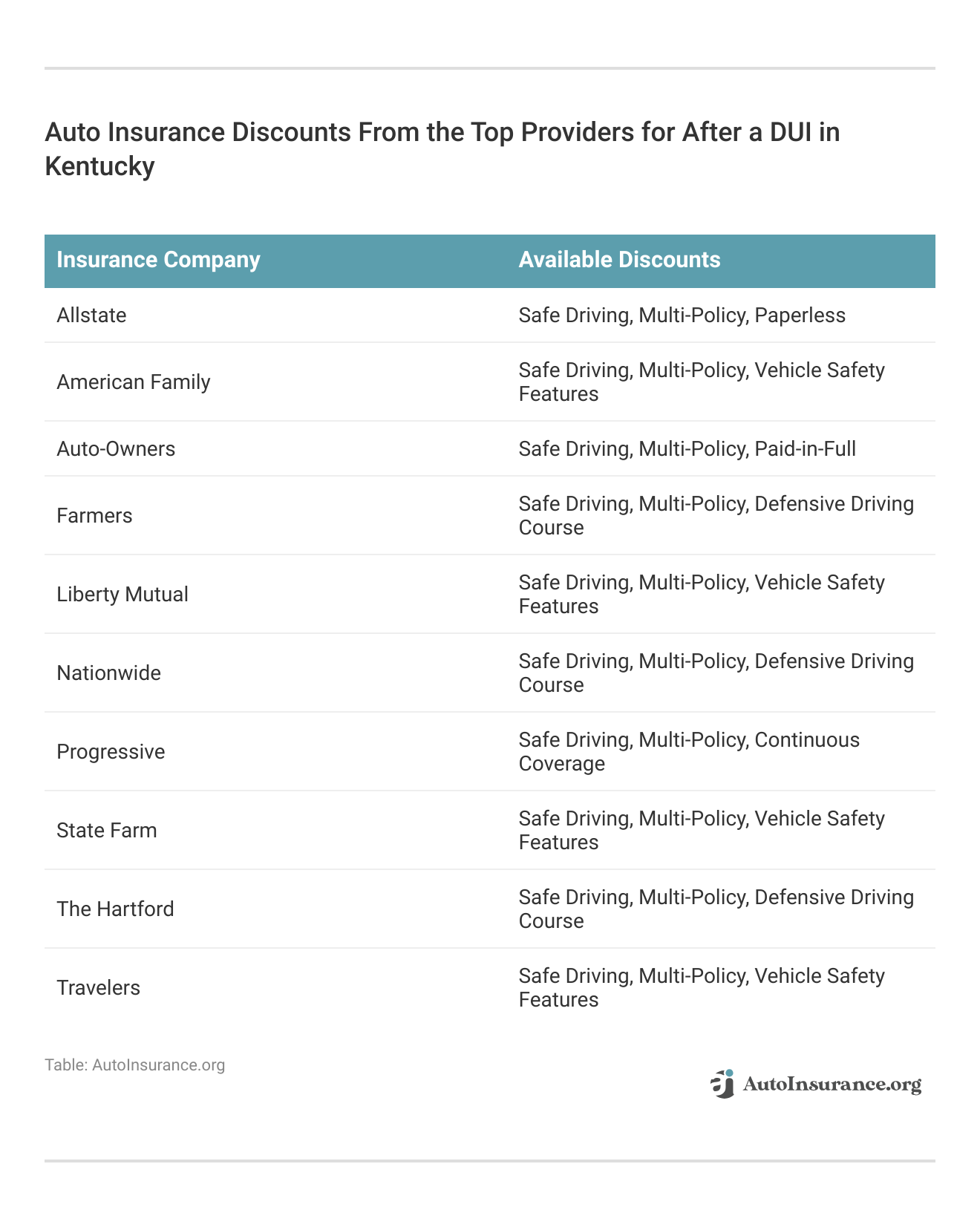

Reducing Kentucky Auto Insurance Premiums After a DUI

If you have a DUI, make sure to do research into how to lower car insurance after DUI charges. While it’s hard to find cheap car insurance for drivers with DUI charges, this doesn’t mean you can’t effectively lower your auto insurance costs after a DUI in Kentucky. To find cheap auto insurance with a DUI, consider a multi-pronged approach.

First, explore the possibility of bundling your auto insurance with other policies, like home or renters insurance, to save money by bundling insurance policies.

Maintaining a clean driving record post-DUI is crucial, as safe driving over time can gradually reduce your premiums. Participating in a defensive driving course is another smart move, as completing such programs can lead to significant premium reductions by demonstrating a commitment to safe driving.

Defensive driving courses teach drivers how to anticipate and avoid hazards, which helps drivers prevent accidents.

You’ll also qualify for defensive driver auto insurance discounts. Your insurance company may also offer a good driver program you can participate in for a discount, such as Progressive’s Snapshot program.

Progressive’s Snapshot program can further reduce premiums for safe driving, making it the top choice for DUI drivers seeking cost-effective solutions.Dani Best Licensed Insurance Producer

Use this table for a complete list of the best auto insurance discounts for Kentucky drivers with DUIs and score the cheapest auto insurance after a DUI:

Additionally, opting for higher deductibles can immediately reduce your monthly payments on the best car insurance after a DUI, though it’s important to ensure you can cover the deductible if needed. Insurance companies that will cover DUI drivers usually offer adjustable deductibles to help make coverage more affordable.

Shopping around and comparing quotes from the best Kentucky auto insurance insurers is also vital. Companies with the best auto insurance in KY may offer more competitive rates for drivers with a DUI. Using these strategies, you can better manage the higher insurance costs when shopping for the best auto insurance with a DUI.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Best Auto Insurance After a DUI in Kentucky

Securing auto insurance after a DUI in Kentucky can be challenging, but choosing from among the best insurance companies for DUI offenders can make all the difference. These case studies highlight how Progressive, State Farm, and Allstate offer the best insurance for DUI Kentucky drivers, making them the best insurance companies for DUI drivers in Kentucky:

Case Study #1: Customized Coverage with Progressive

After receiving a DUI in Kentucky, Jake feared unaffordable premiums after looking up the prices of the best insurance for DUI drivers. Progressive stepped in with a flexible, customizable policy that balanced comprehensive coverage with affordability.

Case Study #2: Rebuilding Confidence with State Farm

Lisa was overwhelmed by the potential costs after her DUI conviction. State Farm provided her with a policy that offered competitive rates and accident forgiveness, helping Lisa regain her confidence on the road while getting cheap car insurance with a DUI.

Case Study #3: Rewarding Safe Driving with Allstate

Mike, who was concerned about his rising insurance rates post-DUI, turned to Allstate, which an agent recommended as the best auto insurance for DUI drivers. Through Milewise, Mike was able to reduce his premiums by reducing his monthly mileage.

These case studies underscore the importance of selecting one of the providers of the best car insurance in Kentucky that understands the complexities and challenges associated with a DUI. Progressive, State Farm, and Allstate have the best Kentucky auto insurance and empower drivers to navigate their post-DUI circumstances with confidence and financial stability.

Breaking Down the Best Insurance Providers for DUI Drivers in Kentucky

Out of all the best car insurance companies for DUI offenders, Progressive stands out with the best auto insurance after a DUI in Kentucky. It has the best car insurance for DUI coverage because its policies address the specific requirements of higher-risk drivers, with the added advantage of customizable features to help keep premiums within reach.

Progressive accepts higher-risk drivers who may have trouble getting insured and allows customers to adjust their coverage and deductible for a more affordable policy.Justin Wright Licensed Insurance Agent

State Farm is a close competitor for the best insurance for DUI offenders, recognized for its dependable support and favorable pricing that makes it one of the more affordable DUI insurance companies, particularly with its accident forgiveness program that eases the financial impact of a DUI.

Allstate completes the list of leading auto insurance companies in Kentucky, offering a wide array of coverage choices along with the Milewise initiative, which offers a way to lower premiums with lower mileage.

The best DUI insurance companies not only grasp the difficulties encountered by drivers with a DUI but also deliver tailored strategies that strike a balance between cost-effectiveness and comprehensive auto insurance coverage, making them the top selections for those who need to buy DUI auto insurance in Kentucky.

Regardless of your location and driving record, you can find affordable auto insurance by entering your ZIP code below in our free quote comparison tool. Whether you are shopping for the best auto insurance in California with DUI charges or Kentucky insurance with a clean driving record, our tool will help you find great coverage.

Frequently Asked Questions

How long does DUI affect insurance in Kentucky?

A DUI can impact your insurance rates in Kentucky for up to five years, leading to higher premiums during that period, even with the best car insurance companies in Kentucky. Learn how to get cheap auto insurance after a DUI.

How long does a DUI stay on your record in KY?

In Kentucky, a DUI stays on your driving record for 10 years.

How do I get my DUI off my record in Kentucky?

In Kentucky, you can petition for expungement of a DUI from your record after 10 years if you meet certain eligibility criteria.

What is the difference between a DUI and a DWI in Kentucky?

In Kentucky, DUI (Driving Under the Influence) and DWI (Driving While Intoxicated) are generally used interchangeably, with DUI being the commonly used term. Get more details in our comprehensive guide: DWI vs. DUI: What’s worse and what do they mean?

How much does USAA insurance go up after DUI in Kentucky?

After a DUI, USAA insurance rates can increase by 50% or more, depending on your driving history and location. You will have to get insurance quotes for DUI drivers to find out your exact rate.

What happens when you get your first DUI in Kentucky?

For a first DUI in Kentucky, penalties can include fines, license suspension, mandatory alcohol education, and possible jail time.

What is the best auto insurance for a DUI in Kentucky?

Progressive is considered the best car insurance for a DUI in Kentucky, offering flexible coverage and competitive rates. Compare the best Progressive auto insurance discounts here.

Do you lose your license immediately after a DUI in Kentucky?

In Kentucky, you do not lose your license immediately after a DUI, but you may face suspension after a court hearing.

How much does your Kentucky auto insurance go up after a DUI?

After a DUI in Kentucky, your insurance can increase by $50 to $100 or more per month, depending on the insurer and your driving record. No matter what state you live in, enter your ZIP code below to explore which companies have the cheapest auto insurance rates for you. Whether you are shopping for the best insurance for DUIs in California or Texas, our free tool will help you.

What is the minimum auto insurance you must have in Kentucky?

The minimum car insurance required in Kentucky is $25,000 per person for bodily injury, $50,000 per accident, and $25,000 for property damage.

How long do you lose your license for a DUI in Kentucky?

If you lose your license after your court hearing, how long you’ll lose your license depends on the number of DUI offenses you’ve had and other factors. A first DUI offense, for example, could result in losing your license anywhere from 30 to 120 days.

Is jail time mandatory after your first DUI in Kentucky?

Jail time is not always mandatory for a first DUI in Kentucky, but it can be imposed depending on the severity of the offense and other factors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.