Best Auto Insurance After a DUI in Louisiana (Top 10 Companies Ranked for 2025)

State Farm, Geico, and Allstate have the best auto insurance after a DUI in Louisiana, offering top coverage with rates starting at $36 monthly. State Farm leads with its Safe Driver program, specifically designed to help high-risk drivers restore their driving records after a Louisiana DUI.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage After a DUI in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage After a DUI in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage After a DUI in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe top pick overall is State Farm, with Geico and Allstate following closely, providing the best auto insurance after a DUI in Louisiana.

State Farm’s customized plans for those with a DUI make it stand out, ensuring complete protection.

Geico offers solid coverage at competitive prices, while Allstate excels at outstanding customer support. Learn more in our article, “DWI vs. DUI Differences Explained.”

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Louisiana

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Driver Improvement | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 10% | A+ | Accident Forgiveness | Allstate | |

| #4 | 20% | A+ | Flexible Plans | Progressive | |

| #5 | 10% | A++ | Military Families | USAA | |

| #6 | 15% | A | Comprehensive Coverage | Farmers | |

| #7 | 20% | A+ | Vanishing Deductibles | Nationwide |

| #8 | 12% | A | Customizable Plans | Liberty Mutual |

| #9 | 15% | A | Family Benefits | American Family | |

| #10 | 13% | A++ | Industry Experience | Travelers |

These insurers are your top options for managing insurance after a DUI. Avoid expensive auto insurance premiums after a DUI in Louisiana by entering your ZIP code above to see the cheapest rates for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Economical Premiums: State Farm provides some of the most competitive DUI insurance rates in Louisiana, starting at just $36 monthly. Compare free quotes in our State Farm review.

- Safe Driver Initiative: State Farm’s tailored Safe Driver Initiative aids DUI offenders in Louisiana by helping them enhance their driving skills and possibly reduce their insurance costs.

- Excellent Customer Service: State Farm ranks as one of the top Louisiana DUI auto insurance companies for customer support and claims handling.

Cons

- Rate Fluctuations: Although the initial rates are affordable, DUI drivers in Louisiana might experience changes in premiums based on personal factors.

- Limited Discount Options: The variety of discounts available for DUI drivers in Louisiana with State Farm may be fewer compared to other providers like Geico or Progressive.

#2 – Geico: Best Online Service

Pros

- Competitive Rates: Read our Geico review to compare DUI insurance rates in Louisiana, with premiums starting as low as $77 per month.

- Convenient Online Services: Geico’s digital tools and mobile application simplify policy management for DUI drivers in Louisiana, offering round-the-clock customer assistance.

- Bundling Savings: DUI drivers in Louisiana can benefit from Geico’s discounts when they bundle auto insurance with other types, such as homeowners or renters insurance.

Cons

- Rate Increases: Despite cheap quotes initially, Geico increases Louisiana auto insurance rates after a DUI for its existing policyholders much higher than other companies.

- Fewer Local Representatives: Geico’s mainly online service might lack the personalized touch and local support that some DUI drivers in Louisiana prefer.

#3 – Allstate: Best Accident Forgiveness

Pros

- Outstanding Customer Assistance: Allstate is recognized for its excellent customer service, providing DUI drivers in Louisiana with individualized support and expert advice.

- Accident Forgiveness Policy: Allstate accident forgiveness helps DUI drivers in Louisiana avoid premium increases following an initial accident. Explore our review of Allstate auto insurance.

- Wide Range of Coverage Options: Allstate offers a broad selection of coverage options for DUI drivers in Louisiana, including roadside assistance and rental car coverage.

Cons

- Higher Cost of Premiums: DUI drivers in Louisiana may find that Allstate’s insurance rates are higher compared to providers like State Farm or Geico.

- Strict Discount Eligibility: The qualifications for discounts and programs for DUI drivers in Louisiana with Allstate may be more stringent, limiting access for some customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Customizable Plans

Pros

- Flexible Policy Choices: Progressive offers DUI drivers in Louisiana the ability to customize their insurance plans with various options like collision and comprehensive coverage.

- Snapshot Program Benefits: DUI drivers in Louisiana can take advantage of Progressive Snapshot, which rewards careful driving habits with potential discounts.

- Affordable Premiums: Progressive delivers competitive insurance rates for DUI drivers in Louisiana, often below the industry standard. Get detailed insights in our complete Progressive review.

Cons

- Inconsistent Customer Feedback: DUI drivers in Louisiana might experience varying levels of satisfaction with Progressive’s customer support and claim processing.

- Potential Rate Hikes: Although Progressive starts with low rates, DUI drivers in Louisiana could see significant rate increases following claims or traffic infractions.

#5 – USAA: Best for Military Members

Pros

- Exclusive Benefits for Members: USAA offers specialized services and discounts for military personnel with a DUI in Louisiana, ensuring support tailored to their needs.

- High Levels of Customer Satisfaction: USAA consistently earns high marks for customer satisfaction, providing DUI drivers in Louisiana with dependable service and claims assistance.

- Competitive Pricing: DUI drivers in Louisiana eligible for USAA can take advantage of attractive rates and a comprehensive selection of coverage options. Learn more in our USAA insurance review.

Cons

- Restricted Eligibility: USAA’s services are exclusively available to military members and their families, which excludes many DUI drivers in Louisiana.

- Limited Physical Presence: USAA has few physical offices, making face-to-face consultations challenging for DUI drivers in Louisiana.

#6 – Farmers: Best for Extensive Protection

Pros

- Comprehensive Policy Options: Farmers provides a vast array of coverage choices for DUI drivers in Louisiana, including full coverage and unique endorsements.

- Numerous Discount Opportunities: DUI drivers in Louisiana can access multiple discounts through Farmers, like bundling policies and safe driving incentives.

- Strong Financial Ratings: Farmers’ solid financial status offers DUI drivers in Louisiana the confidence of reliable claims support. Deepen your understanding by reading our complete Farmers review.

Cons

- Higher Insurance Costs: DUI drivers in Louisiana might find that Farmers’ premiums are more costly than those from competitors like Geico or State Farm.

- Limited Online Resources: Farmers’ online tools may not be as advanced as those provided by Geico or Progressive, which could impact DUI drivers in Louisiana.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductibles

Pros

- On Your Side® Review Services: Nationwide provides DUI drivers in Louisiana with personalized insurance evaluations to ensure their coverage aligns with their needs.

- Vanishing Deductibles: Drivers with DUIs in Louisiana who avoid accidents and claims can reduce their deductible by $250. Learn how in our Nationwide insurance review.

- Multiple Discount Options: Nationwide offers various discounts to DUI drivers in Louisiana, including bundling policies and maintaining a clean driving record.

Cons

- Costly Full Coverage: DUI drivers in Louisiana may discover that Nationwide’s full coverage insurance is more expensive compared to other providers.

- Possibility of Rate Increases: DUI drivers in Louisiana might face higher premiums after filing a claim, depending on the severity of the incident.

#8 – Liberty Mutual: Best for Personalized Plans

Pros

- Customizable Coverage: Liberty Mutual allows DUI drivers in Louisiana to tailor their insurance policies with different add-ons and levels of coverage. Read our Liberty Mutual insurance review to find out how.

- Accident Forgiveness Feature: Liberty Mutual offers accident forgiveness, preventing premium increases for DUI drivers in Louisiana after their first accident.

- Easy Mobile Access: Liberty Mutual’s app provides DUI drivers in Louisiana with straightforward access to manage their policies and file claims.

Cons

- High Insurance Premiums: Liberty Mutual typically charges higher premiums for DUI drivers in Louisiana, especially for those needing extensive coverage.

- Fewer Discounts for High-Risk Drivers: DUI drivers in Louisiana might find limited discount opportunities compared to other insurers.

#9 – American Family: Best for Family-Centric Policies

Pros

- Focus on Family: American Family designs policies that cater to DUI drivers in Louisiana with family-oriented coverage options. Read more in our American Family insurance review.

- User-Friendly App: The MyAmFam app allows DUI drivers in Louisiana to easily manage their policies and access customer support.

- Loyalty Discounts: Drivers in Louisiana who remain with American Family over time can benefit from loyalty discounts, helping to lower their overall DUI auto insurance costs.

Cons

- High Initial Rates: New DUI drivers in Louisiana may face higher initial rates with American Family compared to established customers.

- Limited Market Presence: American Family DUI insurance coverage options might not be as widely available in Louisiana as those of larger national insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Industry Experience

Pros

- Comprehensive Forgiveness Program: Travelers offers DUI drivers in Louisiana accident forgiveness, which can help maintain their rates after an incident.

- Safe Driving Discounts: DUI drivers in Louisiana can benefit from Travelers’ discounts by maintaining a clean driving record after their DUI. Explore offerings further in our complete Travelers insurance review.

- Extensive Coverage Options: Travelers provides DUI drivers in Louisiana with comprehensive coverage choices, including rental car coverage and roadside assistance.

Cons

- Expensive Full Coverage Plans: DUI drivers in Louisiana may find that Travelers’ full coverage plans are more costly compared to other insurers.

- Higher Premiums for Frequent Claims: DUI drivers in Louisiana might experience significant premium increases if they file multiple claims within a short timeframe.

Louisiana DUI Auto Insurance Monthly Rates by Company

This table shows a comparison of monthly insurance prices for both minimum and full coverage options from different insurers in Louisiana:

Louisiana DUI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $75 | $280 |

| American Family | $78 | $292 |

| Farmers | $79 | $295 |

| Geico | $77 | $288 |

| Liberty Mutual | $132 | $495 |

| Nationwide | $100 | $374 |

| Progressive | $68 | $253 |

| State Farm | $36 | $135 |

| Travelers | $87 | $325 |

| USAA | $42 | $156 |

For minimum coverage, State Farm emerges as the most cost-effective option at $36 per month, offering a wallet-friendly solution for those aiming to satisfy Louisiana minimum insurance requirements without overspending.

Conversely, Liberty Mutual demands the highest price for both minimum and full coverage, with $132 and $495 per month, respectively, making it a less budget-friendly choice for drivers with a DUI.

Full coverage prices also display notable variation, with State Farm once again leading in affordability at $135 per month, delivering extensive protection at a reasonable price.

Minimum coverage generally provides the necessities required by law, while full coverage includes more extensive protection at a higher rate. Louisiana auto insurance is already more expensive than average, so it’s important to compare multiple companies to balance the expenses against the level of coverage you need.

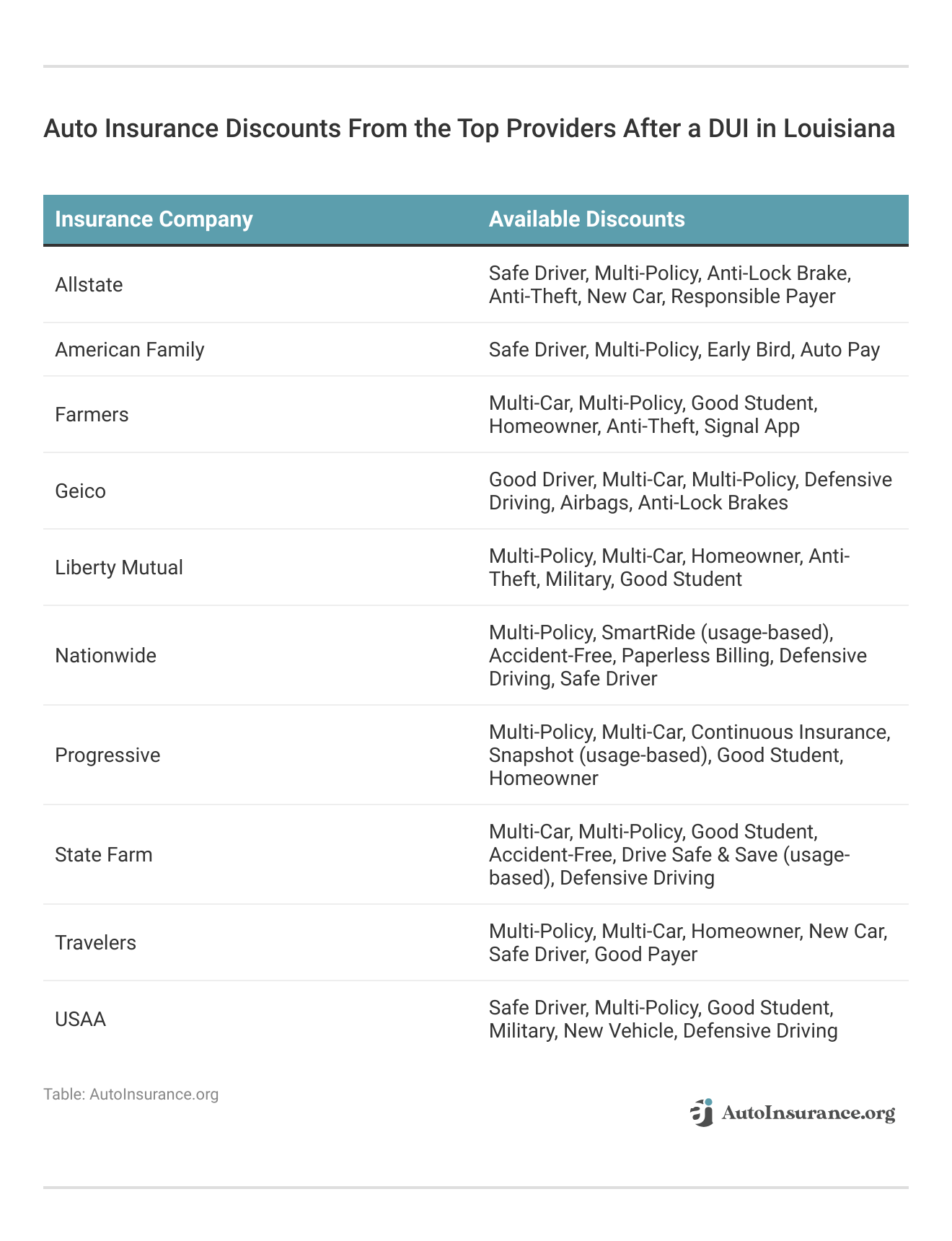

How to Manage Louisiana DUI Auto Insurance Costs

The level of your DUI charge, whether a first-time misdemeanor or a repeated offense, greatly influences your Louisiana high-risk insurance rates. More severe offenses lead to higher premiums.

Younger and less experienced also drivers face steeper insurance costs, especially after a DUI, due to the perceived higher risk they present to insurers.

If you’re considered a high-risk driver, implementing these cost-saving tips can make a significant difference and ensure you find cheap auto insurance after a DUI:

- Insurance Bundling: Explore options for bundling multiple policies, such as combining auto and home insurance, which can lead to substantial discounts.

- Safe Driving: Maintaining a clean driving record post-DUI is crucial — avoid any further infractions, as a spotless record over time can gradually decrease your rates.

- Higher Deductibles: Opting for a higher auto insurance deductible is another strategy that can reduce your monthly premiums, although this means being prepared for higher out-of-pocket costs in the event of a claim.

Think about enrolling in a defensive driving course that your insurer has approved. This can improve your driving abilities and possibly lower your premiums with a defensive driving discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Leading Auto Insurance Providers for Louisiana DUI Drivers

When seeking the best auto insurance after a DUI in Louisiana, several standout providers rise above the rest, each offering distinct advantages tailored to meet the challenges DUI drivers face. State Farm emerges as the top pick for its affordable rates and specialized programs that help drivers regain their footing after getting a DUI in Louisiana.

For Louisiana drivers facing a DUI, State Farm provides tailored insurance solutions that don’t break the bank.Laura Berry Former Licensed Insurance Producer

Geico follows closely, with competitive pricing and a user-friendly digital platform that makes managing your policy straightforward. Allstate also earns a top spot, combining excellent customer service with a wide range of coverage options designed to provide comprehensive auto insurance protection at reasonable rates.

New survey results show that we’re driving distracted with alarming regularity. #DistractedDrivingAwarenessMonth https://t.co/8hJ5zXGd2E

— State Farm (@StateFarm) April 18, 2023

Each of these insurers brings unique strengths to the table, ensuring that drivers in Louisiana have access to the best possible coverage, even after a DUI. Finding cheap auto insurance rates for Louisiana DUI drivers can be difficult, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Frequently Asked Questions

Who offers the cheapest auto insurance in Louisiana?

The cheapest auto insurance companies in Louisiana, even after a DUI, are typically State Farm and USAA.

What is the most popular auto insurance company in Louisiana?

State Farm is the most popular car insurance provider in Louisiana, especially among drivers with a DUI, due to its affordable and comprehensive coverage options.

How much is SR-22 insurance in Louisiana?

It costs between $15-$25 to file SR-22 auto insurance in Louisiana if it’s required after a DUI.

What happens if you drive without insurance in Louisiana?

Driving without insurance in Louisiana, especially after a DUI, can result in severe penalties, including fines, license suspension, and vehicle impoundment. Don’t risk it — get cheap Louisiana auto insurance after a DUI by entering your ZIP code below into our free comparison tool today.

Does insurance follow the car or the driver in Louisiana?

Does insurance follow the car or the driver? In Louisiana, insurance generally follows the car, not the driver, which is important to remember if you’re a DUI offender borrowing someone else’s vehicle.

How many days can you go without insurance in Louisiana?

In Louisiana, it’s illegal to go even a single day without insurance, especially for DUI offenders, as this can lead to fines and other penalties.

What is the grace period for DUI auto insurance in Louisiana?

In Louisiana, the grace period for auto insurance payments varies by insurer, but for DUI offenders, it’s crucial to check with your provider to avoid lapses in coverage.

What is considered full coverage auto insurance in Louisiana?

Full coverage auto insurance in Louisiana includes liability, collision, and comprehensive insurance.

Is Louisiana a no-fault auto insurance state?

No, Louisiana is not a no-fault car insurance state, meaning that in the event of an accident, the driver at fault for the car accident, including those with a DUI, is responsible for damages.

How long does an accident affect your insurance in Louisiana?

In Louisiana, an accident, particularly one involving a DUI, can impact your insurance rates for up to three to five years, depending on your insurer.

How much is high-risk insurance in Louisiana?

High-risk auto insurance in Louisiana, often necessary after a DUI, can be significantly more expensive, with monthly rates varying widely depending on the provider.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.