Best Auto Insurance After a DUI in Washington (10 Standout Companies for 2025)

State Farm, Geico, and Progressive offer the best auto insurance after a DUI in Washington. These top Washington insurance companies provide optimal coverage for high-risk drivers. State Farm is known for reliable support, Geico for mobile access, and Progressive for flexibility. Monthly premiums start at $33.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage After a DUI in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage After a DUI in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage After a DUI in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive are our top choices for the best auto insurance after a DUI in Washington state, each offering distinct advantages.

These leading insurers provide reliable high-risk auto insurance coverage at competitive rates, ensuring drivers with DUIs in Washington can effectively manage their insurance costs.

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Washington

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Support | State Farm | |

| #2 | 25% | A++ | Mobile App | Geico | |

| #3 | 12% | A+ | Cheap Rates | Progressive | |

| #4 | 10% | A+ | Tailored Coverage | Allstate | |

| #5 | 20% | A+ | Customer Service | Nationwide |

| #6 | 29% | A | Industry Reputation | American Family | |

| #7 | 15% | A | Customizable Policies | Farmers | |

| #8 | 10% | A++ | Military Members | USAA | |

| #9 | 10% | A | Diverse Coverage | Liberty Mutual |

| #10 | 10% | A+ | AARP Members | The Hartford |

State Farm and Progressive have the lowest DUI auto insurance rates in Washington, and Geico provides convenient mobile tools to manage policies post-DUI.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code above into our comparison tool today.

- State Farm is the top pick, with competitive rates starting at $33 per month

- Progressive is the second-cheapest WA auto insurance company after a DUI

- The best car insurance after a DUI in Washington caters to high-risk drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Reliable Support: State Farm offers exceptional assistance for managing auto insurance claims after a DUI in Washington. Check out our State Farm review for more information.

- Flexible Payments: State Farm’s diverse payment options alleviate the financial strain of insurance after a DUI in Washington.

- DUI Expertise: State Farm’s experience with high-risk drivers after a DUI in Washington can provide valuable reassurance.

Cons

- Low Financial Grade: State Farm has B from A.M. Best, which is lower than other DUI auto insurance companies in Washington.

- Limited Discounts: Fewer car insurance discounts are available to drivers after a DUI in Washington.

#2 – Geico: Best Mobile App

Pros

- Highly-Rated Mobile App: The Geico mobile app makes it easy to manage Washington DUI auto insurance policies and claims, and it’s rated 4.8/5 by iPhone users and 4.6/5 by Android users.

- Quick Adjustments: Geico’s swift online services facilitate timely adjustments for DUI-related needs after a DUI in Washington.

- Payment Flexibility: Geico’s flexible payment plans help manage expenses effectively after a DUI in Washington. Gain insights from our Geico review.

Cons

- Sparse Local Support: Geico may have limited local agent availability for personalized DUI assistance after a DUI in Washington.

- Reduced DUI Resources: Geico’s resources for addressing DUI-specific concerns can be insufficient after a DUI in Washington.

#3 – Progressive: Best for Cheap Rates

Pros

- Cheap DUI Insurance: Progressive is the second-cheapest VA auto insurance company after a DUI. Rates start at $34/month for minimum coverage.

- Discount Options: Progressive provides a range of discounts that may help reduce DUI auto insurance costs in Washington.

- Broad Coverage: Progressive’s extensive coverage options cater to various high-risk needs after a DUI in Washington. Read our Progressive review for in-depth information.

Cons

- Varied Customer Service Experiences: Drivers with DUIs in Washington report varied customer satisfaction, and many drivers have better experiences at other companies.

- Delayed Claims Processing: The claims process can be slower for complex situations after a DUI in Washington.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Tailored Coverage

Pros

- Tailored Coverage: Allstate’s flexible coverage options are designed to address unique insurance needs after a DUI in Washington. Discover more in our Allstate review.

- Personalized Assistance: Allstate provides targeted support for adjusting DUI auto insurance policies in Washington.

- Strong Claims Handling: Allstate is known for effective management of auto insurance claims after a DUI in Washington.

Cons

- Higher Costs: Premiums may be substantially higher for high-risk drivers after a DUI in Washington.

- Fewer DUI Discounts: DUI-specific discounts may be less extensive with Allstate than other Washington high-risk auto insurance companies.

#5 – Nationwide: Best for Customer Service

Pros

- Excellent Service: Nationwide offers superior customer support for handling insurance matters after a DUI in Washington.

- Comprehensive Options: Nationwide provides a variety of coverage options for high-risk drivers after a DUI in Washington. Get details in our Nationwide review.

- Effective Management: Nationwide’s assistance with policy adjustments is highly effective after a DUI in Washington.

Cons

- Higher Insurance Rates: DUI convictions may lead to Washington auto insurance rate increases that are higher than at other companies.

- Limited DUI Savings: Nationwide offers fewer specialized discounts for high-risk situations after a DUI in Washington.

#6 – American Family: Best Industry Reputation

Pros

- Strong Industry Reputation: American Family is known for its expertise in dealing with high-risk drivers after a DUI in Washington. Explore our American Family review for further details.

- Membership Discounts: High-risk drivers with DUIs in Washington can still earn discounts on coverage if they’re Costco members.

- Loyalty Rewards: AmFam rewards drivers with DUIs in Washington who automatically renew their auto insurance policies.

Cons

- Elevated Rates: Insurance premiums can be high for drivers with DUI records after a DUI in Washington.

- Fewer DUI Discounts: American Family may have limited DUI-specific discounts after a DUI in Washington.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Policies

Pros

- Custom Policies: Farmers provides adaptable policies suited to high-risk situations after a DUI in Washington.

- Comprehensive Support: Farmers offers robust resources and support for DUI-related insurance claims after a DUI in Washington. Find additional details in our Farmers review.

- Personalized Service: Known for its individualized service, Farmers effectively handles high-risk cases after a DUI in Washington.

Cons

- Increased Costs: Insurance premiums are likely to be higher for drivers with DUI records after a DUI in Washington.

- Limited DUI Savings: Farmers offers fewer safe driving discounts specifically after a DUI in Washington.

#8 – USAA: Best for Military Members

Pros

- Military Focus: USAA provides exceptional support for military members who are dealing with DUI convictions in Washington.

- Adaptable Coverage: USAA offers flexible coverage options for high-risk drivers after a DUI in Washington. Find out more in our USAA auto insurance review.

- Compassionate Handling: USAA is recognized for its empathetic approach to managing military car insurance after a DUI in Washington.

Cons

- Restricted Membership: USAA services are available only to military members and their families after a DUI in Washington.

- Premium Increases: Although one of the cheapest Washington DUI insurance companies, USAA will raise rates exponentially for multiple DUIs.

#9 – Liberty Mutual: Best for Diverse Coverage

Pros

- Varied Coverage: Liberty Mutual provides a range of coverage options and add-ons tailored to Washington auto insurance requirements after a DUI.

- Discount Possibilities: Liberty Mutual offers several discounts that may help lower Washington auto insurance costs after a DUI.

- Policy Assistance: Liberty Mutual excels in managing policy adjustments following a DUI in Washington. Check out our Liberty Mutual review for more information.

Cons

- Higher Premiums: DUI insurance costs more at Liberty Mutual than other Washington auto insurance providers.

- Limited DUI-Specific Support: Resources for addressing DUI-specific concerns may be better at other Washington high-risk insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for AARP Members

Pros

- AARP Member Benefits: The Hartford offers customized coverage for AARP members facing DUI challenges in Washington.

- Effective Policy Changes: The Hartford provides reliable support for managing policy adjustments post-DUI after a DUI in Washington.

- Varied Coverage: The Hartford offers multiple coverage options suitable for high-risk drivers after a DUI in Washington. Read our The Hartford review for in-depth information.

Cons

- Higher Costs: DUI-related premiums are more expensive at The Hartford than any other Washington insurer on this list.

- Limited DUI Discounts: The Hartford’s auto insurance discounts after a DUI in Washington are limited to senior drivers who have AARP memberships.

A Closer Look at Washington DUI Insurance Costs

After a DUI conviction in Washington, auto insurance rates typically increase significantly. Insurers view drivers with DUIs as high-risk, which leads to higher premiums.

DUI Auto Insurance Monthly Rates in Washington by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $66 | $152 |

| American Family | $78 | $179 |

| Farmers | $71 | $163 |

| Geico | $89 | $204 |

| Liberty Mutual | $56 | $129 |

| Nationwide | $69 | $159 |

| Progressive | $34 | $79 |

| State Farm | $33 | $76 |

| The Hartford | $150 | $290 |

| USAA | $40 | $92 |

On average, Washington drivers may see their rates rise by 40% to 80%, depending on their provider and driving history. Comparing quotes from multiple companies is essential to find the most affordable option.

Securing affordable auto insurance after a DUI in Washington requires a thorough understanding of the factors that influence your rates. This list highlights the key reasons your auto insurance rates will likely rise after a DUI in Washington:

- Driving Record & Offense Severity: Insurers assess your driving history and the seriousness of the DUI to set your rates. Learn how auto insurance companies check driving records.

- Time Since Conviction & Prior Offenses: The timing of the DUI and the number of past offenses on your record impact your WA auto insurance rates and eligibility for discounts.

- Personal Factors: Age, vehicle type, and defensive driving courses play a role, with affiliation auto insurance discounts potentially lowering costs.

Be aware that DUI convictions typically lead to higher premiums due to increased risk factors. Shop around and compare offers from various companies to find the best rates on high-risk auto insurance in Washington.

By diligently comparing quotes and selecting the right provider with expertise in high-risk policies, you can effectively manage and reduce your insurance costs while maintaining necessary coverage.

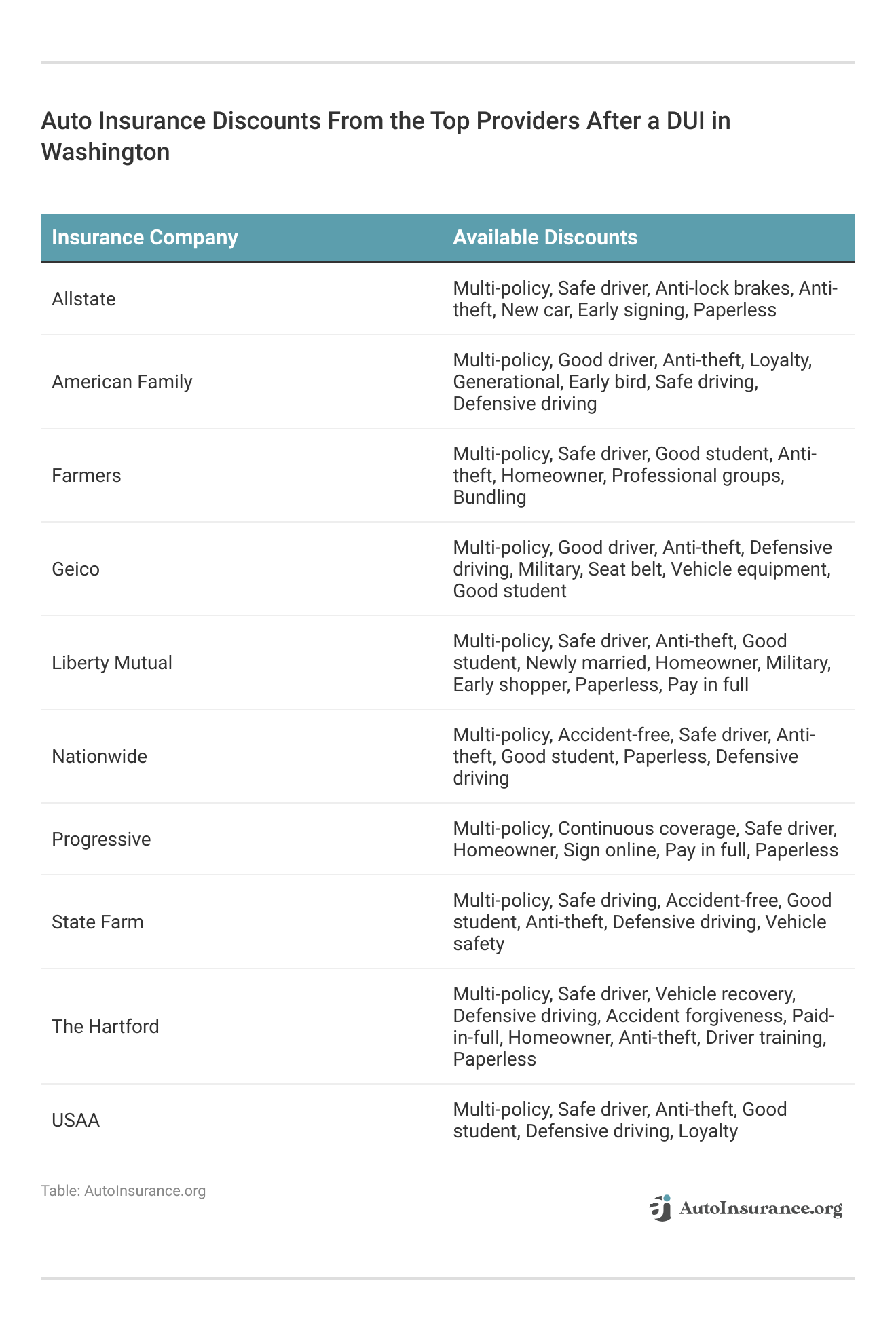

Save Money on Washington DUI Auto Insurance With Discounts

Even after a DUI, you can still find ways to lower your auto insurance premiums in Washington. Look for potential savings through affiliation auto insurance discounts, defensive driving course completions, or bundling policies.

Many insurers offer affiliation auto insurance discounts for memberships with certain organizations, alumni groups, or employers.

Additionally, completing a defensive driving course may qualify you for further discounts. Bundling your auto policy with other insurance products like home or renters can also lead to significant savings.

With a clear understanding of how a DUI impacts your Washington insurance rates, along with leveraging available discounts and offers, you can significantly reduce the financial burden.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Concluding Insights on DUI Auto Insurance Providers in Washington

State Farm, Geico, and Progressive have the best auto insurance after a DUI in Washington at the most competitive rates.

State Farm offers the best auto insurance rates for drivers after a DUI, with monthly premiums starting at just $33.Justin Wright Licensed Insurance Agent

Securing affordable car insurance after a DUI in Washington involves understanding the factors that affect auto insurance rates and exploring available savings. Exploring available discounts, such as those for completing a defensive driving course or qualifying for affiliation auto insurance discounts, can significantly reduce your premium.

By comparing quotes, seeking discounts, and maintaining a clean driving record, you can effectively manage your insurance costs and ensure you have the coverage you need. Get the best Washington auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What auto insurance is best in Washington state after a DUI?

After a DUI in Washington state, Progressive and State Farm are highly recommended for their competitive rates and strong support for older vehicles.

Which Washington auto insurance company has the best claim settlement ratio?

For a DUI, Progressive offers excellent coverage and a high claim settlement ratio, making it a top choice for current insurance needs. Enter your ZIP code below to find the best Washington car insurance company for you.

What auto insurance is required in Washington state for DUI offenders?

DUI offenders in Washington must have SR-22 insurance.

How much is auto insurance per month in Washington

The cost of Washington auto insurance per month typically ranges from $150 to $300, depending on the insurer and driving history.

Which type of Washington insurance is best for a car after a DUI?

After getting a DUI in Washington, the best insurance you need is SR-22 insurance and comprehensive coverage to meet legal requirements.

Which Washington insurance company has the highest customer satisfaction for DUI cases?

USAA and Progressive receive high customer satisfaction ratings and are highly rated for handling high-risk situations like DUIs.

Which Washington company is best for handling DUI insurance claims?

Some insurers may have higher complaint rates from DUI customers, but Progressive is known for effectively managing DUI-related insurance claims. Learn how to check your auto insurance claims history.

Is Washington State a no-fault state for auto insurance?

Washington State is not a no-fault state.

What is the grace period for car insurance in Washington State after a DUI?

Washington State allows a 10-15 day grace period for insurance lapses

What is the minimum full coverage auto insurance in Washington state for high-risk drivers?

Minimum full coverage for high-risk drivers includes liability, collision, and comprehensive insurance. Compare that to the Washington minimum auto insurance requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.