9 Best Auto Insurance Companies That Don’t Use Credit Scores (2025)

The best auto insurance companies that don't use credit scores are Geico, Nationwide, and Allstate usage-based insurance policies. Drivers can save even more with Root or Metromile no-credit-check auto insurance quotes as low as $74/mo. Scroll down for tips to find the best car insurance with no credit check near you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,071 reviews

3,071 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,638 reviews

11,638 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsGeico and Nationwide are the best auto insurance companies that don’t use credit scores with usage-based insurance. Sign up for Geico DriveEasy or Nationwide SmartRide for cheap no-credit-check car insurance.

While many national providers check credit with standard policies, drivers with bad credit can sign up for pay-per-mile or usage-based auto insurance (UBI) from the best auto insurance companies that don’t use credit scores to avoid traditional credit checks.

Our Top 9 Picks: Best Auto Insurance Companies That Don’t Use Credit Scores

Insurance Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Low Rates Geico

#2 20% A+ Usage-Based Rates Nationwide

#3 25% A+ Pay-Per-Mile Rates Allstate

#4 10% NR Good Drivers Root

#5 10% A++ Military Drivers USAA

#6 4% NR Affordable Options Elephant

#7 20% A+ Low-Mileage Drivers Nationwide

#8 13% A++ Safe Driving Habits Travelers

#9 15% A- New Jersey Drivers CURE

You might be surprised to learn how credit scores affect auto insurance rates. Keep reading to learn more about which auto insurance companies don’t check credit and the states where companies cannot use credit scores when setting your premiums. You can also enter your ZIP code above to compare quotes.

- Root and Metromile are auto insurance companies that don’t use credit scores

- Geico is our top pick for the lowest auto insurance rates for bad credit

- Nationwide and Allstate offer affordable usage-based insurance with bad credit

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

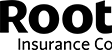

#1 – Geico: Top Pick Overall

Pros:

- Affordable rates: Drivers with bad credit pay around $140/mo

- National availability: Auto insurance in 50 states

- Usage-based savings: Save up to 25% with Geico DriveEasy

- High customer satisfaction: Best customer service for UBI

Cons:

- Traditional rating factors: Credit score, gender, and marital status impact standard rates

- Poor claims satisfaction: Ranks below average in annual J.D. Power survey

Read More: Geico Auto Insurance Review

#2 – Nationwide: Best Usage-Based Insurance With Bad Credit

Pros:

- Widest availability: SmartRide and SmartMiles in 44 states

- Biggest savings: Drivers save up to 40% with UBI plus a 10% sign-up bonus

- Cheap pay-as-you-go rates: Daily mileage caps at 250 miles

- Rewards for safe drivers: Safe driving habits save an additional 10% at renewal

Cons:

- Low customer satisfaction: Drivers are happier with Geico DriveWise

- Poor claims satisfaction: Ranks below average in annual J.D. Power survey

Read More: Nationwide Auto Insurance Review

#3 – Allstate: Best Pay-Per-Mile Insurance With Bad Credit

Pros:

- Cheap pay-as-you-go rates: Daily caps of 250 miles keep rates low

- Cheaper for high-mileage drivers: Milewise Unlimited helps frequent drivers save

- High claims satisfaction: Among the top 10 companies in the J.D. Power annual survey

Cons:

- Not in every state: Allstate Milewise only in 21 states

- High rates for bad credit: Standard monthly rates cost $265 without Milewise

Read More: Allstate Auto Insurance Review

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Root: Best for Good Drivers With Bad Credit

Pros:

- No-credit-check car insurance: Doesn’t use credit score or gender to set rates

- Policy perks: Rental reimbursement covers rideshare costs

- Free roadside assistance: Every policy comes with up to $100 in roadside protection

Cons:

- Not in every state: Only in 34 states

- No high-risk coverage: Root tests driving habits before approving coverage

Read More: Root Auto Insurance Review

#5 – USAA: Best for Military Members With Bad Credit

Pros:

- Lowest rates: Drivers with bad credit pay around $118/mo

- Affordable high-risk insurance: Cheapest rates for teens and drivers with DUIs

- High claims and customer satisfaction: Drivers prefer this company over the competition

Cons:

- Exclusive: Insurance only available to military members

- Traditional rating factors: Credit score, gender, and marital status impact standard rates

Read More: USAA Auto Insurance Review

#6 – MileAuto: Best Pay-Per-Mile Rates Without a Tracking Device

Pros:

- No-credit-check car insurance: Doesn’t use credit score, age, or gender to set rates

- No tracking devices: Drivers send a picture of the odometer instead

- Affordable rates: Pay-per-mile rates can save drivers up to 94%

Cons:

- No daily caps: MileAuto will charge for long road trips

- Not in every state: Only available in 11 states

Read More: Mileauto Auto Insurance Review

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Metromile: Best for Tech-Savvy Drivers

Pros:

- No-credit-check car insurance: Doesn’t use credit score, age, or gender to set rates

- High-tech mobile app: App finds your parked car and decodes check engine lights

- Pet coverage included: Up to $1,000 in pet insurance with full coverage policies

Cons:

- Not in every state: Auto coverage only available in eight states

- Constant monitoring: App needs mobile phone coverage to track mileage

Read More: Metromile Auto Insurance Review

#8 – Dillo: Best for Texas Drivers With Bad Credit

Pros:

- No-credit-check car insurance: Doesn’t use credit score to set rates

- Affordable high-risk insurance: Lower rates for teens and drivers with tickets or accidents

- Local agents: Policies are made for the unique needs of Texas drivers

Cons:

- Not in every state: Auto insurance only in Texas

- Fewer discounts: Only offers five car insurance discounts, two of which require owning a home

#9 – CURE: Best for New Jersey Drivers With Bad Credit

Pros:

- No-credit-check car insurance: Doesn’t use credit score to set rates

- Local agents: Policies are made to meet New Jersey car insurance requirements

- Free roadside assistance: Every policy includes $125 in roadside protection

- Referral rewards: Drivers can earn discounts and rewards for referring friends and family

Cons:

- Not in every state: Auto insurance only in MI, PA, and NJ

- Fewer discounts: Only offers four car insurance discounts

Read More: CURE Auto Insurance Review

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Credit Score Affects Auto Insurance Rates

There are various factors that affect your auto insurance rates, and you might be surprised to learn that your credit score can also have an impact. Take a look at this table that shows you just how much your credit score can affect your auto insurance rates:

Auto Insurance Companies That Don't Use Credit Scores Monthly Rates

| Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $43 | $58 | $74 | |

| $95 | $115 | $135 | |

| $102 | $122 | $142 |

| $110 | $130 | $150 | |

| $85 | $105 | $125 | |

| $60 | $80 | $105 | |

| $115 | $157 | $198 | |

| $90 | $120 | $155 | |

| $111 | $151 | $191 |

Root and Metromile offer the lowest average rates to drivers with bad credit. Both companies do not check credit score — Root sets rates based on your driving habits and location while Metromile exclusively tracks mileage to set rates. Geico and USAA both check credit but still offer affordable auto insurance rates for drivers with bad credit scores.

Unfortunately, finding companies that do not use credit scores is next to impossible unless you look at pay-as-you-go-auto insurance companies or usage-based insurance (UBI) programs.

Why Auto Insurance Companies Check Credit Score

Do auto insurance companies check your credit rating? Yes, most auto insurance companies that do use credit scores believe that drivers who have good credit will be more willing to pay out of pocket for damages and are less likely to file a claim.

Drivers with bad credit are more likely to pay higher rates because companies assume they are more likely to file a claim.Eric Stauffer Licensed Insurance Agent

Do car insurance companies check your credit in all states? No, California, Hawaii, Massachusetts, and Michigan don’t allow auto insurance companies to use your credit score to determine your rates. Read our state insurance guides to learn more about no-credit-check auto insurance near you.

Learn More:

- California Auto Insurance

- Hawaii Auto Insurance

- Massachusetts Auto Insurance

- Michigan Auto Insurance

Other Ways to Save Money on Auto Insurance With Bad Credit

Even if you can’t find car insurance with no credit check, there are other ways you can save on your auto insurance. Signing up for usage-based or pay-per-mile insurance can help you get cheap no-credit-check auto insurance rates. Learn how to sign up in our Geico DriveEasy review.

Take advantage of any available auto insurance discounts. Most auto insurance companies offer a lot of discounts in different areas. For example, you can get a good student discount, a good driver discount, or even discounts based on the safety features of your car.

Read More:

- How to Get a Good Student Auto Insurance Discount

- How to Get a Good Driver Auto Insurance Discount

- How to Get an Anti-Theft Auto Insurance Discount

You can also work to raise your credit score. Make your auto insurance payments on time and be mindful of the credit accounts you have. Raising your credit score will help lower mortgage or auto loan rates as well as car insurance rates.

Tips on Finding The Best Auto Insurance Companies That Don’t Use Credit Scores

While knowing what car insurance company doesn’t check credit can be very difficult, not all auto insurance companies charge high rates for bad credit. Shop around and compare quotes from auto insurance companies that use credit scores and ones that don’t — you might find that a standard company offers you lower rates.

Auto insurance customers with poor credit can expect to pay up to 60% more on their premiums😱! Has your credit increased recently📈? Get updated auto insurance quotes here: https://t.co/27f1xf131D! Learn more about what affects insurance rates👉: https://t.co/1ZJQo5P2Di. pic.twitter.com/biYj1tyf3H

— AutoInsurance.org (@AutoInsurance) February 28, 2023

Geico, Nationwide, and Allstate are all standard companies that use traditional rating factors but still offer low rates to drivers with bad credit. Each company also offers UBI and pay-as-you-go policies that don’t require a credit check.

The good news is getting auto insurance quotes will not hurt your credit score. So, enter your ZIP code below to compare as many online insurance quotes as you can before you buy to ensure you’re getting the best rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What states do not use credit scores for auto insurance?

California, Hawaii, Massachusetts, and Michigan are the only states where it is illegal for insurers to use credit scores when setting rates.

What are the best auto insurance companies that don’t use credit scores?

Root, Mileauto, and Metromile are three car insurance companies that do not check credit scores. You will also find affordable auto insurance with bad credit with Geico, Nationwide, and Allstate UBI programs.

Does State Farm check credit score?

Yes, State Farm generally checks your credit score when evaluating your auto insurance rates.

Does Progressive check credit score?

In states allowing it, Progressive checks credit history as it periodically reviews policies.

Does Geico use credit scores for insurance?

Yes, Geico will check your credit history but still offers low rates to drivers with bad credit.

Does Allstate use credit scores?

Yes, Allstate will check your credit score to set rates unless you sign up for Allstate Milewise pay-as-you-go insurance.

What is the cheapest car insurance for poor credit?

Root offers the lowest rates to qualifying drivers with bad credit at $74/mo.

Why would I want to choose an auto insurance company that doesn’t check credit?

Opting for an auto insurance company that doesn’t check credit can be beneficial if you have a less-than-perfect credit history. It allows you to obtain coverage without worrying about your credit score impacting your premiums or coverage options.

Does shopping for car insurance hurt your credit score?

No, there isn’t a hard credit check when you evaluate auto insurance quotes.

How can I find out if a specific auto insurance company checks credit?

The best way to determine if a particular auto insurance company checks credit is to reach out to them directly. Contact their customer service or visit their official website to inquire about their underwriting process and whether credit checks are part of it.

Can an auto insurance company check my credit without my permission?

Generally, auto insurance companies require your consent to check your credit. They must comply with privacy and data protection regulations, which typically require explicit consent from the policyholder before accessing their credit information. However, it’s essential to review the terms and conditions of the insurance company to understand their specific practices regarding credit checks.

Is it legal for an auto insurance company to deny coverage based on credit scores?

The legality of denying coverage based on credit scores can vary by jurisdiction. In some states or countries, it may be prohibited to use credit scores as the sole basis for denying coverage. However, in other regions, insurance companies may have the discretion to consider credit scores as a factor in determining coverage eligibility. It’s advisable to consult local laws and regulations or seek legal advice to understand the specific rules in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.