Best Auto Insurance Companies That Offer Grants in 2025 (Check Out the Top 10 Providers)

The best auto insurance companies that offer grants include Nationwide, State Farm, and The Hartford, known for their excellent rates and community support. Nationwide stands out with the lowest monthly rate at $42. These providers combine affordability and charitable giving, ideal for conscientious drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage With Grants

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage With Grants

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage With Grants

A.M. Best Rating

Complaint Level

Pros & Cons

Explore the best auto insurance companies that offer grants. Nationwide, State Farm, and The Hartford offer the best rates and grants. Nationwide leads with a $42 monthly rate, while all three prioritize affordability and charitable giving, making them ideal choices for conscientious drivers.

Want to support community organizations? Buy from auto insurance companies that offer grants and improve lives. Get cheap auto insurance while funding scholarships for underprivileged students and supporting non-profits.

Our Top 10 Picks: Best Auto Insurance Companies That Offer Grants

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Community Grants Nationwide

#2 18% B Education Grants State Farm

#3 12% A+ Safety Grants The Hartford

#4 16% A+ Neighborhood Grants Allstate

#5 20% A Environmental Grants Farmers

#6 17% A Relief Grants Liberty Mutual

#7 14% A Youth Grants American Family

#8 19% A++ Business Grants Travelers

#9 11% A+ Personalized service Erie

#10 21% A+ Grant Eligibility Progressive

These grants empower communities in need by providing vital financial assistance. Choose an insurance company that shares your commitment to the wider world. Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Nationwide is the top pick, offering the lowest monthly rate at $42

- These companies offer great rates and support communities with grants

- Top auto insurance companies include Nationwide, State Farm, and The Hartford

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Overall Pick

Pros

- Community Support: Provides significant community support through the Nationwide Foundation, funding hospitals and major non-profits.

- Charity Events: Offers a variety of charity events and fundraisers, helping to generate substantial donations.

- Affordable Rates: Affordable average insurance rate, making it accessible for many consumers. For more information, read our Nationwide auto insurance review.

Cons

- Interest Alignment: Charitable focus might not align with all policyholders’ personal interests or preferred causes.

- Rate Variability: Average rate might vary based on individual factors, potentially leading to higher premiums for some.

#2 – State Farm: Best for Education Grants

Pros

- Community Improvement: Active in community improvement through the State Farm Neighborhood Assist program, addressing local issues.

- Scholarships Provided: Provides scholarships and supports volunteerism, encouraging education and community involvement.

- Low Monthly Rate: Low average monthly insurance rate, making it a cost-effective option.

Cons

- Higher Premiums: Extensive charitable programs might result in higher premiums. For discounts read our State Farm auto insurance discounts.

- Educational Focus: Limited grant support for non-educational causes, which may not appeal to all policyholders.

#3 – The Hartford: Best for Safety Grants

Pros

- Safety Initiatives: Focus on grants promoting safety initiatives, enhancing community well-being and security.

- Customer Service: Recognized for strong customer service, providing reliable support and assistance.

- Senior Rates: Competitive rates for senior drivers, offering affordable options for older customers. Learn more in our The Hartford auto insurance review.

Cons

- Young Drivers: Might not be the cheapest option for younger drivers, who may find better rates elsewhere.

- Grant Coverage: Grant programs might not cover all areas of interest, limiting appeal for some customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Neighborhood Grants

Pros

- Long-Term Commitment: Long-standing commitment to community support since the 1950s, showing a history of reliability.

- Violence Prevention: Focus on ending domestic violence and financial abuse, providing crucial resources and education.

- Youth Leadership: Supports youth leadership and confidence-building programs, helping young people develop essential skills.

Cons

- Higher Cost: Average monthly rates are higher than some competitors, which might be a concern for budget-conscious consumers.

- Charitable Alignment: Grants focus may not align with all policyholders’ priorities. Learn more about their Grants in our Allstate auto insurance review.

#5 – Farmers: Best for Environmental Grants

Pros

- Environmental Focus: Strong focus on environmental grants, supporting sustainability and eco-friendly initiatives.

- Product Variety: Provides a variety of insurance products, offering comprehensive coverage options.

- Community Initiatives: Supports numerous community initiatives, demonstrating a commitment to social responsibility.

Cons

- Higher Rates: Rates can be higher compared to other providers, which might deter price-sensitive customers. Check their rates in our Farmers auto insurance review.

- Environmental Appeal: Environmental focus might not appeal to all customers, particularly those indifferent to eco-friendly efforts.

#6 – Liberty Mutual: Best for Relief Grants

Pros

- Disaster Relief: Active in disaster relief efforts, providing crucial support during emergencies.

- Immediate Needs: Provides grants for immediate relief needs, helping communities recover quickly.

- Product Range: As mentioned in our Liberty Mutual auto insurance review, they have a broad range of insurance products and services.

Cons

- Higher Premiums: Rates might be higher than average, which could be a drawback for some customers.

- Grant Focus: Relief grants focus may not cover all community interests, potentially limiting its appeal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Youth Grants

Pros

- Dreams Foundation: Provides grants through the American Family Insurance Dreams Foundation, supporting various community projects.

- Economic Opportunities: Focus on economic opportunities and education, promoting community growth and development.

- Competitive Rates: Competitive average monthly rate, offering good value for comprehensive coverage (Read more: American Family Auto Insurance Review).

Cons

- Specific Focus: Charitable focus primarily on specific community needs, which might not resonate with everyone.

- Grant Availability: Availability of grants may be limited based on location, affecting access for some policyholders.

#8 – Travelers: Best for Business Grants

Pros

- Business Development: Supports business development through grants, aiding local entrepreneurs and companies.

- Comprehensive Coverage: As outlined in our Travelers auto insurance review, they offers comprehensive insurance products, providing extensive protection.

- Financial Stability: Recognized for strong financial stability, ensuring reliability and trustworthiness.

Cons

- Individual Appeal: Business grant focus might not appeal to individual policyholders looking for personal benefits.

- Rate Variance: Rates can vary widely based on business size and type, affecting affordability for some companies.

#9 – Erie: Best for Personalized Service

Pros

- Excellent Service: Known for excellent customer service, ensuring policyholders feel valued and supported.

- Tailored Plans: Offers personalized insurance plans, catering to individual needs and preferences.

- Strong Reputation: Strong reputation for customer satisfaction, highlighting its reliability. Read more about their ratings in our Erie auto insurance review.

Cons

- Limited Availability: Limited availability in some regions, which can restrict access for potential customers.

- Higher Rates: Rates may not be the lowest compared to larger companies, which could be a consideration for budget-conscious individuals.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Progressive: Best for Grant Eligibility

Pros

- Broad Eligibility: Broad eligibility for various grants, providing support for numerous causes.

- Extensive Discounts: Competitive pricing and extensive discounts, making it an attractive option for many (Read more: Progressive Auto Insurance Discounts).

- Wide Range: Wide range of insurance products, offering flexibility and comprehensive coverage.

Cons

- Rate Variability: Rates can vary significantly based on individual risk factors, leading to potential unpredictability in costs.

- Service Consistency: Customer service ratings can be inconsistent, which might affect overall customer experience.

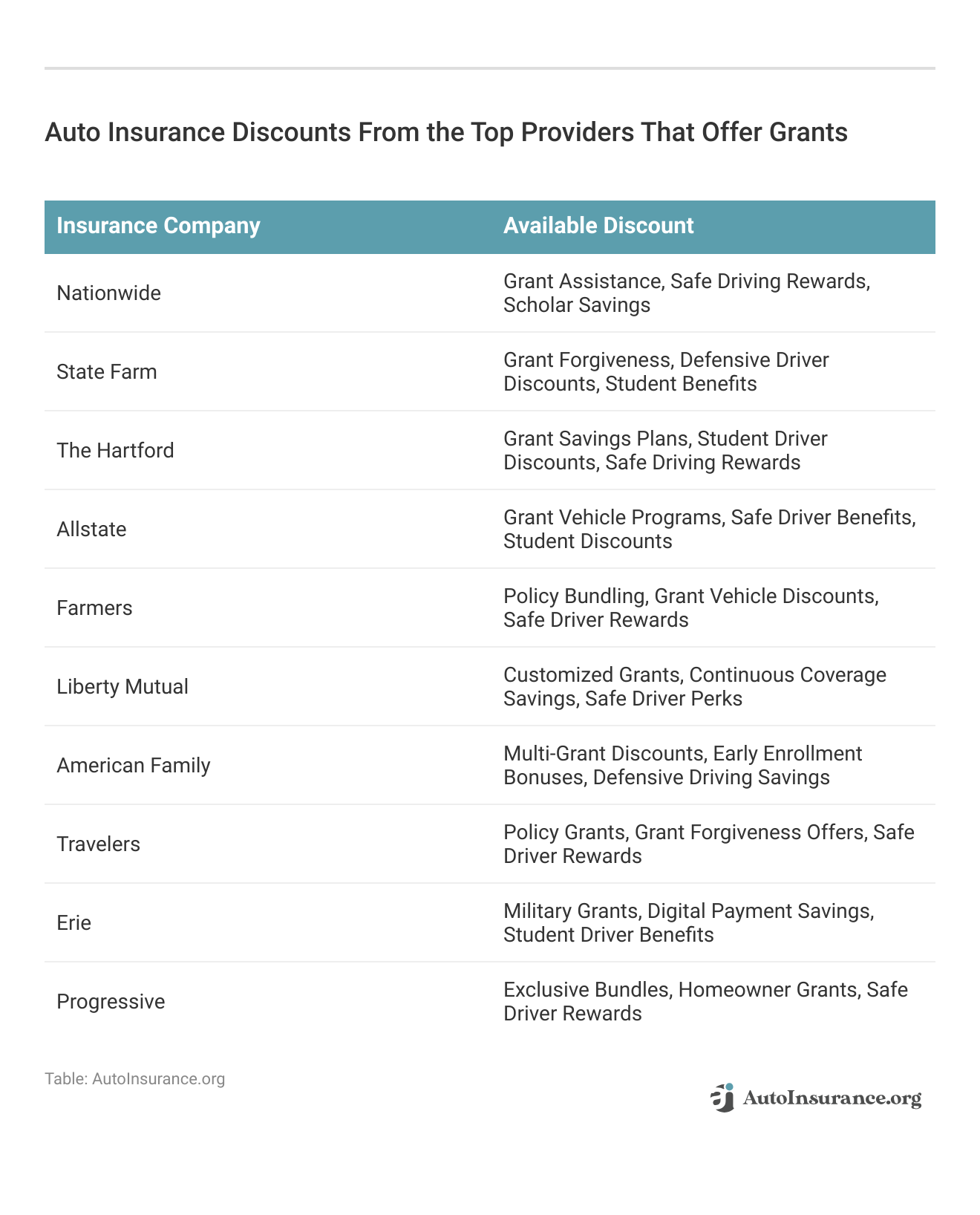

Auto Insurance Companies That Give Out Grants

If you want your money to be used responsibly and are shopping for an auto insurance company, auto insurance companies that offer grants could be a great fit for you.

Auto Insurance Monthly Rates by Coverage Level & Top Providers That Offer Grants

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $50 | $79 |

| American Family | $45 | $73 |

| Erie | $43 | $69 |

| Farmers | $43 | $68 |

| Liberty Mutual | $48 | $77 |

| Nationwide | $42 | $71 |

| Progressive | $48 | $74 |

| State Farm | $46 | $75 |

| The Hartford | $40 | $67 |

| Travelers | $47 | $73 |

Here is a list of seven companies that are able to you get the coverage you need while also providing for the community:

- Amica

- Allstate

- American Family Insurance

- State Farm

- Horace Mann

- Nationwide

- CSAA Insurance Group

Many of the names on this list are some of the best auto insurance companies in the industry. Because of the financial strength of these institutions they can do immense good for others besides providing great insurance coverage.

Let’s examine exactly how these insurance companies work to make the world a better place.

Amica

Founded in 1997, the Amica Companies Foundation primarily restricts its charitable inclinations to residents of Rhode Island.

Through the Amica Companies Foundation grants are given to many Rhode Island organizations that focus on promoting basic needs, the arts, education, and community health.

Amica’s average rate for coverage is $114 per month so as you can see, you can get affordable auto insurance from auto insurance companies that offer grants too.

Allstate

Allstate has been helping others since the 1950s, and these days The Allstate Foundation bestows grants to nonprofits that work to promote long-term change for individuals in their local community.

This foundation prioritizes ending domestic violence and financial abuse by providing abuse survivors with resources and educational materials so they have the tools they need to achieve their goals.

The Allstate Foundation also helps young people recognize what an unhealthy relationship looks like and works to nurture their self-confidence so they can grow up trusting in themselves and become effective leaders.

American Family Insurance

The American Family Insurance Dreams Foundation provides grants to non-profit organizations that primarily work to promote economic opportunities, education, and to fulfill the basic needs of the community.

With an average monthly rate of $121, American Family Insurance can also help you save on your insurance rates.

State Farm

Through its State Farm Neighborhood Assist program, State Farm actively works to make the world a better place by helping communities fix specific problems in their neighborhoods. There are even State Farm Covid grants.

The State Farm Companies Foundation provides scholarships, grants supporting volunteerism, and donations to colleges.

Altruism runs through every level of the State Farm company. To encourage its employees to take part in volunteer opportunities, State Farm actually gifts a $500 grant to a qualified non-profit if an eligible State Farm employee logs at least 40 hours of volunteering.

With an average monthly insurance rate of $97, you can get great coverage from State Farm and rest easy knowing that through the use of State Farm community grants, this company is putting your money to good use.

Horace Mann

Founded in 2020, the Horace Mann Educators Foundation was created to honor the educators that this company serves. The goal of this foundation is to provide financial assistance to teachers who want to help their students reach their potential.

This young foundation has already begun to do great things. $25,000 was given to the Springfield Public School District and those funds were used to implement Second Step, a web-based social-emotional learning (SEL) program.

This program helps children learn how to become well-balanced members of society as they learn how to set realistic goals for themselves, solve problems, and manage their emotions in a healthy way.

The average amount of insurance with this company is unknown but if you work in the education field, it could be well worth your time to get a quote from Horace Mann.

Nationwide

The Nationwide Foundation provides immense community support. Nationwide Foundation grants help the Nationwide Children’s Hospital flourish.

Now The Nationwide Foundation also hosts a slew of charity events like tournaments and marathons to fund the hospital, but it doesn’t stop there. Since 2000, Nationwide has brought in over $120 million for the sole purpose of funding charitable causes.

The Nationwide Foundation also actively works with other well-known non-profit organizations like United Way, Feeding America, and The American Red Cross.Jeff Root LICENSED INSURANCE AGENT

If you’re looking for an auto insurance company that can not only fit your budget but also fund some of your favorite non-profits, Nationwide may be a great fit for you as it offers insurance coverage for $107 per month on average.

CSAA Insurance Group

Drivers who want to work with a company dedicated to making the world a better place need look no further than the CSAA Insurance Group. Awarded The Civic 50 in 2018, CSAA is recognized as a company that has actively created positive change in the wider world. They have online payments as well, read our article titled “Can I pay my auto insurance online?” for more info.

It has earned this reputation by working closely with resource groups and regional councils to verify that the money it donates to various causes is being properly used. Not only does CSAA work to improve the lives of minority groups, but it also works to provide disaster relief as well.

How to Get Quotes From Car Insurance Providers That Offer Grants

Getting quotes from insurance companies that offer grants is relatively simple. You can use free tools to gather quotes from multiple companies at once, or you can visit a company’s site directly to get a free online quote. Shopping for insurance online can be quite advantageous.

Not only can you shop at times that are best for your schedule, but you can review quotes without having a push salesperson breathing down your neck.

Always get at least three quotes and if you have multiple cars be sure to get quotes for each one so you can see what your total monthly bill would be.

Read more: How to Compare Auto Insurance Quote

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Insurance Providers That Offer Grants

Auto insurance companies can do so much more than just provide insurance. Many big names in the insurance industry work to make the world a better place through the use of grants and donations.

Insurance companies like Amica, State Farm, and Nationwide along with others utilize their powerful resources to empower communities that are struggling.

Do you want to avoid shopping for auto insurance rates from auto insurance companies that don’t offer grants? If that’s the case then you’re in luck as you can find the best and most charitably minded insurance company with ease. (Read more: What is the average auto insurance cost per month?)

Enter your ZIP code to get free quotes from auto insurance companies that offer grants.

Frequently Asked Questions

How can I learn more about the grants and initiatives of auto insurance companies?

Individuals interested in learning more about the grants and initiatives of auto insurance companies can visit the companies’ websites, review Corporate Social Responsibility (CSR) reports or press releases, and contact customer service for detailed information.

Additionally, some companies may provide updates or information about their charitable activities through social media channels or community outreach programs.

Read more: Cheap Auto Insurance for Volunteers

What additional benefits or programs do auto insurance companies offer to policyholders?

In addition to providing insurance coverage, some auto insurance companies offer benefits or programs to policyholders, such as reduced rates, specialized coverage options, or access to community initiatives.

These initiatives may include grants to non-profit organizations, scholarships, or support for local community projects. Policyholders interested in accessing such benefits should inquire with their insurance provider for more information about available programs and eligibility requirements.

Can I choose the specific organization or cause to receive the grant?

Auto insurance companies have their own selection processes, but some may allow suggestions or nominations.

Are grants from auto insurance companies tax-deductible?

The tax deductibility of grants may vary depending on the specific circumstances and regulations in your jurisdiction. Generally, grants provided by auto insurance companies to non-profit organizations may be tax-deductible for the companies themselves.

However, individuals should consult a tax professional or local tax authority for guidance on whether their contributions or donations are eligible for tax deductions. Find cheap car insurance quotes by entering your ZIP code below.

How do auto insurance companies decide which organizations receive grants?

Each auto insurance company has its own criteria and selection process for granting funds to organizations. They may consider factors such as the organization’s mission, impact, financial stability, and alignment with the company’s values.

Read more: Understanding Auto Insurance

Can policyholders apply for grants directly from auto insurance companies?

Typically, grants from auto insurance companies are directed towards non-profit organizations rather than individuals. However, some companies may offer benefits or programs that provide additional support to policyholders, such as reduced rates or specialized coverage options.

Policyholders interested in accessing such benefits should inquire with their insurance provider for more information.

Can individuals who are not policyholders apply for grants from auto insurance companies?

Grants from auto insurance companies are typically directed towards non-profit organizations rather than individuals. While policyholders may have access to certain benefits or programs, such as reduced rates or specialized coverage options, grants are usually not available for individual applicants.

Auto insurance companies may have specific criteria and selection processes for granting funds to organizations, which individuals should inquire about directly with the company.

Can individuals suggest or nominate specific organizations or causes to receive grants from auto insurance companies?

While auto insurance companies may have their own selection processes for granting funds to organizations, some companies may allow policyholders or community members to suggest or nominate organizations or causes for consideration.

Policies regarding suggestions or nominations for grant recipients may vary by company, so individuals interested in making recommendations should inquire directly with their insurance provider for more information.

Can individuals or organizations outside of the insurance industry apply for grants from auto insurance companies?

While auto insurance companies primarily focus their grant-making efforts on supporting initiatives related to road safety, education, and community well-being, they may consider applications from organizations outside of the insurance industry.

However, these organizations would need to demonstrate how their projects or programs align with the company’s philanthropic priorities and contribute to the overall betterment of society. Interested parties should reach out to the company directly for information on grant application procedures and eligibility criteria.

How do auto insurance companies ensure transparency and accountability in their grant-giving process?

Auto insurance companies prioritize transparency and accountability in their grant-giving process by adhering to strict guidelines and reporting standards. They may publish annual reports detailing the recipients of their grants, the amount of funding allocated to each organization, and the outcomes or impacts achieved through the grants.

Additionally, companies may engage external auditors or oversight committees to review their grant-making practices and ensure compliance with ethical standards.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.