Best Auto Insurance Discounts for Police Officers in 2025 (Save up to 25% With These Companies)

The best auto insurance discounts for police officers are available from Geico, Farmers, and Allstate, with savings of up to 25%. Police officers can also benefit from telematics programs and first responder discounts, helping reduce premiums significantly. Compare rates to maximize your savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best auto insurance discounts for police officers come from top companies like Geico, Farmers, and Allstate, offering savings of up to 25%.

Police officers can also benefit from law enforcement discounts and telematics programs,which can significantly reduce auto insurance premiums.

Current and retired officers are eligible for these special discounts. Enter your ZIP code to compare quotes and secure the best deal on coverage.

Our Top 10 Company Picks: Best Auto Insurance Discounts for Police Officers

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 25% | A++ | Active or retired law enforcement officers | |

| #2 | 20% | A | Full-time law enforcement officers | |

| #3 | 15% | A | Police officers in good standing | |

| #4 | 12% | A | Law enforcement officers and their families |

| #5 | 10% | B | Police officers with a clean driving record | |

| #6 | 10% | A+ | Active law enforcement officers |

| #7 | 8% | A++ | Military police and ex-law enforcement | |

| #8 | 7% | A+ | Police officers with no major traffic violations | |

| #9 | 5% | A+ | Retired and active law enforcement officers |

| #10 | 5% | A- | Officers who drive fewer miles annually |

- The best auto insurance discounts for police officers offer savings up to 25%

- Officers can combine occupation-based and telematics discounts for more savings

- Geico, Farmers, and Allstate provide top discounts for law enforcement

Key Eligibility Criteria for Police Officer Auto Insurance Discounts

To qualify for the best auto insurance discounts for police officers, you must generally provide proof of your occupation. This proof can include a badge number, department ID, or other official documentation. Both active and retired officers are usually eligible for these discounts.

Many insurance companies offer occupation-based or law enforcement discounts, which may not always be explicitly labeled for police officers. Instead, they may be categorized as first responder discounts, which cover a range of emergency personnel. It’s essential to ask your provider what types of auto insurance discounts you qualify for.

Police officers can save significantly on auto insurance by providing proof of occupation and asking about first responder or union discounts.Brandon Frady Licensed Insurance Producer

In some cases, membership in a police union can also help officers access additional savings on their auto insurance. Union discounts are typically offered in conjunction with standard occupation-based discounts. Check with your insurance provider and union for the best available rates.

While most major insurance companies offer these discounts, the requirements can vary. Confirming the specifics with your insurance company ensures you receive all eligible savings. Comparing quotes from different companies can help you find the best rates and maximize police discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Police Auto Insurance Discounts

Auto insurance providers often offer discounts for police officers that can significantly lower premiums. These discounts, commonly referred to as occupation discounts, may also apply to various other professions, like sheriffs or nurses. Even if you don’t see a discount specifically labeled as a police auto insurance discount, it might still fall under this broader category.

Additionally, your driving record plays a role in determining your rate, so maintaining a clean driving history can further reduce your premium.

Insurance companies may also offer first responder auto insurance discounts, which police officers will also qualify for, even though a first responder auto insurance discount is not explicitly labeled as a discount. You may also see a discount for unions offered, such as police union member discounts.

So, just because you don’t see the wording “police auto insurance discount” doesn’t mean the company won’t have a law enforcement car insurance discount. It might just be labeled under a different discount name.

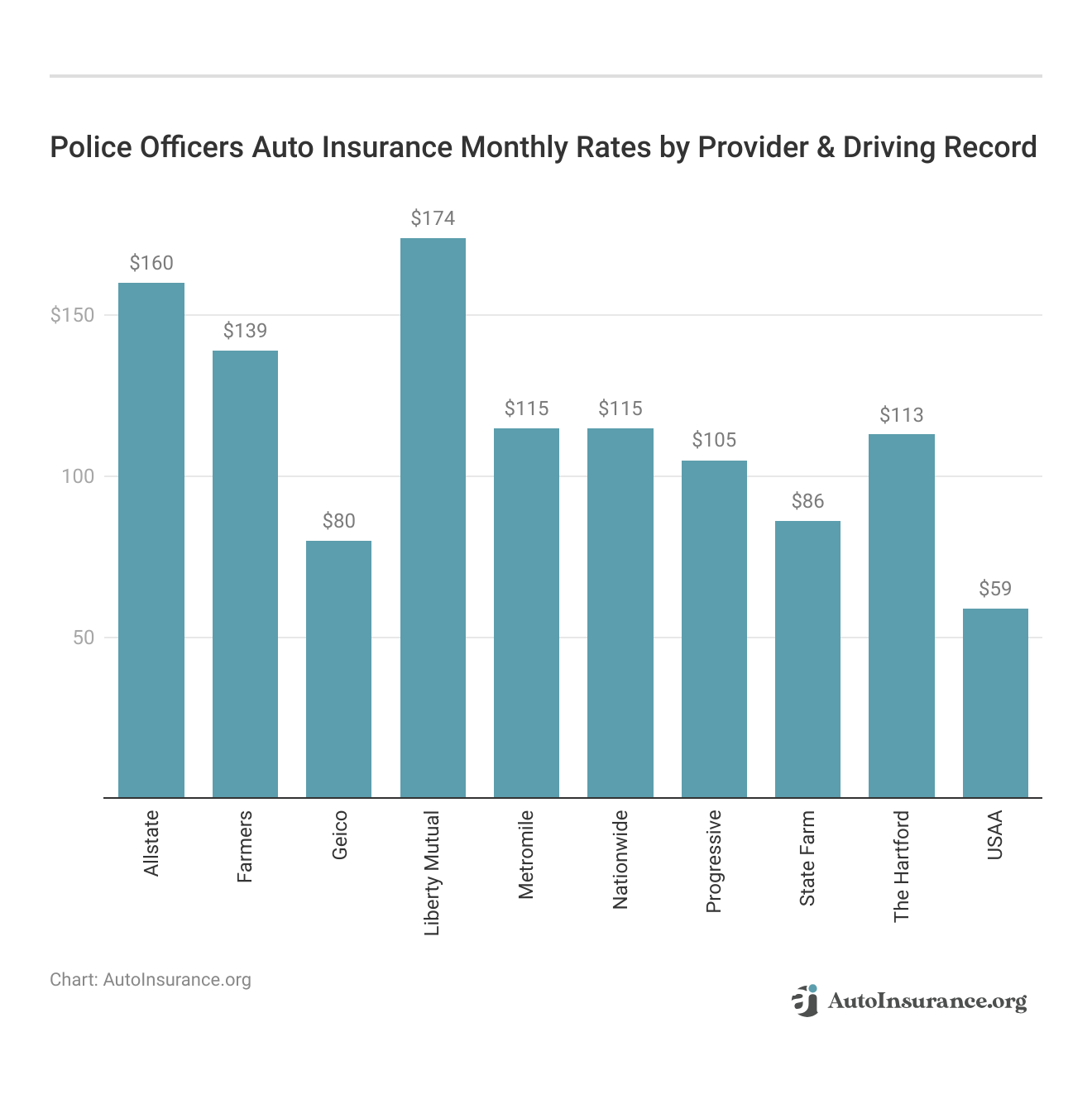

Police officers can benefit from various auto insurance discounts that significantly reduce their premiums. The following tables provide a breakdown of full and minimum coverage rates before and after discounts, along with rate differences based on age and gender. These discounts, offered by top insurance providers, are designed to cater to the unique needs of law enforcement officers and reflect both occupation and first responder discounts.

Top Police Officer Savings: Full Coverage Insurance Monthly Rates After Discount

| Insurance Provider | Rank | After Discount |

|---|---|---|

| #1 | $40 | |

| #2 | $45 | |

| #3 | $50 | |

| #4 | $52 |

|

| #5 | $53 | |

| #6 | $55 | |

| #7 | $58 | |

| #8 | $60 |

| #9 | $62 |

| #10 | $63 |

This table compares full coverage auto insurance rates for police officers, showing the difference between before and after discounts. USAA offers the lowest rates after discount at $40, while Liberty Mutual has the highest rates after discount at $60.

Top Police Officer Savings: Min. Coverage Insurance Monthly Rates After Discount

| Insurance Provider | Rank | After Discount |

|---|---|---|

| #1 | $18 | |

| #2 | $20 | |

| #3 | $22 | |

| #4 | $23 | |

| #5 | $24 | |

| #6 | $26 | |

| #7 | $27 | |

| #8 | $28 |

| #9 | $29 |

| #10 | $31 |

This table highlights minimum coverage auto insurance rates for police officers before and after discounts. Geico provides the lowest post-discount rate at $20, while The Hartford offers the highest post-discount rate at $31.

Police Officer Full Coverage Auto Insurance Monthly Rates by Age and Gender

| Insurance Provider | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male | Age: 25 Female | Age: 25 Male |

|---|---|---|---|---|---|---|

| $868 | $910 | $640 | $740 | $258 | $271 | |

| $1,156 | $1,103 | $853 | $897 | $246 | $256 | |

| $425 | $445 | $313 | $362 | $138 | $133 | |

| $1,031 | $1,121 | $745 | $893 | $267 | $306 |

| $586 | $679 | $432 | $552 | $194 | $213 |

| $1,144 | $1,161 | $843 | $944 | $201 | $209 | |

| $444 | $498 | $327 | $405 | $144 | $158 | |

| $787 | $824 | $580 | $670 | $193 | $204 |

| $349 | $356 | $257 | $289 | $114 | $122 |

This table demonstrates how full coverage auto insurance rates vary by age and gender for police officers. The lowest rates are for 25-year-old females with Geico at $133, while the highest rates are for 16-year-old males with Progressive at $209.

Companies Offering Police Auto Insurance Discounts

Many cheap auto insurance companies offer police car insurance discounts, allowing law enforcement members affordable coverage. We recommend looking at the best companies offering discounts for police officers.

Some insurers offer law enforcement discounts, so it’s worth checking multiple companies. The table below lists which companies offer police auto insurance discounts and the average amount police officers can save. It includes car insurance companies that offer law enforcement discounts. Contact your provider to see if you qualify for a police discount.

Law Enforcement Auto Insurance Discounts by Provider

| Insurance Company | Savings Percentages |

|---|---|

| 25% | |

| 5% | |

| 15% | |

| 5% |

| 12% |

| 5% | |

| 10% |

| 10% | |

| 25% | |

| 8% |

The table presents various car insurance discounts offered to law enforcement officers by different insurance companies. Geico provides up to 15% off premiums for active or retired police officers, while State Farm and Allstate both offer a significant 25% discount to current or former officers. Progressive gives up to 10% off for officers and their families, and Farmers offers a smaller 5% discount.

Liberty Mutual extends up to 12% off for law enforcement officers and their families, and USAA offers 8% off, specifically for military police and ex-officers with a membership. The Hartford and Metromile provide 5% discounts, with Metromile focusing on officers who drive fewer miles annually.

Exploring Your Options for Police Auto Insurance Discounts

When exploring your options for discounts on car insurance for police officers, start by looking at our list in the previous section to find the best auto insurance companies for police auto insurance discounts. If you’re already with one of the companies on our list but aren’t sure if you earn a police discount, contact the company.

If your current company doesn’t offer an auto insurance discount for police officers, consider looking into other companies to see if you can get a better deal with a police insurance discount. Review your insurance police rates annually to ensure you receive all applicable discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Get the Law Enforcement Auto Insurance Discount

Drivers must provide proof of their involvement in law enforcement to get law enforcement auto insurance discounts. Ask your insurance provider about their law enforcement car insurance discount options. Most companies allow police officer insurance discounts for current and retired law enforcement personnel. For police vehicle insurance, officers can save by asking about special occupation-based discounts.

Each company will specify what is needed to qualify for police auto insurance discounts, whether a badge number or a police photo ID. Once you contact your company and prove you’re a police officer, the company will apply the discount to your auto insurance policy.

Strategies for Securing Police Auto Insurance Discounts

Before purchasing a policy, ask for a police quotation from multiple providers. Shop around for police discounts and getting quotes from different companies is the best way to secure the best possible rate because it will show you how much the discount saves you on the overall policy.

For example, while Allstate auto insurance review shows that the company offers one of the most significant discount percentages to police officers, it typically has higher rates than others.

Comparing insurance quotes is one of the best ways to find lower auto insurance rates. But how do you do it? And how much does it cost? At https://t.co/27f1xf1ARb, car insurance quote comparisons are FREE 🥳. Check out our easy guide to comparing quotes 👉 https://t.co/wKUJsuX6su pic.twitter.com/PlXGXe7UMn

— AutoInsurance.org (@AutoInsurance) June 6, 2023

Therefore, the best way to see which company’s police discount will save you the most is to get an auto insurance quote. Getting auto insurance quotes shows how much you’ll pay for a policy after discounts apply.

Maximizing Your Savings on Auto Insurance for Police Officers

Besides police officer auto insurance discounts, there are other auto insurance discounts you can look for at your company, such as:

- Customer Loyalty Auto Insurance Discount

- Good Driver Auto Insurance Discount

- Low-Mileage Auto Insurance Discount

- New Car Auto Insurance Discount

- Anti-Theft Auto Insurance Discount

- Pay-in-Full Auto Insurance Discount

These discounts can be combined with police officer auto insurance discounts to maximize your savings. We recommend looking at your insurance company’s list of offered law enforcement discounts to see what other savings you can apply for to reduce your rates on your vehicle insurance for law enforcement.

Combining police officer discounts with options like customer loyalty, good driver, or anti-theft discounts can significantly reduce costs. Stack every available discount to maximize savings on your auto insurance.Daniel Walker Licensed Auto Insurance Agent

You can also read police officer quotes to understand how other officers have saved on their policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Getting the Best Police Auto Insurance Rates

Drivers shopping for auto insurance for law enforcement officers can get the best rates by comparing discounts for police personnel and rates from different companies. Exploring car insurance for cops can help officers find specialized policies with discounted rates.

Police officers who take the time to evaluate auto insurance quotes can rest assured that they have the best rate on their auto insurance coverage. Insurance companies often offer specialized policies for cars for police officers to ensure comprehensive coverage. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

Who qualifies for a police auto insurance discount?

Most companies allow currently employed police officers and retired police officers to qualify for a police auto insurance discount.

What is the typical savings amount for a police auto insurance discount?

Savings for police auto insurance discounts range from 5% to 25%.

Which providers have a dedicated police auto insurance discount?

Allstate, Geico, Farmers, Progressive, and State Farm offer special insurance rates for police officers, as highlighted in the State Farm auto insurance review.

Which company gives the most significant discount for law enforcement auto insurance?

State Farm and Allstate offer up to 25% off auto insurance for police, the highest percentage discount for a police discount.

Is there a first responder discount that police officers can get?

Yes, some companies offer a first responder auto insurance discount that police officers can qualify for.

Can police officers get USAA insurance?

Yes, if the police officer previously served in the military or has an immediate family member who did, they can get USAA auto insurance. Otherwise, they’ll need to find coverage elsewhere, but they can check out a USAA auto insurance review for additional insights. Police officers can still find savings at other companies with a police officer auto insurance discount.

Does Allstate give a police auto insurance discount?

Yes, Allstate has a police auto insurance discount of up to 25%. Use our free comparison tool below to see what auto insurance quotes look like in your area.

Is there a law enforcement discount at USAA?

USAA doesn’t offer a discount on vehicle insurance for law enforcement.

Can police officers get an auto insurance discount with Progressive?

Yes, according to a Progressive auto insurance review, they offer a police officer auto insurance discount.

Does State Farm have police auto insurance discounts?

Yes, State Farm has a police auto insurance discount of up to 25%.

Is there a Geico police auto insurance discount?

Yes, Geico auto insurance, as highlighted in many Geico auto insurance reviews, offers a police auto insurance discount of up to 15%.

What is the best auto insurance for police officers?

The best car insurance for police officers will be affordable and have good coverage. We recommend starting the search by looking at the top companies that offer police auto insurance discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.