Best Auto Insurance Discounts for University of Michigan Alumni in 2025 (Save up to 25% With These 10 Companies)

The best auto insurance discounts for University of Michigan alumni come from Geico, State Farm, and Progressive. These companies offer University of Michigan car insurance discounts of up to 25%. University of Michigan alums can also save by taking advantage of other discounts and comparing quotes.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Jan 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you graduated from UMich, the best auto insurance discounts for University of Michigan alumni come from Geico, State Farm, and Progressive.

Many insurance companies offer auto insurance discounts for alumni for different colleges, including the University of Michigan.

University of Michigan alumni discounts can help you save up to 25% on your car insurance policy. You may also qualify for additional discounts, like savings for being a good driver.

Our Top 10 Picks: Best Auto Insurance Discounts for University of Michigan Alumni

| Company | Rank | Savings Potential | Description |

|---|---|---|---|

| #1 | 25% | Offers the highest discount for alumni | |

| #2 | 22% | Provides large savings for safe drivers | |

| #3 | 20% | Discounts for bundled home and auto policies | |

| #4 | 18% | Alumni loyalty rewards for lower premium costs |

| #5 | 16% | Safe driving discounts for accident-free drivers | |

| #6 | 15% | Discounts for students with good grades |

| #7 | 14% | Reduced rates for low annual mileage | |

| #8 | 12% | Savings for using electronic payment methods | |

| #9 | 10% | Multi-vehicle policy discount available | |

| #10 | 8% | Alumni association membership discounts |

Explore the best University of Michigan car insurance discounts below, and learn other ways to keep your rates low. Then, enter your ZIP code into our free comparison tool above to see personalized quotes.

- Many insurance companies offer discounts to University of Michigan alums

- University of Michigan alums can take advantage of other car insurance discounts

- Geico and State Farm have the best U of M discounts for alumni

Auto Insurance Discounts for University of Michigan Alumni

One of the benefits of U of M alumni association membership is that you’ll be eligible for car insurance discounts from a variety of companies. Several companies offer a discount for alums, but the five listed below offer the biggest savings:

- Geico: Geico offers a discount of up to 25% for UMich insurance. It also has low overall rates — see how much you might pay in our Geico auto insurance review.

- State Farm: With savings of up to 22%, State Farm offers one of the best University of Michigan discounts. Explore other ways to save in our State Farm auto insurance review.

- Progressive: Use Progressive’s alumni insurance program discount to save 20% on your insurance. Learn how Progressive keeps rates low in our Progressive auto insurance review.

- Liberty Mutual: University of Michigan alumni can benefit from Liberty Mutual’s affinity discount. If you work at the college, check out our Liberty Mutual auto insurance review to see University of Michigan employee discounts.

- Allstate: Allstate includes the University of Michigan in its list of alumni associations eligible for discounts. Alumni heading back to school should read our Allstate auto insurance review to see University of Michigan student discounts.

While these are our top picks for University of Michigan discounts, there are plenty of alternatives. If you want the best car insurance discount for University of Michigan alumni, make sure to compare quotes with as many companies as possible.

Insurance companies consider the same factors when determining your rates but use unique formulas. This is why comparing quotes is so vital - you won't know which company has the best rates for you without checking.Michelle Robbins Licensed Insurance Agent

Aside from car insurance discounts, you should also check other companies for UMich discounts. For example, some graduates may be eligible for Michigan medicine discounts through the UMich Alumni Association.

Auto Insurance Discounts for University of Michigan Employees

If you work for the University of Michigan, the University factors the cost of personal insurance into its mileage reimbursement for employees who use their personal vehicles at work. If your auto insurance doesn’t pay for all your damage, the University’s liability auto insurance may cover some of your expenses.

The UMich mileage reimbursement program can help you keep your transportation costs down. For more information about University of Michigan mileage reimbursement, speak with your supervisor or HR representative.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Costs for University of Michigan Alumni

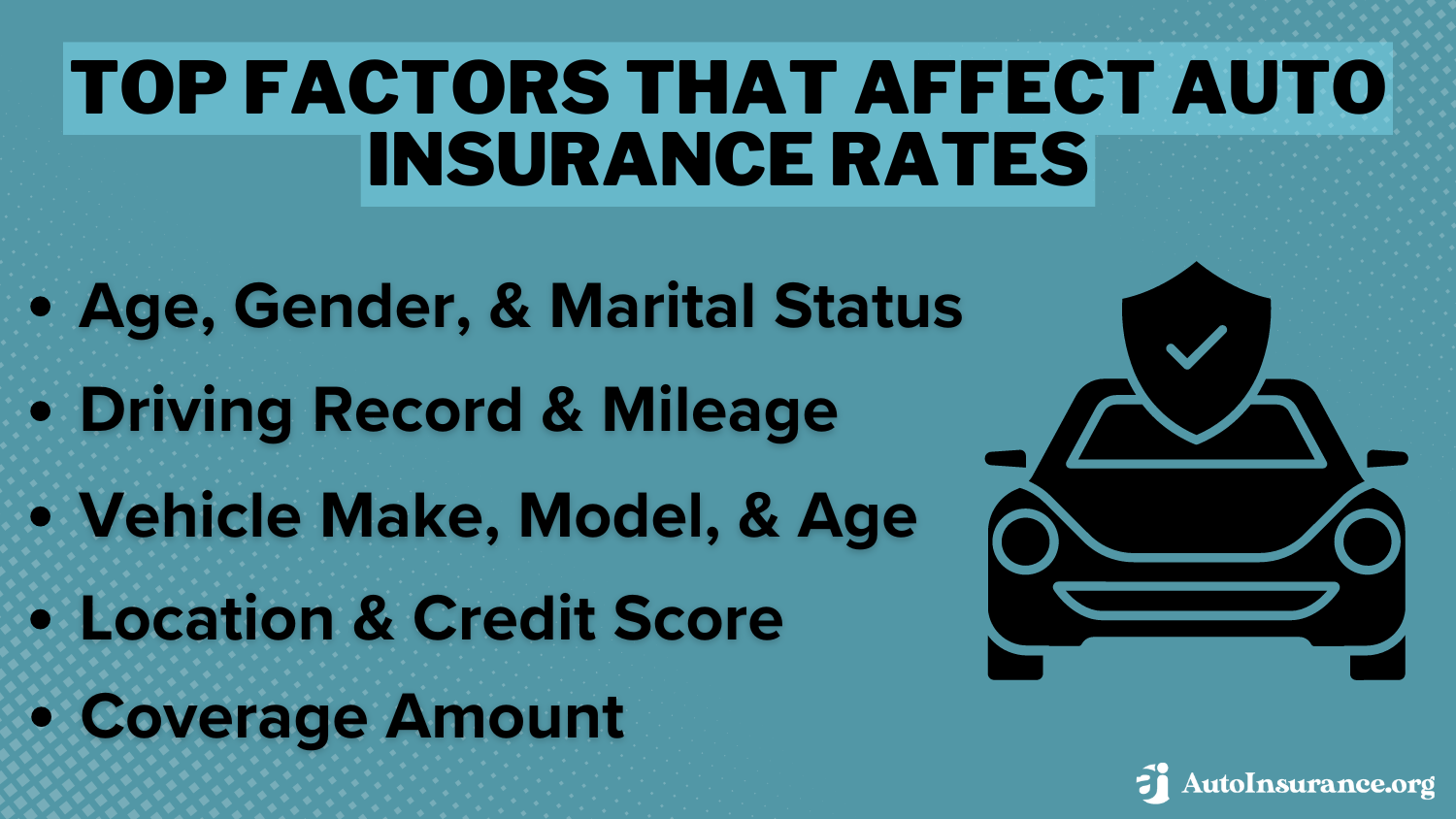

How much is the cheapest car insurance in Michigan? The answer is a little more complicated than the average lowest auto insurance in Michigan. Insurance companies use a variety of factors to determine how much to charge for insurance.

A smaller factor is your education – the more education you have, the less likely you are to drive recklessly or file claims.

Because of this, college graduates usually pay slightly lower rates. To see how much you might pay for your Michigan insurance, check the rates below.

Michigan Monthly Auto Insurance Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Male | $180 | $400 |

| Age: 16 Female | $170 | $390 |

| Age: 25 Male | $150 | $320 |

| Age: 25 Female | $145 | $310 |

| Age: 30 Male | $140 | $300 |

| Age: 30 Female | $130 | $290 |

| Age: 45 Male | $125 | $260 |

| Age: 45 Female | $120 | $250 |

| Age: 55 Male | $115 | $240 |

| Age: 55 Female | $110 | $230 |

| Age: 65 Male | $105 | $220 |

| Age: 65 Female | $100 | $210 |

You might notice that Michigan auto insurance rates are higher than the national average. Due to Michigan’s unique no-fault insurance system and high medical coverage requirements, car insurance premiums are historically high.

However, you don’t have to wonder how to get lower car insurance in Michigan. Aside from University of Michigan Alumni Association discounts, there are plenty of other ways to save.

How to Qualify for a University of Michigan Auto Insurance Discount

You might think that you qualify for an alumni discount just because you graduated from UMich. However, that’s not necessarily true. To qualify for a University of Michigan alumni car insurance discount, you typically need to meet the following criteria:

- Be a Verified Alum: You must be a graduate or former student of the University of Michigan. Some insurance companies may verify your alumni status through the university or alumni association.

- Choose a Participating Insurer: Select an insurance company that offers an alumni discount, such as Geico, State Farm, or Liberty Mutual. Not all companies provide this benefit, so checking with your insurer is key.

- Mention Affinity Discounts: When applying or renewing your policy, inform the insurance provider of your alumni status to apply any eligible discounts.

- Stay in Good Standing: You may need to maintain active membership in the University of Michigan Alumni Association or other qualifying organizations that your insurer partners with.

For the most part, you can only get an affinity discount for one type of membership. For example, if you’re one of the many Wolverines who start a career at the college, you probably won’t qualify for UMich employee discounts and alumni savings.

Alumni discounts usually fall under the broader affiliation or affinity discount many companies offer. If your insurance provider has an affiliation discount, it doesn’t matter if you’re part of multiple qualifying groups – the discount will only apply once.Scott W. Johnson Licensed Insurance Agent

However, it doesn’t hurt to check if you qualify for additional U of M employee discounts. No matter the type of auto insurance you want to purchase, you should always ask a representative to double-check your policy for more discounts.

Other Ways for University of Michigan Alumni to Save on Auto Insurance

Car insurance can be expensive, especially in Michigan. Whether you’re a fresh graduate, you haven’t seen school in a few decades, or you’re considering furthering your education, taking steps to find affordable coverage is integral.

It’s that time of year🗓️. College students are heading back to school🏫. College is expensive enough, so saving money💰 in other areas is essential. https://t.co/27f1xf131D has researched and shared ways to save. Check it out👉: https://t.co/C6jA7IWdXH pic.twitter.com/PfX5enLSai

— AutoInsurance.org (@AutoInsurance) August 29, 2023

While finding an alumni discount is a great way to keep your rates low, it’s not the only way. Check out the tips below to find the cheapest auto insurance companies possible.

- Bundle Policies: Combine the best auto and home insurance in Michigan to receive multi-policy discounts.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to qualify for safe driver discounts and lower rates over time.

- Increase Your Deductible: Opting for a higher deductible can reduce your premium, though you’ll pay more out-of-pocket in the event of a claim.

- Take Advantage of Discounts: Most companies offer a variety of discounts to help you save. Auto insurance discounts usually apply directly to your account, but you can always ask a representative to check that you’re getting everything.

You should also regularly compare quotes from different insurers to ensure you’re getting the best rate and taking advantage of any new savings opportunities. Most companies make getting a personalized quote easy – simply visit their website and fill out a request form.

Alternatively, you can save time and effort by using a free online quote-generator tool to see rates from multiple companies simultaneously.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find the Best Auto Insurance Discounts for University of Michigan Alumni Today

Auto insurance discounts are available for University of Michigan alumni and members of the alumni association from many companies. In addition, if you’re an alumni of the University of Michigan but are pursuing a higher degree, you can still get auto insurance for graduate students and save with the UMich alumni insurance discount.

UMich also offers discounts on life and health insurance, a discount on labor for repairs from Dependable Collision Center, discounts on auto transport, pet insurance, rental cars, hotels, and more. Enter your ZIP code below to compare quotes from various companies and see how a UMich insurance discount could help you save.

Frequently Asked Questions

Who has the best auto insurance discounts for University of Michigan alumni?

Geico, State Farm, and Progressive are the companies with the largest alumni discounts for University of Michigan graduates.

How much does auto insurance for alumni cost in Michigan?

While you’ll need to learn how to evaluate multiple insurance quotes to see what your actual rates will be, the average alum in Michigan pays $130 per month for minimum insurance and $290 for full coverage.

Are there other perks that come with being a University of Michigan alum?

Joining the Alumni Association at the University of Michigan comes with a variety of perks, like special deals, a UMich rental car discount, and access to your former campus.

How do you lower your car insurance rates in Michigan?

To get the cheapest insurance in Michigan, you should look for discounts, choose a higher deductible, keep your driving record clean, and pick a policy that only meets Michigan auto insurance requirements.

What are the best auto insurance companies for University of Michigan students?

The best auto insurance companies for college students include Erie, USAA, and State Farm.

Is Geico cheaper than Progressive for alumni auto insurance?

While you should always compare rates before you purchase a policy, Geico is usually a cheaper option than Progressive. To make sure Geico is your cheapest option, enter your ZIP code into our free quote comparison tool.

Does Geico cover Michigan?

Despite some rumors that you can’t purchase insurance from Geico if you live in Michigan, you can sign up online by visiting the company’s website. You can also call the customer service phone number to speak with a representative to learn how to get auto insurance in Michigan.

Are collision and comprehensive insurance necessary for UMich alumni?

Everyone needs liability insurance to pay for any damage to another person’s vehicle or injuries to them and their passengers, including University of Michigan alumni. You could also save on coverage with a UMich alumni association discount.

It’s also a good idea to get collision auto insurance and comprehensive auto insurance to pay for any repairs to your vehicle. However, you may not need this coverage if you have an older vehicle that’s not worth the cost of full coverage insurance.

Can University of Michigan alumni get additional insurance discounts for good grades?

UMich students and alumni between 16 and 25 can learn how to get a good student auto insurance discount with a variety of auto insurance companies. They usually need at least a B average.

Insurers can only get information from the Department of Motor Vehicles (DMV), so they’ll ask you for copies of your UMich records if you decide that you want to apply for a good student insurance discount.

How can UMich alumni get cheaper auto insurance rates?

You can increase your deductible or lower your coverage to receive cheaper auto insurance rates. See if your company offers an auto insurance discount for University of Michigan alumni, too.

Additionally, shopping online and comparing quotes could help you save hundreds of dollars a year on coverage.

Is there a University of Michigan rental car discount?

Many companies offer UMich car rental discounts, including some of the top rental companies in the country. For example, Hertz offers a University of Michigan car rental discount of up to 25%. Check with your Alumni Association to see what UMich rental car discounts are available to you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.