Best Auto Insurance for Diplomats in 2025 (Your Guide to The Top 8 Providers)

The best auto insurance for diplomats is Geico, State Farm, and AAA. State Farm and Geico have the cheapest diplomat car insurance rates under $60/mo. AAA rounds out the top three companies for diplomat insurance because it can issue International Driving Permits (IDP) for U.S. and foreign diplomats.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate for Diplomats

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Avg. Monthly Rate for Diplomats

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Avg. Monthly Rate for Diplomats

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsGeico has the best auto insurance for diplomats with policies for U.S. diplomats traveling abroad at $50/mo.

Geico and State Farm also top our list of the best auto insurance for federal employees, and each has hefty occupational discounts and cheap diplomat auto insurance rates under $60/mo. However, AAA is the only insurer that issues International Driving Permits (IDP) for U.S. and foreign diplomats.

Our Top 8 Company Picks: Best Auto Insurance for Diplomats

| Company | Rank | Federal Discount | AM Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% | A++ | Low Rates | Geico | |

| #2 | 10% | B | Customer Service | State Farm | |

| #3 | 6% | A | Roadside Assistance | AAA |

| #4 | 11% | A+ | Foreign Diplomats | Dairyland | |

| #5 | 12% | A+ | Biggest Discount | Progressive | |

| #6 | 7% | A | Available Discounts | Farmers | |

| #7 | 9% | A+ | Usage-Based Savings | Nationwide |

| #8 | 5% | A++ | Safe Drivers | Travelers |

Dairyland offers the best car insurance for foreign drivers in the U.S., but Geico has the best rates on overseas coverage for U.S. diplomats going abroad. Enter your ZIP code above to compare quotes from these top providers and more.

- The Foreign Mission Community must have liability insurance if driving in the U.S.

- Minimum diplomat auto insurance requirements are 100/300/100

- The top auto insurance companies for diplomats are Geico, State Farm, and AAA

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros:

- Eagle Discount: Diplomats and federal employees can save 8%-12% (See More: Geico Auto Insurance Discounts)

- Cheap rates: Lowest average rates for diplomats at $50/mo

- Foreign driver: Cheap rates for visiting diplomats with a foreign license

- Overseas insurance: Unique policies for U.S. drivers traveling or moving abroad

Cons:

- Poor claims satisfaction: Scores below average in annual J.D. Power survey

- Missing coverage: No gap insurance for new cars

#2 – State Farm: Best Customer Service

Pros:

- Occupational discount: Federal employees and diplomats save 10% on auto insurance

- Foreign driver: Affordable rates for drivers with a foreign license. Compare quotes in our State Farm auto insurance review.

- Great customer service: Top five company for claims satisfaction

- Affordable rates: Low rates for diplomats at $55/mo

Cons:

- No discounts online: Must speak to an agent to get occupational discount

- Missing coverage: No gap insurance for new cars

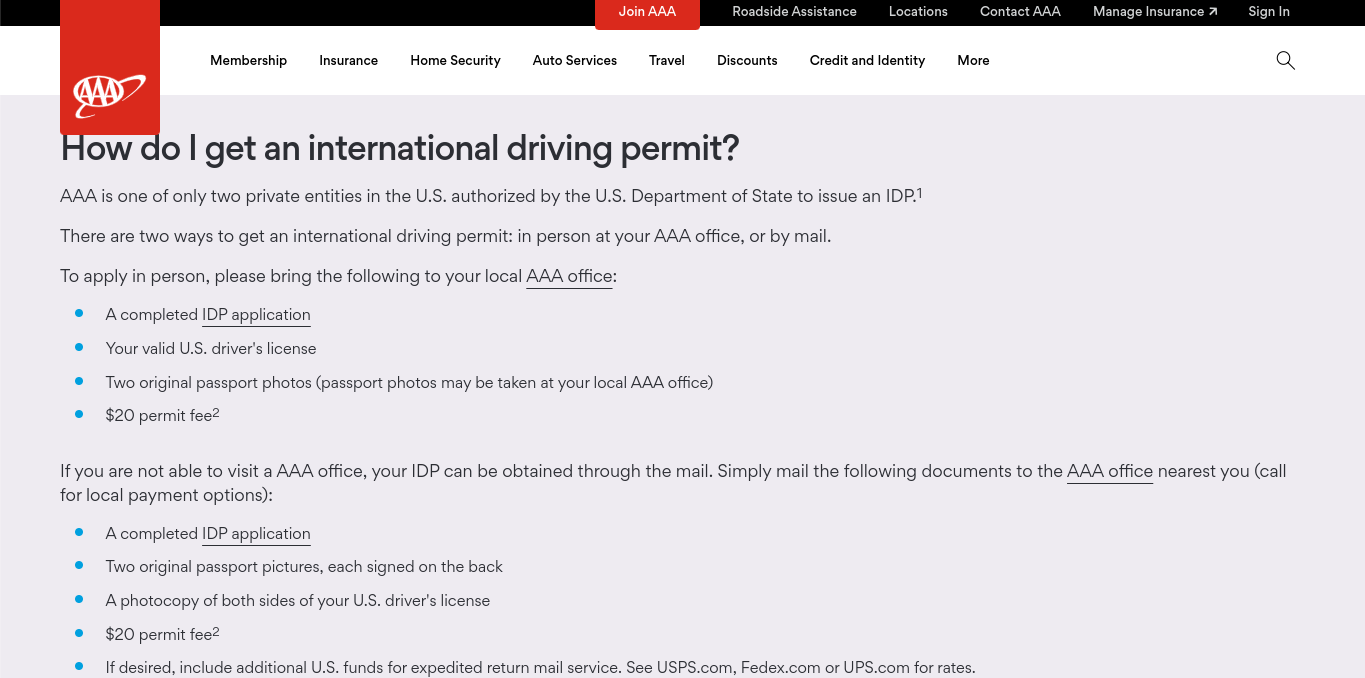

#3 – AAA: Best for Diplomats Who Need an IDP

Pros:

- International Driving Permit (IDP): Issues IDP for foreign and U.S. drivers

- Occupational discount: 6% insurance discount for federal employees and diplomats

- Roadside assistance: International coverage for towing and locksmith and battery services

- Global discounts: AAA members enjoy international savings on hotels and more

Cons:

- No discounts online: Must speak to an agent to get occupational discount

- Membership required: It costs $65/yr to join AAA for insurance and discounts. Learn more in our AAA Car Insurance Review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Dairyland: Best for Foreign Diplomats Visiting the U.S.

Pros:

- Foreign driver: Affordable auto insurance for international drivers with a foreign license

- High-risk insurance: Drivers with accidents or DUIs still qualify for coverage. Explore your high-risk insurance options in our Dairyland auto insurance review.

- Cheap rates: Low average rates for diplomats at $50/mo

- Occupational discount: Diplomats save 11% on auto insurance

Cons:

- Poor customer service: Receives more complaints than other insurers its size

- Poor claims satisfaction: Not rated by J.D. Power and customers report slow processing times

#5 – Progressive: Biggest Auto Insurance Discount for Diplomats

Pros:

- Foreign driver: Affordable auto insurance for drivers with a foreign license

- Occupational discount: Diplomats and federal employees save up to 12% (See More: Progressive Auto Insurance Discounts)

- Low rates: $60/mo for diplomat auto insurance

- Variety of policies: Classic, commercial, and usage-based insurance available

Cons:

- Poor claims satisfaction: Scores below average in annual J.D. Power survey

- Poor customer service: Receives more complaints than other national insurers

#6 – Farmers: Best for Additional Discounts

Pros:

- Long list of discounts: More auto insurance discounts than any other insurer

- Affinity discount: Exclusive 7% savings for diplomats and federal employees

- Variety of policies: Coverage for collector, classic, and sports cars

Cons:

- Need a U.S. license: No auto insurance for drivers with a foreign license

- No discounts online: Must speak to an agent to get affinity discount. Explore all Farmers discount options here: Farmers Auto Insurance Discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Biggest Low-Mileage and Usage-Based Savings

Pros:

- Variety of policies: Classic, commercial, usage-based, and pay-per-mile insurance available

- Occupational discount: Federal employees and diplomats save 9% on auto insurance

- Usage-based discount: Biggest savings of up to 40% for safe drivers (Learn More: Nationwide SmartRide App Review)

Cons:

- Need a U.S. license: Doesn’t have policies for drivers with a foreign license

- Not in every state: No auto insurance in AK, HI, LA, or MA

#8 – Travelers: Best Perks for Safe Drivers

Pros:

- Affinity discount: Exclusive 5% savings for diplomats and federal employees

- Responsible Driver policy: Safe drivers get decreasing deductibles and accident and minor violation forgiveness. Read our full review of Travelers insurance for more information.

- Low rates: Affordable diplomat car insurance rates average $70/mo

Cons:

- Need a U.S. license: Doesn’t sell auto insurance to drivers with a foreign license

- Poor customer service: Customer satisfaction below average in most regions

Who Offers the Best Auto Insurance Rates for Diplomats

Since diplomats have to buy higher liability amounts, it makes sense that diplomats will have higher than average insurance rates.

Diplomats Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $180 |

| $50 | $160 | |

| $80 | $160 | |

| $65 | $200 | |

| $50 | $150 | |

| $75 | $220 |

| $60 | $180 | |

| $55 | $170 | |

| $70 | $210 |

Because diplomatic car insurance can be so expensive, we want to go over the ways to save on diplomatic car insurance. Scroll down to learn how to lower your rates.

How Occupation Affects Diplomat Auto Insurance Rates

Does a job affect auto insurance rates? Yes, your occupation can change your car insurance price, even if you aren’t aware of it. It all comes down to risk — drivers in some occupations are more likely to file a claim, which raises their rates.

For example, diplomats are sometimes subject to targeted attacks, so insurers take on extra risk when insuring diplomats.

Commute and education level also impact how much you pay for auto insurance. So don’t be surprised when your insurer asks what your occupation is. Companies are using it to determine the risk of insuring you since data shows that certain job fields are more likely to file claims.

Auto Insurance Discounts for Diplomats

Diplomat drivers are eligible for all the same discounts as regular drivers plus exclusive savings based on their career. Progressive, Geico, State Farm, and Dairyland have the biggest savings for federal employees, including diplomats.

However, diplomats can lower their rates even more with vehicle discounts, safe driving discounts, policyholder discounts, and personal status discounts:

- Vehicle discounts: Safety features on your car include anti-lock brakes, anti-theft devices, and passive restraint discounts

- Safe driver discounts: Good driving savings for being claim-free, low-mileage, or having usage-based insurance

- Policyholder discounts: Include early signing, multi-policy, multi-vehicle, auto-pay, and bundling discounts

- Personal status discounts: Savings based on age, marital status, education, and occupation

Several insurers offer occupation discounts, but fewer offer federal employee discounts, so always remember to ask for all discounts before you buy car insurance.

Learn More: How to Get a Membership Discount

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Required Auto Insurance for Diplomats

Any diplomat operating a motor vehicle in the United States is bound by the same insurance requirements that any other motorist is required to follow. However, diplomats must carry the specific limits of coverage listed in the Foreign Missions Act as an additional interest in the policy.

The Office of Foreign Missions (OFM) outlines the minimum acceptable limits for any diplomat’s car insurance — 100/300/100. This amount is the minimum level of coverage that a diplomat must purchase, which means they would carry $100,000 coverage for bodily injuries per person, $300,000 coverage for bodily injuries per incident, and $100,000 coverage for property damage per incident.

The table below shows a diplomat’s required liability amounts compared to a normal driver’s required liability amounts in the District of Columbia.

Diplomatic Liability Limits Compared to District of Columbia

| Required Liability Amounts | Diplomats | Regular Drivers in the District of Columbia |

|---|---|---|

| For all people injured in an accident | $300,000 | $50,000 |

| For one person injured in an accident | $100,000 | $25,000 |

| For property damage | $100,000 | $10,000 |

Diplomats have higher liability amounts because they don’t have a driving record if they are new to a country. Most companies need to see that drivers can consistently have at least a few years of safe driving without accidents or tickets before they can lower rates and give discounts.

During the purchase process, it’s important to inform the insurance provider about the minimum limits that are acceptable for a diplomat to carry.

Additional Considerations for Diplomat Auto Insurance

Car insurance for diplomatic individuals comes with a host of requirements that must be followed to maintain their privileges within the United States.

It's important to remember that anyone required to carry one of these policies must submit proof of coverage every six months to the Diplomatic Motor Vehicle Office. Failure to do so may result in a loss of privileges or fines and fees.Daniel Walker Licensed Auto Insurance Agent

If a driver’s diplomat insurance is about to end, the OFM will send out reminders to renew the auto insurance policy, but diplomats are required to notify the OFM of the following:

- policy changes

- insurance cancellations

- tickets and auto accidents

The OFM has a complete program in place to help manage and follow up on moving violations and parking tickets that may occur. It includes payable violations and “must appear” violations. This office also handles situations where an individual drives under the influence of drugs or alcohol.

Additionally, there are regional offices that work with each Foreign Mission to make sure that the proper requirements are being followed. For example, if you have concerns or questions about coverage, such as before renting a non-owned vehicle, contact your regional office.

How to Get Auto Insurance for Drivers With a Foreign License

If you’re a diplomat visiting the United States, realize that not all insurers offer foreign driver auto insurance. You will need to shop with companies that sell policies to drivers with an IDP or foreign license. AAA is the best auto insurance company for diplomats offering IDP.

Fortunately, Geico and State Farm also offer foreign car insurance as well as affordable auto insurance for government employees living and working in the U.S.

Temporary Auto Insurance for Foreign Drivers

Most visiting diplomats and other international drivers do not need a U.S. license or insurance policy for up to six months. You can get temporary car insurance from a rental car company or purchase short-term coverage from the providers on this list. Unfortunately, foreign diplomats cannot get coverage through Nationwide, Farmers, or Travelers.

Read More: Best Auto Insurance For International Drivers

If you are a U.S. diplomat traveling abroad, you can also buy temporary car insurance from a rental car company. Your personal policy may already cover you when traveling to Mexico, Canada, and other countries, so confirm with your provider before buying additional coverage.

Long-Term Auto Insurance for International Drivers

If you plan on being in the country for longer than 180 days, you will need to buy auto insurance for non-U.S. citizens. While Dairyland offers the best auto insurance for international diplomats, shop around with multiple companies in the state where you will be living to find the cheapest quotes.

Bottom Line on The Best Auto Insurance for Diplomats

Not all insurers offer diplomatic car insurance. However, you can apply for diplomatic car insurance at almost any provider. You just have to inform them that you are buying diplomatic car insurance. Why? The insurer will raise the liability limits on your car insurance policy.

Geico, State Farm, and AAA have the best auto insurance for diplomats with cheap rates, international coverage, and competitive occupational discounts for federal employees.Michelle Robbins Licensed Insurance Agent

Remember, you need to meet the OFM’s requirements for minimum liability coverage, which is much higher than liability coverage for a regular driver. The OFM will also monitor your insurance and make sure it is covering both you and your vehicle properly.

If a diplomat is found to be lacking the proper coverage, they may face surcharges or fees if they cause an accident or injury. Additionally, if the coverage is not in place, the Department of State may request to waive your immunity, which could leave you open to legal action as well as fines and the loss of any privilege to drive in the United States.

While you have to have the minimum liability amount required by the OFM, this doesn’t mean you need to go with the first insurer that offers diplomatic insurance. Shop around to find rates that best fit your budget. You can use our free quote comparison tool below to find affordable diplomat insurance rates near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Do diplomats have car insurance?

Diplomats can typically get liability, collision, comprehensive, uninsured/underinsured motorist coverage, and other optional coverages.

Which companies offer auto insurance discounts for diplomats?

Geico, State Farm, AAA, Farmers, Travelers, and Nationwide all offer car insurance discounts to diplomats and federal employees.

Do diplomats need a driver’s license?

Yes, diplomats do need a driver’s license. According to the U.S. Department of State, diplomats need to apply for a Diplomatic Driver’s License through the DMV’s eGov system. The processing time takes anywhere from one to five business days.

What does it mean to have a diplomatic license plate?

A diplomatic license plate shows law enforcement that the vehicle is exempt from certain restrictions, such as being impounded or searched. These license plates are specially marked, usually with the word diplomat or CD written on the license plate.

What rules are there for diplomatic vehicles?

As long as the car is legally registered with the state the diplomat is living in and has a diplomat license plate, you are good to go.

To register your diplomatic vehicle, bring the following to your local DMV:

- Completed form for diplomatic vehicles

- Certificate of origin or car title

- Insurance policy

- Proof of reassignment of title or a car receipt for a new car

Before you can register your car, the most important thing to have is car insurance. The DMV won’t register vehicles without proof of insurance.

Can you buy auto insurance in the U.S. with an international license?

Yes, most companies will sell car insurance to drivers with an IDP, including Geico, State Farm, and Progressive.

Does Geico auto insurance cover international drivers?

Yes, Geico provides personal auto coverage for foreign diplomats visiting the U.S. and policies for U.S. diplomats traveling overseas.

Is Allstate Insurance international?

Allstate does provide travel insurance for international trips, but you cannot buy Allstate auto insurance abroad.

Is Liberty Mutual Insurance international?

Yes, Liberty Mutual sells auto insurance in 20 countries.

Who is better for diplomat auto insurance, Geico or Progressive?

Geico has cheaper auto insurance rates for diplomats than Progressive, but Progressive has the bigger federal employee insurance discount.

What happens when a diplomat has an auto accident?

If a diplomat has an accident, they should exchange information, notify law enforcement if necessary, and report it to their insurance company. Additional considerations may apply based on their diplomatic status.

Are diplomats subject to regular auto insurance laws?

Diplomats are generally subject to the same laws and regulations as others, but they may have certain immunities and privileges based on diplomatic conventions.

Is there such a thing as international auto insurance?

You can get auto insurance in most countries with an IDP.

How long can you drive with a foreign license in the U.S.?

Visitors can drive for up to 180 days in the United States with a foreign license.

How are drivers eligible for diplomatic auto insurance?

Only diplomats can have diplomatic car insurance. If a driver is officially registered with the U.S. Foreign Service as a diplomat, they can apply for diplomatic car insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.