Best Auto Insurance for Regular Maintenance in 2025 (10 Expert Favorites)

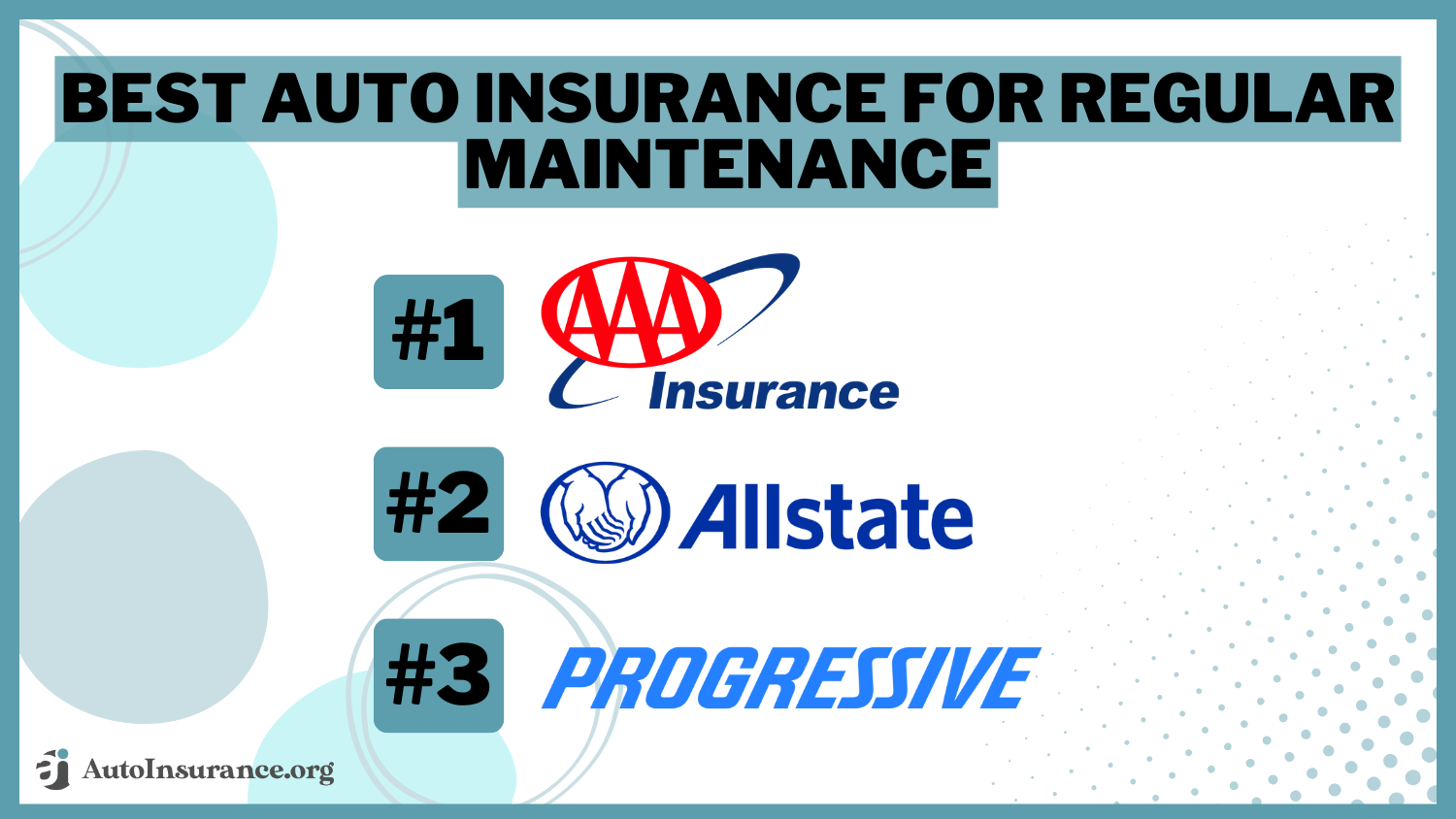

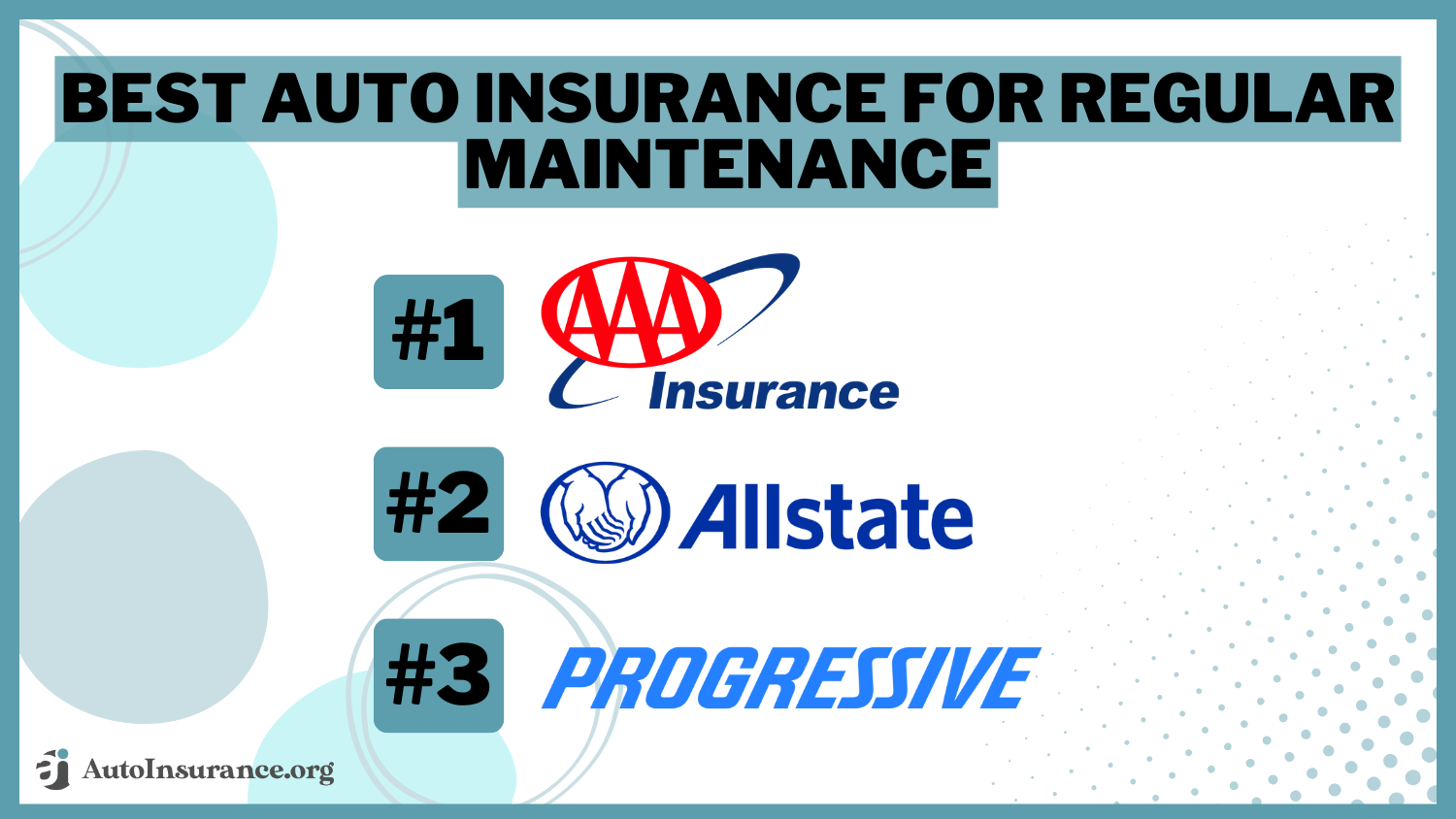

Explore the best auto insurance for regular maintenance with AAA, Allstate, and Progressive, offering competitive rates and comprehensive coverage. AAA provides the lowest monthly rate at $63 and excellent customer service. These companies balance affordability, reliability, and customer satisfaction effectively.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Regular Maintenance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Regular Maintenance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Regular Maintenance

A.M. Best Rating

Complaint Level

Pros & Cons

Discover best auto insurance for regular maintenance with AAA, Allstate, and Progressive stand out as top contenders, offering competitive rates and comprehensive coverage. With AAA leading the pack with a low monthly rate of $63 and exceptional customer service.

These companies strike the perfect balance between affordability, reliability, and customer satisfaction. Whether you’re in need of routine maintenance coverage or protection against unforeseen incidents, these insurers have you covered.

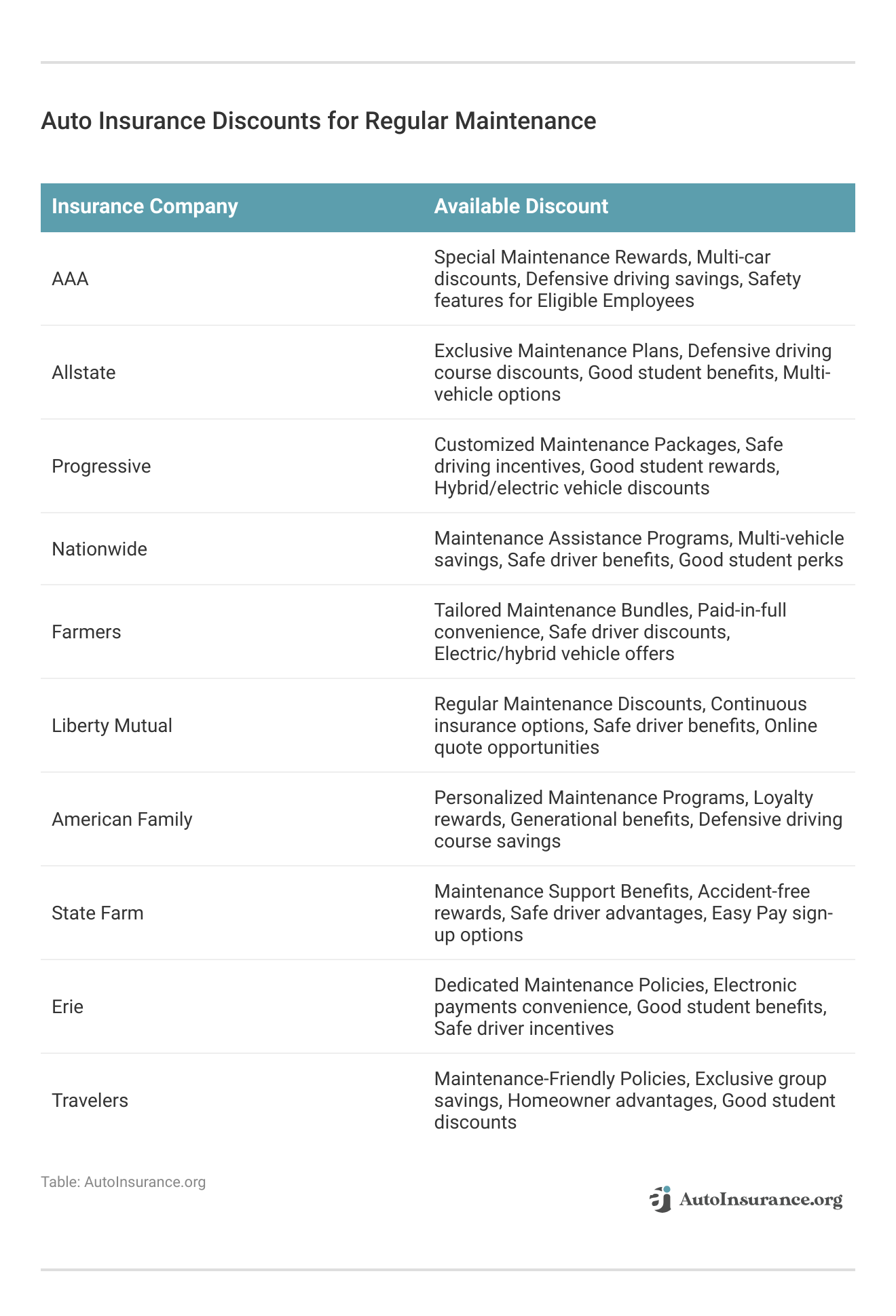

Our Top 10 Company Picks: Best Auto Insurance for Regular Maintenance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 14% A Customer Satisfaction AAA

#2 17% A+ Comprehensive Coverage Allstate

#3 13% A+ Online Convenience Progressive

#4 15% A+ Nationwide Coverage Nationwide

#5 19% A Personalized Policies Farmers

#6 16% A Policy Bundling Liberty Mutual

#7 11% A Accident Forgiveness American Family

#8 18% B Personalized Service State Farm

#9 10% A+ Local Presence Erie

#10 20% A++ Extensive Discounts Travelers

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers.

- AAA offers the lowest rate at $104 per month along with excellent service

- File car as non-operational for insurance exemption during maintenance

-

Insurance excludes maintenance to prioritize vehicle upkeep

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – AAA: Top Overall Pick

Pros

- Low Monthly Rates: AAA offers competitive rates, making it affordable for many customers. Learn more in our AAA auto insurance review.

- Excellent Customer Service: AAA is known for its exceptional customer service, providing assistance and support when needed.

- Comprehensive Coverage Options: AAA offers a wide range of coverage options, allowing customers to customize their policies according to their needs.

Cons

- Limited Availability: AAA may not be available in all areas, limiting accessibility for some customers.

- Membership Required: To access AAA’s auto insurance, customers may need to become AAA members, which can involve additional fees.

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Wide Range of Discounts: Allstate offers various discounts, including safe driver discounts, multi-policy discounts, and more, helping customers save on premiums.

- User-Friendly Technology: Allstate provides innovative technology solutions, such as the Drivewise program, which tracks driving habits to potentially lower rates.

- Strong Financial Stability: Our Allstate auto insurance review showcases a robust financial strength rating, highlighting its capability to promptly fulfill claims.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some other insurers, especially for certain coverage options.

- Mixed Customer Service Reviews: While Allstate offers good customer service overall, some customers have reported mixed experiences with claims processing and support.

#3 – Progressive: Best for Online Convenience

Pros

- Name Your Price Tool: Progressive’s Name Your Price tool allows customers to customize their coverage and find a policy that fits their budget.

- Snapshot Program: Progressive offers the Snapshot program, which tracks driving habits and can lead to discounts for safe driving behavior.

- Strong Financial Stability: Progressive auto insurance review showcases a financially stable company with a strong reputation in the insurance industry, offering policyholders peace of mind.

Cons

- Average Customer Service: While Progressive offers convenient online services, some customers have reported average experiences with customer service representatives.

- Limited Agent Availability: Progressive primarily operates online, which may not be ideal for customers who prefer in-person interaction with agents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Nationwide Coverage

Pros

- Wide Range of Coverage Options: Nationwide offers a variety of coverage options, allowing customers to tailor their policies to their specific needs.

- Multi-Policy Discounts: Nationwide auto insurance review highlights their discounts for bundling multiple policies, such as auto and home insurance, helping customers save on premiums.

- Strong Financial Stability: Nationwide has a solid financial reputation, instilling confidence in its ability to fulfill claims and provide reliable coverage.

Cons

- Limited Availability: Nationwide may not be available in all areas, limiting choices for some customers.

- Mixed Customer Reviews: While Nationwide has many satisfied customers, some have reported mixed experiences with claims processing and customer service.

#5 – Farmers: Best for Personalized Policies

Pros

- Personalized Service: Farmers offers personalized service through its network of agents, providing individualized attention and assistance.

- Discount Opportunities: Farmers provides various discounts, helping customers save on premiums (Read more: Farmers auto insurance discounts).

- Innovative Coverage Options: Farmers offers innovative coverage options, such as rideshare insurance and customizable policies, catering to diverse customer needs.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some other insurers, especially for certain coverage options.

- Complex Claims Process: Some customers have reported challenges with the claims process, citing complexities and delays in claim resolution.

#6 – Liberty Mutual: Best for Policy Bundling

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, discover more about offerings in our complete Liberty Mutual auto insurance review.

- Accident Forgiveness: Liberty Mutual provides accident forgiveness programs, which may help prevent premium increases after an at-fault accident.

- Online Tools and Resources: Liberty Mutual offers convenient online tools and resources for policy management, claims filing, and customer support.

Cons

- Limited Discounts: Liberty Mutual may not offer as many discounts compared to some other insurers, potentially resulting in higher premiums for some customers.

- Mixed Customer Service Reviews: While Liberty Mutual provides online tools for convenience, some customers have reported mixed experiences with customer service representatives.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Accident Forgiveness

Pros

- Flexible Coverage Options: American Family auto insurance review showcases a range of coverage options, allowing customers to customize their policies to meet their specific needs.

- Discount Programs: American Family provides various discount programs, such as safe driving discounts and bundling discounts, helping customers save on premiums.

- Local Agents: American Family operates through a network of local agents, offering personalized service and support to customers in their communities.

Cons

- Limited Availability: American Family may not be available in all regions, restricting options for some customers.

- Claims Process: Some customers have reported challenges with the claims process, citing delays or difficulties in claim resolution.

#8 – State Farm: Best for Personalized Service

Pros

- Extensive Network of Agents: State Farm has a vast network of agents across the country, providing personalized assistance and support to customers.

- Good Student Discounts: State Farm offers discounts for good students, encouraging academic excellence and helping young drivers save on premiums.

- Robust Online Tools: State Farm provides comprehensive online tools. Discover insights in our guide titled State Farm auto insurance review.

Cons

- Premiums May Be Higher: State Farm’s premiums may be higher compared to some other insurers, especially for certain demographics or coverage options.

- Limited Discounts: State Farm may not offer as many discounts as some other insurers, potentially resulting in higher overall premiums for some customers.

#9 – Erie: Best for Local Presence

Pros

- Affordable Rates: As mentioned in our Erie auto insurance review, they offer competitive rates, making it an attractive option for budget-conscious customers.

- Excellent Customer Service: Erie is known for its outstanding customer service, with high customer satisfaction ratings and personalized attention.

- Add-On Coverages: Erie provides various add-on coverages, such as pet injury coverage and locksmith services, enhancing policyholders’ protection and peace of mind.

Cons

- Limited Availability: Erie’s coverage may be limited to specific regions, restricting options for customers in other areas.

- Fewer Online Tools: Erie may have fewer online tools and resources compared to larger insurers, potentially impacting convenience for tech-savvy customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Extensive Discounts

Pros

- Wide Range of Coverage Options: Travelers auto insurance review offers a diverse range of coverage options, allowing customers to tailor their policies to their individual needs.

- Strong Financial Stability: Travelers has a strong financial reputation, instilling confidence in its ability to fulfill claims and provide reliable coverage.

- Discount Opportunities: Travelers provides various discount opportunities, such as safe driver discounts and multi-policy discounts, helping customers save on premiums.

Cons

- Mixed Customer Service Reviews: While Travelers offers comprehensive coverage options, some customers have reported mixed experiences with customer service representatives.

- Complex Claims Process: Travelers’ claims process may be perceived as complex by some customers, with reports of delays or difficulties in claim resolution.

Ensuring Vehicle Health and Financial Security

If you don’t maintain your vehicle properly, it will run inefficiently and then eventually vital components will fail. Vehicle owners are going to pay more in the long run when they don’t invest the money that’s needed to maintain their vehicle, including:

- Change their oil

- Top off their fluids

- Rotate their tires

- Service their transmission

Depending on the source of a problem, a major vehicle breakdown can cost a small fortune to fix. In fact, some people have to let their cars sit for weeks or months at a time before they can afford to get them up and running again.

It may seem as though your only option would be to cancel your auto policy, however there are actually penalties if you drive or own a vehicle that doesn’t have insurance. The title is yours, which means the responsibility is as well. For more info, read our article titled “Driving Without Auto Insurance.”

AAA stands out as the top choice, offering competitive rates, user-friendly interface, and comprehensive features.Jeff Root Licensed Insurance Agent

If you bought a fixer-upper or you have a broken down car in your driveway, here’s a guide to car insurance for maintenance.

Broken-Down Car Insurance

Car insurance is necessary when you own a car. For people who don’t know the ins and outs of the law, it might seem silly that you have to insure a car that will not and cannot be operated. You will still need proof of insurance, even if your car is sitting in your driveway waiting for repairs.

Auto Insurance Monthly Rates for Regular Maintenance by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $63 $104

Allstate $67 $108

Progressive $71 $117

Nationwide $67 $108

Farmers $58 $100

Liberty Mutual $75 $121

American Family $67 $108

State Farm $63 $104

Erie $63 $104

Travelers $75 $121

Unfortunately, if you’re a little too eager to cancel your insurance on the car, you’ll have to answer to the motor vehicle agency.

By law, you have to satisfy whatever the financial responsibility laws are in your state for as long as you’re the legal owner of the car and it has valid tags.

While it may seem like this is only for operational vehicles, it’s for any type of vehicle you own. No period of time should pass where your owned vehicles are not insured. If you have a valid registration and you don’t have valid auto insurance in place, you’re not complying with the law as a car owner, regardless of the car’s condition.

Read more: Does your car need to be registered to get auto insurance?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Car Insurance Requirements

You should have learned about car insurance requirements when you were studying your driver’s manual to test for your license, such as the difference between collision and comprehensive coverage. If you moved to a new state, chances are you had to retest and answer new questions on driving laws and insurance laws. In theory, all licensed drivers should be fluent in the state’s insurance laws.

If you don’t know what type of auto insurance you must have, you can find out the requirements by visiting the official state DMV website or by getting an updated copy of the driver’s manual. In most states, where fault is used to determine who pays for damages, you have to carry liability insurance which consists of bodily injury and property damage.

Filing Your Car as Non-Operational

Who wants to pay for insurance they can’t possibly use when their car is sitting? You can be fined for removing insurance from your car but there is always a solution. One option for people who aren’t going to take their car in for maintenance immediately is to file the car as planned non-operational.

A Planned Non-Op filing changes your registration status so that the car can legally sit on public property without being towed. When it is filed as PNO, you don’t have to maintain insurance because you can’t drive or tow the car on public roads until the registration is temporarily or permanently reactivated.

Read more: Do you need auto insurance to be towed?

Keep Parked Car Insurance on Cars That Need Repair

You don’t need the third-party coverage when your car has a PNO filing but that doesn’t mean that deleting your insurance from the car is always the answer. Some reasons that you should keep parked car coverage includes:

- You will have coverage if your car is vandalized, stolen, flooded, damaged by animals, or damaged by falling objects.

- You can keep continuous coverage on the car to avoid lapses that could land you in a high-risk class when you get insurance in the future.

- Keep your loyalty discounts through your carrier if you keep the policy active (Read more: How to Get a Customer Loyalty Auto Insurance Discount).

- Reactivating your liability coverage is much easier when you suspend your policy instead of canceling it.

One of the better options would be to suspend your coverage so that you can still maintain parked car insurance with your comprehensive physical damage coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Car Insurance Maintenance Coverage

Maintenance is a cost you can’t avoid if you’re a responsible vehicle owner. Maintenance services and other small repairs are costs that will add up over time.

That’s a huge reason why more and more Millennials are choosing to take ride-sharing services instead of buying a car.

Your insurance will be a lifesaver if you ever have an accident but you can’t assume that your policy will always be there for you when you incur expenses as a car owner.

At first glance, it might seem as if your insurance would pay for the maintenance that you need to have done. Unfortunately, there’s an exclusion that specifically says maintenance is not part of the coverage even with physical damage coverage.

Read more: How do insurance companies value totaled cars?

Meaning of Wear and Tear Exclusion

Property insurance policies will pay for mechanical repairs if those repairs are needed after you get into a collision or there’s a sudden, unexpected loss to your car while it’s parked.

That’s completely different from the policy covering mechanical failure that’s caused by wear and tear not something unforeseen.

Your car insurance policy has a very straightforward and detailed section written into it that explains what’s not covered.

Under the exclusions section of your plan, one of the primary exclusions on a car insurance policy is the wear and tear exclusion.

It basically says that normal and expected deterioration of the insured property won’t be covered because the policy is meant to cover unforeseen losses.

You need auto insurance to drive your car to the maintenance shop but your policy won’t actually pay for the invoice. Make sure you know what types of auto insurance is meant to cover and what it’s not.

Once you know the law and you are familiar with the protection, you can start to shop around online and get instant quotes for a policy on a car that needs maintenance. Enter your ZIP code below to begin comparison shopping today.

Frequently Asked Questions

Is auto insurance coverage available for regular maintenance of my vehicle?

No, auto insurance does not cover regular maintenance expenses for your vehicle. Insurance policies are designed to protect you financially in the event of accidents, theft, or other covered perils, but they do not cover routine maintenance costs.

What is considered regular maintenance for a vehicle?

Regular maintenance includes tasks such as oil changes, tire rotations, brake pad replacements, fluid checks, and other routine services required to keep your vehicle in good working condition. These are generally considered the responsibility of the vehicle owner and are not covered by auto insurance.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Can I file an insurance claim for maintenance-related issues?

No, you cannot file an insurance claim for maintenance-related issues. Insurance claims are typically reserved for unexpected events like accidents or damage caused by covered perils. Maintenance-related issues are considered part of the normal wear and tear of a vehicle and are not covered by insurance.

Read more: How to File an Auto Insurance Claim

What types of expenses does auto insurance cover?

Auto insurance typically covers expenses related to accidents, theft, vandalism, and other covered perils. This includes repairs to your vehicle, medical expenses for injuries sustained in an accident, and liability coverage for damages you may cause to other people or their property.

Are there any benefits of having auto insurance for regular maintenance?

While auto insurance does not directly cover regular maintenance, having insurance in place can provide financial protection in case your vehicle sustains damage during maintenance or if an accident occurs while your car is being serviced. It’s always wise to have comprehensive and collision coverage as part of your policy to mitigate unforeseen expenses.

To learn more, refer to our comprehensive handbook titled “Roadside Assistance Coverage.”

Are there any downsides to relying on auto insurance for maintenance costs?

Relying on auto insurance for maintenance costs can have some downsides. First, you may have to pay a deductible before your insurance coverage kicks in, which could make small maintenance expenses not worth filing a claim. Additionally, filing frequent claims for maintenance-related issues may result in higher insurance premiums or even policy cancellation.

Can auto insurance cover the cost of routine maintenance for my vehicle?

No, auto insurance typically does not cover regular maintenance expenses such as oil changes, tire rotations, or brake pad replacements. Insurance policies are designed to provide financial protection for unexpected events like accidents or theft, not routine upkeep.

Is it possible to file an insurance claim for maintenance-related issues?

No, insurance claims are typically reserved for unexpected events like accidents or damage caused by covered perils. Maintenance-related issues, such as wear and tear or mechanical failures, are considered part of the normal upkeep of a vehicle and are not covered by insurance.

Read more: Can I file an insurance claim without a police report?

How can I ensure financial security for regular vehicle maintenance without relying on auto insurance?

To ensure financial security for regular maintenance, it’s essential to budget for upkeep expenses separately from insurance coverage. Setting aside funds specifically for routine maintenance tasks like oil changes and tire rotations can help you avoid relying solely on insurance for these costs.

Additionally, consider exploring extended warranty or maintenance plans offered by vehicle manufacturers or third-party providers for added coverage.

Does auto insurance cover routine maintenance expenses like oil changes and tire rotations?

No, auto insurance policies are designed to protect you financially in the event of accidents, theft, or other covered perils. Routine maintenance tasks such as oil changes, tire rotations, and brake pad replacements are considered the responsibility of the vehicle owner and are not covered by auto insurance.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.