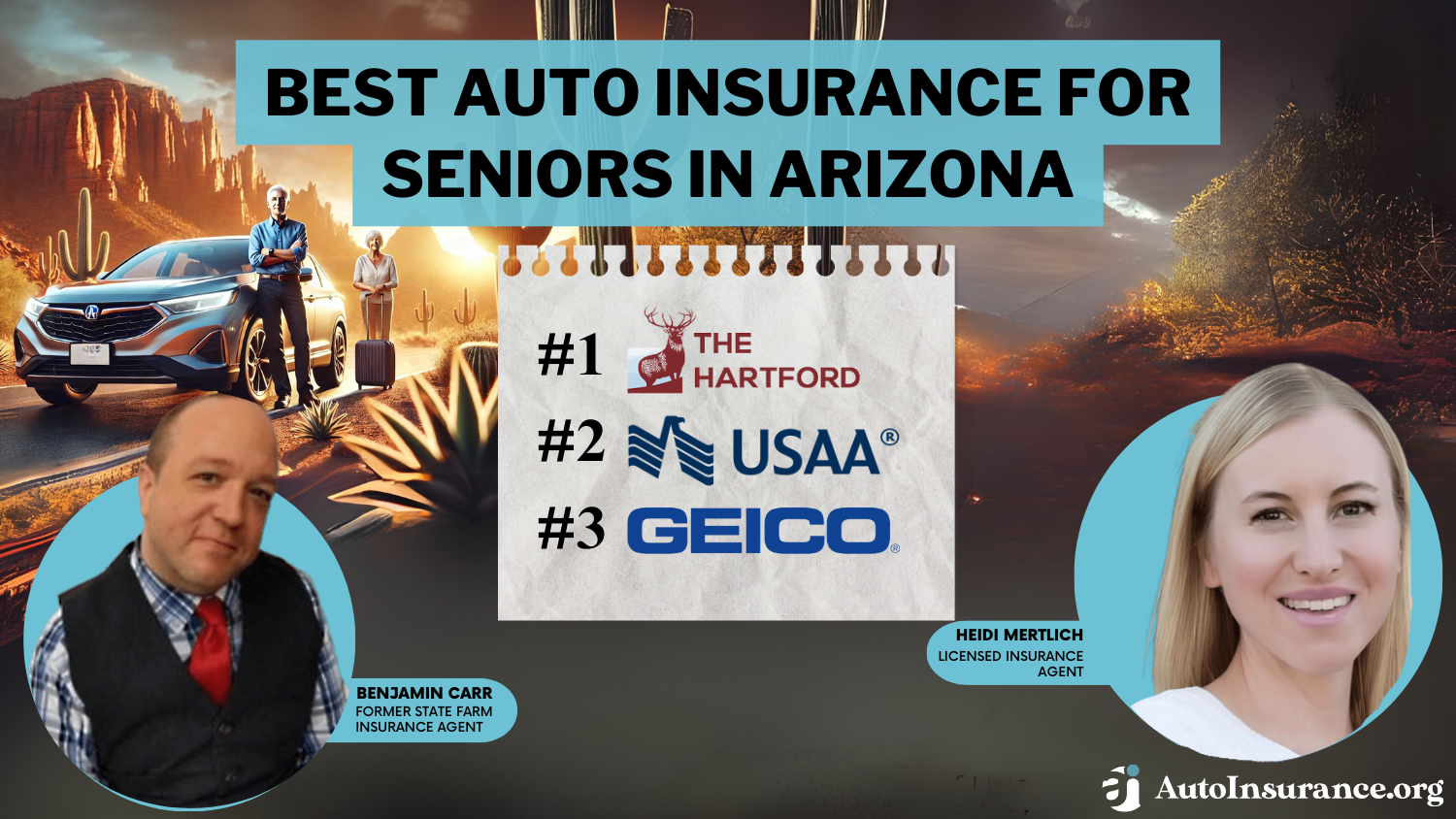

Best Auto Insurance for Seniors in Arizona (Top 10 Companies for 2025)

The Hartford, USAA, and Geico have the best auto insurance for seniors in Arizona. The Hartford also offers discounts on Arizona auto insurance for members of the American Association of Retired Persons (AARP). At the best companies for AZ seniors, minimum rates start as low as $32 per month for senior drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

765 reviews

765 reviewsCompany Facts

Full Coverage for AZ Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for AZ Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for AZ Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best auto insurance for seniors in Arizona is offered by The Hartford, USAA, and Geico, which provide great coverage and benefits for older drivers. The Hartford has exclusive AARP discounts and rates at $67 per month.

Want more options for senior car insurance? The top 10 companies with the best auto insurance for seniors in Arizona are listed below.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Arizona

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Tailored Policies | The Hartford |

| #2 | 30% | A++ | Military Benefits | USAA | |

| #3 | 25% | A++ | Cheap Rates | Geico | |

| #4 | 30% | B | Customer Service | State Farm | |

| #5 | 40% | A+ | Add-On Coverages | Allstate | |

| #6 | 30% | A+ | Qualifying Coverage | Progressive | |

| #7 | 30% | A | Affinity Discounts | Liberty Mutual |

| #8 | 30% | A | Discount Selection | Farmers | |

| #9 | 40% | A+ | Infrequent Drivers | Nationwide |

| #10 | 30% | A | Costco Members | American Family |

Continue reading to learn more about the pros and cons of each Arizona senior auto insurance company.

If you want to start shopping for cheap auto insurance for seniors in Arizona today, enter your ZIP code in our free quote comparison tool.

- The Hartford has the best auto insurance in Arizona for seniors

- USAA has the best auto insurance for AZ military and veteran senior drivers

- AZ senior drivers are one of the most affordable age groups to insure

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – The Hartford: Top Pick Overall

Pros

- Tailored Policies: The Hartford works with senior Arizona drivers to personalize policies to meet their needs.

- AARP Discounts: The Hartford offers specialized insurance and discounts to AARP drivers in Arizona.

- Financial Stability: The company has an A+ rating from A.M. Best, so senior Arizona policies will be backed by a financially stable company.

Cons

- Customer Complaints: Arizona senior drivers will find that customers have a few complaints about The Hartford’s customer service.

- Higher Rates: The Hartford rates for senior AZ drivers are a little higher than some of the other companies on our list. Visit our review of The Hartford auto insurance to learn more.

#2 – USAA: Best for Miltary Benefits

Pros

- Military Benefits: Senior military and veteran customers in Arizona qualify for multiple shopping and traveling discounts with their USAA membership.

- Customer Service: USAA is one of the highest-rated companies for customer service on our list of the best Arizona senior companies. Learn more in our USAA auto insurance review.

- SafePilot Program: Senior drivers in Arizona can join USAA’s free program to earn rewards for good driving habits.

Cons

- No Local Agents: Senior drivers in Arizona won’t be able to visit agents in person.

- Coverage Options: USAA has a decent selection for Arizona seniors, but it is missing some add-ons like modified car coverage.

#3 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico has some of the most affordable rates on average for senior drivers in Arizona at $24 per month.

- Mobile App: Geico’s free app is highly rated and makes it simple for Arizona seniors to manage policies and file claims online.

- Extensive Discounts: Senior drivers in Arizona can apply for good driver discounts and more. Visit our Geico auto insurance review to see what’s offered.

Cons

- No Local Agents: Arizona seniors won’t be able to visit a local agent in person for assistance with their Geico policy or claim.

- Coverage Options: Geico sells the most common coverages to Arizona senior drivers, but it is missing a few extras like gap coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Customer Service

Pros

- Customer Service: Senior Arizona drivers can visit local agents stationed around Arizona for personalized support.

- Affordable Rates: State Farm offers some of the cheapest senior auto insurance rates in Arizona. Visit our State Farm auto insurance review to learn more.

- Bundling Discount: Arizona senior customers can also purchase other types of insurance from State Farm for a bundling discount.

Cons

- Coverage Options: Senior drivers in Arizona won’t be able to purchase some add-ons from State Farm, such as gap coverage.

- Financial Stability: With a “B” rating from A.M. Best, State Farm has the lowest rating among the best senior auto insurance companies in Arizona.

#5 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate has great extras for senior Arizona drivers, such as gap coverage. For a list of coverages, read our Allstate auto insurance review.

- Drivewise Program: Senior drivers can join Drivewise for free to earn discounts on Arizona insurance policies.

- Mature Driver Discount: Allstate offers a discount to senior drivers in Arizona who are over 55 and are safe drivers.

Cons

- Customer Complaints: Allstate has more customer complaints than most of the best Arizona companies for seniors on our list.

- Higher Rates: Allstate is one of the more expensive choices for senior drivers in Arizona.

#6 – Progressive: Best for Qualifying Coverage

Pros

- Qualifying Coverage: Progressive offers great coverage that meets state requirements to senior Arizona drivers.

- Affordable Rates: Progressive has affordable rates for senior drivers in Arizona. Visit our Progressive auto insurance review to learn more.

- Snapshot Program: Arizona senior drivers can earn discounts for safe driving by joining the free Snapshot program.

Cons

- Customer Service Ratings: Progressive’s ratings could be better, as other Arizona senior companies on our list have better customer service satisfaction.

- Adding Young Drivers: Arizona senior drivers who add young drivers to their policy will find Progressive isn’t the cheapest for younger drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Affinity Discounts

Pros

- Affinity Discounts: Liberty Mutual offers affinity discounts to some senior drivers in Arizona, such as veterans. Visit our Liberty Mutual auto insurance review for a list of discounts.

- Coverage Options: Liberty Mutual has multiple add-ons for senior drivers in Arizona, from gap coverage to roadside assistance.

- RightTrack Program: Senior drivers can earn discounts on Arizona policies for safe driving through the RightTrack program.

Cons

- Higher Rates: Liberty Mutual is one of the more expensive options for seniors in Arizona.

- Claims Satisfaction: Liberty Mutual’s claim satisfaction ratings are lower than other Arizona senior companies on our list.

#8 – Farmers: Best for Discount Selection

Pros

- Discount Selection: Senior Arizona drivers have access to plenty of savings with Farmers discount selection. Find out more in our Farmers auto insurance review.

- Coverage Selection: Farmers has more add-ons available for senior Arizona drivers, such as glass coverage and new car replacement coverage.

- Accident Forgiveness: Farmers forgive an at-fault accident every three years for safe senior drivers in Arizona.

Cons

- Online Options: Senior Arizona drivers may find Farmers’ online tools lacking.

- Customer Service: Arizona senior drivers may find some customer service issues based on a few negative reviews about customer service.

#9 – Nationwide: Best for Infrequent Drivers

Pros

- Infrequent Drivers: Low-mileage senior drivers in Arizona can apply for pay-per-mile insurance at Nationwide with SmartMiles.

- Bundling Discount: Arizona senior drivers can purchase other types of insurance for a discount. Visit our Nationwide auto insurance review to learn more.

- Accident Forgiveness: Safe senior drivers in Arizona could be forgiven an accident.

Cons

- Claims Satisfaction: Nationwide has low claim satisfaction ratings, which could affect senior Arizona drivers’ customer satisfaction.

- Coverage Options: Senior Arizona drivers will find Nationwide is missing a few add-ons like rideshare insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Costco Members

Pros

- Costco Members: Senior Arizona drivers can purchase American Family insurance from Costco for a discounted deal.

- Coverage Selection: Arizona senior drivers have plenty of coverage selection at American Family. Visit our American Family auto insurance review to see what is offered.

- Discount Selection: Senior drivers in Arizona will have access to plenty of saving opportunities.

Cons

- Customer Service Ratings: American Family isn’t the highest-rated senior driver company in Arizona.

- Claims Ratings: Senior drivers in Arizona may find claims are processed a little slower.

Auto Insurance Rates for Seniors in Arizona by Coverage Type

The best companies’ average senior driver rates for minimum and full coverage are displayed below. Not sure which coverage to get? The cheapest companies for full coverage insurance in Arizona for seniors include USAA, Geico, and State Farm.

Arizona Senior Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $93 | $245 | |

| $58 | $155 | |

| $70 | $183 | |

| $33 | $89 | |

| $92 | $242 |

| $60 | $158 |

| $43 | $114 | |

| $42 | $110 | |

| $67 | $176 |

| $32 | $86 |

Senior drivers will need to carry coverage that meets the Arizona minimum auto insurance requirements. Minimum coverage will be the cheapest option for senior drivers, although full coverage will be required on leased vehicles.

Senior drivers may opt for Arizona’s minimum coverage if their vehicle’s value has depreciated, making full coverage unnecessary.Dani Best Licensed Insurance Producer

For senior drivers over the age of 65, opting for minimum liability can be a cost-effective choice. However, the downside is that minimum coverage may not fully protect against all potential risks, such as theft, vandalism, or damage in a non-collision incident. On the other hand, full coverage provides more comprehensive protection and peace of mind, but it comes at a higher cost.

If senior drivers want to carry full coverage, there are plenty of auto insurance discounts at the best companies that can help lower rates.

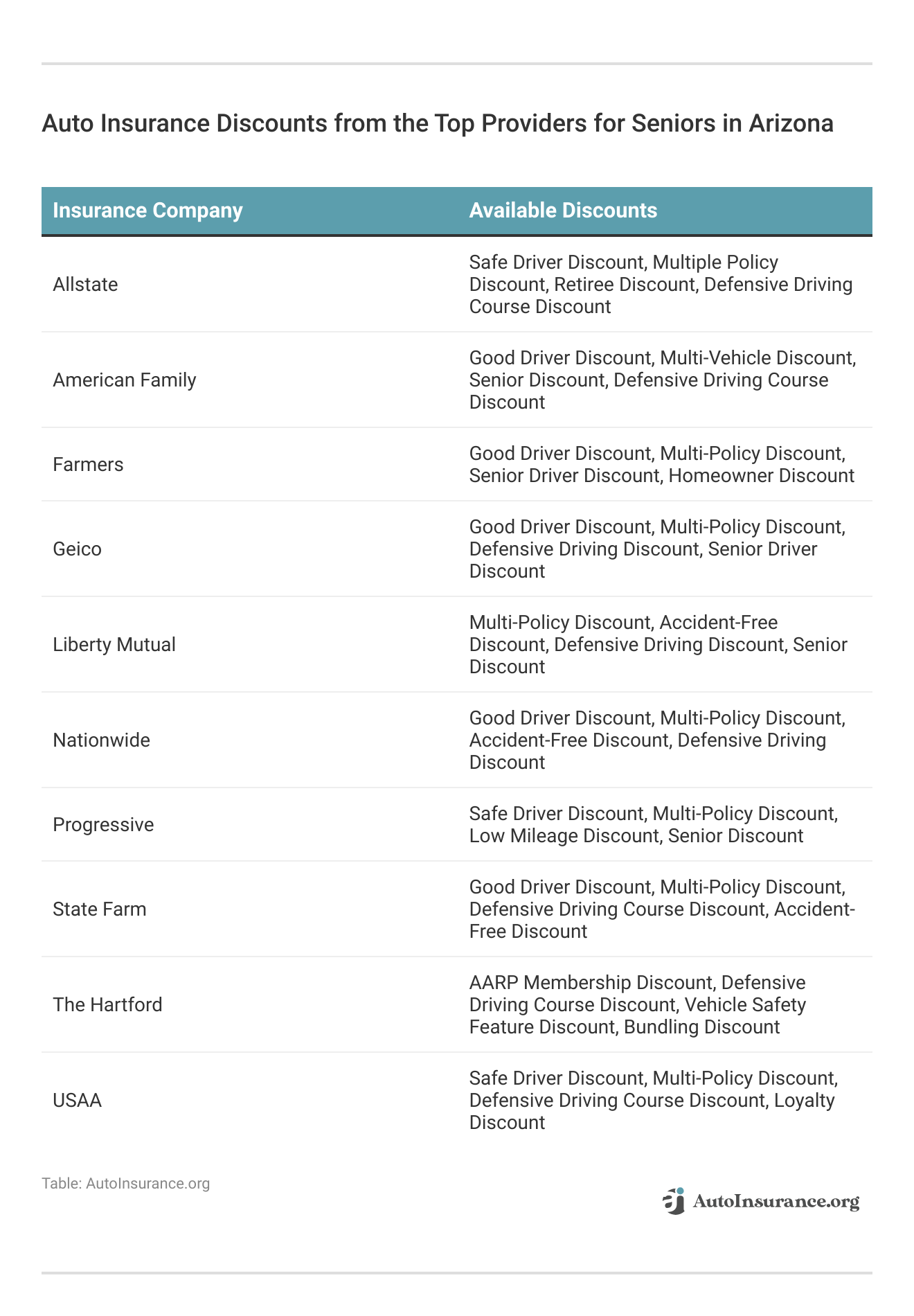

How Seniors in Arizona Can Save on the Best Auto Insurance

Seniors in Arizona can save on car insurance in a few simple ways. Many top companies like State Farm, Geico, and Allstate offer auto insurance discounts for older drivers. One of the easiest ways to lower costs is by driving less. If you drive under 10,000 miles a year, you may qualify for a low-mileage discount, which helps reduce the average auto insurance cost in Arizona.

Choosing the cheapest category of car insurance, like basic liability coverage, can also help keep costs low. However, if you want more protection, full coverage might be a better option. If you own a luxury or sports car, expect higher rates since these fall under the most expensive type of car insurance in Arizona.

Your auto insurance deductible amounts in Arizona also affect your rate. A higher deductible lowers your monthly premium but means paying more out of pocket if you have a claim. Most companies consider 65, the age considered as a senior citizen, for discounts.

Additionally, Seniors in Arizona can find low-cost auto insurance for seniors by shopping around, driving safely, and asking for discounts. Checking senior car insurance reviews helps find the best deals. Companies like State Farm, Geico, and Allstate offer Arizona’s cheapest auto insurance options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Auto Insurance for Seniors in Arizona

When looking for the top auto insurance companies in Arizona for seniors, consider The Hartford, USAA, and Geico. These companies offer great coverage, fair pricing, and discounts that help senior drivers save. A good auto insurance plan for senior citizens should cover accidents, car damage, and medical costs when needed.

If you want extra protection, you can look into the best supplemental insurance for seniors in Arizona, which can help with things like medical bills or roadside assistance. The kind of car insurance you need in Arizona depends on your driving habits and the level of coverage you want. Some seniors go for full coverage, while others choose basic liability to save on costs.

It’s also helpful to understand the top 3 types of auto insurance in Arizona: liability, collision, and comprehensive. Comparing quotes from different companies will help you find the best deal for the coverage you need.

Cheapest Auto Insurance Options for Seniors in Arizona

If you’re a senior in Arizona looking for the cheapest auto insurance in Arizona, it’s smart to get quotes from the top car insurance companies in Arizona like The Hartford, USAA, and Geico. These companies are known for offering the best auto insurance rates for seniors in Arizona. They often provide discounts for seniors who drive less or have a clean driving record.

The maximum age for car insurance in Arizona doesn’t typically affect seniors too much as long as they maintain a safe driving history. But it’s important to remember that rates can increase as you get older.

Still, you can find the cheapest auto insurance options for seniors in Arizona by comparing plans from these companies. By shopping around and exploring your options, seniors can find affordable coverage without sacrificing important benefits.

Best Full Coverage Auto Insurance for Seniors in AZ

Getting the best full coverage auto insurance for seniors in AZ means finding the right balance between cost and protection. Many insurers offer cheap car insurance for seniors, but full coverage provides better financial security for accidents, theft, or damage.

For car insurance for drivers over 65 years old, providers like Geico, USAA, and The Hartford offer competitive rates and discounts. Geico auto insurance for seniors is a top choice for affordability and reliable service. If you’re looking for the cheapest car insurance for seniors over 60 years old, comparing quotes from multiple companies can help you find the best deal.

Seniors in Arizona can get the best auto insurance rates and discounts from The Hartford, USAA, and Geico, which offer affordable and reliable coverage.Joel Ohman Certified Financial Planner

Seniors with a clean driving record or lower annual mileage may qualify for extra discounts. Many insurers provide options to lower costs while still offering the lowest car insurance rates for seniors, ensuring full protection without overpaying.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Age Affects Auto Insurance Rates for Seniors in Arizona

As drivers get older, their car insurance rates change. In Arizona, car insurance for drivers 50 years old and over is usually cheaper because they have more experience and a lower risk of accidents. However, once drivers reach 65, rates may start to rise due to age-related factors.

Seniors looking for auto insurance for seniors over 65 years old can still find good deals with the right provider. Companies like American Family Insurance in Nogales, AZ, offer policies that help older drivers save money.

There is no age limit for auto insurance, but insurance companies adjust rates based on health, driving history, and accident risk. Although the minimum age to obtain car insurance in Arizona is 16, older drivers can reduce costs by comparing quotes and seeking low-cost auto insurance for seniors.

Discounts for safe driving, bundling policies, and reduced mileage can also help keep coverage affordable while ensuring proper protection on the road.

Read more: What are the recommended auto insurance coverage levels?

Key Factors Seniors Should Consider When Choosing Auto Insurance in AZ

Finding the right auto insurance is important for seniors in Arizona. With so many options, it’s good to know what to look for to get the best coverage at the best price. Here are some key things to consider:

- Cost and Discounts: Saving money matters, so look for an auto insurance discount for seniors in Arizona. Many companies give discounts for safe driving, low mileage, and bundling policies.

- Coverage Options: Getting the best full-coverage car insurance for seniors means better protection against accidents, theft, and damage. Full coverage includes liability, collision, and comprehensive insurance.

- Comparing Quotes: Checking auto insurance quotes in Nogales, AZ, from different companies can help you find the best deal. Prices vary, so shopping around can help you save money.

- Trusted Companies: Choosing a reliable provider like Geico car insurance for seniors ensures good service and fair pricing.

- Affordability: Seniors on a budget should look for the cheapest car insurance for senior citizens while still getting good coverage.

- More Ways to Save: Taking advantage of auto insurance discounts for seniors can lower costs. Discounts are often available for safe drivers, defensive driving courses, and multi-policy bundles.

By keeping these things in mind, seniors can get the right insurance at a price that works for them.

Read more: How to Manage Your Auto Insurance Policy

AARP and Other Senior-Specific Auto Insurance Programs

Finding the auto insurance is important for seniors who want affordable and reliable coverage. AARP’s best car insurance options for seniors offer benefits like accident forgiveness, roadside assistance, and savings for safe drivers. The automobile insurance plans by AARP provide a tailored need for the needs of the aging driver and contain manageable costs.

If you’re looking for the best auto insurance for seniors in Arizona, comparing different providers can help you find the best rates. AARP car insurance coverage for seniors includes flexible plans with coverage options that fit different budgets. For those in Arizona, cheap auto insurance for seniors in AZ is available through providers that offer special discounts based on driving history and mileage.

Seniors can save with AARP’s best car insurance options for seniors, special discounts, and competitive rates from top providers.Schimri Yoyo Licensed Agent & Financial Advisor

Seniors can explore Allstate car insurance in Nogales, AZ, which provides customized plans and competitive rates. Many insurance companies offer senior auto insurance discounts to help lower costs. Getting a senior auto insurance quote from multiple companies helps secure the best auto insurance for seniors in Arizona at the lowest price.

Read more: AARP Auto Insurance Program from The Hartford Review

Ready to buy affordable senior auto insurance in Arizona today? Compare rates with our free quote comparison tool to find the best Arizona auto insurance company for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the best AZ insurance company for seniors?

The Hartford is the best auto insurance company for senior drivers in Arizona.

Who has the cheapest car insurance for seniors in Arizona?

USAA offers the cheapest coverage for military and veteran seniors, and Geico offers the cheapest average rates for non-military and non-veteran seniors. To find the cheapest rates for you, compare rates from multiple companies using our free quote tool.

What is the cheapest auto insurance for seniors in Arizona?

The cheapest type of car insurance for Arizona seniors will be minimum coverage. However, minimum coverage doesn’t cover much in the event of an accident (Learn More: When to Buy More Than Minimum Auto Insurance).

Is AARP auto insurance cheaper than Progressive?

The AARP auto insurance program from The Hartford actually costs more on average than auto insurance from Progressive.

Is USAA auto insurance good for seniors?

Yes, USAA is a great choice for senior drivers in Arizona who are military or veterans.

What age is auto insurance most expensive?

Car insurance is the most expensive for teenagers (Read More: Reasons Auto Insurance Costs More for Young Drivers).

At what age is auto insurance the cheapest?

Generally, drivers will get the lowest rates around age 60.

What is the average cost of auto insurance in AZ?

The average cost of car insurance in Arizona is $46 per month for minimum coverage and $176 per month for full coverage.

What is the best auto insurance for old cars?

Old cars that aren’t classic can usually carry just minimum coverage, which will be the cheapest option. Old cars that are classics should carry classic car insurance.

Which gender pays more for auto insurance in Arizona?

Male drivers tend to pay slightly more on average for AZ car insurance than female drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.