Best Auto Insurance for Seniors in Illinois (Top 10 Companies for 2025)

The Hartford, Allstate, and State Farm have the best auto insurance for seniors in Illinois, offering rates starting at $39 per month. These senior car insurance providers stand out for their tailored policies for infrequent drivers, affordable rates, excellent customer service, and senior-friendly discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

765 reviews

765 reviewsCompany Facts

Full Coverage for IL Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for IL Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for IL Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsTo secure the best auto insurance for seniors in Illinois, prioritize affordable rates, comprehensive coverage, and specialized discounts designed for older drivers. The Hartford, Allstate, and State Farm stand out by offering competitive pricing, customized policies, and excellent customer support to meet seniors’ unique needs.

Illinois seniors benefit from a government-mandated auto insurance discount for seniors, along with additional savings for safe driving, low mileage, and bundling policies. While minimum liability coverage meets Illinois state requirements, full coverage offers better protection, especially for retirees who drive frequently or own newer vehicles.

The Hartford provides the best overall policies for seniors, while Allstate’s Milewise program benefits infrequent drivers, and State Farm excels in customer service. Geico offers the lowest rates, with premiums starting at just $18 monthly.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Illinois

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Tailored Policies | The Hartford |

| #2 | 40% | A+ | Comprehensive Coverage | Allstate | |

| #3 | 30% | B | Customer Service | State Farm | |

| #4 | 25% | A++ | Cheap Rates | Geico | |

| #5 | 30% | A | Customizable Policies | Liberty Mutual |

| #6 | 30% | A | Insurance Discounts | Farmers | |

| #7 | 30% | A+ | Budgeting Tools | Progressive | |

| #8 | 20% | A | Roadside Assistance | AAA |

| #9 | 30% | A+ | Filing Claims | Erie |

| #10 | 30% | A+ | Dividend Payments | Amica |

Comparing multiple providers ensures seniors find the best Illinois auto insurance companies that offer great options for seniors. Enter your ZIP code to compare rates and unlock the best discounts.

- The Hartford offers the best senior auto insurance in Illinois

- Allstate Milewise is the best option for low-mileage senior drivers

- Geico has the cheapest IL senior auto insurance at $18 per month

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – The Hartford: Top Overall Pick

Pros

- Exclusive AARP Member Benefits: Provides special perks for AARP members, helping seniors in IL save more on their premiums.

- Customized Coverage for Seniors: Offers policies tailored to the needs of older drivers, including lower rates for infrequent drivers and benefits designed for retirees. Read more in our The Hartford auto insurance review.

- Strong Customer Support & Claims Service: Delivers dedicated customer service with a reputation for hassle-free claims processing, ensuring seniors receive prompt and reliable assistance.

Cons

- Limited Availability: The Hartford’s specialized senior auto insurance policies are only available to Illinois AARP members.

- Higher Premiums: The Hartford is the most expensive IL senior auto insurance company on this list at $160 per month for minimum coverage.

#2 – Allstate: Best for Infrequent Drivers

Pros

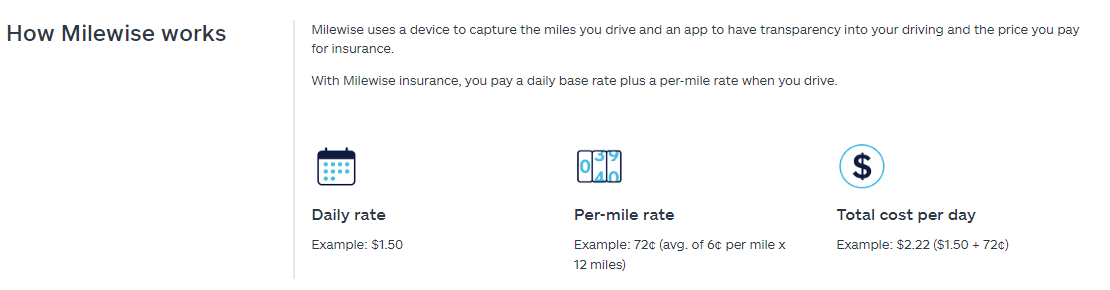

- Affordable Rates for Infrequent Drivers: Allstate Milewise and Milewise Unlimited help low-mileage senior drivers save money on IL auto insurance.

- Flexible Coverage: Provides flexible coverage options that cater to the needs of seniors in Illinois who may not drive often. Learn about it in our Allstate auto insurance review.

- Customer Support: Is Allstate a good insurance company? Yes. Allstate has a strong reputation for customer support for seniors in Illinois who may have specific needs.

Cons

- Potentially Higher Costs for Frequent Drivers: Seniors who drive more frequently may find Allstate to be more expensive than other Illinois auto insurance companies.

- Limited Customization: While great for infrequent drivers, Allstate’s policies may not offer as much customization for seniors in Illinois who have unique coverage needs.

#3 – State Farm: Best Customer Service

Pros

- Personalized Service: Offers personalized service that caters to the specific needs of seniors in IL, including easy-to-reach agents and tailored advice. Read our State Farm auto insurance review.

- Top-tier Customer Service: Delivers personalized, outstanding customer service, ensuring their providers get the support they need with ease and confidence.

- Local Agents for Seniors: State Farm has a large network of local agents in Illinois, making it easier for seniors to get face-to-face assistance.

Cons

- Low Financial Ratings: State Farm’s financial grade of B is lower than other Illinois senior auto insurance companies.

- Limited Online Resources: Seniors in Illinois who prefer online interactions might find State Farm’s digital resources less comprehensive compared to other providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Cheap Rates

Pros

- Low Premiums: Geico offers the cheapest senior auto insurance in Illinois starting at $18 monthly for minimum coverage. Compare free senior auto insurance quotes in our review of Geico auto insurance.

- Easy Claims Filing: Senior drivers in Illinois can file Geico insurance claims directly from the mobile app.

- Senior Discounts: Illinois seniors can save on auto insurance with Geico’s discounts, including deals for defensive driving courses and policy bundling.

Cons

- Limited Specialized Coverage: Geico’s focus on low rates may result in less specialized coverage options.

- Customer Service Challenges: Compared to other competitors, Seniors in IL might find Geico’s customer support less personalized.

#5 – Liberty Mutual: Best Customizable Policies

Pros

- Customizable Options: Liberty Mutual offers highly customizable policies, allowing seniors in Illinois to tailor their coverage to specific needs. Check our Liberty Mutual auto insurance review.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, helping seniors avoid rate increases after their first at-fault accident.

- New Car Replacement: If a senior’s car is totaled within the first model year and under 15,000 miles, Liberty Mutual replaces it with a brand-new vehicle.

Cons

- Policy Complexity: The extensive customization options may feel overwhelming for some Illinois seniors who prefer straightforward insurance plans.

- Possible Higher Costs: Customizable policies might come at a higher cost, which could be a disadvantage for budget-conscious seniors in Illinois.

#6 – Farmers: Best Senior Insurance Discounts

Pros

- Generous Discounts: Farmers provides more senior insurance discounts in Illinois than any other company. Check out the list in our Farmers auto insurance review.

- Special Discounts for Safe Driving: Drivers over 55 are eligible for discounts on senior auto insurance in Illinois if they take an approved defensive driving course.

- Bundling Discounts: Seniors in Illinois can take advantage of bundling discounts when combining auto insurance with other policies.

Cons

- Discount Availability May Vary: The availability and amount of discounts may vary based on location and personal driving history, which could affect some seniors in Illinois.

- Complex Discount Structure: The various discount options might be complicated to navigate, potentially confusing seniors in Illinois.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best Budgeting Tools

Pros

- Helpful Budgeting Tools: Progressive offers budgeting tools that are useful for senior drivers who want to manage their Illinois auto insurance costs effectively. Read our Progressive Snapshot review to learn what else is offered.

- Easy-to-Use Online Resources: Provides user-friendly online tools that help seniors in Illinois keep track of their insurance expenses.

- Usage-Based Savings: Features like Snapshot can help seniors in Illinois find ways to save on their insurance premiums.

Cons

- Takes Time to Get Used To: Some Illinois seniors may find the budgeting tools a bit tricky to figure out at first.

- Lacks Personal Touch: Progressive prioritizes online tools, which may frustrate some seniors who prefer speaking with a live agent for support.

#8 – AAA: Best for Roadside Assistance

Pros

- Comprehensive Roadside Assistance: Illinois seniors feel secure if they experience a breakdown or need help on the road since AAA provides reliable roadside support.

- Additional Benefits: AAA membership includes additional perks and services, such as travel discounts, which can be valuable for seniors in Illinois.

- Reliable Support: Known for reliable emergency support, which is crucial for seniors in Illinois who might need assistance while on the road. Read more about this in our AAA auto insurance review.

Cons

- Higher Premiums: AAA auto insurance for seniors in Illinois is more expensive than other companies at $78 per month.

- Limited Availability: AAA car insurance is only available to senior drivers in Illinois who are members, which costs an additional annual fee.

#9 – Erie: Best for Filing Claims

Pros

- Efficient Claim Filing: Erie is known for its efficient claims process, which benefits seniors in Illinois who need quick resolutions. Read our Erie auto insurance review to learn more.

- Supportive Assistance: Erie is top-rated for senior auto insurance customer support and satisfaction in Illinois and surrounding states.

- Safe Driving Discounts: Senior drivers in Illinois who maintain a clean, claim-free record can save 20% on car insurance.

Cons

- Fewer Discounts: As a smaller company, Erie doesn’t offer as many senior citizen auto insurance discounts as other Illinois insurers.

- Variable Customer Experiences: Despite efficient claims, some senior drivers in Illinois report poor customer service from some local agents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Dividend Payments

Pros

- Dividend Payments: Amica offers dividend payments, which can be a valuable financial benefit for seniors in Illinois. Learn more in our Amica auto insurance review.

- Lower Premiums With Dividends: Seniors in Illinois who receive dividends can potentially see lower insurance premiums over time.

- Financial Benefits: Provides a reward for safe driving and responsible insurance management, which is beneficial for seniors in Illinois.

Cons

- Varying Dividend Payments: Dividends are not guaranteed and may vary, which can be uncertain for seniors in Illinois.

- Possible Complexity: The structure of dividend payments may be complicated, which could be challenging for some seniors in Illinois to understand.

Illinois Senior Citizens’ Monthly Auto Insurance Premiums

What is the average auto insurance cost per month? For seniors in Illinois, monthly auto insurance rates vary widely. Geico offers the lowest rates, with minimum coverage at $18 and full coverage at $46, while AAA and The Hartford have the highest rates, with minimum coverage at $78 and $85, and full coverage at $150 and $160, respectively.

Illinois Senior Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $83 | $83 |

| $107 | $279 | |

| $78 | $150 | |

| $66 | $172 |

| $71 | $186 | |

| $29 | $75 | |

| $45 | $120 |

| $55 | $142 | |

| $39 | $102 | |

| $160 | $160 |

If you’re still wondering, how to choose the best car insurance plan? The top factors affecting auto insurance rates for Illinois seniors are where they live in the state and their driving records.

Vehicle make, model, and coverage levels also impact rates. Seniors who understand these factors can find the most cost-effective policies.

- Driving History: Seniors with a history of accidents or traffic violations may face higher premiums, while lower annual mileage can reduce insurance costs due to decreased accident risk.

- Vehicle Type: Luxury or sports cars usually cost more to insure, whereas standard or older vehicles may be cheaper, with advanced safety features often leading to discounts.

- Coverage Levels: Minimum liability coverage is the most affordable but offers limited protection, while full coverage provides broader protection but at a higher cost.

- Location: Big cities have more traffic and higher crime rates, which is why Chicago auto insurance for seniors costs more than other areas in the state.

Seniors can manage their auto insurance costs and tailor their coverage by carefully assessing the factors above.

Lowering Auto Insurance Costs for Seniors in Illinois

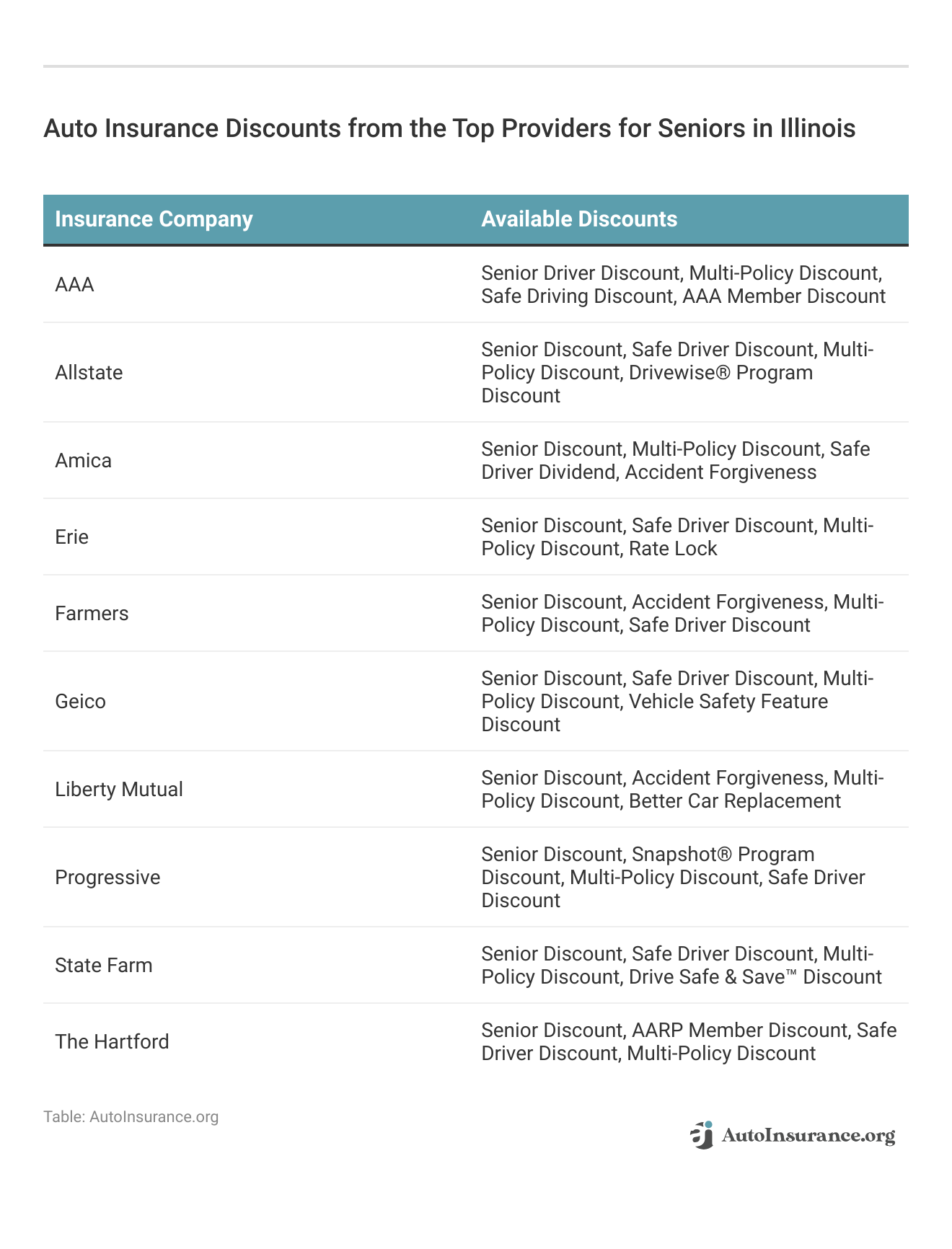

Seniors can save on auto insurance through discounts for safe driving, bundling with other policies, and usage-based programs that reward low mileage and good driving habits.

The Hartford offers exclusive savings for senior drivers as well as discounts for safe driving, multi-policy bundles, and more. These are the best The Hartford auto insurance discounts to ask for.

Seniors who drive safely or infrequently can save money with usage-based policies, which offer discounts based on driving habits. This type of insurance adjusts rates according to how often and how well seniors drive.

Allstate and State Farm both offer cheap pay-as-you-go auto insurance in Illinois, but State Farm will reduce your discount for speeding and hard braking. Allstate, on the other hand, bases senior car insurance rates on mileage. Check out how it works below:

By comparing rates and taking advantage of discounts, seniors in Illinois can secure the best auto insurance coverage for their needs while managing costs effectively.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Customizing Senior Auto Insurance in Illinois

Finding an auto insurance premium that fits the unique needs of Illinois seniors is essential. These case studies below show how the right provider and policy help senior drivers secure the best coverage solutions.

Case Study #1: The Infrequent Drivers

John and Mary, with a 2015 Camry, secured affordable IL senior auto insurance at $25 monthly from Allstate Milewise, saving $300 with discounts and accident forgiveness.

Case Study #2: The Budget-Conscious Retiree

Susan, 68, a retired teacher on a fixed income, reduced her auto insurance costs with Geico using discounts for safe driving, good credit, and senior status. She also saved more by taking a defensive driving course. Learn how you can qualify for similar savings in our article, “How to Get a Defensive Driver Auto Insurance Discount.”

Case Study #3: The Comprehensive Coverage Seeker

Robert, 72, lives in Chicago and loves taking road trips. He chose The Hartford’s comprehensive coverage for $85 per month, taking advantage of the AARP auto insurance program and clean driving discounts.

By using available discounts and selecting coverage that matches their driving habits, seniors can save money while staying well-protected on the road.

What are the recommended auto insurance coverage levels? Seniors should carry enough coverage to meet Illinois requirements. If you drive often, consider full coverage to insure against these risks and more.

Finding Affordable Auto Insurance for Seniors in Illinois

The Hartford, Allstate, and State Farm are top choices for the best auto insurance for seniors in Illinois, with significant discounts available for clean driving records and multi-policy bundles.

The Hartford offers seniors in Illinois top-rated auto insurance with great rates, tailored policies, and excellent customer service.Dani Best Licensed Insurance Producer

Seniors can lower auto insurance costs by comparing quotes, increasing deductibles, and considering usage-based policies. Understanding factors that affect insurance rates, like driving history and coverage levels, helps in making informed decisions to find the best and most affordable senior insurance coverage.

Enter your ZIP code to find cheap auto insurance rates in Illinois for seniors.

Frequently Asked Questions

Who has the best auto insurance for senior citizens?

What is the best car insurance company for seniors? Several insurance companies offer favorable policies for senior drivers. According to Forbes Advisor, Nationwide is considered the best overall for seniors, with USAA, Travelers, and Erie also performing well in areas like claims processing and customer satisfaction.

Who has the best auto insurance in Illinois?

In Illinois, State Farm is recognized for its user-friendly services, including efficient online policy management and a highly-rated mobile app. Additionally, The Hanover offers the best full coverage car insurance for seniors in the state.

What are the top 10 auto insurance companies?

Based on various evaluations, the best car insurance companies in Illinois include:

- The Hartford

- Allstate

- State Farm

- Geico

- Liberty Mutual

- Farmers

- Progressive

- AAA

- Erie

- Amica

Which company is best for car insurance?

The ideal car insurance company varies based on individual needs, driving history, and location. USAA consistently ranks highly but is limited to military members and their families. For broader availability, companies like Auto-Owners and State Farm are well-regarded.

What is the best-rated insurance for seniors?

Nationwide is highlighted as the top choice for senior drivers, excelling in claims handling and offering competitive rates. USAA, Travelers, and Erie also receive commendations for their services to seniors.

Which insurance is best for senior citizens?

In addition to Nationwide, The Hartford, in partnership with AARP, offers policies tailored specifically for senior drivers, including benefits like RecoverCare, which assists with daily tasks after an accident.

It is considered one of the best car insurance for seniors over 70 due to its tailored benefits, including accident forgiveness, lifetime renewability, and RecoverCare, which helps with daily tasks after an accident. It also provides competitive rates and specialized coverage for those seeking auto insurance for seniors over 80, ensuring affordability and support for aging drivers.

Who are the top 5 insurance companies?

Who are the top 5 auto insurance companies? According to U.S. News & World Report, the top five car insurance companies are:

- USAA

- Auto-Owners

- Nationwide

- State Farm

- Geico

Is Allstate a good insurance company?

Allstate is a reputable insurance provider, ranking sixth in U.S. News & World Report’s evaluation. It offers a wide range of coverage options and has a strong financial standing.

Why is auto insurance so high in Illinois?

Auto insurance rates in Illinois can be influenced by factors such as urban density, weather-related risks, and the state’s minimum insurance requirements. Additionally, individual factors like driving history and vehicle type play significant roles.

Which insurance company has the highest customer satisfaction?

Customer satisfaction varies by region and individual experiences. USAA often receives high marks for customer satisfaction, but it’s limited to military families. Among companies with broader availability, Auto-Owners and State Farm are frequently praised.

Read More: How to Research Auto Insurance Companies

Who is the number 1 insurance provider?

Which insurance company is best? In terms of market share, State Farm is the largest auto insurance provider in the U.S., commanding about 18% of the market. The “best” insurance company depends on individual needs, preferences, and circumstances. Factors to consider include coverage options, customer service, pricing, and financial stability. It’s advisable to compare quotes and reviews to determine the best fit.

Which car insurance company has the best claim settlement ratio?

While specific claim settlement ratios can vary, companies like USAA and Auto-Owners are known for efficient claims processing and high customer satisfaction in this area.

Which type of vehicle insurance is best?

The optimal type of auto insurance depends on individual needs. Full coverage, which includes liability, collision

Who has the best auto insurance for seniors?

Several companies cater to senior drivers. Nationwide, The Hartford (AARP), and USAA are among the top choices for their competitive rates and senior-friendly policies.

What age is considered a senior citizen?

Generally, a senior citizen is considered to be 60 or 65 years old, but for insurance purposes, discounts often start at age 50–55.

What is the best Medicare insurance for seniors?

The best Medicare plan depends on personal needs. UnitedHealthcare, Humana, and Aetna offer top-rated Medicare Advantage and Supplement plans.

What is the age limit for term insurance?

Most term insurance policies have an entry age limit of 18–65 years, with coverage extending up to 85 years.

Read More: How to Manage Your Auto Insurance Policy

At what age is insurance the cheapest?

Auto insurance is generally cheapest for drivers in their mid-50s. Rates tend to be highest for teenagers and then drop significantly after age 25.

Who is the largest auto insurance company in the U.S.?

State Farm is the largest auto insurer, holding about 18% of the market.

Who is Allstate’s biggest competitor?

Allstate’s main competitors include State Farm, Geico, and Progressive. Check our “State Farm vs. Allstate Auto Insurance” for a comparison between Allstate and State Farm.

Who is the most trusted insurance company?

USAA is often rated the most trusted insurer, but it’s limited to military families. State Farm and Auto-Owners are widely trusted among the general public.

Where is Allstate ranked?

Allstate ranks around 4th–6th among top insurers, depending on the source. It’s strong in claims satisfaction and coverage options.

What is the Illinois state minimum for auto insurance?

Illinois requires:

- $25,000 bodily injury per person

- $50,000 bodily injury per accident

- $20,000 property damage per accident (Illinois DOI)

How much is the average car insurance in Illinois?

The average cost of full coverage in Illinois is around $1,500 per year, while minimum coverage is about $500 per year.

Will my insurance go up if I’m not at fault in Illinois?

In Illinois, your rate may increase after a not-at-fault accident, depending on your insurer’s policy. Some companies offer accident forgiveness. Read more: Factors That Affect Auto Insurance Rates

What are the top 10 car companies?

Based on global sales and reputation:

- Toyota

- Volkswagen

- Hyundai-Kia

- General Motors

- Ford

- Honda

- Nissan

- Mercedes-Benz

- BMW

The best-selling car in the U.S. is the Ford F-Series pickup, followed by the Chevrolet Silverado and Toyota RAV4.

Related Article: Compare Auto Insurance Rates by Vehicle Make and Model

Which company is best for car insurance?

For affordability, Geico and State Farm are top choices. For customer service, Auto-Owners and USAA rank highest.

Is Geico or Progressive better?

Geico has lower average rates and is best for budget-conscious drivers. Progressive has more coverage options and is best for high-risk drivers.

Read More: Geico vs. Progressive Auto Insurance Review

What is the most sold car in the U.S.?

The Ford F-Series remains the best-selling vehicle in the U.S., with 765,649 units sold as of 2024.

Which auto insurance company has the best claims service?

Auto-Owners, USAA, and Amica are highly rated for claims satisfaction. Enter your ZIP code below to compare coverage options and find the best policy for your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.