Best Auto Insurance for Seniors in Indiana (See the Top 10 Companies for 2025)

State Farm, Geico, and Allstate offer the best auto insurance for seniors in Indiana. Senior car insurance rates with Geico start at $33 per month. Allstate and State Farm offer extensive agent networks and cost savings through multi-policy discounts, making them the best senior car insurance companies in Indiana.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for IN Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for IN Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for IN Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsFinding the best auto insurance for seniors in Indiana can help older drivers save money while staying covered. State Farm, Geico, and Allstate are good choices, with Geico offering the lowest rates at $33 per month.

Many companies offer senior discounts for safe driving, bundling policies, owning multiple vehicles, and keeping a low mileage. The best type of insurance for seniors depends on their needs, whether they want basic coverage or full coverage.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Indiana

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | B | Agency Network | State Farm | |

| #2 | 25% | A++ | Cost Savings | Geico | |

| #3 | 25% | A+ | Multi-Policies | Allstate | |

| #4 | 25% | A+ | Exclusive Benefits | The Hartford |

| #5 | 20% | A+ | Usage-Based Discounts | Nationwide |

| #6 | 12% | A+ | Online Management | Progressive | |

| #7 | 25% | A | Insurance Add-Ons | Liberty Mutual |

| #8 | 8% | A++ | Unique Coverage | Travelers | |

| #9 | 20% | A | Additional Discounts | Farmers | |

| #10 | 20% | A | Loyalty Discounts | American Family |

The average cost of car insurance in Indiana varies, so it’s smart to compare quotes to find the best deal.

Enter your ZIP code above to find affordable senior auto insurance anywhere in Indiana.

- State Farm is the top pick for auto insurance for seniors in Indiana

- Geico offers the cheapest seniors’ auto insurance, with rates starting at $21 monthly

- Senior drivers can save 25% when they bundle home and auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Agency Network: State Farm’s extensive agency network in Indiana enables seniors to quickly access neighborhood service and one-on-one service.

- Personalized Assistance: State Farm’s large agency network guarantees that Indiana seniors are able to get in-person consultations for more personalized insurance handling.

- Cheap Rates: State Farm is one of the cheapest senior auto insurance companies in Indiana, with rates starting at $24 per month. Compare quotes in our State Farm auto insurance review.

Cons

- Limited Online Tools: Seniors in Indiana who prefer online management might find State Farm’s digital tools less robust compared to competitors.

- Poor Financial Ratings: Even with high claims satisfaction, State Farm is not necessarily the most dependable at paying Indiana senior auto insurance claims.

#2 – Geico: Best for Cost Savings

Pros

- Cost Savings: Geico has the cheapest senior auto insurance for $21 per month, making it an affordable choice for those on a fixed income. Read more in our Geico auto insurance review.

- Discount Opportunities: Seniors in Indiana can take advantage of several discounts provided by Geico, including safe driver and multi-policy discounts.

- Easy Online Quotes: Seniors in Indiana who prefer managing their insurance online will find Geico’s user-friendly platform convenient.

Cons

- Limited Local Presence: Geico‘s emphasis on online and phone support is not necessarily suited for Indiana seniors who would like to deal directly with their insurance agents.

- Coverage Options: A few Indiana seniors may find the coverage options less inclusive with Geico than those of insurers who have more options.

#3 – Allstate: Best Multi-Policy Discounts

Pros

- Discounts for Multiple Policies: Indiana seniors can save as much as 25% by bundling multiple policies with Allstate.

- Comprehensive Coverage: Allstate offers a range of coverage options that can be tailored to the specific needs of seniors in Indiana.

- Strong Customer Service: Seniors in Indiana can rely on Allstate’s reputable customer service for support and assistance, which you can read more about in our review of Allstate.

Cons

- Higher Premiums: Some seniors in Indiana might experience higher premiums compared to other insurers, particularly if they don’t qualify for discounts.

- Complex Policy Management: Managing multiple policies with Allstate could be a little confusing for Indiana seniors because they have to monitor the details.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits for Seniors: The Hartford offers specialized senior auto insurance in Indiana, such as tailored coverage options and senior-specific discounts.

- Comprehensive Support: Seniors in Indiana can access a range of services and support designed specifically for older drivers. Read more in our review of The Hartford.

- Well-Reviewed for Senior Coverage: The Hartford is known for its focus on senior insurance needs, which can be beneficial for Indiana residents looking for age-specific services.

Cons

- Restricted Availability: In Indiana, The Hartford offers senior auto insurance exclusively to AARP members.

- Potentially Higher Rates: Indiana senior auto insurance costs start at $30 per month, which is higher than most companies on this list.

#5 – Nationwide: Best Usage-Based Discounts

Pros

- Usage-Based Savings: Nationwide SmartRide and SmartMiles can help senior drivers reduce IN insurance rates with safe driving or low-mileage discounts.

- Bundling Discounts: Seniors in Indiana can take advantage of 20% bundling discounts by combining auto insurance with other types of coverage, potentially lowering overall costs.

- Flexible Coverage Options: As per our Nationwide auto insurance review, the company offers a variety of coverage options that can be customized to meet the needs of seniors in IN.

Cons

- Higher Premiums for Some: Senior auto insurance rates could be higher for Indiana drivers who don’t qualify for UBI programs.

- Low Usage-Based Satisfaction: Indiana senior drivers have more grievances with Nationwide UBI than with other insurers’ programs.

#6 – Progressive: Best for Online Management

Pros

- Online Management: Seniors in Indiana who prefer managing their insurance online will appreciate Progressive’s user-friendly digital tools and resources.

- Competitive Rates: Progressive has competitive rates that can prove beneficial for Indiana seniors seeking economic coverage.

- Customizable Coverage: Progressive provides options that allow seniors in IN to tailor their coverage to their specific needs. Learn more about this in our Progressive auto insurance review.

Cons

- Limited In-Person Service: Seniors in Indiana who like talking to someone in person might not prefer Progressive’s online service.

- Customer Service Reviews: Some seniors in Indiana might find Progressive’s customer service reviews mixed compared to insurers with a stronger local presence.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best Insurance Add-Ons

Pros

- Comprehensive Add-Ons: Indiana drivers can add unique coverage to senior auto insurance policies that offer new car replacement, accident forgiveness, and more.

- Adaptable Coverage Choices: Liberty Mutual provides a range of coverage options that can be tailored to the needs of seniors in Indiana.

- Personalized Assistance: Seniors in Indiana can receive personalized service from Liberty Mutual’s network of agents. Find out more in our Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Some seniors in Indiana may find Liberty Mutual’s premiums higher than those of other insurers, especially if they don’t qualify for discounts.

- Complex Policy Management: Managing multiple policies with Liberty Mutual might be more complex for seniors in Indiana.

#8 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage Options: Travelers offers unique coverage options that can be customized for the individual requirements of seniors in Indiana, which is detailed in our review of Travelers.

- Discount Opportunities: Seniors in Indiana can avail themselves of numerous discounts, such as those for safe driving and policy bundling.

- Strong Reputation: Travelers is well-regarded for delivering dependable coverage and excellent customer service to seniors in Indiana.

Cons

- Complex Coverage Options: The variety of unique coverage options might be overwhelming for some seniors in Indiana, requiring careful consideration.

- Low Claims Satisfaction: Senior drivers in Indiana have better claims handling experiences with other insurance companies.

#9 – Farmers: Best for Additional Discounts

Pros

- Additional Discounts: Seniors are also eligible for other discounts that Farmers provides, which can further lower Indiana auto insurance rates.

- Comprehensive Coverage: Farmers provides a range of coverage options tailored to the needs of seniors in Indiana.

- Good Customer Support: Seniors in Indiana can benefit from Farmers’ strong customer service and support. Learn more in our Farmers auto insurance review.

Cons

- Complex Policy Options: The variety of policy options available from Farmers might be confusing for some seniors in Indiana.

- Variable Claims Service: Senior drivers in Indiana have mixed reviews about the ease and efficiency of claims filing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Discounts: American Family offers discounts to old customers, which can assist seniors in Indiana by saving their money.

- Comprehensive Coverage: The insurer provides a range of coverage options that can be tailored to the needs of seniors in Indiana.

- Strong Customer Service: Seniors in Indiana can rely on the American Family’s good customer service for support and assistance. Read our American Family auto insurance review to learn more.

Cons

- Complex Policy Options: American Family’s wide range of policies and discounts can be complex for seniors in Indiana, making it challenging to select the right coverage without help.

- Limited Discounts for New Customers: Seniors in Indiana who are new customers may not receive the same level of discounts as those who have been long-term policyholders.

Cost-Effective Auto Insurance Plans for Seniors in Indiana

Finding affordable IN auto insurance can be a challenge, especially for senior drivers on a fixed income. Fortunately, many Indiana insurance providers offer competitive rates and a variety of discounts specifically tailored for older drivers.

Indiana Senior Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $73 | $213 | |

| $56 | $163 | |

| $42 | $120 | |

| $33 | $97 | |

| $96 | $279 |

| $51 | $147 |

| $36 | $104 | |

| $37 | $107 | |

| $83 | $83 |

| $36 | $105 |

Seniors can find cheap Geico senior auto insurance with the lowest rates at $21 per month for minimum and $62 per month for full coverage. Other notable options include State Farm at $24 per month for minimum and $69 per month for full coverage, and Farmers at $27 per month for minimum and $77 per month for full coverage.

State Farm delivers top-notch coverage and affordability, making it the best choice for seniors in Indiana.Michelle Robbins Licensed Insurance Agent

Understanding the top 7 factors that impact Indiana auto insurance rates can help seniors find the most affordable and appropriate coverage. For instance, seniors might see their premiums decrease if they reduce coverage or go up if they buy a new vehicle.

Seniors who drive fewer miles annually may qualify for cheaper premiums due to reduced risk, so report accurate mileage to your insurer and inquire about low-mileage discounts. Keep reading for more ways to save on Indiana senior car insurance.

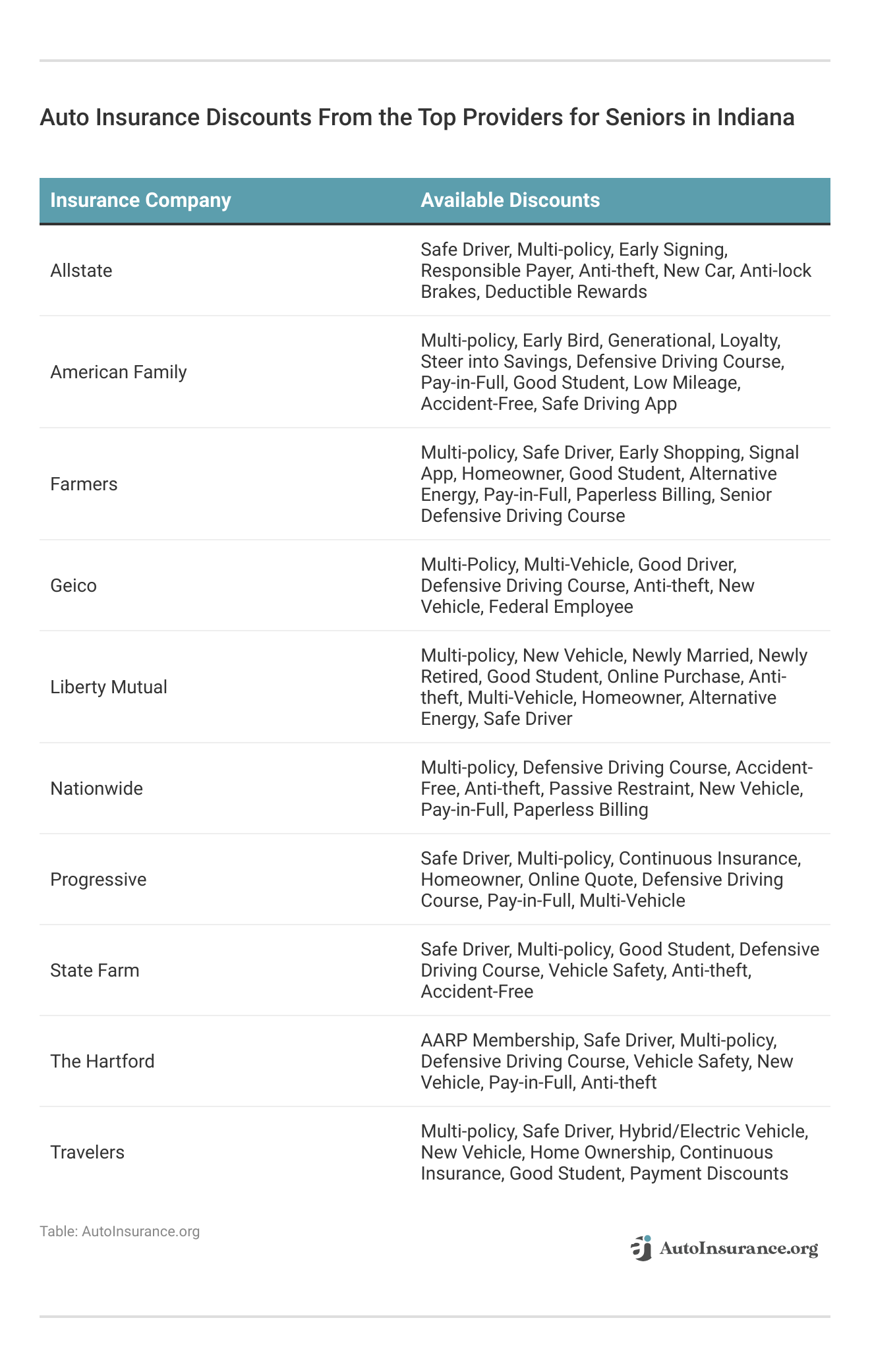

Ways for Seniors to Lower Their Auto Insurance Expenses in Indiana

To lower auto insurance premiums, Indiana seniors need to shop around, have a clean driving record, and take advantage of available discounts. Allstate, American Family, and State Farm, among other companies, provide numerous discounts such as safe driver, multi-policy, defensive driving course, and many others.

Use these discounts to reduce your insurance premiums. Reducing the levels of coverage, raising deductibles, and using safe driving features can all reduce premiums.

Bundling policies and having a good credit record are other ways to save money that assist older drivers in obtaining lower car insurance rates in Indiana.

Moreover, seniors in Indiana can save money on car insurance by looking for discounts and choosing the right coverage. The best full-coverage car insurance for seniors offers good protection at a fair price. Companies like Geico car insurance for seniors have affordable rates and rewards for safe drivers.

Joining programs like AARP car insurance for senior citizens can also help seniors get special discounts. For those who don’t drive much, cheap liability coverage for seniors is a good way to meet state requirements without overpaying. Shopping around for auto insurance for seniors can lead to big savings.

Read More: Best Low-Mileage Auto Insurance Discounts

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Key Factors Seniors Should Consider When Choosing Auto Insurance in Indiana

Finding the right auto insurance for senior citizens can feel overwhelming, but it doesn’t have to be. Seniors just need to focus on getting the right coverage at a fair price while taking advantage of discounts and special offers.

- Make Sure You Have Enough Coverage: A good policy should include liability, collision, and medical coverage to keep you protected if something happens.

- Look for Discounts: Many companies give savings for safe drivers and low mileage, helping you get the lowest car insurance rates for seniors.

- Check for State Discounts: Some states offer special deals, like the auto insurance discount in Indiana, which can help lower costs.

- Compare Different Companies: Checking out options like State Farm’s free auto insurance for seniors can help you find the best plan for your needs.

- Find Extra Benefits: If you’re looking for the cheapest car insurance for seniors over 70 or auto insurance for seniors over 80, make sure your policy includes things like roadside assistance.

Seniors can save money and stay protected by comparing policies, looking for discounts, and choosing the plan that fits their needs. Taking the time to shop around can make a big difference.

Read more: Do you need medical payment coverage on auto insurance?

Exclusive Discounts and Savings for Senior Drivers in Indiana

Senior drivers in Indiana have several ways to save on car insurance. Many insurance companies offer discounts to help older drivers find the lowest-cost auto insurance for seniors while still getting the necessary coverage.

Indiana law requires a government-mandated auto insurance discount for seniors who complete a state-approved defensive driving course. This will lower insurance costs and help seniors improve their driving skills and stay safe on the road.

To get the cheapest car insurance for seniors over 60, it’s important for you to compare different companies. You must check options like State Farm car insurance for seniors, it can help find affordable coverage with good benefits.

For seniors in their 70s, finding the best car insurance means looking for policies that offer accident forgiveness, roadside assistance, and flexible coverage. Many companies also provide extra savings for safe drivers.

By utilizing discounts and rate comparisons, car insurance for seniors in Indiana can be affordable and trustworthy, providing senior citizens with the peace of mind that comes from knowing they are protected on the road.

Want to know what is the average auto insurance cost per month? Check out our guide to see how different coverage options affect your budget and help you find the best policy for your needs.

Minimum Car Insurance Requirements for Seniors in Indiana

Seniors in Indiana must have the state’s required car insurance to drive legally. The law says drivers need at least $25,000 for one person’s injuries, $50,000 for total injuries in an accident, and $25,000 for property damage. To get the best deal, it helps to compare top-rated insurance companies in Indiana that offer reliable coverage at good prices.

A great option for seniors is Indiana Farmers Mutual auto insurance, known for affordable rates and good service. Bundling policies can also help seniors find the best home and auto insurance for seniors in Indiana, which can save money.

Seniors who don’t drive much might want to look into low-mileage car insurance for seniors in Indiana, which bases costs on how many miles they drive. To save even more, checking out cheap car insurance in Indiana is a good idea. If high-risk coverage is needed, finding the cheapest SR-22 auto insurance in Indiana can help meet legal requirements without overspending.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Smart Savings Strategies for Senior Drivers in Indiana

Navigating auto insurance can be tricky for seniors in Indiana, but these case studies demonstrate that with a little proactive effort, seniors in Indiana can effectively lower their auto insurance premiums.

- Case Study #1 – Maximizing Multi-Policy Discounts: Linda, a 68-year-old retiree in Indianapolis, reduced her total insurance costs by $400 by bundling her auto and home insurance policies with Allstate. Compare Indianapolis auto insurance rates.

- Case Study #2 – Leveraging Safe Driving Discounts: Tom, a 72-year-old from Fort Wayne with a clean driving record, completed a defensive driving course and received a 15% discount from State Farm. He also asked, Does State Farm give an AARP discount?, which helped him find more savings options.

- Case Study #3 – Reducing Costs with Low-Mileage Savings: Betty, a 70-year-old from Bloomington, drove rarely and told Geico about her low mileage. This got her a 30% discount since she didn’t drive much.

Whether through bundling policies, taking advantage of safe driving discounts, or reporting low mileage, these strategies can result in substantial financial benefits and ensure more affordable coverage. Remember to compare quotes and take advantage of the discounts offered by the best Indiana auto insurance companies.

Getting the right auto insurance at a good price is important for seniors. They should at least have the minimum car insurance required in Indiana to stay legal while keeping costs down. By knowing the rates and discounts available, Indiana seniors can save money and still get the coverage they need.

Discovering the Best Auto Insurance for Seniors in Indiana

Frequently Asked Questions

How much is auto insurance in Indiana per month for seniors?

Car insurance rates for seniors in Indiana can vary based on factors such as driving history, coverage levels, and insurance providers. On average, minimum coverage might start around $21 per month, while full coverage could be approximately $62 per month. It’s best for seniors to compare quotes from multiple insurers to find the most affordable rate for their specific needs.

What is the best auto insurance for seniors in Indiana?

The best car insurance for seniors in Indiana often depends on individual needs and preferences. However, top-rated companies like State Farm, Geico, and Allstate are frequently recommended for their competitive rates, comprehensive coverage options, and discounts tailored for seniors. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What auto insurance is required in Indiana?

Indiana minimum auto insurance requirements include coverage for bodily injury and property damage. The coverage limits are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage. Seniors should ensure their policy meets these requirements to stay compliant with state laws.

Who has the cheapest auto insurance for seniors in Indiana?

Geico is known for offering some of the lowest car insurance rates for seniors in Indiana, with rates starting as low as $21 per month for minimum coverage. However, rates can vary based on personal factors, so it’s important for seniors to obtain quotes from various companies to ensure they get the best deal.

Are there insurance discounts available for seniors in Indiana?

Yes, many insurance providers offer discounts specifically for seniors in Indiana. These can include discounts for safe driving records, completing defensive driving courses, and bundling multiple policies. Seniors should inquire about available discounts to help lower their insurance premiums.

What happens if you don’t have auto insurance in Indiana?

Driving without auto insurance in Indiana can lead to serious consequences, including fines, license suspension, and vehicle impoundment. Additionally, if you are involved in an accident without insurance, you may be personally liable for all damages and medical expenses, which can be financially devastating.

How much is full coverage insurance in Indiana for seniors?

Full coverage car insurance in Indiana typically costs more than minimum coverage. For seniors, full coverage insurance rates might start around $62 per month, depending on the insurer and other factors like driving history and vehicle type.

How can seniors in Indiana lower their auto insurance premiums?

Seniors in Indiana can lower their auto insurance premiums by maintaining a clean driving record, taking advantage of discounts, and adjusting coverage levels. Additionally, increasing deductibles and considering usage-based insurance options can help reduce costs. Comparing quotes from different insurers is also a key strategy for finding savings.

What factors affect senior auto insurance rates in Indiana?

Several factors that affect auto insurance rates for seniors in Indiana include their driving history, age, type of vehicle, location, and coverage levels. Insurance providers may also consider credit scores and whether the senior has completed any driver safety courses. Understanding these factors can help seniors make informed decisions about their coverage and find the best rates.

Does your car insurance go up when you turn 65?

It depends. Some insurers may raise rates due to increased risk, while others offer senior discounts. Comparing providers can help you find the best rate.

Who offers the best auto insurance for senior citizens in Indiana?

Top providers include State Farm, Geico, AARP/The Hartford, and Indiana Farmers Mutual, offering competitive rates and senior discounts.

At what age is Indiana auto insurance the cheapest?

Indiana auto insurance costs start to drop when drivers reach retirement age, typically around 55 and 65 years. Compare auto insurance rates by age to learn more.

Who has the lowest car insurance rates in Indiana?

Geico, State Farm, and Progressive often have the lowest rates for seniors. They also offer discounts for safe driving and low mileage car insurance for seniors in Indiana, making it easier for seniors who drive less to save on their premiums.

Is AARP auto insurance good for seniors?

Yes, AARP auto insurance (by The Hartford) offers senior-focused benefits like accident forgiveness and lifetime renewability, but comparing quotes ensures the best deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.