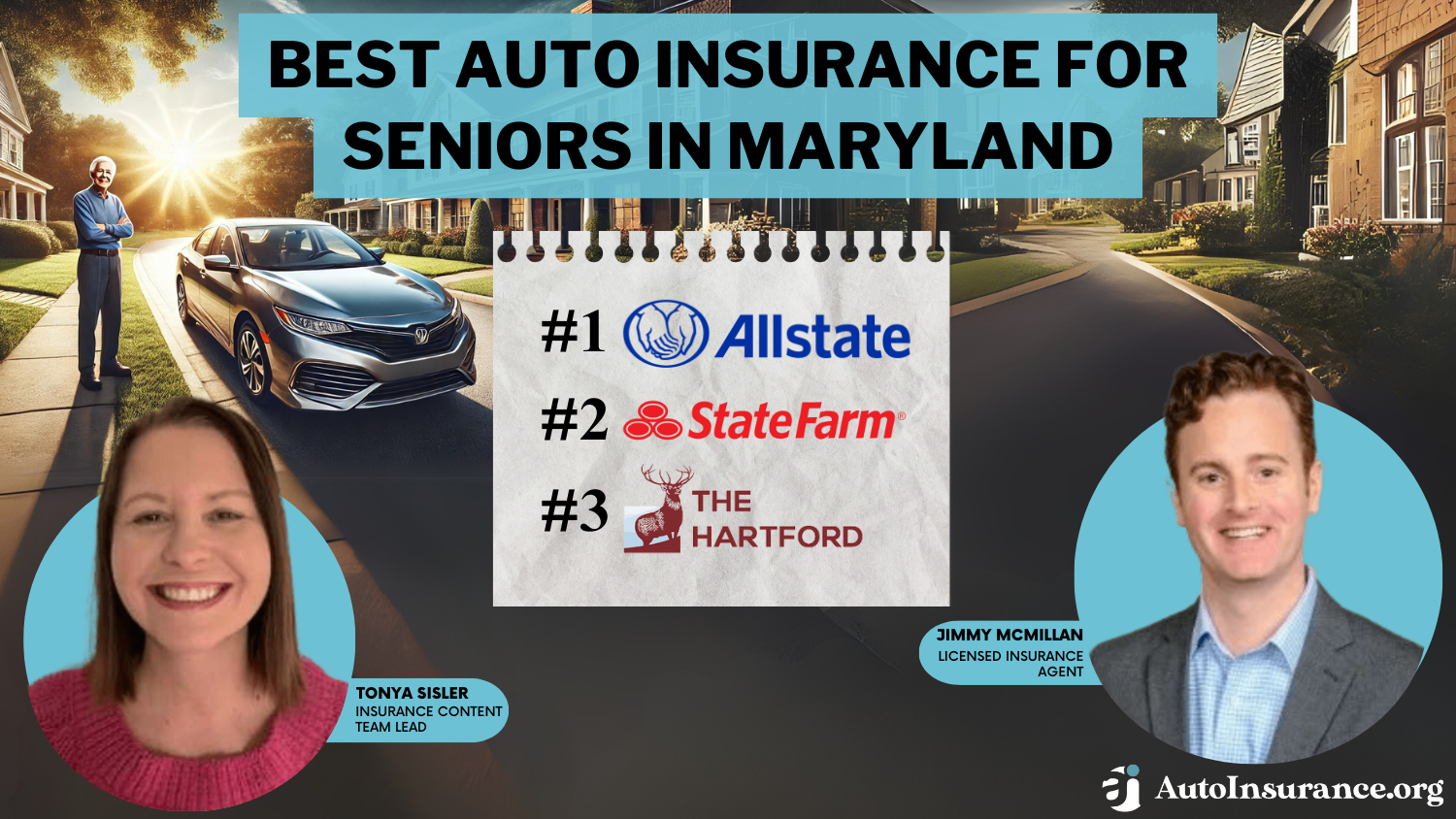

Best Auto Insurance for Seniors in Maryland (Top 9 Companies Ranked for 2025)

You’ll find the best auto insurance for seniors in Maryland from Allstate, State Farm, and The Hartford. Rates start as low as $103 monthly with State Farm, but low-mileage senior drivers will get cheaper Maryland auto insurance rates with Allstate. The Hartford offers the best MD senior auto insurance to AARP members.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for MD Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for MD Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsCompany Facts

Full Coverage for MD Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews

The best auto insurance for seniors in Maryland is Allstate, which provides the most competitive rates for low-mileage senior drivers.

Other top choices include State Farm and The Hartford, both recognized for their high customer satisfaction.

These companies provide seniors with cost-effective options and robust protection. Allstate stands out for its excellent service and affordable monthly auto insurance premiums starting at $54.

Our Top 9 Company Picks: Best Auto Insurance for Seniors in Maryland

Company Rank Bundling

DiscountA.M. Best Best For Jump to Pros/Cons

#1 25% A+ Senior Discounts Allstate

#2 20% B Personalized Service State Farm

#3 10% A+ AARP Benefits The Hartford

#4 20% A+ Coverage Options Progressive

#5 20% A Accident Forgiveness Liberty Mutual

#6 20% A+ Vanishing Deductible Nationwide

#7 15% A Personalized Coverage Farmers

#8 15% A Safe Driving American Family

#9 13% A++ Hybrid Discounts Travelers

Comparing quotes from these top insurers can help you find the best value and coverage tailored to your needs. Enter your ZIP code to start saving on your auto insurance.

- Allstate offers the best auto insurance for seniors in Maryland at $54 monthly

- State Farm and The Hartford provide reliable coverage tailored for seniors

- Compare quotes to find the most cost-effective and comprehensive options

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Senior Discounts: Allstate is famous for providing significant discounts clearly designed for seniors, thus earning it a top spot as one of the best auto insurance for seniors in Maryland.

- Multi-Policy Discount: With a 25% discount for purchasing multiple policies, Allstate offers substantial savings for senior auto insurance in Maryland.

- Low-Mileage Savings: Older drivers in Maryland can save money on car insurance with Allstate Milewise, which monitors miles to determine prices. Read more in our Allstate Milewise review.

Cons

- Higher Minimum Coverage Rates: At $105 a month for minimum coverage, Allstate’s rates are more than those of some of its competitors for auto insurance for seniors in Maryland.

- Limited Customization: While Allstate does come with a selection of discounts, its car insurance policies may lack the degree of customization for motor vehicle insurance that certain seniors within Maryland might be seeking.

#2 – State Farm: Best for Personalized Services

Pros

- Personalized Service: State Farm excels in providing tailored services to seniors in Maryland. Wondering about its level of customer service? Find out in our State Farm auto insurance review.

- Low Rates: State Farm offers competitive monthly rates at $56 for minimum coverage auto insurance for seniors in Maryland.

- Multi-Policy Discount: With a 20% discount for combining policies, Maryland senior drivers can also save more with State Farm car insurance.

Cons

- Lower A.M. Best Rating: State Farm boasts a B rating with A.M. Best, which could be a factor for those seeking the best-rated auto insurance providers for seniors in Maryland.

- Limited Discount Options: State Farm’s choice of discounts available for auto insurance for elderly drivers in Maryland may be limited compared to certain competitors.

#3 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits: The Hartford offers exclusive benefits for AARP members who need senior auto insurance in Maryland. Our review of The Hartford auto insurance provides more detail about what’s offered.

- A+ Rating: Hartford’s A+ rating from A.M. Best indicates strong financial stability and reliable auto insurance service for Maryland seniors.

- Competitive Rates: With minimum coverage rates at $68 per month, Hartford provides affordable auto insurance options for Maryland seniors.

Cons

- Lower Multi-Policy Discount: Hartford offers a 10% discount for bundling policies, which is lower than some other senior auto insurance providers in Maryland.

- Limited Coverage Options: The range of coverage options might be less extensive compared to other Maryland senior auto insurance companies, potentially limiting choices.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best Coverage Options

Pros

- Coverage Options: Progressive excels due to its varied coverage options, so it is a good choice for seniors looking for comprehensive auto insurance in Maryland.

- A+ Rating: With an A+ rating from A.M. Best, Progressive guarantees reliable service and financial stability for its auto insurance for seniors in Maryland.

- Affordable Rates: Offering minimum coverage at $63 per month, Progressive provides budget-friendly options for senior auto insurance in Maryland. Compares costs in our Progressive auto insurance review.

Cons

- Limited Personalization: Progressive’s policies may not be as personalized as some of its competitors for auto insurance for seniors in Maryland.

- Average Multi-Policy Discount: The 20% multi-policy discount is good but not the best offered on senior auto insurance in Maryland.

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual’s accident forgiveness feature is a significant plus, especially for senior drivers in Maryland.

- Financial Rating: The A rating of the insurer by A.M. Best represents reliability and excellent service for auto insurance in MD for seniors. Read more in our Liberty Mutual auto insurance review.

- Competitive Rates: With a minimum coverage of $95 per month, Liberty Mutual provides cost-effective auto insurance coverage for seniors in Maryland.

Cons

- Limited Discount Range: While accident forgiveness is a key feature, the overall range of available discounts is limited compared to other MD senior auto insurance companies.

- Higher Full Coverage Rates: Liberty Mutual’s rates for full coverage auto insurance for seniors in Maryland are $177 per month, higher than those of other providers.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible feature greatly benefits seniors, reducing out-of-pocket costs over time for auto insurance for seniors in Maryland.

- A+ Financial Rating: With an A+ rating from A.M. Best, Nationwide is a trusted choice for senior auto insurance in Maryland.

- Low Rates: Offering minimum coverage at $58 per month, Nationwide provides cost-effective auto insurance for seniors in Maryland. Compare quotes in our Nationwide auto insurance review.

Cons

- Average Multi-Policy Discount: The 20% multi-policy discount is helpful but not the most competitive for auto insurance for seniors in Maryland.

- Complex Policies: Some elderly people might feel the policy options with Nationwide are more distracting than those with other auto insurance companies for elderly people in Maryland.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Coverage

Pros

- Personalized Coverage: Farmers is also famous for its personalized coverage choices, which is a great reason to choose it for Maryland senior auto insurance.

- Financial Rating: With an A rating from A.M. Best, Farmers offers reliable service and economic stability for auto insurance for seniors in Maryland.

- Competitive Rates: With minimum coverage at $73 per month, Farmers provides affordable options for seniors auto insurance in Maryland. Our review of Farmers auto insurance offers more details.

Cons

- Lower Multi-Policy Discount: The 15% discount for policy bundles is less than others provide for senior auto insurance in Maryland.

- Limited Online Tools: Farmers may not have access to some of the high-end online tools and resources that other insurers offer for auto insurance for Maryland seniors.

#8 – American Family: Best for Safe Drivers

Pros

- Safe Driving Discounts: The American Family offers significant discounts for safe driving, making it ideal for senior drivers in Maryland.

- Financial Rating: With an A rating from A.M. Best, American Family is a reliable choice for auto insurance for seniors in Maryland.

- Affordable Rates: American Family provides cheap auto insurance for seniors in Maryland, starting at $61 monthly. Read our American Family auto insurance review to compare rates.

Cons:

- Lower Multi-Policy Discount: 15% multi-policy discount is good but not as good as some firms in the case of auto insurance coverage for seniors in Maryland.

- Limited Availability: American Family’s availability may be restricted in certain places relative to other automobile insurance providers to older adults in Maryland.

#9 – Travelers: Best for Hybrid Discounts

Pros

- Hybrid Discounts: Travelers offer significant discounts on hybrid vehicles, making it an excellent option for seniors’ auto insurance in Maryland.

- A++ Rating: With an A++ rating from A.M. Best, Travelers guarantees excellent financial stability and auto insurance service for Maryland seniors.

- Affordable Rates: With minimum coverage at $54 per month, Travelers provides budget-friendly options for seniors for auto insurance for seniors in Maryland.

Cons

- Lower Multi-Policy Discount: The 13% multi-policy discount is lower than other senior auto insurance providers in Maryland. Take a look at our Travelers auto insurance review to learn more.

- Limited Senior-Specific Discounts: While Travelers offers hybrid discounts, it might not have as many senior-specific discounts as some Maryland auto insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Breaking Down Senior Auto Insurance Rates in Maryland

Consider the monthly rates various providers offer for minimum and full-coverage auto insurance. The costs can vary significantly depending on the Maryland insurance company and your coverage level.

Maryland Senior Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$193 $361

$112 $209

$134 $252

$175 $326

$103 $191

$116 $217

$103 $192

$139 $139

$99 $185

For instance, State Farm emerges as one of the most affordable options for senior auto insurance in MD, offering minimum coverage at $56 per month and full coverage at $105. Travelers also provide competitive rates, with the lowest minimum coverage cost at $54 monthly and full coverage at $101 per month.

On the higher end, Allstate has some of the most expensive rates, but low-mileage drivers can save by signing up for Milewise pay-as-you-go auto insurance in Maryland.

Other providers, such as American Family and Auto-Owners, offer similar pricing, with minimum coverage rates at $61 and full coverage from $114 to $125. Companies like Liberty Mutual and The Hartford fall in the mid-range category, offering monthly coverage between $140 and $177.

Comparing these rates can help seniors find the most cost-effective plan that still offers the protection they need on the road.

Comprehensive Coverage Choices for Maryland Senior Drivers

When selecting auto insurance, seniors in Maryland should be aware of Maryland auto insurance requirements. Liability coverage is the foundation of any auto insurance policy and is required by law in Maryland. It includes both bodily injury liability auto insurance and property damage liability.

Personal injury protection is also required in Maryland. It pays for medical and lost income for you and your passengers, no matter who caused an accident. PIP may also pay for services such as childcare or housekeeping if you are unable to do these tasks because of injury.

Optional insurance listed below might be required if you have a new car or auto lease or want to cover out-of-pocket costs after an accident or claim.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who has little or no insurance. Medical bills and property damage are covered even when the other driver cannot afford to pay.

- Collision and Comprehensive Coverage: Collision automobile insurance coverage will pay for your car’s repair if it is damaged in a collision, no matter who is responsible. Comprehensive coverage covers non-collision-related damage, like theft, vandalism, or damage from a natural disaster.

- Roadside Assistance: Optional roadside assistance is provided by many insurance companies, and for seniors, this can be a lifesaver. It covers services such as towing, jump-starting the battery, changing a flat tire, and lockout service.

- Vanishing Deductible: A vanishing deductible is a benefit in which your deductible drops over time if you have a clean driving history. This is an option that can save you a lot of money if you’re a safe driver.

These coverage options allow Maryland senior drivers to tailor their auto insurance policies to meet their unique needs.

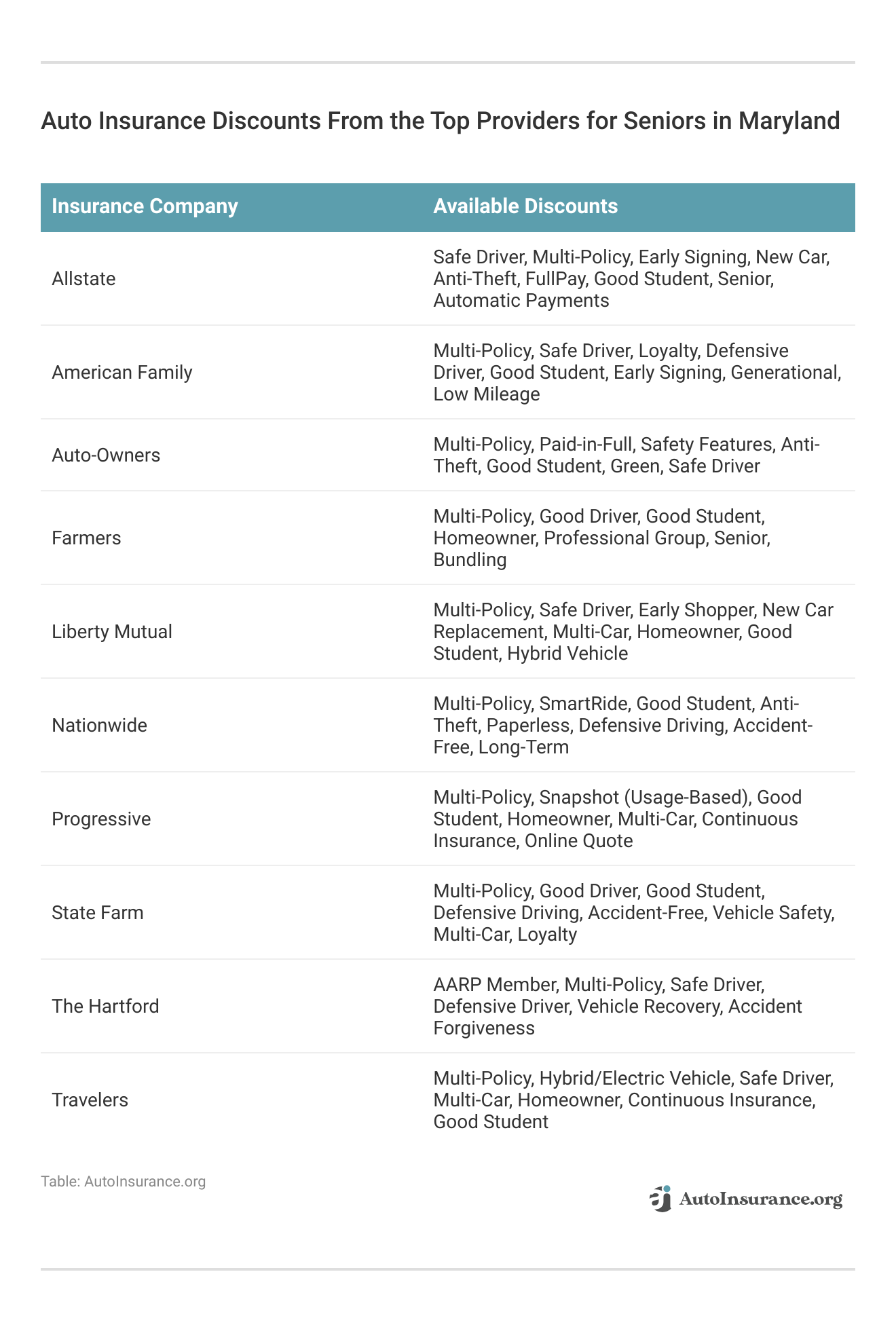

Top Senior Auto Insurance Discounts in Maryland

When searching for the best auto insurance, seniors in Maryland can take advantage of various discounts that help lower premiums. These discounts are specifically designed for seniors and can significantly reduce the overall cost of coverage.

By combining multiple discounts, seniors can maximize their savings and enjoy comprehensive coverage at an affordable rate.

- Senior Discount: Some insurance providers offer specific discounts for drivers over a certain age, usually starting at 55 or 65. These senior discounts are often automatic but sometimes require enrollment in a particular plan or program.

- Accident Forgiveness: While not a direct discount, accident forgiveness is a feature that some insurers offer to prevent your rates from increasing after your first at-fault accident. This can benefit seniors who want peace of mind without worrying about rate hikes.

- Pay-in-Full Discount: Many insurers offer discounts if you pay your annual premium in full rather than in monthly installments. Getting a pay-in-full auto insurance discount is ideal for seniors who prefer to manage their finances with one lump sum payment and enjoy the added savings.

- Telematics Discount: Monitoring your driving habits with a telematics device or app can also lead to discounts. Insurance companies offer lower rates to seniors who demonstrate safe driving patterns through these tracking programs.

These options provide additional opportunities to save on insurance premiums, making coverage more affordable without sacrificing quality.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get Senior Auto Insurance Quotes Online

Comparing cheap online auto insurance quotes is a straightforward process that can save you time and help you make informed decisions about your coverage. To start, visit the website of an auto insurance provider or a comparison tool. Most insurance companies offer a user-friendly interface where you can quickly input your details to receive a quote.

You must provide basic information such as your ZIP code, vehicle details, driving history, and personal information. This data helps insurers calculate a rate that reflects your risk profile. If you’re searching for what is the best auto insurance company for seniors, entering these details will help you compare policies designed specifically for senior drivers. Some sites offer instant quotes, while others may take a few minutes to process.

Compare quotes from multiple insurers to find the best rates and coverage. Adjusting options online helps tailor a policy to your needs and budget.Kalyn Johnson Insurance Claims Support & Sr. Adjuster

After learning how to get free online auto insurance quotes, carefully review the coverage options and costs for each one. Look beyond the premium to understand the policy’s liability limits, deductibles, and any additional benefits or discounts.

Real-Life Success: Case Studies of Seniors Finding the Best Auto Insurance in Maryland

These short case studies point out how Maryland seniors have effectively managed their automobile insurance choices to obtain the most comprehensive coverage at the lowest prices.

- Case Study #1—Finding Affordable Full Coverage With Allstate: Mary, a retired 68-year-old, decreased her monthly premium by 30% when she switched to Allstate, which gave her full coverage for $75 a month along with the bonus of accident forgiveness.

- Case Study #2 – Leveraging AARP Benefits With The Hartford: John, age 72 and an AARP member learned that The Hartford provided substantial discounts specific to his situation. Utilizing AARP benefits lowered his full coverage premium to $85 per month.

- Case Study #3—Personalized Service From State Farm: Susan, age 70 and a senior citizen, chose State Farm because of its tailored customer service and choice of flexible plans. Following an in-depth consultation, she was able to get a plan that cost her $20 less every month than with her previous company.

- Case Study #4 – Maximizing Discounts With Auto-Owners: Robert, age 74, combined his auto and home insurance with Auto-Owners and achieved a 15% discount on total insurance payments. This approach gave him solid coverage while keeping his monthly bill in line with his retirement budget.

- Case Study #5 – Securing Budget-Friendly Coverage With Travelers: Betty, a 69-year-old widow, selected Travelers for bare-bones coverage of only $54 per month. This change enabled her to commit more of her fixed income to other living costs without giving up necessary coverage.

By shopping around and leveraging available auto insurance discounts to request, Maryland seniors can find solid, affordable coverage. Whether by bundling, individualized service, or special perks, the proper selection can result in substantial savings and increased peace of mind.

Choosing the Best Auto Insurance for Maryland Seniors

Choosing the best car insurance for seniors in Maryland requires carefully comparing rates, coverage, and discounts. The top car insurance companies, such as Allstate, State Farm, and Hartford, provide solid coverage at competitive rates, making them excellent options.

Allstate stands out as a top choice for senior auto insurance in Maryland, offering comprehensive coverage, exceptional service, and tailored benefits.Daniel Walker Licensed Auto Insurance Agent

It’s important to shop around for quotes from several companies and select the best fit for personal requirements. Ultimately, careful research and educated choices result in big savings and peace of mind. Get the top auto insurance company in your area by putting your ZIP code into our free quote tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Who has the best Maryland auto insurance for senior citizens?

Allstate offers the best auto insurance for senior citizens in Maryland, with competitive rates starting at $54 per month. Whether looking for auto insurance for seniors near you or exploring AK personal lines for tailored coverage, Allstate provides excellent protection with top-notch service.

Which Maryland insurance companies are the best options for senior drivers?

Allstate is notable for its top-notch service and budget-friendly monthly premiums beginning at $54. State Farm and The Hartford also rank highly, offering dependable coverage and high customer satisfaction. These insurers present seniors with affordable choices and strong protection. Enter your ZIP code below to find out if you can get a better deal.

Which category of senior auto insurance is best?

Fully comprehensive auto insurance gives you the highest level of coverage. This could be the right policy if you want peace of mind or have a new or expensive car.

Which is the most expensive form of auto insurance for seniors?

Comprehensive insurance is usually the most expensive option but provides extensive coverage, including accidental damage protection, regardless of fault. For those looking for the best senior car insurance, this coverage can offer valuable peace of mind, while shopping around can help find cheap insurance for seniors without sacrificing essential benefits.

What is the cheapest Maryland auto insurance for seniors?

Travelers offer the best auto insurance for senior drivers. It provides the cheapest full-coverage Maryland insurance for seniors at $361 per month, with a minimum monthly coverage of $54. According to the reviews of the best auto insurance for seniors, Travelers is recognized for its affordability and dependable coverage.

Is 55 or 65 a senior citizen for auto insurance?

For most senior benefits, you must be 65, but some auto insurance companies will offer senior car insurance discounts when drivers turn 55 or 60. Compare the best Maryland auto insurance companies.

How much is auto insurance in Maryland?

The average cost of minimum auto insurance in Maryland is around $75 monthly, but senior auto insurance rates start as low as $54 per month with discounts and safe driving habits.

What age is Maryland auto insurance most expensive?

Maryland car insurance costs more for young drivers under 21, but seniors can often secure better rates by looking for senior car insurance near them or requesting a quote tailored to their needs.

Why is auto insurance in Maryland so expensive?

Car insurance in Maryland is expensive because minimum liability requirements are high, and personal injury protection and uninsured motorist coverage are required. In Maryland, you can expect to pay approximately $417 per month for full coverage car insurance or $176 per month for minimum coverage.

Which Maryland insurance company has the most complaints?

Allstate and Liberty Mutual have twice as many senior driver auto insurance complaints on this list.

What is the cheapest car insurance for seniors in Maryland?

GEICO and USAA typically offer the most affordable car insurance for seniors in Maryland, with discounts available for safe driving and bundling policies.

At what age is car insurance the cheapest?

Car insurance is typically cheapest for drivers between 50 and 65 before rates increase again for senior drivers.

To secure the best auto insurance for seniors in Maryland, enter your ZIP code and compare full coverage rates tailored to your needs.

Which company provides the best car insurance in Maryland?

State Farm and Erie Insurance are highly rated in Maryland for their affordable rates, strong customer service, and comprehensive coverage options.

What is the average cost of auto insurance in Maryland?

The average cost of auto insurance in Maryland is around $1,600 per year for full coverage and about $800 per year for minimum coverage.

Which insurance plan is most suitable for senior citizens?

Hartford’s AARP auto insurance plan is designed for seniors, offering tailored discounts and benefits as part of its commitment to providing auto insurance for different types of drivers, including retirees seeking specialized coverage.

What is the highest-rated insurance for seniors?

USAA (for military members and their families) and The Hartford (for AARP members) are among the highest-rated auto insurance providers for seniors.

Why is car insurance in Maryland so expensive?

Maryland has high insurance costs due to dense traffic, high accident rates, and state insurance requirements.

Is Allstate a reliable insurance company?

Allstate is a reliable insurer with strong financial stability, good customer service, and various coverage options. It is a good choice for those looking for cheap auto insurance for high-risk drivers in Maryland.

Is Progressive a good insurance provider?

Progressive is a well-rated insurance provider known for competitive pricing, online tools, and accident forgiveness programs.

Which car insurance company is the most trusted?

USAA is one of the most trusted car insurance companies due to its high customer satisfaction, financial strength, and service quality.

Is Geico better than Progressive?

Geico generally offers lower rates, making it a strong option for low-income drivers looking for the best auto insurance. At the same time, Progressive provides more customization options and accident forgiveness benefits. The best choice depends on individual needs.

What is the minimum required car insurance in Maryland?

Maryland requires at least 30/60/15 coverage: $30,000 per person, $60,000 per accident for bodily injury, and $15,000 for property damage.

What is the cheapest full-coverage car insurance in Maryland?

Geico and Erie Insurance offer some of Maryland’s most affordable full-coverage auto insurance options.

Does Maryland consider credit scores when determining car insurance rates?

Yes, insurers in Maryland use credit scores as a factor when determining car insurance premiums, which can also affect the rates for those looking for the best auto insurance after a DUI in Maryland.

Does Progressive offer coverage in Maryland?

Yes, Progressive provides auto insurance coverage in Maryland.

Which company provides the most affordable insurance for seniors?

Geico and The Hartford (for AARP members) offer some of the lowest rates for senior drivers.

What is the best Medicare insurance option for seniors?

Medicare Advantage (Part C) and Medigap supplemental plans from providers like Aetna, UnitedHealthcare, and Humana are popular for seniors.

Find the best auto insurance for seniors in Maryland by comparing full coverage rates—enter your ZIP code to get started.

What type of insurance is most essential for retirees?

Health insurance (Medicare or supplemental plans) and auto insurance with senior discounts are essential for retirees.

Which insurance provider is best for senior citizens?

The Hartford (AARP), USAA, and Geico are among the best insurance providers for seniors.

Who offers the best auto insurance for seniors?

Allstate is often considered the best auto insurance for seniors due to its competitive rates, senior discounts, and benefits for low-mileage drivers. It is also a top choice for those looking for the best low-mileage auto insurance discounts.

What is the average price of car insurance in Maryland?

Maryland’s average annual car insurance cost is around $1,600 for full coverage and $800 for minimum coverage.

Who is Allstate’s most significant competitor?

Geico and Progressive are Allstate’s biggest competitors.

At what age is a person considered a senior citizen?

A person is typically considered a senior citizen at age 65, though some insurance companies offer senior discounts starting at age 55. Seniors who need high-risk coverage may also find options for the cheapest SR-22 insurance in Maryland to meet state requirements.

Which insurance company offers better rates than Allstate?

Geico and Erie Insurance often provide lower rates than Allstate, depending on the driver’s profile and coverage needs.

Who are the top five insurance companies?

The top five auto insurance companies in the U.S. based on market share are State Farm, Geico, Progressive, Allstate, and USAA.

Is it illegal to drive without car insurance in Maryland?

Yes, driving without insurance in Maryland is illegal and can result in fines, license suspension, and other penalties. Understanding how to buy a car without auto insurance is essential, as most dealerships and lenders require proof of coverage before finalizing the purchase.

Which insurance provider is more affordable than Progressive?

Geico and USAA (for military families) generally offer lower rates than Progressive.

Does Erie Insurance operate in Maryland?

Yes, Erie Insurance offers auto insurance coverage in Maryland.

What does the ‘golden rule’ at Progressive mean?

Progressive’s “golden rule” refers to its commitment to customer service, transparency, and fair treatment of policyholders.

Enter your ZIP code to start comparing full coverage rates for the best auto insurance for seniors in Maryland.

Is Safeco a good insurance company?

Safeco is a reputable insurance provider known for competitive pricing, strong financial stability, and customizable coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.