Best Auto Insurance for Seniors in New York (Top 10 Companies for 2025)

Top providers like The Hartford, USAA, and Allstate offer the best auto insurance for seniors in New York. USAA has the cheapest senior car insurance rates at $43/month. The Hartford provides extensive senior programs and benefits, while Allstate offers customizable coverage for seniors' needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

765 reviews

765 reviewsCompany Facts

Full Coverage for Seniors in New York

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Seniors in New York

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Seniors in New York

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsTop providers like The Hartford, USAA, and Allstate offer the best auto insurance for seniors in New York. The Hartford stands out with its exclusive senior car insurance discounts.

These companies excel in senior programs, including membership and affinity benefits with comprehensive coverage options that ensure the best protection for senior drivers in New York.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in New York

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A+ | Senior Programs | The Hartford |

| #2 | 10% | A++ | Member Benefits | USAA | |

| #3 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #4 | 20% | A | Accident Forgiveness | Liberty Mutual |

| #5 | 17% | B | Personalized Service | State Farm | |

| #6 | 20% | A+ | Vanishing Deductible | Nationwide |

| #7 | 12% | A+ | Discount Variety | Progressive | |

| #8 | 13% | A++ | Mature Driver | Travelers | |

| #9 | 29% | A | Customer Support | American Family | |

| #10 | 20% | A | Safe Driver | Farmers |

Compare their offerings to find the right fit for your needs. Keep reading to secure comprehensive coverage and the most competitive rates on the best car insurance for seniors. This guide provides a detailed look at the monthly auto insurance rates for seniors in New York, highlighting companies with savings programs for senior drivers.

Finding cheap auto insurance companies in New York can be difficult, but you don’t have to do it alone. Enter your ZIP code to find the most affordable quotes in your area.

- The Hartford offers tailored coverage and competitive rates at $85 a month

- USAA has the cheapest senior auto insurance rates for $43 a month

- Compare quotes online to find the best auto insurance for elderly in New York

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – The Hartford: Top Overall Pick

Pros

- Senior-Specific Discounts: Offers senior auto insurance discounts in New York, which can help reduce overall premiums. Learn more in our The Hartford auto insurance review.

- Strong Reputation: Renowned for its outstanding customer service and strong financial stability, providing seniors in New York with peace of mind.

- Easy Claims Process: Seniors in New York benefit from a streamlined and straightforward claims process, making it easier to handle any issues that arise.

Cons

- Age Restrictions on Discounts: Certain discounts or programs for car insurance for older drivers in New York may have age restrictions that could limit eligibility for some seniors.

- Limited Availability: The Hartford’s seniors auto insurance programs might not be accessible in every region of New York, which could restrict options for some seniors in New York.

#2 – USAA: Best for Member Benefits

Pros

- Exclusive Benefits for Military Families: USAA provides exceptional benefits and discounts for seniors in New York who are part of military families or veterans.

- Competitive Rates: Provides some of the most competitive rates available, which can be especially beneficial for seniors in New York who are looking to reduce their premiums.

- Flexible Payment Plans: Provides flexible payment options designed to assist seniors in New York with managing their insurance expenses more efficiently. Read our USAA auto insurance review for a full list.

Cons

- Online Tools Limitations: Seniors in New York may find USAA’s online tools and website less user-friendly than those of other providers, which could disadvantage those less comfortable with technology.

- Eligibility Restrictions: USAA’s services are only available to military families and veterans, which means many seniors in New York might not be eligible.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Allstate offers extensive coverage that includes liability, collision, and comprehensive insurance, ensuring robust protection for seniors in New York.

- Flexible Coverage Plans: Allstate offers senior car insurance plans in New York with customizable coverage options. Learn more in our Allstate auto insurance review.

- Strong Customer Service: Allstate is recognized for its dependable customer support, which is essential for seniors in New York who might require help with their policies or claims.

Cons

- Potential for Complex Policies: The variety of coverage options and add-ons can be overwhelming, making it difficult for seniors in New York to select the most appropriate policy.

- Inconsistent Discounts: Not all elderlies in New York might be eligible for every senior citizen auto insurance discounts offered, resulting in differences in rates and benefits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Accident Forgiveness

Pros

- No Rate Increase for First Accident: Liberty Mutual’s accident forgiveness prevents rate increases after your first accident, benefiting seniors in New York who may have occasional minor accidents.

- Peace of Mind: Seniors in New York can drive with peace of mind, knowing that their insurance rates won’t increase after their first accident, which helps to lessen financial stress.

- Encourages Safe Driving: Knowing their first accident won’t affect premiums can encourage seniors in New York to drive more carefully, as explained in our Liberty Mutual auto insurance review.

Cons

- Eligibility Requirements: To be eligible for accident forgiveness, seniors in New York might need to fulfill certain requirements or maintain a spotless driving record.

- Limited Coverage Details: Accident forgiveness might not include senior citizen auto insurance coverage for every type of accident or damage.

#5 – State Farm: Best for Personalized Service

Pros

- Dedicated Agent: Seniors in New York gain from having a dedicated agent who provides tailored assistance and support. Read more in our review of State Farm auto insurance.

- Flexible Options: State Farm’s tailored approach enables seniors in New York to adjust their policies flexibly as their needs evolve over time.

- Community Engagement: State Farm’s local agents are frequently engaged in the community, providing reassurance for seniors in New York who are looking for a reliable insurance partner.

Cons

- Varied Service Quality: The quality of personalized service for seniors in New York can differ based on the individual agent and location, potentially impacting their overall experience.

- Potentially Higher Costs: Personalized service for seniors in New York may be more expensive than more standardized insurance options.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Reduced Deductibles Over Time: Nationwide’s vanishing deductible program lowers your deductible amount each year you drive without filing a claim. Read our Nationwide auto insurance review.

- Lower Out-of-Pocket Costs: As deductibles decrease, seniors in New York save money on out-of-pocket expenses when making a claim, which makes insurance more affordable in the long run.

- Financial Stability: Lowering deductibles can assist seniors in New York in managing their finances more effectively by decreasing the potential costs linked to accidents or claims.

Cons

- Initial Deductible Costs: Although deductibles decrease over time, seniors in New York might encounter higher initial deductible costs before any reductions are applied.

- Program Limitations: The vanishing deductible may not be available in all states or for all types of coverage, potentially limiting its benefits for some seniors in New York.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Discount Variety

Pros

- Wide Range of Discounts: Progressive offers discounts for safe driving, multi-policy bundling, and defensive driving courses, helping seniors in New York lower their insurance costs.

- Flexibility: Seniors in New York can customize their policy with discounts based on their needs and driving habits to save more. Read our Progressive auto insurance review to learn more.

- Easy Comparison Tools: Progressive’s online tools make it easy for seniors in New York to compare various coverage options and discounts, assisting them in finding the most affordable policy.

Cons

- Limited Personal Interaction: Seniors in New York who prefer face-to-face interactions may find Progressive’s online management less appealing than traditional customer service.

- Potential Rate Increases: While discounts can reduce premiums, rates for seniors in New York might rise if their driving record changes or if they no longer qualify for specific discounts.

#8 – Travelers: Best for Mature Driver

Pros

- Mature Drivers Discounts: Travelers provides discounts tailored for mature drivers, which can reduce insurance premiums for seniors in New York. Learn more in our Travelers auto insurance review.

- Reputation for Reliability: Travelers has a well-established reputation for dependability and customer satisfaction, providing seniors in NY with a reassuring sense of stability in their insurance coverage.

- Roadside Assistance: Various plans include roadside assistance, which offers additional reassurance for seniors in New York who might encounter vehicle problems while traveling.

Cons

- Limited Senior-Specific Programs: While Travelers provides discounts for mature drivers, it might not have as many senior-focused programs or benefits as other companies, particularly for seniors in NY.

- Complex Policy Options: The extensive variety of coverage options can be overwhelming for seniors in New York who prefer simple policies with fewer variables.

#9 – American Family: Best for Customer Support

Pros

- Exceptional Customer Service: American Family is recognized for its exceptional customer support, which is especially advantageous for seniors in New York who might require additional help.

- Educational Resources: The company offers resources and assistance to help seniors in New York better understand their coverage. Find out more in our American Family auto insurance review.

- Accessible Claims Process: The American Family’s efficient claims process simplifies filing and managing claims for seniors in New York, helping to reduce stress following an accident.

Cons

- Limited Availability in Some Areas: Their services might not be accessible in every region, which could disadvantage seniors in New York who live in less populated areas.

- Potentially Higher Costs: American Family insurance may be more expensive for seniors in New York compared to other options, depending on their driving habits and location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Safe Drivers

Pros

- Discounts for Safe Driving: Farmers offers significant discounts to seniors in NY with a clean driving record, helping lower their premiums. Learn more about Farmers’ insurance discounts.

- Senior-Friendly Customer Service: Renowned for its attentive and supportive customer service, which can be particularly beneficial for seniors in New York who might require additional help.

- Flexible Payment Plans: Seniors in New York can benefit from flexible payment options that can help them manage insurance premiums more easily on a fixed income.

Cons

- Higher Rates for Certain Vehicles: Seniors in New York who drive newer or high-value vehicles may have higher premiums with Farmers, even if they have a spotless driving record.

- Complexity of Policies: The variety of coverage options and discounts can be daunting for seniors in New York.

Auto Insurance Rates for Senior Citizens in New York

As New York seniors navigate retirement, securing affordable auto insurance becomes increasingly important. With various providers offering a range of coverage levels and monthly rates, it’s essential to compare options from multiple companies to find the best senior car insurance that is fit for your needs.

By examining these rates, you can make an informed decision and ensure that you get the protection you need without breaking the bank. You can also compare auto insurance rates by state.

New York Seniors Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $144 | |

| $70 | $134 | |

| $84 | $162 | |

| $102 | $196 |

| $84 | $160 |

| $49 | $94 | |

| $70 | $134 | |

| $85 | $160 |

| $89 | $171 | |

| $43 | $83 |

For New York seniors, monthly auto insurance rates vary by provider and coverage level. Minimum coverage rates range from $43 with USAA to $102 with Liberty Mutual.

Full coverage options range from $83 with USAA to $196 with Liberty Mutual. Notable providers include Progressive, which offers the lowest minimum coverage rate at $49, and Travelers, which offers competitive full coverage at $171.

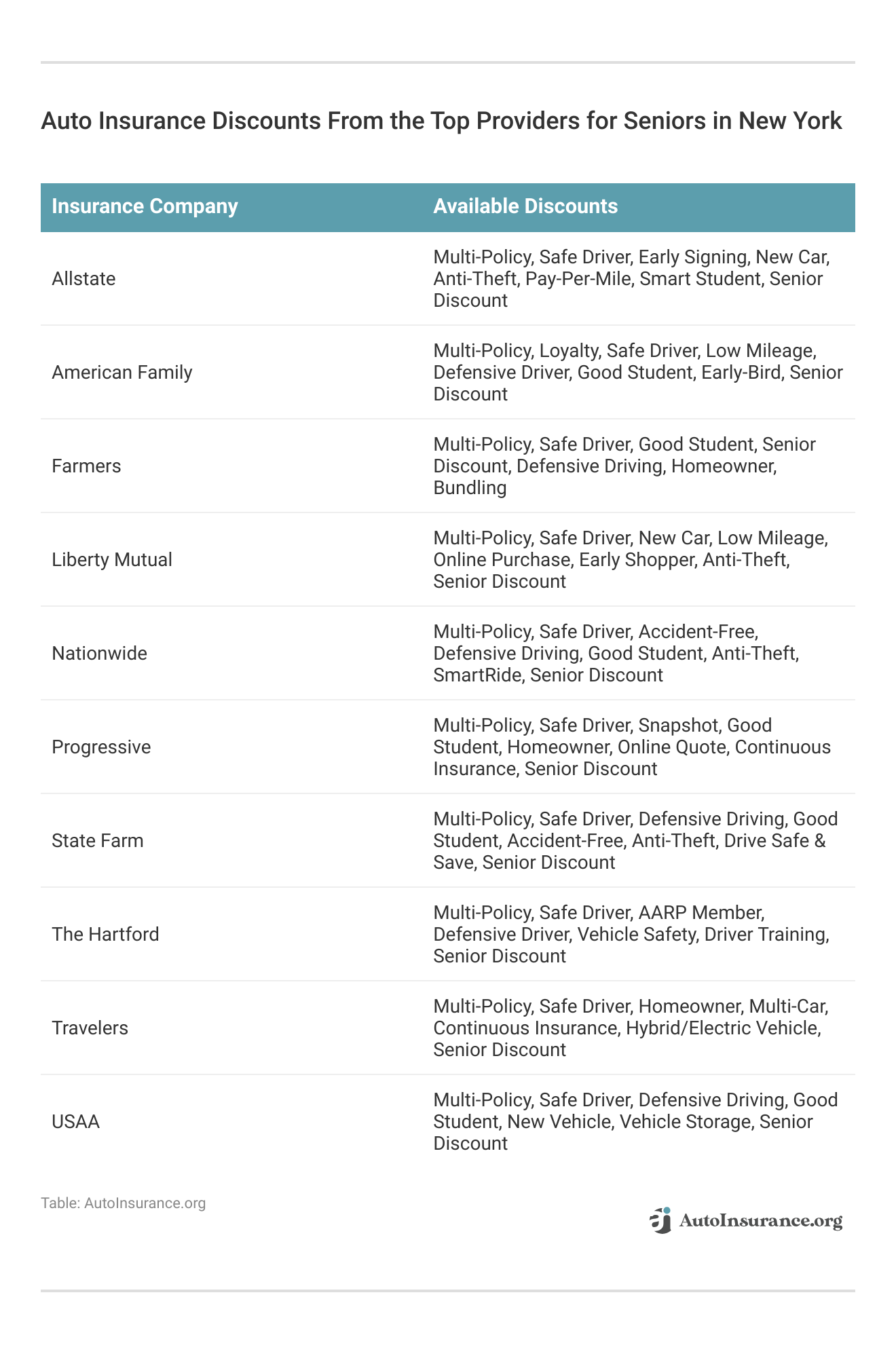

Auto Insurance Discounts for Seniors in New York

Car insurance discounts for seniors include multi-policy, safe driver, and defensive driving. Discover top auto insurance discounts for New York seniors:

And who has the cheapest car insurance for seniors? The Hartford and Progressive have the best discount variety and savings tailored for seniors, but you should compare auto insurance discounts from multiple companies to find the best rates to suit your needs.

Seniors can lower insurance costs with discounts for safe driving, low mileage, and vehicle safety features.Jeff Root Licensed Insurance Agent

So, what is the cheapest car insurance for senior citizens? Choosing the right auto insurance is essential for New York seniors to balance cost and coverage and get cheap car insurance for seniors. Compare rates and coverage from top providers to find a policy that fits your budget and needs. Look for discounts to get the best deal and ensure peace of mind on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Impacting Auto Insurance Costs for Seniors in New York

Navigating auto insurance costs for seniors in New York involves considering various factors such as driving record, coverage type, vehicle specifics, location, and annual mileage. Each of these elements plays a significant role in determining premiums, affecting both affordability and coverage adequacy.

- Driving Record: A clean driving history generally results in lower premiums, as insurers view drivers with a history of safe driving as lower risk and less likely to file claims or be involved in accidents.

- Vehicle Type: The make, model, age, and safety features play crucial roles in determining insurance rates. High-value and -performance cars cost more to insure due to higher repair or replacement costs.

- Location: Living in a high-risk ZIP code can lead to higher auto insurance premiums. Traffic congestion, vehicle theft, vandalism, repair costs, and medical expenses in your area all impact rates.

- Annual Mileage: Driving fewer miles typically results in lower insurance costs. Learn how annual mileage affects your auto insurance rates.

The type of auto insurance you buy also impacts senior insurance rates. Minimum coverage is typically the least expensive option for auto insurance. It meets the basic legal requirements set by the state and is designed to provide the minimum protection necessary to comply with legal mandates.

Navigating auto insurance costs can be a complex process, especially for seniors in New York who may face unique challenges and opportunities when it comes to their premiums. Understanding these key factors can help seniors make informed decisions and potentially lower their insurance expenses.

By staying informed and possibly exploring different insurance options, seniors can optimize their insurance plans to suit their driving habits and budgetary constraints effectively.

Essential Auto Insurance Guide for Seniors in New York

Seniors in New York must meet state minimums for auto insurance, including liability coverage for bodily injury and property damage, along with personal injury protection and uninsured motorist coverage. Additional options like collision, comprehensive, and roadside assistance are recommended for comprehensive protection.

What is the best insurance for senior citizens? To find the best coverage, seniors should compare quotes online, consider their specific needs, and regularly review and update their policies as circumstances change.

Top insurance providers for seniors in New York include The Hartford, USAA, Allstate, Liberty Mutual, and State Farm, known for competitive rates and tailored senior programs.

Rates are affected by driving record, vehicle type, annual mileage, location, and health. Seniors can often qualify for discounts such as senior discounts, safe driver incentives, multi-policy savings, and defensive driving course reductions.

How to Save on Auto Insurance for Seniors in New York

Navigating auto insurance for elderly drivers in New York comes with its own set of challenges and opportunities for savings. By employing strategic approaches, seniors can effectively manage their insurance costs while ensuring they have adequate coverage. Here are some valuable tips to help you save on auto insurance in New York.

- Leverage Senior Discounts: Ak about any senior discounts that may apply. These discounts can significantly reduce your premium, making it crucial to inquire and take full advantage of such offers.

- Bundle Policies: Senior drivers can save money by bundling insurance policies, such as auto and life insurance.

- Defensive Driving Course: Completing a defensive driving course can be a smart move for seniors looking to lower their insurance premiums. These courses teach advanced safety tips to help prevent accidents.

- Review and Adjust Coverage: Regularly reviewing your auto insurance policy is essential to ensure it continues to meet your needs. Consider adjusting your coverage based on your current driving habits and vehicle age.

One of the most effective ways to save on auto insurance is to compare quotes from various insurance providers.

Frequently Asked Questions

What is the best car insurance for seniors in New York?

What are the best auto insurance companies in New York? The best car insurance for seniors in NY often depends on individual needs, but companies like The Hartford, USAA, and Allstate are highly recommended. They offer tailored programs and discounts for seniors, such as accident forgiveness and senior discounts, providing comprehensive coverage and competitive rates.

What is the cheapest senior citizen insurance?

The cheapest car insurance for senior citizens typically comes from companies like USAA and Progressive. USAA offers competitive rates for military families, while Progressive offers various discounts that can help lower costs. It’s crucial to compare quotes from multiple providers to find the most affordable car insurance for seniors.

Finding the cheapest car insurance for seniors is as easy as entering your ZIP code into our free quote comparison tool.

Who has the lowest auto insurance rates in New York?

In New York, insurance companies like USAA and Progressive are known for offering low-cost auto insurance for seniors. However, rates can vary widely based on factors like driving history, location, and coverage level.

It’s best to use a comparison tool to get personalized quotes for the cheapest auto insurance for seniors. Find out where to compare auto insurance rates.

Which insurance plan is best for senior citizens?

The best insurance plan for senior citizens depends on individual needs. For health insurance, Medicare and Medicare Advantage plans are popular choices. For life insurance, whole life or guaranteed issue life insurance may be beneficial. Auto insurance providers like Geico, AARP/The Hartford, and State Farm offer senior-friendly policies with discounts.

What is the best type of insurance for seniors?

Seniors may benefit from health insurance (Medicare, Medigap, Medicare Advantage), life insurance (term or whole life), long-term care insurance, and auto insurance with senior discounts.

At what age is car insurance cheapest?

Auto insurance rates tend to be the cheapest for drivers in their 50s and 60s. The best auto insurance companies for seniors often view this age group as having a lower risk due to their experience and typically safer driving habits. Rates may increase again for drivers over 70, but discounts for auto insurance for senior citizens and specialized senior programs can help mitigate costs.

What age is considered a senior citizen?

What is the age of a senior citizen in NY? A senior citizen is typically anyone aged 60 to 65 and older, though this varies by country and organization.

What is the basic auto insurance in NYC?

What is the minimum car insurance required in New York? In New York, the minimum auto insurance coverage required includes $25,000 per person and $50,000 per accident for bodily injury liability, $10,000 per accident for property damage liability, $50,000 per person for personal injury protection (PIP), and $25,000 per person and $50,000 per accident for uninsured motorist coverage.

How can I lower my car insurance in NYC?

To lower car insurance in NYC, consider:

- Taking a defensive driving course

- Bundling policies (home and auto)

- Raising your deductible

- Asking about senior or low-mileage discounts

- Comparing quotes from different insurers

Find out by entering your ZIP code into our free quote comparison tool.

Which insurance company has the most complaints?

The insurance company with the most complaints varies by year and state. Generally, customer dissatisfaction reports are available from the National Association of Insurance Commissioners (NAIC) and state insurance departments. Common complaints involve claim denials and delays.

Which type of insurance is most important for retired persons?

For retired persons, the most important insurance types include:

- Health Insurance (Medicare, Medigap)

- Long-Term Care Insurance (for nursing home or in-home care costs)

- Auto Insurance (with senior discounts)

- Life Insurance (for estate planning or funeral expenses)

What is the senior citizen plan?

“Senior citizen plan” typically refers to insurance plans tailored for older adults, including Medicare, Medigap, life insurance, and auto insurance discounts. Some insurers offer specialized senior coverage with added benefits.

Is New York car insurance high?

Yes, New York has some of the highest car insurance rates in the U.S. due to dense traffic, high accident rates, and no-fault insurance laws. NYC rates are particularly expensive. You may check the details for cheap no-fault auto insurance here.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.