Best Auto Insurance for Seniors in North Carolina (Top 10 Companies for 2025)

State Farm, Farmers, and Nationwide are the best auto insurance companies for seniors in North Carolina. With minimum coverage rates as low as $13 per month, these companies also offer car insurance discounts for seniors, such as savings for low mileage and safe driving habits.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Seniors in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Seniors in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Seniors in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, Farmers, and Nationwide offer the best auto insurance for seniors in North Carolina. Senior drivers can save 30% with the State Farm usage-based insurance program (UBI).

The top ten companies with the best auto insurance for seniors in North Carolina offer unique benefits to customers.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in North Carolina

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | B | Reliable Coverage | State Farm | |

| #2 | 30% | A | Comprehensive Plans | Farmers | |

| #3 | 40% | A+ | Flexible Options | Nationwide |

| #4 | 30% | A+ | Competitive Rates | Progressive | |

| #5 | 30% | A+ | Strong Reputation | Allstate | |

| #6 | 30% | A | Extensive Discounts | Liberty Mutual |

| #7 | 25% | A++ | Online Management | Geico | |

| #8 | 30% | A++ | Wide Network | Travelers | |

| #9 | 30% | A | Excellent Service | American Family | |

| #10 | 30% | A++ | Military Benefits | USAA |

To learn more about each North Carolina company for seniors, read on. We go over each company’s pros and cons, as well as ways to save on your coverage.

You can also jump right into finding senior NC auto insurance quotes by entering your ZIP in our free quote tool.

- State Farm has the best car insurance for seniors in North Carolina

- Farmers and Nationwide are the next best NC companies for seniors

- Senior auto insurance is the most affordable in North Carolina

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Reliable Coverage: State Farm has a reputation as a dependable coverage company, so seniors in North Carolina can feel safe in their coverage choices.

- Discount Options: Seniors in North Carolina can apply for good driver discounts, bundling discounts, and more.

- Local Agents: North Carolina agents offer personalized assistance to senior drivers. Read our State Farm auto insurance review for more customer service details.

Cons

- Financial Rating: State Farm’s “B” rating from A.M. Best makes it the lowest-ranked NC senior auto insurance company on our list.

- Online Management: Local NC agents handle most tasks, so seniors will find online management lacking in some areas.

#2 – Farmers: Best for Comprehensive Plans

Pros

- Comprehensive Plans: Senior drivers in North Carolina can easily get comprehensive coverage plans from Farmers.

- Discount Options: North Carolina senior drivers can save with over twenty discounts available at Farmers. Visit our Farmers auto insurance review to learn more.

- Customer Service: Farmers have fewer NAIC complaints than expected for a North Carolina senior car insurance company of its size.

Cons

- Accident Forgiveness Costs Extra: Senior drivers in North Carolina must pay an extra fee to qualify for accident forgiveness.

- Higher Rates: Farmers’ rates are in the middle of the pack of best auto insurance companies for senior drivers in North Carolina, so it won’t be the cheapest choice.

#3 – Nationwide Best for Flexible Coverage

Pros

- Flexible Options: Senior drivers in North Carolina can save up to 40% with flexible usage-based coverage. Learn more by visiting our Nationwide auto insurance review.

- Discount Opportunities: Senior drivers in North Carolina can save with good driver discounts and more.

- Online Management: Senior drivers can manage most North Carolina policy changes and claims online.

Cons

- Higher Rates: Nationwide’s senior auto insurance rates are higher than most of the other North Carolina companies on our list.

- Claim Reviews: Nationwide has some negative customer reviews regarding its claims, so seniors in North Carolina may run into issues.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive has the cheapest rates on average for senior drivers in North Carolina.

- Snapshot Program: Snapshot is available for free in North Carolina and rewards safe senior drivers with discounted rates.

- Coverage Options: Progressive offers multiple extras for senior drivers in North Carolina. Explore our Progressive auto insurance review to learn more.

Cons

- Snapshot Rate Increases: Senior drivers in North Carolina may have increased rates if they earn bad driving scores in the program.

- Customer Service: Other senior driver companies in North Carolina, such as State Farm or USAA, have better service ratings.

#5 – Allstate: Best for Strong Reputation

Pros

- Strong Reputation: Allstate has a strong reputation as one of the leading companies, making it a solid pick for North Carolina senior drivers.

- Roadside Assistance: North Carolina senior drivers can choose from three different roadside assistance plans at Allstate.

- Discount Options: Senior drivers can save on North Carolina insurance with several of Allstate’s discounts. Take a look at our Allstate auto insurance review to learn more.

Cons

- Higher Rates: Allstate is the most expensive North Carolina company on our list for senior car insurance.

- Customer Complaints: Senior drivers in North Carolina may find service lacking, as Allstate has a higher number of customer complaints.

#6 – Liberty Mutual: Best for Extensive Discounts

Pros

- Extensive Discounts: Senior drivers in North Carolina can save with the company’s extensive discount list, which you find in our Liberty Mutual auto insurance review.

- Coverage Options: Liberty Mutual offers comprehensive coverage options to senior drivers in North Carolina.

- Accident Forgiveness: Eligible senior drivers can enroll in the company’s accident forgiveness program to be forgiven for an accident in North Carolina.

Cons

- Claims Satisfaction: Because Liberty Mutual has lower ratings, senior drivers in North Carolina may not be completely satisfied with their claims services.

- Customer Ratings: Liberty Mutual’s customer service may not be as great as other North Carolina companies for seniors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Online Management

Pros

- Online Convenience: Geico is among the best North Carolina senior driver companies for online convenience, with a highly-rated app and user-friendly website.

- Discount Options: Senior drivers in North Carolina can qualify for several discounts at Geico.

- Affordable Premiums: Geico’s rates for senior drivers are some of the cheapest in North Carolina. Check our Geico auto insurance review to learn more about its affordability.

Cons

- No Local Agents: Geico doesn’t have local NC insurance agents, so senior drivers won’t be able to get in-person help.

- Coverage Options: Geico doesn’t offer as many add-on coverage options for senior drivers in North Carolina.

#8 – Travelers: Best for Wide Network

Pros

- Wide Network: Travelers has a wide network of repair shops and more for North Carolina senior drivers.

- Coverage Options: Travelers offer more add-on coverages than usual to senior drivers in North Carolina. Discover more in our Travelers auto insurance review.

- Bundling Discount: Travelers sells more than just auto insurance to North Carolina seniors.

Cons

- Higher Rates: Travelers is the third most expensive company on our list for North Carolina senior auto insurance.

- Customer Satisfaction: Travelers isn’t the highest-rated for customer satisfaction on our list of North Carolina senior companies.

#9 – American Family: Best for Excellent Service

Pros

- Excellent Service: American Family has local agents to help provide services to North Carolina seniors. Learn more in this American Family auto insurance review.

- Coverage Options: Senior drivers in North Carolina can add extras like gap or roadside assistance to their policies.

- Bundling Discount: Senior drivers can purchase more than North Carolina car insurance policies from the company.

Cons

- Claims Processing: Based on ratings for the company’s overall claims satisfaction, North Carolina senior drivers’ claims may not be processed quickly.

- Higher Rates: American Family’s rates aren’t the most expensive, but it isn’t the cheapest company for North Carolina senior drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers the best military and veteran benefits for North Carolina senior drivers. Our USAA auto insurance review covers more details.

- Affordable Rates: USAA is one of the cheapest companies for North Carolina senior drivers. It offers USAA auto insurance discounts for seniors, such as savings for safe driving and military service.

- Roadside Assistance: Senior drivers in North Carolina can purchase roadside assistance, which is useful for older cars that are more likely to break down.

Cons

- No Local Agents: USAA provides NC auto insurance customer service to seniors virtually.

- Eligibility Restricted: USAA sells to North Carolina senior drivers who are military or veterans.

North Carolina Senior Auto Insurance Rates by Coverage Type

Senior drivers will have a few different options for policies at the top auto insurance companies in North Carolina.

North Carolina Senior Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $70 | $166 | |

| $34 | $80 | |

| $41 | $97 | |

| $29 | $67 | |

| $35 | $81 |

| $46 | $108 |

| $13 | $31 | |

| $32 | $75 | |

| $43 | $98 | |

| $18 | $43 |

A minimum coverage policy meets the North Carolina minimum auto insurance requirements, while a full coverage policy includes collision and comprehensive insurance in addition to the NC minimums.

The state of North Carolina does require it, but full coverage provides the best protection. Most lenders will require it, so you’ll need it if you’re leasing or paying off your vehicle.

How Senior Drivers Can Save on North Carolina Auto Insurance

There are several ways senior drivers can lower North Carolina auto insurance rates. One simple way is to apply for discounts on senior policies that reward safe driving habits, low mileage, and defensive driving courses. Read more: How to Get a Defensive Driver Auto Insurance Discount

Seniors who may have less-than-perfect driving records can still bundle home and auto insurance to get cheaper rates. State Farm offers a 17% discount for bundling and a State Farm senior discount for additional savings. Farmers and Nationwide provide up to 20% off with a bundle.

Senior drivers in North Carolina will have the best rates if they keep a clean driving record and participate in good driver programs.Brandon Frady Licensed Insurance Producer

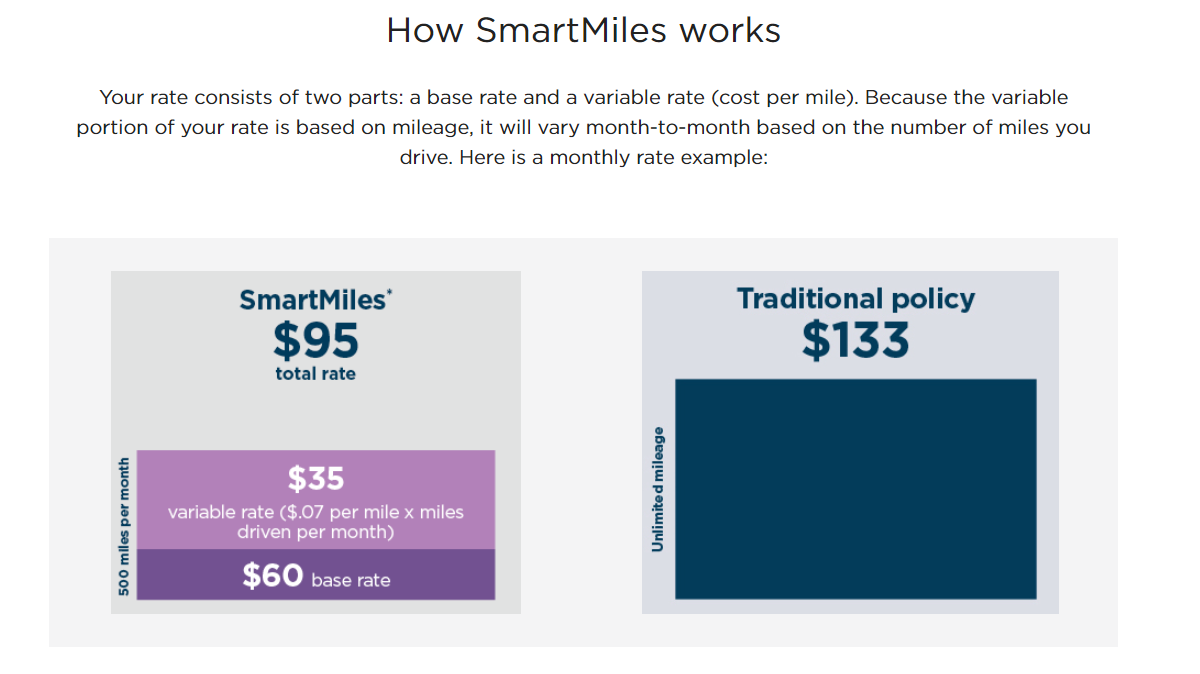

Retired seniors who drive less often can get cheaper North Carolina insurance with UBI programs. Usage-based car insurance for seniors tracks driving habits and mileage to calculate rates.

For instance, senior drivers in North Carolina can save around $60 per month with Nationwide by signing up for SmartMiles pay-as-you-go insurance.

North Carolina senior drivers with higher rates should get quotes from a few different companies to ensure they are getting the best deal and find which insurance company offers the best discounts for seniors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best North Carolina Senior Driver Auto Insurance Companies

Senior drivers looking for a new provider should start with State Farm, Farmers, and Nationwide. These companies have the best auto insurance for seniors in North Carolina. Each company offers senior discounts, comprehensive coverage options, and some of the best auto insurance discounts while maintaining a strong reputation in the insurance market.

Insurance suggestions in NC–who provides best service/prices here?

byu/Son_of_Zardoz inNorthCarolina

Ready to shop for the best senior auto insurance in North Carolina? Compare rates today with our free quote comparison tool.

Frequently Asked Questions

Who is the best car insurance company in NC for seniors?

State Farm is the top choice for senior drivers in North Carolina, offering competitive rates and discounts. Seniors can also take advantage of free State Farm car insurance quotes, helping them find affordable and reliable coverage tailored to their needs.

What is the senior citizen plan?

The senior citizen plan refers to specialized insurance, including health, auto, and life insurance policies that offer discounts and benefits tailored to older adults. These plans help seniors secure the best auto insurance rates for seniors and car insurance savings for North Carolina drivers.

What is the recommended auto insurance coverage in North Carolina?

We recommend that most senior drivers in North Carolina carry full coverage auto insurance.

Is Progressive Insurance good in NC?

Yes, Progressive is one of the top companies in North Carolina for seniors. It provides a senior car insurance discount, helping older drivers save on premiums. The company also offers low-cost auto insurance for seniors, making it a budget-friendly option.

Is Allstate or Progressive auto insurance cheaper?

Progressive offers cheap car insurance for seniors near you, making it one of the more affordable options for senior drivers in North Carolina. It also provides auto insurance discounts for senior citizens, helping to reduce overall costs.

How do I lower auto insurance in NC?

Senior drivers looking to lower their car insurance rates can shop for quotes, drop nonessential coverages, and adjust deductibles to lower rates.

What age is auto insurance most expensive?

Car insurance is most expensive for drivers in their teens, but senior automobile rates can also increase with age. Reviewing the best auto insurance for seniors reviews can help older drivers find more affordable coverage.

Why is auto insurance so high in North Carolina?

Car insurance in North Carolina is more expensive due to weather patterns, car accident ratios, and other local factors. However, seniors can still find the cheapest car insurance for seniors by comparing providers and taking advantage of senior auto insurance discounts offered for safe driving and low mileage.

What is the cheapest auto insurance for seniors in NC?

Minimum coverage is the cheapest insurance for seniors in North Carolina. Seniors looking for the cheapest rate should use our free quote comparison tool to find cheap NC insurance.

What is the minimum auto insurance in NC?

Minimum car insurance in North Carolina is 30/60/25 in liability auto insurance. Many providers offer senior discounts on car insurance, making coverage more affordable. Choosing the right auto insurance senior plan can help older drivers save while ensuring adequate protection.

Which type of insurance is most important for retired persons?

Health insurance is the most important form of coverage for retired people, as it helps cover medical costs, especially if Medicare doesn’t provide full coverage.

Is auto insurance cheaper in NC or SC?

South Carolina auto insurance rates tend to be higher since car insurance is generally cheaper in North Carolina.

What is the best car insurance in North Carolina?

State Farm is often considered the best car insurance provider in North Carolina due to its affordable rates and strong customer service.

How can I lower car insurance in NC?

You can lower car insurance in NC by maintaining a clean driving record, increasing your deductible, and asking about available discounts.

Is Allstate a good insurance company?

Allstate is considered a good insurance company, known for its reliable customer service and wide range of coverage options. Our Allstate MileWise review explores its pay-per-mile program, which provides affordable and flexible coverage for low-mileage drivers.

What are the four recommended types of insurance?

The four recommended types of insurance are health, life, home, and auto insurance, covering the most important aspects of personal security.

Why is insurance more expensive as you get older?

Insurance tends to be more expensive for older individuals due to increased health risks and, in the case of car insurance, higher accident rates.

Which supplemental insurance is best for seniors?

Medigap is considered the best supplemental insurance for seniors, as it helps cover costs not included in Medicare.

Get personalized auto insurance rates near you by using our free quote tool—just enter your ZIP code.

What car has the lowest insurance rates?

Due to their safety features and affordability, cars with the lowest insurance rates typically include models like the Honda Civic, Subaru Outback, and Toyota Camry.

Why is Progressive so much cheaper?

Progressive offers competitive rates by utilizing technology to compare prices across multiple providers and offering discounts for bundling policies.

Which gender pays more for car insurance?

On average, men tend to pay more for car insurance than women due to higher accident rates among male drivers. Finding cheap auto insurance for high-risk drivers in North Carolina is essential for those who need affordable coverage, especially since risk factors can significantly impact insurance rates.

What is the most significant expense in retirement?

Healthcare costs are typically the most significant expense in retirement, including premiums, prescriptions, and long-term care.

Which is the best policy for retirement?

A combination of a 401(k), pension, or IRA, along with Medicare for health coverage, is considered the best policy for retirement.

What age is considered a female senior citizen?

In most contexts, a female senior citizen is considered someone aged 65 or older, which can impact eligibility for cheap auto insurance for drivers over 60.

Who are senior citizens above 70 years old?

Senior citizens above 70 years old are typically individuals who are more likely to be retired and may require additional health and life insurance coverage.

What benefits do senior citizens receive?

Senior citizens often receive benefits such as Social Security, Medicare, tax breaks, and discounts on various services.

Which is the best saving scheme for senior citizens?

The Senior Citizens Savings Scheme (SCSS) is often considered the best saving scheme, offering tax benefits and a higher interest rate.

Find your area’s most affordable auto insurance by entering your ZIP code into our free comparison tool.

The disadvantages of senior citizen schemes include limited flexibility in withdrawing funds and penalties for early withdrawal.

What kind of car insurance do I need in NC?

In North Carolina, you need liability insurance, including bodily injury and property damage coverage, as well as uninsured motorist coverage.

What is AAA auto insurance’s rating by A.M. Best?

AAA Auto Insurance has a strong A+ rating from A.M. Best, indicating its financial stability and reliability, and offers some of the best AAA auto insurance discounts for eligible policyholders.

What is a “super senior”?

A “super senior” typically refers to someone who is over 80 years old, often with additional healthcare or retirement needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.