Best Auto Insurance for Seniors in Pennsylvania (Top 9 Companies for 2025)

The Hartford, USAA, and State Farm offer the best auto insurance for seniors in Pennsylvania, with rates starting at $19 per month. The Hartford is best for AARP members, USAA offers top rates for military veterans, and State Farm provides strong coverage for unaffiliated drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

765 reviews

765 reviewsCompany Facts

Full Coverage for Seniors in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Seniors in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Seniors in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe Hartford, USAA, and State Farm have the best auto insurance for seniors in Pennsylvania. USAA and State Farm have the lowest rates, but The Hartford takes our top spot with unique benefits for senior drivers.

The Hartford offers the best Pennsylvania auto insurance for seniors because of its partnership with AARP.

While you must be an AARP member to purchase coverage, seniors find low rates and unique discounts when shopping at The Hartford.

Our Top 9 Company Picks: Best Auto Insurance for Seniors in Pennsylvania

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 5% | A+ | AARP Benefits | The Hartford |

| #2 | 10% | A++ | Superior Service | USAA | |

| #3 | 17% | B | Local Agents | State Farm | |

| #4 | 10% | A | Customized Policies | Liberty Mutual |

| #5 | 10% | A+ | Safe Driver | Allstate | |

| #6 | 20% | A+ | Vanishing Deductible | Nationwide |

| #7 | 5% | A+ | Snapshot Program | Progressive | |

| #8 | 13% | A++ | Customer Service | Travelers | |

| #9 | 10% | A | Senior Discounts | Farmers |

Read on to explore more options for the best car insurance in Pennsylvania for seniors. Then, enter your ZIP code into our free tool to see personalized quotes today.

- The Hartford and USAA are the best Pennsylvania insurance companies for seniors

- Most older drivers get affordable car insurance quotes in Pennsylvania

- Some Pennsylvania auto insurance companies also offer senior discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – The Hartford: Top Overall Pick

Pros

- AARP Partnership: The Hartford offers exclusive benefits and senior discounts to AARP members. Learn more in our review of The Hartford auto insurance.

- RecoverCare: Add The Hartford RecoverCare to cover costs for home services if senior drivers are injured in an accident.

- Lifetime Renewability: So long as you meet basic requirements, the Hartford guarantees that senior drivers can renew their policy for the rest of their lives.

Cons

- Membership Required: The Hartford only sells AARP car insurance for seniors, so you’ll need an AARP membership to purchase a policy.

- Expensive Rates: Senior auto insurance is more costly at The Hartford at $89 per month.

#2 – USAA: Best for Miltary Veterans

Pros

- Military-Focused Benefits: USAA provides specialized services and senior insurance discounts for military members and veterans.

- Exceptional Customer Service: USAA offers some of Pennsylvania’s best senior auto insurance customer service, particularly for claims handling.

- Comprehensive Coverage: With a wide range of coverage options tailored for military needs, USAA offers comprehensive senior auto insurance quotes in Pennsylvania.

Cons

- Eligibility Restrictions: Senior insurance is only available to military members and their families. See if you qualify for membership in our USAA auto insurance review.

- Limited Local Branches: Pennsylvania has fewer USAA insurance offices than other top providers.

#3 – State Farm: Best for Access to Local Agents

Pros

- Extensive Network of Local Agents: State Farm maintains a strong local presence in Pennsylvania, offering personalized service and support for senior auto insurance.

- Policy Customization Options: You can customize senior insurance with add-ons like roadside assistance and rideshare insurance. See how in our State Farm auto insurance review.

- Good Driver Discounts: Get affordable State Farm senior car insurance with multiple discounts for safe driving and vehicle safety features.

Cons

- Average Digital Experience: Tech-savvy seniors report being unimpressed with State Farm’s online tools and mobile app.

- Financial Rating Dropped: A. M. Best recently downgraded State Farm’s financial rating to a B, indicating the company may be struggling in Pennsylvania.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Unique Coverage Options: Liberty Mutual offers add-ons for senior auto insurance that can be hard to find elsewhere. Explore your options in our Liberty Mutual auto insurance review.

- RightTrack: Senior drivers who sign up for Liberty Mutual’s usage-based insurance (UBI) program RightTrack to save up to 30% for safe driving habits.

- 24/7 Customer Support: Get the best senior car insurance experience with Liberty Mutual’s 24/7 claims support, available over the phone and online.

Cons

- Expensive Rates: Libert Mutual is a more costly senior auto insurance company.

- Limited Digital Tools: Liberty Mutual’s online tools are less user-friendly than most senior drivers.

#5 – Allstate: Best for UBI Savings

Pros

- Drivewise Program: Allstate offers one of the best UBI discounts, up to 40%, for senior drivers who sign up for Drivewise. Learn more in our Allstate auto insurance review.

- Retirement Discounts: Get the cheapest car insurance for seniors over 60 with Allstate’s special discounts for retired drivers.

- Full Coverage Options: Allstate offers a wide range of policies and add-ons to help you get the best car insurance in Pennsylvania for seniors.

Cons

- Higher Premiums: No matter what type of driver you are, Allstate is usually one of the most expensive options for senior car insurance, especially full coverage policies.

- Inconsistent Customer Service: Senior drivers with Allstate report varying experiences with customer support.

#6 – Nationwide: Best for Deductible Savings

Pros

- Vanishing Deductible Program: Earn up to $500 off your senior insurance deductible by staying claims-free. Learn how in our Nationwide auto insurance review.

- Comprehensive Coverage Options: Get the best car insurance for seniors over 70 with Nationwide’s coverage options, including gap coverage and accident forgiveness.

- Good Customer Support: Nationwide senior insurance coverage generally receives high ratings for its customer service.

Cons

- Limited Local Offices: Senior drivers who prefer speaking to a local agent will have difficulty finding Nationwide offices in Pennsylvania.

- Higher Rates for High-Risk Drivers: Some senior drivers in Pennsylvania will see higher rates from Nationwide, particularly if they have a less-than-perfect driving record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Innovative Digital Tools

Pros

- Snapshot: Progressive’s user-friendly UBI program Snapshot makes it easy for seniors in Pennsylvania to get cheap car insurance as long as they’re safe drivers.

- Advanced Digital Tools: Find affordable Pennsylvania insurance for seniors with its user-friendly online tools, like the Name Your Price tool.

- Multiple Discounts: One way Progressive offers the cheapest car insurance in Pennsylvania is through its discount opportunities.

Cons

- Unexpected Rate Increases: Many senior drivers report that their rates unexpectedly increased despite nothing having changed about their policies.

- Customer Loyalty: Despite offering some of the best Pennsylvania auto insurance for seniors, Progressive struggles to keep its customers. See how it works in our Progressive auto insurance review.

#8 – Travelers: Best for Customer Service

Pros

- Discount Variety: Travelers offer a wide range of discounts beneficial for Pennsylvania seniors with multiple vehicles and safe driving habits.

- Superior Customer Service: Travelers isn’t just one of our cheapest car insurance recommendations in Pennsylvania – it’s also a great choice for drivers who want an excellent customer service experience.

- Financial Stability: With an A++ from A.M. Best, Travelers’ strong financial ratings ensure reliability for Pennsylvania seniors.

Cons

- Limited Coverage Options: Senior drivers earning extra cash with apps like Uber may be unable to buy rideshare insurance in Pennsylvania.

- Higher Premiums: Travelers’ senior auto insurance policies may be more expensive than some competitors. Read our Travelers auto insurance review to see how much you might pay.

#9 – Farmers: Best Selection of Pennsylvania Discounts

Pros

- Strong Local Presence: A massive network of local agents in Pennsylvania allows Farmers to offer personalized service and support for senior drivers.

- Comprehensive Support for Seniors: The company provides dedicated support and advice for seniors in Pennsylvania. See how many you might qualify for in our Farmers auto insurance review.

- Solid Customer Service Ratings: Most seniors in Pennsylvania agree that Farmers offers excellent customer service, especially for the speed of its claims handling process.

Cons

- Higher Quotes: Depending on your driving history, Farmers may be an expensive option for senior auto insurance in Pennsylvania.

- Limited Availability: Farmers sell senior insurance in Pennsylvania, but it doesn’t cover every state. If you move, you may need to find a different car insurance company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Unlocking the Best Auto Insurance Deals for Pennsylvania Seniors

There’s significant variation between quotes from different companies. It’s helpful to look at average quotes to understand where to start your search. Check below to see senior auto insurance rates from our top providers.

Senior Auto Insurance Monthly Rates in Pennsylvania by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $49 | $145 | |

| $43 | $128 | |

| $72 | $214 |

| $28 | $84 |

| $49 | $145 | |

| $25 | $74 | |

| $89 | $183 |

| $25 | $74 | |

| $19 | $56 |

Comparing quotes from multiple companies is crucial to avoid overpaying for car insurance—without comparison, you cannot know which company has the lowest rates.

Understanding how much you might have to pay for auto insurance can be confusing. Many factors affect auto insurance rates, including gender, location, and age.

Insurance rates depend on apparent factors like your car type and driving record, but credit scores and marital status can also have an impact.Travis Thompson Licensed Insurance Agent

Luckily, seniors looking for the best car insurance in Pennsylvania can easily get quotes. If you’re wondering who has the best car insurance for seniors, most top companies offer quick online forms that take about 10 minutes to complete. The forms require details like your driver’s license number and vehicle information.

If you don’t want to spend the time to fill out multiple forms, you can use our free online tool to compare various insurance quotes at once.

How Seniors Can Lower Pennsylvania Auto Insurance Costs

While Pennsylvania senior car insurance rates often run on the high side, there are plenty of ways to save. Consider the following tips to lower your insurance rates:

- Lower your coverage levels.

- Increase your deductible.

- Keep your driving record clean.

- Choose the best usage-based insurance.

- Improve your credit score.

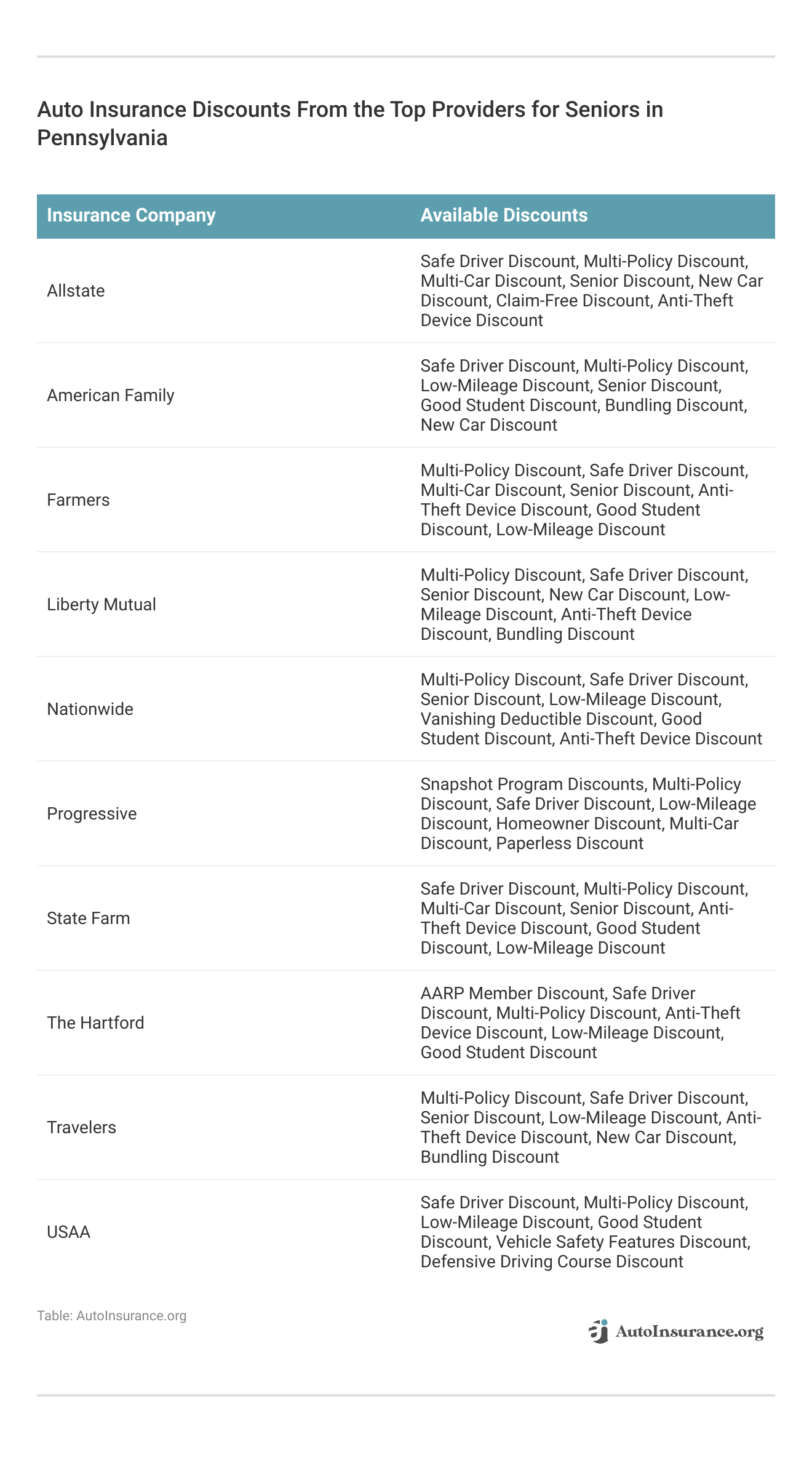

A more straightforward step to take is to look for auto insurance discounts. Most companies offer a variety of discounts to help drivers save. Finding the company that provides the most discounts you qualify for takes a little research, but the savings are worth it.

Below, we’ve compiled a list of some of the most popular senior car insurance discounts from our top companies in Pennsylvania to help you find the best auto insurance for senior citizens.

The final and most important step in saving on your insurance is to compare quotes. Skipping this crucial step guarantees you’ll overpay for senior car insurance.

Pennsylvania Auto Insurance Requirements for Seniors

The insurance requirements for seniors in Pennsylvania are the same as for every driver. Before you can drive on a Pennsylvania street, you’ll need the following:

- Bodily Injury Liability: $15,000 per person, $30,000 per accident

- Property Damage Liability: $5,000 per accident

- First Party Benefits: $5,000

Insurance companies must also offer uninsured/underinsured motorist coverage, but you can reject the coverage.

The minimum insurance requirements in Pennsylvania don’t cover damage to your car. Many senior drivers have new or collectible vehicles that would benefit from a full coverage policy. If you’re unsure what coverage would work best for you, an insurance representative can help.

In today’s #AARPMinute, three things your car insurance policy probably won’t cover, plus use your next family gathering to share health-history information. pic.twitter.com/mU52NScYF6

— AARP (@AARP) July 17, 2022

Even if your car isn’t worth much, you should always carry the minimum insurance required by Pennsylvania before driving. Driving without insurance in the Keystone State can have serious consequences, including fines, license suspension, and registration suspension.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Discover the Best Car Insurance for Seniors in Pennsylvania

Now that you know how to evaluate auto insurance quotes, you’ll have a much easier time finding cheap car insurance for seniors in Pennsylvania. While it’s essential to explore multiple companies, our top picks for the best auto insurance for seniors in Pennsylvania are a great place to start when comparing coverage options.

The Hartford, USAA, and State Farm have the best car insurance for seniors in Pennsylvania. USAA is the best for military members while The Hartford caters to AARP members. All seniors qualify for State Farm auto insurance, and rates start at $25 per month.

While comparing quotes is essential, finding the best coverage can be time-consuming. If you’re wondering what is the best car insurance for seniors, researching individual websites and filling out forms can make the process even more overwhelming. Streamline the process by entering your ZIP code into our free comparison tool to skip the endless forms and save.

Frequently Asked Questions

How can seniors save on their car insurance?

To save on their insurance, seniors should look for discounts, choose the right amount of coverage, consider a higher deductible, and compare quotes from multiple providers. Finding the best auto insurance companies for seniors can help them secure affordable rates, while specialized auto insurance for elderly drivers may offer additional benefits and discounts.

What car insurance does AARP recommend for seniors?

AARP recommends that its members buy car insurance from The Hartford, which provides the best auto insurance for senior drivers. With exclusive AARP benefits, The Hartford is often considered the best auto insurance company for seniors.

Is auto insurance more expensive for seniors?

For the most part, seniors enjoy affordable car insurance rates until about the age of 75. However, finding the best auto insurance for seniors over 70 is important, as rates tend to rise gradually after this age.

Seniors also get lower rates because they often qualify for various discounts. For example, seniors who don’t drive frequently can get affordable car insurance with low-mileage discounts.

What happens if you drive without car insurance in Pennsylvania?

Driving without insurance in Pennsylvania has serious consequences, including fines exceeding $1,000 and suspension of your license and registration. To avoid these penalties, seniors should consider the best auto insurance rates for seniors from the best car insurance companies for senior citizens to ensure affordable and reliable coverage.

What is the age requirement for a senior citizen?

Most organizations consider 60 or 65 as the minimum age for senior citizen status, affecting eligibility and reviews for the best auto insurance for seniors. These reviews highlight how age influences coverage options and access to the best auto insurance rates for seniors.

Are there auto insurance discounts for seniors in Pennsylvania?

Finding the best car insurance for senior citizens can be challenging since not many companies offer specific discounts for older drivers. However, some insurers provide savings for retired drivers, helping them secure the best car insurance rates for seniors.

For example, The Hartford’s car insurance discounts include several ways for older drivers to save. You can also save with non-senior-specific discounts, like savings for being a safe driver or paying for your policy in full.

Who offers the best auto insurance for seniors?

The Hartford, USAA, and State Farm offer the best car insurance for elderly drivers, with The Hartford providing exclusive AARP benefits. These companies also provide affordable car insurance for low-income seniors, ensuring budget-friendly coverage for those on a fixed income.

Which insurance is the best for senior citizens?

The Hartford provides the best vehicle insurance for seniors, especially AARP members, while USAA is ideal for military seniors. State Farm offers strong coverage and some of the cheapest auto insurance for seniors.

What are the minimum insurance requirements in Pennsylvania?

Pennsylvania’s car insurance requirements include a 15/30/5 liability insurance plan and $5,000 worth of first-party benefits.

Who has the best auto insurance rates in Pennsylvania?

USAA has the lowest rates for eligible military members, while The Hartford and State Farm offer competitive rates for seniors in Pennsylvania. Qualified drivers can also use Pennsylvania auto insurance discounts to lower their premiums.

What is the cheapest car insurance for people over 60?

USAA offers the cheapest rates for military seniors, while The Hartford and Geico provide affordable options for non-military drivers.

What are the best auto insurance companies in Pennsylvania for seniors?

Our research shows that The Hartford, USAA, and State Farm are the best auto insurance companies for seniors in Pennsylvania.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

Does State Farm offer free insurance for seniors?

No, State Farm does not offer free insurance for seniors, but it provides discounts for safe driving, bundling policies, and low-mileage use, which can lower costs.

At what age is car insurance the cheapest?

Car insurance is usually cheapest between ages 50 and 65, but rates may increase after that due to higher risk factors.

How much does Pennsylvania auto insurance cost for seniors?

Many driving and non-driving factors impact auto insurance rates, but the average senior driver in Pennsylvania pays $43 per month for minimum insurance and $120 per month for full coverage.

Which type of insurance is most important for retired individuals?

Health insurance, auto insurance, and life insurance are the most important insurance policies for retirees, with Medicare and supplemental plans crucial for healthcare.

What is the best type of life insurance for a 70-year-old?

Guaranteed issue whole life insurance is best for a 70-year-old, as it provides lifelong coverage without a medical exam.

Why is car insurance so expensive in Pennsylvania?

Pennsylvania has high insurance rates due to many uninsured drivers, extreme weather risks, and no-fault insurance laws. Additionally, auto insurance rates are higher for males because they are statistically more likely to engage in risky driving behaviors, leading to increased premiums.

What is the most reliable car insurance company?

State Farm, USAA, and Geico are among the most reliable car insurance companies based on financial strength and customer satisfaction.

Who offers cheaper car insurance than Progressive?

Depending on location and discounts, Geico, State Farm, and USAA (for military members) often offer lower rates than Progressive.

Why do insurance rates increase as you age?

Insurance rates increase with age for a few reasons, including worsening eyesight, slower reaction speeds, and an increased likelihood of being injured in an accident. However, your rates won’t increase until 75, and you won’t see prices higher than younger drivers pay.

Enter your ZIP code into our free comparison tool to see how much you might pay today for your car insurance.

Who provides the best car insurance for seniors?

The Hartford, USAA, and State Farm are the best choices for senior drivers, offering discounts and specialized coverage.

Which is the best company for car insurance?

State Farm is the best overall, while Geico and USAA provide competitive rates for different customer groups.

What are the top 10 auto insurance companies?

The top 10 auto insurance companies are State Farm, Geico, Progressive, Allstate, USAA, The Hartford, Nationwide, Farmers, Liberty Mutual, and Travelers. Some insurers offer cheap auto insurance for high-risk drivers, providing specialized coverage and discounts.

What are the four recommended types of insurance?

The four essential types of insurance are health insurance, auto insurance, homeowners or renters insurance, and life insurance.

Why does insurance become more expensive as you get older?

Insurance rates increase with age due to a higher likelihood of claims, declining reaction times, and increased medical costs.

What is the best full coverage car insurance for seniors?

The best cheap full coverage auto insurance for seniors depends on driving history, location, and available discounts. The Hartford (AARP), USAA (for military families), and State Farm offer top-rated full coverage policies with senior discounts and benefits, making them affordable options for older drivers.

Which company offers the best low-mileage car insurance for seniors?

The best low-mileage car insurance for seniors includes Metromile (pay-per-mile option), Nationwide’s SmartMiles, and The Hartford, which offers discounts for low-mileage drivers through its AARP program.

How do I become an SD Property & Casualty Producer?

To become a South Dakota (SD) Property & Casualty Producer, complete pre-licensing education, pass the state licensing exam, apply through the National Insurance Producer Registry (NIPR), and complete a background check.

What is the best type of insurance for seniors?

Seniors should consider full coverage auto insurance with liability, collision, and comprehensive coverage for better protection.

Where can I get a senior car insurance quote?

You can get senior car insurance quotes from providers like The Hartford (AARP), State Farm, and Geico by visiting their websites, using online comparison tools, or speaking with an insurance agent.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.