Best Auto Insurance for Seniors in Virginia (See the Top 10 Companies for 2025)

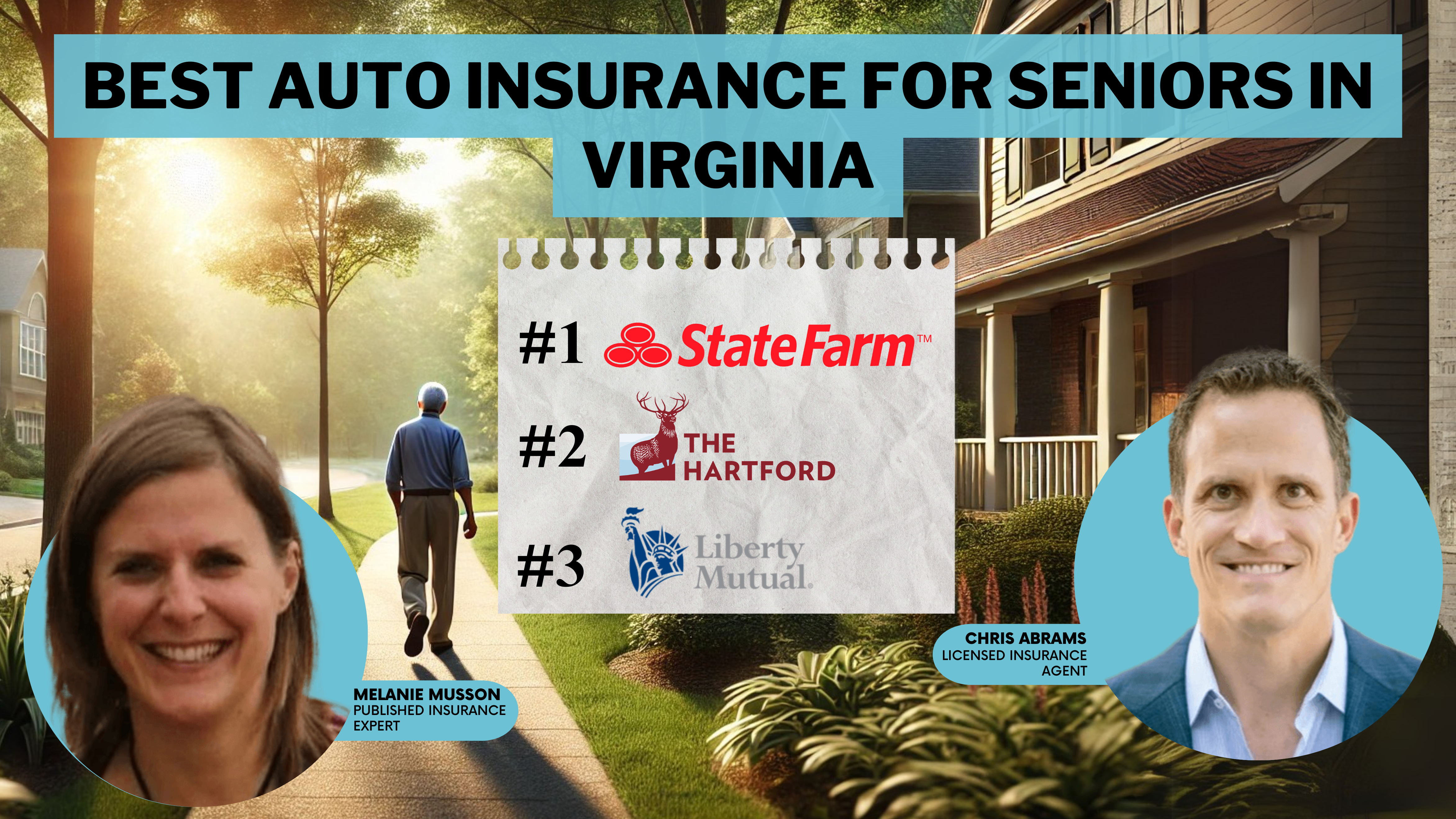

State Farm, The Hartford, and Liberty Mutual have the best auto insurance for seniors in Virginia, with rates starting at $42/month. These top picks provide excellent senior citizen discounts for car insurance in Virginia, personalized service, and tailored auto insurance coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for VA Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage for VA Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for VA Seniors

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

State Farm, The Hartford, and Liberty Mutual have the best auto insurance for seniors in Virginia. Virginia senior auto insurance rates start as low as $42/month.

State Farm stands out with the best Virginia auto insurance overall for its competitive rates, extensive senior discounts, and personalized service. For seniors managing expenses, many providers offer fixed-income payment plans and senior citizen car financing options to help make insurance more affordable.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Virginia

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Personalized Service State Farm

#2 10% A+ Senior Discounts The Hartford

#3 12% A Comprehensive Coverage Liberty Mutual

#4 10% A+ Claim Support Allstate

#5 20% A+ Vanishing Deductible Nationwide

#6 10% A Policy Flexibility Farmers

#7 5% A Gap Coverage American Family

#8 10% A++ Safe Driving Travelers

#9 17% A++ Customer Satisfaction Auto-Owners

#10 12% A+ Usage-Based Savings Progressive

These providers offer tailored, affordable coverage for seniors in Virginia, ensuring excellent protection and great value. Find the cheapest auto insurance in VA, no matter how much coverage you need, by entering your ZIP code above into our comparison tool today.

- Virginia senior auto insurance costs start at just $25/month

- State Farm has great rates and senior insurance discounts

- The Hartford offers comprehensive senior insurance to AARP members

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Personalized Service: State Farm offers its services that cater to the unique resources of senior drivers in Virginia, providing a more personalized insurance experience.

- State Farm Senior Discount: Seniors in Virginia get big discounts on their auto insurance, according to our State Farm auto insurance review.

- Local Agents for Seniors in Virginia: With a strong local presence, State Farm provides easy access to agents who understand the specific needs of seniors in Virginia.

Cons

- Limited Vehicle Classifications: Some seniors in Virginia may find mature driver vehicle classifications more restrictive compared to other companies.

- Financial Stability: A.M. Best downgraded State Farm’s financial rating to a B recently which could impact senior auto insurance claims in Virginia.

#2 – The Hartford: Best for Senior Discounts

Pros

- Senior Discounts: The Hartford provides substantial discounts like AARP defensive driving discounts, which you can learn about in our The Hartford auto insurance review.

- Tailored Coverage for Seniors: Coverage options specifically address Virginia seniors’ driving habits, including senior carpooling coverage and enhanced safety features.

- Reputation for Senior Support: The Hartford is well-regarded for its Virginia senior auto insurance plans, backed by consistent positive community feedback.

Cons

- Limited Availability: The Hartford senior auto insurance is only available to drivers in Virginia who are AARP members.

- Expensive Rates: Premium rates for Virginia senior drivers are higher than other insurance providers.

#3 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: The company offers specialized health condition auto coverage that considers age-related medical needs. Learn more in our Liberty Mutual auto insurance review.

- Customizable Policies: Policies can be adjusted to accommodate vision test requirements for seniors in Virginia.

- Good Customer Support: The support team demonstrates particular expertise in addressing Virginia senior drivers’ questions and coverage concerns.

Cons

- Higher Premiums: Virginia senior drivers seeking complete coverage packages should expect to pay higher monthly premiums.

- Discount Eligibility: Most insurance discounts need Virginia drivers over 55 to qualify plus meet specific requirements for acceptance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Claim Support

Pros

- Excellent Claim Support: Allstate provides very reliable claim support that suits seniors in Virginia who need extra help during claims. You’ll find more info in our Allstate auto insurance review.

- Senior-Friendly Policies: Allstate develops its policies to match what Virginia seniors need, plus adds perks like accident forgiveness next to safe driving rewards.

- Local Agent Network: The extensive network of local agents provides Virginia seniors with personalized, face-to-face support.

Cons

- Higher Premiums: Virginia senior drivers typically pay more for premiums due to the enhanced claims support services.

- Limited Discounts: Fewer Virginia-specific senior discount programs are available compared to other leading insurance providers.

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program helps seniors in Virginia by lowering their deductible progressively as they keep a clean driving record. Learn more in our Nationwide auto insurance review.

- Customizable Policies: Multiple coverage options give Virginia seniors the flexibility to match their unique driving habits and risk preferences.

- Strong Customer Service: Support representatives demonstrate particular expertise in guiding Virginia’s senior drivers through policy decisions.

Cons

- Eligibility for Vanishing Deductible: Virginia seniors must meet specific driving record criteria to qualify for deductible reduction benefits.

- Complex Policy Terms: Insurance documents and policy formats are complicated and hard to understand for seniors in Virginia unless they seek professional help.

#6 – Farmers: Best for Policy Flexibility

Pros

- Military Coverage: As mentioned in our Farmers auto insurance review, it also offers special retired military auto coverage options for veterans in Virginia.

- Senior Discounts Available: Senior drivers in Virginia can enjoy a number of discounts that make the insurance cost substantially lower.

- Supportive Customer Service: Local representatives provide Virginia seniors with detailed guidance through coverage selection and claims processes.

Cons

- Variable Premium Costs: The premium for Virginia senior drivers may vary depending on the coverage combinations selected and driving patterns.

- Discount Complexity: All the available discounts can be complex to understand and apply for by Virginia seniors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Gap Coverage

Pros

- Gap Coverage: American Family offers affordable gap insurance for senior drivers in Virginia who have new vehicles. Read our American Family auto insurance review to learn what else is offered.

- Tailored Coverage Options: Coverage options specifically consider the driving patterns and risk factors common among Virginia’s senior motorists.

- Supportive Customer Service: Customer service representatives dedicate additional time to helping Virginia’s elderly drivers understand complicated coverage features.

Cons

- Potentially Higher Costs: Full-coverage options will lead to more expensive premiums. Seniors in Virginia may view this as too costly.

- Fewer Senior Insurance Discounts: There are fewer auto insurance discounts available to senior citizens from American Family compared to the competition in Virginia.

#8 – Travelers: Best for Safe Drivers

Pros

- Safe Driving Discounts: While age-related premium increases may occur, Travelers offers safe driving discounts that can help offset these costs.

- Bundled Insurance: Options for bundling Medicare insurance plans that can help seniors save on both auto and health coverage.

- Financial Stability: Travelers is known for its financial stability, providing peace of mind for seniors in Virginia, which you can read more about in our Travelers auto insurance review.

Cons

- Discounts May Vary: Safe driving rewards for Virginia senior drivers vary significantly based on location and driving history requirements.

- Policy Complexity: Virginia seniors often need additional guidance to understand the complex policy terms and coverage combinations.

#9 – Auto-Owners: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Auto-Owners receive high marks for customer satisfaction, making it a great choice for seniors in Virginia who require dependable service.

- Helping Hand: Discover in our Auto-Owners auto insurance review how its local agents can help seniors complete their senior driver assessment in Virginia.

- Personalized Service: Local Virginia representatives provide experienced senior drivers with dedicated attention throughout the policy duration.

Cons

- Limited Discounts: Virginia senior drivers find fewer age-specific discount opportunities compared to other major insurance providers.

- Potentially Higher Rates: Premium rates for Virginia seniors can exceed competitor prices depending on coverage level and location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Progressive: Best for Usage-Based Savings

Pros

- Usage-Based Savings: Progressive Snapshot usage-based insurance allows seniors in Virginia to potentially save on premiums based on their driving habits. Read our Progressive auto insurance review for more details.

- Flexible Coverage Options: Seniors in Virginia can adjust their coverage based on how frequently they drive and their typical driving distances.

- Good Customer Support: The customer service team receives high marks from Virginia senior drivers for handling age-specific insurance concerns. Learn more in our Progressive Snapshot review.

Cons

- Discounts Depend on Driving Habits: Virginia senior drivers must maintain consistent driving patterns to maximize savings through usage-based monitoring.

- Complex Policy Options: Multiple coverage options and program features can overwhelm Virginia seniors seeking straightforward insurance plans.

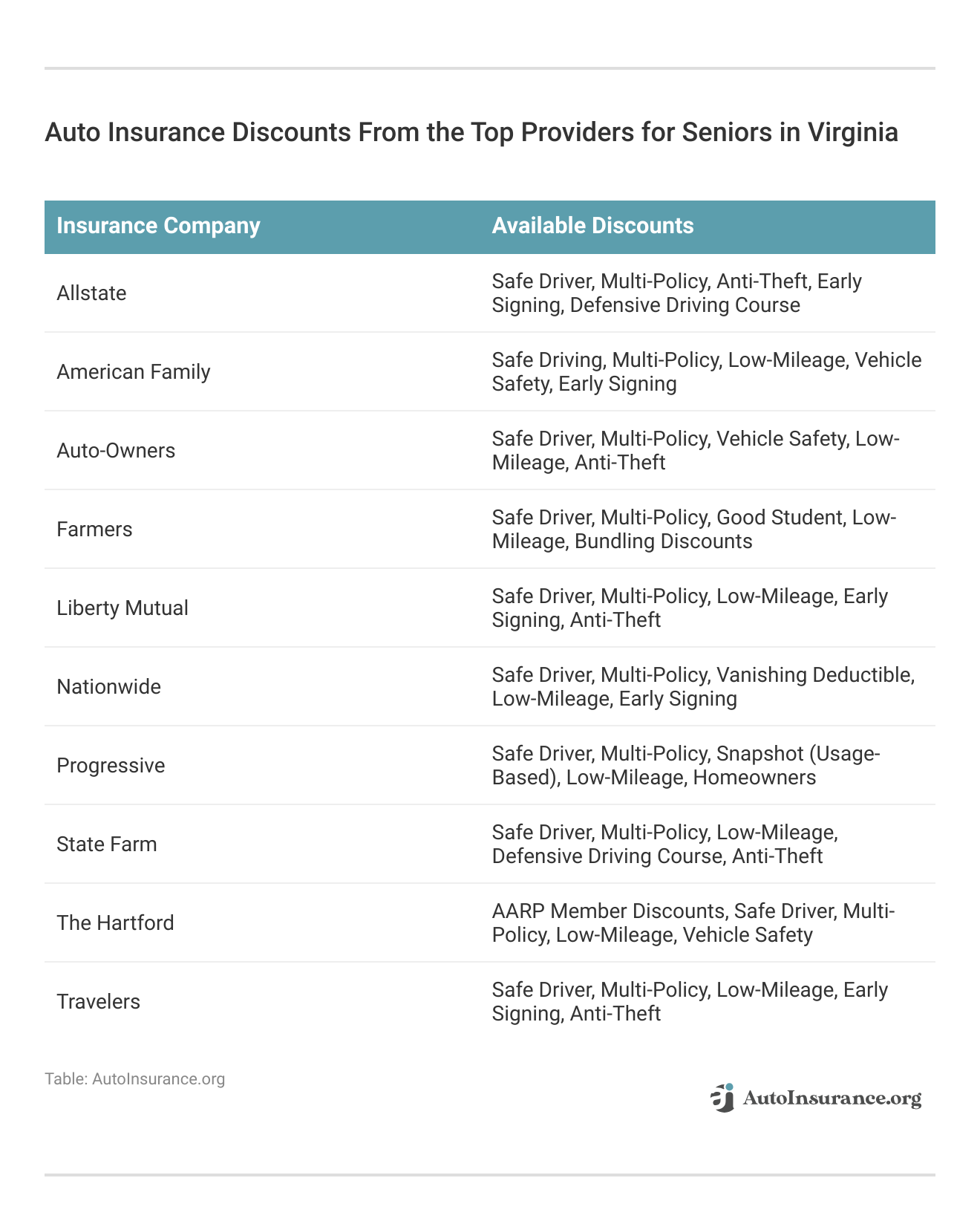

Understanding Auto Insurance Rates for Virginia Seniors

According to Virginia senior driver statistics, monthly auto insurance rates vary by provider and coverage level. Many insurers now offer flexible options like part-time driving insurance for those who drive less frequently. For minimum coverage, rates range from $25/month with Progressive to $78 monthly with The Hartford.

Virginia Senior Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$70 $165

$55 $132

$35 $85

$67 $160

$86 $206

$57 $137

$41 $97

$42 $101

$50 $120

$49 $117

Finding cheap Virginia auto insurance premiums for seniors in Virginia is easy if you maintain a clean driving record. Insurance companies consider medical payment coverage for seniors that need when determining comprehensive coverage options.

Recent studies analyzing senior citizen crash rates in Virginia have helped insurers develop more accurate risk assessments. Find out how auto insurance companies check driving records.

Living in urban areas with higher traffic density, accident rates, and local crime rates can increase premiums. VA DMV senior regulations require drivers to maintain appropriate coverage based on their driving patterns.

Smart Ways to Reduce Senior Auto Insurance Costs in Virginia

Seniors in Virginia can lower their auto insurance costs by maintaining a clean driving record. They’ll earn safe driver discounts, which can reduce rates by 30% or more with the top Virginia companies.

Senior drivers can also earn discounts by bundling policies with home insurance and maintaining memberships in certain organizations. To learn more, check out how to save money bundling insurance policies.

Retired drivers can benefit from low mileage discounts for elderly drivers, and many companies in VA offer multi-car senior discounts for households with multiple vehicles as well as usage-based insurance.

Driving vehicles with high safety ratings will further help to reduce rates. Compare rates from multiple Virginia insurers to see which has the best senior insurance rates and coverage options near you.

Safety Programs and Equipment Benefits

Many insurers offer senior driving refresher courses that can lead to additional discounts. Providers also recognize investments in senior safety technology with special discounts and some offer coverage for adaptive equipment that helps seniors drive safely for longer.

Age-specific insurance riders and elderly driver rehabilitation programs are available through select providers, helping seniors maintain their independence while staying protected on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: How to Save Money on Senior Auto Insurance in Virginia

If you want examples of how to save money on senior car insurance, these case studies show how Virginia seniors have successfully found policies that suit their needs:

Case Study #1: Maximizing Savings With Senior Discounts

Alice, a 68-year-old retiree from Richmond, researched the cheapest car insurance for seniors over 60 and successfully switched to The Hartford. She found their comprehensive coverage and specialized benefits offered the best value among senior car insurance company options.

Case Study #2: Balancing Coverage and Affordability

Robert, a 72-year-old in Virginia Beach with a well-maintained vehicle, compared car insurance for seniors over 70. He found Liberty Mutual’s comprehensive coverage, including roadside assistance and rental car benefits, to be the ideal solution for balancing extensive protection with affordability.

Case Study #3: Finding the Best Overall Value

Margaret, a 65-year-old in Alexandria new to insurance shopping, researched the best insurance rates for seniors and found State Farm offered the most competitive rates. Her neighbor Helen, 82, found valuable insights about auto insurance for seniors over 80 through the same provider.

Each individual’s experience underscores the importance of making informed choices to secure the best possible insurance solution. Seniors in Virginia can find auto insurance policies that offer both excellent value and comprehensive auto insurance coverage.

Finding Affordable Auto Insurance Providers for Seniors in Virginia

The best auto insurance for seniors in Virginia is provided by State Farm, The Hartford, and Liberty Mutual. They offer competitive costs that start at $25/month, excellent senior discounts, and tailored coverage.

State Farm offers the best overall value for seniors in Virginia with its competitive rates and extensive discounts.Michelle Robbins Licensed Insurance Agent

State Farm leads with its overall value, while The Hartford excels in senior discounts. Liberty Mutual offers comprehensive coverage. Comparing quotes from these and other top insurers can help seniors find the best protection and savings.

See which Virginia companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

Who has the cheapest auto insurance for seniors in Virginia?

Several providers offer cheap auto insurance for seniors in Virginia. Companies like Progressive and State Farm are known for their affordable options and senior discounts.

How much is auto insurance for seniors in Virginia per month?

For seniors in Virginia, auto insurance premiums can vary. On average, seniors might expect to pay between $50 to $100 per month for minimum coverage, with full coverage costing more. Rates depend on factors such as driving history, vehicle type, and coverage levels.

Enter your ZIP code into our free quote tool below to find reviews of the best auto insurance for seniors for your needs and budget.

What is the best auto insurance for seniors in Virginia?

The best auto insurance for seniors in Virginia often includes providers like The Hartford, which is known for senior citizen auto insurance discounts, and State Farm, which offers comprehensive coverage options and competitive rates tailored to seniors. Check out our ranking of the top providers: 10 Best Auto Insurance Companies

What is the minimum auto insurance requirement in Virginia?

Virginia minimum auto insurance requirements include liability coverage of $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage.

What is the cheapest insurance company for seniors in Virginia?

While rates can vary, companies like Progressive and Geico are often cited for offering lower premiums for seniors in Virginia. Shopping around for senior car insurance quotes from different insurers is the best way to find the most affordable option.

What is the basic vehicle insurance coverage in Virginia?

Basic vehicle insurance coverage in Virginia includes liability insurance, which covers bodily injury and property damage caused to others. Optional coverages such as collision, comprehensive, and uninsured motorist protection are also available but not required by state law.

How much is full coverage auto insurance for seniors in Virginia?

The best full coverage auto insurance for seniors in Virginia typically ranges from $70 to $150 per month, depending on factors like the vehicle’s make and model, driving record, and coverage limits.

What are the major insurance companies serving seniors in Virginia?

Major insurance companies serving car insurance for the elderly in Virginia include State Farm, The Hartford, Liberty Mutual, Allstate, and Progressive. These companies offer a range of coverage options and discounts tailored to senior drivers.

Do seniors in Virginia need a driver’s license to get auto insurance?

Yes, seniors in Virginia need a valid driver’s license to obtain auto insurance. While there are ways to get auto insurance without a driver’s license, most VA insurance companies require it to verify the driver’s identity and driving history.

Does auto insurance in Virginia follow the vehicle or the driver?

In Virginia, seniors’ car insurance typically follows the vehicle. This means that coverage is generally tied to the vehicle itself rather than the driver. However, drivers must be listed on the policy to ensure they are covered while driving the insured vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.