Best Auto Insurance for Shipt Drivers in 2025 (Your Guide to the Top 10 Companies)

State Farm, Progressive, and Geico have the best auto insurance for Shipt drivers. State Farm's minimum coverage for Shipt drivers is an average of $47/mo. Shipt drivers can save more on their Shipt insurance by participating in good driver programs at the best Shipt car insurance companies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage Shipt Driver

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Shipt Driver

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Shipt Driver

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, Progressive, and Geico have the best auto insurance for Shipt drivers.

Knowing what kind of auto insurance coverage you need as a Shipt delivery driver is not always easy. You want to be protected if you’re ever in an accident, but you don’t want to pay too much for car insurance.

Our Top 10 Company Picks: Best Auto Insurance for Shipt Drivers

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | B | Many Discounts | State Farm | |

| #2 | 20% | A+ | Online Convenience | Progressive | |

| #3 | 18% | A++ | Cheap Rates | Geico | |

| #4 | 22% | A+ | Add-on Coverages | Allstate | |

| #5 | 20% | A | Customizable Polices | Liberty Mutual |

| #6 | 10% | A++ | Military Savings | USAA | |

| #7 | 25% | A++ | Accident Forgiveness | Travelers | |

| #8 | 20% | A | Roadside Assistance | AAA |

| #9 | 17% | A+ | Usage Discount | Nationwide |

| #10 | 20% | A | Local Agents | Farmers |

While driving for Shipt may offer the flexibility and freedom you want in a job, it will likely cause you to pay more monthly or annual rates for auto insurance coverage. This is because Shipt does not provide its drivers with auto insurance while they’re on the clock, but the company does require drivers to meet their state’s minimum liability auto insurance limits.

Compare rates today to find the best coverage if you drive for Shipt.

- State Farm has the best insurance for Shipt drivers

- Shipt drivers have to meet their state’s minimum liability requirements

- Shipt does not provide its drivers with auto insurance coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Many Discounts: Shipt drivers will find one of the largest discount selections at State Farm.

- Personalized Service: Shipt customers can find local agents for more personalized service.

- Coverage Variety: Tailor coverages on your car to be fully protected when driving for Shipt. Learn more in our State Farm review.

Cons

- Financial Stability: State Farm has a below-average rating.

- Online Tools: State Farm offers fewer online services to customers.

#2 – Progressive: Best for Online Convenience

Pros

- Online Convenience: One of the perks at Progressive is the free online tools that make policy management a breeze. Learn more by reading our review of Progressive.

- Snapshot Discount: Letting Snapshot track your driving data will earn most Shipt drivers a discount.

- Coverage Options: Shipt drivers can add roadside assistance and other useful coverages for frequent drivers.

Cons

- Customer Reviews: Service reviews are mixed from Progressive customers.

- Snapshot Rates: Shipt drivers who have poor driving scores at the end of the program could have increased rates.

#3 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Most Shipt customers will find rates economical at Geico. Learn more in our review of Geico.

- User-Friendly: Free online tools and apps make Geico a user-friendly choice.

- Financial Rating: Geico has the highest rating for financial stability.

Cons

- Local Agents: Availability is very limited, so most customers won’t be able to have personalized support.

- Coverage Options: Geico is missing a few optional coverage options, such as gap coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate is great for Shipt drivers who want to customize coverage with optional add-on coverages.

- Multiple-Vehicle Discount: Shipt drivers who own multiple vehicles will get lower rates.

- Online Convenience: Allstate’s apps and website provide online convenience. Learn more in our Allstate review.

Cons

- Claims Processing: Reviews mention slow processing and poor customer service.

- Higher Rates: Allstate is a more expensive choice for most drivers.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Shipt drivers have several options to personalize their policy at Liberty Mutual.

- 24/7 Claims: Shipt customers can get help with claims at any time.

- Good Driver Discount: Participating in RightTrack, Liberty Mutual’s UBI program, will reward some drivers with lower rates.

Cons

- Higher Rates: Liberty Mutual often isn’t the cheapest company available.

- Customer Reviews: Some customers report inconsistent service. Learn more about customer service in our review of Liberty Mutual.

#6 – USAA: Best for Military Savings

Pros

- Military Savings: USAA has the most competitive rates for military and veterans. Find out more in our USAA review.

- Customer Service: USAA representatives provide excellent service, according to customer reviews and ratings.

- Coverage Variety: Shipt drivers can add on optional coverages or stick with a basic policy.

Cons

- Eligibility Restrictions: Coverage is only available to Shipt drivers who are military or veterans.

- Local Agents: Service is provided online, not in person.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Shipt customers with clean driving records may be forgiven an accident.

- Financial Stability: Travelers has a great rating, which you can learn more about in our Travelers review.

- IntelliDrive Discount: Shipt drivers who let IntelliDrive track their driving data can get a discount.

Cons

- IntelliDrive Rate Increases: This discount program’s downside is that it could also raise rates for bad drivers.

- Customer Reviews: The majority of customers rate service as average.

#8 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Shipt drivers have several levels of coverage to choose from. Learn more in our AAA review.

- Membership Perks: AAA customers also get discounts on travel.

- Coverage Options: Carry a basic policy when driving for Shipt or add more coverage for specialized protection.

Cons

- Membership Fee: Shipt customers must pay an annual AAA membership fee.

- Discount Availability: Discounts can be limited by location.

#9 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide discounts rates for good drivers. Learn more in our Nationwide review.

- Multi-Policy Discount: Shipt drivers can score lower rates by bundling.

- Financial Stability: Nationwide is financially stable in the market.

Cons

- Availability: A few states don’t carry insurance.

- Customer Reviews: Customer service is average, based on the majority of reviews left by customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Local Agents

Pros

- Local Agents: Most Shipt customers should have access to local support. Learn more in our review of Farmers.

- Multi-Policy Discounts: Shipt customers can get lower rates if they bundle at Farmers.

- Good Driver Discount: Shipt drivers can lower rates by driving safely.

Cons

- Claims Processing: Unhappy customers say service is average and processing is slow.

- Higher Rates: Compared to the market average, Farmers’ rates are a little higher.

Shipt Requirements for Drivers

Does Shipt provide drivers with Shipt auto insurance? To be a Shipt driver, you must find your own car insurance.

Some delivery companies provide their drivers with proper auto insurance coverage when they’re working, but there is no option for Shipt car insurance coverage.Dani Best Licensed Insurance Producer

Instead, Shipt requires its drivers to maintain the proper levels of coverage based on each state’s laws. In addition, Shipt has a few more Shipt driver requirements for its delivery drivers. To work for Shipt, drivers must:

- Be at least 18 years old.

- Have a U.S. driver’s license.

- Have a vehicle that is 1997 or newer.

- Be able to lift up to 40 pounds.

- Be knowledgeable about the produce selection available in a supermarket.

- Have a smartphone.

Shipt does not specify the type of coverage a driver must have, so driving for the company necessitates having auto insurance coverage that meets your state’s minimum requirements (learn more: Minimum Auto Insurance Requirements by State). However, you should consider additional coverage to ensure you’re adequately protected if you’re ever in an accident.

Shipt Auto Insurance Costs

How much is Shipt car insurance? The amount you will pay for auto insurance as a Shipt driver depends on several factors, including:

- Age

- Gender

- Marital status

- Car make and model

- Credit score

- Driving history

- Coverage types

- ZIP code

If you only plan to carry your state’s minimum liability coverage when you drive for Shipt, your rates will probably be pretty low. Check the table below to see your state’s average cost for liability coverage.

Liability Auto Insurance Monthly Rates by State

State Rates

Alabama $25

Alaska $26

Arizona $26

Arkansas $28

California $29

Colorado $30

Connecticut $30

Delaware $31

Florida $32

Georgia $33

Hawaii $33

Idaho $34

Illinois $34

Indiana $34

Iowa $35

Kansas $36

Kentucky $36

Louisiana $36

Maine $38

Maryland $38

Massachusetts $39

Michigan $39

Minnesota $39

Mississippi $42

Missouri $42

Montana $42

Nebraska $43

Nevada $43

New Hampshire $45

New Jersey $45

New Mexico $45

New York $46

North Carolina $46

North Dakota $46

Ohio $47

Oklahoma $50

Oregon $51

Pennsylvania $51

Rhode Island $51

South Carolina $53

South Dakota $55

Tennessee $57

Texas $60

Utah $66

Vermont $67

Virginia $68

Washington $68

Washington, D.C. $31

West Virginia $69

Wisconsin $74

Wyoming $75

U.S. Average $30

As you probably already know, you will pay more for car insurance if you add coverages to your liability policy. However, adding coverage is the only way you’ll be fully covered if you’re in a wreck. You can get quotes from State Farm and other top companies to determine who has the best rate on extra coverages.

The average costs of different coverages are below.

Shipt Driver Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Full coverage will give the best protection as a Shipt driver (learn more: What is full coverage auto insurance?).

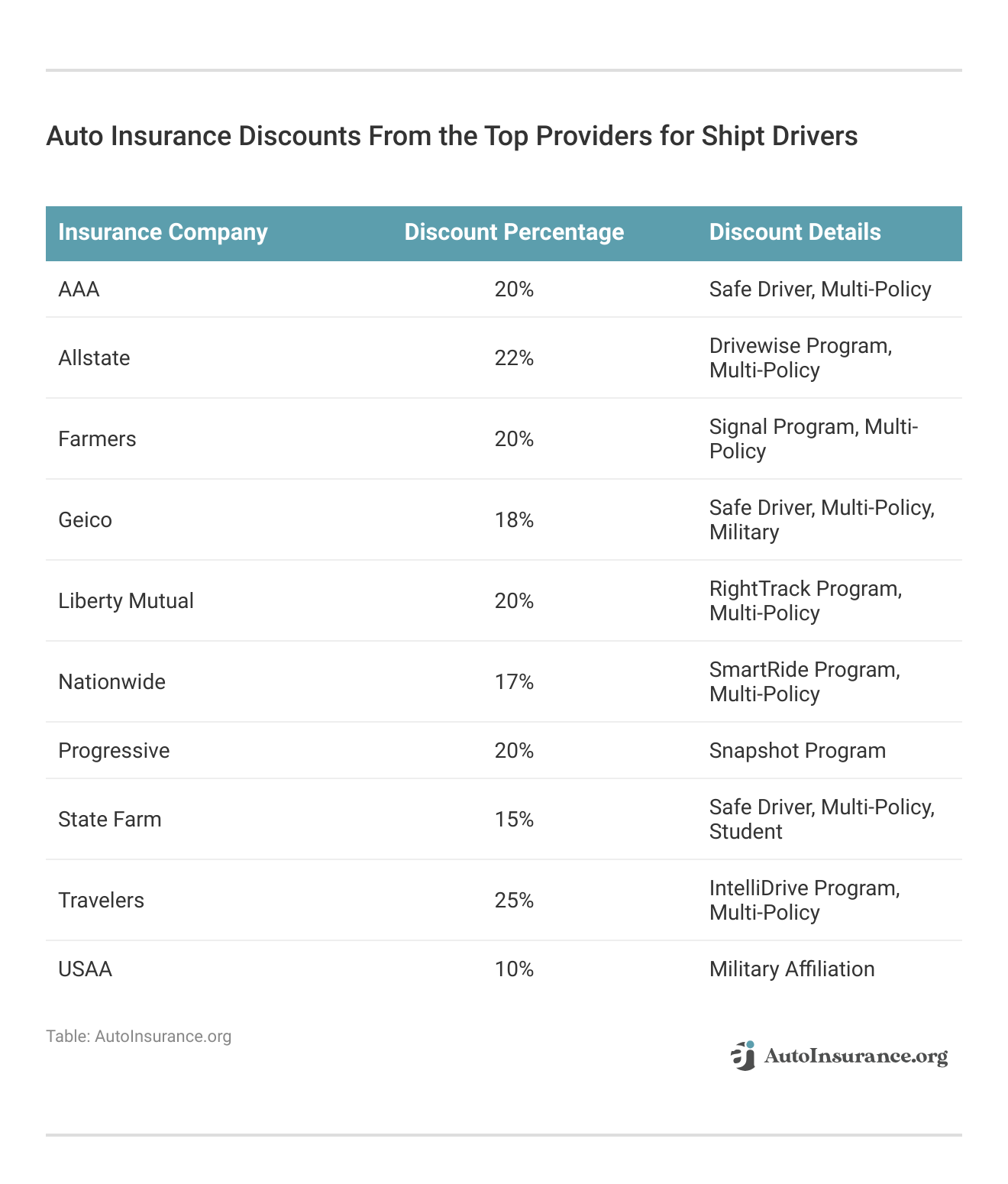

How to Save on Shipt Insurance

One of the ways to save on your Shipt coverage is to apply for discounts to help lower delivery driver insurance costs.

The more discounts you can qualify for, the better.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Shipt Auto Insurance Coverage

How much liability insurance do I need for Shipt? There is no federal law concerning liability coverage for drivers. Instead, the minimum car insurance required in each state varies. Depending on where you live, you may need specific property damage insurance and bodily injury coverage on your vehicle. The table below shows each state’s requirements for car insurance.

Liability Auto Insurance Requirements by State

State Coverages Limits

Alabama Bodily injury & property damage liablity 25/50/25

Alaska Bodily injury & property damage liablity 50/100/25

Arizona Bodily injury & property damage liablity 15/30/10

Arkansas Bodily injury, property damage liablity, & personal injury protection 25/50/25

California Bodily injury & property damage liablity 15/30/5

Colorado Bodily injury & property damage liablity 25/50/15

Connecticut Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/20

Delaware Bodily injury, property damage liablity, & personal injury protection 25/50/10

Florida Property damage liablity, & personal injury protection 10/20/10

Georgia Bodily injury & property damage liablity 25/50/25

Hawaii Bodily injury, property damage liablity, & personal injury protection 20/40/10

Idaho Bodily injury & property damage liablity 25/50/15

Illinois Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/20

Indiana Bodily injury & property damage liablity 25/50/25

Iowa Bodily injury & property damage liablity 20/40/15

Kansas Bodily injury, property damage liablity, & personal injury protection 25/50/25

Kentucky Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/25

Louisiana Bodily injury & property damage liablity 15/30/25

Maine Bodily injury, property damage liablity, uninsured motorist/underinsured motorist, & MedPay 50/100/25

Maryland Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 30/60/15

Massachusetts Bodily injury, property damage liablity, & personal injury protection 20/40/5

Michigan Bodily injury, property damage liablity, & personal injury protection 20/40/10

Minnesota Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 30/60/10

Mississippi Bodily injury & property damage liablity 25/50/25

Missouri Bodily injury, property damage liablity, & Uninsured Motorist 25/50/25

Montana Bodily injury & property damage liablity 25/50/20

Nebraska Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

Nevada Bodily injury & property damage liablity 25/50/20

New Hampshire Financial responsibility (None required)

25/50/25

New Jersey Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 15/30/5

New Mexico Bodily injury & property damage liablity 25/50/10

New York Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/10

North Carolina Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 30/60/25

North Dakota Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/25

Ohio Bodily injury & property damage liablity 25/50/25

Oklahoma Bodily injury & property damage liablity 25/50/25

Oregon Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/20

Pennsylvania Bodily injury, property damage liablity, & personal injury protection 15/30/5

Rhode Island Bodily injury & property damage liablity 25/50/25

South Carolina Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

South Dakota Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

Tennessee Bodily injury & property damage liablity 25/50/15

Texas Bodily injury, property damage liablity, & personal injury protection 30/60/25

Utah Bodily injury, property damage liablity, & personal injury protection 25/65/15

Vermont Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/10

Virginia Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/20

Washington Bodily injury & property damage liablity 25/50/10

Washington, D.C. Bodily injury, property damage liablity, & Uninsured Motorist 25/50/10

West Virginia Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

Wisconsin Bodily injury, property damage liablity, uninsured motorist, & MedPay 25/50/10

Wyoming Bodily injury & property damage liablity 25/50/20

So, if you live in Delaware, you will need to carry $25,000 in bodily injury liability per person, $50,000 in bodily injury liability per accident, and $10,000 in property damage.

But if you compare Delaware’s requirements to the New Jersey minimum auto insurance requirements, you’ll notice a difference in coverage limits. So you must pay attention to your state’s requirements to ensure you have the coverage you need.

Other Shipt Insurance Coverages

Should I carry more than liability as a Shipt driver? Shipt does not require that you carry more than your state’s minimum liability requirements, but you should consider adding coverages to your policy for added protection when working at Shipt.

There are many different types of auto insurance coverage. The most common way drivers add coverage is to purchase a full coverage policy, essentially adding collision and comprehensive insurance to a liability policy. For example, full coverage auto insurance will protect you and your vehicle if you’re in an accident or if your car is damaged while parked.

Collision car insurance comes into play when you’re in a wreck. Collision pays for the necessary repairs following an accident, while liability coverage only covers damage to other people and their vehicles.

Unlike collision coverage, comprehensive insurance will cover your vehicle if it’s damaged in a non-accident-related event.

Some of the most common incidents covered under a comprehensive policy include:

- Damage caused by animals

- Flood damage

- Hail damage

- Fire damage

- A broken or damaged windshield

- Vandalism

- Theft

A full coverage policy will help any driver stay protected on the road, but your insurance policy may have stipulations concerning coverage when driving for work purposes. If you find a personal insurance policy will not offer you proper coverage as a Shipt driver, you may want to pursue commercial auto insurance.

Shipt Commerical Insurance

Do Shipt drivers need commercial car insurance? Commercial auto insurance will cover you when driving a car for work purposes. If you drive your vehicle and primarily work part-time rather than full-time, you may be able to purchase a business use add-on and save money on commercial coverage.

Since there is no option for Shipt commercial car insurance, you’ll need to speak with your car insurance company to see what coverage you need as a delivery driver.

Auto insurance providers often see the business use of a vehicle as more of a risk than someone using their vehicle for personal use. Because of this, your insurance company may require you to purchase a commercial policy.

Commercial auto insurance can cost a lot more than a personal insurance policy, so you should ensure you need the coverage before purchasing it. Speak with your insurance provider if you have any questions.

Shipt Auto Insurance: The Bottom Line

As a Shipt driver, you must carry your state’s minimum liability requirements for coverage. Shipt does not offer car insurance, so you’ll need to purchase a policy on your own. Though Shipt only requires liability, you may want to purchase additional coverage to make sure you’re protected (learn more: How much car insurance do I need?).

For example, you can get a full coverage policy on your car, but this coverage may not extend to the business use of your vehicle.

Another option you may want to consider is commercial coverage. Speak to your insurance provider to see if you can include a business use add-on to your existing policy. In addition, you can shop online and compare quotes from multiple companies to ensure you get the best policy at the lowest price.

Frequently Asked Questions

Does Shipt provide drivers with Shipt auto insurance?

No, Shipt does not provide auto insurance coverage for its drivers. Shipt drivers are required to maintain the proper levels of coverage based on their state’s laws.

How much liability insurance do I need for Shipt?

The minimum liability insurance required varies by state. Each state has its own requirements for bodily injury liability per person, bodily injury liability per accident, and property damage liability. It is important to check your state’s requirements to ensure you have the necessary coverage.

How much is Shipt car insurance?

The cost of car insurance for Shipt drivers depends on several factors, including the driver’s occupation, location, driving history, and the coverage options selected (learn more: Does your job affect auto insurance rates?). Rates for liability coverage may be lower if you only carry the state’s minimum requirements. Shop for car insurance today by entering your ZIP into our free tool.

Should I carry more than liability as a Shipt driver?

While Shipt does not require drivers to carry more than the state’s minimum liability requirements, it is recommended to consider additional coverage for added protection. This may include collision and comprehensive coverage to ensure you are fully covered in case of an accident or damage to your vehicle.

Do Shipt drivers need commercial car insurance?

Shipt does not offer commercial car insurance. If you primarily use your vehicle for work purposes as a Shipt driver, you may need to speak with your car insurance company to determine if you require commercial coverage. Some insurance companies may require drivers to purchase a commercial policy for business use of their vehicles.

How old do you have to be to do Shipt?

The Shipt age requirement is 18. Drivers must also meet Shipt car requirements by having a reliable vehicle. Having a reliable, safe car will also reduce auto insurance rates (learn more: Which cars have the lowest auto insurance premiums?).

How much do Shipt drivers make?

How much you make with Shipt will depend on how many deliveries you make, the cost of gas used during the deliveries, and other factors.

Can you do Shipt without a car?

No, Shipt requires drivers to have a car to work for the company. In some cases, you may be able to use someone else’s car with permissive use (read more: Can you drive a car if your name is not on the insurance?).

How do you work for Shipt?

You will need to apply online to Shipt and be approved.

Is there Shipt health insurance?

While Shipt doesn’t have its own health insurance, drivers can get discounts on health insurance by purchasing it through Shipt.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.