Best Auto Insurance After a DUI in Florida (Top 9 Companies for 2025)

Dairyland, The Hartford, and USAA offer the best auto insurance after a DUI in Florida. DUI insurance costs $148/month with Dairyland, but high-risk drivers can save with low mileage and membership discounts. USAA has the cheapest DUI auto insurance in Florida at $28/month, but it's only for military members.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

175 reviews

175 reviewsCompany Facts

Full Coverage After a DUI in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

175 reviews

175 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage After a DUI in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews

Company Facts

Full Coverage After a DUI in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Our top picks for the best auto insurance after a DUI in Florida are Dairyland, The Hartford, and USAA, offering the most competitive comprehensive auto insurance rates.

Dairyland is more expensive but offers group discounts to lower rates, including 11% off for government employees and 15% for low-mileage drivers.

Our Top 10 Company Picks: Best Auto Insurance in Florida After a DUI

Company Rank Low-Mileage Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Group Discounts Dairyland

#2 18% A+ Customer Service The Hartford

#3 20% A++ Military Benefits USAA

#4 14% A Loyalty Rewards American Family

#5 19% A+ Vanishing Deductibles Nationwide

#6 13% A+ Infrequent Drivers Allstate

#7 17% A++ Online Tools Geico

#8 16% A Flexible Payments Safeco

#9 12% A++ Coverage Options Travelers

We will delve into the key factors influencing insurance premiums for drivers with a DUI, including state regulations, individual driving records, and the variety of discounts available. Understanding these elements is crucial for securing the best possible rates and ensuring adequate coverage.

Get the best DUI car insurance — enter your ZIP code to shop for coverage from the top insurers.

- Dairyland offers high-risk auto insurance in Florida after a DUI for $148 monthly

- USAA has the cheapest car insurance after a DUI for $28 per month

- DUI drivers are required to carry SR-22 or FR-44 insurance in Florida

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Dairyland: Top Overall Pick

Pros

- Group Discounts: Explore our Dairyland auto insurance review to see which discounts you qualify for as a high-risk driver.

- Flexible Payment Options: Provides flexible payment plans tailored for high-risk drivers in Florida after a DUI.

- Specialized Coverage: Focuses on comprehensive auto insurance specifically designed for drivers in Florida after a DUI.

Cons

- Higher Premiums: Generally higher premiums compared to standard policies in Florida after a DUI.

- Limited Discounts: Fewer discount opportunities are available for DUI drivers in Florida.

- Coverage Variability: Coverage options may vary widely based on individual circumstances in Florida after a DUI.

#2 – The Hartford: Best for Customer Service

Pros

- Competitive Rates: According to our The Hartford auto insurance review, it offers competitive rates for Florida drivers after a DUI, helping to manage costs.

- Customer Service: Known for reliable customer service and support for drivers in Florida after a DUI.

- Comprehensive Policies: Provides comprehensive auto insurance policies tailored for those in Florida after a DUI.

Cons

- Fewer Discounts: Limited discount programs specifically for DUI drivers in Florida.

- Premium Increases: Possible premium increases upon policy renewal for DUI drivers in Florida.

#3 – USAA: Best for Military Benefits

Pros

- Military Benefits: Provides excellent benefits and discounts for military members in Florida after a DUI.

- Affordable Rates: Visit our USAA auto insurance review to learn about its competitive rates for high-risk drivers in Florida after a DUI.

- High Customer Satisfaction: Consistently high ratings for customer satisfaction among DUI drivers in Florida.

Cons

- Eligibility Restrictions: Only available to military members and their families in Florida after a DUI.

- Limited Availability: Coverage options may be limited based on individual circumstances in Florida after a DUI.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Discount Programs

Pros

- Discounts Available: See our American Family auto insurance review to understand how it offers various discounts that can benefit DUI drivers in Florida.

- Reliable Coverage: Provides reliable coverage options tailored for DUI drivers in Florida.

- Customer Support: Known for strong customer support for those in Florida after a DUI.

Cons

- Higher Rates: May face higher rates compared to other insurance providers in Florida after a DUI.

- Premium Increases: Possible premium increases upon renewal for DUI drivers in Florida.

#5 – Nationwide: Best for Accident-Free Drivers

Pros

- Wide Range of Discounts: Offers numerous discounts beneficial for DUI drivers in Florida.

- Vanishing Deductibles: DUI drivers who avoid accidents or claims are rewarded with shrinking deductibles.

- Customer Service: In our Nationwide auto insurance review, find out about its good customer service ratings for high-risk drivers in Florida.

Cons

- Higher Premiums: Higher premiums for DUI drivers in Florida compared to drivers with clean records.

- Limited Availability: There may be limited availability of certain coverage options in Florida after a DUI.

#6 – Allstate: Best for Low-Mileage Drivers

Pros

- Discount Programs: Various discount programs are available for DUI drivers in Florida. Read more in our Allstate Milewise review.

- Comprehensive Coverage: Offers comprehensive coverage tailored for high-risk drivers in Florida.

- Reliable Support: Take a look at our Allstate auto insurance review for insights into its strong customer support for those in Florida after a DUI.

Cons

- Higher Costs: Generally higher costs for DUI drivers in Florida.

- Limited Flexibility: Less flexibility in payment options for DUI drivers in Florida.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Online Management

Pros

- User-Friendly Website: Easy to manage policies and claims online for DUI drivers in Florida.

- Affordable Rates: Based on our Geico auto insurance review, DUI insurance costs start at $65 per month in Florida.

- Discount Opportunities: Numerous discount opportunities are available for high-risk drivers in Florida.

Cons

- Coverage Limits: Limited coverage options for high-risk drivers in Florida.

- Premium Increases: Possible premium increases upon renewal for DUI drivers in Florida.

#8 – Safeco: Best for Flexible Payment Plans

Pros

- Competitive Rates: Explore our Safeco auto insurance review to learn how it offers competitive rates for DUI drivers in Florida.

- Discounts Available: Provides various discounts beneficial for high-risk drivers in Florida.

- Strong Customer Support: Known for strong customer support for DUI drivers in Florida.

Cons

- Limited Availability: Coverage options may be limited for DUI drivers in Florida.

- Rate Increases: Possible rate increases upon policy renewal for DUI drivers in Florida.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Provides comprehensive coverage options for DUI drivers in Florida.

- Discount Opportunities: Offers discounts beneficial for high-risk drivers in Florida.

- Reliable Support: Delve into our Travelers auto insurance review to explore its strong customer support for those in Florida after a DUI.

Cons

- Limited Discounts: Fewer discount opportunities specifically for DUI drivers in Florida.

- Premium Increases: Potential premium increases upon renewal for DUI drivers in Florida.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Costs of Auto Insurance After a DUI in Florida

In Florida, high-risk auto insurance rates for drivers with a DUI differ widely. Allstate’s rates are $77 per month for minimum and $231 per month for full coverage, while American Family charges $105 and $312 per month, respectively. Dairyland’s minimum and full coverage rates are $148 and $410 per month.

Florida DUI Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $77 | $231 | |

| $105 | $312 | |

| $148 | $410 | |

| $65 | $194 | |

| $72 | $215 |

| $47 | $122 | |

| $65 | $167 |

| $116 | $347 | |

| $28 | $85 |

Geico charges a minimum coverage of $65 per month and a full coverage of $194 per month, while Nationwide rates range between $72 and $215 per month. Finding the right coverage at an affordable rate requires careful comparison.

An individual's driving record heavily impacts premiums. A DUI marks the driver as high-risk, often leading to substantial rate increases.Laura Berry Former Licensed Insurance Producer

Additionally, the costs of DUI car insurance in Florida are much higher because of strict DUI laws. Insurance companies see DUI drivers as high-risk, which leads to expensive rates. Shopping around for auto insurance quotes for a DUI in Florida can help find better deals.

The best car insurance for a DUI depends on coverage and affordability. Some companies, like Dairyland Insurance in Florida, offer policies designed for high-risk drivers, making it easier for people with a DUI to get insured.

Read More: What is a DUI?

Factors Influencing Auto Insurance Rates After a DUI in Florida

Several factors affect auto insurance rates in Florida after a DUI. Knowing these factors can help drivers find better coverage and lower costs.

-

- State Rules: Florida requires DUI drivers to have FR-44 insurance with higher coverage limits.

- Choosing the Right Company: Shopping around can help find the best car insurance for someone with a DUI.

- FR-44 Requirement: Some companies offer the best insurance after a DUI, providing special plans for high-risk drivers.

- Discounts: Taking a defensive driving course or adding anti-theft devices can help lower insurance costs.

- Finding Affordable Rates: Drivers looking for cheap DUI insurance should check companies that offer discounts.

- Company Reputation: Dairyland offers SR-22 insurance in Florida and provides the best car insurance for DUI offenders, ensuring flexible coverage for high-risk drivers.

Obtaining car insurance with a DUI in Florida is costly, but being aware of these factors can enable drivers to acquire the best insurance at an affordable rate.

Quote comparison, discounts, and company selection can be a huge help in controlling expenses and remaining legally insured.

Read more: What are SR-22 and FR-44 insurance in Florida?

What to Look for in DUI Auto Insurance Policies in Florida

If you have a DUI in Florida, finding the right coverage can be hard, but knowing what to look for can help. You need to make sure you get the right insurance for a DUI in Florida that meets state requirements.

Florida law requires SR-22 auto insurance or FR-44 for high-risk drivers. These policies have higher coverage limits, so shopping around can help you find a better rate. If you need proof of filing, you may need to check your SR-22 case number lookup in Florida to stay compliant.

Many people ask, how long does a DUI stay on your record in Florida? The answer is 75 years, meaning it affects your insurance rates for a long time.

To save money, compare quotes from the best auto insurance providers for a DUI like Geico, Progressive, and State Farm. Discounts and safe driving can help lower your costs over time.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

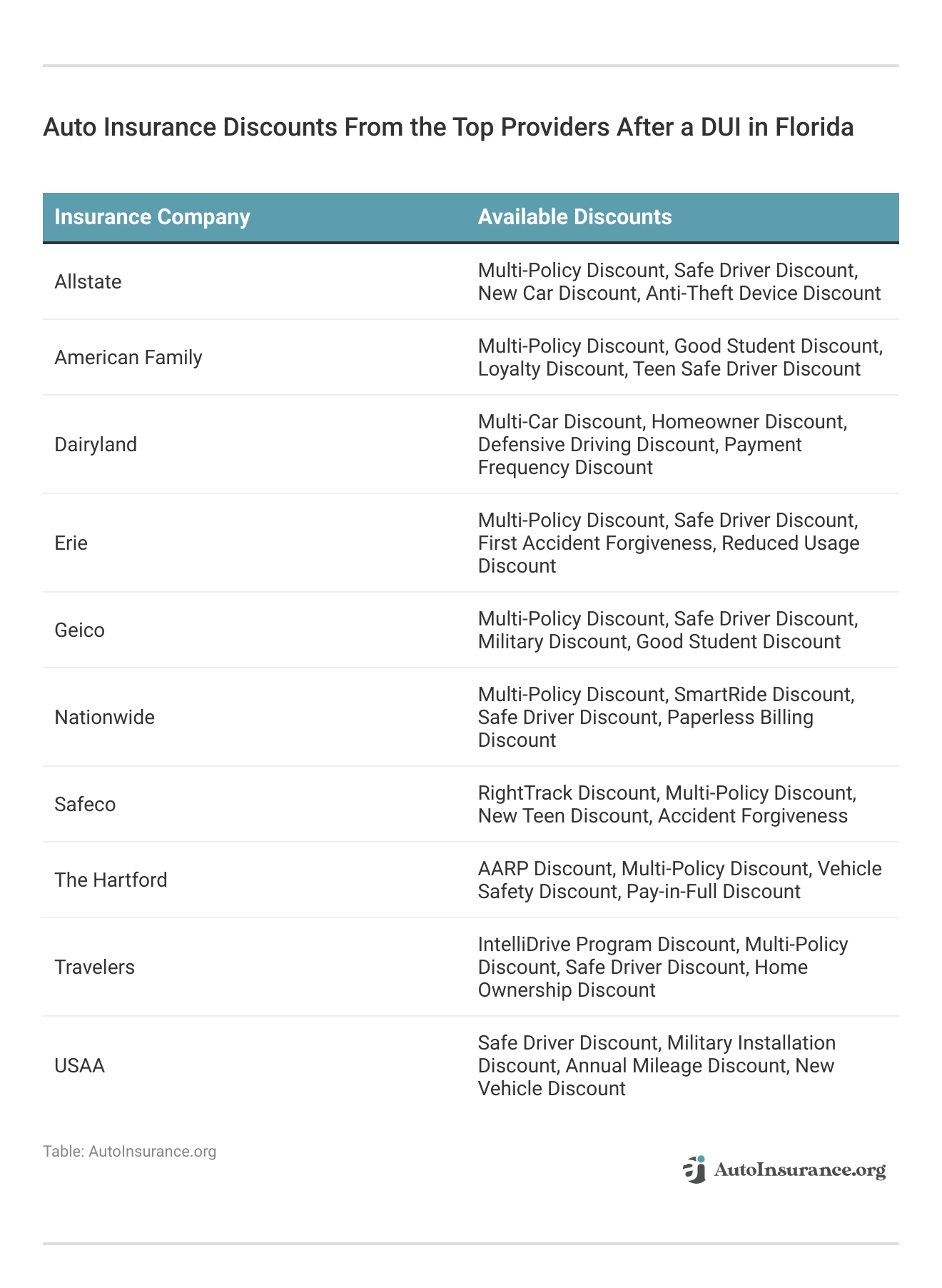

Auto Insurance Discounts for DUI Drivers in Florida

Getting cheap auto insurance after a DUI can be difficult, but some companies offer discounts to help reduce costs. Many insurers providing the best DUI car insurance in Florida offer savings for bundling policies, maintaining a safe driving record, being a good student, military service, and completing a defensive driving course.

Finding cheap car insurance for DUI drivers is challenging because a DUI raises insurance rates. However, taking a defensive driving course can help lower costs and may qualify drivers for the cheapest DUI car insurance available.

Keeping continuous coverage without gaps can also lead to loyalty discounts. Some insurance providers even offer lower rates for good credit scores. When searching for Florida car insurance after a DUI, comparing multiple companies can help find the best deal.

data-media-max-width=”560″>

Right coverages to maximizing discounts, there’s a lot you can do to lower your auto rate. Click on link from Dairyland for more! https://t.co/FWaExaSllb #autoinsurance #insuranceagent #coverage pic.twitter.com/be1b5nvFdM

— MarketPlace 4 Insurance Agency (@4_starkville) April 20, 2023

A common question is, “Will car insurance pay for a car totaled in a DUI accident in Florida?” If you caused the accident, most insurers won’t cover damages, especially if your policy excludes DUI-related claims.

Our list of the best high-risk car insurance companies in Florida provides discounts such as multi-policy, safe driver, good student, military, and defensive driving. Exploring these discounts can help lower insurance costs effectively.

Read more: 10 Cheapest Auto Insurance Companies

Other Ways to Lower DUI Auto Insurance Rates in Florida

Dealing with high insurance costs after a DUI in Florida can be tough, but there are ways to save money. Here are some tips to lower your rates and make DUI insurance in Tampa, Florida, or anywhere in the state more affordable:

- Take a Defensive Driving Course: Many insurers offer discounts if you complete a state-approved course. This can help lower the average car insurance in Florida after a DUI.

- Install Safety Features: Adding anti-theft devices and other safety features can qualify you for discounts.

- Maintain a Clean Driving Record: Avoid more violations, especially if you’re facing a 3rd DUI in Florida, which can lead to even higher rates.

- Opt for a Higher Deductible: A higher deductible can lower your monthly payment, but make sure you can afford it if needed.

- Bundle Policies: Combining auto and home insurance can help you get multi-policy discounts.

Each provider treats DUI drivers in Florida differently, and comparing rates can help you find the best match for your budget.

Compare quotes often to find the best auto insurance companies for a DUI and check for the recommended auto insurance coverage in Florida to meet state requirements while keeping costs down.

Learn More: How Auto Insurance Companies Check Driving Records

Case Studies: Auto Insurance After a DUI in Florida

Dealing with high auto insurance rates after a DUI can be tough, but there are ways to save money. These case studies show how different strategies helped drivers find affordable insurance after a DUI.

- Case Study #1 — Competitive Rates: John from Miami got a DUI last year, and his insurance rates went way up. He shopped around and found a policy for $148 per month with Dairyland, much cheaper than his old rate. He saved money by choosing one of the DUI-friendly insurance providers and taking advantage of discounts.

- Case Study #2—Customer Service: Sarah from Orlando wanted good customer service after her DUI. She picked The Hartford, where agents helped her understand her options and made it easy to get FR-44 insurance in Florida.

- Case Study #3 — Military Benefits: Mike, a retired military officer in Tampa, required insurance for a DUI in Florida. He went with USAA, which gave him lower rates and extra support.

Shopping around and using discounts can help find the best DUI auto insurance at a lower cost.

Dairyland is the best choice for auto insurance in Florida after a DUI, with customer review ratings of 92% satisfaction.Michelle Robbins Licensed Insurance Agent

Learn how to lower your auto insurance rates to find more strategies that will help you find cheaper DUI insurance in Florida.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Where to Find the Best Auto Insurance in Florida After a DUI

Dairyland, The Hartford, and USAA are some of the top choices for the best car insurance after a DUI in Florida. Dairyland is the most expensive at $148 per month, while USAA offers the cheapest DUI insurance in Florida at just $28 per month. That’s why it’s important to compare different policies to find the best deal.

The cost of car insurance after a DUI in Florida depends on factors like age and driving history. Since high-risk insurance is more expensive, finding a company that specializes in DUI insurance in Florida can help lower costs.

Maintaining a clean driving record post-DUI and demonstrating responsible behavior can gradually reduce insurance costs over time.Schimri Yoyo Licensed Agent & Financial Advisor

Florida laws determine how long a DUI affects your insurance, which can be several years. Choosing the right provider and taking defensive driving courses may help reduce premiums over time.

Insurance companies also consider the type of vehicle you drive. Some cars are classified as top DUI vehicles, which can lead to higher rates. Comparing coverage options and bundling policies can also help save money.

What to Expect From Auto Insurance Companies After a DUI in Florida

After a DUI in Florida, your insurance rates will go up, and some companies may even cancel your policy. Finding insurance for drivers with a DUI can be tough, but some providers specialize in helping high-risk drivers.

A common question is, how much is car insurance after a DUI in Florida? In most cases, your rates can double or even triple, depending on your driving history and the insurance company. Florida also requires an FR-44 filing, which means higher liability coverage.

Some companies offer options for high-risk drivers. Geico FR-44 insurance in Florida meets state requirements, making it a popular choice. AARP car insurance in Florida may also offer coverage for older drivers looking for better rates.

To save money, compare quotes, ask about discounts, and keep a clean driving record. Over time, safe driving can help lower your insurance costs. Explore the types of auto insurance coverage to find the best policy after a DUI in Florida.

See if you’re getting the best deal on car insurance by entering your ZIP code.

Frequently Asked Questions

How much will my insurance go up after DUI in Florida?

After a DUI in Florida, your insurance rates can increase significantly. On average, drivers may see their premiums rise by 50% to 100% or more, depending on their insurance provider and driving history.

What is DUI insurance called in Florida?

In Florida, DUI insurance is often referred to as SR-22 insurance. This form of coverage is required for drivers who have been convicted of a DUI to reinstate their driving privileges.

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

How long do you need SR-22 insurance after a DUI in Florida?

You typically need FR-44 insurance in Florida for three years after a DUI conviction. This requirement ensures that you carry the minimum liability coverage mandated by the state.

What is SR-44 insurance in Florida?

SR-44 auto insurance in Florida is similar to SR-22 insurance but is only required for drivers who have been convicted of more severe offenses, such as multiple DUIs. SR-44 insurance mandates higher liability coverage limits than SR22.

Does auto insurance cover DUI accidents in Florida?

Car insurance generally covers DUI accidents in Florida, but it can depend on the terms of your policy. However, insurance companies may choose to non-renew or cancel your policy following a DUI accident, and you could face increased premiums.

How does a DUI affect your life in Florida?

A DUI in Florida can have severe repercussions, including higher car insurance premiums, potential job loss, difficulty finding employment, and personal and financial stress. It may also lead to legal consequences such as fines, license suspension, and mandatory rehabilitation programs.

How long does a DUI stay on your insurance in Florida?

A DUI can impact your insurance premiums for up to ten years in Florida. Insurance companies may consider this violation when calculating your rates during this period.

What is the highest cost of a DUI in Florida?

The highest cost of a DUI in Florida can exceed $20,000 when considering fines, legal fees, increased insurance rates, DUI school, and other associated expenses. The long-term financial impact can be substantial.

Do you automatically lose your license with a DUI in Florida?

Yes, you automatically lose your license with a DUI in Florida. The length of the suspension can vary based on the specifics of the offense, but it typically starts with a minimum of six months for a first-time DUI. For more details, learn how a suspended license affects auto insurance rates.

Can you get a DUI removed from your record in Florida?

It is challenging to get a DUI removed from your record in Florida. While expungement is possible in some cases, DUIs are generally not eligible for removal from criminal records, making it essential to understand the long-term consequences.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.