Best Auto Insurance After a DUI in Texas (Top 9 Companies for 2025)

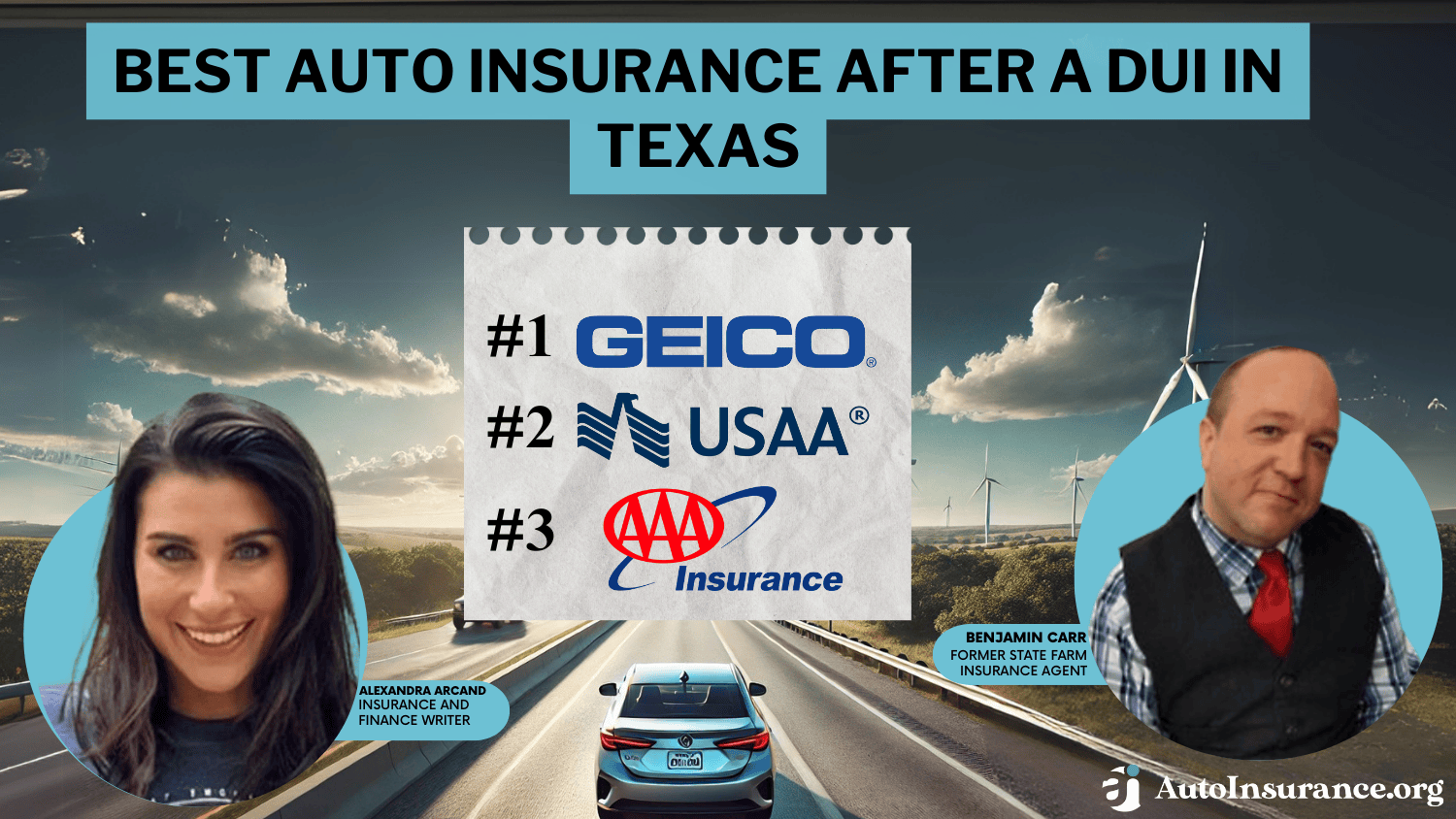

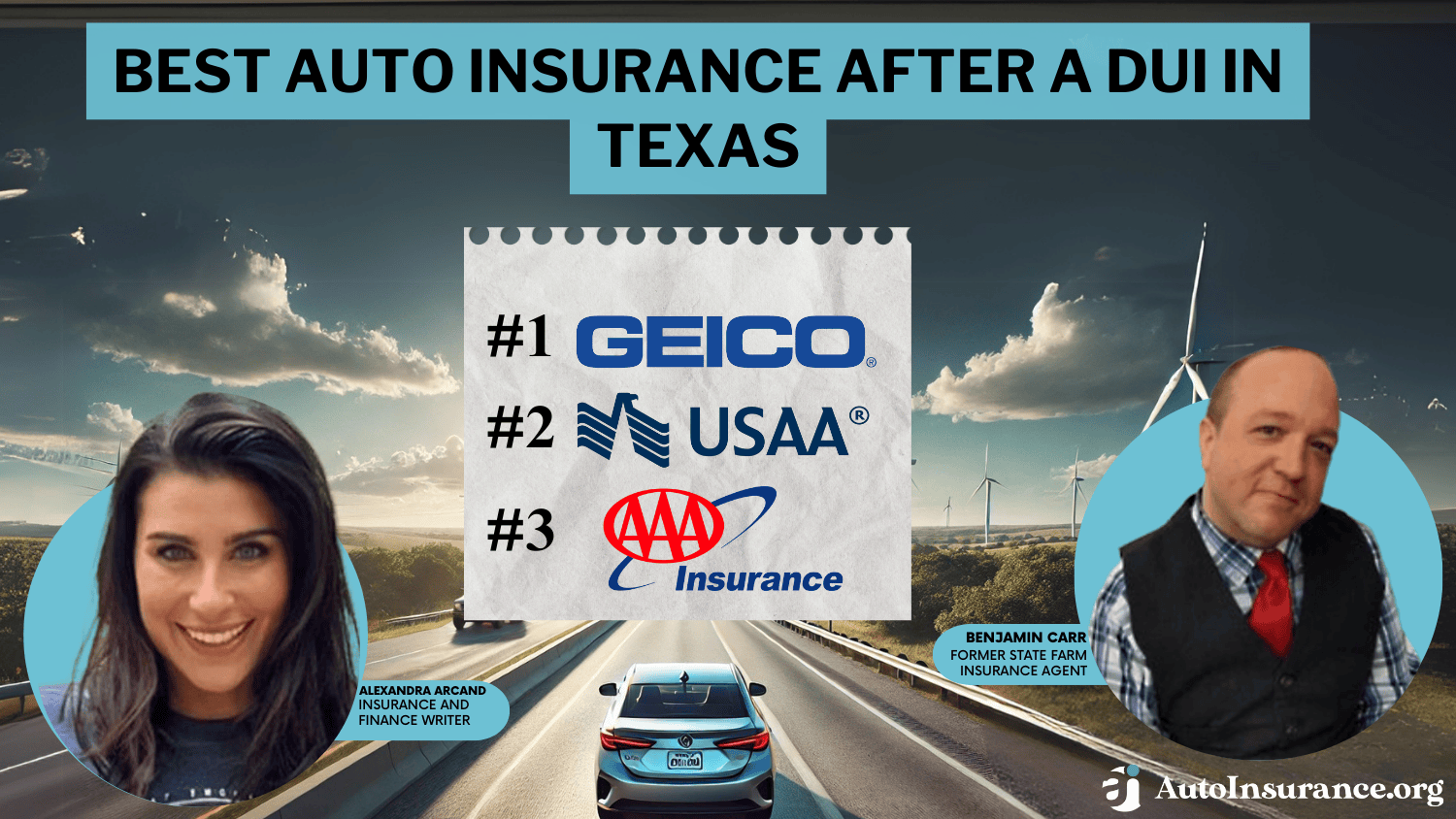

Geico, USAA, and AAA have the best auto insurance after a DUI in Texas. Geico is the top choice for Texas high-risk drivers with its easy online claims service, but USAA has the cheapest auto insurance after a DUI for military members at $34 a month. Use low-mileage discounts to get the best insurance for a DUI.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage After a DUI in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage After a DUI in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews

Get the best auto insurance after a DUI in Texas from Geico, USAA, or AAA. Affordable DUI auto insurance starts as low as $34 a month for military members.

These companies cater to high-risk drivers in Texas, offering add-on coverages and discounts unrelated to driving history. Geico has the best car insurance for DUI drivers online with a streamlined mobile app.

Our Top 9 Company Picks: Best Auto Insurance in Texas After a DUI

Company Rank Low Mileage Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A++ Online Tools Geico

#2 18% A++ Add-on Coverages USAA

#3 12% A Personalized Policies AAA

#4 10% A Multiple DUIs The General

#5 14% A+ Senior Discounts The Hartford

#6 17% A+ First-Responder Discount Dairyland

#7 16% A++ Safe Drivers Auto-Owners

#8 19% A+ Low Mileage Allstate

#9 11% A Family Plans Safeco

Start comparing Texas insurance companies that cover DUI drivers in our guide below. We explain how DUI/DWI insurance in Texas works and where to find the best auto insurance with a DUI.

Shopping for auto insurance? Enter your ZIP code into our free comparison tool to find affordable Texas insurance for DUI drivers.

- Geico is the top pick for the best auto insurance for DUIs in Texas

- USAA has cheap DUI insurance rates starting at $34 per month

- The best Texas DUI insurance companies offer comprehensive add-ons

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Strong Online Tools: The user-friendly website and mobile app make it easy for DUI drivers in Texas to manage their policies and access support.

- Policy Customization: Geico is the best insurance company if you have a DUI, with an extensive range of coverage options for Texas drivers to tailor their policies. Learn more in our Geico auto insurance review.

- Affordable Rates: Geico DUI insurance rates start as low as $45 monthly in most parts of Texas, making it the cheapest insurance for DUI drivers.

Cons

- Limited Local Presence: Geico doesn’t employ agents, which might disadvantage individuals seeking in-person assistance in Texas after a DUI.

- Limited Discounts for High-Risk Drivers: Geico may offer fewer discounts for drivers in some parts of Texas, making it hard to find cheap insurance quotes for DUI drivers.

#2 – USAA: Best for Add-on Coverages

Pros

- Extensive Add-on Coverages: With USAA auto insurance, DUI drivers in Texas can pick from add-ons like accident forgiveness and rental reimbursement. Read our USAA auto insurance review for a full list.

- Military-Focused Benefits: USAA provides specialized benefits and support for military families in Texas and has the cheapest insurance for DUI drivers in the military.

- Excellent Customer Service: USAA provides essential support services for high-risk drivers in Texas after a DUI, which can be vital when filing SR-22s.

Cons

- Military Eligibility Requirement: USAA auto insurance is generally available only to military families, which excludes many drivers in Texas after a DUI.

- Limited Physical Branches: USAA has fewer physical locations, potentially complicating face-to-face interactions for Texas drivers after a DUI.

#3 – AAA: Best for Personalized Policies

Pros

- Personalized Policies: Texas drivers can tailor their AAA Insurance DUI policy and customize coverage for individual needs. Find out more in our AAA auto insurance review.

- Variety of Add-ons: AAA provides a range of add-on coverages specifically designed for Texas drivers after a DUI, ensuring comprehensive protection.

- Trusted Customer Service: AAA is renowned for reliable and responsive customer service, which is beneficial for drivers in Texas who need ongoing support after a DUI.

Cons

- Membership Required: Texas drivers must be AAA members and pay annual membership fees to buy AAA auto insurance after a DUI.

- Limited Locations: Finding AAA insurance offices in Texas after a DUI can be tough if there are none in your city, especially for those who prefer local agents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – The General: Best for Multiple DUIs

Pros

- Non-Standard Policy Approval: The General specializes in DUI auto insurance for drivers who don’t qualify for coverage with standard Texas insurance companies. Learn about it in our The General auto insurance review.

- Flexible Payment Arrangements: Provides various payment plans that accommodate the budget needs of drivers in Texas after a DUI.

- Easy Online Quotes: A simplified online quote process allows drivers in Texas after a DUI to quickly compare and select insurance options.

Cons

- Basic Online Tools: The General’s online tools and app are less advanced than other Texas auto insurers, especially for those with a DUI.

- Expensive Rates: The General is the most expensive company on our list for auto insurance in Texas after a DUI.

#5 – The Hartford: Best for Seniors With DUIs

Pros

- AARP Affiliation: The Hartford’s affiliation with AARP offers exclusive benefits and discounts for older Texas drivers looking for cheap auto insurance with a DUI.

- Customizable Policies: Allows extensive customization, enabling Texas drivers after a DUI to choose specific coverages that suit their needs. Read more in our The Hartford auto insurance review.

- Lifetime Renewability: Offers policies with lifetime renewability, ensuring continuous coverage for Texas drivers after a DUI as long as premiums are paid.

Cons

- Senior Focus: The Hartford primarily targets older drivers, which might not be as suitable for younger drivers with DUIs in Texas.

- Complex Policy Structures: The extensive customization options can make policies complicated to understand and manage for Texas drivers after a DUI.

#6 – Chubb: Best for First-Responder Discount

Pros

- First-Responder Discount: Chubb offers a discount for first responders, which can be a significant benefit for eligible drivers in Texas after a DUI. For a complete list, read our Chubb auto insurance review.

- High-Value Asset Protection: Chubb offers extensive auto insurance coverage in Texas for both sports cars and luxury vehicles, including protection after a DUI.

- Efficient Claims Processing: It is highly regarded by customers in Texas after a DUI for handling high-risk auto insurance claims.

Cons

- Luxury Focus: Chubb often caters to high-end vehicles, which might not be ideal for all drivers in Texas after a DUI.

- Geographical Limitations: Chubb DUI insurance options may not be available in every part of Texas after a DUI.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Auto-Owners: Best for Safe Drivers

Pros

- Safe Driving Incentives: Provides substantial discounts for safe driving in Texas after a DUI, assisting in lowering insurance expenses. Read our Auto-Owners auto insurance review to learn what else is offered.

- Local Agent Network: Auto-Owners offers robust support for drivers in Texas after a DUI through its extensive network of local agents.

- Bundle Discounts: Offers discounts for combining auto insurance with other types of Texas insurance after a DUI.

Cons

- Limited Digital Presence: The company’s digital tools and online services may be less advanced, impacting convenience for tech-savvy drivers in Texas after a DUI.

- Availability Issues: Availability might be restricted in certain regions of Texas, which could limit insurance options for drivers after a DUI.

#8 – Allstate: Best for Low-Mileage Discounts

Pros

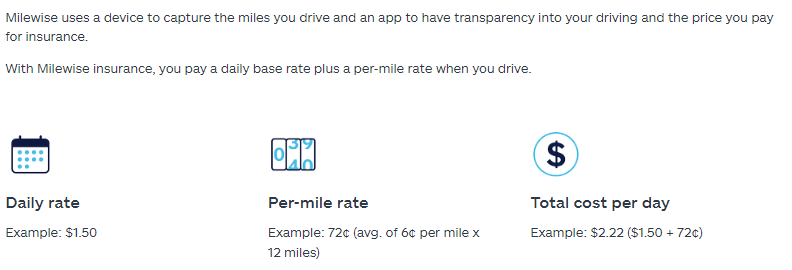

- Milewise Program: Allstate’s Milewise program only tracks your mileage, helping high-risk drivers in Texas get the best car insurance after a DUI without monitoring driving habits.

- Safety Discounts: Allstate offers discounts for safe driving that can help lower auto insurance expenses in Texas after a DUI. Find out more in our Allstate auto insurance review.

- Reputation for Service: Known for good customer service and support, which is beneficial for drivers in Texas after a DUI.

Cons

- High Renewal Rates: Allstate’s renewal rates are higher, impacting long-term affordability for drivers in Texas after a DUI.

- Complex Discount Structure: The discount structure might be complex, making it harder for drivers in Texas after a DUI to qualify for potential savings.

#9 – Safeco: Best for Family Plans

Pros

- Family Plans: Safeco offers family plans that can be cost-effective for households with multiple drivers in Texas after a DUI. Learn more in our Safeco auto insurance review.

- Comprehensive Mobile App: Provides a robust mobile app for easy policy management and claims filing, which is convenient for Texas drivers after a DUI.

- Flexible Payment Options: Offers flexible payment plans, which can help manage insurance costs in Texas after a DUI.

Cons

- Higher Family Plan Costs: Family plans might result in higher premiums overall, which could be a drawback for drivers in Texas who need cheap car insurance with a DUI.

- Customer Service Variability: Customer service experiences can vary widely by city, which might be inconsistent for drivers in Texas after a DUI.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Texas Auto Insurance Quotes With a DUI

The impact of a DUI on your insurance premiums is significant. Having a DUI on your record makes you a high-risk driver and insurance providers will increase rates.

If you have a DUI and need cheap high-risk auto insurance in Texas, start with these nine companies. This table provides a comparison of monthly auto insurance rates for drivers with a DUI in Texas, broken down by coverage level and insurance provider.

Texas DUI Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $57 | $148 |

| $120 | $323 | |

| $51 | $130 | |

| $148 | $410 | |

| $45 | $120 | |

| $47 | $122 | |

| $166 | $426 | |

| $65 | $167 |

| $34 | $92 |

Monthly minimum coverage rates with a DUI range from $34 with USAA to $166 with The General, while full coverage rates span from $92 per month with USAA to $426 monthly with The General.

Auto insurance for high-risk drivers in Texas is more expensive than average, with DUIs having the biggest increase. It’s important to know how auto insurance companies check driving records so you aren’t surprised by any sudden rate hikes.

Factors Impacting DUI Auto Insurance in Texas

After a DUI, securing affordable auto insurance in Texas will be challenging. A DUI conviction negatively impacts your driving record, making you a high-risk driver in the eyes of insurers, which leads to increased premiums.

To effectively manage high-risk auto insurance rates after a DUI, it’s essential to understand how insurance companies that accept DUI drivers price their coverage. Different Texas insurance companies have varying criteria for assessing DUI convictions. Some may penalize more severely than others, resulting in different rate increases.

Texas High-Risk Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | DUI | Reckless Driving | At-Fault Accident |

|---|---|---|---|---|

| $180 | $320 | $290 | $250 |

| $190 | $340 | $310 | $270 | |

| $170 | $310 | $280 | $240 | |

| $210 | $390 | $370 | $330 | |

| $160 | $300 | $270 | $230 | |

| $175 | $320 | $290 | $250 | |

| $220 | $400 | $380 | $350 | |

| $185 | $330 | $300 | $260 |

| $150 | $280 | $260 | $220 |

If you’re looking for a Texas no-DUI insurance reduction, you must have a clean driving record. Avoid driving drunk to save the most on car insurance — Geico and USAA have the cheapest rates for safe drivers. They have cheap car insurance for drivers with DUIs too, but rates nearly double after one conviction.

Insurance companies that will cover DUI drivers also consider other factors that could have a negative impact on your premiums depending on your age, coverage level, and where you live in Texas:

- Location: Local accident rates, crime rates, and traffic conditions influence how much you pay for Texas insurance after a DUI. Houston, TX auto insurance typically has the highest rates.

- Coverage Level: Choosing between minimum coverage and full coverage significantly affects Texas DUI insurance costs.

- Age and Gender: Texas auto insurance companies consider a driver’s age and gender when setting rates after a DUI, with young drivers and male drivers paying the most.

This table shows how drivers under 21 pay hundreds more for Texas car insurance after a DUI. Underage drivers caught drunk behind the wheel can also face additional penalties and fees. Experienced drivers over 40 see the smallest rate hikes.

Texas Auto Insurance Monthly Rates by Age, Gender & Driving Record

| Driver | Clean Record | DUI | Reckless Driving | At-Fault Accident |

|---|---|---|---|---|

| Age: 18 Female | $220 | $350 | $330 | $290 |

| Age: 18 Male | $250 | $400 | $380 | $340 |

| Age: 21 Female | $190 | $320 | $300 | $270 |

| Age: 21 Male | $210 | $350 | $320 | $290 |

| Age: 25 Female | $170 | $280 | $260 | $240 |

| Age: 25 Male | $180 | $300 | $280 | $260 |

| Age: 30 Female | $160 | $260 | $240 | $220 |

| Age: 30 Male | $165 | $270 | $250 | $230 |

| Age: 40 Female | $150 | $250 | $230 | $210 |

| Age: 40 Male | $155 | $260 | $240 | $220 |

| Age: 50 Female | $140 | $240 | $220 | $200 |

| Age: 50 Male | $145 | $250 | $230 | $210 |

| Age: 60 Female | $130 | $230 | $210 | $190 |

| Age: 60 Male | $135 | $240 | $220 | $200 |

| Age: 70 Female | $120 | $220 | $200 | $180 |

| Age: 70 Male | $125 | $230 | $210 | $190 |

Keep scrolling to learn how to save money on auto insurance after a DUI in Texas, including tips on finding insurers who specialize in discounts for high-risk drivers and utilizing pay-per-mile programs.

Saving Money on Texas Auto Insurance After a DUI

After a DUI conviction in Texas, several of the best auto insurance companies offer various discounts to help manage costs. Many insurers offer savings for completing safe-driving courses, installing anti-theft devices, or maintaining a clean driving record post-DUI.

Texas DUI Auto Insurance Discounts by Provider & Savings Amount

| Insurance Company | Anti-Theft | Auto-Pay | Bundling | Good Student | Pay-in-Full |

|---|---|---|---|---|---|

| 5% | 10% | 15% | 8% | 12% |

| 6% | 9% | 12% | 7% | 10% | |

| 5% | 10% | 14% | 9% | 11% | |

| 7% | 12% | 18% | 10% | 15% | |

| 5% | 9% | 12% | 7% | 10% | |

| 6% | 10% | 14% | 8% | 11% | |

| 8% | 13% | 20% | 11% | 16% | |

| 6% | 9% | 13% | 7% | 11% |

| 5% | 10% | 15% | 9% | 12% |

Each provider has its own range of discounts that DUI drivers can qualify for, including discounts for low mileage and bundling. Bundling policies has the biggest Texas DUI insurance reduction of 20% with The General and 18% with Dairyland.

Additionally, consider pay-as-you-go auto insurance in Texas that adjusts rates based on mileage rather than driving behavior. For instance, Allstate Milewise provides DUI-friendly auto insurance by charging a low daily rate plus a per-mile rate for cheaper coverage.

Allowing your insurance company to track your odometer can help you lower DUI auto insurance costs gradually as you work to maintain a clean driving record. Learn how in our Allstate Milewise review.

What is Geico DriveEasy, and how does it compare? Unlike Milewise, the Geico usage-based program tracks driving habits like speeding and hard braking. Our Geico DriveEasy review explains why some DUI drivers do not qualify. However, high-risk drivers with Geico can opt for higher deductibles to reduce premiums, but make sure you can afford it if you ever need to file a claim.

Look for insurers that specialize in high-risk coverage, and enroll in a defensive driving course, which might lead to discounts.Rick Musson Police Sergeant

Compare high-risk auto insurance quotes from multiple companies to find rates, discount programs, and deductibles that fit your budget. Maintaining a clean driving record to gradually lower your rates will help you save money on Texas DUI insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Lowering Texas Auto Insurance for DUI Drivers

Ready to find the best car insurance with a DUI? By examining these case studies and comparing the best auto insurance by drivers with different records, we hope you gain useful insights into how to use your own DUI insurance tricks to get affordable Texas high-risk auto insurance:

- Case Study #1 – Affordable Insurance After a DUI: Alex Johnson, a 32-year-old graphic designer with a DUI conviction, used comparison shopping and higher deductibles to reduce his Allstate monthly insurance premium from $250 to $120.

- Case Study #2 – Finding Personalized Coverage: Maria Sanchez, a 29-year-old school teacher with a DUI conviction from a year ago, found an affordable $148 monthly policy through AAA by emphasizing her improved driving habits.

- Case Study #3 – Lowering Insurance Costs After a DUI: Chris Brown, 45, IT Manager, reduced his insurance premium from $350 to $180 per month by enrolling in a usage-based program, bundling policies, and opting for low mileage discounts after a DUI conviction.

Remember, comparing quotes, exploring discounts, and customizing your policy are key strategies to securing the best insurance for DUI offenders.

Read More: Does a criminal record affect auto insurance rates?

Finding the Best Auto Insurance for DUI Drivers in Texas

Geico, USAA, and AAA offer competitive rates on the best auto insurance after a DUI in Texas. USAA is the best car insurance for DUI drivers in the military, while Geico is available to all drivers throughout Texas for an affordable $45 per month. AAA offers excellent benefits for its members, with free roadside assistance and highly-rated customer service.

We are proud to join @USDOT & @SecretaryPete as an ally in action. AAA’s mission is rooted in safety & now more than ever we are committed to reducing the number of people killed on our roadways. https://t.co/noG5WxYPKj

— AAA (@AAAnews) February 3, 2023

To reduce the cost of car insurance for DUI offenders in Texas, consider increasing your deductible, taking a defensive driving course, and maintaining a clean driving record. Compare quotes from the cheapest auto insurance companies, as pricing can vary.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code in our free quote tool.

Frequently Asked Questions

What is the best insurance after a DUI in Texas?

Geico, USAA, and AAA have the best insurance for DUI drivers in Texas.

What is the cheapest full coverage auto insurance in Texas after a DUI?

USAA and Geico have the cheapest full coverage car insurance after a DUI in Texas.

How long does a DUI affect your insurance in Texas?

A driving while intoxicated conviction can affect your car insurance in Texas for at least three years, although it may be much longer for multiple DUIs. Your rates going forward will depend on factors such as your age, gender, any other violations on your driving record, and which insurance company you use. Find cheaper insurance rates today by entering your ZIP code into our free quote comparison tool.

Do you lose your license immediately after a DUI in Texas?

Not immediately. You may still drive legally after an arrest. However, failure to request a hearing within 15 days will result in an automatic suspension. The suspension will go into effect approximately 40 days from the arrest date.

What happens if you get in an accident while drunk in Texas?

Penalties upon a conviction include up to 180 days in jail and a fine of up to $2,000.

Will my insurance cover DUI accidents in Texas?

Yes, Texas insurance companies may cover the costs associated with DUI accidents if you have collision auto insurance, but the drunk driver may face monetary consequences, especially if they caused the collision. Be mindful of potential financial repercussions.

Does a DUI show up on background checks in Texas?

A DUI stays on your criminal record permanently in Texas unless you can get it expunged or sealed. With a DUI conviction, anyone who runs a criminal background check on you will be able to see it.

Can you get rid of a DUI in Texas?

A DUI/DWI conviction cannot be expunged in Texas. However, a charge that did not result in a final conviction can be expunged in some circumstances. Charges that can’t be expunged may be eligible to be sealed under Texas’s DWI Second Chance Law.

What age is the zero-tolerance policy in Texas?

The zero-tolerance policy for DUI in Texas applies to drivers under the age of 21. Any detectable amount of alcohol in their system can lead to DUI charges.

Why is Texas auto insurance so high?

Texas auto insurance rates are higher than average due to the increased risk of accidents and claims in the state with the fastest posted highway speed limits (Learn More: Drunk Driving Auto Insurance Rates by State).

What is the Texas no DUI discount?

A Texas insurance reduction for no DUI doesn’t exist. Texas auto insurance with no DUI simply costs less because providers consider drivers without DUIs less likely to get into accidents and file claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.