Best BMW X4 Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Geico, and Progressive offer the best BMW X4 auto insurance at $108/month. These top providers excel with competitive premiums, extensive coverage, and multiple discounts tailored for BMW X4 owners. Compare these options to secure the best rates and coverage for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for BMW X4

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for BMW X4

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for BMW X4

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top pick overall for the best BMW X4 auto insurance are State Farm, Geico, and Progressive, offering competitive rates starting at $108/month. These providers excel in affordability, comprehensive coverage, and multiple discounts, making them the top choices for BMW X4 owners.

State Farm stands out for its exceptional bundling options and low-mileage discounts, ensuring significant savings. Compare these top companies to find the best rates and coverage for your BMW X4.

Our Top 10 Company Picks: Best BMW X4 Auto Insurance

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | B | Competitive Rates | State Farm | |

| #2 | 25% | A++ | Affordable Premiums | Geico | |

| #3 | 30% | A+ | Multiple Discounts | Progressive | |

| #4 | 30% | A++ | Member Benefits | USAA | |

| #5 | 30% | A+ | Comprehensive Coverage | Allstate | |

| #6 | 30% | A | Customizable Policies | Liberty Mutual |

| #7 | 40% | A+ | Financial Stability | Nationwide |

| #8 | 30% | A | Extensive Options | Farmers | |

| #9 | 30% | A | Strong Service | American Family | |

| #10 | 20% | A+ | High Satisfaction | Amica |

Take a look at the details we’ve gathered on what affects BMW auto insurance for a X4. You can also compare BMW X4 auto insurance rates to the average cost of insurance for competitors like Jeep Commander and Subaru XV Crosstrek Hybrid.

To compare BMW X4 auto insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- State Farm stands out as the best BMW X4 auto insurance

- Compare top companies for the best rates and comprehensive coverage

- Customizable policies and multiple discounts cater to the unique needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Low Monthly Rates: State Farm offers competitive monthly rates at $108 for minimum coverage and $160 for full coverage for the BMW X4.

- Bundling Policies: State Farm auto insurance review provides significant discounts for bundling multiple insurance policies, enhancing savings for BMW X4 owners.

- High Low-Mileage Discount: State Farm offers substantial discounts for low-mileage usage, benefiting those who drive their BMW X4 less frequently.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the BMW X4.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting BMW X4 owners.

#2 – Geico: Best for Affordable Premiums

Pros

- Affordable Premiums: Geico provides affordable monthly rates at $100 for minimum coverage and $150 for full coverage for the BMW X4.

- Discounts for Safety Features: Geico offers discounts for vehicles equipped with advanced safety features, benefiting BMW X4 owners.

- Good Driver Discounts: As mention in Geico auto insurance discounts, Geico rewards safe drivers with lower premiums, making it a cost-effective choice for BMW X4 owners.

Cons

- Customer Service: Geico’s customer service may not be as personalized compared to other providers for BMW X4 insurance.

- Limited Local Agents: Geico relies heavily on online and phone support, which might not be ideal for BMW X4 owners preferring in-person service.

#3 – Progressive: Best for Multiple Discounts

Pros

- Multiple Discounts: Progressive auto insurance review highlights the offers competitive monthly rates at $114 for minimum coverage and $165 for full coverage for the BMW X4.

- Snapshot Program: Progressive’s usage-based insurance program can help BMW X4 owners save more based on their driving habits.

- Multi-Car Discount: Progressive provides discounts for insuring multiple vehicles, beneficial for BMW X4 owners with more than one car.

Cons

- Price Increases: Progressive’s rates may increase significantly after the initial policy term for BMW X4 owners.

- Repair Shop Network: BMW X4 owners might be limited to Progressive’s network of repair shops, which could be inconvenient.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Member Benefits

Pros

- Member Benefits: USAA offers competitive monthly rates at $95 for minimum coverage and $145 for full coverage for the BMW X4, exclusively for military members and their families.

- Exceptional Customer Service: USAA is known for its excellent customer service, which is beneficial for BMW X4 owners.

- Comprehensive Coverage Options: USAA auto insurance review provides extensive coverage options tailored to meet the needs of BMW X4 owners.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting access for other BMW X4 owners.

- Digital Experience: Some BMW X4 owners may find USAA’s digital tools less intuitive compared to competitors.

#5 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate offers competitive monthly rates at $120 for minimum coverage and $170 for full coverage for the BMW X4.

- Claim Satisfaction Guarantee: Allstate auto insurance review provides a satisfaction guarantee on claims, ensuring peace of mind for BMW X4 owners.

- Accident Forgiveness: Allstate’s accident forgiveness program prevents rates from increasing after an accident for BMW X4 owners.

Cons

- High Premiums for Young Drivers: BMW X4 owners who are young drivers may find Allstate’s premiums higher compared to other insurers.

- Discount Availability: Some discounts may be harder to qualify for, potentially limiting savings for BMW X4 owners.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers competitive monthly rates at $115 for minimum coverage and $175 for full coverage for the BMW X4.

- Customizable Coverage: Liberty Mutual auto insurance review provides flexible policy options that can be tailored to the specific needs of BMW X4 owners.

- Better Car Replacement: Liberty Mutual offers a better car replacement feature, which can be beneficial for BMW X4 owners.

Cons

- Customer Service: Some BMW X4 owners may experience inconsistent customer service with Liberty Mutual.

- Online Experience: Liberty Mutual’s online tools and mobile app may not be as user-friendly compared to competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Financial Stability

Pros

- Financial Stability: Nationwide offers competitive monthly rates at $112 for minimum coverage and $164 for full coverage for the BMW X4.

- Vanishing Deductible: Nationwide’s vanishing deductible program rewards BMW X4 owners for safe driving.

- On Your Side Review: Nationwide auto insurance review provides annual insurance reviews to ensure BMW X4 owners are getting the best rates and coverage.

Cons

- Limited Availability: Some discounts and programs may not be available in all states for BMW X4 owners.

- Claim Processing: Nationwide’s claim processing times can be slower compared to other insurers, potentially affecting BMW X4 owners.

#8 – Farmers: Best for Extensive Options

Pros

- Extensive Options: Farmers offers competitive monthly rates at $125 for minimum coverage and $180 for full coverage for the BMW X4.

- Customizable Coverage: Farmers auto insurance review provides a wide range of coverage options that can be tailored to BMW X4 owners’ needs.

- Affinity Discounts: Farmers offers discounts for BMW X4 owners who are members of certain professional groups or associations.

Cons

- Higher Premiums for Older Vehicles: BMW X4 owners with older models may face higher premiums with Farmers.

- Limited Digital Tools: Farmers’ digital tools and online experience may not be as advanced compared to other insurers.

#9 – American Family: Best for Strong Service

Pros

- Strong Service: American Family offers competitive monthly rates at $105 for minimum coverage and $155 for full coverage for the BMW X4.

- Personalized Service: American Family is known for its strong customer service, providing a personalized experience for BMW X4 owners.

- Discounts for Young Drivers: American Family auto insurance review highlights the offers discounts specifically for young BMW X4 drivers, helping to reduce costs.

Cons

- Limited Availability: American Family’s coverage options and discounts may not be available in all areas for BMW X4 owners.

- Higher Rates for High-Risk Drivers: BMW X4 owners with a history of accidents or violations may find higher rates with American Family.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for High Satisfaction

Pros

- High Satisfaction: Amica auto insurance review provides offers competitive monthly rates at $110 for minimum coverage and $161 for full coverage for the BMW X4.

- Customer Satisfaction: Amica is known for high customer satisfaction, providing excellent service for BMW X4 owners.

- Dividend Policies: Amica offers dividend policies that return a portion of premiums to BMW X4 owners.

Cons

- Fewer Discounts: Amica offers fewer discounts compared to other insurers, potentially affecting savings for BMW X4 owners.

- Limited Availability: Amica’s policies and benefits may not be available in all states, limiting options for some BMW X4 owners.

Factors Influencing the Cost of BMW X4 Insurance

BMW X4 insurance cost can vary significantly based on several key factors. While the average annual rate provides a general idea, individual insurance rates can be higher or lower depending on various elements.

BMW X4 Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $120 | $170 |

| American Family | $105 | $155 |

| Amica | $110 | $161 |

| Farmers | $125 | $180 |

| Geico | $100 | $150 |

| Liberty Mutual | $115 | $175 |

| Nationwide | $112 | $164 |

| Progressive | $114 | $165 |

| State Farm | $108 | $160 |

| USAA | $95 | $145 |

Personal factors such as the driver’s age, home address, and driving history are also crucial. Younger drivers and those living in high-crime areas may face higher premiums, while a clean driving record can help reduce costs.

Additionally, the model year of the BMW X4 influences insurance rates, with newer models often attracting higher premiums due to their higher market value and advanced technologies. For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance Discounts.”

The Expense of Insuring Vehicles Like the BMW X4

Take a look at how insurance rates for similar models to the BMW X4 look. These insurance rates for other SUVs like the Jeep Commander, BMW X7, and Subaru XV Crosstrek Hybrid give you a good idea of what to expect.

SUV Auto Insurance Monthly Rates by Coverage Type

| Coverage | Rates |

|---|---|

| Comprehensive | $28 |

| Collision | $49 |

| Minimum Coverage | $33 |

| Full Coverage | $122 |

When examining SUV average insurance rates, we see a breakdown into different coverage types: comprehensive, collision, liability, and full coverage.These figures illustrate the layered nature of insurance costs, where comprehensive and collision coverage make up significant portions of the total premium.

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| BMW X4 | $42 | $80 | $34 | $156 |

| Tesla Model X | $45 | $94 | $31 | $183 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| Land Rover Range Rover | $38 | $73 | $35 | $158 |

| Mercedes-Benz GLA 250 | $31 | $60 | $38 | $143 |

| Chevrolet Tahoe Hybrid | $24 | $43 | $38 | $118 |

| Infiniti QX60 | $34 | $63 | $31 | $140 |

| Kia Telluride | $31 | $57 | $26 | $126 |

| Land Rover Discovery Sport | $31 | $56 | $35 | $134 |

This detailed comparison underscores the importance of considering insurance rates when choosing a vehicle like the BMW X4. By examining the costs for similar SUVs, prospective buyers can better understand the financial commitment involved and make more informed decisions regarding their auto insurance options.

To broaden your understanding, explore our comprehensive resource titled “Auto Insurance Premium Defined.”

BMW X4 Crash Test Ratings

BMW X4 crash test ratings can impact the cost of your BMW X4 car insurance. These ratings can help you anticipate insurance costs and make informed decisions about coverage options. See BMW X4 crash test results here.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

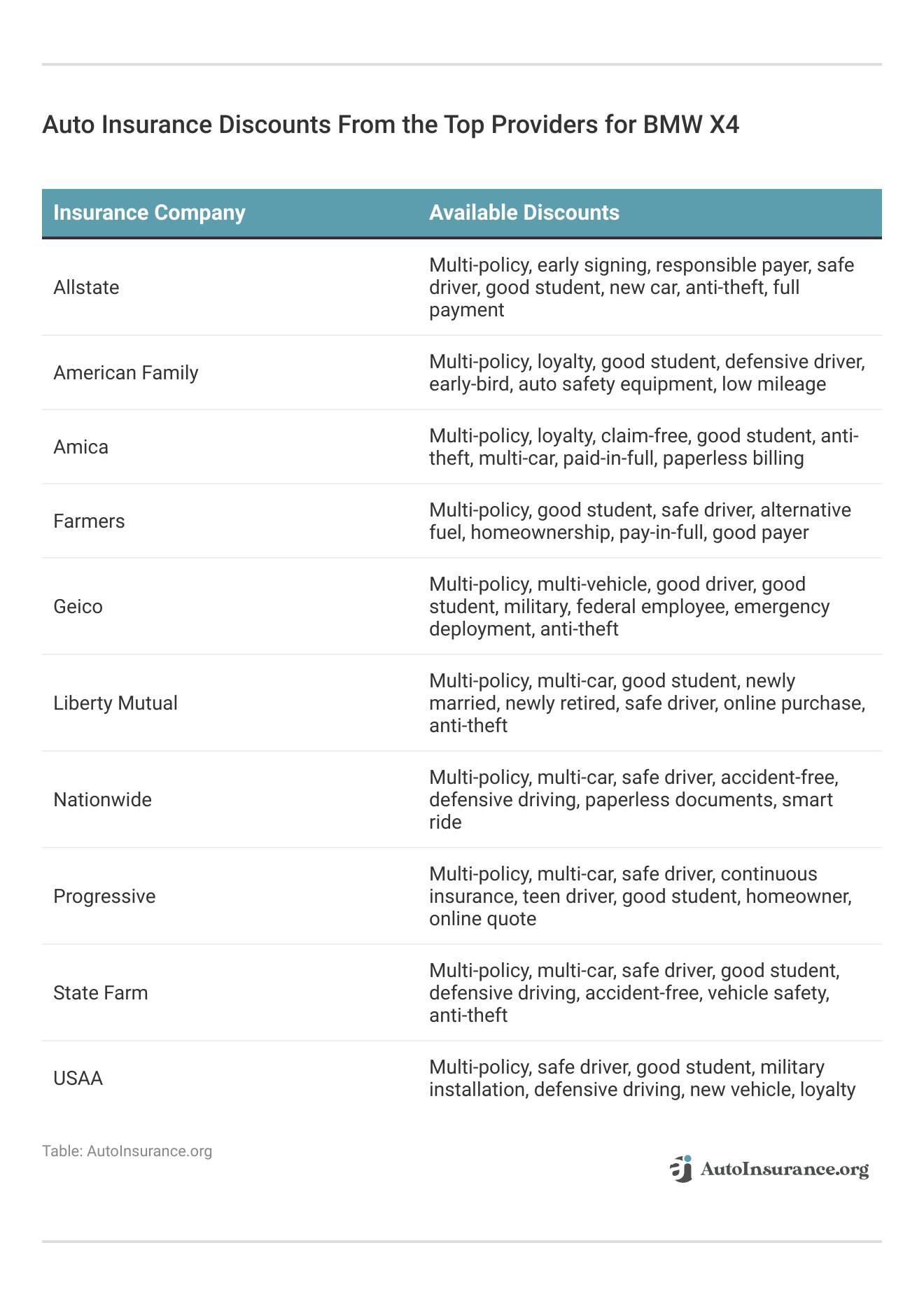

Ways to Save on BMW X4 Insurance

To reduce the cost of your BMW X4 insurance rates, consider re-checking quotes every six months. Insurance rates can fluctuate based on various factors, and regular comparison shopping can help you find better deals.

Additionally, ensure you renew your BMW X4 insurance coverage promptly to avoid any lapses, as gaps in coverage can lead to higher premiums. Opting for an older BMW X4 can also lower insurance costs since older vehicles typically have lower replacement values and repair costs.

Another effective way to save is by monitoring your odometer. Best auto insurance companies often offer discounts for low-mileage vehicles, so driving less can result in significant savings. Lastly, inquire about farm and ranch vehicle discounts if applicable. Some insurers provide special rates for vehicles used primarily for farming or ranching purposes.

Top BMW X4 Insurance Companies

Several insurance companies offer competitive rates for the BMW X4 based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with BMW X4 drivers organized by market share. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

| Rank | Insurance Company | Volume | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.30% |

| #2 | Geico | $46,106,971 | 6.60% |

| #3 | Progressive | $39,222,879 | 5.60% |

| #4 | Liberty Mutual | $35,600,051 | 5.10% |

| #5 | Allstate | $35,025,903 | 5.00% |

| #6 | Travelers | $28,016,966 | 4.00% |

| #7 | USAA | $23,483,080 | 3.30% |

| #8 | Chubb | $23,388,385 | 3.30% |

| #9 | Farmers | $20,643,559 | 2.90% |

| #10 | Nationwide | $18,442,145 | 2.60% |

Progressive, with its innovative usage-based insurance program, caters to drivers looking for personalized rates based on their driving habits. By considering these top providers, BMW X4 owners can find the best insurance coverage that meets their needs and maximizes their savings.

Comparing Free BMW X4 Insurance Quotes Online

You can compare quotes for BMW X4 auto insurance rates from some of the best auto insurance companies by using our free online tool now. By using our free online tool, you can quickly and easily gather quotes from top insurance companies like State Farm, Geico, and Progressive.

This comparison process helps you understand the different pricing structures and discounts each company offers, ensuring you get the most value for your money. Whether you prioritize low premiums, comprehensive coverage, or specific discounts, comparing quotes online provides a clear picture of your options.

Additionally, comparing BMW X4 insurance quotes online saves time and effort compared to traditional methods. Instead of contacting multiple insurance agents individually, our tool aggregates the information in one place, making the process efficient and straightforward.

We keep an eye on the entire value chain – from design and the increasing use of secondary materials for parts and components, all the way to effective recycling of end-of-life vehicles. 🚗♻️

Read more: https://t.co/97rtFaFEMQ

#BMWGroup #THEiVisionCircular #sustainability pic.twitter.com/p9r2h2oQtf— BMW Group (@BMWGroup) July 12, 2024

This convenience allows you to make informed decisions based on comprehensive data, ultimately helping you secure the best insurance policy for your BMW X4. By leveraging the power of online comparison, you can confidently choose the provider that best meets your insurance needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Best BMW X4 Auto Insurance Providers

Choosing the best BMW X4 auto insurance requires understanding how top providers cater to unique needs. Here are three case studies that highlight how State Farm, Geico, and Progressive deliver tailored insurance solutions for BMW X4 owners.

- Case Study #1 – Bundling Options: John, a BMW X4 owner, needed comprehensive coverage at a reasonable price. He wanted to bundle his home and auto insurance to maximize savings. State Farm offered a competitive rate of $160/month, with significant discounts for bundling his policies and low-mileage driving.

- Case Study #2 – Safety Feature Discounts: Sarah, a BMW X4 driver, prioritized affordable premiums and safety feature discounts. Her BMW X4 had advanced safety features, and she wanted to leverage these for lower insurance rates. Geico provided a rate of $150/month, including discounts for her vehicle’s safety features.

- Case Study #3 – Usage-Based Insurance: Mark, who owns a BMW X4, looked for savings based on his driving habits. He drove less frequently and wanted his low mileage to reflect in his insurance premiums. Progressive’s Snapshot program offered a rate of $165/month with additional savings based on his actual driving patterns.

These case studies show how State Farm, Geico, and Progressive cater to the unique needs of BMW X4 owners with competitive rates and tailored discounts.

State Farm offers the best BMW X4 auto insurance with competitive rates and substantial bundling discounts.Jeff Root Licensed Insurance Agent

By choosing the right provider, BMW X4 owners can secure the best insurance coverage while maximizing their savings. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

What factors affect the cost of auto insurance for a BMW X4?

The cost is influenced by the driver’s age, location, driving history, coverage options, auto insurance deductible amount, and the model year of the BMW X4. Repair and replacement costs also matter.

Do I need a specific type of insurance for a BMW X4?

No, but you should have enough coverage to meet your needs and state requirements. Common types include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

Are BMW X4 models more expensive to insure compared to other vehicles?

Yes, because BMWs are luxury vehicles with higher repair and replacement costs, leading to higher premiums. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Can I get discounts on BMW X4 auto insurance?

Yes, you can get discounts for being a safe driver, having multiple policies, completing defensive driving courses, and having safety features like anti-theft systems (Read more: Why You Should Take a Defensive Driving Class).

How can I find the best insurance rates for my BMW X4?

Shop around and compare quotes from multiple insurance companies. Use online tools or work with an independent insurance agent to get various options. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

Should I choose a higher deductible to lower my BMW X4 insurance premiums?

Yes, a higher deductible can lower your premiums, but make sure you can afford the deductible if you need to make a claim.

Are there any specific maintenance or security measures that can help lower BMW X4 insurance costs?

Yes, installing security features like alarms or tracking devices and keeping up with regular maintenance can help lower costs.

Can I transfer my existing auto insurance policy to a new BMW X4?

Yes, you can transfer your policy to a new BMW X4, but inform your insurance company to update your policy and premiums. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

How does the model year of my BMW X4 affect insurance premiums?

Newer models usually cost more to insure because they have higher market values and advanced technologies that are more expensive to repair or replace. For additional details, explore our comprehensive resource titled “Types of Auto Insurance.”

What should I do if I can’t afford my BMW X4 insurance premiums?

Consider adjusting your coverage options, shopping around for better rates, increasing your deductible, or looking for more discounts. An insurance agent can help you find ways to lower your premiums.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.