Best Cadillac ATS Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Geico, State Farm, and Progressive offer the best Cadillac ATS auto insurance, offering rates around $70/month. These companies provide competitive pricing, comprehensive coverage, and multiple discounts, making them the best choices for Cadillac ATS owners seeking affordable and reliable auto insurance options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Cadillac ATS

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Cadillac ATS

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Cadillac ATS

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

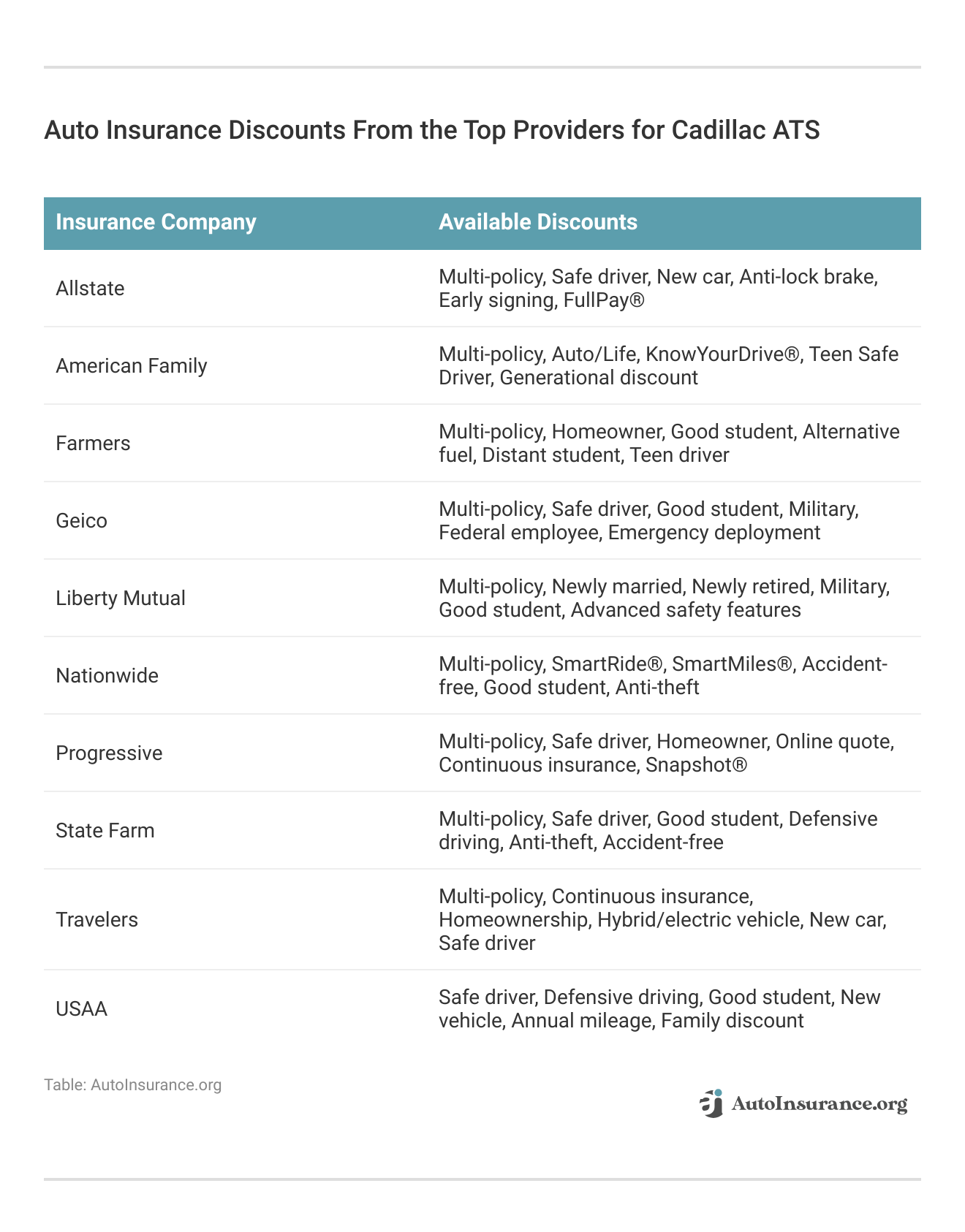

13,283 reviewsSave money on earned policy discounts, and often you can find auto insurance discounts that can help you save money too.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers.

- Geico, the top pick, offers the best Cadillac ATS auto insurance

- Best Cadillac ATS auto insurance rates at $70/month with comprehensive coverage

- Discounts and customizable policies meet Cadillac ATS owners’ needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Extensive Discounts: Geico offers numerous discount opportunities, making it a cost-effective choice for Cadillac ATS owners.

- Low Monthly Rates: Geico provides competitive rates at $70 per month for minimum coverage and $160 per month for full coverage for the Cadillac ATS.

- Multi-Policy Discount: As mention in Geico auto insurance discounts, With a 20% discount, Geico allows Cadillac ATS owners to save significantly by bundling policies.

Cons

- Limited Local Agent Support: Geico has fewer local agents, which may be less convenient for Cadillac ATS owners needing in-person assistance.

- Complex Discount Qualification: Some discounts may have strict eligibility requirements, which could be challenging for some Cadillac ATS owners to meet.

#2 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm offers personalized service with a network of local agents, making it ideal for Cadillac ATS owners seeking in-person support.

- Low Monthly Rates: State Farm offers competitive monthly rates at $75 for minimum coverage and $165 for full coverage for the Cadillac ATS.

- Bundling Policies: State Farm auto insurance review provides significant discounts for bundling multiple insurance policies, enhancing savings for Cadillac ATS owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is 15%, which is not as high compared to some competitors for the Cadillac ATS.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Cadillac ATS owners.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive is known for offering competitive rates, making it an attractive option for Cadillac ATS owners.

- Low Monthly Rates: Progressive auto insurance review highlighted the affordable monthly rates at $78 for minimum coverage and $170 for full coverage for the Cadillac ATS.

- Snapshot Program: The Snapshot program can lower rates for Cadillac ATS drivers with safe driving habits.

Cons

- Limited Customization: Some Cadillac ATS owners might find fewer customization options in their policies compared to other providers.

- Average Multi-Policy Discount: The 8% multi-policy discount is lower than some competitors, offering less savings for Cadillac ATS owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate offers extensive coverage options, ensuring Cadillac ATS owners have thorough protection.

- Low Monthly Rates: Allstate auto insurance review provides competitive rates at $85 per month for minimum coverage and $175 per month for full coverage for the Cadillac ATS.

- Rewarding Safe Drivers: Allstate’s Safe Driving Bonus can benefit Cadillac ATS owners who maintain a clean driving record.

Cons

- Higher Premiums for Young Drivers: Younger Cadillac ATS drivers may face higher premiums with Allstate compared to other insurers.

- Limited Availability: Allstate’s discounts and coverage options may not be available in all areas, potentially affecting Cadillac ATS owners in certain regions.

#5 – USAA: Best for Military Personnel

Pros

- Military Benefits: USAA auto insurance review provides unique benefits tailored for military personnel and their families, ideal for Cadillac ATS owners with a military background.

- Low Monthly Rates: USAA offers highly competitive rates at $68 per month for minimum coverage and $155 per month for full coverage for the Cadillac ATS.

- Superior Customer Service: USAA is known for exceptional customer service, which can be beneficial for Cadillac ATS owners.

Cons

- Membership Restrictions: USAA is only available to military personnel and their families, limiting access for other Cadillac ATS owners.

- Limited Local Offices: Fewer local branches may be less convenient for Cadillac ATS owners seeking in-person support.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s unique vanishing deductible program rewards Cadillac ATS owners with reduced deductibles over time.

- Low Monthly Rates: Nationwide offers affordable rates at $80 per month for minimum coverage and $168 per month for full coverage for the Cadillac ATS.

- Comprehensive Coverage: Nationwide auto insurance review provides extensive coverage options suitable for Cadillac ATS owners.

Cons

- Average Multi-Policy Discount: The 25% multi-policy discount is good but not exceptional compared to some competitors of Cadillac ATS.

- Higher Initial Rates: Initial rates may be higher for Cadillac ATS owners before discounts and programs are applied.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Farmers auto insurance review provides highly customizable insurance policies tailored to the specific needs of Cadillac ATS owners.

- Low Monthly Rates: Farmers offers competitive monthly rates at $83 for minimum coverage and $172 for full coverage for the Cadillac ATS.

- Excellent Customer Service: Farmers is known for excellent customer service, benefiting Cadillac ATS owners who need support.

Cons

- Limited Discounts: The 10% multi-policy discount is lower compared to other insurers, offering fewer savings for Cadillac ATS owners.

- Higher Premiums for High-Risk Drivers: High-risk Cadillac ATS drivers might face higher premiums with Farmers.

#8 – Liberty Mutual: Best for Multi-Policy Discount

Pros

- Multi-Policy Discount: Liberty Mutual auto insurance review provides a generous 12% discount for bundling multiple policies, benefiting Cadillac ATS owners.

- Low Monthly Rates: Liberty Mutual offers competitive rates at $90 per month for minimum coverage and $180 per month for full coverage for the Cadillac ATS.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program can be advantageous for Cadillac ATS owners with minor incidents.

Cons

- Higher Premiums for Young Drivers: Young Cadillac ATS drivers may face higher premiums compared to other providers.

- Limited Availability: Some discounts and coverage options may not be available in all areas, affecting certain Cadillac ATS owners.

#9 – Travelers: Best for Financial Standing

Pros

- Financial Stability: Travelers is highly rated for financial stability, providing confidence to Cadillac ATS owners.

- Low Monthly Rates: Travelers offers affordable rates at $82 per month for minimum coverage and $170 per month for full coverage for the Cadillac ATS.

- Extensive Coverage Options: Travelers Auto insurance review highlighted the wide range of coverage options suitable for Cadillac ATS owners.

Cons

- Average Multi-Policy Discount: The 15% multi-policy discount is moderate compared to some competitors of Cadillac ATS.

- Higher Rates for Older Vehicles: Older Cadillac ATS models may face higher premiums with Travelers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Flexible Coverage

Pros

- Flexible Coverage: American Family auto insurance review provides flexible coverage options tailored to the needs of Cadillac ATS owners.

- Low Monthly Rates: American Family offers competitive rates at $77 per month for minimum coverage and $165 per month for full coverage for the Cadillac ATS.

- Excellent Customer Service: American Family is known for excellent customer service, benefiting Cadillac ATS owners who need support.

Cons

- Limited Discounts: The 10% multi-policy discount is lower compared to other insurers of Cadillac ATS.

- Higher Rates for High-Risk Drivers: High-risk Cadillac ATS drivers might face higher premiums with American Family.

The Cost of Cadillac ATS Insurance

Cadillac ATS Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $85 | $175 |

| American Family | $77 | $165 |

| Farmers | $83 | $172 |

| Geico | $70 | $160 |

| Liberty Mutual | $90 | $180 |

| Nationwide | $80 | $168 |

| Progressive | $78 | $170 |

| State Farm | $75 | $165 |

| Travelers | $82 | $170 |

| USAA | $68 | $155 |

For instance, minimum coverage rates range from $68 with USAA to $90 with Liberty Mutual, while full coverage rates range from $155 with USAA to $180 with Liberty Mutual. Other notable providers such as Geico, State Farm, and American Family offer competitive rates that fall within this spectrum. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Cadillac ATS Auto Insurance Monthly Rates by Category

| Category | Rates |

|---|---|

| Average Rate | $118 |

| Discount Rate | $69 |

| High Deductibles | $102 |

| High Risk Driver | $251 |

| Low Deductibles | $149 |

| Teen Driver | $431 |

Additionally, specific categories also impact the insurance cost; for example, a high-risk driver might pay as much as $251 monthly, whereas a teen driver could see rates soaring to $431 per month. Conversely, those opting for high deductibles or qualifying for discounts might enjoy significantly lower rates, around $102 and $69 per month, respectively.

Cadillac ATS Insurance Expenses

The Cadillac ATS insurance expenses are competitive compared to other sedans like the Nissan Sentra, Toyota Corolla, and Nissan Versa. The comprehensive coverage for the Cadillac ATS is $25 per month, similar to the Toyota Corolla and slightly higher than the Nissan Sentra and Nissan Versa.

Cadillac ATS Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Cadillac ATS | $25 | $47 | $33 | $118 |

| Nissan Sentra | $21 | $48 | $33 | $114 |

| Toyota Corolla | $25 | $45 | $33 | $115 |

| Nissan Versa | $22 | $45 | $33 | $113 |

| Chevrolet Malibu | $27 | $44 | $31 | $115 |

| Subaru WRX | $27 | $47 | $28 | $113 |

| Chrysler 300 | $28 | $52 | $33 | $126 |

Collision coverage for the Cadillac ATS is $47 per month, comparable to the Subaru WRX and Chrysler 300, but higher than the Nissan Sentra and Toyota Corolla. The minimum coverage rate for the Cadillac ATS is $33 per month, consistent across the compared vehicles.

The full coverage auto insurance rate is $118 per month, higher than most other vehicles except for the Chrysler 300 at $126 per month. Overall, the Cadillac ATS has slightly elevated collision and full coverage expenses, reflecting its luxury status.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Impacting the Cost of Cadillac ATS Insurance

The Cadillac ATS trim and model you choose can impact the total price you will pay for Cadillac ATS auto insurance premium coverage.

It may or may not be surprising that the trim levels will determine what you pay, but that’s just because the base price usually goes up for custom work, and the maintenance on vehicles with premium luxury versions of standard features is a lot higher too. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

Older Cadillac ATS models generally cost less to insure. Based on the table, the monthly auto insurance rates for the Cadillac ATS by coverage type and model year are: for 2024, comprehensive is $25, collision auto insurance is $47, minimum is $33, and full coverage is $118. For 2023, comprehensive is $24, collision is $46, minimum is $35, and full coverage is $118.

Cadillac ATS Auto Insurance Monthly Rates by Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Cadillac ATS | $25 | $47 | $33 | $118 |

| 2023 Cadillac ATS | $24 | $46 | $35 | $118 |

| 2022 Cadillac ATS | $23 | $44 | $36 | $116 |

| 2021 Cadillac ATS | $22 | $43 | $37 | $114 |

| 2020 Cadillac ATS | $21 | $40 | $38 | $111 |

| 2019 Cadillac ATS | $20 | $37 | $38 | $108 |

The 2022 model has comprehensive at $23, collision at $44, minimum at $36, and full coverage at $116. For 2021, comprehensive is $22, collision is $43, minimum is $37, and full coverage is $114. The 2020 model rates are $21 for comprehensive, $40 for collision, $38 for minimum, and $111 for full coverage. Finally, the 2019 model has comprehensive at $20, collision at $37, minimum at $38, and full coverage at $108.

Driver Age

Cadillac ATS Auto Insurance Monthly Rates by Age

| Age | Monthly Rates |

|---|---|

| Age: 18 | $450 |

| Age: 20 | $400 |

| Age: 30 | $250 |

| Age: 40 | $200 |

| Age: 50 | $175 |

| Age: 60 | $160 |

Therefore, it’s crucial to educate younger drivers on road safety. Monthly insurance rates also reflect this trend, with 18-year-olds paying $450, 20-year-olds $400, 30-year-olds $250, 40-year-olds $200, 50-year-olds $175, and 60-year-olds $160.

Driver Location

Driver location significantly impacts Cadillac ATS insurance rates due to factors such as traffic density and commute times. For instance, drivers in New York pays more annually than those in Seattle, reflecting higher congestion and longer commutes.

Cadillac ATS Auto Insurance Monthly Rates by City

| City | Monthly Rates |

|---|---|

| Chicago, IL | $210 |

| Columbus, OH | $190 |

| Houston, TX | $220 |

| Indianapolis, IN | $180 |

| Jacksonville, FL | $200 |

| Los Angeles, CA | $240 |

| New York, NY | $260 |

| Philadelphia, PA | $230 |

| Phoenix, AZ | $195 |

| Seattle, WA | $185 |

Despite these variances, affordable car insurance remains accessible. Monthly rates for Cadillac ATS insurance vary by city, with New York at $260, Los Angeles at $240, and Houston at $220, while cities like Indianapolis and Seattle enjoy lower rates at $180 and $185, respectively.

Driving Record

Your driving record significantly impacts the cost of Cadillac ATS auto insurance, with violations leading to higher premiums. Teens and drivers in their 20s experience the steepest increases. For example, an 18-year-old with a clean record pays $450 monthly, but rates rise to $575 with one accident, $700 with one DUI, and $525 with one ticket.

Cadillac ATS Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $450 | $575 | $700 | $525 |

| Age: 20 | $400 | $510 | $630 | $470 |

| Age: 30 | $250 | $320 | $400 | $290 |

| Age: 40 | $200 | $260 | $320 | $230 |

| Age: 50 | $175 | $225 | $275 | $205 |

| Age: 60 | $160 | $205 | $250 | $190 |

Similarly, at age 20, rates are $400 with a clean record, increasing to $510 for one accident, $630 for one DUI, and $470 for one ticket. Older drivers see lower premiums, but violations still lead to noticeable increases.

Cadillac ATS Safety Ratings

The Cadillac ATS is a model that benefits from robust safety ratings, which can positively impact auto insurance rates. The Insurance Institute for Highway Safety (IIHS) has rated the Cadillac ATS with high marks, including “Good” ratings for small overlap front (driver-side), moderate overlap front, side impact, roof strength, and head restraints and seats.

Cadillac ATS Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Acceptable |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

However, the small overlap front (passenger-side) received an “Acceptable” rating. These strong safety ratings indicate the vehicle’s ability to protect occupants in various crash scenarios, making it a safer choice and potentially lowering insurance premiums.

You can’t reinvent the wheel, but the all-electric #ESCALADEIQ is here to declare that you can boldly reimagine it. #BeIconic pic.twitter.com/AZgS0GgBqP

— Cadillac (@Cadillac) August 9, 2023

In addition to its commendable crash test performance, the Cadillac ATS is equipped with an array of safety features that further enhance its protective capabilities. Key features include multiple air bags (driver, passenger, front head, rear head, and front side), 4-wheel ABS and disc brakes, electronic stability control, and traction control.

Other features like daytime running lights, integrated turn signal mirrors, front tow hooks, anti-theft systems, and an emergency trunk release contribute to the vehicle’s overall safety profile.

These advanced safety technologies not only help prevent accidents but also reduce the severity of injuries, leading to more favorable insurance rates for Cadillac ATS owners. Furthermore, the vehicle’s anti-theft features can deter potential thefts, enhancing its safety and potentially lowering insurance premiums.

Cadillac ATS Crash Test Ratings

The Cadillac ATS boasts impressive crash test ratings across multiple years, consistently earning 5 stars in overall, frontal, and side crash tests, with a 4-star rating for rollover tests from 2020 to 2024.

Cadillac ATS Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Cadillac ATS | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Cadillac ATS | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Cadillac ATS | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Cadillac ATS | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Cadillac ATS | 5 stars | 5 stars | 5 stars | 4 stars |

These excellent safety ratings not only ensure better protection for occupants during a crash but also contribute to lower auto insurance rates for the Cadillac ATS, as insurers often offer more favorable premiums for vehicles with high safety standards. Read our article to find the best accident forgiveness auto insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Insurance Loss Probability of a Cadillac ATS

Cadillac ATS Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | 21% |

| Property Damage | -3% |

| Comprehensive | 3% |

| Personal Injury | 7% |

| Medical Payment | -4% |

| Bodily Injury | -10% |

Conversely, property damage and medical payment coverages show negative loss probabilities (-3% and -4%, respectively), indicating lower risks and potentially lower premiums. Comprehensive coverage has a slight loss probability of 3%, personal injury at 7%, and bodily injury at -10%, suggesting favorable rates for these coverages.

Insurance for a Financed Cadillac ATS

If you are financing a Cadillac ATS, most lenders will require your carry higher coverages, which may include comprehensive coverage. So be sure to compare auto insurance rates from the cheap auto insurance companies using our FREE tool below.

Ways to Save Money on Cadillac ATS Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Companies for the Best Auto Insurance Rates

For Cadillac ATS insurance rates, the top auto insurance company by market share is State Farm, with a volume of $65,615,190 and a market share of 9.30%. Other leading providers include Geico, Progressive, Liberty Mutual, and Allstate, all offering competitive rates and various discounts, especially for vehicles equipped with advanced security systems and safety features that the Cadillac ATS offers.

Top 10 Cadillac ATS Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.3% |

| #2 | Geico | $46,106,971 | 6.6% |

| #3 | Progressive | $39,222,879 | 5.6% |

| #4 | Liberty Mutual | $35,600,051 | 5.1% |

| #5 | Allstate | $35,025,903 | 5% |

| #6 | Travelers | $28,016,966 | 4% |

| #7 | USAA | $23,483,080 | 3.3% |

| #8 | Chubb | $23,388,385 | 3.3% |

| #9 | Farmers | $20,643,559 | 2.9% |

| #10 | Nationwide | $18,442,145 | 2.6% |

The rates from these companies can vary based on several factors, including auto insurance discounts, driving history, location, and specific policy details, but these insurers are well-regarded for their comprehensive coverage options and customer service.

Comparing Auto Insurance Quotes Online

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is auto insurance for a Cadillac ATS?

Auto insurance for a Cadillac ATS protects your vehicle against financial loss from accidents, theft, or damage. It covers repairs, medical expenses, and liability claims.

What factors influence the cost of Cadillac ATS auto insurance?

Costs are influenced by your location, driving record, age, gender, credit score, vehicle value, coverage limits, auto insurance deductible, and optional coverages.

What types of coverage should I consider for my Cadillac ATS?

Consider liability, comprehensive, collision, uninsured/underinsured motorist, personal injury protection, and medical payments coverage.

Can I save money on Cadillac ATS auto insurance?

Yes, by exploring discounts and comparing quotes from multiple insurance providers. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Can I transfer my existing auto insurance to cover my Cadillac ATS?

Yes, but inform your insurance company about the new vehicle to adjust coverage and premiums.

What should I do if I’m involved in an accident with my Cadillac ATS?

Ensure safety, report the accident to authorities, exchange information with the other party, and notify your insurance company.

How can I find the best insurance rates for my Cadillac ATS?

Compare quotes from multiple insurance providers, use online tools, or consult an independent agent. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Are there specific considerations for insuring a luxury vehicle like the Cadillac ATS?

Yes, luxury vehicles may have higher premiums due to their value and repair costs. Consider adequate coverage limits and optional gap insurance.

What discounts are available for Cadillac ATS auto insurance?

Discounts include safe driver, multi-policy insurance discount, good student, and safety feature discounts.

How does my driving record affect Cadillac ATS auto insurance rates?

A clean driving record lowers your rates, while accidents or violations increase them (Read more: Why You Should Take a Defensive Driving Class).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.