Best Cadillac Escalade Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Cadillac Escalade auto insurance rates start at $100 per month from top companies like Allstate, Erie, and Geico. These providers offer competitive rates and comprehensive coverage options, making them the best choices for Cadillac Escalade insurance. Compare quotes to find the best that suits your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Cadillac Escalade

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Cadillac Escalade

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews

Company Facts

Full Coverage for Cadillac Escalade

A.M. Best Rating

Complaint Level

Pros & Cons

The best Cadillac Escalade auto insurance providers are Allstate, Erie, and Geico, with rates starting as low as $100 per month. This article examines why these companies offer the best options by evaluating comprehensive auto insurance coverage, customer satisfaction, and affordability.

Allstate stands out for its excellent combination of coverage and cost-effectiveness. Erie and Geico also provide competitive rates and strong customer support. Explore how factors like vehicle age, driver location, and safety features impact your premiums.

Our Top 10 Company Picks: Best Cadillac Escalade Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Coverage Options Allstate

#2 10% A+ Customer Service Erie

#3 25% A++ Competitive Rates Geico

#4 20% B Nationwide Network State Farm

#5 8% A++ Policy Bundling Travelers

#6 10% A++ Military Benefits USAA

#7 12% A+ Discounts Variety Progressive

#8 20% A+ Claims Process Nationwide

#9 25% A+ High Ratings Amica

#10 25% A Customization Options Liberty Mutual

By understanding these variables, you can make informed decisions to reduce your insurance costs. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Best Cadillac Escalade auto insurance rates start at $100/month

- Factors like vehicle age, driver location, and safety features impact premiums

- Consider coverage, customer satisfaction, and affordability

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Coverage Options: Allstate offers a comprehensive range of coverage options tailored for Cadillac Escalade owners. Minimum coverage starts at $125.

- Multi-Vehicle Discount: Allstate provides a 25% discount for insuring multiple vehicles, making it a strong choice for Cadillac Escalade auto insurance.

- Customer Service: Our analysis of Allstate auto insurance review reveals Allstate is known for excellent customer service and support for Cadillac Escalade owners.

Cons

- Premium Costs: Premiums for Cadillac Escalade auto insurance with Allstate may be higher than some competitors.

- Limited Availability: Some discounts and coverage options for Cadillac Escalade insurance are not available in every state.

#2 – Erie: Best for Customer Service

Pros

- Excellent Customer Service: Erie is renowned for exceptional customer support and satisfaction, particularly for Cadillac Escalade auto insurance.

- Comprehensive Coverage: According to our Erie auto insurance review, Erie provides extensive coverage options suitable for Cadillac Escalade owners, with minimum coverage starting at $110.

- Competitive Rates: Offers affordable rates and a 10% multi-vehicle discount, making it a top pick for Cadillac Escalade insurance.

Cons

- Regional Availability: Erie’s Cadillac Escalade auto insurance is not available in all states.

- Online Services: Limited online policy management options for Cadillac Escalade insurance.

#3 – Geico: Best for Competitive Rates

Pros

- Low Rates: Geico offers highly competitive rates for Cadillac Escalade insurance. Geico auto insurance discounts also help lower auto insurance premiums with minimum coverage starting at $105..

- Multi-Vehicle Discount: Provides a 25% discount for insuring multiple vehicles for Cadillac Escalade auto insurance owners.

- User-Friendly: Geico’s easy online quote and policy management tools make it a convenient choice for Cadillac Escalade insurance.

Cons

- Coverage Options: Geico offers fewer coverage options compared to some competitors for Cadillac Escalade auto insurance.

- Customer Service: Mixed reviews on customer service experiences for Cadillac Escalade insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Nationwide Network

Pros

- Extensive Network: State Farm has a vast network of agents and service providers nationwide, ideal for Cadillac Escalade owners.

- Customizable Coverage: Offers various coverage options tailored for Cadillac Escalade, with minimum coverage at $115.

- Low-Mileage Discount: Our examination of State Farm auto insurance review shows State Farm provides substantial discounts for low-mileage drivers, enhancing Cadillac Escalade auto insurance value.

Cons

- Premium Costs: Premiums for Cadillac Escalade insurance with State Farm may be higher despite discounts.

- Limited Multi-Policy Discount: The discount for bundling policies for Cadillac Escalade auto insurance is not as high as some competitors.

#5 – Travelers: Best for Policy Bundling

Pros

- Bundling Discounts: Travelers offers significant discounts for bundling multiple policies, benefiting Cadillac Escalade owners.

- Strong Financial Ratings: Insights from our Travelers auto insurance reviews shows Travelers’ A++ rating indicates financial stability, making it a reliable choice for Cadillac Escalade insurance.

- Coverage Options: Provides comprehensive coverage choices for Cadillac Escalade, with minimum coverage starting at $120.

Cons

- Multi-Vehicle Discount: Only offers an 8% discount for insuring multiple vehicles compared to other providers for Cadillac Escalade auto insurance.

- Availability: Some discounts and services may not be available in all states for Cadillac Escalade auto insurance.

#6 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers exclusive benefits and discounts for military members and their families, ideal for Cadillac Escalade owners.

- High Customer Satisfaction: Our USAA auto insurance review indicates USAA is known for exceptional customer service and support for Cadillac Escalade auto insurance.

- Competitive Rates: Provides affordable Cadillac Escalade auto insurance rates with a 10% multi-vehicle discount, with minimum coverage starting at $100.

Cons

- Membership Restrictions: Only available to military members, veterans, and their families for Cadillac Escalade insurance.

- Online Services: Some users report issues with the online platform for Cadillac Escalade auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Discounts Variety

Pros

- Wide Range of Discounts: Progressive offers a variety of discounts for Cadillac Escalade insurance.

- Snapshot Program: Potential savings through usage-based insurance for Cadillac Escalade owners.

- Competitive Rates: According to our Progressive auto insurance review, Progressive offers affordable Cadillac Escalade auto insurance premiums with a 12% multi-vehicle discount, with minimum coverage at $108.

Cons

- Customer Service: Mixed reviews on customer service experiences for Cadillac Escalade insurance.

- Coverage Options: May offer fewer coverage options for Cadillac Escalade auto insurance compared to some competitors.

#8 – Nationwide: Best for Claims Process

Pros

- Efficient Claims Process: Nationwide is known for a smooth and quick claims handling process for Cadillac Escalade owners.

- Multi-Vehicle Discount: Offers a 20% discount for insuring multiple vehicles, making it a solid choice for Cadillac Escalade insurance.

- Comprehensive Coverage: Our assessment of Nationwide auto insurance review illustrates Nationwide’s wide range of coverage options for Cadillac Escalade, with minimum coverage starting at $113.

Cons

- Premium Costs: Higher premiums despite available discounts for Cadillac Escalade auto insurance.

- Availability: Some discounts and coverage options for Cadillac Escalade auto insurance may not be available in every state.

#9 – Amica: Best for High Ratings

Pros

- High Customer Ratings: Our Amica auto insurance review highlights Amica consistently receives high ratings for customer satisfaction for Cadillac Escalade insurance.

- Multi-Vehicle Discount: Provides a 25% discount for insuring multiple vehicles, benefiting Cadillac Escalade owners.

- Customizable Coverage: Offers various coverage options for Cadillac Escalade, with minimum coverage at $112.

Cons

- Premium Costs: Higher premiums compared to some competitors for Cadillac Escalade insurance.

- Limited Availability: Not all discounts and services for Cadillac Escalade auto insurance are available in every state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customization Options

Pros

- Customizable Coverage: Liberty Mutual offers a range of customizable coverage options for Cadillac Escalade insurance.

- Multi-Vehicle Discount: Provides a 25% discount for insuring multiple vehicles, which is advantageous for Cadillac Escalade owners.

- Financial Stability: The results of our Liberty Mutual auto insurance review suggests Liberty Mutual has strong financial rating ensuring reliability, making it a solid choice for Cadillac Escalade auto insurance.

Cons

- Premium Costs: Higher premiums compared to some competitors for Cadillac Escalade insurance.

- Customer Service: Mixed reviews on customer service experiences by Cadillac Escalade auto insurance policyholders.

The Cost of Insuring a Cadillac Escalade

How much is insurance for a Cadillac Escalade? When considering auto insurance rates for a Cadillac Escalade, it is essential to compare the costs across different providers and coverage levels. The table presents monthly rates from various insurance companies. Allstate charges $125 for minimum coverage and $250 for full coverage auto insurance.

Amica’s rates are slightly lower, with $112 for minimum coverage and $232 for full coverage. Erie offers even more competitive pricing at $110 for minimum coverage and $230 for full coverage. Geico provides one of the lowest rates, with $105 for minimum coverage and $225 for full coverage.

Cadillac Escalade Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $125 $250

Amica $112 $232

Erie $110 $230

Geico $105 $225

Liberty Mutual $118 $238

Nationwide $113 $235

Progressive $108 $228

State Farm $115 $240

Travelers $120 $245

USAA $100 $220

Liberty Mutual’s rates are $118 for minimum coverage and $238 for full coverage. Nationwide offers minimum coverage for $113 and full coverage for $235. Progressive’s rates are $108 for minimum coverage and $228 for full coverage. State Farm charges $115 for minimum coverage and $240 for full coverage.

Travelers’ rates are $120 for minimum coverage and $245 for full coverage. USAA has the lowest rates among the providers listed, with $100 for minimum coverage and $220 for full coverage. By reviewing these rates, potential Cadillac Escalade owners can make informed decisions about their insurance options, balancing cost with the desired level of coverage.

Factors Affecting Cadillac Escalade Insurance Costs

The trim and model you choose can impact the total Cadillac Escalade price you will pay for insurance coverage. First is the age of the vehicle. Older Cadillac Escalade models generally cost less to insure.

Cadillac Escalade Auto Insurance Monthly Rates by Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Cadillac Escalade | $38 | $65 | $39 | $159 |

| 2023 Cadillac Escalade | $37 | $63 | $41 | $156 |

| 2022 Cadillac Escalade | $35 | $62 | $42 | $155 |

| 2021 Cadillac Escalade | $34 | $61 | $43 | $154 |

| 2020 Cadillac Escalade | $33 | $58 | $45 | $152 |

| 2019 Cadillac Escalade | $31 | $56 | $46 | $150 |

| 2018 Cadillac Escalade | $30 | $52 | $47 | $145 |

| 2017 Cadillac Escalade | $29 | $49 | $48 | $142 |

| 2016 Cadillac Escalade | $27 | $44 | $48 | $136 |

| 2015 Cadillac Escalade | $26 | $40 | $48 | $130 |

| 2014 Cadillac Escalade | $25 | $38 | $48 | $128 |

Next is driver’s age. This can have a significant effect on the cost of Cadillac auto insurance for Escalade. For example, 30-year-old drivers pay approximately $42 more for their Cadillac Escalade car insurance than 40-year-old drivers.

Cadillac Escalade Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 18 | $580 |

| Age: 20 | $349 |

| Age: 30 | $159 |

| Age: 40 | $201 |

| Age: 50 | $185 |

| Age: 60 | $175 |

Another factor is where you live. Driver’s location can have a large impact on Cadillac Escalade insurance rates. For example, drivers in Chicago, IL may pay $90 a month more than drivers in Seattle.

Cadillac Escalade Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $310 |

| Columbus, OH | $230 |

| Houston, TX | $295 |

| Indianapolis, IN | $240 |

| Jacksonville, FL | $260 |

| Los Angeles, CA | $340 |

| New York, NY | $420 |

| Philadelphia, PA | $370 |

| Phoenix, AZ | $250 |

| Seattle, WA | $220 |

Your driving record also has an impact on the cost of Cadillac Escalade auto insurance. How auto insurance companies check driving records, teens and drivers in their 20s see the highest jump in their Cadillac Escalade auto insurance rates with violations on their driving record.

Cadillac Escalade Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $580 | $725 | $865 | $660 |

| Age: 20 | $349 | $435 | $520 | $398 |

| Age: 30 | $159 | $198 | $238 | $179 |

| Age: 40 | $201 | $251 | $301 | $226 |

| Age: 50 | $185 | $231 | $277 | $208 |

| Age: 60 | $175 | $219 | $263 | $197 |

Understanding the factors influencing Cadillac Escalade insurance rates is crucial for making informed decisions. From the impact of vehicle age and driver demographics to location and driving record, each element plays a role in determining your insurance costs. By evaluating these factors carefully, you can effectively manage and potentially reduce your Cadillac Escalade insurance expenses.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cadillac Escalade Safety Features

The more safety features you have on your Cadillac Escalade, the more likely it is that you can earn a discount. The Cadillac Escalade’s safety features include a driver air bag, a passenger air bag, front head air bags, rear head air bags, front side air bags, 4-wheel ABS, 4-wheel disc brakes, electronic stability control, child safety locks, integrated turn signal mirrors, adjustable pedals, and traction control.

Having these advanced safety features equipped on your Cadillac Escalade not only enhances your safety on the road but also increases your eligibility for potential insurance discounts.

Understanding the average auto insurance cost per month can help you see the potential savings from these safety features.

Cadillac Escalade Insurance Loss Probability

Another contributing factor that plays a direct role in Cadillac Escalade insurance rates is the loss probability for each type of auto insurance coverage. The variation in Cadillac Escalade insurance rates can be significantly influenced by the probability of losses associated with different types of coverage.

Cadillac Escalade Auto Insurance Loss Probability

| Coverage | Probability |

|---|---|

| Collision | 56% |

| Property Damage | NA |

| Comprehensive | 22% |

According to data from the Insurance Institute for Highway Safety, collision coverage exhibits a high loss rate of 56%, while comprehensive coverage shows a lower loss probability of 22%. These statistics underscore how insurers assess risk factors such as vehicle type and coverage type when determining insurance premiums for the Cadillac Escalade.

Ways to Save on Cadillac Escalade Insurance

Although it may seem like your Cadillac Escalade auto insurance rates are set, there are a few measures that you can take to lower your auto insurance rates and secure the best possible rates. One effective approach is to choose a Cadillac Escalade with cheaper repair costs, as lower repair expenses can translate into lower insurance auto insurance premiums.

Additionally, checking for organization-based discounts, such as those available through alumni associations or employers, can provide significant savings. It is also beneficial to inquire about Cadillac Escalade safety discounts, which insurers often offer for vehicles equipped with advanced safety features.

Furthermore, purchasing a Cadillac Escalade with an anti-theft device can lead to reduced insurance rates, as these devices lower the risk of theft. Lastly, considering the option of renting a car instead of buying a second Cadillac Escalade can be a cost-effective alternative, potentially saving you money on insurance for an additional vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

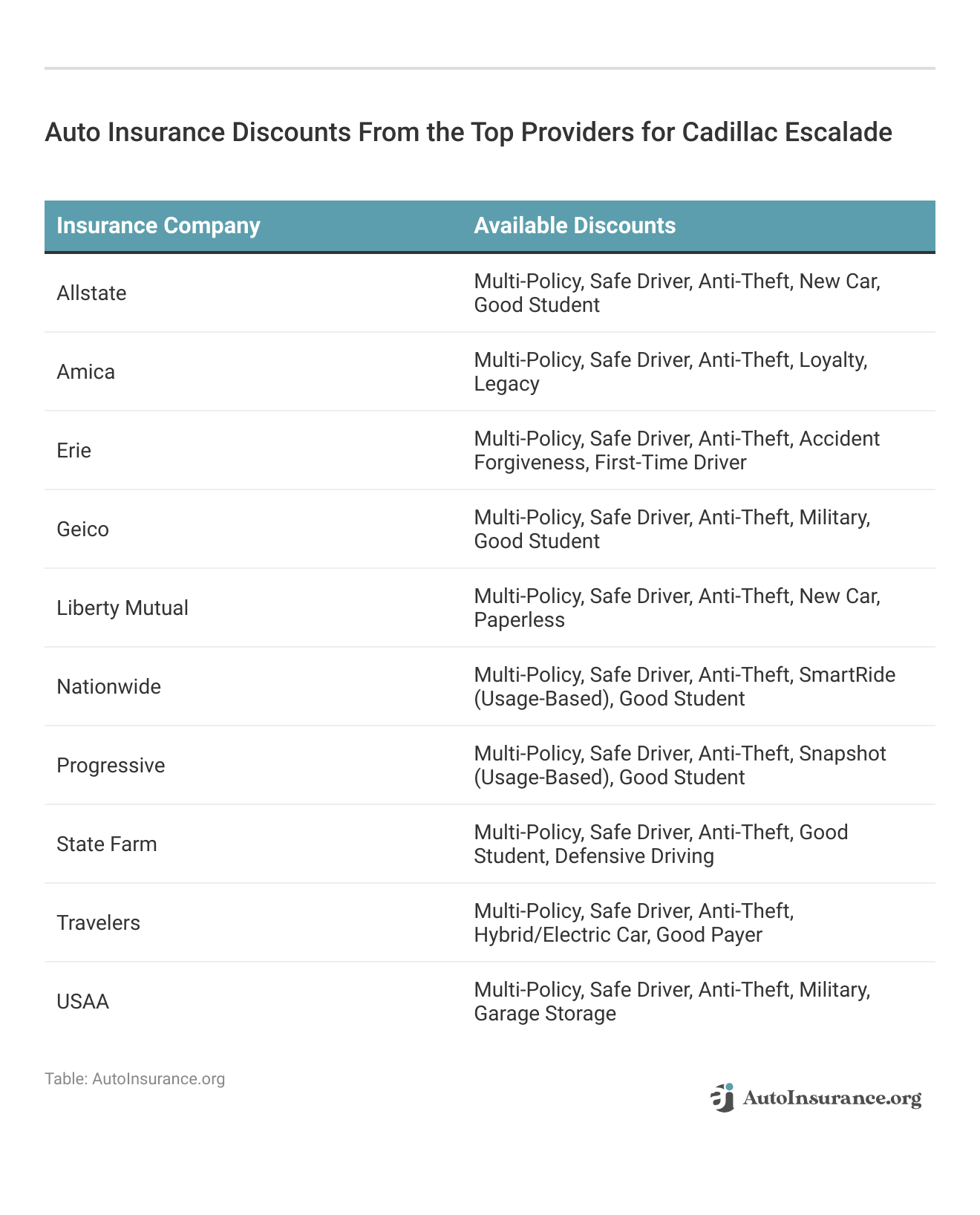

Top Cadillac Escalade Insurance Companies

Who is the top auto insurance company for Cadillac Escalade insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Cadillac Escalade auto insurance coverage (ordered by market share). Many of these companies offer auto insurance discounts for security systems and other safety features that the Cadillac Escalade offers.

Top 10 Cadillac Escalade Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.5 million | 3.3% |

| #8 | Chubb | $23.4 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

The table lists the top ten insurance providers for Cadillac Escalade owners, ranked by market share. State Farm leads with a volume of $65.6 million, capturing 9.3% of the market. Geico follows with $46.1 million and a 6.6% share. Progressive is third with $39.2 million and 5.6%. Liberty Mutual and Allstate are close, with volumes of $35.6 million and $35 million, holding 5.1% and 5% respectively.

Travelers has a 4% share at $28 million. USAA and Chubb both capture 3.3% with similar volumes around $23 million. Farmers and Nationwide round out the list with 2.9% and 2.6% shares, at $20.6 million and $18.4 million respectively.

How to Obtain an Online Quote for Cadillac Escalade Insurance

Getting free online auto insurance quote is a straightforward process that begins with visiting an insurance comparison website or the websites of individual insurance providers. To start, you will typically be asked to enter some basic information about yourself, such as your ZIP code, age, and driving history.

Next, you’ll provide details about your Cadillac Escalade, including its model year, trim level, and any safety features it may have. After submitting this information, the website’s algorithm will generate personalized Cadillac Escalade quotes from multiple insurance companies, allowing you to compare rates and coverage options side by side.

It’s important to review the details of each quote carefully, considering not only the cost but also the coverage limits and any additional benefits offered. This way, you can make an informed decision and choose the insurance policy that best meets your needs and budget.

Case Studies: Finding the Best Cadillac Escalade Auto Insurance

Choosing the right auto insurance for your Cadillac Escalade can be challenging due to various factors affecting premiums. Here, we present three concise case studies illustrating how different drivers found the best insurance options for their needs.

- Case Study #1 – Young Driver Seeks Affordable Coverage: Emily, a 25-year-old driver in Los Angeles, saved $120 annually by switching from Allstate to Geico, thanks to Geico’s competitive rates for young drivers. She also benefited from a discount for having multiple safety features on her Escalade.

- Case Study #2 – Retiree Prioritizes Customer Service: John, a retired 65-year-old from Phoenix, chose Erie for his Escalade after comparing quotes and prioritizing customer service. Erie’s excellent support and lower rates for older drivers helped him save $200 annually compared to his previous insurer.

- Case Study #3 – Family Man Bundles Policies: Michael, a 40-year-old father of three in Denver, saved on his Escalade insurance by bundling his home and auto policies with State Farm. This policy bundling provided him with a 15% discount and streamlined his insurance management. Learn more information on our “How to Get a Homeowners Auto Insurance Discount.”

These case studies highlight how drivers with different needs and backgrounds can find tailored insurance solutions. By comparing quotes, considering specific discounts, and prioritizing factors like customer service and policy bundling, you can secure the best coverage for your Cadillac Escalade.

Allstate is the top choice for Cadillac Escalade insurance, offering a perfect blend of coverage and cost-effectiveness.Daniel Walker Licensed Auto Insurance Agent

Use these examples as inspiration to evaluate your own insurance needs and take advantage of available options to maximize your savings and coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Bottom Line: Securing Optimal Insurance for Your Cadillac Escalade

Finding the best auto insurance for your Cadillac Escalade involves comparing quotes from top providers like Allstate, Erie, and Geico. Consider factors such as vehicle age, driver location, and driving record to determine the most affordable and comprehensive coverage. Utilizing discounts and maintaining a clean driving record can help reduce premiums.

Regularly reviewing and updating your insurance policy ensures it continues to meet your needs. Make sure to compare the best insurance companies to secure what suits your needs. By taking these steps, you can secure the best possible insurance rates for your Cadillac Escalade. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Are Cadillacs expensive to insure compared to other vehicles?

Luxury vehicles like the Cadillac Escalade generally have higher insurance costs due to their market value and repair expenses. Premiums are influenced by the vehicle’s price, safety features, theft rates, and repair costs. While insuring a Cadillac Escalade is more expensive than a regular sedan, rates vary between insurance companies, so it’s wise to shop around for the best deal.

How much does insurance for a Cadillac Escalade cost?

The cost of insurance for Cadillac Escalade can vary depending on several factors This includes auto insurance rates by age, location, driving history, age, and the specific model and trim of your Escalade. Additionally, insurance companies have their own pricing models and considerations.

What types of coverage should I consider for my Cadillac Escalade?

For your Cadillac Escalade, consider these coverages: liability (protects against damage or injury you cause), collision (covers damage from collisions), comprehensive (covers non-collision incidents like theft or vandalism), and uninsured/underinsured motorist (protects against drivers with insufficient insurance).

Enter your ZIP code below to find out if you can get a better deal.

Can I get discounts on insurance for my Cadillac Escalade?

Insurance companies offer various discounts to reduce premiums. Common discounts include multi-policy discounts for having multiple policies with the same company, safe driver discounts for clean driving records, anti-theft discounts for vehicles with anti-theft devices, and good student discounts for students with good grades.

Can my Cadillac Escalade’s insurance be affected by my credit score?

In some states and with certain insurers, your credit score affects auto insurance rates. Insurers may use credit-based insurance scores to assess risk. A higher credit score often suggests financial responsibility, potentially leading to lower premiums. However, not all states or insurers utilize credit scores in rate calculations, so it’s advisable to verify with your insurance provider.

Should I consider additional liability coverage for my Cadillac Escalade?

Additional liability coverage may be worth considering, especially if you want extra protection beyond the minimum required by your state. Cadillac Escalades are large and powerful vehicles, so any accident involving them could potentially result in higher damage or injury costs. Supplementing your liability coverage can provide greater financial security and protect your assets in the event of a significant accident.

Is Cadillac considered luxury?

Cadillac, with a heritage spanning more than a century, has consistently led the way in defining and redefining automotive luxury. Since its inception in 1902, Cadillac has been renowned for its association with luxury, sophistication, and continuous innovation in the automotive industry.

What car has the highest insurance cost?

The Maserati Quattroporte stands out as the priciest car to insure, commanding an average monthly premium of $514. Delve more details with our guide on the “Best Auto Insurance for Luxury Cars.”

How much is insurance for a Cadillac Escalade?

The monthly insurance premiums for a Cadillac Escalade vary significantly depending on the coverage type. Opting for liability coverage alone typically costs around $80, whereas full coverage averages about $195 per month.

Are Cadillacs expensive cars to fix?

Repair costs for vehicles can vary significantly based on the complexity of the model. Cadillacs, known for their intricate design, often incur higher maintenance expenses compared to other brands. The average repair cost for Cadillacs is approximately $783.

How much is insurance on a new Escalade?

The average annual monthly cheap Cadillac auto insurance for comprehensive type on an Escalade from Titan is approximately $76, which stands out as a highly competitive rate. It’s important to note, however, that insurance premiums can fluctuate significantly based on various factors.

Is Cadillac a premium car?

In 1909, General Motors (GM) acquired Cadillac, solidifying its position as one of America’s leading luxury automobile manufacturers. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.