Best Cadillac XT5 Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

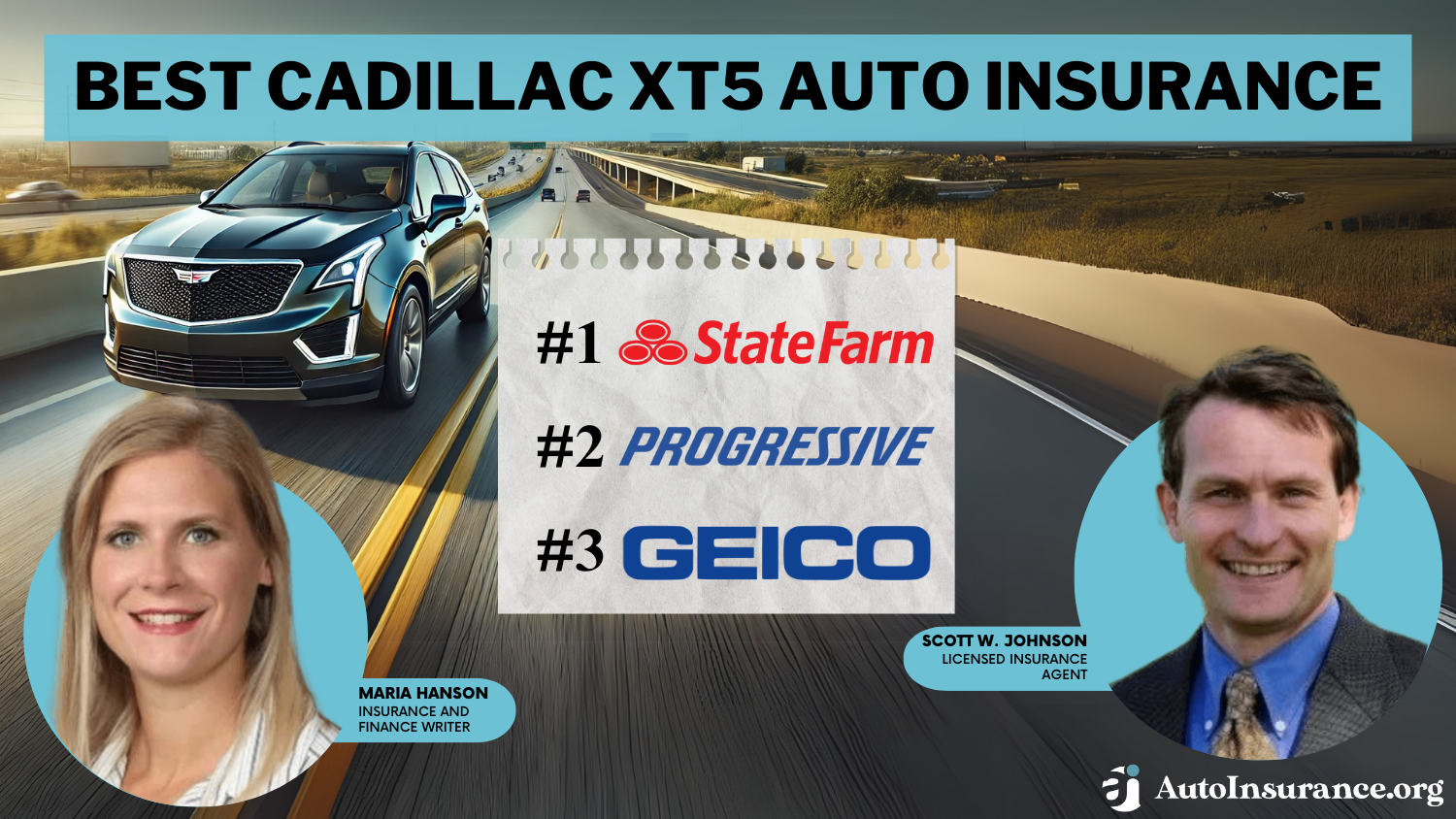

Explore the best Cadillac XT5 auto insurance with top providers like State Farm, Progressive, and Geico, offering rates as low as $32 per month. These companies excel in competitive pricing and comprehensive coverage. Get a Cadillac XT5 insurance quote to compare and secure the best deals for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Cadillac XT5

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Cadillac XT5

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Cadillac XT5

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, Progressive, and Geico are the best Cadillac XT5 auto insurance, with rates starting at just $32 per month. For the most competitive Cadillac XT5 crossover vehicle quote, State Farm stands out as the top choice due to its exceptional value and coverage options.

Our Top 10 Company Picks: Best Cadillac XT5 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Many Discounts | State Farm | |

| #2 | 12% | A+ | Student Savings | Progressive | |

| #3 | 10% | A++ | Cheap Rates | Geico | |

| #4 | 13% | A++ | Military Savings | USAA | |

| #5 | 10% | A+ | Add-on Coverages | Allstate | |

| #6 | 10% | A+ | Usage Discount | Nationwide |

| #7 | 10% | A | Online Convenience | American Family | |

| #8 | 12% | A | Customizable Polices | Liberty Mutual |

| #9 | 15% | A | Local Agents | Farmers | |

| #10 | 10% | A++ | Accident Forgiveness | Travelers |

Evaluate each provider’s full coverage plan to ensure you get the best balance of cost and benefits. Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Top Cadillac XT5 insurance rates start at $32 per month

- Full coverage options offer the best protection for your Cadillac XT5

- State Farm is the top pick for Cadillac XT5 auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Premiums: State Farm offers some of the lowest rates for Cadillac XT5 insurance at $103 per month, making it an affordable choice for budget-conscious owners seeking quality coverage.

- Discount Opportunities: State Farm provides a variety of discounts, including those for safe driving and bundling policies, which can significantly reduce your Cadillac XT5 insurance costs and enhance savings. For discounts read our State Farm auto insurance discounts.

- Extensive Network of Agents: With a large network of agents, State Farm ensures personalized customer service and support for Cadillac XT5 owners, allowing for tailored advice and effective handling of insurance needs.

Cons

- Limited Coverage Options: State Farm may offer fewer specialized coverage options for the Cadillac XT5 compared to other providers. This could be a drawback if you need more comprehensive or customized coverage.

- Lower Coverage Limits: The lower monthly premium might come with lower coverage limits for Cadillac XT5 insurance, potentially leaving you underinsured in the event of a significant claim or accident.

#2 – Progressive: Best for Student Savings

Pros

- Customizable Coverage: Progressive allows Cadillac XT5 owners to customize their insurance policies with various add-ons and options, ensuring tailored coverage to fit specific needs and preferences.

- Competitive Rates with Comprehensive Coverage: At $124 per month, Progressive offers a balance between competitive pricing and comprehensive coverage for Cadillac XT5, providing good value for the insurance you receive.

- User-Friendly Online Tools: Progressive auto insurance review showcases their website and mobile app feature easy-to-use tools for managing Cadillac XT5 insurance, allowing you to view and update coverage options, track claims, and access support efficiently.

Cons

- Higher Premiums for Some Drivers: While Progressive’s rates are competitive, some drivers, particularly those with less-than-ideal driving records, might find their premiums higher compared to other providers for Cadillac XT5 insurance.

- Mixed Customer Service Reviews: Progressive has received mixed reviews for customer service. Some Cadillac XT5 owners may experience delays or difficulties when filing claims or seeking assistance, which could be a concern.

#3 – Geico: Best for Cheap Rates

Pros

- Strong Financial Stability: Geico’s solid financial ratings ensure reliable coverage and support for Cadillac XT5 owners, ensuring that claims are paid promptly and efficiently, providing peace of mind.

- Extensive Discounts: Geico offers numerous discounts applicable to Cadillac XT5 insurance, including multi-policy and safe driver discounts, which can help offset the higher premium costs.

- Efficient Claims Process: Geico auto insurance review highlights its streamlined and efficient claims process, providing Cadillac XT5 owners with quick and hassle-free claims handling, minimizing stress during the claims process.

Cons

- Higher Premiums for Luxury Vehicles:

Geico’s premiums for Cadillac XT5, at $152 per month, may be higher than some competitors, reflecting the cost of insuring a luxury vehicle and potentially affecting overall affordability. - Limited Personalized Service:

Geico’s focus on online and phone-based service may lack the personalized touch that some Cadillac XT5 owners prefer, potentially impacting the quality of customer service and support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Savings

Pros

- Lowest Premiums: As mentioned in our USAA auto insurance review, USAA offers the most competitive rate for Cadillac XT5 insurance at $77 per month, providing substantial cost savings while maintaining high-quality insurance options.

- Exceptional Customer Service: USAA is renowned for its outstanding customer service, delivering personalized support and assistance to Cadillac XT5 owners, which enhances the overall insurance experience.

- Extensive Military Discounts: USAA provides generous discounts for military members and their families, making it an excellent choice for eligible Cadillac XT5 owners seeking both affordability and comprehensive coverage.

Cons

- Eligibility Restrictions: USAA’s insurance is available only to military members and their families, which limits access to their excellent rates and service for Cadillac XT5 insurance to a specific group.

- Limited Physical Locations: With fewer physical locations, USAA might not offer the in-person service that some Cadillac XT5 owners prefer, potentially impacting those who value face-to-face interactions.

#5 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options for Cadillac XT5 owners, including optional add-ons for enhanced protection, allowing you to customize your policy to meet specific needs.

- Numerous Discount Programs: Allstate offers various discount programs, such as those for safe driving and bundling, helping Cadillac XT5 owners reduce their overall insurance costs while maintaining robust coverage. Learn more about their discounts in our Allstate auto insurance review.

- Strong Local Agent Network: Allstate’s extensive network of local agents ensures personalized service and support for Cadillac XT5 insurance, providing tailored advice and effective handling of insurance needs.

Cons

- Higher Premiums for Some Drivers: At $137 per month, Allstate’s premiums might be higher for certain drivers, particularly those with less favorable driving histories, potentially impacting overall affordability.

- Mixed Customer Service Experiences: Customer service reviews for Allstate are mixed, with some Cadillac XT5 owners reporting less satisfactory experiences with claims processing and support, which could be a concern.

#6 – Nationwide: Best for Usage Discount

Pros

- Competitive Pricing: Nationwide offers competitive insurance rates for Cadillac XT5 at $123 per month. This balance of cost and coverage provides good value for Cadillac XT5 owners seeking affordability. For more information, read our Nationwide auto insurance review.

- Flexible Coverage Options: Nationwide allows Cadillac XT5 owners to customize their insurance policies with a range of coverage options, ensuring that you can find a plan that fits your specific needs and preferences.

- Strong Customer Satisfaction: Nationwide is known for high customer satisfaction, which reflects positively on their handling of Cadillac XT5 insurance policies. This ensures a more reliable and supportive insurance experience.

Cons

- Moderate Premiums: While Nationwide’s premiums are competitive, they are higher than some of the lowest options available, potentially impacting affordability for budget-conscious Cadillac XT5 owners.

- Limited Discounts for Luxury Vehicles: Nationwide may offer fewer discounts specifically for luxury vehicles like the Cadillac XT5 compared to other providers, which could limit opportunities for additional savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Online Convenience

Pros

- Wide Range of Coverage Options: American Family offers a diverse array of coverage options for Cadillac XT5 owners, including optional add-ons that can be tailored to provide comprehensive protection specific to your vehicle.

- Discount Programs: American Family provides several discount opportunities, such as safe driver and multi-policy discounts, which can significantly reduce your Cadillac XT5 insurance premiums. (Read More: American Family Auto Insurance Review).

- Solid Customer Service: With a reputation for good customer service, American Family supports Cadillac XT5 owners with reliable assistance and advice, ensuring a smooth insurance experience.

Cons

- Higher Premiums for Some Drivers: At $133 per month, American Family’s rates might be higher compared to some other providers. This could be a concern for those seeking more budget-friendly insurance options.

- Limited Regional Availability: American Family’s services might not be available in all states, potentially restricting access for Cadillac XT5 owners depending on their location.

#8 – Liberty Mutual: Best for Customizable Polices

Pros

- Comprehensive Coverage Options: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual provides extensive coverage options for Cadillac XT5 owners, including a variety of add-ons and enhancements that offer robust protection for your vehicle.

- High Coverage Limits: Liberty Mutual’s higher premiums typically come with higher coverage limits, which can provide Cadillac XT5 owners with more extensive protection in case of major claims or accidents.

- Discount Opportunities: Liberty Mutual offers various discounts, such as those for safe driving and bundling policies, which can help offset some of the higher costs associated with Cadillac XT5 insurance.

Cons

- Highest Premiums: At $207 per month, Liberty Mutual’s premiums are the highest among the listed providers. This could be a significant drawback for Cadillac XT5 owners looking for more affordable insurance options.

- Potential for Higher Out-of-Pocket Costs: The higher premiums might be associated with higher out-of-pocket costs for Cadillac XT5 insurance claims, potentially impacting the overall value of the coverage.

#9 – Farmers: Best for Local Agents

Pros

- Customizable Policies: Farmers offers customizable insurance policies for Cadillac XT5 owners, allowing you to select from various coverage options and add-ons to fit your specific needs and preferences.

- Variety of Discounts: Farmers provides multiple discount opportunities, including those for safe driving and bundling, which can help reduce your overall Cadillac XT5 insurance costs.

- Strong Customer Service: Farmers is known for its solid customer service, offering Cadillac XT5 owners responsive support and assistance, ensuring a positive insurance experience. Check out this page Farmers auto insurance review to know more details.

Cons

- Higher Premiums: At $153 per month, Farmers’ premiums for Cadillac XT5 insurance are higher compared to many other providers, which could be a concern for those looking for more cost-effective options.

- Limited Availability of Discounts for Luxury Vehicles: Farmers may offer fewer discounts specifically tailored to luxury vehicles like the Cadillac XT5, potentially limiting opportunities for additional savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Accident Forgiveness

Pros

- Affordable Premiums: As outlined in our Travelers auto insurance review, Travelers offers relatively affordable rates for Cadillac XT5 insurance at $118 per month, providing good coverage options without significantly impacting your budget.

- Customizable Coverage: Travelers provides a range of coverage options and add-ons for Cadillac XT5 owners, allowing for personalized insurance plans that cater to specific needs and preferences.

- Discount Programs: Travelers offers various discount opportunities, such as safe driving and multi-policy discounts, which can help reduce the overall cost of Cadillac XT5 insurance.

Cons

- Coverage Limitations: Some Cadillac XT5 owners may find Travelers’ coverage options to be less comprehensive compared to other providers, which could be a drawback if you need more extensive protection.

- Customer Service Variability: Customer service reviews for Travelers can be mixed, with some Cadillac XT5 owners reporting less satisfactory experiences with claims processing and support, which could be a concern.

Cadillac XT5 Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Cadillac XT5 from various providers.

Cadillac XT5 Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $46 | $137 |

| American Family | $44 | $133 |

| Farmers | $50 | $153 |

| Geico | $50 | $152 |

| Liberty Mutual | $67 | $207 |

| Nationwide | $38 | $123 |

| Progressive | $40 | $124 |

| State Farm | $32 | $103 |

| Travelers | $37 | $118 |

| USAA | $25 | $77 |

While USAA offers the most affordable insurance rates for the Cadillac XT5, other providers like Liberty Mutual and Farmers offer extensive coverage options at higher premiums. It’s crucial to compare quotes and coverage levels to find the best balance between cost and protection for your Cadillac XT5.

Cadillac XT5 Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $135 |

| Discount Rate | $80 |

| High Deductibles | $117 |

| High Risk Driver | $288 |

| Low Deductibles | $170 |

| Teen Driver | $495 |

Insurance rates for the Cadillac XT5 vary significantly based on deductible levels and driver profiles, with high deductibles and low-risk drivers enjoying the most affordable premiums. Conversely, higher-risk drivers and those with low deductibles face substantially higher costs.

Read More: High-Risk Auto Insurance

Why Cadillac XT5s are Expensive to Insure

The chart below details how Cadillac XT5 insurance rates compare to other SUVs like the Mercedes-Benz GLS 450, Chevrolet Traverse, and Toyota Highlander.

Cadillac XT5 Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Cadillac XT5 | $31 | $60 | $31 | $135 |

| Chevrolet Traverse | $28 | $39 | $26 | $105 |

| Ford Explorer | $26 | $39 | $31 | $109 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| Mercedes-Benz GLE 350 | $37 | $73 | $33 | $155 |

| Mercedes-Benz GLS 450 | $38 | $75 | $33 | $159 |

| Toyota Highlander | $28 | $43 | $33 | $116 |

Overall, the Cadillac XT5’s insurance rates are higher than some SUVs like the Chevrolet Traverse and Toyota Highlander but lower than the Mercedes-Benz GLS 450 and GLE 350. This highlights the Cadillac XT5’s competitive pricing within the luxury SUV segment while still offering substantial coverage.

Read More: Cheap Mercedes-Benz Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Cadillac XT5 Insurance

The cost of Cadillac XT5 insurance is influenced by factors such as the vehicle’s age, driver’s age, and location. Newer models and younger drivers typically face higher premiums, while older vehicles and more experienced drivers usually have lower rates.

Your location also affects premiums, with urban areas generally costing more due to higher risks.Justin Wright LICENSED INSURANCE AGENT

Additional factors include your driving history and the type of coverage. A clean driving record leads to lower rates, while a history of accidents or violations results in higher premiums.

The type of coverage and deductible levels also impact costs; higher coverage and lower deductibles increase premiums, while higher deductibles can lower monthly payments. Understanding these elements can help manage and potentially reduce your insurance costs.

Read More: Cheap Auto Insurance for a Bad Driving Record

Age of the Vehicle

Older Cadillac XT5 models generally cost less to insure. For example, insurance for a 2020 Cadillac XT5 typically results in higher monthly premiums compared to the 2017 Cadillac XT5, reflecting the lower cost of insuring older models.

Cadillac XT5 Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Cadillac XT5 | $32 | $61 | $32 | $136 |

| 2023 Cadillac XT5 | $32 | $61 | $32 | $136 |

| 2022 Cadillac XT5 | $31 | $60 | $31 | $135 |

| 2021 Cadillac XT5 | $31 | $60 | $31 | $135 |

| 2020 Cadillac XT5 | $31 | $60 | $31 | $135 |

| 2019 Cadillac XT5 | $30 | $58 | $33 | $133 |

| 2018 Cadillac XT5 | $29 | $57 | $33 | $132 |

| 2017 Cadillac XT5 | $28 | $56 | $35 | $131 |

Insurance costs for the Cadillac XT5 decrease as the vehicle ages, reflecting lower value and repair expenses for older models. This trend highlights how older Cadillac XT5s generally incur lower insurance premiums compared to newer models.

Driver Age

Driver age can have a significant impact on Cadillac XT5 auto insurance rates. For example, 20-year-old drivers typically pay around $165 more per month for their Cadillac XT5 insurance compared to 30-year-old drivers.

Cadillac XT5 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $420 |

| Age: 18 | $377 |

| Age: 20 | $307 |

| Age: 30 | $141 |

| Age: 40 | $135 |

| Age: 45 | $128 |

| Age: 50 | $123 |

| Age: 60 | $121 |

Insurance rates for the Cadillac XT5 vary significantly by driver age, with younger drivers facing much higher premiums. For example, teen drivers pay substantially more compared to those in their 60s, highlighting the impact of age on insurance costs.

Driver Location

Where you live can significantly impact Cadillac XT5 insurance rates. For example, drivers in Los Angeles may pay much more per month compared to drivers in Phoenix.

Cadillac XT5 Auto Insurance Monthly Rates by City

| State | Rates |

|---|---|

| Los Angeles, CA | $231 |

| New York, NY | $214 |

| Houston, TX | $212 |

| Jacksonville, FL | $196 |

| Philadelphia, PA | $181 |

| Chicago, IL | $179 |

| Phoenix, AZ | $157 |

| Seattle, WA | $131 |

| Indianapolis, IN | $115 |

| Columbus, OH | $112 |

Cadillac XT5 insurance rates vary widely across U.S. cities, with Los Angeles and New York experiencing the highest premiums. Conversely, cities like Columbus and Indianapolis offer significantly lower insurance costs, reflecting the impact of location on rates.

Your Driving Record

Your driving record can have an impact on your Cadillac XT5 auto insurance rates. Teens and drivers in their 20’s see the highest jump in their Cadillac XT5 car insurance with violations on their driving record.

Cadillac XT5 Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Ticket | Speed + Accident |

|---|---|---|---|

| Age: 20 | $307 | $334 | $588 |

| Age: 30 | $141 | $154 | $271 |

| Age: 40 | $135 | $147 | $259 |

| Age: 50 | $123 | $134 | $237 |

| Age: 60 | $121 | $132 | $232 |

Cadillac XT5 insurance rates increase significantly with traffic violations and accidents, especially for younger drivers. Maintaining a clean driving record can help keep insurance costs lower across all age groups.

Safety Ratings

Your Cadillac XT5 auto insurance rates are influenced by the Cadillac XT5’s safety ratings. See the breakdown below:

Cadillac XT5 Safety Ratings

| Test Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Cadillac XT5’s strong safety ratings contribute to potentially lower insurance premiums. With consistently high ratings across various safety tests, the XT5 demonstrates its value in maintaining both driver and passenger protection.

Crash Test Ratings

Not only do good Cadillac XT5 crash test ratings mean you are better protected in a crash, but good crash ratings also mean cheaper Cadillac XT5 auto insurance rates.

Cadillac XT5 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Cadillac XT5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Cadillac XT5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Cadillac XT5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Cadillac XT5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Cadillac XT5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Cadillac XT5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Cadillac XT5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Cadillac XT5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Cadillac XT5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Cadillac XT5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Cadillac XT5 SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Cadillac XT5 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Cadillac XT5 SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Cadillac XT5 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Cadillac XT5 SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Cadillac XT5 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

The Cadillac XT5’s high crash test ratings underscore its strong safety performance, contributing to potentially lower insurance premiums. Consistently high ratings across various tests highlight the vehicle’s robust protection and value.

Cadillac XT5 Safety Features

The more safety features you have on your Cadillac XT5, the more likely it is that you can earn a discount. The Cadillac XT5’s safety features include:

- Air Bags: Driver, passenger, front head, rear head, and front side air bags

- Braking System: 4-wheel ABS and 4-wheel disc brakes

- Safety Features: Daytime running lights and child safety locks

- Driver Assistance: Traction control, lane departure warning, and lane keeping assist

- Visibility Enhancements: Integrated turn signal mirrors

The Cadillac XT5’s comprehensive safety features can contribute to potential insurance discounts. Enhanced safety and driver assistance technologies not only improve protection but may also help lower insurance premiums.

Cadillac XT5 Finance and Insurance Cost

If you are financing a Cadillac XT5, you will pay more if you purchase Cadillac XT5 car insurance at the dealership, so be sure to shop around and compare Cadillac XT5 car insurance quotes from the best companies using our free tool below.

Read More: What are the benefits of auto insurance?

Ways to Save on Cadillac XT5 Insurance

There are many ways that you can save on Cadillac XT5 car insurance. Below are five actions you can take to find cheap Cadillac XT5 auto insurance rates.

- Move to an area with a lower cost of living.

- Ask about a student away from home discount.

- Remove young drivers from your Cadillac XT5 insurance when they move out or go to school.

- Park your Cadillac XT5 somewhere safe – like a garage or private driveway.

- Ask for a Cadillac XT5 discount if you have college degree or higher.

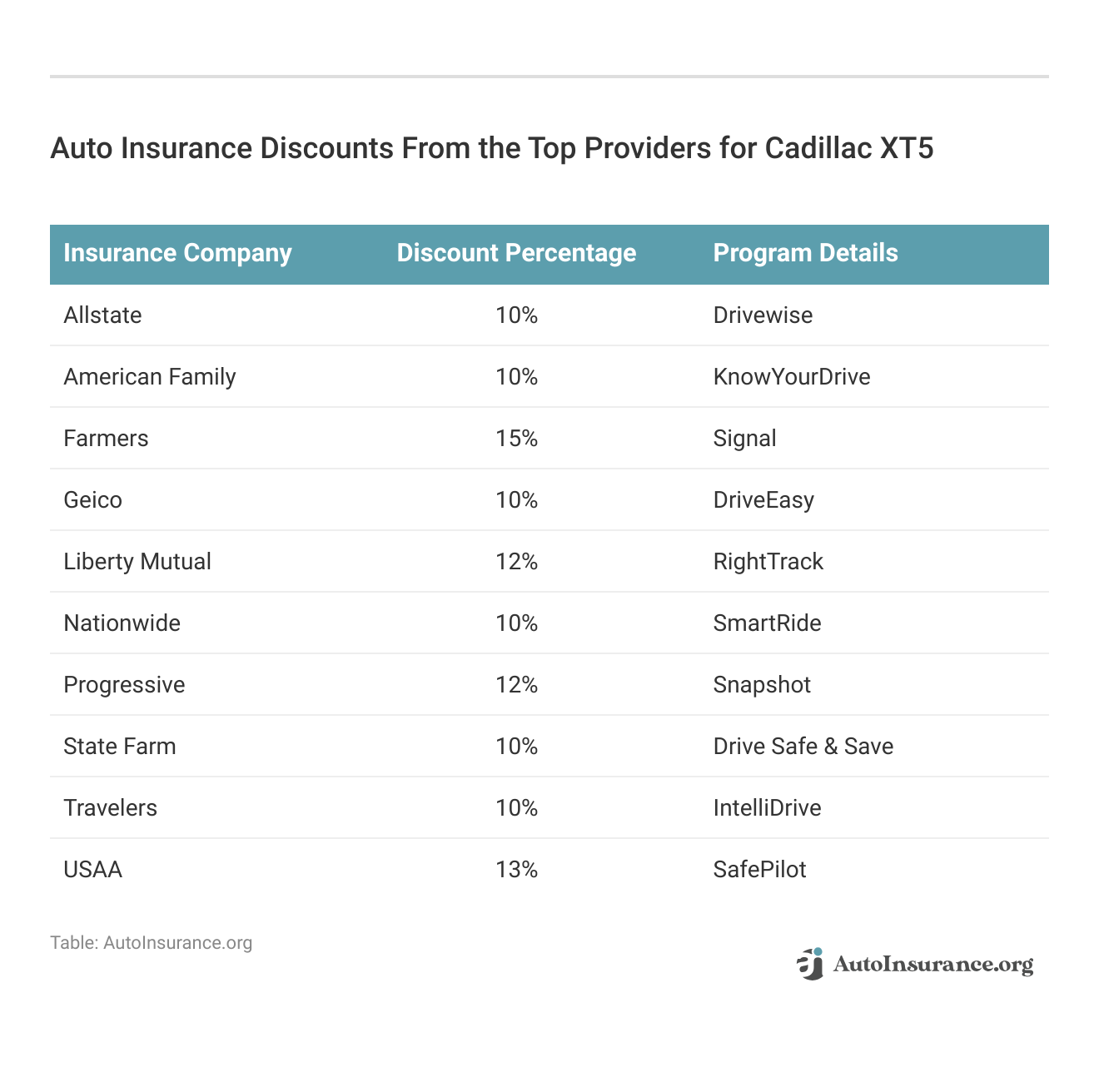

Discover the variety of auto insurance discounts offered by top providers for Cadillac XT5 to help you save on your premiums.

These discounts from top insurance providers for Cadillac XT5 offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Cadillac XT5 Insurance Companies

The best auto insurance companies for Cadillac XT5 car insurance rates will offer competitive rates, discounts, and account for the Cadillac XT5’s safety features. The following list of car insurance companies outlines which companies hold the highest market share.

Top Cadillac XT5 Auto Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9% |

| #2 | Geico | $46.1 million | 6% |

| #3 | Progressive | $39.2 million | 5% |

| #4 | Liberty Mutual | $35.6 million | 5% |

| #5 | Allstate | $35.0 million | 5% |

| #6 | Travelers | $28.0 million | 4% |

| #7 | USAA | $23.4 million | 3% |

| #8 | Chubb | $23.3 million | 3% |

| #9 | Farmers | $20.6 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

The top insurance companies for Cadillac XT5 offer competitive rates and valuable discounts while considering the vehicle’s safety features. Choosing among these leading providers can help ensure you get the best coverage and savings for your Cadillac XT5.

Compare Free Cadillac XT5 Insurance Quotes Online

You can start comparing quotes for Cadillac XT5 car insurance rates from some of the best insurance providers by using our free online tool. This tool allows you to evaluate coverage options, discounts, and premiums from top-rated companies, ensuring you find cheap Cadillac auto insurance that fits your needs and budget.

By comparing multiple quotes, you can secure comprehensive coverage at competitive rates and potentially save on your monthly premiums. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

How much does Cadillac XT5 insurance cost on average?

The average cost of Cadillac XT5 insurance is $135 per month. Comprehensive coverage costs about $33 per month, collision coverage around $48 per month, and liability coverage approximately $38 per month

How does having a clean driving record impact Cadillac XT5 insurance rates?

Having a clean driving record positively affects Cadillac XT5 insurance rates. Drivers with no accidents or violations typically enjoy lower premiums compared to those with a history of traffic violations or claims.

Read More: Do points affect auto insurance rates?

How can I lower my Cadillac XT5 insurance premiums?

To lower your Cadillac XT5 insurance premiums, you can increase your deductible, maintain a clean driving record, take advantage of available discounts (such as for safety features or bundling policies), and compare quotes from different insurance companies.

Are Cadillac XT5s expensive to insure?

Compared to other SUVs like the Mercedes-Benz GLS 450, Chevrolet Traverse, and Toyota Highlander, Cadillac XT5 insurance rates are higher on average. However, there are ways to find cheaper insurance rates for Cadillac XT5s.

What factors impact the cost of Cadillac XT5 insurance?

Several factors can influence the cost of Cadillac XT5 insurance, including the age of the vehicle, driver age, driver location, driving record, and safety features. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How does having a garage or private driveway affect Cadillac XT5 auto insurance rates?

Having a garage or private driveway can lower your Cadillac XT5 auto insurance rates. Vehicles parked in a garage or secured driveway are less susceptible to theft and vandalism, which insurers often take into account for providing discounts.

How does the age of the vehicle affect Cadillac XT5 insurance rates?

Older Cadillac XT5 models typically have lower insurance costs. For example, insuring a 2020 Cadillac XT5 may cost $135 per month, while insuring a 2017 Cadillac XT5 might be around $131 per month.

How does driver age impact Cadillac XT5 insurance rates?

Driver age has a significant impact on Cadillac XT5 insurance rates. Younger drivers in their 20s can expect to pay about $166 more per month compared to drivers in their 30s.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

Which insurance company is recommended for Cadillac XT5 owners?

State Farm is often recommended for Cadillac XT5 owners due to its competitive rates, comprehensive coverage options, and strong customer service. It offers one of the best rates among leading insurance providers for this vehicle.

Are there specific discounts available for Cadillac XT5 insurance?

Yes, many insurers offer specific discounts for Cadillac XT5 insurance. These may include discounts for having advanced safety features, being a safe driver, maintaining a good credit score, and bundling multiple policies with the same provider.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.