Best Chevrolet Avalanche Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Chevrolet Avalanche auto insurance comes from State Farm, USAA, and Progressive, with rates starting at $78 per month. These companies offer competitive rates, comprehensive coverage options, and excellent customer service, making them top choices for Chevrolet Avalanche owners seeking quality insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Chevrolet Avalanche

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Chevrolet Avalanche

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Chevrolet Avalanche

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The top picks for the best Chevrolet Avalanche auto insurance are State Farm, USAA, and Progressive, with rates starting at $78 per month. These companies stand out for their competitive pricing, comprehensive coverage options, and exceptional customer service, making them ideal choices for Chevrolet Avalanche owners.

Factors such as driver age, location, and driving record significantly influence insurance rates, with younger drivers and those in high-risk areas typically paying more. Additionally, the Chevrolet Avalanche’s safety features can help lower premiums.

Our Top 10 Company Picks: Best Chevrolet Avalanche Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Comprehensive Coverage State Farm

#2 10% A++ Military Benefits USAA

#3 12% A+ Snapshot Program Progressive

#4 12% A Accident Forgiveness Liberty Mutual

#5 20% A+ Drivewise Program Allstate

#6 15% A+ Vanishing Deductible Nationwide

#7 15% A Customized Policies Farmers

#8 10% A+ AARP Benefits The Hartford

#9 13% A++ Multiple Discounts Travelers

#10 15% A Safe Driver American Family

By comparing quotes from multiple insurers and leveraging discounts, you can find the best coverage at the most affordable rates. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- State Farm offers the best rates starting at $78 per month

- Best Chevrolet Avalanche auto insurance is influenced by different factors

- Chevrolet Avalanche safety features help reduce insurance premiums

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: Our examination of State Farm auto insurance review shows State Farm offers significant discounts for bundling policies, lowering overall costs for Chevrolet Avalanche auto insurance.

- High Low-Mileage Discount: State Farm provides substantial discounts for low-mileage Chevrolet Avalanche drivers, making it a great option for those with less driving.

- Comprehensive Coverage: State Farm offers a wide range of coverage options tailored to Chevrolet Avalanche needs making it the best Chevrolet Avalanche auto insurance.

Cons

- Limited Multi-Policy Discount: State Farm’s multi-policy discount for Chevrolet Avalanche auto insurance is lower compared to some competitors.

- Higher Premiums: Premiums for Chevrolet Avalanche auto insurance might still be relatively higher for certain coverage levels despite discounts.

#2 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: USAA offers special discounts on Chevrolet Avalanche insurance for military personnel and minimum coverage starts at $78.

- High Customer Satisfaction: Our USAA auto insurance review indicates USAA is highly rated for customer service and satisfaction among Chevrolet Avalanche owners.

- Comprehensive Coverage: USAA provides a wide range of coverage options suited for Chevrolet Avalanche.

Cons

- Membership Restrictions: USAA’s Chevrolet Avalanche auto insurance is available only to military members, veterans, and their families.

- Limited Local Agents: Fewer local agents compared to other providers for Chevrolet Avalanche auto insurance may impact personalized service.

#3 – Progressive: Best for Snapshot Program

Pros

- Usage-Based Discounts: Progressive’s Snapshot program offers discounts based on safe driving habits for Chevrolet Avalanche.

- Competitive Rates: According to our Progressive auto insurance review, Progressive provides competitive rates for Chevrolet Avalanche auto insurance starting at $90.

- Wide Range of Discounts: Various discounts, including multi-policy and good driver discounts, are available for Chevrolet Avalanche drivers.

Cons

- Snapshot Privacy Concerns: Some drivers may have privacy concerns regarding the data collected by Snapshot for Chevrolet Avalanche auto insurance.

- Rate Increases: Poor Snapshot scores can lead to increased rates for Chevrolet Avalanche drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual prevents rate increases after the first accident for Chevrolet Avalanche owners.

- Multiple Policy Discounts: The results of our Liberty Mutual auto insurance review suggests Liberty Mutual offers discounts for Chevrolet Avalanche auto insurance for bundling multiple insurance policies.

- Comprehensive Coverage: Liberty Mutual offers various coverage options tailored to Chevrolet Avalanche drivers.

Cons

- Higher Premiums: Premiums for Chevrolet Avalanche can be higher compared to some competitors. Minimum coverage starts at $92.

- Limited Availability: Accident forgiveness is not available in all states for Chevrolet Avalanche auto insurance owners.

#5 – Allstate: Best for DriveWise Program

Pros

- DriveWise Program: Rewards safe driving with discounts for Chevrolet Avalanche drivers.

- Extensive Agent Network: Our analysis of Allstate auto insurance review reveals Allstate is known for its large network of local agents offers personalized service for Chevrolet Avalanche auto insurance policyholders.

- Comprehensive Coverage Options: A wide range of coverage options is available for Chevrolet Avalanche owners.

Cons

- DriveWise Participation: Not all drivers with Chevrolet Avalanche auto insurance may be comfortable with the monitoring required by DriveWise.

- Higher Premiums: Premiums can be higher for Chevrolet Avalanche auto insurance, especially without DriveWise discounts, can start at $95.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Our assessment of Nationwide auto insurance review illustrates Nationwide offers a program that reduces deductibles for Chevrolet Avalanche owners with safe driving possibly making the cost of minimum coverage at $88.

- Multi-Policy Discounts: Provides discounts for bundling multiple policies for Chevrolet Avalanche owners.

- Comprehensive Coverage: Offers a variety of coverage options to suit Chevrolet Avalanche needs.

Cons

- Limited Availability: Vanishing deductible is not available in all states for Chevrolet Avalanche auto insurance policyholders.

- Higher Rates: Rates for Chevrolet Avalanche auto insurance can be higher compared to some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customized Policies

Pros

- Customized Coverage: Offers flexible policy options tailored to Chevrolet Avalanche owners.

- Strong Customer Service: According to our Farmers auto insurance review, Farmers is known for reliable customer service and claims handling on Chevrolet Avalanche auto insurance owners.

- Multi-Policy Discounts: Discounts are available for Chevrolet Avalanche auto insurance to those bundling multiple insurance products.

Cons

- Higher Premiums: Premiums can be higher compared to other insurers starting at $89 for Chevrolet Avalanche owners.

- Limited Discount Options: Fewer discount options for Chevrolet Avalanche auto insurance compared to some competitors.

#8 – The Hartford: Best for AARP Benefits

Pros

- AARP Member Discounts: Offers special The Hartford auto insurance discounts and benefits for AARP members insuring a Chevrolet Avalanche starting at $91.

- Comprehensive Coverage: Provides a wide range of coverage options for Chevrolet Avalanche owners.

- Reliable Claims Service: Known for Chevrolet Avalanche auto insurance dependable claims service.

Cons

- Membership Requirement: Discounts are only available to AARP members for Chevrolet Avalanche owners.

- Higher Rates: Rates for Chevrolet Avalanche auto insurance can be higher compared to some other insurers.

#9 – Travelers: Best for Multiple Discounts

Pros

- Wide Range of Discounts: Offers numerous discounts, including multi-policy and safe driver discounts for Chevrolet Avalanche.

- Competitive Rates: Provides competitive rates for Chevrolet Avalanche insurance. Minimum coverage starts at $87 per month.

- Comprehensive Coverage: Insights from our Travelers auto insurance reviews shows Travelers’ Chevrolet Avalanche auto insurance extensive coverage options available.

Cons

- Limited Local Agents: Fewer local agents for Chevrolet Avalanche auto insurance compared to some other providers.

- Rate Increases: Rates can increase significantly after claims Chevrolet Avalanche owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Safe Driver

Pros

- Safe Driver Discounts: Offers substantial discounts for Chevrolet Avalanche owners with safe driving records.

- Bundling Policies: Provides discounts for Chevrolet Avalanche auto insurance to those bundling multiple policies with rates starting at $86 monthly.

- Strong Customer Service: Our American Family auto insurance review highlights American Family being known for excellent customer service on Chevrolet Avalanche auto insurance.

Cons

- Higher Premiums: Premiums can be higher without safe driver discounts for Chevrolet Avalanche owners.

- Limited Availability: Some discounts and coverage options for Chevrolet Avalanche auto insurance may not be available in all states.

The Cost of Insuring a Chevrolet Avalanche

When evaluating auto insurance rates for a Chevrolet Avalanche, there’s a notable range in monthly premiums depending on both the insurance provider and the level of coverage. For minimum coverage, USAA offers the most competitive rate at $78 per month, while State Farm follows with a rate of $85.

In contrast, Allstate’s rate of $95 stands at the higher end of the spectrum for minimum coverage. This disparity illustrates how different insurance companies price their policies based on various factors and underwriting criteria.

Chevrolet Avalanche Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $160

American Family $86 $143

Farmers $89 $150

Liberty Mutual $92 $155

Nationwide $88 $148

Progressive $90 $150

State Farm $85 $145

The Hartford $91 $152

Travelers $87 $140

USAA $78 $130

For those opting for full coverage auto insurance, USAA remains the most affordable, charging $130 per month, while Allstate again emerges as the priciest option at $160. The variation in full coverage rates further underscores the importance of comparing policies to find the best balance between cost and coverage.

Ultimately, selecting the right insurance provider involves weighing both the monthly premium and the comprehensiveness of the coverage provided.

Chevrolet Avalanches Cost by Model and Coverage Type

The chart below details how Chevrolet Avalanche insurance rates compare to other trucks like the Chevrolet Silverado 2500HD, Chevrolet Silverado 3500HD, and Ford F-150 by type of auto insurance.

Chevrolet Avalanche Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Avalanche | $30 | $57 | $35 | $138 |

| Chevrolet Silverado 3500HD | $34 | $55 | $35 | $138 |

| Ford F-150 | $27 | $39 | $31 | $110 |

| Chevrolet Silverado | $27 | $47 | $35 | $124 |

| GMC Canyon | $23 | $40 | $33 | $109 |

| Ford Ranger | $21 | $39 | $31 | $105 |

The table compares insurance costs for various vehicles, detailing comprehensive, collision, minimum, and full coverage prices. The Chevrolet Avalanche and Chevrolet Silverado 3500HD both have full coverage costs of $138, with similar comprehensive and collision rates.

The Ford F-150 and Ford Ranger have lower full coverage costs at $110 and $105, respectively, with the Ranger having the lowest comprehensive insurance at $21. The Chevrolet Silverado and GMC Canyon fall in the middle range, with full coverage costs of $124 and $109, respectively. Overall, the Ford Ranger offers the lowest insurance costs across all coverage types.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting Chevrolet Avalanche Insurance Costs

The trim and model you choose will affect the total price you will pay for Chevrolet Avalanche auto insurance by vehicle coverage.

Driver age can have a significant impact on the cost of Chevrolet Avalanche auto insurance. For example, 20-year-old drivers pay as much as $253 more each month for their Chevrolet Avalanche auto insurance than 40-year-old drivers.

Chevrolet Avalanche Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 18 | $482 |

| Age: 20 | $425 |

| Age: 30 | $189 |

| Age: 40 | $172 |

| Age: 50 | $160 |

| Age: 60 | $150 |

Where you live can have a large impact on Chevrolet Avalanche insurance rates. For example, drivers in Los Angeles may pay $79 more per month than drivers in Columbus.

Chevrolet Avalanche Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $176 |

| Columbus, OH | $159 |

| Houston, TX | $198 |

| Indianapolis, IN | $165 |

| Jacksonville, FL | $182 |

| Los Angeles, CA | $238 |

| New York, NY | $215 |

| Philadelphia, PA | $201 |

| Phoenix, AZ | $189 |

| Seattle, WA | $172 |

Your driving record can have an impact on the cost of Chevrolet Avalanche auto insurance. Teens and drivers in their 20’s see the highest jump in their Chevrolet Avalanche auto insurance with violations on their driving record.

Chevrolet Avalanche Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $482 | $723 | $964 | $602 |

| Age: 20 | $425 | $638 | $850 | $531 |

| Age: 30 | $189 | $284 | $378 | $236 |

| Age: 40 | $172 | $258 | $344 | $215 |

| Age: 50 | $160 | $240 | $320 | $200 |

| Age: 60 | $150 | $225 | $300 | $188 |

Understanding the factors influencing Chevrolet Avalanche insurance rates is crucial for making informed decisions. From the impact of vehicle age and driver demographics to location and driving record, each element plays a role in determining your insurance costs. By evaluating these factors carefully, you can effectively manage and potentially reduce your Chevrolet Avalanche insurance expenses.

The Impact of Chevrolet Avalanche Safety Features

The safety features of the Chevrolet Avalanche can impact your Chevrolet Avalanche auto insurance rates. The Chevrolet Avalanche has the following safety features:

Chevrolet Avalanche Safety Features

| Feature | Description |

|---|---|

| 4-Wheel ABS | Prevents wheel lockup during braking for better control. |

| 4-Wheel Disc Brakes | Provides strong and reliable stopping power. |

| Adjustable Pedals | Allows driver to adjust pedal height for comfort. |

| Daytime Running Lights | Increases vehicle visibility during the day. |

| Driver Air Bag | Protects the driver in the event of a collision. |

| Electronic Stability Control | Helps maintain vehicle control on slippery roads. |

| Front Head Air Bag | Protects front passengers during a collision. |

| Front Side Air Bag | Protects front passengers in side-impact crashes. |

| Integrated Turn Signal Mirrors | Improves visibility of turn signals for other drivers. |

| Passenger Air Bag | Protects the front passenger in a collision. |

| Rear Head Air Bag | Protects rear passengers during a collision. |

| Traction Control | Prevents wheel spin for better grip and stability. |

Equipping your Chevrolet Avalanche with these advanced safety features not only improves your road safety but also makes you more likely to qualify for potential insurance discounts such as good driver auto insurance discount.

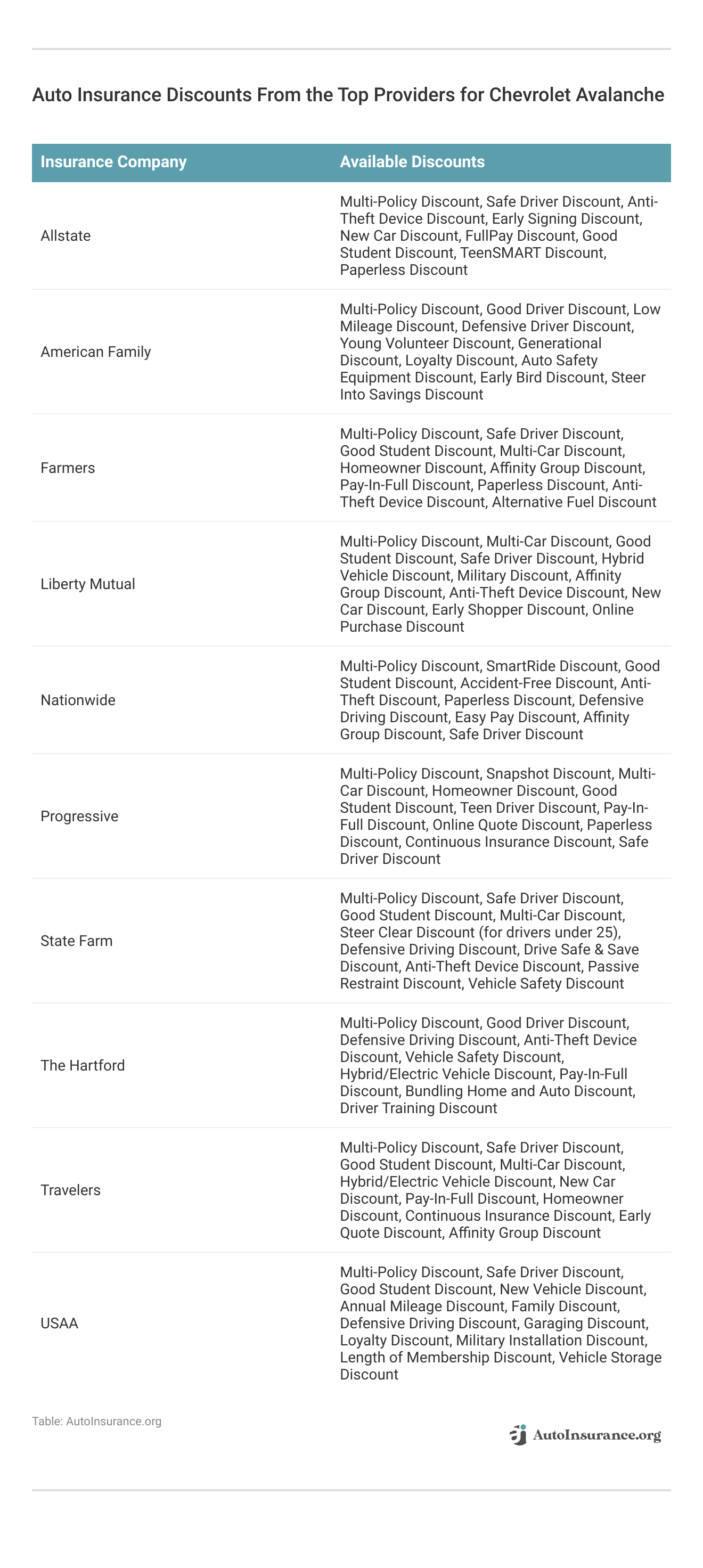

Ways to Save on Chevrolet Avalanche Insurance

When looking to reduce your auto insurance costs for a Chevrolet Avalanche, there are several effective strategies to consider. One approach is to check the odometer on your vehicle, as lower mileage can sometimes qualify you for better rates. If you’re driving an older Chevrolet Avalanche, opting for a plan with only liability coverage can also lead to significant savings.

Additionally, if you have a student who is away from home, it’s worth inquiring about a student away from home discount. For young drivers, insurance rates can be more affordable if you highlight their good grades or GPA to qualify for good student auto insurance discount.

Finally, purchasing an older Chevrolet Avalanche might also help reduce your insurance premiums. By implementing these strategies, you can make the most of your insurance policy and enjoy greater savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Chevrolet Avalanche Insurance Companies

Several top auto insurance companies offer competitive rates for the Chevrolet Avalanche rates based on factors like discounts for safety features. Take a look at this list of the best insurance companies that are popular with Chevrolet Avalanche drivers organized by market share.

Chevrolet Avalanche Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.5 million | 3.3% |

| #8 | Chubb | $23.4 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

The table ranks insurance companies by their volume and market share, with State Farm leading at $65.6 million and a 9.3% share. Geico and Progressive follow, holding 6.6% and 5.6% of the market, respectively. Liberty Mutual and Allstate each have about a 5% share.

Travelers has a 4% share, while USAA and Chubb each hold 3.3%. Farmers captures 2.9%, and Nationwide rounds out the list with a 2.6% market share.

Obtaining an Online Quote for Chevrolet Avalanche Auto Insurance

Obtaining and comparing cheap online auto insurance quote for Chevrolet Avalanche auto insurance is a straightforward process that allows you to compare rates from multiple insurers quickly and conveniently. To start, visit a reputable insurance comparison website or the websites of individual insurance companies. Most platforms will ask you to enter essential information.

Information are required such as your ZIP code, the make and model of your vehicle, and personal details like your age, gender, and driving history. This information helps the insurance providers assess the risk associated with insuring you and determine your potential premium. After filling in these details, you’ll typically be asked about the coverage options you prefer, such as liability, collision, and comprehensive coverage.

Some websites may also inquire about your mileage and how you use your vehicle, as these factors can influence your rate. Once all the required information is submitted, the website will generate quotes from various insurers, allowing you to compare prices and coverage options side by side. Reviewing these quotes helps you find the best deal tailored to your specific needs.

Additionally, many insurance providers offer discounts for safe driving, bundling policies, or having safety features in your vehicle, so be sure to look out for these options as you review your quotes. By taking the time to compare online quotes, you can ensure you get the most competitive rate for your Chevrolet Avalanche auto insurance.

Real-Life Experiences: Chevrolet Avalanche Auto Insurance Case Studies

To better understand how different insurance options work for Chevrolet Avalanche owners, we’ve compiled a few real-life case studies. These brief examples highlight how various factors can influence insurance costs and coverage.

- Case Study #1 – Young Driver Savings: A 20-year-old driver in Los Angeles found her insurance rates significantly reduced by opting for Progressive’s Snapshot program, saving her over $300 annually. Her clean driving record and participation in the program qualified her for substantial discounts.

- Case Study #2 – Military Family Benefits: A military family in Virginia chose USAA for their Chevrolet Avalanche due to its exclusive military benefits and for being the best auto insurance for military families and veterans. Their rates were highly competitive, and they enjoyed excellent customer service tailored to their unique needs.

- Case Study #3 – Maximizing Discounts: A 40-year-old driver in Chicago leveraged multiple discounts from State Farm, including safe driver and multi-policy discounts. By bundling his home and auto insurance, he saved over 20% on his premiums.

- Case Study #4 – High-Risk Driver Options: After a speeding ticket, a 30-year-old driver in New York saw his rates increase but managed to find a better deal with Liberty Mutual. The company’s accident forgiveness policy helped mitigate the cost impact of his driving record.

- Case Study #5 – Customized Coverage Needs: A 50-year-old Avalanche owner in Texas needed customized insurance for his modified truck. Farmers provided a tailored policy that covered his specific modifications without a significant increase in premiums.

These case studies illustrate the diverse ways Chevrolet Avalanche owners can save on insurance by choosing the right company and taking advantage of various programs and discounts.

State Farm offers the best overall auto insurance for Chevrolet Avalanche owners, with rates starting at $78 per month.Daniel Walker Licensed Auto Insurance Agent

By comparing quotes and understanding the factors that impact rates, you can find the best coverage to meet your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Final Thoughts on Chevrolet Avalanche Auto Insurance

Finding the best auto insurance for your Chevrolet Avalanche involves considering top companies like State Farm, USAA, and Progressive. These providers offer competitive rates starting at $78 per month, along with comprehensive auto insurance coverage and excellent customer service. Factors such as driver age, location, and driving record significantly impact insurance rates, making it crucial to compare quotes.

Utilize available discounts and safety features to lower your premiums further. By doing thorough research and leveraging online comparison tools, you can secure the best coverage at the most affordable rates. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

How much does Chevrolet Avalanche insurance cost?

On average, Chevrolet Avalanche insurance rates are $1,422 per year or $119 per month. The cost breakdown includes an average of $346 for comprehensive coverage, $506 for collision coverage, and $401 for liability coverage.

Are Chevrolet Avalanches expensive to insure?

Compared to other trucks like the Chevrolet Silverado 2500HD, Chevrolet Silverado 3500HD, and Ford F-150, Chevrolet Avalanche insurance rates are generally in a similar range. However, the actual cost can vary based on factors such as the trim and model of the Avalanche. Learn more information about the best Chevrolet Silverado auto insurance.

What factors impact the cost of Chevrolet Avalanche insurance?

Several factors can affect the cost of Chevrolet Avalanche insurance, including the age of the vehicle, driver age, driver location, and driving record. Older Avalanche models and drivers with clean records may have lower insurance rates. Enter your ZIP code below to find out if you can get a better deal.

Do financing and loan requirements affect Chevrolet Avalanche insurance?

If you’re financing a Chevrolet Avalanche, lenders typically require higher insurance coverages, including comprehensive coverage. It’s important to compare insurance rates from different companies to find the best options for your needs.

How do safety ratings and features affect Chevrolet Avalanche insurance rates?

The safety ratings of the Chevrolet Avalanche can influence insurance rates. Poor crash test ratings may result in higher insurance rates. Additionally, the presence of safety features in the vehicle, such as airbags and anti-lock brakes, can contribute to lower auto insurance premiums.

Is the Chevrolet Avalanche a good vehicle?

The large Chevy Avalanche was produced from 2001 to 2013. While it was a notable vehicle, certain model years are best avoided if you want to get the most out of your investment. Specifically, you should steer clear of the 2002, 2003, 2004, 2005, 2007, 2008, and 2010 models.

How long will a Chevrolet Avalanche last?

According to a study, the Chevy Avalanche has the potential to last up to 250,000 miles.

Which type of auto insurance coverage is most important?

Liability insurance covers costs from accidents you cause. Comprehensive and collision auto insurance protect against various damages. Medical payments coverage handles medical expenses. Uninsured/underinsured motorist coverage and rental reimbursement protect you if the other driver lacks insurance or your car needs repairs.

Why did Chevy discontinue the Avalanche?

The production of the Chevrolet Avalanche ceased after the 2013 model year, following a 2.6% decline in sales in 2011, which totaled 20,088 units. Similarly, production of the Cadillac Escalade EXT also concluded after the 2013 model year.

What is the Chevy Avalanche known for?

The Chevrolet Avalanche is a versatile pickup equipped with an automatic transmission that offers seamless shifting. It boasts a robust 5.1-liter V-8 engine delivering 285 horsepower and 335 lb-ft of torque. This power translates into a towing capacity exceeding 5,000 pounds.

Which type of car insurance is best?

Comprehensive car insurance policy. This insurance policy offers extensive coverage, protecting against both third-party liabilities such as bodily injury liability and damages to your own vehicle. Additionally, in the event of a fatal accident, it provides compensation to your family members.

Why do people not like the Chevy Avalanche?

Underwhelming performance. The Chevy Avalanche is capable of carrying a load, but it falls short compared to other trucks in its class. Its build isn’t designed for the heavy-duty tasks that some competitors can handle. This limitation can lead to frustration, especially when dealing with equipment or towing multiple passengers.

What’s the worst year for the Chevy Avalanche?

The 2001-2002 Chevrolet Avalanches are considered the least reliable years for this model due to problems with body cladding, transmission issues, and their aging design, which is approximately 20 years old. If you’re determined to have a first-generation Avalanche and appreciate the body cladding feature, it’s advisable to opt for a 2003-2005 model instead.

Which brand of car has the cheapest insurance?

Subaru models generally offer the lowest insurance rates. Similarly, vehicles from Ford, Honda, and Toyota also tend to have affordable insurance premiums. The following sections will explore the most cost-effective makes and models for insurance. Delve more details on cheap Subaru auto insurance.

Is a Chevy Avalanche a truck or SUV?

The Chevrolet Avalanche, which uniquely combined the features of an SUV and a pickup truck, established its distinct presence in the automotive market from 2002 to 2013. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.