Best Chevrolet Camaro Auto Insurance in 2025 (Compare the Top 10 Companies)

State Farm, USAA, and Progressive offer the best Chevrolet Camaro auto insurance, with rates starting at $80/month. These companies stand out for their comprehensive coverage, military discounts, and customer service excellence, making them the top picks for Chevrolet Camaro insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Chevrolet Camaro

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Chevrolet Camaro

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Chevrolet Camaro

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top picks overall for the best Chevrolet Camaro auto insurance are State Farm, USAA, and Progressive, with rates averaging $80/month. State Farm excels with comprehensive coverage, USAA offers exclusive military discounts, and Progressive is renowned for customer service. Delve our guide titled “Progressive Snapshot Review.”

These companies provide competitive rates and robust options tailored for Camaro owners. Compare their offerings to find the best coverage for your needs.

Our Top 10 Company Picks: Best Chevrolet Camaro Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Comprehensive Coverage | State Farm | |

| #2 | 10% | A++ | Military Savings | USAA | |

| #3 | 12% | A+ | Customer Service | Progressive | |

| #4 | 10% | A+ | Safe Driving | Allstate | |

| #5 | 20% | A+ | Dividend Policies | Amica | |

| #6 | 15% | A+ | Vanishing Deductible | Nationwide |

| #7 | 15% | A | Accident Forgiveness | Liberty Mutual |

| #8 | 10% | A | Personalized Service | Farmers | |

| #9 | 13% | A++ | New Car | Travelers | |

| #10 | 15% | A | Safe Driver | American Family |

Discover the Chevrolet Camaro insurance rates for full coverage and learn how you can save money on Camaro insurance rates.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers.

- State Farm is the top pick for the best Chevrolet Camaro auto insurance

- Rates vary by vehicle age, driver age, location, and driving record

- Discover the best Chevrolet Camaro auto insurance providers at $80/month

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage: State Farm excels in providing comprehensive coverage options for the Chevrolet Camaro.

- Low Monthly Rates: State Farm offers competitive monthly rates at $85 for the Chevrolet Camaro with minimum coverage.

- Bundling Policies: State Farm auto insurance review provides significant discounts for bundling multiple insurance policies, enhancing savings for Chevrolet Camaro owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the Chevrolet Camaro.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Chevrolet Camaro owners.

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers exclusive discounts for military members and their families, reducing costs for Chevrolet Camaro insurance.

- Superior Customer Service: USAA is known for its exceptional customer service, providing a personalized experience for Chevrolet Camaro owners.

- Low Rates for Safe Drivers: USAA auto insurance review offers competitive rates at $80 per month for the Chevrolet Camaro with minimum coverage.

Cons

- Restricted Membership: USAA is only available to military members, veterans, and their families, limiting access for Chevrolet Camaro owners.

- Limited Local Agents: USAA has fewer local agents, which might be a drawback for Chevrolet Camaro owners preferring face-to-face interactions.

#3 – Progressive: Best for Customer Service

Pros

- Customer Service: Progressive is renowned for its excellent customer service, ensuring a positive experience for Chevrolet Camaro owners.

- Competitive Rates: Progressive offers affordable rates at $90 per month for the Chevrolet Camaro with minimum coverage.

- Extensive Discount Options: Progressive auto insurance review provides a variety of discounts, including multi-car and homeowner discounts, beneficial for Chevrolet Camaro owners.

Cons

- High Rates for High-Risk Drivers: Progressive tends to have higher rates for drivers with poor driving records, affecting Chevrolet Camaro owners with past infractions.

- Customer Service Variability: While known for good service, Progressive’s customer service experiences can vary by location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Safe Driving

Pros

- Safe Driving Discounts: Allstate rewards Chevrolet Camaro owners with discounts for safe driving behaviors and maintaining a clean record.

- Comprehensive Coverage Options: Allstate auto insurance review emphasize the wide range of coverage options, providing flexibility for Chevrolet Camaro owners.

- New Car Replacement: Allstate’s new car replacement policy is beneficial for owners of newer Chevrolet Camaros.

Cons

- Higher Premiums: Allstate’s premiums might be higher compared to other insurers, with minimum coverage costing $95 per month for the Chevrolet Camaro.

- Strict Claims Process: Some customers report a stringent claims process, which can be a hassle for Chevrolet Camaro owners needing to file a claim.

#5 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Amica offers dividend policies that can return a portion of the premium to Chevrolet Camaro owners.

- Excellent Customer Service: Amica is known for its top-tier customer service, ensuring a positive experience for Chevrolet Camaro owners.

- Wide Range of Discounts: Amica auto insurance review provides various discounts, including loyalty and bundling discounts, benefiting Chevrolet Camaro owners.

Cons

- Higher Upfront Costs: Amica’s premiums can be higher initially, which might be a concern for Chevrolet Camaro owners on a budget, with minimum coverage costing $88 per month.

- Limited Availability: Amica has limited availability in some regions, restricting access for certain Chevrolet Camaro owners.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program rewards Chevrolet Camaro owners for safe driving by reducing their deductible over time.

- Flexible Payment Options: Nationwide auto insurance review has various payment plans, providing flexibility for Chevrolet Camaro owners.

- Accident Forgiveness: Nationwide’s accident forgiveness program can prevent rate increases after the first at-fault accident, benefiting Chevrolet Camaro drivers.

Cons

- Average Customer Service: Nationwide’s customer service is rated as average, which might not meet the expectations of all Chevrolet Camaro owners.

- Complex Discount Eligibility: Some discounts can have complex eligibility requirements, making it difficult for Chevrolet Camaro owners to qualify, with minimum coverage costing $92 per month.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, which can help Chevrolet Camaro owners avoid premium increases after an accident.

- Better Car Replacement: Liberty Mutual’s better car replacement program is advantageous for Chevrolet Camaro owners who want additional protection.

- Various Discount Options: Liberty Mutual auto insurance review provides multiple discount options, such as for safety features and early shopping, benefiting Chevrolet Camaro owners.

Cons

- Higher Base Rates: Liberty Mutual’s base rates can be higher compared to other insurers, affecting the overall cost for Chevrolet Camaro owners, with minimum coverage costing $100 per month.

- Customer Service Variations: Customer service quality can vary by location, which might impact the experience for Chevrolet Camaro owners.

#8 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers offers personalized coverage options tailored to the specific needs of Chevrolet Camaro owners.

- Discounts for Safe Drivers: Farmers auto insurance review provides discounts for maintaining a good driving record, benefiting Chevrolet Camaro drivers.

- Excellent Local Agents: Farmers has a strong network of local agents, ensuring personalized service for Chevrolet Camaro owners.

Cons

- Higher Premiums for Young Drivers: Farmers tends to have higher premiums for young Chevrolet Camaro drivers, affecting affordability, with minimum coverage costing $98 per month.

- Limited Online Tools: Farmers’ online tools and resources are less comprehensive compared to some competitors, which might be a drawback for tech-savvy Chevrolet Camaro owners.

#9 – Travelers: Best for New Car

Pros

- New Car Replacement: Travelers’ new car replacement policy is ideal for Chevrolet Camaro owners with newer models.

- Competitive Rates: Travelers offers competitive rates at $94 per month for the Chevrolet Camaro with minimum coverage.

- Wide Range of Coverage Options: Travelers Auto insurance review provides a variety of coverage options, ensuring comprehensive protection for Chevrolet Camaro owners.

Cons

- Average Customer Service: Travelers’ customer service is considered average, which might not meet the expectations of all Chevrolet Camaro owners.

- Limited Availability: Travelers has limited availability in some regions, restricting access for certain Chevrolet Camaro owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Safe Driver

Pros

- Safe Driver Discounts: American Family offers discounts for safe driving habits, rewarding Chevrolet Camaro owners with a clean record.

- Excellent Customer Support: American Family is known for its exceptional customer support, providing a positive experience for Chevrolet Camaro owners.

- Comprehensive Coverage Options: American Family auto insurance review highlighted the wide range of coverage options, ensuring tailored protection for Chevrolet Camaro owners.

Cons

- Higher Rates for High-Risk Drivers: American Family tends to have higher rates for drivers with past violations, affecting Chevrolet Camaro owners with poor driving records, with minimum coverage costing $87 per month.

- Fewer Online Resources: American Family’s online resources are less extensive compared to some competitors, which might be a drawback for digital-savvy Chevrolet Camaro owners.

Chevrolet Camaro Insurance Cost

Chevrolet Camaro Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $95 | $185 |

| American Family | $87 | $168 |

| Amica | $88 | $170 |

| Farmers | $98 | $185 |

| Liberty Mutual | $100 | $190 |

| Nationwide | $92 | $180 |

| Progressive | $90 | $175 |

| State Farm | $85 | $165 |

| Travelers | $94 | $182 |

| USAA | $80 | $160 |

Other providers like State Farm, Progressive, and American Family offer competitive rates, with State Farm being one of the most affordable for both minimum and full coverage at $85 and $165 per month, respectively. The average annual insurance cost for a Chevrolet Camaro is about $1,472, equating to $123 per month.

Chevrolet Camaro Auto Insurance Monthly Rates by Category

| Category | Rates |

|---|---|

| Average Rate | $123 |

| Discount Rate | $72 |

| High Deductibles | $106 |

| High Risk Driver | $261 |

| Low Deductibles | $154 |

| Teen Driver | $448 |

Monthly rates can vary based on specific categories, with high-risk drivers paying the highest at $261 per month, while those who qualify for discounts pay around $72 per month. For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance Discounts.”

Teen drivers face the steepest rates at $448 per month, highlighting the importance of driving history and age in determining insurance premiums. High deductibles can lower monthly payments to about $106, whereas low deductibles increase them to around $154.

Chevrolet Camaros Insurance Expenses

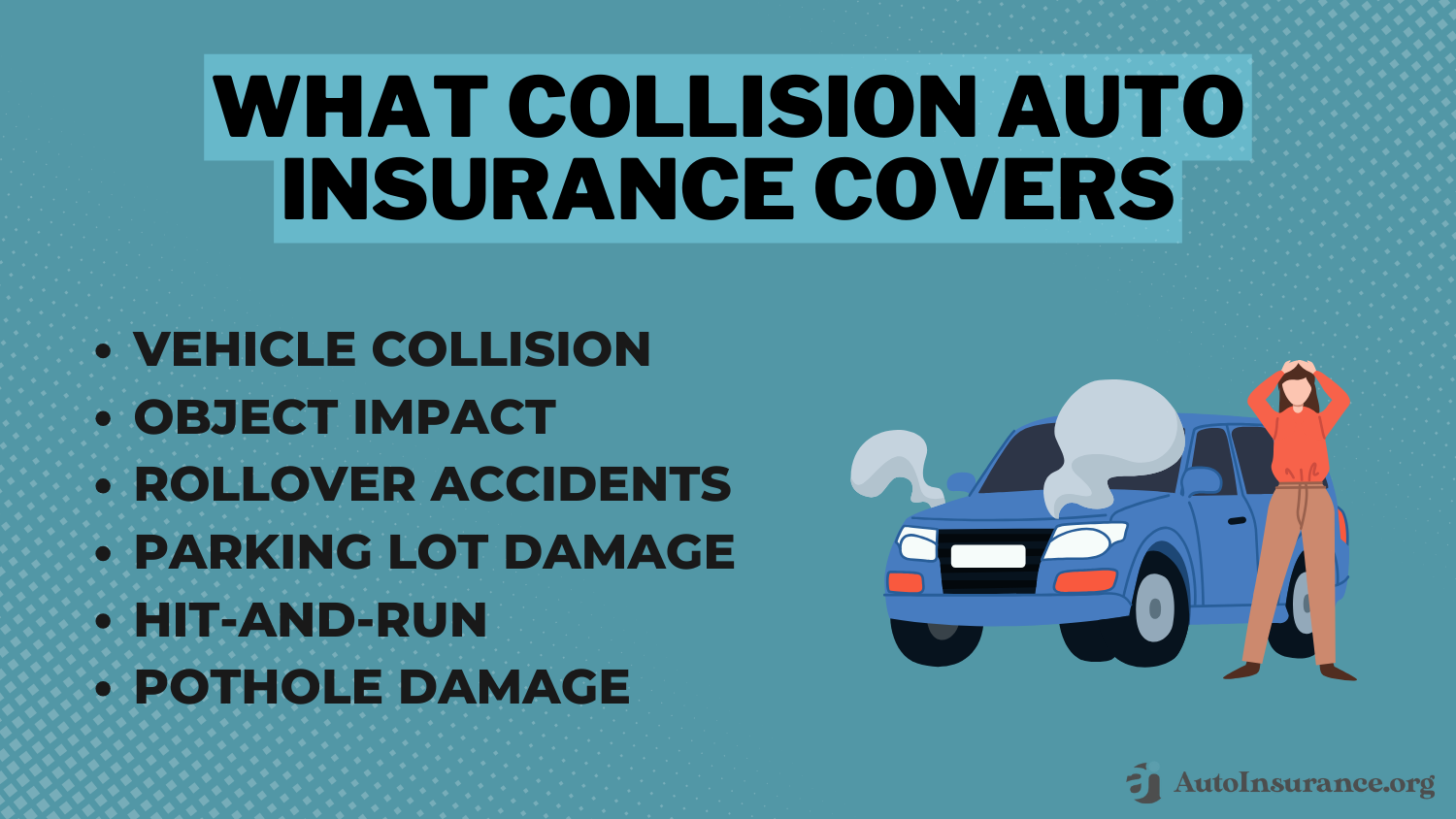

Chevrolet Camaro insurance expenses are relatively moderate compared to other sports cars. With comprehensive coverage at $29, collision coverage at $50, minimum coverage at $31, and full coverage auto insurance at $123 per month, the Camaro stands out as one of the more affordable options.

Chevrolet Camaro Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Camaro | $29 | $50 | $31 | $123 |

| Audi TTS | $33 | $60 | $28 | $132 |

| Audi TT RS | $35 | $65 | $28 | $139 |

| Cadillac ATS-V | $34 | $70 | $33 | $150 |

| Porsche 911 | $40 | $87 | $33 | $173 |

| Ford Mustang | $29 | $60 | $35 | $139 |

| Jaguar F-TYPE | $42 | $92 | $33 | $181 |

In comparison, the Audi TTS and TT RS, as well as the Cadillac ATS-V, have higher rates across the board. The Porsche 911 and Jaguar F-TYPE, both high-end sports cars, show significantly higher insurance costs, with full coverage rates reaching $173 and $181 per month, respectively.

The Ford Mustang, while slightly more expensive in collision and full coverage, also presents an affordable alternative. Overall, the Chevrolet Camaro offers competitive insurance rates within the sports car category.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Impacting the Cost of Chevrolet Camaro Insurance

Based on the average monthly rate for the Chevrolet Camaro, your policy can be higher or lower depending upon your profile. Those factors include your age, home address, driving history, and the model year of your Chevrolet Camaro. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Age of the Vehicle

The age of a vehicle significantly impacts auto insurance rates, as demonstrated by the Chevrolet Camaro. Newer models tend to have higher insurance costs due to their higher market value and replacement parts cost.

Chevrolet Camaro Auto Insurance Monthly Rates by Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Chevrolet Camaro | $29 | $50 | $31 | $123 |

| 2023 Chevrolet Camaro | $28 | $48 | $33 | $121 |

| 2022 Chevrolet Camaro | $27 | $47 | $33 | $120 |

| 2021 Chevrolet Camaro | $26 | $46 | $35 | $120 |

| 2020 Chevrolet Camaro | $25 | $44 | $36 | $118 |

| 2019 Chevrolet Camaro | $24 | $43 | $37 | $116 |

| 2018 Chevrolet Camaro | $23 | $40 | $38 | $113 |

| 2017 Chevrolet Camaro | $22 | $37 | $38 | $110 |

Monthly rates also vary by coverage type and model year, with comprehensive and collision coverage decreasing steadily as the car ages.

For a 2024 Camaro, comprehensive coverage is $29 per month, while it’s only $22 for a 2017 model. This trend illustrates that older vehicles generally have lower insurance rates across all coverage types. Learn more about collision vs. comprehensive auto insurance.

Driver Age

Driver age can have a significant affect on Chevrolet Camaro auto insurance rates. Auto insurance rates by age, 20-year-old drivers pay more for their Chevrolet Camaro auto insurance each year than 30-year-old drivers.

Chevrolet Camaro Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 18 | $448 |

| Age: 20 | $385 |

| Age: 30 | $210 |

| Age: 40 | $190 |

| Age: 50 | $175 |

| Age: 60 | $160 |

Seniors tend to have an easier time finding cheap rates and driver discounts due to years of experience. As well, a 17-year-old driver will typically have a harder time finding auto insurance coverage at an affordable rate due to their demographic, as teens are considered high-risk by the auto insurance industry as a whole.

Driver Location

Driver location significantly influences Chevrolet Camaro insurance rates, with premiums varying considerably between cities. This discrepancy highlights the importance of location in determining auto insurance costs.

Chevrolet Camaro Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $250 |

| Columbus, OH | $210 |

| Houston, TX | $270 |

| Indianapolis, IN | $220 |

| Jacksonville, FL | $230 |

| Los Angeles, CA | $300 |

| New York, NY | $320 |

| Philadelphia, PA | $280 |

| Phoenix, AZ | $240 |

| Seattle, WA | $230 |

Urban areas with higher traffic, crime rates, and accident frequency typically incur higher premiums. For example, monthly rates for Camaro insurance range from $210 in Columbus, OH, to $320 in New York, NY, reflecting these location-based factors.

Your Driving Record

Your driving record can have an impact on the cost of Chevrolet Camaro auto insurance. Teens and drivers in their 20’s see the highest jump in their Chevrolet Camaro auto insurance prices with violations on their driving record.

Chevrolet Camaro Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $448 | $560 | $720 | $520 |

| Age: 20 | $385 | $480 | $615 | $450 |

| Age: 30 | $210 | $270 | $350 | $240 |

| Age: 40 | $190 | $245 | $320 | $220 |

| Age: 50 | $175 | $225 | $290 | $205 |

| Age: 60 | $160 | $205 | $270 | $190 |

A clean record will have a better chance at finding a deal for the cost of auto insurance than one that has had several infractions. Read thoroughly our guide on how credit scores affect auto insurance rates.

Chevrolet Camaro Safety Ratings

The safety ratings of the Chevrolet Camaro play a crucial role in determining auto insurance rates. The Camaro has received impressive safety ratings, with “Good” ratings in categories such as small overlap front (driver and passenger-side), moderate overlap front, side, and head restraints and seats.

Chevrolet Camaro Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Acceptable |

| Head restraints and seats | Good |

However, its roof strength is rated as “Acceptable.” These ratings indicate a strong safety performance, which can positively influence insurance premiums by demonstrating the vehicle’s ability to protect occupants in various crash scenarios.

Additionally, the Chevrolet Camaro is equipped with a range of safety features that further impact insurance rates. These features include driver and passenger air bags, front and rear head air bags, front side air bags, and 4-wheel ABS.

Our Crisis Assist Services are now available to@Chevrolet, @Buick, @GMC & @Cadillac owners impacted by Tropical Storm #Beryl. Just push your OnStar button and say “Advisor” for assistance. #BeSafeOutTherehttps://t.co/OlJCbM93cC pic.twitter.com/HnwEu9V0hd

— OnStar (@OnStar) July 7, 2024

The vehicle also boasts 4-wheel disc brakes, brake assist, electronic stability control, daytime running lights, traction control, and an emergency trunk release. These safety systems contribute to the overall safety profile of the Camaro, potentially leading to lower insurance costs due to the reduced risk of injury and accidents.

Chevrolet Camaro Crash Test Ratings

Chevrolet Camaro crash test ratings play a crucial role in determining auto insurance rates. The crash test results for the Chevrolet Camaro from 2020 to 2024 consistently show high safety standards, with an overall rating of 5 stars, 5 stars for frontal and side impacts, and 4 stars for rollover resistance.

Chevrolet Camaro Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Chevrolet Camaro | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Chevrolet Camaro | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Chevrolet Camaro | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Chevrolet Camaro | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Chevrolet Camaro | 5 stars | 5 stars | 5 stars | 4 stars |

These excellent ratings can positively influence insurance premiums by indicating a lower risk of severe injury in accidents. Read our article to find the best accident forgiveness auto insurance companies.

Learn how safety ratings can impact your premiums further. Discover the benefits of choosing a safer vehicle and how it can lead to significant savings on your insurance costs.

Chevrolet Camaro Insurance Loss Probability

Chevrolet Camaro Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | 39% |

| Property Damage | 18% |

| Comprehensive | 23% |

| Personal Injury | 23% |

| Medical Payment | 30% |

| Bodily Injury | 27% |

For the Camaro, collision coverage has a loss probability of 39%, property damage is 18%, comprehensive is 23%, personal injury is 23%, medical payment is 30%, and bodily injury is 27%. These variations in loss probability directly affect the cost of insurance for each coverage type. Check out our guide “Do you need medical payment coverage on auto insurance?”

Chevrolet Camaro Finance and Insurance Cost

If you are financing a Chevrolet Camaro, you will pay more if you purchase Chevrolet Camaro auto insurance at the dealership, so be sure to shop around and compare Chevrolet Camaro auto insurance quotes from the best companies using our free tool below (Read more: How to Compare Auto Insurance Quotes).

Ways to Save on Chevrolet Camaro Insurance

Additionally, review your driving habits when moving or starting a new job, and be selective about who drives your Camaro to maintain lower insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Chevrolet Camaro Insurance Companies

Several best auto insurance companies offer competitive rates for the Chevrolet Camaro rates based on factors like discounts for safety features. Take a look at this list of top auto insurance companies that are popular with Chevrolet Camaro drivers organized by market share.

Top 10 Chevrolet Camaro Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.3% |

| #2 | Geico | $46,106,971 | 6.6% |

| #3 | Progressive | $39,222,879 | 5.6% |

| #4 | Liberty Mutual | $35,600,051 | 5.1% |

| #5 | Allstate | $35,025,903 | 5% |

| #6 | Travelers | $28,016,966 | 4% |

| #7 | USAA | $23,483,080 | 3.3% |

| #8 | Chubb | $23,388,385 | 3.3% |

| #9 | Farmers | $20,643,559 | 2.9% |

| #10 | Nationwide | $18,442,145 | 2.6% |

These companies are well-regarded for their coverage options and customer satisfaction among Camaro owners. When choosing an insurer, consider not only the premium rates but also the specific coverage options, discounts, and customer service reputation each company offers.

Compare Free Chevrolet Camaro Insurance Quotes Online

Start comparing quotes for Chevrolet Camaro auto insurance rates from top insurance companies with our free online tool. This convenient tool allows you to quickly and easily compare rates from multiple providers, helping you find the most competitive prices.

By entering your information, you can receive customized quotes tailored to your specific needs and coverage preferences. This process saves you time and ensures you get the best possible deal on your Chevrolet Camaro insurance.

Don’t miss out on potential savings—start comparing quotes online today and make an informed decision for your auto insurance needs. Check out our guide “Where to Compare Auto Insurance Rates.“

Case Studies: Best Chevrolet Camaro Auto Insurance Providers

This section explores three case studies that highlight the unique benefits and offerings of the top Chevrolet Camaro auto insurance provider. These real-life examples illustrate how each company meets the diverse needs of Camaro owners.

- Case Study #1 – Comprehensive Coverage and Affordable Rates: John, a Camaro owner in Texas, chose State Farm for its comprehensive coverage and affordable rate of $85/month. He valued the extensive coverage options, including collision, liability, and uninsured motorist protection.

- Case Study #2 – Exclusive Military Discounts: Sarah, a military veteran, found USAA ideal for her Camaro with a rate of $82/month. She benefited from exclusive military discounts and exceptional customer service tailored to service members.

- Case Study #3 – Excellent Customer Service: Mike, a young driver in California, opted for Progressive due to its excellent customer service and secured a premium of $87/month. He appreciated the easy-to-use mobile app and various discounts (Read more: Progressive Snapshot Review).

These case studies demonstrate how State Farm, USAA, and Progressive cater to different needs while providing the best Chevrolet Camaro auto insurance.

Whether it’s comprehensive coverage, military discounts, or superior customer service, Camaro owners can find tailored solutions to suit their insurance requirements. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are Chevrolet Camaros expensive to insure?

Yes, Chevrolet Camaros can be expensive to insure compared to other sports cars. However, the actual insurance rates can vary depending on several factors. For additional details, explore our comprehensive resource titled “Types of Auto Insurance.”

What factors impact the cost of Chevrolet Camaro insurance?

The cost of Chevrolet Camaro insurance can be influenced by various factors, including the age of the vehicle, driver age, driver location, driving record, and safety ratings of the Chevrolet Camaro.

How does the age of the vehicle affect Chevrolet Camaro insurance rates?

Newer models of the Chevrolet Camaro generally have higher insurance rates compared to older models. The difference in rates can be significant, with newer models costing more to insure. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Does driver age affect Chevrolet Camaro insurance rates?

Yes, driver age has a significant impact on Chevrolet Camaro insurance rates. Younger drivers, such as 20-year-olds, tend to pay significantly higher premiums compared to older drivers. Senior drivers, with more experience, may have an easier time finding cheaper rates and driver discounts.

Dive into our guide titled “Cheap Auto Insurance for Drivers Over 60.”

How does driver location affect Chevrolet Camaro insurance rates?

The location where you live plays a role in determining your Chevrolet Camaro insurance rates. For example, drivers in certain areas, like Los Angeles, may pay more compared to drivers in other locations, such as Philadelphia.

How does a driving record affect Chevrolet Camaro insurance rates?

A clean driving record generally results in lower insurance costs for a Chevrolet Camaro. Drivers with violations or accidents on their record are likely to face higher premiums. Delve into our guide “How Auto Insurance Companies Check Driving Records.”

How do safety ratings of the Chevrolet Camaro affect insurance rates?

Higher safety ratings can lead to lower insurance rates for the Chevrolet Camaro. Vehicles with better safety ratings are considered less risky to insure because they are less likely to result in severe injuries during accidents.

Are there specific discounts available for Chevrolet Camaro insurance?

Yes, many insurance companies offer specific discounts for Chevrolet Camaro insurance, such as safe driving discounts, multi-policy discounts, and discounts for vehicles with advanced safety features.

What is the average cost of insuring a Chevrolet Camaro?

The average annual cost for insuring a Chevrolet Camaro is about $1,472, which equates to approximately $123 per month. Rates can vary significantly based on the level of coverage and the insurance provider.

How can I lower my Chevrolet Camaro insurance premiums?

To lower your Chevrolet Camaro insurance premiums, consider comparing quotes from multiple insurance providers, maintaining a clean driving record, taking advantage of available discounts, opting for higher deductibles if feasible, and ensuring your Camaro is equipped with advanced safety features.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.