Best Chevrolet Silverado Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Allstate, Progressive, and Nationwide are the top three companies for the best Chevrolet Silverado auto insurance. Minimum coverage will range from $58-160 per month for your Chevrolet Silverado auto insurance. Chevy Silverado insurance costs depend on the year of the vehicle, as well as your age, location, and driving record.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Chevrolet Silverado

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Silverado

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Chevrolet Silverado

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews

When it comes to finding the best best Chevrolet Silverado auto insurance, Allstate, Progressive, and Nationwide are going to be the top three choices.

Rates for minimum coverage range between $60-160 per month, with pricing affected by factors such as driving history, vehicle details, and location.

Competitive rates can be found by comparing auto insurance quotes from different companies, as well as weighing the pros and cons of each provider.

Our Top 10 Company Picks: Best Chevrolet Silverado Auto Insurance

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Infrequent Drivers | Allstate | |

| #2 | 10% | A+ | Qualifying Coverage | Progressive | |

| #3 | 10% | A+ | Usage-Based Coverage | Nationwide |

| #4 | 15% | B | Customer Service | State Farm | |

| #5 | 10% | A | Safe-Driving Discounts | Farmers | |

| #6 | 10% | A | Loyalty Rewards | American Family | |

| #7 | 22% | A++ | Cheap Rates | Geico | |

| #8 | 10% | A+ | Personalized Policies | Erie |

| #9 | 10% | A | Roadside Assistance | AAA |

| #10 | 10% | A | Add-on Coverages | Liberty Mutual |

Stop overpaying for auto insurance. Enter your ZIP code above to find out if you can get a better deal.

- The highest rates are for teenage drivers at around $452 each month

- Good drivers can save as much as $612 a year by earning policy discounts

- Chevrolet Silverado insurance costs around $35 less per year than average

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Coverage: When you have comprehensive auto insurance, your vehicle will be covered from anything other than a collision.

- Discount Opportunities: Allstate provides multiple discounts including safe driver, multi-policy, and others, which can lower your rates.

- Customer Support: Allstate has high rates of satisfaction from drivers. Learn more with our Allstate auto insurance review.

Cons

- Expensive Rates: Allstate’s policies tend to be more expensive than the competition.

- Customer Service Reviews: Many customers are satisfied, but there are some about claim handling time.

#2– Progressive: Best for Safe Drivers

Pros

- Snapshot Program: This program allows drivers to earn discounts based on their driving habits. Learn more with our Progressive auto insurance review.

- Wide Variety of Coverage: Progressive also offers homeowners, renters, motorcycle, and RV coverage, which you can bundle together.

- Customer Service: Progressive offers 24/7 customer support, which includes claim handling.

Cons

- Local Limitations: Progressive doesn’t have many local agents, with emphasis put on the website, app, and calling.

- Rate Increases: Many drivers report increases with policy renewals.

#3 – Nationwide: Best With Bundling Coverage

Pros

- Vanishing Deductible: This reduces your deductible by $100 for each year that goes by without an accident on your record.

- Extensive Coverage: Drivers can opt into many different add-ons, including pet insurance. Learn more with our Nationwide auto insurance review.

- Multi-Policy Discounts: Offered for those who bundle insurance policies together.

Cons

- Claim Handling: Drivers have reported long wait times with processing claims.

- High Risk, High Rates: Drivers with infractions will see more expensive rates on their auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Drivers With Speeding Tickets

Pros

- Drive Safe & Save: This program allows customers with safe driving habits to save money on their auto insurance.

- Customer Service: State Farm has high marks for customer service, as well as claim handling.

- Affordable Rates: Drivers with speeding tickets will pay less than average. Learn more with our State Farm auto insurance review.

Cons

- Poor Credit, High Rates: Drivers with a low credit score will end up paying more for coverage.

- Expensive Add-Ons: Adding more to your coverage will end up costing more than with other companies.

#5 – Farmers: Best for Minimum Coverage

Pros

- Claim-Free Discount: Drivers without any claims on their record will get a special discount. Learn more with our Farmers auto insurance review.

- Accident Forgiveness: Not offered by every company, this means Farmers will not raise your rates after your first accident.

- App Options: You can manage payments, get quotes, report claims, and request roadside assistance directly through the app.

Cons

- Expensive Rates: Add-ons and full coverage will be much more expensive than the average.

- Availability: Farmers auto insurance is not available in every state.

#6 – American Family: Best for Coverage Variety

Pros

- KnowYourDrive: This program allows drivers to save money based on their driving habits.

- Coverage Options: You can purchase gap coverage, rental car reimbursement, and property damage liability coverage.

- Claim Satisfaction: American Family is in the top ten for claim satisfaction. Learn more with our American Family auto insurance review.

Cons

- Availability: American Family auto insurance can’t be purchased in all 50 states.

- Claim Handling: Drivers have reported low quality service when it comes to claim processing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best With Discounts

Pros

- Discount Options: More than a dozen discounts exist, including good student, military, federal employee, and good driver.

- DriveEasy Program: Allows drivers to save money if they are low-mileage and safe while driving.

- Customer Service: Geico has overall positive reviews from drivers. Learn more with our Geico auto insurance review.

Cons

- High Rates After DUI: Geico auto insurance rates are more expensive after a DUI than the national average.

- No Gap Coverage: Geico does not offer gap coverage, which helps you pay off your vehicle if you still owed money after an accident.

#8 – Erie: Best for Unchanged Policies

Pros

- Rate Lock: With Erie’s rate lock, your rates won’t increase unless you make changes to your policy. Learn more with our Erie auto insurance review.

- Coverage Options: You can purchase personal injury protection, bodily injury liability, and uninsured motorist coverage.

- Financial Stability: Erie has an A+ rating with A.M. Best, which is superior.

Cons

- Negative Reviews: Drivers report complaints regarding customer service.

- Availability: Not available in most states.

#9 – AAA: Best for AAA Members

Pros

- Member Discounts: If you’re a member of AAA, you can get exclusive discounts and services.

- Gap Coverage: Not offered by every company.

- Membership Benefits: AAA members are provided towing, vehicle lockout services, and mechanical first aid. Learn more with our AAA auto insurance review.

Cons

- Expensive Membership Rates: The higher tiered membership costs will be triple a standard membership.

- Claim Handling: Drivers report inconsistent experiences with claims, most of them being slow to be processed.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best With Discount Program

Pros

- Better Car Replacement: This offers a replacement to your totaled vehicle one model year newer.

- RightTrack Program: Liberty Mutual’s discount program that rewards safe drivers. Learn more with our Liberty Mutual auto insurance review.

- Discount Options: You can get a discount for bundling, being a safe driver, and having a new and safe vehicle.

Cons

- High Rates: Auto insurance is going to be more expensive than the national average.

- Customer Service: Mixed reviews from drivers, with some stating they have difficulties with claim handling and rate increases.

Chevrolet Silverado Insurance Costs

The average Chevrolet Silverado auto insurance rates are $1,484 a year or $124 a month.

Chevrolet Silverado Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $32 $86

Allstate $61 $160

American Family $44 $117

Erie $22 $58

Farmers $53 $139

Geico $30 $80

Liberty Mutual $68 $174

Nationwide $44 $115

Progressive $39 $105

State Farm $33 $86

The above Chevy Silverado auto insurance rates highlight the variations based on different factors and the risk factors associated with drivers.

Comparing Chevrolet Model Rates

Are Chevys expensive to insure? The chart below details how Chevrolet Silverado insurance rates compare to other trucks like the Chevrolet Colorado, GMC Sierra 2500HD, and GMC Sierra.

Chevrolet Silverado vs. Other Trucks: Monthly Rates by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Colorado | $21 | $37 | $31 | $75 |

| Chevrolet Silverado | $27 | $47 | $35 | $85 |

| Chevrolet Silverado 3500HD | $34 | $55 | $35 | $95 |

| Ford Ranger | $21 | $39 | $31 | $77 |

| GMC Sierra | $28 | $50 | $31 | $83 |

| GMC Sierra 2500HD | $28 | $55 | $35 | $90 |

| Honda Ridgeline | $26 | $45 | $38 | $80 |

Read more: Dodge Ram 1500 vs. Chevrolet Silverado Auto Insurance

The data above shows that pricing will vary based on model, and whether you have full coverage or the bare minimum. The Chevy Silverado averagees in the middle, being neither the cheapest nor the most expensive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Chevrolet Silverado Insurance?

You might have noticed that there is a multitude of factors that impact Chevrolet Silverado auto insurance rates. Your age, location, driving record, and model year all play a role in what you will ultimately pay to insure the Chevrolet Silverado.

Age of the Vehicle

The average Chevrolet Silverado auto insurance rates are higher for newer models. For example, auto insurance for a 2020 Chevrolet Silverado costs $1,484, while 2010 Chevrolet Silverado insurance costs are $1,238, a difference of $246.

Chevrolet Silverado Auto Insurance Monthly Rates by Coverage Type & Model Year

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Chevrolet Silverado | $30 | $50 | $34 | $92 |

| 2023 Chevrolet Silverado | $29 | $49 | $34 | $90 |

| 2022 Chevrolet Silverado | $28 | $48 | $34 | $88 |

| 2021 Chevrolet Silverado | $27 | $47 | $34 | $86 |

| 2020 Chevrolet Silverado | $27 | $47 | $35 | $85 |

| 2019 Chevrolet Silverado | $26 | $45 | $37 | $83 |

| 2018 Chevrolet Silverado | $25 | $45 | $38 | $81 |

| 2017 Chevrolet Silverado | $24 | $44 | $39 | $80 |

| 2016 Chevrolet Silverado | $23 | $42 | $41 | $78 |

| 2015 Chevrolet Silverado | $22 | $40 | $42 | $76 |

| 2014 Chevrolet Silverado | $21 | $38 | $43 | $74 |

| 2013 Chevrolet Silverado | $20 | $35 | $43 | $72 |

| 2012 Chevrolet Silverado | $19 | $32 | $43 | $70 |

| 2011 Chevrolet Silverado | $18 | $29 | $43 | $68 |

| 2010 Chevrolet Silverado | $17 | $27 | $44 | $66 |

The condition in which you keep your vehicle is also a factor. Chevrolet auto insurance will be much more affordable if you have a wide variety of safety features in your vehicle.

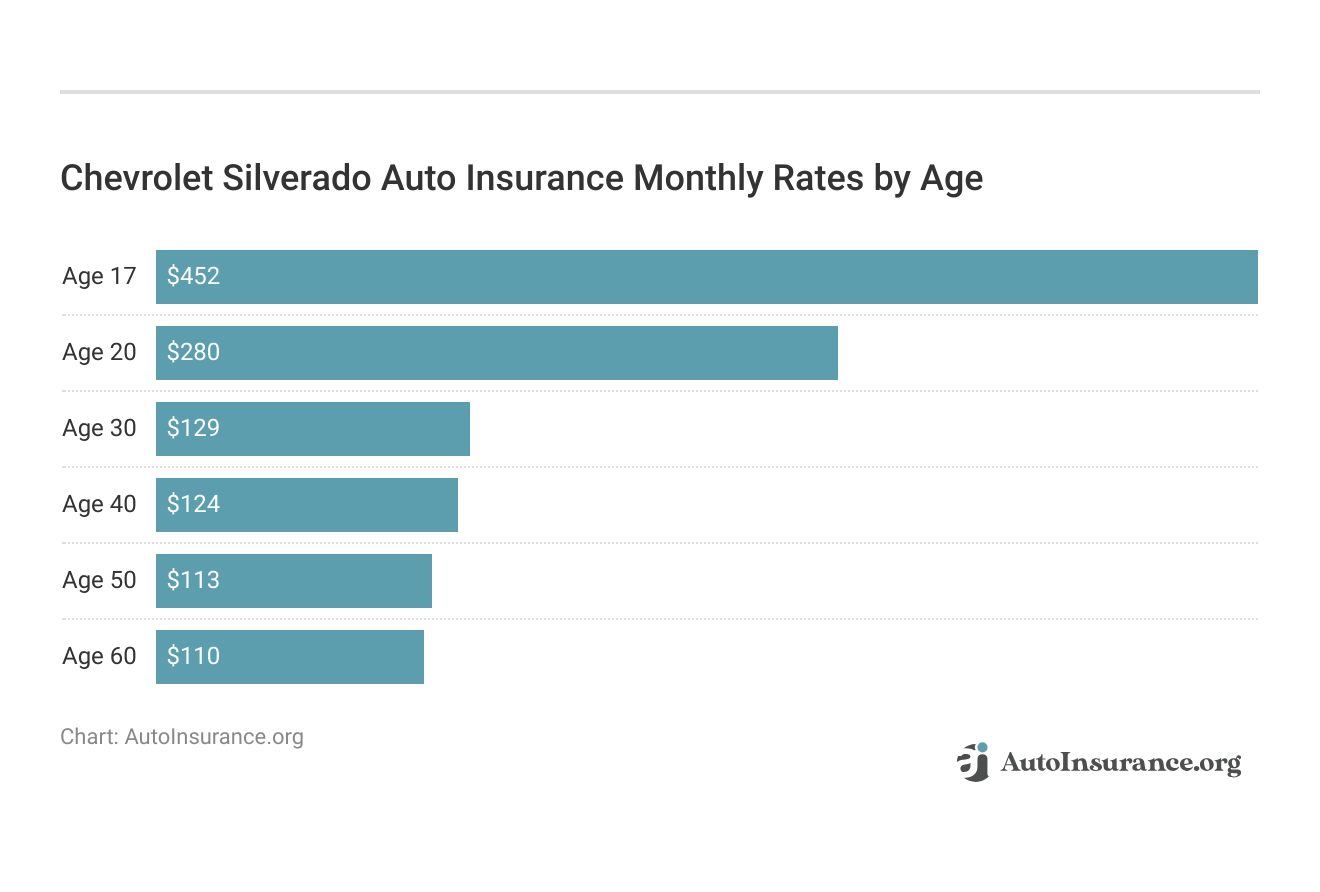

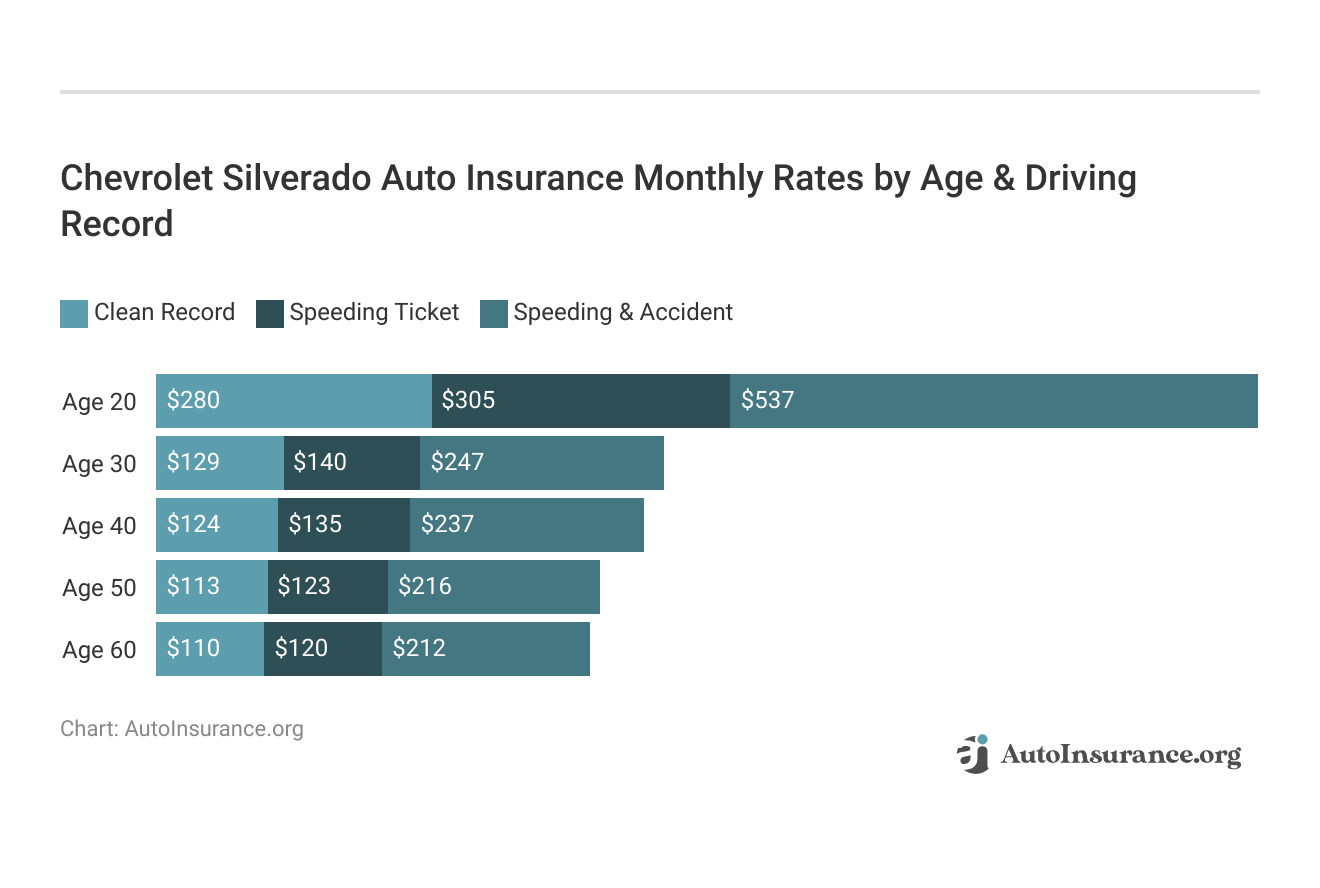

Driver Age

Driver age can have a significant impact on the cost of Chevrolet Silverado auto insurance. For example, 20-year-old drivers pay approximately $1,815 each year for their Chevrolet Silverado auto insurance policy than 30-year-old drivers.

Younger drivers can always expect to have higher than average insurance rates. However even older drivers will see higher rates if they have infractions.

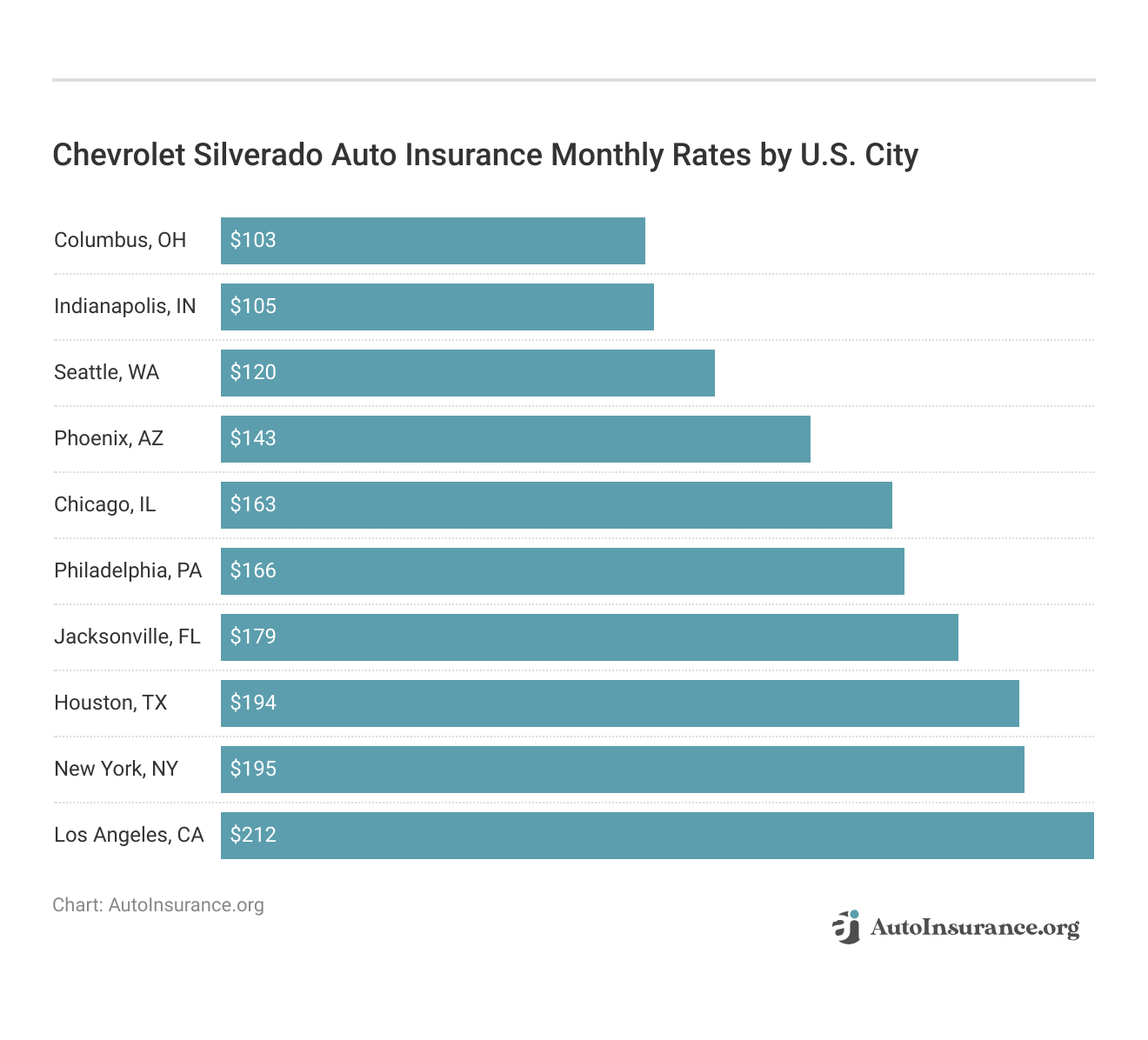

Driver Location

Where you live can have a large impact on Chevrolet Silverado insurance rates, especially if you live in one of the worst or best states for pickup owners. For example, drivers in New York may pay $906 a year more than drivers in Seattle.

It’s important to note when looking for Chevy insurance that where you live will also determine what you pay for coverage.

Your Driving Record

Your driving record can have an impact on the cost of Chevrolet Silverado auto insurance coverage. Teens and drivers in their 20s see the highest jump in their Chevrolet Silverado auto insurance with violations on their driving record.

It should also be noted that monthly auto insurance costs will significantly increase after a DUI or speeding ticket.

Chevrolet Silverado Safety Ratings

The Chevrolet Silverado’s safety ratings will affect your Chevrolet Silverado auto insurance rates.

Chevrolet Silverado Safety Ratings From IIHS

| Test Type | Rating |

|---|---|

| Small Overlap Front: Driver-Side | Good |

| Small Overlap Front: Passenger-Side | Marginal |

| Moderate Overlap Front | Good |

| Side | Good |

| Roof Strength | Good |

| Head Restraints and Seats | Good |

Monthly insurance costs have numerous factors which determine rates, and by having a safe vehicle, you could end up saving money. The Chevrolet Silverado has an average score of ‘good’ across the board.

Chevrolet Silverado Crash Test Ratings

Good Chevrolet Silverado crash test ratings can lower your Chevrolet Silverado auto insurance rates. See Chevrolet Silverado crash test results below:

Chevrolet Silverado: Comprehensive Crash Test Ratings From National Highway Traffic Safety Administration (NHTSA)

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Chevrolet Silverado 1500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2024 Chevrolet Silverado 1500 PU/RC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2024 Chevrolet Silverado 1500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2024 Chevrolet Silverado 1500 PU/EC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2024 Chevrolet Silverado 1500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2024 Chevrolet Silverado 1500 PU/CC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Chevrolet Silverado 1500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Chevrolet Silverado 1500 PU/RC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Chevrolet Silverado 1500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Chevrolet Silverado 1500 PU/EC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Chevrolet Silverado 1500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Chevrolet Silverado 1500 PU/CC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Chevrolet Silverado 1500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Chevrolet Silverado 1500 PU/RC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Chevrolet Silverado 1500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Chevrolet Silverado 1500 PU/EC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Chevrolet Silverado 1500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Chevrolet Silverado 1500 PU/CC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Chevrolet Silverado 1500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Chevrolet Silverado 1500 PU/RC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Chevrolet Silverado 1500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Chevrolet Silverado 1500 PU/EC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Chevrolet Silverado 1500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Chevrolet Silverado 1500 PU/CC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Chevrolet Silverado 1500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Chevrolet Silverado 1500 PU/EC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Chevrolet Silverado 1500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Chevrolet Silverado 1500 PU/CC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Chevrolet Silverado 2500 PU/RC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2020 Chevrolet Silverado 2500 PU/RC 2WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2020 Chevrolet Silverado 2500 PU/EC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2020 Chevrolet Silverado 2500 PU/EC 2WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2020 Chevrolet Silverado 2500 PU/CC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2020 Chevrolet Silverado 2500 PU/CC 2WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2020 Chevrolet Silverado 1500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Chevrolet Silverado 1500 PU/RC 2WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 3500 PU/RC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2019 Chevrolet Silverado 3500 PU/RC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2019 Chevrolet Silverado 3500 PU/CC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2019 Chevrolet Silverado 3500 PU/CC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2019 Chevrolet Silverado 2500 PU/RC RWD | 4 Stars | 3 Stars | 5 Stars | 3 Stars |

| 2019 Chevrolet Silverado 2500 PU/RC 4WD | 4 Stars | 3 Stars | 5 Stars | 3 Stars |

| 2019 Chevrolet Silverado 2500 PU/EC RWD | 4 Stars | 3 Stars | 5 Stars | 3 Stars |

| 2019 Chevrolet Silverado 2500 PU/EC 4WD | 4 Stars | 3 Stars | 5 Stars | 3 Stars |

| 2019 Chevrolet Silverado 2500 PU/CC RWD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2019 Chevrolet Silverado 2500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2019 Chevrolet Silverado 1500 PU/RC RWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 1500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 1500 PU/EC RWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 1500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 1500 PU/CC RWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 1500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 1500 LD PU/EC RWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Chevrolet Silverado 1500 LD PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2018 Chevrolet Silverado 3500 PU/RC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2018 Chevrolet Silverado 3500 PU/RC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2018 Chevrolet Silverado 3500 PU/EC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2018 Chevrolet Silverado 3500 PU/EC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2018 Chevrolet Silverado 3500 PU/CC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2018 Chevrolet Silverado 3500 PU/CC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2018 Chevrolet Silverado 2500 PU/RC RWD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2018 Chevrolet Silverado 2500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2018 Chevrolet Silverado 2500 PU/EC RWD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2018 Chevrolet Silverado 2500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2018 Chevrolet Silverado 2500 PU/CC RWD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2018 Chevrolet Silverado 2500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2018 Chevrolet Silverado 1500 PU/RC RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2018 Chevrolet Silverado 1500 PU/RC 4WD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2018 Chevrolet Silverado 1500 PU/EC RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2018 Chevrolet Silverado 1500 PU/EC 4WD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2018 Chevrolet Silverado 1500 PU/CC RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2018 Chevrolet Silverado 1500 PU/CC 4WD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2017 Chevrolet Silverado 3500 PU/RC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2017 Chevrolet Silverado 3500 PU/RC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2017 Chevrolet Silverado 3500 PU/EC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2017 Chevrolet Silverado 3500 PU/EC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2017 Chevrolet Silverado 3500 PU/CC RWD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2017 Chevrolet Silverado 3500 PU/CC 4WD | 4 Stars | 4 Stars | 4 Stars | 3 Stars |

| 2017 Chevrolet Silverado 2500 PU/RC RWD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2017 Chevrolet Silverado 2500 PU/RC 4WD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2017 Chevrolet Silverado 2500 PU/EC RWD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2017 Chevrolet Silverado 2500 PU/EC 4WD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2017 Chevrolet Silverado 2500 PU/CC RWD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2017 Chevrolet Silverado 2500 PU/CC 4WD | 4 Stars | 4 Stars | 5 Stars | 3 Stars |

| 2017 Chevrolet Silverado 1500 PU/RC RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2017 Chevrolet Silverado 1500 PU/RC 4WD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2017 Chevrolet Silverado 1500 PU/EC RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2017 Chevrolet Silverado 1500 PU/EC 4WD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

Knowing that you have a safe and reliable vehicle is just as important as researching what your average monthly insurance cost will be.

Chevrolet Silverado Safety Features

Chevrolet Silverado safety features can help to lower the cost of your insurance. The safety features for the 2020 Chevrolet Silverado include:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

- 4-Wheel ABS

- 4-Wheel Disc Brakes

- Electronic Stability Control

- Daytime Running Lights

- Integrated Turn Signal Mirrors

- Front Tow Hooks

- Traction Control

- Blind Spot Monitor

- Cross-Traffic Alert

Average insurance prices take safety features into consideration, but you’ll still want to mention the features your Chevrolet Silverado has in case you’ve had it modified or it’s not on record.

Chevrolet Silverado Insurance Loss Probability

Another contributing factor that plays a direct role in Chevrolet Silverado insurance rates is the loss probability for each type of coverage. Loss probability is associated with the likelihood of a company having to pay out for an insurance claim.

Chevrolet Silverado Auto Insurance Loss Probability by Coverage

| Coverage Category | Loss Rate |

|---|---|

| Bodily Injury | 25% |

| Collision | -24% |

| Comprehensive | -15% |

| Medical Payment | -31% |

| Personal Injury | -22% |

| Property Damage | 18% |

Higher loss probabilities means a higher chance of claims being filed, which in turn can lead to higher average monthly auto insurance costs.

Ways to Save on Chevrolet Silverado Insurance

If you want to reduce the cost of your Chevrolet Silverado insurance rates, follow these tips below:

- Ask About Farm and Ranch Vehicle Discounts

- Ask About Discounts for People with Disabilities

- Re-Check Chevrolet Silverado Insurance Rates Every 6 Months

- Buy a Dashcam for Your Chevrolet Silverado

- Remove Young Drivers from Your Chevrolet Silverado Auto Insurance Plan

Always consider asking about ways you can save money, you may learn there are multiple ways to cut down on your average insurance cost per month.

Top Chevrolet Silverado Insurance Companies

Who is the best company for Chevrolet Silverado insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Chevrolet Silverado insurance coverage (ordered by market share).

Chevrolet Silverado Auto Insurance: Top Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share | A.M. Best |

|---|---|---|---|---|

| #1 | State Farm | $75,371,000 | 16.90% | B |

| #2 | Progressive | $57,443,000 | 13.00% | A+ |

| #3 | Geico | $52,225,000 | 12.00% | A++ |

| #4 | Allstate | $44,315,000 | 10.20% | A+ |

| #5 | USAA | $26,078,000 | 6.00% | A++ |

| #6 | Liberty Mutual | $22,511,000 | 5.10% | A |

| #7 | Farmers | $21,212,000 | 4.80% | A |

| #8 | Nationwide | $18,564,000 | 4.30% | A+ |

| #9 | American Family | $14,358,000 | 2.80% | A |

| #10 | Travelers | $13,894,000 | 2.60% | A++ |

Many of these companies offer discounts for security systems and other safety features that the Chevrolet Silverado offers.

The insurance company you choose is another factor in the rates you’ll receive. You also want to pay attention to the types of auto insurance coverage available to best determine what you need and the limits on each.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chevy Silverado Variations

Part of your insurance cost depends on the overall cost of your vehicle. The Chevrolet website notes the 2012 Silverado comes in several models with varying price points. Auto insurance prices vary depending on the make and model, as well as the options you choose to go with your vehicle. Choices include the following:

- Silverado 1500

- Silverado Hybrid

- Silverado 2500HD

- Silverado 3500 HD

- Silverado Chassis with a covered truck bed

Other factors that play into the overall value of the vehicle include the specific options you choose for each vehicle. Each truck offers different trim levels ranging from the very basic to the more elaborate.

The more elaborate trim levels for the Silverado 1500 include additional interior amenities. These are cloth front seats instead of vinyl, locking storage underneath the seat and a steering wheel wrapped in leather. The more elaborate and costly your truck, the more expensive your insurance is likely to be.

Comfort in a vehicle is important, but so is knowing how that comfort will translate via your auto insurance costs.Schimri Yoyo Licensed Agent & Financial Advisor

If you have a used or older existing Silverado you are looking to insure, your price of insurance may also be lower. In the case of older or used vehicles, you may want to assess the overall value of the vehicle before you spend a lot of money on insurance to cover repairs or replacement.

Features That Can Help Lower Insurance Costs

Not all of the added features on your Chevy Silverado necessarily result in an increase in insurance costs. In fact, some may actually lower your insurance rates. Examples include anti-theft and safety devices, according to the Idaho Department of Insurance.

Silverado options that fall into these categories include anti-lock brakes and side airbags. Other devices that can often lower insurance costs include vehicle alarm systems, tracking systems, and automatic seat belts. Safety features can help financially as well as protecting you on the road, no matter what kind of vehicle you own.

Did you know some RV-specific GPS systems can identify difficult road features like steep gradients and tight turns? What kind of tech do you have in your RV? Tell us below 👇#RVLife #RVTips pic.twitter.com/42Od5Zo6Zh

— Progressive (@progressive) February 16, 2024

A new model also comes with a limited warranty, which may save you money on insurance. Since you don’t want to duplicate insurance coverage, you can use the coverage under your warranty to substitute for collision auto insurance or comprehensive coverage while the warranty is in effect. Once it expires, you can then add those types of coverage to your policy.

Chevrolet offers warranties even with the most basic 1500 at the lowest trim level.

These include bumper-to-bumper coverage for three years or 36,000 miles, powertrain/drivetrain coverage for five years or 100,000 miles, and roadside assistance and courtesy transportation for five years or 100,000 miles.

Although your used or existing Silverado may be past the manufacturer’s warranty zone, you can still look into installing anti-theft and safety devices. These devices may lower your premium while offering you an upgraded level of safety and security.

Factors That May Work Against Insurance Costs

The high price of a brand new elaborate Silverado may work against you in terms of getting cheap Chevrolet auto insurance prices, although the latest safety and security devices Chevy offers may help even it out a bit. Chevy full-size trucks are also a hot commodity for thieves, as noted by the National Insurance Crime Bureau.

The 1999 full-size Chevy pickup ranked in at No. 7 on the NICB’s top 10 list of most stolen vehicles for 2011.

This may increase the cost of insurance if you happen to have a Silverado that fits those parameters. The way you use your truck could also work against you when it comes to insurance costs. In general, insuring a vehicle you use only for pleasure is less costly than insuring one you use to drive to work every day.

Mileage and Chevrolet Silverado Auto Insurance Rates

One more factor in your insurance rates is your overall annual mileage. Low annual mileage typically keeps rates on the lower end of the scale, while a high annual mileage leads to higher rates.

Storing or parking your truck in a secured lot or location may net you lower rates than keeping it on the street. A street or open location is more likely to invite theft.

Where you live and drive the truck may also play a part. Rural locations with few chances of accidents or theft usually mean lower rates than highly populated urban locations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Personal Factors That Determine Insurance Rates

Other factors that play a part in your insurance rates will also include your driving record. If your record is rife with accidents, insurance claims, and violations, you are likely to face a higher insurance rate than someone with a squeaky-clean record.

Your age, gender, and marital status are also taken into account when determining rates. While marital status does not seem to be a major factor for older drivers, statistics show younger married drivers generally have a safer driving record than younger single drivers do.

Have you heard of Drivewise? It’s located in our Allstate app. We recently found out that customers who choose to use Drivewise are 25% less likely to have a severe collision than those who don’t. https://t.co/HNMxg3hVAZ

— Allstate (@Allstate) May 13, 2024

On the flip side of the insurance rate scale, motorists over age 50 are often eligible for mature driver discounts. Getting cheap auto insurance over the age of 60 is also going to be easy to do.

One more personal factor that can play a part in your car insurance rates is your credit score. A solid history of paying your bills on time and a positive credit report may net you lower rates than a poor credit rating.

Types of Insurance Coverage Available

Obtaining insurance that complies with your state laws is the first place to start when insuring your Silverado. Most states generally require bodily injury liability and property damage liability. Driving without auto insurance can come with fines, or worse, jail time.

States may also require uninsured or underinsured motorist coverage, again for bodily injuries or property damage. These types of insurance cover damage to your own vehicle or your own injuries if the other person is at fault but has insufficient coverage to meet your needs.

Physical damage coverage, which consists of collision and comprehensive, covers the damage to your Silverado. It usually kicks in regardless of who is at fault for the accident. Here’s where it may be worth it to opt for a higher limit on a newer Silverado, even if it increases your premium since the value of your truck is still high.

Collision covers damage from a collision while comprehensive covers damage from events other than a collision. Vandalism, storm damage, fire, and theft fall under comprehensive.

Optional Coverage for Your Chevy Silverado

Car insurance companies may offer a wide variety of optional coverage, but these types are generally not required by state law and will increase your premium. There are some choices you may want however, including the following: towing, car rental reimbursement, and custom parts replacement.

- Towing: If your Chevrolet Silverado is still covered under the roadside warranty, towing coverage would duplicate the coverage that you already have until the warranty expires.

- Rental Car Reimbursement: Pays you back for the cost of renting a car while your Silverado is inoperable and being repaired.

- Custom Parts Replacement: Takes care of additional electronics or other after-market features you may add to your truck. A stereo system, GPS mapping, and tracking devices may fall into the custom equipment category.

The former reimburses you for medical bills resulting from an accident that cost more than the bodily injury coverage limits. The latter pays a set amount to the family of the insured if the insured dies from accident-related causes.

If you are leasing a Silverado instead of buying one outright, another type of insurance may be useful for you. GAP coverage for leased vehicles takes into account the Silverado’s actual cash value and the amount you still need to pay on the lease. It then pays the difference between the two.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Chevrolet Silverado Auto Insurance

Finding competitive rates for your Chevrolet Silverado is easy as long as you compare rates from different providers, inquire about any special discounts you qualify for, and understand the impact different factors will have on your rates. You will also want to know the minimum auto insurance requirements in your state so that you don’t get into trouble driving with less coverage than necessary.

By utilizing online tools and keeping up with insurance rates, you’ll be able to make the best decision for your budget and lifestyle. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Frequently Asked Questions

How does auto insurance for a Chevrolet Silverado work?

Auto insurance for a Chevrolet Silverado works like insurance for any other vehicle. It typically includes coverage for liability, collision, comprehensive coverage, and optional add-ons.

What types of coverage are available for a Chevrolet Silverado?

The available types of coverage for a Chevrolet Silverado are similar to those for other vehicles. Common coverage options include liability, collision, and comprehensive.

Are Chevrolet Silverado insurance rates generally higher or lower than average?

Insurance rates for a Chevrolet Silverado can vary depending on several factors. In general, Silverado insurance rates may be slightly higher than average due to factors such as the vehicle’s size, power, and potential repair costs. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Can I get discounts on Chevrolet Silverado insurance?

Yes, many insurance companies offer various discounts on auto insurance that may apply to Chevrolet Silverado owners.

Do I need special insurance for modifications or accessories added to my Chevrolet Silverado?

If you have made modifications or added accessories to your Chevrolet Silverado, it’s important to inform your insurance provider. In some cases, you may need to purchase additional coverage to protect the value of the modifications or accessories.

Can I save on insurance costs by raising my deductible?

Yes, opting for a higher deductible can often lower your insurance premiums. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. However, it’s important to consider your financial situation and ability to pay the deductible in the event of a claim.

Are there any specific insurance considerations for different Chevrolet Silverado models or trims?

Yes, insurance considerations can vary based on the specific model or trim level of your Chevrolet Silverado. Factors that affect auto insurance include engine size, horsepower, and safety features. Generally, higher-performance models or trims may have higher premiums due to increased repair costs or a higher likelihood of accidents.

What should I do if my Chevrolet Silverado is involved in an accident or gets damaged?

If your Chevrolet Silverado is involved in an accident or sustains damage, immediately contact law enforcement and your insurance provider.

How much will insurance cost for Chevy Silverado 1500 models?

Rates will vary based on what coverage you want, but a Chevy Silverado 1500 will average around $124 per month.

Does the year of a vehicle affect auto insurance rates?

Yes, the age of a vehicle will determine auto insurance costs. For example, 2017 Chevy Silverado insurance costs will be much different than 2023 Chevy Silverado insurance costs.

How much is insurance for a Chevy Silverado?

There are various factors which will determine your rates. Full coverage versus minimum coverage, the age of your Silverado, and your driving habits will all be considered by insurance companies.

Does leasing affect the average insurance cost for Chevy Silverado models?

If you lease your vehicle, not only will that affect your average monthly car insurance payment, but it will also mean you will have to pay more for coverage. Most companies require full auto insurance coverage on a leased vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.