Best Auto Insurance for Classic Cars in 2025 (Your Guide to the Top 10 Companies)

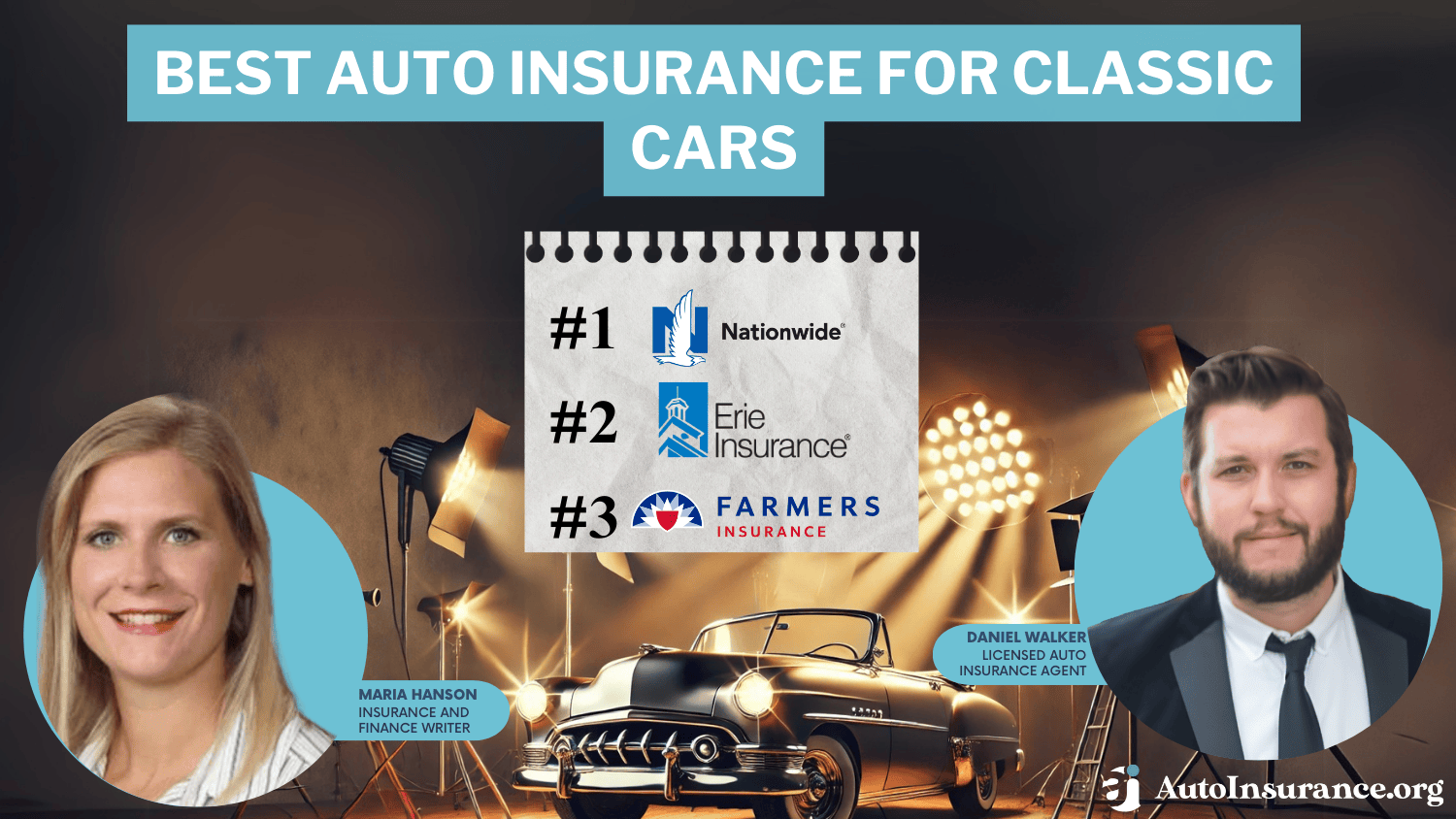

Nationwide, Erie, and Farmers have the best auto insurance for classic cars. Nationwide and Erie both offer guaranteed value on classic cars, but Erie is one of the cheapest classic cars insurance companies at $28 a month. Classic auto insurance is more affordable since classic vehicles are driven less frequently.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

$15k Coverage for Classic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 1,883 reviews

1,883 reviewsCompany Facts

$15k Coverage for Classic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

$15k Coverage for Classic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsNationwide, Erie, and Farmers have the best auto insurance for classic cars. Nationwide has no mileage limits, and Erie has the cheapest classic car insurance rates for $28 a month.

Does my car qualify for classic auto insurance? Vehicles must be at least ten years old to qualify for coverage. Check out the classic car insurance comparison below if you need cheap historic auto insurance:

Our Top 10 Company Picks: Best Auto Insurance for Classic Cars

| Company | Rank | Pay-in-Full Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A+ | Simple Claims | Nationwide |

| #2 | 18% | A+ | Senior Discounts | Erie |

| #3 | 12% | A | Online Convenience | Farmers | |

| #4 | 10% | A+ | Coverage Upgrades | Amica Mutual | |

| #5 | 14% | A++ | No Restrictions | Auto-Owners | |

| #6 | 17% | A++ | Military Members | USAA | |

| #7 | 16% | A | Roadside Assistance | AAA |

| #8 | 13% | B | Local Agents | State Farm | |

| #9 | 19% | A+ | Policy Options | Allstate | |

| #10 | 11% | A | Costco Members | American Family |

Who is the best classic car insurance? Erie has cheap classic car insurance, but Nationwide and Farmers offer more coverage add-ons. Scroll down to learn about each provider and pick out the perfect classic car insurance company for you. Start shopping for auto insurance quotes now using our free tool.

- Nationwide has the best classic car auto insurance at $52 a month

- Erie has cheap car insurance for classic cars at $28 monthly

- Classic car insurance is often cheaper than new vehicle car insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Pick Overall

Pros

- No Mileage Limits: Nationwide doesn’t have mileage limits on classic car insurance.

- Simple Claims: Nationwide has a simple claims process for classic cars, which drivers can start online or from the mobile app.

- Guaranteed Value Coverage: Nationwide will pay the full classic car value in a total loss.

Cons

- Customer Ratings: Ratings could be better from classic car customers overall, as seen in our Nationwide auto insurance review.

- High Driver Rates: Nationwide classic car insurance rates are more expensive than other companies.

#2 – Erie: Best for Low Rates

Pros

- Affordable Rates: Classic car insurance costs much less with Erie, where minimum coverage starts at $28 per month.

- Guaranteed Value Coverage: Erie’s guaranteed value ensures totaled car owners get the full worth of their classic vehicle in a claim payout.

- Simple Policy Management: Erie allows customers to add a classic vehicle to their regular insurance policy rather than purchasing a separate one.

Cons

- Availability: Erie classic car insurance isn’t available in every state. Check our Erie Insurance review to see if it’s available in your state.

- Limited Add-Ons: As a regional provider, Erie may have fewer customizable options for classic auto insurance.

#3 – Farmers: Best for Online Convenience

Pros

- Online Convenience: Farmers’ customers can use the website or app to check on their classic car coverage and make changes.

- Guaranteed Value Coverage: Farmers guarantees classic car owners will get the full value of their car in a total loss.

- Spare Parts Coverage: Ideal for classic car owners with spare vehicle repair parts.

Cons

- Customer Ratings: Classic car insurance services could be improved, which you can learn about in our Farmers auto insurance review.

- High Rates: Classic car insurance is expensive with Farmers, which starts at $65 monthly for $15,000 policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Amica: Best for Affordable Upgrades

Pros

- Coverage Upgrades: Amica Platinum Choice Auto upgrade includes credit monitoring and new car replacement. Learn more in our Amica auto insurance review.

- Customer Service: Amica has good customer service reviews for its classic car insurance.

- Discount Variety: Customers can save by applying for Amica discounts, including classic multi-car insurance discounts.

Cons

- Coverage Limits: Despite a lot of policy options, Amica is the only one of the top five classic car insurance companies with policy caps below $50,000.

- Higher Rates: Amica is one of the more expensive companies for classic car insurance at $60 a month.

#5 – Auto-Owners: Best for No Driving Restrictions

Pros

- No Driving Restrictions: Auto-Owners is more lenient with mileage and driving habits when it comes to insuring classic cars.

- Cost Savings: Auto-Owners is an affordable company for classic car insurance, starting at $42 monthly. Read our Auto-Owners auto insurance review to learn more.

- Coverage Options: Auto-Owners sell extras like modified parts coverage or roadside assistance, which can be helpful to classic car owners.

Cons

- Online Management: Online services for classic car owners are limited at Auto-Owners.

- Availability: Currently, Auto-Owners doesn’t sell classic car coverage in every state.

#6 – USAA: Best for Military Members

Pros

- Military Members: USAA specializes in classic auto insurance for military and veteran drivers. Learn more in our USAA auto insurance review.

- Mobile App: Customers can manage their USAA classic car insurance policies from their phone.

- Add-On Coverages: Get extra protection for classic cars with add-ons like roadside assistance.

Cons

- Restrictions on Eligibility: Classic car owners must be military or veterans to buy USAA insurance.

- Mileage Limits: Drivers must pay more if they drive a classic car more than 5,000 miles a year.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA classic car insurance has a free roadside assistance program included with every member’s policy.

- AAA Membership Perks: Classic car owners can use their AAA membership for discounts when shopping and traveling. Learn more in our AAA auto insurance review.

- Bundling Options: AAA sells more than classic car insurance, so there are opportunities to bundle if customers wish.

Cons

- Membership Fee: Classic car owners need an AAA membership to buy car insurance.

- Claim Reviews: AAA doesn’t have great overall reviews for its classic car insurance claims handling.

#8 – State Farm: Best for Customer Satisfaction

Pros

- Great Customer Service: Local agents can help customers directly with classic car insurance.

- Availability: State Farm classic car insurance is available in every state.

- Discounts: State Farm has plenty of classic car discounts. For a full list of discounts, read our State Farm auto insurance review.

Cons

- Financial Stability: The company isn’t as stable as its classic car insurance competitors.

- Online Management: Management online can be limited due to local agents handling most classic car policy issues.

#9 – Allstate: Best for Policy Options

Pros

- Policy Options: Allstate has plenty of options to personalize classic auto policies with coverages, deductibles, etc.

- Discount Options: Our Allstate auto insurance review covers all available discounts on classic car insurance, from good drivers to bundling discounts.

- Online App: Allstate’s free app lets drivers make classic auto policy changes, file claims, and more.

Cons

- Customer Ratings: Allstate has more complaints from customers than other classic car insurance companies.

- Higher Rates: Allstate charges higher rates for classic car insurance, starting at $75 a month.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Costco Members

Pros

- Costco Members: Costco members with classic vehicles can buy American Family at Costco for a discounted rate.

- Discount Options: Read our American Family auto insurance review for a full list of classic auto insurance discounts, from good student discounts to good driver discounts.

- Adjustable Deductibles: Customers can choose a classic car deductible that they feel comfortable with.

Cons

- Availability: American Family classic car insurance is not available in every state.

- Expensive Rates: American Family classic car insurance rates are less competitive than other companies on this list.

The Best Auto Insurance Companies for Classic Cars

How much is classic car insurance? The average cost of classic car insurance varies by company, with Erie and USAA having the cheapest rates. USAA is only available to military members, but Erie remains the cheapest car insurance for classic cars for all drivers, no matter how much coverage they need.

Classic Car Auto Insurance Monthly Rates by Provider & Agreed Value

| Insurance Company | $15k Policy | $25k Policy | $30k Policy | $50k Policy |

|---|---|---|---|---|

| $40 | $55 | $65 | X |

| $75 | $100 | $115 | X | |

| $55 | $75 | $85 | X | |

| $60 | $90 | $105 | X | |

| $42 | $60 | $75 | $90 | |

| $28 | $40 | $50 | $65 |

| $65 | $85 | $100 | $120 | |

| $52 | $70 | $85 | $100 |

| $45 | $60 | $78 | $95 | |

| $30 | $42 | $55 | $70 |

Unlike standard insurers, antique car insurance companies sell policies based on the agreed value of the vehicle. As you can see, some companies do not offer all policy limits. If you’re buying classic car insurance, compare policies from multiple companies to find the right coverage limits.

Drivers need policies that protect the vehicle’s true worth since classic and collector autos increase in value as they age and cost more to repair. If you drive an expensive collector or exotic auto, our top three classic car insurance companies offer coverage up to $50,0000.

However, insurance companies might also require more or certain types of coverage for classic cars, and some policies come with mileage restrictions or garaging requirements. Read classic car insurance reviews and shop around with multiple providers to get the best auto insurance for your classic car.

Learn More: Best States for Classic Car Owners

Understanding Classic Auto Insurance Coverage

Unlike standard car insurance, which pays out based on a car’s depreciated value, classic car insurance includes agreed-value coverage. This means you and the insurer decide on a set value for your vehicle upfront, ensuring you get its full worth if it’s totaled.

You and your provider agree on the guaranteed value amount, factoring in appraisals, market trends, and restoration costs, with no depreciation.Zach Fagiano Licensed Insurance Broker

To qualify, your car usually needs to be at least 10 to 25 years old, well-maintained, and not used as your daily vehicle. Companies also set driver restrictions — most require a clean driving record and enforce limited mileage, often under 5,000 miles per year, to minimize wear and tear and collision risks.

Many classic auto insurance companies limit coverage to specific models or won’t offer coverage to drivers under 25. Read antique car insurance reviews and compare rates by vehicle and driver age and gender to find the best auto insurance for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Classic Car Insurance Quotes

How much does it cost to insure a classic car? Finding affordable classic car insurance depends on two things: the driver and the vehicle. Classic auto insurance rates increase for higher mileage, exotic models, and younger drivers.

Classic car insurance is generally cheaper than minimum policies for non-classic cars, and full coverage costs are comparable. Check out the tables below to compare classic car insurance quotes by driver and vehicle type.

Read More: Best Auto Insurance For Exotic Cars

Classic Insurance by Driver Age

Do you need classic car insurance for a young driver? Cheap antique car insurance can be hard to find for teens and young drivers. Most companies consider anyone under 25 to be at risk for filing claims, and some companies won’t offer high policy limits to drivers under 21.

Classic Car Auto Insurance Monthly Rates by Age, Gender & Agreed Value

| Age and Gender | $15k Policy | $25k Policy | $30k Policy | $50k Policy |

|---|---|---|---|---|

| Age: 16 Female | $120 | $180 | $210 | X |

| Age: 16 Male | $140 | $200 | $235 | X |

| Age: 18 Female | $100 | $160 | $190 | X |

| Age: 18 Male | $120 | $180 | $215 | X |

| Age: 21 Female | $80 | $140 | $175 | $210 |

| Age: 21 Male | $90 | $150 | $185 | $220 |

| Age: 25 Female | $70 | $130 | $165 | $200 |

| Age: 25 Male | $75 | $135 | $170 | $205 |

| Age: 30 Female | $65 | $125 | $160 | $195 |

| Age: 30 Male | $70 | $130 | $165 | $200 |

| Age: 35 Female | $60 | $120 | $155 | $190 |

| Age: 35 Male | $65 | $125 | $160 | $195 |

| Age: 40 Female | $55 | $110 | $145 | $180 |

| Age: 40 Male | $60 | $115 | $150 | $185 |

| Age: 45 Female | $50 | $100 | $135 | $170 |

| Age: 45 Male | $55 | $105 | $140 | $175 |

Classic car insurance for drivers under 25 is the most expensive, starting at $140 monthly and climbing to around $200 a month for higher coverage limits. Consider the best auto insurance companies for drivers under 25 for better rates.

Classic Cars With Cheap Insurance

What cars are considered classic for insurance? This table lists the most popular classic autos, including the Porsche 911 and Chevrolet Camaro vs. Corvette insurance rates:

Car insurance for older cars and classic vehicles have similar rates, with auto insurance quotes for classic cars running slightly cheaper depending on the model. However, some insurance companies for old cars will have restrictions on what autos are classic or antique.

Companies with the best auto insurance by vehicle type will have flexible options for different drivers. For instance, Erie sells classic policies for cars 10 years or older but offers special antique insurance for vehicles over 25 years old. On the other hand, Nationwide sells classic car insurance for old cars and collector vehicles from 1980 or newer.

How to Save Money on Auto Insurance for Classic Cars

Saving on classic car insurance is easy because vintage cars aren’t driven like regular vehicles, meaning drivers are eligible for low-mileage and garaging auto insurance discounts. Specialized insurers also reward responsible ownership, like installing anti-theft devices.

Classic Car Auto Insurance Discounts by Provider

| Insurance Company | Auto Pay | Bundling | Early Signing | Multi-Vehicle | Pay in Full |

|---|---|---|---|---|---|

| 5% | 10% | X | 8% | 6% |

| 6% | 12% | 5% | 10% | 7% | |

| 5% | 10% | 6% | 9% | 6% | |

| 4% | 10% | X | 8% | 5% | |

| 5% | 11% | 7% | 10% | 6% | |

| 5% | 9% | X | 7% | 6% |

| 6% | 10% | 6% | 8% | 7% | |

| 5% | 12% | 6% | 9% | 6% |

| 4% | 10% | X | 7% | 5% | |

| 5% | 10% | X | 9% | 6% |

Bundling classic insurance with standard auto policies or home insurance is the best way to maximize savings. Here are more ways to cut down your classic car auto insurance costs:

- Join a Classic Car Club: Membership in groups like the Antique Automobile Club of America (AACA) often unlocks special rates.

- Limit Your Mileage: Top companies like Nationwide and Erie offer big savings if you drive a classic car less than 500 miles a year.

- Shop Around: Compare auto insurance companies for classic cars online before you buy to get an idea of the cost and your coverage options.

Insurance discounts lower your premium by reducing the risk insurers take on your classic car. Taking advantage of these strategies ensures you get the best coverage.

Finding the Right Classic Car Auto Insurance For You

When comparing classic car insurance companies, reviews can help you determine which has the policy coverage you need. Nationwide, Erie, and Farmers have the best auto insurance for classic cars, with auto insurance discounts for low mileage and perks like agreed-value coverage.

The best policies for classic cars have guaranteed value and additional coverage for restorations and spare parts, so always read classic auto insurance company reviews to know what each provider offers. Compare local companies now with our free comparison tool. It will help you find great classic car coverage from insurers in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Who has the best classic car insurance?

Nationwide, Erie, and Farmers are the best auto insurance companies for classic cars.

How much does classic car insurance cost?

The average classic car insurance cost is between $20 and $50 per month, depending on the age and value of your vehicle. Learn how insurance companies value a car and compare classic insurance by company to see which is most competitive.

How much is classic car insurance for young drivers?

Classic car insurance for young people is between $120 and $215 monthly, much more expensive than average. Insurers consider drivers under 25 to be inexperienced and less likely to maintain a classic or collector car appropriately and charge them more.

What are the limitations of classic car insurance?

Classic car insurance only covers the pleasure use of a classic car. It will not insure cars that are used daily for work, for example. Some insurance companies will place mileage caps on classic car insurance (Read More: Pleasure Use vs. Commuter Auto Insurance).

How many miles can you do on classic car insurance?

It depends on what car insurance company you choose. Some companies will have mileage caps for classic cars, while others don’t set a limit on how much a classic car can be driven.

How old does a car have to be until it’s a classic for auto insurance?

It depends on the car insurance company, but most companies require a car to be at least ten years old to be considered a classic. Compare rates for older cars now with our free quote tool.

Are classic cars more expensive to insure?

Classic cars actually tend to be cheaper to insure, as they are driven less. However, rates can be more expensive if drivers don’t properly store classic cars in garages when not driving (Read More: Best Classic Car Insurance Without a Garage).

How do you determine the value of a classic car?

Car insurance companies can appraise your vehicle to determine its value, and you can also research on your own to see what similar vehicles are worth.

What cars are classic insurance?

Classic auto insurance companies will offer policies to any car over 20-years-old. Some providers will accept vehicles that are at least 10-years-old.

What classic car is worth the most money?

Classic Mercedes-Benz are some of the most expensive classic cars on the market.

Is it worth getting insurance on a 10-year-old car?

Yes, even old cars need to meet state minimum auto insurance requirements if you plan on driving them.

Which insurance is best for an old car?

Full coverage classic car insurance is the best auto insurance for older cars that are considered collectors. Old vehicles that are not classics can often carry just minimum coverage for a cheaper rate (Learn More: Cheap Auto Insurance for Older Vehicles).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.