Best Ford F-350 Super Duty Auto Insurance in 2025 (10 Standout Companies)

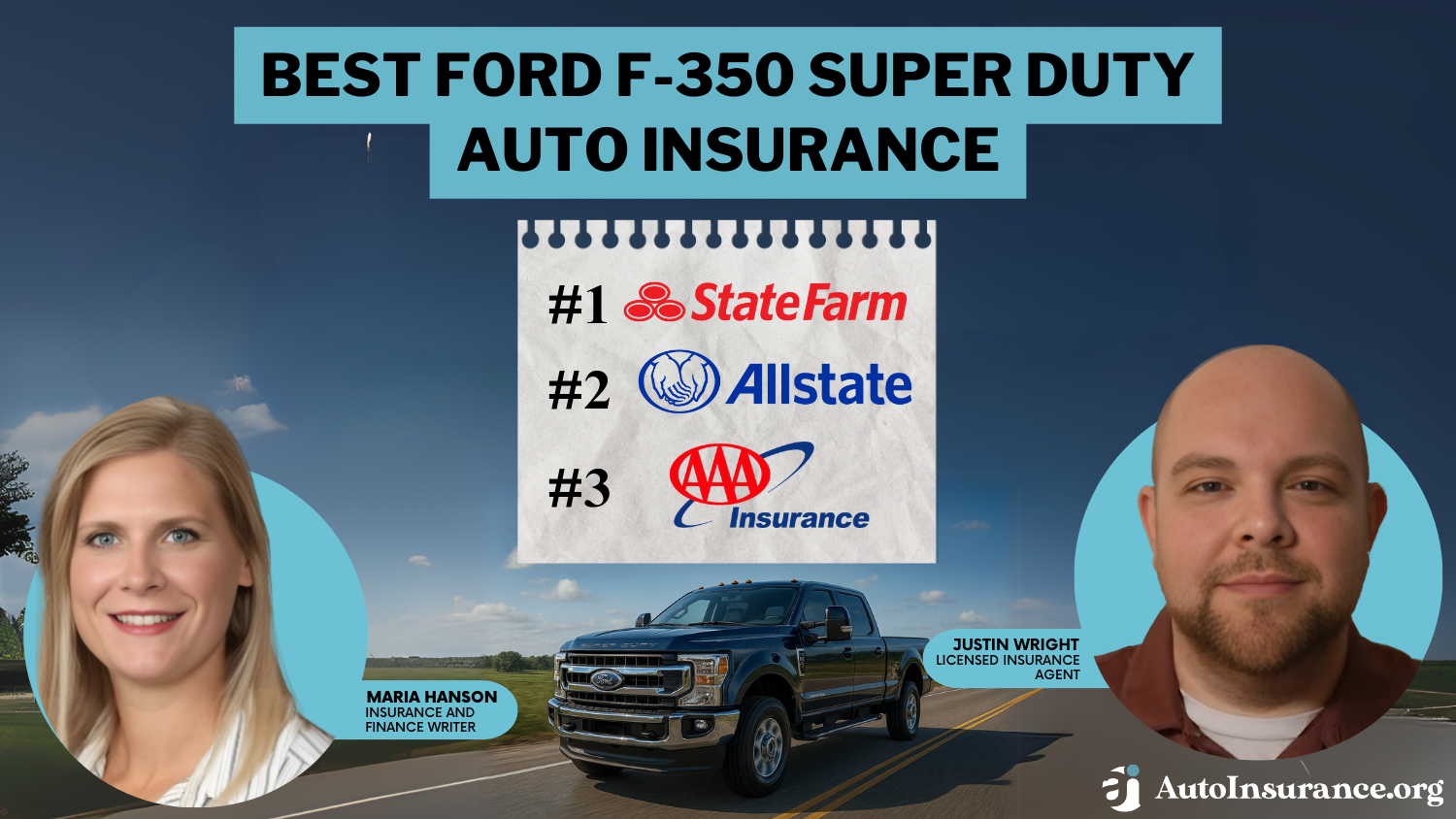

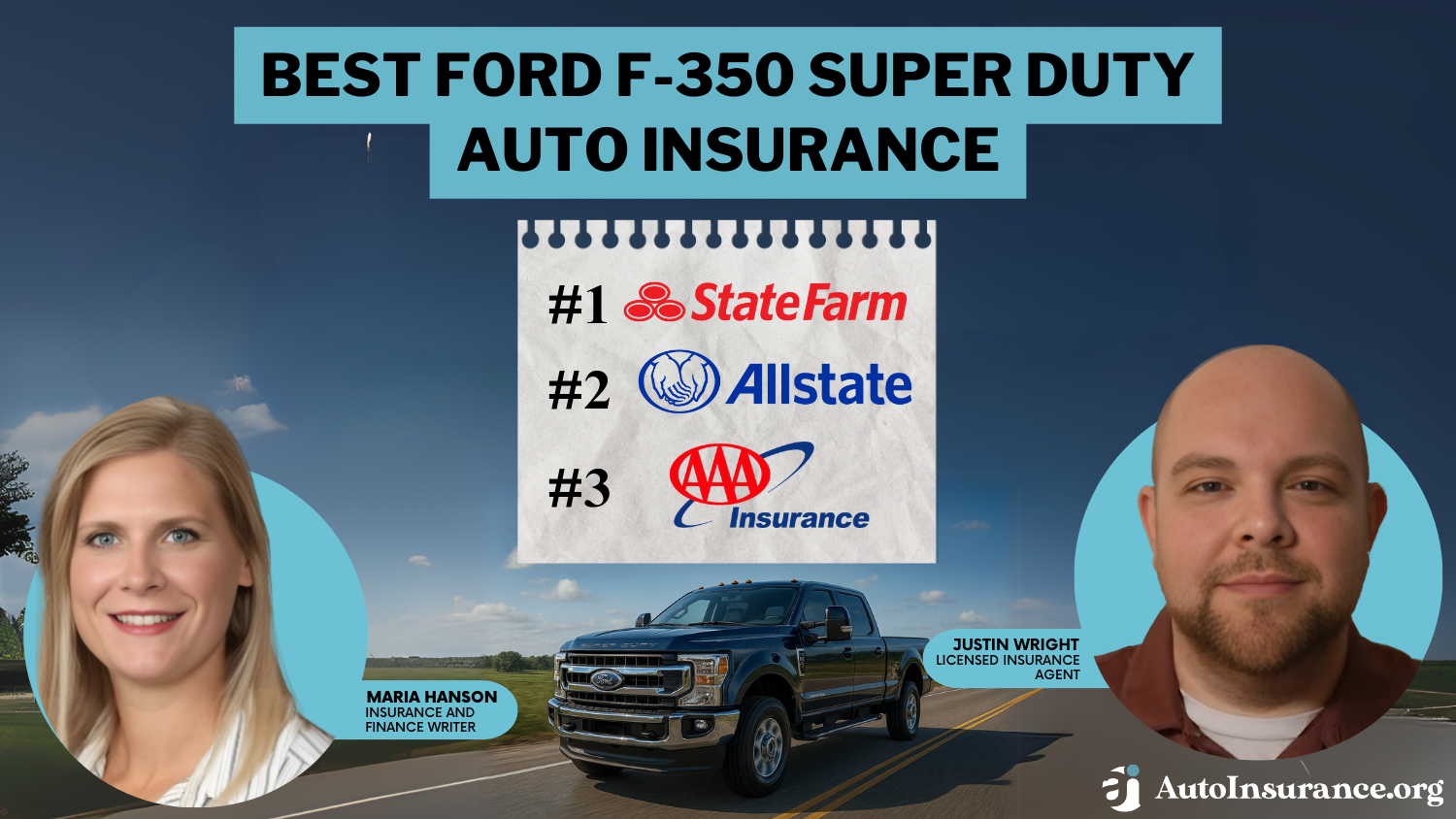

State Farm, Allstate, and AAA provide the best F-350 Super Duty auto insurance, with State Farm leading at just $117 per month. State Farm delivers low-cost coverage for safe drivers, Allstate adds long-term savings with accident forgiveness, and AAA includes affordable full coverage with roadside perks.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsThe best F-350 Super Duty auto insurance comes from State Farm, Allstate, and AAA, with rates starting at $117 per month. State Farm offers a competitive multi-policy discount and competitive accident-free savings that reward safe drivers.

Allstate adds value with accident forgiveness and vanishing deductibles, helping reduce long-term costs.

Our Top 10 Company Picks: Best Auto Insurance for Ford F-350 Super Duty

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 17% | Many Discounts | State Farm | |

| #2 | A+ | 25% | Add-on Coverages | Allstate | |

| #3 | A | 15% | Roadside Plan | AAA |

| #4 | A+ | 20% | Usage Discount | Nationwide |

| #5 | A++ | 25% | Custom Plan | Geico | |

| #6 | A | 25% | Customizable Polices | Liberty Mutual |

| #7 | A++ | 13% | Accident Forgiveness | Travelers | |

| #8 | A+ | 10% | Innovative Programs | Progressive | |

| #9 | A | 20% | Local Agents | Farmers | |

| #10 | A++ | 10% | Military Savings | USAA |

AAA improves coverage by offering roadside assistance and loyalty awards, but these are only available to members who pay an annual fee.

- State Farm offers $117 per month rates for F-350 Super Duty insurance

- Allstate offers accident forgiveness and vanishing deductibles to lower costs

- AAA includes roadside assistance and towing benefits for frequent F-350 drivers

No matter what you’re looking for, this guide will help you find the best Ford F-350 car insurance company. Discover which auto insurance companies best suit your needs and price range by using our free quote tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Reasonably Priced Premiums: State Farm is one of the least expensive insurance companies, with Ford F-350 Super Duty coverage starting at $117 monthly.

- Multi-Policy Savings: F-350 Super Duty owners can save up to 17% on their overall expenses by combining their home and auto insurance.

- Accident-Free Perks: Clean driving records mean lower F-350 Super Duty auto insurance rates at renewal. Check out more savings in our complete State Farm insurance review.

Cons

- Inconsistent Pricing: Rates for F-350 auto insurance can vary greatly based on location and claims history.

- Limited Customization: Unlike competitors, State Farm F-350 Super Duty coverage has fewer specialized add-ons, such as OEM parts replacement or disappearing deductibles.

#2 – Allstate: Best for Add-On Coverages

Pros

- Accident Forgiveness: The Your Choice Auto Program prevents rate hikes after the first at-fault accident in your F-350 Super Duty. Learn more in our Allstate auto insurance review.

- Vanishing Deductible: The Deductible Rewards Program reduces collision deductibles by $100 every year if you never file a Ford F-350 Super Duty insurance claim.

- Bundling Discount: By bundling auto and home insurance, policyholders can save up to 25%, greatly lowering F-350 Super Duty insurance rates.

Cons

- Fewer Discounts for High-Risk Drivers: F-350 Super Duty owners with prior claims or DUIs may see limited savings compared to other providers.

- Usage-Based Savings Limitations: The Drivewise program offers discounts for low-mileage drivers, but heavy F-350 Super Duty users may not qualify for savings.

#3 – AAA: Best for Roadside Coverage

Pros

- 24/7 Roadside Assistance: Includes free towing, fuel delivery, and battery service—a huge plus for truck owners.

- Member-Exclusive Savings: AAA members get up to 15% off their F-350 Super Duty insurance. Access comprehensive insights into our AAA auto insurance review.

- Highly Rated Mobile App: AAA’s 4.8-star app rating allows F-350 Super Duty drivers to manage policies, track claims, and request emergency services effortlessly.

Cons

- Membership Requirement: F-350 Super Duty insurance is less accessible to non-members because only AAA members are eligible for full policy benefits.

- Regional Price Variations: F-350 Super Duty drivers may see variable pricing due to state-specific discounts and coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Usage-Based Discounts

Pros

- SmartRide Savings: Safe F-350 Super Duty drivers save up to 20% by enrolling in Nationwide’s telematics program.

- Accident-Free Renewal Perks: F-350 Super Duty owners with no claims for five years qualify for Vanishing Deductible, reducing deductibles by $100/year.

- OEM Parts Coverage: Ensures F-350 Super Duty repairs use only manufacturer-approved parts after accidents. Read how in our Nationwide auto insurance review.

Cons

- Data-Based Discounts: The SmartRide program bases savings on driving habits, meaning F-350 Super Duty owners with high mileage may not see full benefits.

- Higher Deductibles: Collision and comprehensive deductibles start higher than competitors, making claims more expensive for F-350 Super Duty drivers.

#5 – Geico: Best for Custom Plans

Pros

- Military Savings: Active-duty military and veterans get up to 25% off their F-350 Super Duty insurance. Discover insights in our Geico insurance review.

- Covers Aftermarket Mods: Protects custom parts and upgrades on your F-350 Super Duty with flexible coverage.

- Strong Financial Stability: Geico holds an A++ rating from A.M. Best, ensuring reliable claims payouts for F-350 Super Duty owners.

Cons

- Online-Only Claims Process: In contrast to rivals, Geico primarily manages claims online, which could be cumbersome for owners of F-350 Super Duty who would rather receive assistance in person.

- Restricted Repair Shop Network: Geico limits F-350 Super Duty drivers’ options by requiring claims repairs at authorized service locations.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- RightTrack Telematics: Safe F-350 Super Duty drivers can earn up to 25% off based on real-time driving data. Explore your options in our Liberty Mutual insurance review.

- Better Car Replacement: If an F-350 Super Duty is totaled, Liberty Mutual covers a newer model year instead of just the current value.

- OEM Parts Guarantee: Ensures all F-350 Super Duty repairs use factory-original parts, preserving truck value.

Cons

- Fewer Discounts Than Competitors: While Liberty Mutual offers some savings, F-350 Super Duty drivers may find better discount options with State Farm or Geico.

- State-Based Coverage Limits: Some policy features, such as gap insurance, aren’t available in every state for F-350 Super Duty owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Prevents rate increases after one at-fault claim for F-350 Super Duty owners with qualifying records.

- Safe-Driver Savings: The IntelliDrive program tracks habits and offers up to 20% off for cautious F-350 Super Duty drivers.

- Affinity Discounts: Members of professional organizations receive exclusive pricing on F-350 Super Duty insurance. For details, read our Travelers insurance review.

Cons

- Fewer Physical Agents: F-350 Super Duty owners in rural areas may struggle to find local Travelers agents for in-person support.

- Mobile App Limitations: Lacks certain digital tools, making policy management less convenient for F-350 Super Duty drivers.

#8 – Progressive: Best for Innovative Programs

Pros

- Snapshot Discounts: Safe F-350 Super Duty drivers save based on real-time driving behavior. Get more quotes in our Progressive insurance review.

- Name Your Price Tool: Allows F-350 Super Duty owners to customize policies to fit their budget.

- Loan/Lease Payoff: Covers remaining balances on financed F-350 Super Duty trucks after total loss.

Cons

- Rate Fluctuations: Snapshot users may see increased F-350 Super Duty premiums if their driving habits are considered risky.

- Limited Bundling Perks: Home and auto discounts for F-350 Super Duty drivers aren’t as competitive as other insurers.

#9 – Farmers: Best for Local Agents

Pros

- Personalized Service: Local agents tailor F-350 Super Duty policies to fit specific coverage needs.

- New Car Replacement: Covers a brand-new F-350 Super Duty if totaled within the first two years.

- Strong Bundling Discounts: Save up to 20% by combining home and auto coverage. Get a list of discounts in our Farmers auto insurance review.

Cons

- Higher Premiums: Initial F-350 Super Duty rates tend to be higher than those of competitors.

- Limited Digital Tools: Farmers lacks robust online policy management features for F-350 Super Duty owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Savings

Pros

- Exclusive Member Rates: Military families get lower premiums for F-350 Super Duty coverage. Discover insights in our USAA auto insurance review.

- Highly Rated Customer Service: USAA consistently ranks top for claims satisfaction among F-350 Super Duty owners.

- Flexible Coverage Options: Includes rental car reimbursement and roadside assistance for F-350 Super Duty drivers.

Cons

- Restricted Membership: Only available to active-duty military, veterans, and their families.

- Limited Physical Locations: Fewer in-person USAA branches for F-350 Super Duty policyholders needing assistance.

Comparing Ford F-350 Super Duty Insurance Costs Across Top Providers

Your provider and the coverage you choose will affect the Ford F-350 Super Duty insurance costs. While comprehensive coverage offers you extra protection for accidents, theft, and weather damage, minimum coverage is the most affordable and merely meets state criteria. If your truck is financed or brand-new, comprehensive coverage is absolutely the wiser choice.

Ford F-350 Super Duty Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $120 | $174 |

| $125 | $181 | |

| $140 | $209 | |

| $128 | $186 | |

| $132 | $194 |

| $125 | $183 |

| $129 | $206 | |

| $117 | $178 | |

| $137 | $198 | |

| $144 | $217 |

State Farm has the lowest minimum coverage at 117 per month, making it a budget-friendly option. AAA at 120 per month and Allstate at 125 per month also offer reasonable rates. USAA charges the highest at 144 monthly, likely due to its military-exclusive perks. This also highlights how F-250 vs. F-350 insurance cost differences may come into play, as heavier trucks like the F-350 often see higher premiums even within the same company.

AAA offers the cheapest option for full coverage auto insurance at 174 per month, while State Farm at 178 per month and Nationwide at 183 per month keep costs manageable. USAA at 217 per month and Farmers at 209 per month have the highest rates, likely because of extra policy benefits and claims support.

State-by-State Breakdown of F-350 Super Duty Insurance Costs

Where you live greatly impacts your Ford F-350 Super Duty insurance costs. Auto insurance laws, high medical claim payouts, strict no-fault laws, severe weather risks, or high accident rates tend to drive up premiums, while states with lower claim rates and competitive markets offer more affordable coverage.

Ford F-350 Super Duty Auto Insurance Monthly Premiums by State

| State | Minimum Coverage | Full Coverage |

|---|---|---|

| Alabama | $120 | $224 |

| Alaska | $95 | $185 |

| Arizona | $110 | $210 |

| Arkansas | $125 | $230 |

| California | $140 | $256 |

| Colorado | $135 | $239 |

| Connecticut | $160 | $305 |

| Delaware | $145 | $252 |

| Florida | $170 | $300 |

| Georgia | $135 | $245 |

| Hawaii | $55 | $98 |

| Idaho | $90 | $170 |

| Illinois | $95 | $178 |

| Indiana | $100 | $183 |

| Iowa | $75 | $145 |

| Kansas | $105 | $193 |

| Kentucky | $155 | $279 |

| Louisiana | $200 | $358 |

| Maine | $70 | $135 |

| Maryland | $115 | $219 |

| Massachusetts | $90 | $175 |

| Michigan | $225 | $423 |

| Minnesota | $90 | $174 |

| Mississippi | $110 | $210 |

| Missouri | $105 | $198 |

| Montana | $110 | $202 |

| Nebraska | $90 | $170 |

| Nevada | $160 | $281 |

| New Hampshire | $100 | $196 |

| New Jersey | $120 | $215 |

| New Mexico | $115 | $220 |

| New York | $110 | $204 |

| North Carolina | $65 | $126 |

| North Dakota | $95 | $173 |

| Ohio | $80 | $154 |

| Oklahoma | $135 | $246 |

| Oregon | $120 | $224 |

| Pennsylvania | $105 | $189 |

| Rhode Island | $165 | $315 |

| South Carolina | $115 | $214 |

| South Dakota | $105 | $192 |

| Tennessee | $120 | $226 |

| Texas | $125 | $227 |

| Utah | $110 | $193 |

| Vermont | $75 | $149 |

| Virginia | $70 | $140 |

| Washington | $100 | $186 |

| West Virginia | $100 | $187 |

| Wisconsin | $100 | $186 |

| Wyoming | $90 | $174 |

Michigan has the highest rate at $423 per month due to mandatory unlimited medical coverage under its no-fault system. Louisiana at $358 and Florida at $300 are closely followed, driven by hurricane-related claims and high uninsured motorist rates.

On the cheaper end, Hawaii has the lowest cost at $98 per month, benefiting from strict insurance laws and fewer accidents. North Carolina, at $126, and Maine, at $135, also see lower rates due to fewer claims and a highly competitive insurance market.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding F-350 Super Duty Insurance Costs and Policy Options

Insuring a Ford F-350 Super Duty can get pricey due to its size, towing power, and repair costs. Insurance companies look at your driving history, coverage level, and auto insurance deductible choices, so picking the right plan helps keep costs down while giving you solid protection.

Ford F-350 Super Duty Auto Insurance Monthly Rates by Policy Type

| Category | Monthly Rate |

|---|---|

| Average Rate | $145 |

| Discount Rate | $120 |

| High Deductibles | $110 |

| High Risk Driver | $210 |

| Low Deductibles | $175 |

| Teen Driver | $250 |

The average rate for F-350 insurance is $145 monthly, but costs vary. High-deductible insurance reduces monthly premiums to $110, making them excellent for people ready to pay more out of cash for claims. Discounted rates of $120 per month apply to safe drivers and policy bundlers.

Teen drivers pay the highest at $250 monthly, reflecting their accident risk. High-risk drivers face $210 per month, while low-deductible plans cost $175, offering more protection but at a higher monthly cost.

The Impact of Violations on F-350 Super Duty Insurance Rates

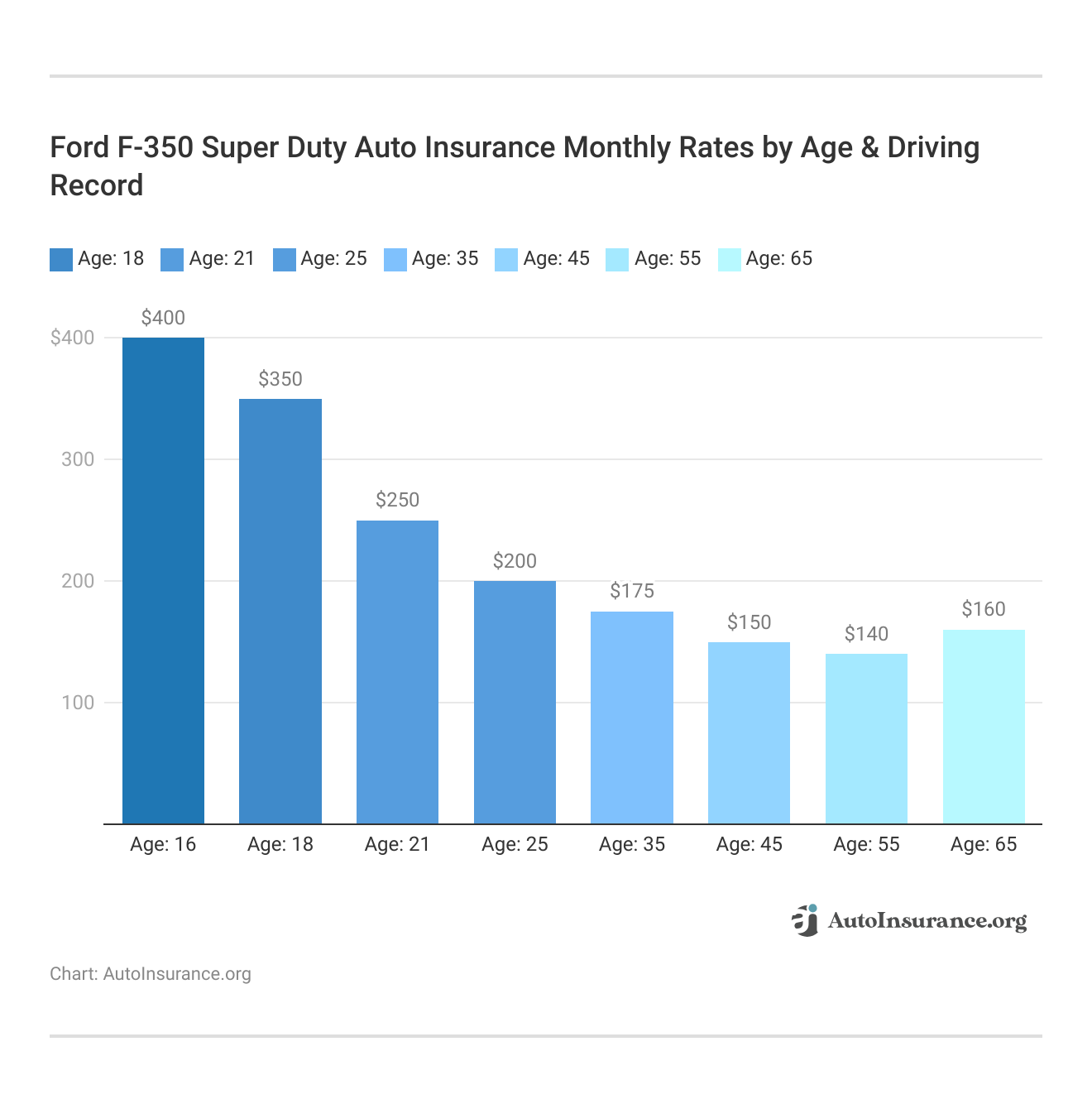

Owning a Ford F-350 Super Duty comes with higher insurance costs due to its size, power, and repair expenses. However, your age and driving record have a huge impact on what you’ll pay. Younger drivers face higher rates because they’re considered riskier, while older drivers typically pay less.

However, a DUI, accident, or speeding ticket can raise auto insurance premiums by over $100 per month, making safe driving critical for keeping costs low. 16-year-olds pay the highest rates at $400 per month, with a DUI pushing it to $550 per month. By age 25, rates drop to $200 per month for a clean record, but a DUI still increases it to $350 per month.

Accident forgiveness can be a valuable add-on for Ford F-350 Super Duty drivers, preventing rate hikes after their first at-fault accident.Justin Wright Licensed Insurance Agent

The lowest rates are for drivers in their 50s, averaging $140 per month, while at age 65, insurance costs climb again to $160 per month due to higher accident risk. F-350 Super Duty owners can save by keeping a clean record, taking defensive driving courses, bundling policies, and using accident forgiveness programs to offset rate increases.

Maximizing Savings on F-350 Super Duty Insurance

Insuring a Ford F-350 Super Duty can get expensive, but the right discounts can bring those costs down. Providers offer savings for bundling, safe driving, having a newer vehicle, and even military service. Picking a company with the best auto insurance discounts can make a huge difference in what you pay monthly.

F-350 Super Duty Auto Insurance Discounts From the Top Providers

| Insurance Company | Anti-Theft | Multi-Policy | New Car | Safe Driver |

|---|---|---|---|---|

| 8% | 15% | 10% | 10% |

| 10% | 25% | 12% | 18% | |

| 10% | 20% | 15% | 20% | |

| 25% | 25% | 15% | 15% | |

| 35% | 25% | 20% | 20% |

| 5% | 20% | 10% | 12% |

| 25% | 10% | 12% | 10% | |

| 15% | 17% | 18% | 20% | |

| 15% | 13% | 12% | 17% | |

| 15% | 10% | 15% | 10% |

State Farm, Allstate, and Farmers offer top bundling discounts, making them great for multi-policy savings. AAA, Nationwide, and Progressive reward good students, perfect for families. Geico and USAA provide exclusive military discounts, helping active duty and veterans save.

Allstate and Travelers give discounts for new vehicles, while AAA, State Farm, and Nationwide lower rates for defensive driving courses. Combining discounts can help F-350 Super Duty owners save significantly while keeping strong coverage. Comparing providers ensures the best possible deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Essential Coverage Options for Heavy-Duty Protection

It takes more than the bare minimum to insure a Ford F-350 Super Duty. Getting the right coverage isn’t just smart—it’s necessary—because of how much it costs to fix and how often accidents happen. Listed below are some of the more important considerations and potential dangers associated with owning and operating this type of heavy-duty truck.

- Collision Coverage: Covers damage to your F-350 from accidents, crucial for repairs that can exceed $5,000 due to the truck’s size and specialized parts.

- Comprehensive Coverage: Covers theft, hail, vandalism, and other non-collision incidents—ideal for trucks often parked outdoors or at worksites.

- Property Damage Liability: With an 85% loss probability, this covers damages your F-350 may cause to other vehicles or property in at-fault accidents.

- Medical Payments (MedPay): Helps with passenger medical bills post-accident; important given the F-350’s 40% injury-related loss rate.

- Uninsured Motorist Coverage: Provides protection if hit by an uninsured driver—valuable in states like Florida where uninsured rates exceed 20%.

These coverages are more than just recommendations—they’re designed to match the realities of owning a sizeable work-focused truck like the F-350. With a high potential for impact damage and passenger injuries, cutting corners on coverage can leave you exposed. Choosing the proper protections upfront ensures your vehicle and finances stay secure.

Ford F-350 Super Duty Safety Ratings and Insurance Impact

Due to its low accident risk and claim payout rates, the Ford F-350 Super Duty has excellent safety ratings and can help bring down insurance premiums. The truck is safer for drivers and passengers thanks to crash protect truck’s other innovative safety features and is also more insurance-friendly.

Ford F-350 Super Duty Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

| Automatic Emergency Braking | Available |

| Blind Spot Monitoring | Available |

| Lane Departure Warning | Available |

| Adaptive Cruise Control | Available |

| Rearview Camera | Standard |

| Parking Sensors | Available |

| Trailer Sway Control | Standard |

The F-350 Super Duty holds “Good” ratings in all major crash tests, including small overlap front, side impact, and roof strength, proving its structural durability. Standard features like a rearview camera and trailer sway control improve visibility and towing safety.

Additional safety measures that reduce the chance of accidents include lane departure warnings, blind spot monitoring, and automated emergency braking. The F-350 Super Duty is an affordable and secure choice for drivers thanks to its excellent crash ratings and state-of-the-art safety features.

Ford F-350 Super Duty Crash Ratings Breakdown

If you drive a Ford F-350 Super Duty, you should know how it performs in crash tests. The table below shows how the vehicle performed in the NHTSA’s accident safety ratings between 2020 and 2024.

Ford F-350 Super Duty Crash Test Ratings (NHTSA)

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford F-350 Super Duty 4 DR | ★★★☆☆ (3/5) | ★★★☆☆ (3/5) | ★★★★☆ (4/5) | ★★★☆☆ (3/5) |

| 2023 Ford F-350 Super Duty 4 DR | ★★★☆☆ (3/5) | ★★★☆☆ (3/5) | ★★★★☆ (4/5) | ★★★☆☆ (3/5) |

| 2022 Ford F-350 Super Duty 4 DR | ★★★☆☆ (3/5) | ★★★☆☆ (3/5) | ★★★★☆ (4/5) | ★★★☆☆ (3/5) |

| 2021 Ford F-350 Super Duty 4 DR | ★★★☆☆ (3/5) | ★★★☆☆ (3/5) | ★★★★☆ (4/5) | ★★★☆☆ (3/5) |

| 2020 Ford F-350 Super Duty 4 DR | ★★★☆☆ (3/5) | ★★★☆☆ (3/5) | ★★★★☆ (4/5) | ★★★☆☆ (3/5) |

Across all five years, the F-350 scored 3 out of 5 stars overall, with 3-star ratings in both frontal crashes and rollover tests. This is largely because the truck has a higher center of gravity and a heavier design, which can alter how it absorbs impacts and how likely it is to tilt under specific circumstances.

Positively, its strengthened door frames and strong side protection help it perform better in side-impact testing, earning it four out of five ratings. If you use your F-350 for daily driving or hauling passengers, it’s smart to have extra injury coverage or Medical Payments (MedPay) in your policy just in case—especially given the average safety scores in frontal and rollover areas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Breaking Down Insurance Risk for the Ford F-350 Super Duty

The Ford F-350 Super Duty is a powerful truck, but its size, weight, and towing capability mean certain types of insurance claims are more common. Loss probability shows how often claims are filed for different coverages, which directly affects your insurance rates. Higher loss probability means higher premiums, especially for property damage and medical coverage, while lower loss probability keeps some costs down.

Ford F-350 Auto Insurance Loss Probability by Coverage Type

| Coverage Type | Loss Probability |

|---|---|

| Collision | 25% |

| Comprehensive | 10% |

| Property Damage Liability | 85% |

| Personal Injury Protection (PIP) | 30% |

| Medical Payments (MedPay) | 40% |

| Bodily Injury Liability | 10% |

Property damage liability has the highest loss probability at 85%, reflecting the F-350’s potential to cause significant damage in collisions. MedPay at 40% and PIP at 30% show frequent medical claims, making injury-related coverage more expensive. Collision coverage sits at 25%, indicating moderate repair claim frequency.

Comprehensive and bodily injury liability has the lowest loss probability at 10%, with fewer claims for non-collision damage and lower injury risks compared to property damage. Since high-risk coverages come with higher premiums, F-350 owners can lower costs through safe driving, bundling policies, and leveraging safety feature discounts while ensuring adequate protection against major claims.

Comparing the Best Ford F-350 Super Duty Insurance Rates

State Farm, AAA, and Allstate offer the best Ford F-350 Super Duty insurance, each with unique perks. State Farm keeps it budget-friendly with the lowest minimum coverage at $117 per month.

AAA has the cheapest full coverage at $174 per month, giving solid protection without breaking the bank. Allstate helps long-term with accident forgiveness and vanishing deductibles, saving safe drivers money over time. Since the F-350 comes with higher repair and towing costs, having the right coverage is a must.

If you drive a luxury Ford F-350, specialized policies can protect against expensive repairs and custom upgrades. Comparing multiple insurance quotes online is the easiest way to find the best deal for your F-350. Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Frequently Asked Questions

How much is the cost of insuring a Ford F-350 Super Duty?

Although prices vary based on region, driving history, and kind of coverage, the average monthly cost of insurance for a Ford F-350 Super Duty is $145. Hawaii has the lowest monthly cost ($98), while Michigan has the highest ($423).

Is the Ford F-350 Super Duty expensive to maintain?

Ford F-350 Super Duty maintenance costs are higher due to its heavy-duty engine, advanced towing components, and diesel repair expenses, with monthly upkeep averaging $108–$125.

Which type of Ford F-350 Super Duty car insurance is best?

Full coverage, including collision, comprehensive, liability, and uninsured motorist protection, is recommended, especially for newer models or trucks used for towing, hauling, or commercial work.

What is the cheapest Ford car to insure?

The Ford Escape, Edge, and Maverick typically have the cheapest insurance rates. The Escape’s average monthly rate is $110 due to lower repair costs and strong safety ratings.

What’s the difference between the F-250 and the Ford F-350 Super Duty?

The F-350 Super Duty has a higher towing capacity (up to 32,000 lbs), firmer suspension, and a reinforced frame, making it ideal for heavy-duty commercial use compared to the lighter-duty F-250.

What color of Ford F-350 Super Duty is the cheapest to insure?

Insurance rates are not affected by color; premiums are based on driving history, location, vehicle safety ratings, claims data, and policies offered by the best auto insurance companies rather than aesthetics.

Which is better for auto insurance, the F-250 or the Ford F-350 Super Duty?

The F-250 generally has lower insurance rates because it weighs less, has lower repair costs, and is classified as a lighter-duty truck. At the same time, the F-350’s commercial-grade build makes coverage slightly more expensive.

Which is better for auto insurance, Ford or Toyota?

Toyota models typically have lower insurance rates due to higher reliability ratings and lower repair costs. At the same time, Ford trucks offer superior towing and off-road capabilities, which can lead to higher premiums.

What are the four recommended types of insurance for Ford F-350 Super Duty?

Collision, comprehensive, liability auto insurance, and uninsured motorist coverage are essential for Ford F-350 Super Duty owners to cover accident damage, theft, storm damage, at-fault accidents, and at-fault liability.

Which is the best company for Ford F-350 Super Duty auto insurance?

State Farm, AAA, and Allstate provide the best Ford F-350 Super Duty insurance based on affordable rates, accident forgiveness, and bundling discounts. State Farm offers the lowest minimum coverage, $117 per month, while AAA has the cheapest full coverage, $174 per month.

What truck has the cheapest insurance?

Smaller trucks like the Ford Maverick, Chevrolet Colorado, and Toyota Tacoma have cheaper insurance rates. The Maverick’s average monthly premium is $120 due to lower repair costs and safety features.

Are older or newer Ford F-350 Super Duty cheaper to insure?

Older Ford F-350 Super Duty models are typically less expensive to insure because of lower replacement costs. Still, newer models with advanced safety features can qualify for discounts on comprehensive auto insurance and collision coverage.

What is considered high mileage for a Ford F-350 Super Duty?

A Ford F-350 Super Duty is considered high mileage at 200,000+ miles, but proper maintenance and diesel engine care can extend its lifespan beyond 300,000 miles.

How can I get cheaper insurance for my Ford F-350 Super Duty?

By combining policies, keeping a spotless driving record, raising deductibles, enrolling in a defensive driving course, and installing anti-theft devices, you can reduce the cost of your Ford F-350 Super Duty insurance.

What type of insurance do I need for Ford F-350 Super Duty?

Liability insurance is necessary at a minimum, but collision auto insurance and comprehensive and uninsured motorist coverage are strongly advised for F-350 owners who tow, haul, or use the truck for business.

Where can I get insurance for my Ford F-350 Super Duty?

Major insurers like State Farm, AAA, Geico, and Allstate offer Ford F-350 Super Duty insurance, and comparing multiple quotes online can help secure the best rates and discounts.

Are V8 trucks more expensive to insure?

Yes, V8 trucks generally have higher insurance costs because their engines produce more horsepower and torque, increasing the risk of high-speed accidents and more severe collisions. Insurers also consider the higher repair and replacement costs associated with V8 engines, especially in performance or heavy-duty models.

Is insurance higher on a diesel truck?

Insurance for diesel trucks is usually more expensive due to costlier engine components, heavier curb weight, and more complex repairs. Diesel-powered Ford F-350 models can cost 10–15% more to insure than gas versions, especially when used for towing or commercial purposes.

Get fast and the best auto insurance coverage today with our quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.