Best Ford F-450 Super Duty Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Ford F-450 Super Duty auto insurance is from Geico, State Farm, and Progressive. Geico has the lowest F-450 insurance rates from $22 a month, but State Farm has better claims handling and cheap rates starting at $23 monthly. Strong safety ratings keep Ford F-series insurance costs affordable.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

Geico, State Farm, and Progressive offer the best Ford F-450 Super Duty auto insurance rates, with Geico being the cheapest option for most drivers.

This guide explores how these top insurers compare in terms of pricing, coverage options, and available discounts.

Our Top 10 Company Picks: Best Ford F-450 Super Duty Auto Insurance

Company Rank A.M. Best Bundling

DiscountBest For Jump to Pros/Cons

#1 A++ 25% Affordable Rates Geico

#2 A++ 17% Comprehensive Options State Farm

#3 A+ 10% Flexible Coverage Progressive

#4 A+ 25% Personalized Service Allstate

#5 A++ 10% Military Families USAA

#6 A+ 25% Regional Expertise Erie

#7 A 20% Local Agents Farmers

#8 A+ 20% Usage-Based Savings Nationwide

#9 A++ 13% Customizable Plans Travelers

#10 A 25% Custom Parts Liberty Mutual

Finding the best Ford insurance at the lowest price depends on factors such as driving history, location, and policy choices.

Keep reading for important strategies for getting cheap Ford auto insurance — such as comparing several quotes, modifying coverage limits, and bundling insurance policies.

- Geico offers the best mix of affordability and coverage for the F-450 Super Duty

- Get the best Ford F-450 Super Duty auto insurance for as low as $22 per month

- Coverage should protect heavy-duty use and high towing capacity for this truck

Protect your truck at the best price by entering your ZIP code into our free auto insurance quote comparison tool to compare multiple Ford insurance companies near you at once.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Based on our Geico auto insurance review, it offers some of the most competitive pricing for Ford F-450 Super Duty auto insurance, starting at $22 a month.

- Strong Digital Tools: The company’s user-friendly app and online platform make managing Ford F-450 policies quick and easy.

- Safe Driver Discounts: Geico provides multiple discounts for safe driving, helping policyholders save on F-450 insurance premiums.

Cons

- Inconsistent Customer Service: Some policyholders report mixed experiences with claims and support when handling Ford F-450 Super Duty auto claims.

- Limited Agent Availability: Geico primarily operates online, which may not be ideal for those who prefer in-person support with Ford policies.

#2 – State Farm: Best for Comprehensive Options

Pros

- Several Discounts: State Farm offers a variety of discounts, like safe driving and bundling, to help lower the cost of Ford F-450 Super Duty auto insurance.

- Personalized Service: With a vast network of local agents, State Farm provides hands-on support, making it easier to manage your Ford F-450 Super Duty coverage.

- Reliable Claims Process: As per our State Farm auto insurance review, the company is known for effective claims handling, ensuring a smooth experience for Ford F-450 Super Duty policyholders.

Cons

- Higher Base Rates: Without discounts, premiums for a Ford F-450 Super Duty may be more expensive compared to direct insurers.

- Limited Digital Features: State Farm’s online tools and app may lack the advanced functionality offered by some competitors for managing Ford F-450 Super Duty policies.

#3 – Progressive: Best for Flexible Coverage

Pros

- Snapshot Program Savings: Progressive’s usage-based Snapshot program can reduce Ford F-450 Super Duty car insurance rates for good drivers. Learn how in our Progressive Snapshot review.

- Flexible Coverage Options: The company offers customizable policies, allowing policyholders to tailor their Ford F-450 Super Duty coverage. Our Progressive review lists all policy options.

- Strong Online Experience: Progressive’s website and mobile app make it easy to compare, purchase, and manage Ford F-450 Super Duty policies.

Cons

- Higher Rates for High-Risk Drivers: Premiums for Ford F-450 Super Duty coverage may be more expensive for drivers with past violations.

- Customer Service Variability: Some customers report mixed experiences with claims and support when dealing with Ford F-450 Super Duty insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Personalized Service

Pros

- Strong Local Agent Support: A large network of agents provides in-person assistance for managing Ford F-450 Super Duty coverage.

- Personalized Coverage: Our Allstate auto insurance review breaks down the customizable policy add-ons and coverage options for Ford F-450 Super Duty owners.

- Drivewise Discount Program: Policyholders can save on Ford F-450 Super Duty insurance with Allstate’s telematics program for safe driving.

Cons

- Higher Premiums: Ford F-450 Super Duty insurance costs are higher with Allstate than other companies.

- Discounts Can Be Limited: Certain Ford F-450 Super Duty insurance discounts are not available in all states, which may reduce potential savings.

#5 – USAA: Best for Military Families

Pros

- Exclusive Military Benefits: USAA offers specialized coverage and discounts for Ford F-450 Super Duty owners who are military members and their families.

- Highly Rated Customer Service: USAA consistently earns high marks for claims satisfaction and support for Ford F-450 Super Duty policies.

- Affordable Rates: The company offers some of the lowest premiums for the best Ford F-450 Super Duty auto insurance, especially for safe drivers. Get free quotes in our USAA insurance review.

Cons

- Membership Restrictions: Only military members, veterans, and their families are eligible for Ford F-450 Super Duty coverage through USAA.

- Limited Local Agents: USAA operates primarily online and by phone, which may be inconvenient for in-person assistance with Ford F-450 policies.

#6 – Erie: Best for Regional Expertise

Pros

- Competitive Regional Rates: As highlighted in our Erie auto insurance review, it often provides the cheapest Ford F-450 Super Duty auto insurance rates in the areas it serves.

- Generous Coverage Options: Erie offers add-ons like rate lock and accident forgiveness, helping drivers maintain affordable Ford F-450 Super Duty coverage.

- Strong Customer Satisfaction: Erie receives high ratings for claims handling and support among Ford F-450 Super Duty policyholders.

Cons

- Limited Availability: Erie insurance for the Ford F-450 Super Duty is only offered in select states.

- Fewer Digital Tools: Online account management for Ford F-450 Super Duty policies is less advanced compared to some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- Local Agent Support: Farmers’ strong agent network offers personalized help with Ford F-450 Super Duty coverage.

- Diverse Coverage Options: Our Farmers auto insurance review highlights multiple policy add-ons that allow customization of Ford F-450 Super Duty coverage.

- Accident Forgiveness Program: Safe drivers may benefit from reduced rate increases on their Ford F-450 Super Duty policy after an accident.

Cons

- Higher Base Premiums: Farmers’ insurance rates for the Ford F-450 Super Duty may be more expensive than competitors.

- Discount Availability Varies: Some discounts for Ford F-450 Super Duty insurance are not offered in all states.

#8 – Nationwide: Best for Usage-Based Savings

Pros

- Usage-Based Discounts: The Nationwide SmartRide program offers savings to safe drivers, while SmartMiles allows low-mileage drivers to pay for Ford F-450 insurance by the mile.

- Nationwide Coverage: Nationwide provides Ford F-450 Super Duty insurance in 46 states and Washington, D.C.

- Vanishing Deductible: Safe drivers can lower their deductible over time with Ford F-450 coverage.

Cons

- Higher Premiums for Some Drivers: Ford F-450 Super Duty auto insurance rates may be higher without discounts. Compare rates and discounts now in our Nationwide insurance review.

- Limited Agent Presence: Nationwide’s in-person support for Ford F-450 coverage may not be as strong as competitors.

#9 – Travelers: Best for Customizable Plans

Pros

- Customizable Policies: Travelers offer flexible options to tailor Ford F-450 Super Duty coverage.

- Strong Financial Stability: Travelers have an A++ rating, ensuring reliability when paying out Ford F-450 car insurance claims. Get full ratings in our Travelers auto insurance review.

- Safe Driver Discounts: The IntelliDrive usage-based program rewards safe drivers with lower Ford F-450 rates.

Cons

- Mixed Customer Reviews: Some policyholders report delays in claims processing for Ford F-450 coverage.

- Fewer Local Agents: Travelers rely more on online and phone support for Ford F-450 policies than in-person service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Custom Parts

Pros

- Innovative Coverage Options: Liberty Mutual offers unique add-ons for the Ford F-450 Super Duty, such as new car replacement and OEM coverage for custom parts.

- Multiple Discount Opportunities: Policyholders can save on Ford insurance with discounts for bundling, safety features, and more.

- Strong Digital Tools: It offers an easy-to-use app for managing Ford F-450 Super Duty auto insurance policies. Learn how it works in our Liberty Mutual auto insurance review.

Cons

- Higher Premiums Without Discounts: Base rates for Ford F-450 Super Duty coverage can be costly if you don’t qualify for discounts.

- Customer Service Concerns: Some policyholders report inconsistent service when handling claims for the F-450.

Ford F-450 Super Duty Auto Insurance Cost Breakdown

Getting the best Ford F-450 Super Duty auto insurance depends on coverage level, provider, and several cost factors. Knowing the factors affecting auto insurance costs for heavy-duty trucks allows you to find the best policy for your F-Series truck while keeping costs manageable.

For example, the type of car insurance you choose affects your total cost, with full coverage offering better protection than minimum coverage. Below, we compare monthly auto insurance premiums by provider and coverage level and see how the Ford F-450 compares to other vehicles.

Ford F-450 Super Duty Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$43 $163

$19 $73

$35 $120

$22 $60

$40 $130

$28 $95

$30 $102

$23 $76

$32 $110

$42 $150

Insurance rates for the Ford F-450 Super Duty vary significantly across providers. Erie offers the cheapest car insurance, with minimum monthly coverage at $19 and full coverage at $73 a month, while USAA and Allstate have higher premiums.

Home and auto? That’s us. Fighting The Joker? Not so much. @J_the_stallion8 @JakeStateFarm pic.twitter.com/OHGin6M5RK

— State Farm (@StateFarm) March 11, 2025

Understanding what makes car insurance more expensive for this F-Series truck can help drivers find the cheapest car insurance without compromising on protection. Compared to other vehicles, the Ford F-450 has higher car insurance coverage costs due to its size and classification.

Auto Insurance Monthly Rates for Popular Truck Models

| Vehicle Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Ford F-450 Super Duty | $99 | $172 |

| Ford F-350 Super Duty | $106 | $176 |

| Ford F-250 Super Duty | $100 | $155 |

| Chevrolet Silverado 1500 | $81 | $197 |

| Ram 1500 | $94 | $241 |

| GMC Sierra 1500 | $92 | $214 |

| Toyota Tundra | $89 | $192 |

| Nissan Titan | $98 | $203 |

| Honda Ridgeline | $87 | $190 |

As a Ford Super Duty model, it falls into a heavy-duty truck category, making it one of the most expensive F-Series trucks to insure. Its comprehensive and collision coverage rates are higher than sedans like the Honda Accord or Toyota Camry but remain competitive with the F-150 and Chevrolet Silverado.

For a Ford F-450 Super Duty, bundling policies or raising deductibles can lower costs. Compare providers to balance price and coverage.Brandon Frady Licensed Insurance Producer

Choosing the best car insurance for a Ford F-450 requires comparing providers and coverage options. While Erie and Geico offer lower rates, factors like location, driving history, and usage impact pricing.

Factors That Impact Ford F-450 Super Duty Auto Insurance Rates

The average annual cost to insure a Ford F-450 Super Duty varies on several factors such as driver age, model year, location, and driving history. Scroll down to get Ford F-450 Super Duty auto insurance quotes.

Read More: Best Ford Mustang Mach-E Auto Insurance

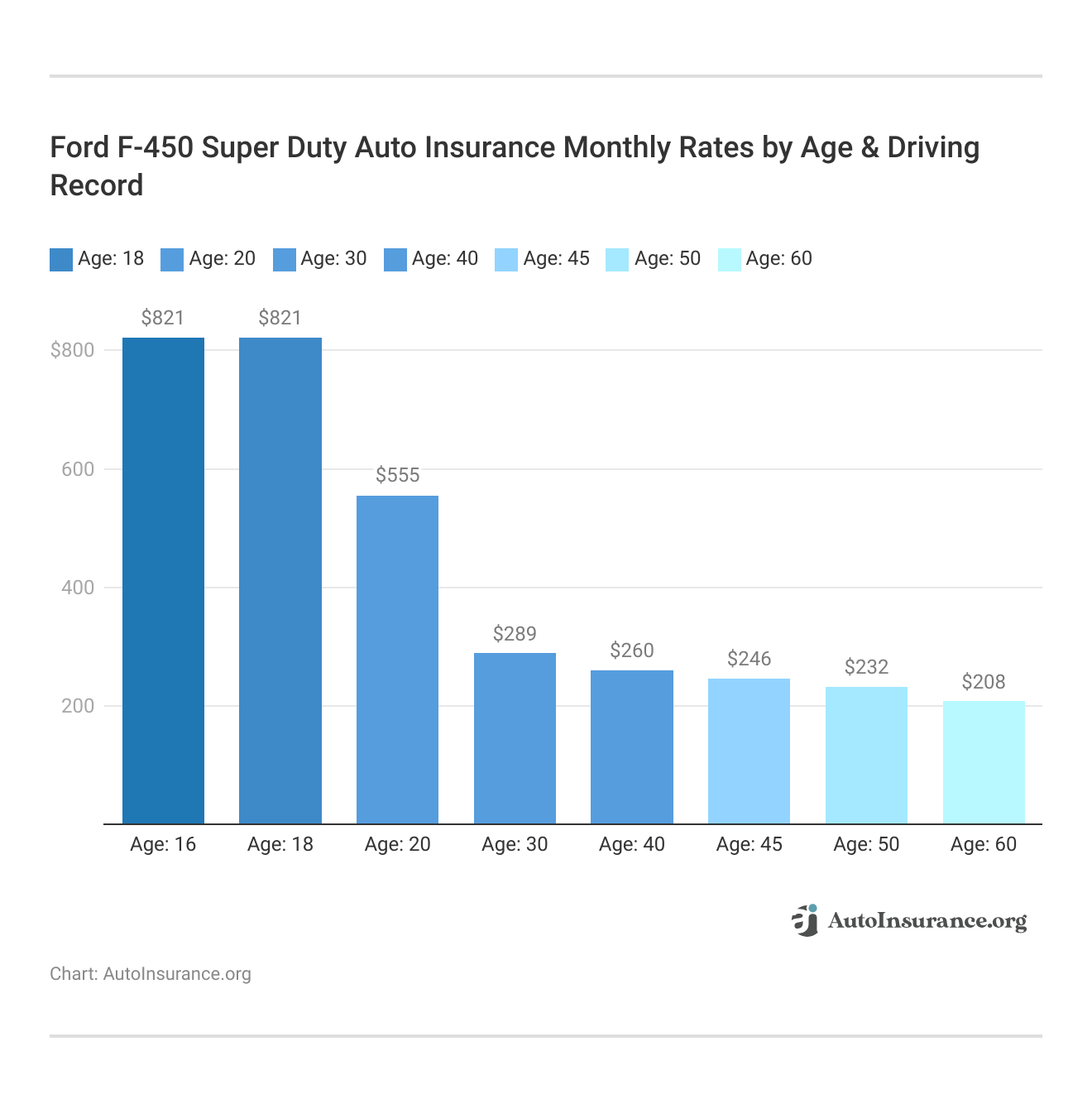

Ford F-450 Super Duty Insurance Rates by Age

Younger drivers typically pay the highest premiums, as car insurance is most expensive if you’re under 25. The table below shows estimated monthly F-450 auto insurance rates by age.

Younger drivers may lower costs through good student discounts or being added to a parent’s policy, while older drivers can save by bundling policies and taking defensive driving courses.

Ford F-450 Super Duty Insurance Rates by Model

Along with driver age, premiums differ according to the model year and the classification of a Ford F-450. The table below provides an estimate of the monthly insurance premiums for different model years of the Ford F-450 Super Duty, broken down by coverage type, including comprehensive, collision, liability, and full coverage.

Ford F‑450 Super Duty Auto Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2025 Ford F-450 Super Duty | $125 | $135 | $105 | $155 |

| 2024 Ford F-450 Super Duty | $120 | $130 | $100 | $150 |

| 2023 Ford F-450 Super Duty | $115 | $125 | $95 | $145 |

| 2022 Ford F-450 Super Duty | $110 | $120 | $90 | $140 |

| 2021 Ford F-450 Super Duty | $105 | $115 | $85 | $135 |

Out of the most popular F-Series trucks, newer models have higher comprehensive and collision coverage rates because repair and replacement costs are higher. As vehicles age, these costs will be lower. If you want to lower your Ford F-450 Super Duty insurance premiums faster, consider factors such as raising deductibles, bundling policies, or being eligible for safe-driving discounts.

Read More: How Vehicle Year Affects Auto Insurance Rates

Ford F-450 Super Duty Insurance Rates by Location

Insurance premiums for the Ford F-450 Super Duty vary by location due to accident rates, traffic density, theft risks, and state regulations. The table below shows estimated monthly insurance rates for select U.S. cities:

Ford F‑450 Super Duty Auto Insurance Monthly Rates by City

| City | Minimum Coverage | Full Coverage |

|---|---|---|

| Chicago, IL | $77 | $193 |

| Houston, TX | $96 | $240 |

| Los Angeles, CA | $122 | $306 |

| New York, NY | $76 | $190 |

| Philadelphia, PA | $111 | $278 |

| Phoenix, AZ | $100 | $251 |

| San Antonio, TX | $88 | $221 |

| San Jose, CA | $81 | $202 |

Urban areas typically have higher costs due to increased risks, while rural locations tend to be cheaper. Cities like Los Angeles and Philadelphia have higher premiums due to more accidents and theft, while places like San Antonio and Chicago tend to be more affordable.

To lower costs, drivers can take advantage of discounts, maintain a clean record, or adjust coverage options based on the minimum auto insurance requirements by state.

Ford F-450 Super Duty Insurance Rates by Driving Record

Your driving record is a major factor in your Ford F-450 Super Duty insurance premiums. Drivers with clean records receive the lowest premiums, while accidents, speeding violations, and DUIs can lead to high increases.

The table below shows how driving history impacts monthly insurance rates across different age groups. Younger drivers face even higher penalties due to their higher risk profile.

Ford F‑450 Super Duty Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI |

|---|---|---|---|

| Age: 16 | $821 | $1,205 | $1,410 |

| Age: 18 | $821 | $1,205 | $1,410 |

| Age: 20 | $555 | $815 | $953 |

| Age: 30 | $289 | $424 | $496 |

| Age: 40 | $260 | $382 | $447 |

| Age: 45 | $246 | $362 | $424 |

| Age: 50 | $232 | $341 | $399 |

| Age: 60 | $208 | $307 | $359 |

Having a clean record will result in discounts and reduced premiums over time. Defensive driving courses, safe driving, and insurer programs also lower the price, which will make insurance inexpensive in the long run.

Read More: Why You Should Take a Defensive Driving Class

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ford F-450 Super Duty Safety Ratings

The Ford F-450 Super Duty has received strong safety ratings, which can positively impact insurance costs. Insurers consider vehicles with high safety scores to be lower risk, often leading to reduced premiums.

Ford F‑450 Super Duty Safety Ratings

| Safety Feature | Rating |

|---|---|

| Blind Spot Information System (BLIS) with Trailer Coverage | Good |

| Pre-Collision Assist with Automatic Emergency Braking (AEB) | Good |

| Lane-Keeping System | Good |

| Adaptive Cruise Control | Good |

| Rear View Camera with Dynamic Hitch Assist | Good |

| AdvanceTrac with Roll Stability Control (RSC) and Trailer Sway Control | Good |

The Ford F-450 Super Duty has consistently performed well in crash tests. High crash test ratings, with its durable design, help improve driver and passenger safety and ultimately reduce F-450 insurance costs.

The Ford F-450 Super Duty has consistently earned 5-star overall ratings from the National Highway Traffic Safety Administration (NHTSA), reflecting its durability and crashworthiness. However, its 4-star rollover rating indicates a moderate tipping risk due to its high center of gravity.

Ford F‑450 Super Duty Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

| 2023 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

| 2022 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

| 2021 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

| 2020 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

| 2019 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

| 2018 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

| 2017 Ford F-450 Super Duty | 5 stars | 5 stars | 4 stars | 4 stars |

The Ford F-450 Super Duty’s strong crash test scores may lead to lower liability and personal injury protection (PIP) rates, but its rollover risk could slightly increase comprehensive and collision costs. Insurers factor in crash test ratings when determining premiums, making safety a key advantage for lowering Ford F-450 Super Duty insurance rates.

Learn More: Best Ford Escape Auto Insurance

Ford F-450 Super Duty Auto Insurance Loss Probability

Loss probabilities for different coverage types reveal varying levels of risk. Liability-only auto insurance coverage has the lowest loss probability at 10% since this kind of insurance is geared towards repairing damages to third parties, meaning you are not at risk to a great extent.

Ford F‑450 Super Duty Auto Insurance Loss Probability by Coverage Type

| Coverage Type | Loss Probability | Comments |

|---|---|---|

| Liability Only | 10% | Minimal exposure; covers only third‐party damages. |

| Collision Coverage | 18% | Reflects risk from vehicle damage in a collision. |

| Comprehensive Coverage | 15% | Includes non‐collision losses (theft, vandalism, etc.). |

| Standard Full Coverage | 22% | Combines collision and comprehensive risks. |

| Premium Full Coverage | 25% | Higher limits and broader coverage may reflect higher risk exposure. |

Collision ensures damage caused to a vehicle in an accident is 18%, while comprehensive coverage, at 15%, covers risks such as theft and vandalism. Standard full coverage, covering both collision and comprehensive risks, has a higher probability of loss at 22%, while premium full coverage, providing wider coverage, is 25%.

Choosing the best Ford F-450 Super Duty car insurance means evaluating coverage needs alongside provider reliability. Loss probability information helps determine risk exposure, and comparing providers and types of coverage ensures the best balance of affordability with optimal protection for your vehicle.

Ways to Save on Ford F-450 Super Duty Auto Insurance

Insurance companies provide a variety of discounts that can lower the cost of Ford F-450 Super Duty insurance. These discounts are often provided for bundling policies, having a clean driving record, and qualifying for certain criteria, including being a homeowner, military personnel, or a good student

Auto Insurance Discounts From Top Providers

Company Bundling Multi-Vehicle Pay-in-Full Safe Driver

25% 10% 10% 18%

25% 20% 7% 20%

20% 10% 10% 20%

25% 10% 15% 15%

25% 12% 20% 20%

20% 15% 12% 12%

10% 15% 10% 10%

17% 15% 20% 20%

13% 15% 17% 17%

10% 20% 10% 10%

Auto insurance and your credit score also play a role in determining rates, so maintaining good credit by paying bills on time can help lower your premiums. Reviewing your policy annually and shopping around for new quotes ensures you always get the best rate.

Saving money on Ford F-450 Super Duty car insurance involves comparing rates with State Farm, Geico, Progressive, and other providers because premium rates vary widely. You can also lower your monthly premiums by increasing the deductible from $500 to $1,000.

Increase your deductible to save, but ensure you're prepared for higher out-of-pocket costs. Don’t sacrifice essential coverage for discounts.Kristen Gryglik Licensed Insurance Agent

To save money further, you can take advantage of discounts for bundling policies, maintaining a clean driving record, and installing safety features, such as an anti-theft device. If your F-450 Super Duty is an older model, it might also be worthwhile to consider dropping collision and comprehensive coverage.

Read More: Best Ford Focus Auto Insurance

Get The Best Deals on Ford F450 Super Duty Auto Insurance

The best Ford F-450 Super Duty auto insurance comes from Geico, State Farm, and Progressive, offering rates as low as $22 per month. Insurance cost depends on the level of coverage, driving history, and location, with Erie offering the lowest minimum coverage premiums at $19 a month.

Insuring an F-450 will be more expensive than Ford Fiesta auto insurance, but getting affordable Ford F-450 Super Duty auto insurance is possible with discounts for safe driving, bundling policies, and low annual mileage. Drivers with clean records usually get lower premiums.

Find insurers that specialize in commercial and heavy-duty truck coverage if you use your F-450 for work. Shopping around for quotes from multiple companies and comparing them ensures the best price with the most coverage. Find your Ford car insurance options by putting your ZIP code into our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is insurance on an F-450?

The average cost of insurance on an F-450 ranges from $200 to $400 per month for personal policies, while commercial truck insurance can exceed $1,000 monthly based on coverage needs, driving history, and location.

Is a Ford F-450 considered a commercial vehicle?

The Ford F-450 is often classified as a commercial vehicle due to its high towing capacity and gross vehicle weight rating (GVWR), especially when used for business purposes. However, personal use may qualify it for standard auto insurance.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

What coverage options should be included in Ford F-450 Super Duty auto insurance policies?

Comprehensive and collision coverage, liability protection, uninsured motorist coverage, and roadside assistance are essential for Ford F-450 Super Duty owners. Adding gap insurance may also be beneficial for financed vehicles.

Does a Ford F-450 need commercial insurance?

A Ford F-450 requires commercial insurance if it is used for business activities, such as hauling goods, towing trailers, or transporting equipment. For personal use, a personal policy may be sufficient.

What is the average cost of commercial truck insurance per month?

The average monthly cost of commercial truck insurance ranges from $800 to $1,500, depending on factors like the truck’s size, usage, coverage limits, and driver history. Heavy-duty trucks like the F-450 often have higher premiums.

How does commercial vs. personal use affect Ford F-450 Super Duty auto insurance quotes?

Using the Ford F-450 Super Duty for business, such as hauling or towing, typically requires commercial auto insurance, which costs more than personal coverage. Insurers assess risk based on vehicle usage when determining rates.

Why is my truck so expensive to insure?

Trucks are often more expensive to insure due to their size, repair costs, and towing capabilities. Trucks used for commercial purposes face even higher premiums due to increased liability risks and cargo coverage requirements.

Does a Ford F-350 require commercial insurance?

A Ford F-350 may need commercial insurance if it is used for business activities. However, if driven for personal use, it can typically be insured with a personal policy. The F-350’s lighter weight often makes it easier to insure under personal coverage.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Does a Ford F-450 require commercial insurance in Texas?

In Texas, a Ford F-450 may need commercial coverage if its GVWR exceeds 26,001 pounds or is used for business. For personal use, standard coverage may suffice. Compare policies to find the best Texas auto insurance for an F-450.

Can I get a personal policy on a commercial truck?

It is possible to get a personal policy on a commercial truck if it is used exclusively for personal purposes. However, if the truck is used for business, a commercial policy is typically required to cover liability and cargo risks.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.