Best Ford Fusion Auto Insurance in 2025 (Check Out the Top 10 Companies!)

The top providers for the best Ford Fusion auto insurance are State Farm, USAA, and Travelers, offering rates as low as $32 per month. These companies excel in providing significant discounts, and superior customer service, making them the top choices for Ford Fusion drivers seeking reliable auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Ford Fusion

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Ford Fusion

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Ford Fusion

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsThe best Ford Fusion auto insurance providers are State Farm, USAA, and Travelers. These companies offer the most competitive rates, starting at $32 per month. State Farm stands out for its comprehensive coverage and discounts, while USAA and Travelers excel in customer service and tailored insurance programs for Ford Fusion drivers.

Enroll in liability-only coverage to save on Ford Fusion insurance. For more information, read our article titled “Cheapest Liability-Only Auto Insurance.”

Our Top 10 Company Picks: Best Ford Fusion Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Comprehensive Coverage | State Farm | |

| #2 | 20% | A++ | Military Discounts | USAA | |

| #3 | 25% | A++ | IntelliDrive Program | Travelers | |

| #4 | 10% | A | Accident Forgiveness | Liberty Mutual |

| #5 | 20% | A+ | Snapshot Program | Progressive | |

| #6 | 15% | A+ | AARP Benefits | The Hartford |

| #7 | 10% | A | Customizable Policies | Farmers | |

| #8 | 15% | A+ | Vanishing Deductible | Nationwide |

| #9 | 13% | A+ | Safe Driving | Allstate | |

| #10 | 20% | A | Teen Driver | American Family |

Teen driver insurance can be costly, but you can significantly reduce rates with annual policy discounts. Continue reading to learn how you can save money on Ford Fusion insurance.

You can start comparing quotes for Ford Fusion auto insurance rates from some of the best auto insurance companies by using our free online tool now.

- Explore the best Ford Fusion auto insurance providers

- Learn how State Farm stands out with comprehensive coverage

- Discover strategies to save on Ford Fusion insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage: State Farm offers a wide range of coverage options that can be customized for the Ford Fusion, ensuring that drivers have protection tailored to their specific needs, from liability to comprehensive and collision.

- Multi-Policy Discount: With a 17% discount for bundling auto insurance with other policies, Learn more about their discounts in our State Farm auto insurance review.

- Extensive Network: State Farm’s large network of agents and approved repair shops across the U.S. ensures that Ford Fusion owners can easily access support and services, minimizing downtime and inconvenience after an accident.

Cons

- Lower A.M. Best Rating: With an A.M. Best rating of ‘B’, there may be concerns about State Farm’s financial stability and ability to handle claims effectively, which is crucial for Ford Fusion owners seeking reliable coverage.

- Potentially Higher Premiums: Some Ford Fusion drivers have reported higher premiums with State Farm compared to other insurers, particularly for younger drivers or those with less-than-perfect records.

- Mixed Reviews: While State Farm has a broad network, some Ford Fusion owners have experienced inconsistent customer service, which can be a drawback when dealing with claims or policy changes.

#2 – USAA: Best for Military Discounts

Pros

- Military Discounts: USAA auto insurance review provides significant discounts specifically for military members, veterans, and their families, making it an attractive option for those Ford Fusion owners who qualify.

- Top-Tier Financial Stability: With an A++ rating from A.M. Best, USAA provides Ford Fusion drivers with the confidence of dealing with a financially robust insurer capable of handling claims efficiently.

- Excellent Customer Satisfaction: USAA consistently receives high marks for customer service and claims satisfaction, ensuring Ford Fusion owners receive top-notch support when they need it most.

Cons

- Restricted Eligibility: USAA’s insurance products are only available to military members, veterans, and their families, excluding many potential Ford Fusion owners from taking advantage of their offerings.

- Limited Physical Presence: With fewer physical branches compared to other insurers, Ford Fusion owners may find it inconvenient if they prefer in-person services.

- Specific Military Focus: While beneficial for those who qualify, USAA’s focus on military-related benefits may not provide added value to Ford Fusion owners outside the military community.

#3 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Travelers’ IntelliDrive program uses telematics to monitor driving behavior and reward safe Ford Fusion drivers with potential premium discounts, promoting safer driving habits.

- Strong Financial Health: With an A++ rating from A.M. Best, Travelers provides Ford Fusion owners with the assurance of dealing with a financially stable insurer capable of paying claims reliably.

- Comprehensive Coverage Options: Travelers auto insurance review highlights a wide range of coverage options that can be tailored to fit the needs of Ford Fusion owners, from basic liability to full coverage, ensuring adequate protection.

Cons

- Telematics Privacy Concerns: Some Ford Fusion drivers may be uncomfortable with the data collection involved in the IntelliDrive program, raising privacy issues.

- Mixed Customer Reviews: While many Ford Fusion owners are satisfied with Travelers, some have reported issues with claims processing and customer service responsiveness.

- Higher Premiums: Certain Ford Fusion drivers, especially those with less-than-perfect driving records, may find Travelers’ premiums to be higher compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual auto insurance review provides accident forgiveness, which prevents rate increases after the first accident, providing peace of mind for Ford Fusion drivers who may have minor incidents.

- Customizable Coverage Options: Liberty Mutual allows Ford Fusion owners to tailor their policies with various add-ons and optional features, ensuring comprehensive protection suited to their specific needs.

- Financial Stability: With an A rating from A.M. Best, Liberty Mutual demonstrates good financial health, ensuring Ford Fusion owners that their claims will be handled efficiently.

Cons

- Potential for Higher Premiums: Liberty Mutual’s premiums can be higher than average, particularly for Ford Fusion drivers with less-than-perfect records or those opting for full coverage.

- Discount Limitations: Some Ford Fusion owners have found that the available discounts do not significantly reduce their premiums, resulting in higher overall costs compared to competitors.

- Inconsistent Customer Service: There have been reports of inconsistent customer service experiences, which can be a drawback for Ford Fusion owners needing reliable support.

#5 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program for: Progressive’s Snapshot program rewards safe driving habits specific to Ford Fusion drivers with potential premium discounts, providing a personalized approach to savings.

- Strong Financial Stability: With an A+ rating from A.M. Best, Progressive ensures that Ford Fusion owners are dealing with a financially stable insurer.

- Wide Range of Discounts: Progressive auto insurance review showcases various discounts, including bundling, continuous insurance, and safe driving, helping Ford Fusion owners save on their premiums.

Cons

- Telematics Privacy Issues: Similar to other telematics programs, Snapshot may raise privacy concerns for Ford Fusion drivers uncomfortable with their driving data being monitored.

- Mixed Reviews: While many Ford Fusion owners are satisfied, there have been reports of issues with claims processing and customer service responsiveness.

- Higher Rates for Riskier Drivers: Ford Fusion drivers with a history of violations or accidents may find Progressive’s premiums to be higher compared to other insurers.

#6 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits for: The Hartford auto insurance review highlights the company’s exclusive benefits and discounts for AARP members, providing significant savings and added value to senior Ford Fusion drivers.

- Strong Financial Rating: With an A+ rating from A.M. Best, The Hartford ensures that Ford Fusion owners are dealing with a financially reliable insurer.

- Lifetime Renewability: The Hartford provides a guarantee of lifetime renewability for its auto insurance policies, ensuring long-term coverage for Ford Fusion owners.

Cons

- Age-Specific Benefits: The primary benefits and discounts are geared towards older drivers, particularly AARP members, which may not appeal to younger Ford Fusion drivers.

- Higher Premiums for Younger Drivers: Some younger Ford Fusion owners may find that premiums are higher, particularly if they do not qualify for AARP discounts.

- Limited Availability: The Hartford’s auto insurance products may not be available in all regions, limiting access for some Ford Fusion owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Policies

Pros

- Customizable Coverage: Farmers offers a variety of customizable policy options, allowing Ford Fusion owners to build coverage that fits their specific needs and preferences.

- Financial Stability: With an A rating from A.M. Best, Farmers is financially stable and dependable, ensuring reliable claims handling for Ford Fusion drivers.

- Good Customer Service: Farmers auto insurance review showcases strong customer service, with many Ford Fusion owners reporting positive experiences with policy management and claims processing.

Cons

- Higher Premiums: Some Ford Fusion owners have noted that Farmers’ premiums can be higher than those of other insurers, making it less competitive for price-sensitive drivers.

- Limited Discount Options: The range of available discounts is narrower compared to some competitors, potentially resulting in fewer savings opportunities for Ford Fusion drivers.

- Regional Availability: Farmers’ auto insurance products may not be available in all areas, limiting access for some Ford Fusion owners.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a unique vanishing deductible program, which reduces the deductible amount for each year of safe driving, benefiting careful Ford Fusion drivers.

- Financial Stability: With an A+ rating from A.M. Best, Nationwide demonstrates strong financial health, ensuring reliable claims processing for Ford Fusion owners.

- Comprehensive Coverage Options: Nationwide auto insurance review provides a wide range of coverage options, allowing Ford Fusion owners to tailor their policies to fit their specific needs.

Cons

- Higher Rates for High-Risk: Nationwide’s premiums can be higher for Ford Fusion drivers with a history of violations or accidents, making it less affordable for some.

- Mixed Reviews on Claims Handling: Some Ford Fusion owners have reported dissatisfaction with the claims handling process, citing delays and communication issues.

- Limited Availability of Discounts: The available discounts may not significantly reduce premiums for all Ford Fusion drivers, resulting in potentially higher costs.

#9 – Allstate: Best for Safe Driving

Pros

- Safe Driving Discounts: Allstate rewards safe driving habits with various discounts specific to Ford Fusion drivers, encouraging responsible behavior behind the wheel.

- Financial Stability: With an A+ rating from A.M. Best, Allstate is financially stable and dependable, ensuring reliable claims handling for Ford Fusion owners.

- Extensive Agent Network: Allstate auto insurance review provides personalized service and support to Ford Fusion owners across the country.

Cons

- Higher Premiums: Some Ford Fusion owners have reported that Allstate’s premiums can be higher compared to other insurers, particularly for full coverage options.

- Mixed Customer Satisfaction: While many Ford Fusion owners are satisfied, there have been reports of inconsistent customer service experiences, particularly regarding claims processing.

- Limited Availability of Discounts: The available discounts may not significantly reduce premiums for all Ford Fusion drivers, leading to potentially higher costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Teen Driver

Pros

- Teen Driver Discounts: American Family offers significant discounts and programs tailored for teen drivers, making it a cost-effective choice for families with young Ford Fusion drivers.

- Financial Stability: With an A rating from A.M. Best, American Family is financially strong and reliable, ensuring Ford Fusion owners that their claims will be handled efficiently.

- Wide Range of Coverage Options: American Family auto insurance review provides a variety of coverage options and add-ons, allowing Ford Fusion owners to customize their policies for comprehensive protection.

Cons

- Regional Availability: American Family is not available in all states, limiting access for some Ford Fusion owners who may seek its benefits.

- Higher Rates for Non-Qualifying Discounts: Ford Fusion drivers who do not qualify for specific discounts, such as those for teen drivers, may find premiums to be higher than average.

- Limited Digital Tools: Compared to other insurers, American Family’s digital tools and online services may not be as advanced, potentially impacting the convenience for tech-savvy Ford Fusion drivers.

Ford Fusion Insurance Cost

Owning a Ford Fusion involves understanding the typical insurance expenses associated with this vehicle. In this section, we’ll explore the average insurance costs for a Ford Fusion and provide a detailed comparison of monthly rates from leading insurance companies, broken down by coverage levels.

Ford Focus Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$76 $198

$96 $248

$63 $164

$56 $150

$47 $123

$61 $161

$53 $141

$32 $84

These figures highlight the variance in insurance premiums among different providers. USAA offers the lowest rates for both minimum and full coverage, making it an attractive option for eligible members. On the other hand, Liberty Mutual presents the highest rates for full coverage, indicating the importance of comparing different insurers to find the best deal.

State Farm stands out for its comprehensive coverage and discountsDaniel Walker LICENSED AUTO INSURANCE AGENT

Always remember to review your options thoroughly and consider factors beyond just the monthly premium to ensure you get the best coverage for your Ford Fusion. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

Ford Fusion Insurance Comparison

The chart below details how Ford Fusion insurance rates compare to other sedans like the Kia Optima, Buick Regal, and Honda Civic. Understanding these comparisons can help you make an informed decision when choosing the best insurance for your vehicle.

Ford Fusion Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Liability | Total |

|---|---|---|---|---|

| Ford Fusion | $28 | $52 | $31 | $124 |

| Kia Optima | $27 | $44 | $35 | $121 |

| Buick Regal | $26 | $45 | $33 | $117 |

| Honda Civic | $23 | $55 | $35 | $128 |

| Nissan Maxima | $31 | $53 | $33 | $129 |

| Nissan Sentra | $21 | $48 | $33 | $114 |

| Chevrolet Blazer | $31 | $57 | $26 | $126 |

However, there are a few things you can do to find the cheapest Ford insurance rates online. Start by comparing quotes from multiple providers to ensure you are getting the best deal. Additionally, consider bundling your insurance policies and maintaining a good driving record to further reduce your premiums.

Read More: How to Get a Good Driver Auto Insurance Discount

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Ford Fusion Insurance

The Ford Fusion trim and model you choose can impact the total price you will pay for Ford Fusion insurance coverage. See more details in our guide titled “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

The age of your Ford Fusion plays a crucial role in determining your auto insurance rates. Newer models typically cost more to insure compared to older ones.

Ford Fusion Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Ford Fusion | $29 | $53 | $30 | $125 |

| 2023 Ford Fusion | $28 | $52 | $31 | $124 |

| 2022 Ford Fusion | $27 | $51 | $32 | $123 |

| 2021 Ford Fusion | $27 | $51 | $33 | $123 |

| 2020 Ford Fusion | $28 | $52 | $31 | $124 |

| 2019 Ford Fusion | $27 | $50 | $33 | $122 |

| 2018 Ford Fusion | $26 | $50 | $33 | $122 |

| 2017 Ford Fusion | $25 | $49 | $35 | $121 |

| 2016 Ford Fusion | $24 | $47 | $36 | $119 |

| 2015 Ford Fusion | $23 | $45 | $37 | $117 |

| 2014 Ford Fusion | $22 | $42 | $38 | $114 |

| 2013 Ford Fusion | $21 | $39 | $38 | $111 |

| 2012 Ford Fusion | $20 | $35 | $38 | $107 |

| 2011 Ford Fusion | $19 | $32 | $38 | $103 |

| 2010 Ford Fusion | $18 | $30 | $39 | $100 |

As demonstrated, newer Ford Fusion models generally incur higher insurance premiums compared to older ones. By understanding these variations, you can better anticipate your insurance costs and make more informed decisions when purchasing or insuring your vehicle.

Driver Age

Driver age is a significant factor that influences the cost of insuring a Ford Fusion. Younger drivers, especially teenagers, often face much higher premiums than older, more experienced drivers.

Ford Fusion Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $225 |

| Age: 30 | $191 |

| Age: 40 | $178 |

| Age: 45 | $165 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Clearly, the age of the driver has a substantial impact on Ford Fusion insurance rates. Younger drivers tend to pay more, while rates generally decrease with age and experience.

Driver Location

Your location is another critical determinant of your Ford Fusion insurance rates. Insurance costs can vary widely from one city to another due to factors like local traffic conditions, crime rates, and accident statistics.

Ford Fusion Auto Insurance Monthly Rates by City

| State | Rates |

|---|---|

| Los Angeles, CA | $213 |

| New York, NY | $196 |

| Houston, TX | $195 |

| Jacksonville, FL | $180 |

| Philadelphia, PA | $167 |

| Chicago, IL | $164 |

| Phoenix, AZ | $144 |

| Seattle, WA | $121 |

| Indianapolis, IN | $106 |

| Columbus, OH | $103 |

As shown, where you live significantly affects your Ford Fusion insurance premiums. Cities with higher traffic congestion and crime rates tend to have higher insurance costs.

Your Driving Record

Your driving record can have an impact on the cost of Ford Fusion auto insurance. Teens and drivers in their 20’s see the highest jump in their Ford Fusion auto insurance with violations on their driving record.

Ford Fusion Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $570 | $615 | $750 | $890 |

| Age: 18 | $450 | $485 | $620 | $770 |

| Age: 20 | $282 | $307 | $470 | $620 |

| Age: 30 | $130 | $141 | $230 | $380 |

| Age: 40 | $124 | $135 | $225 | $370 |

| Age: 45 | $120 | $130 | $220 | $365 |

| Age: 50 | $113 | $123 | $210 | $350 |

| Age: 60 | $111 | $121 | $205 | $340 |

Your driving record is pivotal in determining your Ford Fusion insurance rates. Clean records usually result in lower premiums, while violations and accidents can substantially increase costs.

Ford Fusion Safety Ratings

The safety ratings of your Ford Fusion are essential in shaping your auto insurance rates. Vehicles with higher safety ratings generally qualify for lower insurance premiums due to their better performance in crash tests.

Ford Fusion Safety Ratings

| Test Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Not Tested |

By choosing a model with excellent safety ratings, you can benefit from lower insurance premiums while enjoying enhanced protection on the road.

Ford Fusion Crash Test Ratings

Crash test ratings provide valuable insights into the safety and durability of the Ford Fusion in various collision scenarios. These ratings can influence your insurance costs, as vehicles with better crash test performance are often cheaper to insure.

Ford Fusion Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2024 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford Fusion HEV 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford Fusion Energi 4 DR FWD | NR | NR | NR | 4 stars |

| 2020 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford Fusion Hybrid 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford Fusion Energi 4 DR FWD | NR | NR | NR | 4 stars |

| 2019 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford Fusion Hybrid 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford Fusion Energi 4 DR FWD | NR | NR | NR | 4 stars |

| 2018 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Ford Fusion Hybrid 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Ford Fusion Energi 4 DR FWD | NR | NR | NR | 4 stars |

| 2017 Ford Fusion 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Ford Fusion 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Ford Fusion Hybrid 4 DR FWD | 5 stars | 5 stars | 4 stars | 4 stars |

| 2016 Ford Fusion Energi 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford Fusion 4 DR FWD | 5 stars | 5 stars | 4 stars | 4 stars |

| 2016 Ford Fusion 4 DR AWD | 5 stars | 5 stars | 4 stars | 4 stars |

Models that score highly in these tests are typically seen as safer and thus less costly to insure. Understanding these ratings can help you select a model that not only offers great protection but also comes with more affordable insurance.

Ford Fusion Safety Features

The Ford Fusion safety features play a vital role in keeping passengers safe in crashes, but they can also help lower your Ford Fusion auto insurance rates. The Ford Fusion’s safety features include:

Ford Fusion Safety Features

| Feature | Description |

|---|---|

| 4-Wheel ABS | Prevents wheel lockup during braking for better control. |

| 4-Wheel Disc Brakes | Provides strong and reliable stopping power. |

| Blind Spot Monitor | Alerts you to vehicles in your blind spots. |

| Brake Assist | Applies maximum braking force in emergency situations. |

| Child Safety Locks | Prevents children from opening rear doors from inside. |

| Cross-Traffic Alert | Warns of approaching vehicles when reversing. |

| Daytime Running Lights | Increases vehicle visibility during the day. |

| Driver Air Bag | Protects the driver in the event of a collision. |

| Electronic Stability Control | Helps maintain vehicle control on slippery roads. |

| Front Head Air Bag | Protects front passengers during a collision. |

| Front Side Air Bag | Protects front passengers in side-impact crashes. |

| Lane Departure Warning | Alerts you if you unintentionally drift out of your lane. |

| Lane Keeping Assist | Helps keep your vehicle centered in its lane. |

| Passenger Air Bag | Protects the front passenger in a collision. |

| Rear Head Air Bag | Protects rear passengers during a collision. |

| Traction Control | Prevents wheel spin for better grip and stability. |

The comprehensive safety features of the Ford Fusion not only ensure better protection for occupants but can also contribute to lower insurance premiums.

Ford Fusion Insurance Loss Probability

The lower percentage means lower Ford Fusion auto insurance rates; higher percentages mean higher Ford Fusion auto insurance rates. The Ford Fusion’s insurance loss probability varies for each form of coverage.

Ford Fusion Insurance Loss Probability

| Insurance Coverage | Loss Rate |

|---|---|

| Collision | 10% |

| Property Damage | -5% |

| Comprehensive | 8% |

| Personal Injury | 16% |

| Medical Payment | 11% |

| Bodily Injury | 5% |

Lower loss rates are favorable as they often lead to reduced insurance premiums. By considering these probabilities, you can make more informed decisions about your insurance needs and potentially find ways to lower your overall insurance costs.

Ford Fusion Finance and Insurance Cost

If you are financing a Ford Fusion, most lenders will require your carry higher Ford Fusion coverages including comprehensive coverage, so be sure to compare Ford Fusion auto insurance rates from the best companies using our free tool below.

When financing a Ford Fusion, it’s crucial to understand the insurance requirements set by lenders, as they typically necessitate higher levels of coverage (Read more: How to Compare Auto Insurance Quotes).

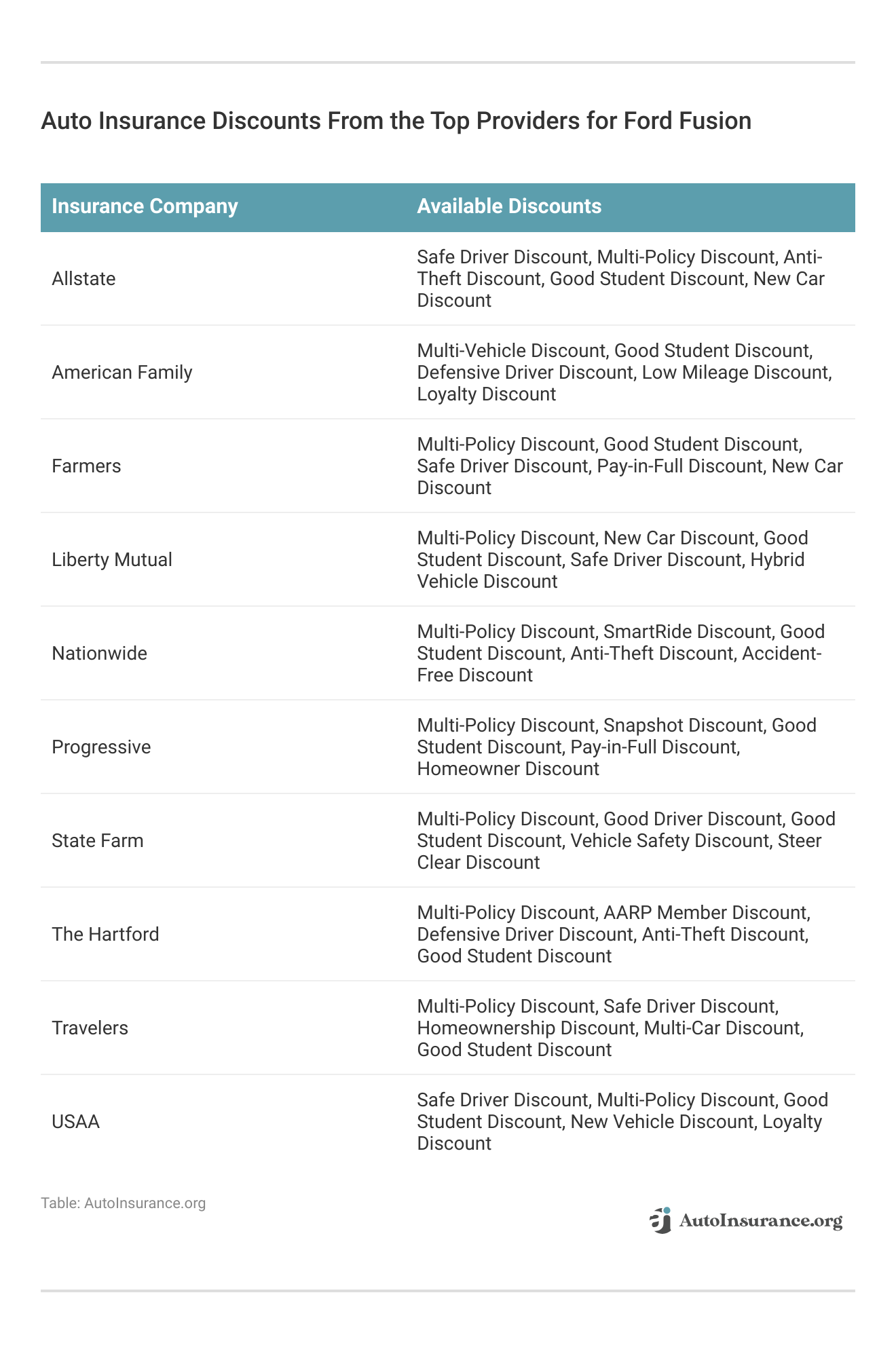

Ways to Save on Ford Fusion Insurance

Although it may seem like your Ford Fusion auto insurance rates are set, there are a few measures that you can take to secure the best Ford Fusion auto insurance rates possible. Take a look at the discounts you can get from the top providers. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Always review the discounts available to you and consider bundling policies, maintaining a good driving record, and exploring specific provider programs. These measures can help you achieve the best possible rates and make your insurance more affordable.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Ford Fusion Insurance Companies

The best auto insurance companies for Ford Fusion car insurance rates will offer competitive rates, discounts, and account for the Ford Fusion’s safety features. The following list of auto insurance companies outlines which companies hold the highest market share.

Largest Auto Insurance Providers by Market Share

| Insurance Company | Premiums Written |

|---|---|

| State Farm | $65,615,190 |

| Geico | $46,106,971 |

| Progressive | $39,222,879 |

| Liberty Mutual | $35,600,051 |

| Allstate | $35,025,903 |

| Travelers | $28,016,966 |

| USAA | $23,483,080 |

| Chubb | $23,388,385 |

| Farmers | $20,643,559 |

| Nationwide | $18,442,145 |

Choosing the right insurance company for your Ford Fusion is essential for securing the best rates and coverage. The companies listed above are the largest in the market, offering a range of options and discounts tailored to meet your needs.

Save money by comparing Ford Fusion insurance rates with free quotes online now.

Frequently Asked Questions

Can I change my Ford Fusion insurance coverage at any time?

In most cases, you have the flexibility to change your Ford Fusion insurance coverage during the policy term. However, it’s advisable to consult with your insurance provider to understand any potential implications or restrictions before making changes to your coverage.

Learn more by reading our guide titled, “What are the benefits of auto insurance?“

What should I do if my Ford Fusion is involved in an accident?

If your Ford Fusion is involved in an accident, prioritize your safety and the safety of others involved. Contact the authorities and your insurance provider to report the accident. Provide accurate and detailed information about the incident to facilitate the claims process.

Are there any specific Ford Fusion models or trims that are more expensive to insure?

Insurance rates can vary based on the specific model and trim of the Ford Fusion. Generally, higher-performance trims or models with additional features may have higher insurance rates due to the increased cost of repairs or replacement.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Can I transfer my existing insurance policy to a new Ford Fusion?

Yes, you can usually transfer your existing insurance policy to a new Ford Fusion. However, it’s important to notify your insurance provider about the change in vehicle and update your policy accordingly. This will ensure that you have the appropriate coverage for your new vehicle.

Is it more expensive to insure a leased Ford Fusion compared to an owned one?

Insuring a leased Ford Fusion may be slightly more expensive than insuring an owned one. This is because leased vehicles often require higher coverage limits, such as comprehensive and collision insurance, as mandated by the leasing company.

To learn more, explore our comprehensive resource on “Cheapest Liability-Only Auto Insurance.“

Does the color of my Ford Fusion affect insurance rates?

No, insurance companies generally do not consider the color of your vehicle when determining insurance rates. Factors such as the make, model, year, safety features, driving record, and location are typically more influential in determining your premiums.

What factors affect the cost of Ford Fusion insurance?

The cost of Ford Fusion insurance is influenced by several factors, including the driver’s age, driving history, location, the specific model and trim of the vehicle, and the coverage options selected. Safety features and crash test ratings of the vehicle also play a role.

How can I lower my Ford Fusion insurance premiums?

You can lower your Ford Fusion insurance premiums by maintaining a clean driving record, opting for higher deductibles, bundling insurance policies, taking advantage of available discounts, and installing safety features in your vehicle. Shopping around and comparing quotes from multiple insurers can also help you find better rates.

How does the age of my Ford Fusion affect insurance rates?

The age of your Ford Fusion can significantly impact insurance rates. Newer models tend to have higher insurance premiums due to their higher replacement costs and more advanced technology, while older models generally have lower premiums.

To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

Can installing anti-theft devices lower my Ford Fusion insurance costs?

Yes, installing anti-theft devices can lower your Ford Fusion insurance costs. Many insurance providers offer discounts for vehicles equipped with security features, as they reduce the risk of theft and damage.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.