Best Gap Insurance in 2025 (Your Guide to the Top 10 Companies)

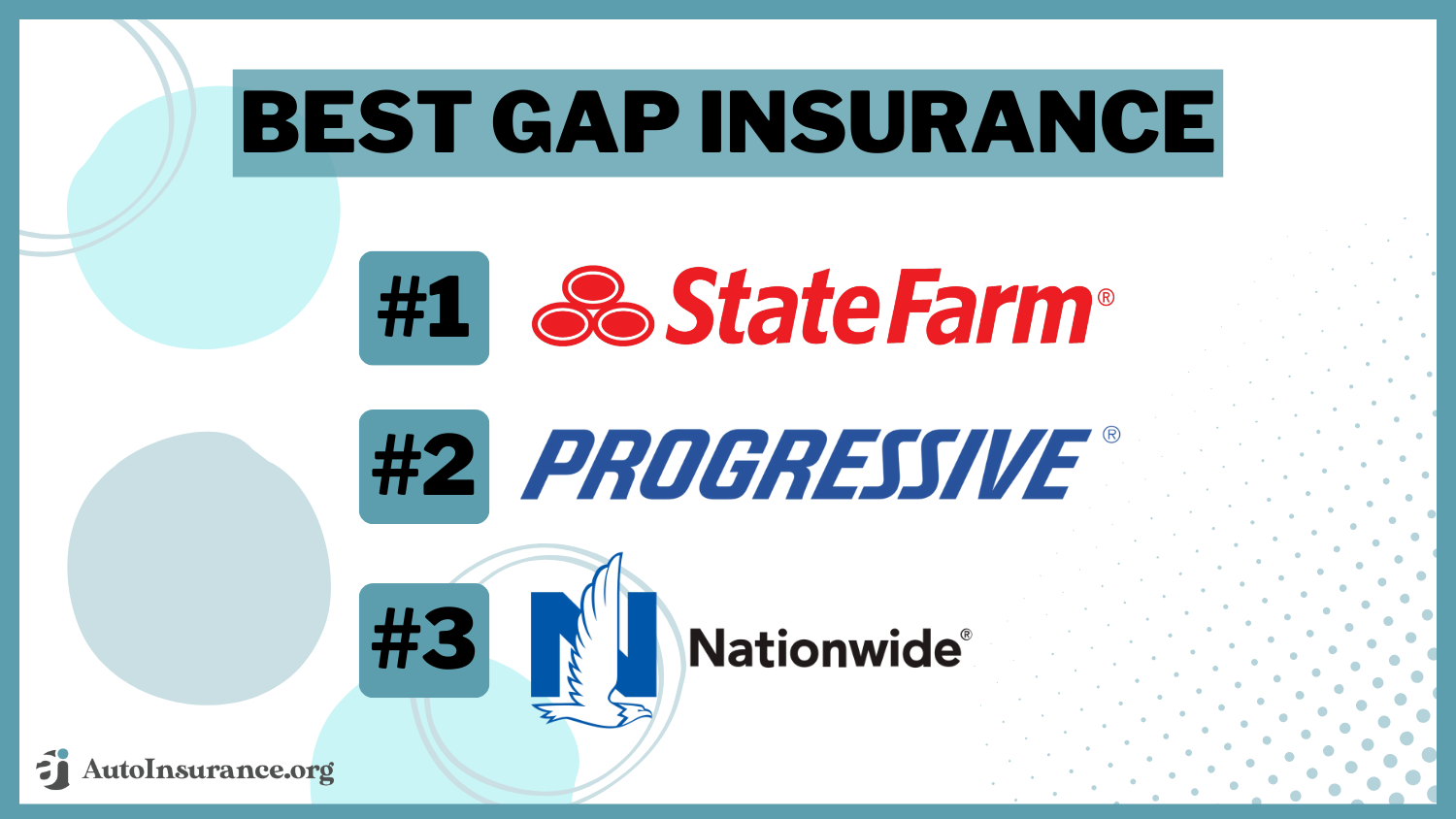

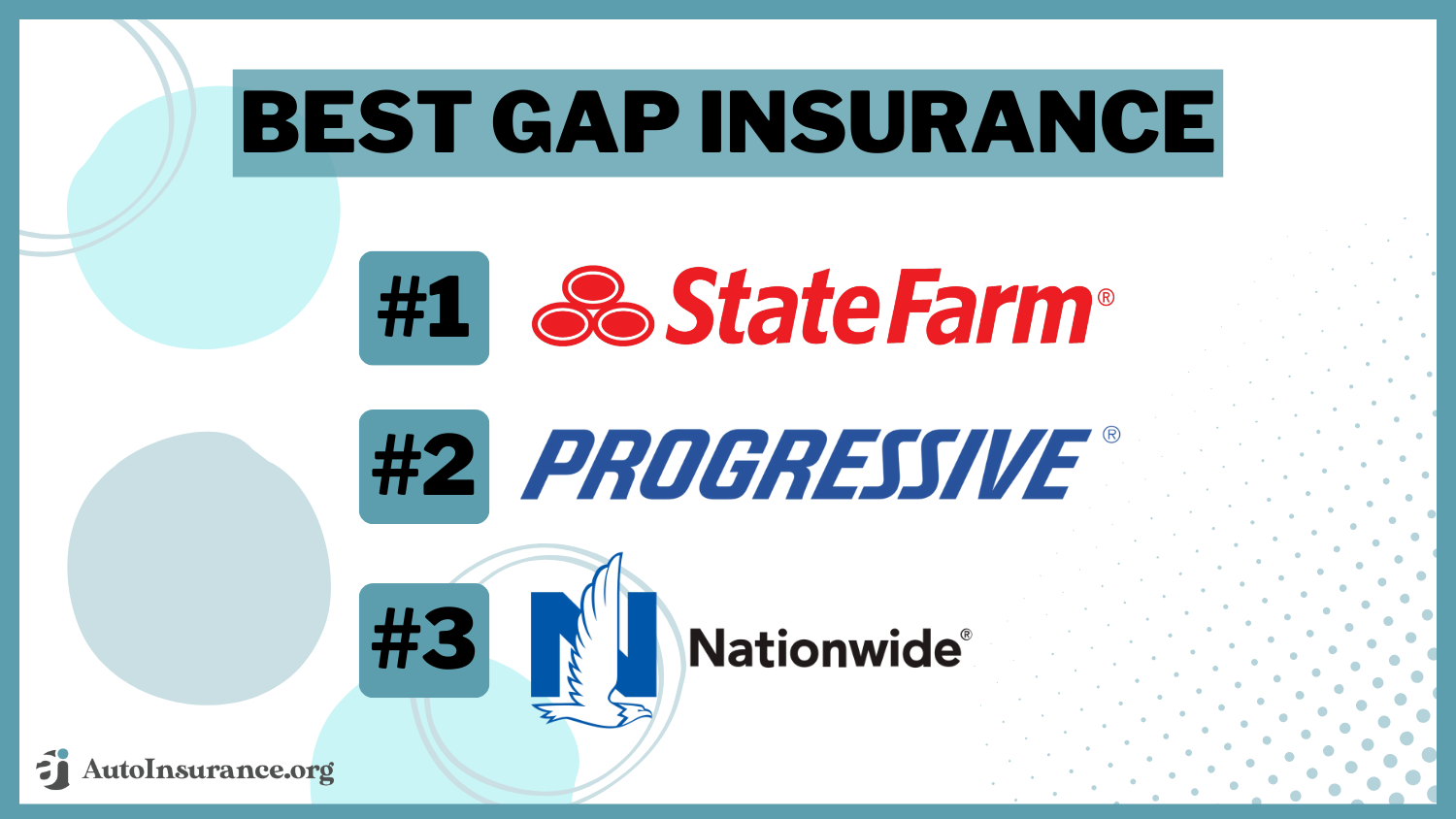

State Farm, Progressive, and Nationwide sell the best gap insurance. As leading gap insurance providers, they offer the best deals for gap insurance for new car owners with a lease or loan on their vehicle. At State Farm, gap insurance costs an average of just $8/mo when added to a minimum coverage policy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Gap

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Gap

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Gap

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, Progressive, and Nationwide offer the best gap insurance on the market with rates as low as $8 per month. Gap customers can sign up for usage-based insurance to save even more money.

When comparing top gap insurance companies and reading gap insurance company reviews, you’ll find that guaranteed auto protection insurance is great for customers looking for extra protection for their new vehicles. Other top companies that offer excellent gap coverage are listed below.

Our Top 10 Company Picks: Best Gap Insurance

| Company | Rank | Usage-Based Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | B | Customer Service | State Farm | |

| #2 | 30% | A+ | Online Tools | Progressive | |

| #3 | 40% | A+ | Bundling Discounts | Nationwide |

| #4 | 40% | A+ | Infrequent Drivers | Allstate | |

| #5 | 30% | A | Customizable Policies | Liberty Mutual |

| #6 | 30% | A | Signal App | Farmers | |

| #7 | 30% | A++ | Unique Coverage | Travelers | |

| #8 | 30% | A | Loyalty Rewards | American Family | |

| #9 | 25% | A+ | Tailored Policies | The Hartford |

| #10 | 30% | A++ | Reliability Focused | Auto-Owners |

Read on to learn more about the best gap insurance companies and pick one that’s right for you. You can also compare rates at top companies by entering your ZIP in our free quote comparison tool.

- State Farm has the best gap insurance at an affordable price

- Progressive and Nationwide are also great gap insurance companies

- Gap is great coverage for new vehicles with a lease or loan

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Customer Service: Customers shopping for gap coverage can talk directly to local agents.

- Affordable Rates: State Farm has affordable average rates for gap insurance. Learn more about rates in our State Farm auto insurance review.

- Bundling Discount: Auto insurance customers will save on gap insurance if they also get their home or renters insurance from State Farm.

Cons

- Financial Stability: The company’s rating from A.M. Best could be much better than other companies who offer gap insurance on our list.

- Online Management Limitations: Customers will have to contact local agents for help with most tasks related to gap insurance.

#2 – Progressive: Best for Online Tools

Pros

- Online Tools: Progressive has an online app, a budget calculator, and more for its gap insurance customers.

- Snapshot Discount: Gap customers can join Snapshot to earn lower rates for safe driving habits.

- Loyalty Rewards: Progressive offers discounts on gap insurance and other perks for loyal customers. Our review of Progressive delves more into its perks.

Cons

- Snapshot Gap Rate Increases: Snapshot is best for good drivers, as poor driving could raise rates in some states.

- Gap Claim Customer Satisfaction: The quality of service for customers filing gap claims doesn’t always receive the best gap insurance reviews.

#3 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Discounts: Auto insurance customers can save on gap insurance by also purchasing their home or renters insurance from Nationwide.

- SmartMiles Coverage: Low-mileage drivers can opt for pay-per-mile insurance for cheaper rates on gap coverage.

- Accident Forgiveness: Good drivers could avoid gap rate increases if they qualify for accident forgiveness.

Cons

- Customer Satisfaction: There are varying reviews about the quality of service for customers filing gap claims at Nationwide, which you can learn about in our Nationwide auto insurance review.

- Affordability for Bad Drivers: A poor driving record will make Nationwide’s gap insurance quotes less affordable compared to competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Infrequent Drivers

Pros

- Infrequent Drivers: As one of the best gap insurance providers, Allstate offers cheaper gap insurance rates for low mileage drivers. Allstate also offers pay-per-mile insurance in some states.

- Safe Driving Discounts: Gap customers can join Drivewise to earn a good driving discount.

- Adjustable Deductibles: Gap insurance customers can change their deductibles. Learn more in our Allstate auto insurance review.

Cons

- Young Driver Gap Rates: Allstate isn’t affordable compared to other companies’ prices for young drivers.

- Customer Complaints About Gap Claims: The quality of claims service has a higher-than-average number of complaints.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Among insurance companies that offer gap, Liberty Mutual has great customizable policies, as customers can adjust deductibles on their gap insurance.

- Multi-Vehicle Gap Discount: Customers who are insuring more than one vehicle will get a lower rate on gap insurance. For more gap insurance comparison options, read our Liberty Mutual auto insurance review.

- Accident Forgiveness: Liberty Mutual forgives first accidents for safe drivers, so gap insurance rates rates won’t increase.

Cons

- Gap Coverage Affordability for High-Risk Drivers: Liberty Mutual isn’t a top company for affordability for high-risk customers.

- Customer Satisfaction With Gap Claims: There are some complaints about the quality of service.

#6 – Farmers: Best for Signal App

Pros

- Signal App: Safe drivers can earn a discount on gap insurance from Signal after successfully completing the program.

- Adjustable Deductibles: For a detailed gap car insurance comparison, check out our Farmers auto insurance review to see how gap customers can adjust deductibles.

- Discount Options: Gap customers can bundle coverages, go paperless, and more to save on coverage.

Cons

- Customer Service: There are varying reviews about the quality of service from Farmers, such as filing gap claims.

- Accident Forgiveness Costs Extra: While most companies offer accident forgiveness for free, Farmers require customers to pay a small additional fee to avoid increased rates on gap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage: As a top gap insurance provider, Travelers has great coverage options besides just gap coverage. Read more in our Travelers auto insurance review.

- IntelliDrive Program: Safe driving habits will earn customers a discount on gap insurance.

- Financial Stability: Travelers is one of the most financially stable gap companies on the market.

Cons

- IntelliDrive Rate Increases: Only safe drivers should join IntelliDrive, as bad driving could increase gap rates.

- Customer Reviews: There are some negative reviews about the quality of service, such as gap claims.

#8 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: As one of the best gap auto insurance providers, loyal customers will earn gap discounts and other perks.

- Multi-Vehicle Gap Discount: American Family discounts gap insurance for multi-vehicle policies. Visit our American Family auto insurance review for a full discount list.

- Good Driver Discount: Good drivers can reduce rates by joining the KnowYourDrive UBI program.

Cons

- Availability: American Family doesn’t sell gap auto insurance in all 50 U.S. states.

- Online Management: American Family may offer less comprehensive online functions to manage gap insurance due to local agent availability.

#9 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: The Hartford works with customers to tailor gap policies to meet their needs.

- AARP Discount: The Hartford offers discounted gap insurance coverage to AARP members.

- Accident Forgiveness: The Hartford won’t raise gap rates on some accidents. Learn more in our review of The Hartford.

Cons

- Young Driver Gap Rates: The Hartford specializes in insurance for senior drivers, so its rates aren’t as great for young drivers.

- Customer Reviews: The quality of service for gap claims has mixed reviews from customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for Reliable Service

Pros

- Reliability Focused: Auto-Owners focuses on reliability for its gap customers, which you can learn about in our review of Auto-Owners.

- Financial Stability: Auto-Owners is more financially stable than most of its gap insurance competitors.

- Online Payments: Customers can pay for gap insurance online.

Cons

- Availability: Auto-Owners is not available in all states.

- Online Functions: Auto-Owners’ app and website don’t allow customers to perform as many online functions as other companies.

Average Auto Insurance Rates With Gap Coverage

What is gap insurance? Gap insurance is an affordable add-on coverage, as it costs less than $10 per month at most top companies when added to a minimum coverage policy. Compare gap insurance from top providers below:

Gap Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Monthly Rates |

|---|---|

| $20 | |

| $25 | |

| $18 | |

| $22 | |

| $24 |

| $21 |

| $19 | |

| $23 | |

| $26 |

| $20 |

According to gap car insurance reviews, gap coverage is recommended for most new cars that still have a lease or loan on them, as it ensures that customers with a totaled car don’t have to continue to pay off a lease or loan to a car they no longer own (Read More: How do insurance companies value totaled cars?).

Our Catastrophe Response Team is on the ground and ready to help customers recover from the devastating wildfires. https://t.co/Ad5q6XAYIy

— State Farm (@StateFarm) January 28, 2025

Because gap coverage is so affordable, new vehicle owners should consider carrying it for the first year or two of ownership. You should also get the best gap coverage as possible as it is an affordable add on.

Pros and Cons of Gap Insurance

According to gap insurance reviews and gap insurance comparison sites, understanding the advantages and disadvantages of gap coverage is crucial before purchasing.

Based on leading auto gap insurance providers, gap insurance protects you from financial loss if your new vehicle is totaled. Insurance companies that offer gap coverage explain that this protection is especially valuable when you owe more on your loan than your car is worth.

While this protection is valuable, gap insurance isn’t necessary for everyone. According to various gap insurance providers, drivers who made a large down payment or have paid off most of their loan may not need this coverage.

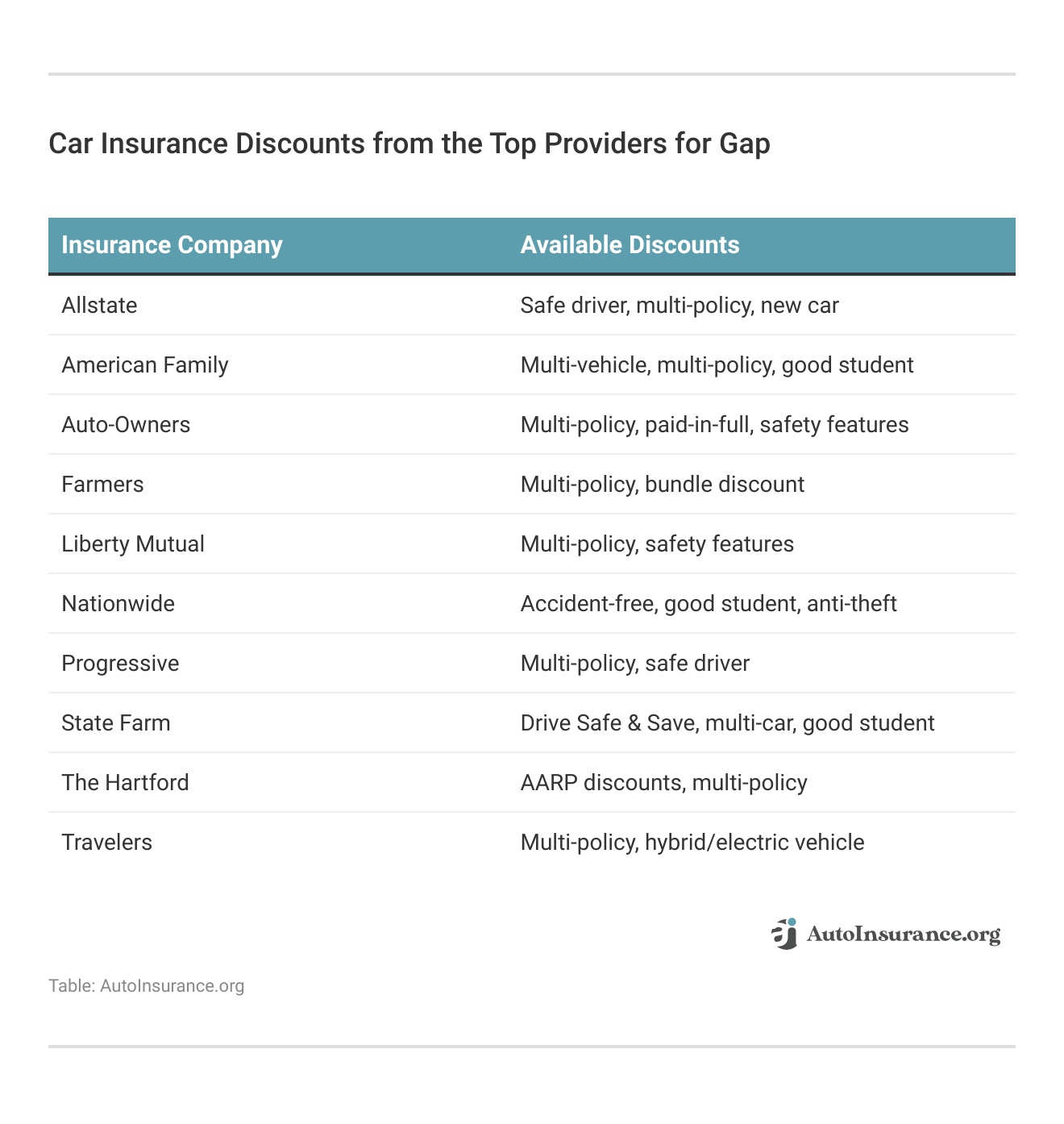

How to Save Money on Gap Insurance

For those getting price comparisons for gap insurance, there are a few things drivers can do if adding on extras like gap makes car insurance too expensive. The first is to check out auto insurance discounts at your company.

Even little discounts like safety feature discounts will lower gap insurance costs and make it more affordable for customers.

If applying for discounts doesn’t make gap coverage more affordable, then drivers can also shop around at different companies to find cheap gap insurance rates.

Drivers looking for affordable gap coverage should compare quotes from at least three different providers to find the best deal.Dani Best Licensed Insurance Producer

Drivers will also find that the longer they keep a clean driving record, the lower their rates will fall over time. Insurance providers also offer deals for good drivers, like diminishing deductibles and accident forgiveness.

Finding the Best Gap Insurance Company for You

Gap coverage is the best auto insurance for leased vehicles that are brand new. You will find the best gap insurance at companies like State Farm, Progressive, and Nationwide.

Ready to shop for the best gap insurance today? Compare rates now with our free quote comparison tool to get the best deal on insurance companies with gap coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the best gap insurance company in the U.S.?

We found that State Farm is the best gap insurance company due to its affordability and widespread availability in the U.S.

What are the cons of gap insurance?

Gap insurance may not fully cover the financial losses you’ll suffer when your car is totaled, as your policy may have a cap limit. Make sure to check the fine print at your insurance company.

What is the most that gap insurance will pay?

Gap insurance will pay out the actual cash value of your totaled vehicle (Learn More: Replacement Cost vs. Actual Cash Value).

Why would a gap insurance claim be denied?

A gap claim could be denied if the insurance company determines that the driver was driving recklessly, such as under the influence. Start comparing the best gap insurance policy by entering your ZIP code here.

What exactly does gap insurance cover?

Gap insurance helps cover the gap between what your vehicle was worth when it was totaled and what is left to pay on your lease or loan.

What is better than gap insurance?

New car replacement might be a better option for some customers, but it is less widely available than gap insurance and often only applies to the first year of new car ownership. State Farm is rated as one of the best gap insurance for new cars.

Is gap coverage worth it?

Gap coverage is worth it for most new vehicle owners due to its low cost. It’s best to compare gap insurance for cars so you can know the best rates possible.

Can gap insurance be added later?

Some companies will allow you to add gap insurance later. Enter your ZIP in our free quote tool to shop for the best gap insurance quote comparison.

Will gap insurance cover a blown engine?

Not, gap insurance doesn’t cover a blown engine (Read More: Does auto insurance cover engine failure?).

How long can you use gap insurance?

Gap insurance usually lasts for the duration of your lease or loan, so a few years.

Which insurance companies offer gap insurance?

The best place to get gap insurance are from major insurers like State Farm, Progressive, Nationwide, Allstate, Liberty Mutual, Farmers, Travelers, American Family, The Hartford, and Auto-Owners all provide gap insurance coverage for vehicles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.