Best Hyundai Elantra Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Progressive, State Farm, and Geico are the best Hyundai Elantra auto insurance providers, with rates starting at $43/month. Progressive offers competitive pricing, State Farm excels in customer service, and Geico provides comprehensive coverage, making them top choices for Hyundai Elantra drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Hyundai Elantra

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hyundai Elantra

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hyundai Elantra

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The top picks for the best Hyundai Elantra auto insurance are Progressive, State Farm, and Geico, each offering exceptional value and coverage.

With Progressive leading the way for overall excellence, and State Farm and Geico providing the most competitive rates averaging $114 per month, these providers stand out in delivering both affordability and quality.

Our Top 10 Company Picks: Best Hyundai Elantra Auto Insurance

Company Rank Bundling

DiscountA.M. Best Best For Jump to Pros/Cons

#1 12% A+ Roadside Assistance Progressive

#2 20% B Customer Service State Farm

#3 25% A++ Extensive Discounts Geico

#4 25% A+ Infrequent Drivers Allstate

#5 10% A++ Military Members USAA

#6 25% A Unique Benefits Liberty Mutual

#7 20% A Great Add-ons Farmers

#8 20% A+ Multi-Policy Savings Nationwide

#9 20% A Young Volunteers American Family

#10 8% A++ Industry Experience Travelers

In this article, we’ll explore the strengths and drawbacks of these top insurers, ensuring you find the best option to suit your Hyundai Elantra insurance needs. The benefits of auto insurance cannot be overstated, providing peace of mind, financial protection, and compliance with legal requirements.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

- Progressive is the top choice for Hyundai Elantra insurance at $114/month

- Affordable rates and comprehensive coverage are key for Hyundai Elantra owners

- Tailored policies enhance insurance benefits for Hyundai Elantra drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Roadside Assistance: Progressive auto insurance review offers excellent roadside assistance for the best Hyundai Elantra auto insurance, ensuring you receive prompt help if you encounter issues on the road.

- High A.M. Best Rating: With an A+ rating from A.M. Best, Progressive is considered a strong choice for the best Hyundai Elantra auto insurance due to its financial stability.

- Multi-Vehicle Discount: Progressive provides a 12% multi-vehicle discount, which can benefit you if you insure your Hyundai Elantra alongside other vehicles.

Cons

- Limited Multi-Vehicle Discount: The 12% multi-vehicle discount might be lower than what other companies offer for the best Hyundai Elantra auto insurance, potentially impacting your overall savings.

- Customer Service Issues: Some customers have reported difficulties with customer service, which could affect your experience with the best Hyundai Elantra auto insurance.

#2 – State Farm: Best for Customer Service

Pros

- Excellent Customer Service: State Farm is highly regarded for its exceptional customer service, making it a top choice for those seeking the best Hyundai Elantra auto insurance with responsive support and personalized assistance.

- High Multi-Vehicle Discount: State Farm offers a generous 20% discount for insuring multiple vehicles, which can result in significant savings on the best Hyundai Elantra auto insurance if you also insure other cars.

- Wide Network of Agents: State Farm has an extensive network of agents, ensuring you can access in-person support and local expertise for the best Hyundai Elantra auto insurance. Learn more in our State Farm auto insurance review.

Cons

- Lower A.M. Best Rating: The B rating from A.M. Best may suggest less financial security compared to higher-rated competitors, which could impact the reliability of the best Hyundai Elantra auto insurance.

- Fewer Discounts: State Farm may offer fewer discounts overall compared to other insurers, which could limit potential savings on the best Hyundai Elantra auto insurance.

#3 – Geico: Best for Extensive Discounts

Pros

- Extensive Discounts: Geico provides a variety of discounts, including those for safe driving, making it a strong option for the best Hyundai Elantra auto insurance.

- Top A.M. Best Rating: With an A++ rating from A.M. Best, Geico’s financial strength supports reliable coverage for the best Hyundai Elantra auto insurance.

- High Multi-Vehicle Discount: Based on our Geico auto insurance review, the company offers a 25% discount for multiple vehicles, enhancing your savings on the best Hyundai Elantra auto insurance if you insure other cars.

Cons

- Potential Higher Premiums: Even with extensive discounts, some drivers might find Geico’s premiums higher than expected for the best Hyundai Elantra auto insurance.

- Claims Service Variability: Experiences with Geico’s claims service can vary, which might affect the overall satisfaction with the best Hyundai Elantra auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Infrequent Drivers

Pros

- Infrequent Drivers Coverage: Allstate offers tailored options for infrequent drivers, which can provide excellent coverage for those seeking the best Hyundai Elantra auto insurance with less frequent use.

- High Multi-Vehicle Discount: With a 25% discount for multiple vehicles, Allstate can help reduce the cost of the best Hyundai Elantra auto insurance if you insure other vehicles as well.

- Strong Financial Rating: Allstate’s A+ rating from A.M. Best reflects its financial stability, ensuring reliable coverage for the best Hyundai Elantra auto insurance. Unlock details in our Allstate auto insurance review.

Cons

- Potentially Higher Rates: Some drivers might find Allstate’s rates higher compared to competitors when seeking the best Hyundai Elantra auto insurance.

- Customer Service Issues: There can be variability in customer service experiences, which might affect your overall satisfaction with the best Hyundai Elantra auto insurance.

#5 – USAA: Best for Military Members

Pros

- Tailored for Military Members: USAA provides specialized coverage options for military members, making it an excellent choice for those seeking the best Hyundai Elantra auto insurance with military benefits.

- Top Financial Rating: With an A++ rating from A.M. Best, USAA offers strong financial stability, supporting dependable coverage for the best Hyundai Elantra auto insurance.

- Competitive Discount: According to our USAA auto insurance review, the company provides 10% discount, which can be a good value for military members looking for the best Hyundai Elantra auto insurance.

Cons

- Limited Availability: USAA’s services are available only to military members and their families, which may exclude others from accessing the best Hyundai Elantra auto insurance.

- Lower Multi-Vehicle Discount: The 10% discount for multiple vehicles is lower compared to some competitors, potentially reducing savings on the best Hyundai Elantra auto insurance.

#6 – Liberty Mutual: Best for Unique Benefits

Pros

- Unique Benefits: Liberty Mutual offers unique benefits and features that can enhance the value of the best Hyundai Elantra auto insurance. See more details on our Liberty Mutual auto insurance review.

- High Multi-Vehicle Discount: With a 25% discount for multiple vehicles, Liberty Mutual provides significant savings for those insuring more than one car, including the Hyundai Elantra.

- Strong Financial Rating: Liberty Mutual’s A rating from A.M. Best ensures solid financial strength and stability, supporting reliable coverage for the best Hyundai Elantra auto insurance.

Cons

- Discount Availability: Some of Liberty Mutual’s unique benefits may not always apply to every driver’s situation, which could affect the overall value of the best Hyundai Elantra auto insurance.

- Customer Service Variability: Experiences with Liberty Mutual’s customer service can be inconsistent, which might impact satisfaction with the best Hyundai Elantra auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Great Add-ons

Pros

- Great Add-Ons: As per our Farmers auto insurance review, they offers valuable add-ons that can enhance the best Hyundai Elantra auto insurance policy, providing additional coverage options.

- High Multi-Vehicle Discount: With a 20% discount for multiple vehicles, Farmers helps reduce costs for the best Hyundai Elantra auto insurance when insuring additional cars.

- Solid Financial Rating: Farmers’ A rating from A.M. Best reflects its strong financial stability, ensuring dependable coverage for the best Hyundai Elantra auto insurance.

Cons

- Potentially Higher Rates: Farmers might have higher base rates compared to some competitors, which could affect the overall cost of the best Hyundai Elantra auto insurance.

- Customer Service Feedback: There can be mixed reviews about Farmers’ customer service, potentially impacting your experience with the best Hyundai Elantra auto insurance.

#8 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Savings: Nationwide auto insurance review provides savings for bundling multiple policies, which can enhance the value of the best Hyundai Elantra auto insurance when combined with other types of coverage.

- High Multi-Vehicle Discount: With a 20% discount for multiple vehicles, Nationwide helps reduce the cost of the best Hyundai Elantra auto insurance for those insuring additional cars.

- Strong Financial Rating: Nationwide’s A+ rating from A.M. Best supports its financial strength, ensuring reliable coverage for the best Hyundai Elantra auto insurance.

Cons

- Discount Availability: While Nationwide offers discounts, some may find that the overall value of the best Hyundai Elantra auto insurance might not be as competitive as other providers.

- Customer Service Variability: There may be variability in customer service experiences, which could affect your satisfaction with the best Hyundai Elantra auto insurance.

#9 – American Family: Best for Young Volunteers

Pros

- Young Volunteers Coverage: American Family provides specialized coverage options for young volunteers, which can be beneficial for those seeking the best Hyundai Elantra auto insurance with unique needs.

- High Multi-Vehicle Discount: As outlined by our American Family auto insurance review, the company offers a 20% discount for multiple vehicles, making it easier to save on the best Hyundai Elantra auto insurance if you have additional cars.

- Solid Financial Rating: With an A rating from A.M. Best, American Family demonstrates strong financial stability, ensuring reliable coverage for the best Hyundai Elantra auto insurance.

Cons

- Potentially Higher Rates: American Family’s rates might be higher compared to some competitors, impacting the overall affordability of the best Hyundai Elantra auto insurance.

- Limited Discounts: The range of discounts offered by American Family may not be as extensive as those from other providers, potentially affecting savings on the best Hyundai Elantra auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Industry Experience

Pros

- Industry Experience: Travelers’ extensive experience in the insurance industry contributes to its reliable coverage, making it a solid choice for the best Hyundai Elantra auto insurance.

- Top Financial Rating: With an A++ rating from A.M. Best, Travelers’ strong financial standing supports dependable coverage for the best Hyundai Elantra auto insurance. Detailed information can be found in our Travelers auto insurance review.

- Competitive Discount: Travelers offers an 8% discount, which can provide additional savings on the best Hyundai Elantra auto insurance.

Cons

- Lower Discount Rate: The 8% discount for the best Hyundai Elantra auto insurance is lower compared to competitors, potentially limiting overall savings.

- Customer Service Variability: There can be variability in customer service experiences with Travelers, which may affect your satisfaction with the best Hyundai Elantra auto insurance.

Hyundai Elantra Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Jeep Compass from various providers.

Hyundai Elantra Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$53 $141

$32 $84

When selecting the best auto insurance for your Hyundai Elantra, it’s important to compare monthly rates and coverage levels across different providers. Evaluating both minimum and full insurance coverage options can help you identify the most cost-effective insurance plan.

For instance, USAA offers the lowest rate for minimum coverage at $35 and the most affordable full coverage at $96, while Allstate provides the highest rates at $52 and $139, respectively. By considering these variations, you can find an insurance plan that balances cost and protection to suit your needs.

Hyundai Elantra Auto Insurance Rates

Understanding the cost of insuring your Hyundai Elantra is crucial for effective budgeting. The average annual insurance rate for a Hyundai Elantra is approximately $1,372, which equates to around $114 per month.

Hyundai Elantra Auto Insurance Monthly Rates by Driver Profile

| Category | Rates |

|---|---|

| Average Rate | $114 |

| Discount Rate | $67 |

| High Deductibles | $99 |

| High Risk Driver | $244 |

| Low Deductibles | $144 |

| Teen Driver | $418 |

Insurance rates can vary significantly based on factors such as age and driving history. Young drivers and those classified as high risk typically face higher premiums. To find the best rates for your Hyundai Elantra, consider comparing quotes from different providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Are Hyundai Elantras Expensive to Insure

The chart below details how Hyundai Elantra insurance rates compare to other sedans like the Honda Accord, Kia Forte, and Chevrolet Sonic.

Hyundai Elantra Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Hyundai Elantra | $23 | $47 | $31 | $114 |

| Honda Accord | $23 | $42 | $31 | $109 |

| Kia Forte | $27 | $42 | $31 | $113 |

| Chevrolet Sonic | $23 | $45 | $33 | $114 |

| Toyota Corolla | $25 | $45 | $33 | $115 |

| Kia Optima | $27 | $44 | $35 | $121 |

| Honda Civic | $23 | $55 | $35 | $128 |

Overall, the Hyundai Elantra’s insurance rates are quite competitive compared to other sedans in its class. It typically features slightly lower costs for collision and full coverage when compared to some of its rivals, such as the Honda Civic and Kia Optima.

This means that while the Elantra provides similar or slightly higher rates for certain coverage types like comprehensive insurance, it generally offers a more affordable option for collision insurance coverage and full coverage, making it a cost-effective choice for those looking to balance insurance costs with comprehensive coverage.

Factors that Impact Hyundai Elantra Insurance Rates

Several factors determine your Hyundai Elantra insurance rates, each affecting your total premium in unique ways. The trim and model year of your Hyundai Elantra play a crucial role, as does the vehicle’s age, with older models often resulting in lower insurance costs.

Progressive offers outstanding coverage options and competitive rates, making it a top choice for the best Hyundai Elantra auto insurance.Dani Best Licensed Insurance Producer

Additionally, factors such as your age, driving history, and location can significantly impact the price of your coverage. By understanding these elements, you can better anticipate and manage your Hyundai Elantra insurance expenses. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

Older Hyundai Elantra models generally cost less to insure. For example, car insurance for a 2020 Hyundai Elantra costs $1,372, while 2010 Hyundai Elantra insurance costs are $1,130, a difference of $242.

Hyundai Elantra Auto Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Hyundai Elantra | $25 | $48 | $32 | $116 |

| 2023 Hyundai Elantra | $25 | $48 | $32 | $115 |

| 2022 Hyundai Elantra | $24 | $48 | $31 | $115 |

| 2021 Hyundai Elantra | $24 | $47 | $31 | $115 |

| 2020 Hyundai Elantra | $23 | $47 | $31 | $114 |

| 2019 Hyundai Elantra | $22 | $45 | $33 | $113 |

| 2018 Hyundai Elantra | $21 | $45 | $33 | $112 |

| 2017 Hyundai Elantra | $21 | $44 | $35 | $112 |

| 2016 Hyundai Elantra | $20 | $42 | $36 | $111 |

| 2015 Hyundai Elantra | $19 | $40 | $37 | $109 |

| 2014 Hyundai Elantra | $18 | $38 | $38 | $107 |

| 2013 Hyundai Elantra | $17 | $35 | $38 | $104 |

| 2012 Hyundai Elantra | $17 | $32 | $38 | $100 |

| 2011 Hyundai Elantra | $16 | $29 | $38 | $96 |

| 2010 Hyundai Elantra | $15 | $27 | $39 | $94 |

As the Hyundai Elantra ages, insurance premiums generally decrease due to lower repair and replacement costs. Evaluating the insurance rates across various model years can help you select an Elantra that offers a balance of both value and affordability in coverage.

Driver Age

Driver age can have a significant effect on Hyundai Elantra car insurance rates. For example, 20-year-old drivers pay $1,678 more for their Hyundai Elantra car insurance each year than 30-year-old drivers.

Hyundai Elantra Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $225 |

| Age: 30 | $191 |

| Age: 40 | $178 |

| Age: 45 | $165 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Understanding how driver age affects Hyundai Elantra car insurance rates can help you make informed decisions about your coverage. Younger drivers often face higher premiums, while older drivers benefit from lower rates.

By knowing these differences, you can better plan your insurance needs and potentially save on your premiums over time. – To gain in-depth knowledge, consult our comprehensive resource titled “Auto Insurance Rates by Age.”

Driver Location

Where you live can have a large impact on Hyundai Elantra insurance rates. For example, drivers in Los Angeles may pay $508 a year more than drivers in Philadelphia.

Hyundai Elantra Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $196 |

| New York, NY | $181 |

| Houston, TX | $179 |

| Jacksonville, FL | $166 |

| Philadelphia, PA | $153 |

| Chicago, IL | $151 |

| Phoenix, AZ | $133 |

| Seattle, WA | $111 |

| Indianapolis, IN | $97 |

| Columbus, OH | $95 |

Insurance rates for your Hyundai Elantra can vary widely depending on where you live. Understanding how location impacts your premiums can help you make informed decisions about your coverage. If you’re looking to save, consider how your city’s rates compare and explore options to find the best value for your insurance needs. Safe driving and smart choices can lead to both lower premiums and better coverage.

Your Driving Record

Your driving record can have an impact on the cost of Hyundai Elantra auto insurance. Teens and drivers in their 20’s see the highest jump in their Hyundai Elantra car insurance with violations on their driving record.

Hyundai Elantra Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $550 | $720 | $1,000 | $680 |

| Age: 18 | $418 | $580 | $820 | $500 |

| Age: 20 | $259 | $410 | $640 | $350 |

| Age: 30 | $119 | $180 | $300 | $160 |

| Age: 40 | $114 | $170 | $290 | $155 |

| Age: 45 | $110 | $165 | $280 | $150 |

| Age: 50 | $104 | $155 | $270 | $145 |

| Age: 60 | $102 | $150 | $260 | $140 |

A clean driving history helps keep your premiums lower, while incidents like accidents, DUIs, and traffic tickets can significantly increase your rates. This impact is particularly pronounced for younger drivers, who face the highest rate increases. Maintaining a clean driving record is essential for managing insurance costs effectively and ensuring you get the best possible rates on your Hyundai Elantra.

Safety Ratings

The Hyundai Elantra’s safety ratings will affect your Hyundai Elantra car insurance rates. See the chart below:

Hyundai Elantra Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Hyundai Elantra’s impressive safety ratings contribute to its favorable insurance rates, with top scores across all major test categories. With high ratings in small overlap front, moderate overlap front, side impact, roof strength, and head restraints and seats, the Elantra demonstrates robust protection for its occupants.

Investing in a vehicle with such strong safety features can help lower your overall insurance costs, reflecting the Elantra’s commitment to safety and reliability.

Crash Test Ratings

Not only do good Hyundai Elantra crash test ratings mean you are better protected in a crash, but good crash ratings also mean cheaper Hyundai Elantra auto insurance rates.

Hyundai Elantra Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Hyundai Elantra GT 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2024 Hyundai Elantra 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2023 Hyundai Elantra GT 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2023 Hyundai Elantra 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2022 Hyundai Elantra GT 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2022 Hyundai Elantra 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2021 Hyundai Elantra GT 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2021 Hyundai Elantra 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2020 Hyundai Elantra GT 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2020 Hyundai Elantra 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2019 Hyundai Elantra GT 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2019 Hyundai Elantra 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Hyundai Elantra GT 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Hyundai Elantra 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Hyundai Elantra GT 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Hyundai Elantra 4 DR FWD Later Release | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Hyundai Elantra 4 DR FWD Early Release | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Hyundai Elantra GT 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Hyundai Elantra 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

These robust crash test ratings highlight the Hyundai Elantra’s commitment to safety and reliability. Good crash ratings not only ensure better protection in the event of an accident but can also contribute to more affordable auto insurance rates. Choosing a Hyundai Elantra means investing in a vehicle that prioritizes both your safety and your wallet.

Hyundai Elantra Safety Features

Equipping your Hyundai Elantra with advanced safety features significantly boosts driving security and can potentially lower your insurance premiums. The vehicle includes several key safety components: driver and passenger air bags to cushion occupants during collisions, front and rear head air bags for added protection, and front side air bags to guard against side impacts.

It also features 4-wheel ABS for enhanced braking control, reliable front disc and rear drum brakes, and brake assist to increase braking force in emergencies. Electronic stability control helps maintain vehicle stability on slippery surfaces, while daytime running lights improve visibility to other drivers.

Additional features include child safety locks to prevent rear door openings from inside, traction control to avoid wheel spin, lane departure warning to alert you if you drift out of your lane, and lane-keeping assist to help steer the vehicle back into its lane. Collectively, these features enhance both occupant protection and vehicle stability, contributing to a safer driving experience and potentially reducing insurance costs.

Insurance Loss Probability

Another contributing factor that plays a direct role in Hyundai Elantra insurance rates is the loss probability for each type of coverage.

Hyundai Elantra Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | 2% |

| Property Damage | 2% |

| Comprehensive | -10% |

| Personal Injury | 33% |

| Medical Payment | 37% |

| Bodily Injury | 17% |

These loss probabilities provide valuable insights into the risk factors associated with insuring a Hyundai Elantra. By understanding these probabilities, you can make more informed decisions when selecting insurance coverage and potentially lower your premiums.

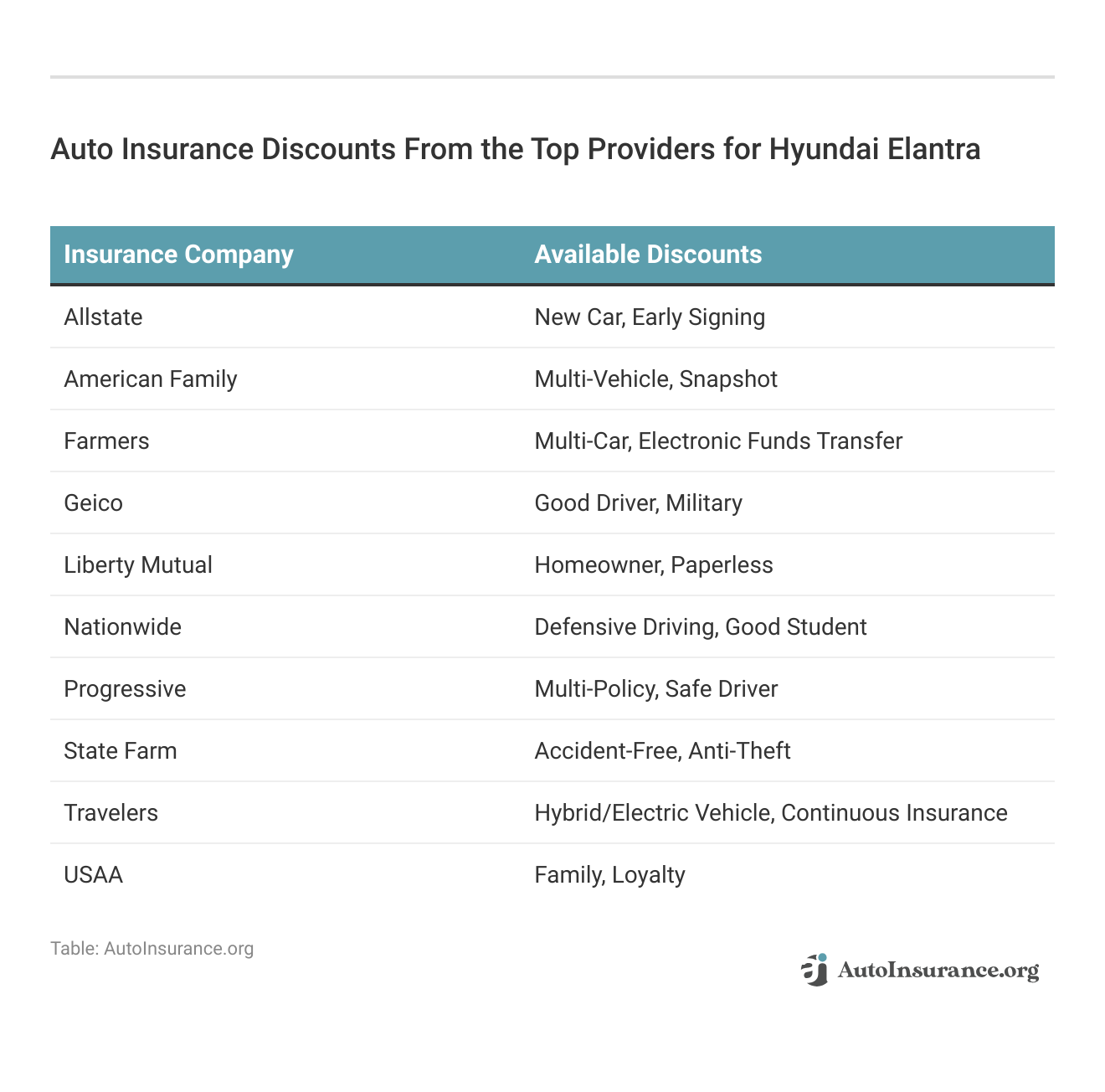

This table outlines the available discounts for Hyundai Elantra insurance from ten top providers. It features the insurance companies and the discounts they offer. The discounts vary from good driver and military benefits to multi-policy and homeowner savings, providing various options for cost reduction based on individual qualifications and circumstances.

Ways to Save on Hyundai Elantra Insurance

While your Hyundai Elantra insurance rates may seem fixed, there are several strategies you can use to find the best possible rates. Consider these five tips to help lower your Hyundai Elantra auto insurance costs:

- Demonstrate Safe Driving Habits: Maintaining a clean driving record can help you qualify for lower insurance premiums, as many insurers offer discounts for safe drivers.

- Inquire About Farm and Ranch Vehicle Discounts: If your Hyundai Elantra is used for farm or ranch purposes, check if you’re eligible for any specialized discounts.

- Ask About Specific Hyundai Elantra Discounts: Contact your insurance provider to see if they offer any discounts specifically for Hyundai Elantra owners, such as loyalty insurance discount or multi-policy discounts.

- Opt for a Hyundai Elantra with Anti-Theft Features: Vehicles equipped with anti-theft devices may qualify for reduced rates. Ensure your Hyundai Elantra is fitted with these features or consider adding them.

- Avoid Relying Solely on the Cheapest Policy: While it’s tempting to choose the lowest-priced option, make sure it provides adequate coverage. Sometimes a slightly higher premium can offer better protection and savings in the long run.

By implementing these strategies, you can effectively lower your Hyundai Elantra insurance costs while ensuring you have the coverage you need. Remember, being a safe driver, exploring available discounts, and choosing the right features and policies can make a significant difference.

Take the time to review your options and talk to your insurance provider to find the best rates for your Hyundai Elantra. With a bit of effort, you can enjoy both savings and peace of mind on the road.

Learn more: Auto Insurance Discounts

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Hyundai Elantra Insurance Companies

Who is the best auto insurance company for Hyundai Elantra insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Hyundai Elantra auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Hyundai Elantra offers.

Top 10 Hyundai Elantra Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Finding the best insurance for your Hyundai Elantra can unlock considerable savings. Explore the top providers mentioned, each offering tailored discounts and coverage options that can maximize the value of your vehicle’s features.

Compare Free Hyundai Elantra Insurance Quotes Online

To find the best Hyundai Elantra auto insurance, start by using our online comparison tool to get free insurance quotes. Gather essential information about your Hyundai Elantra, such as its make, model, year, and VIN, along with your driving history and personal details. Enter this information into the tool to receive quotes from various insurance providers.

Review the quotes to compare coverage options and premiums. Make sure the policies offer comprehensive coverage that meets your needs and fits within your budget. By using our tool, you can efficiently find the best Hyundai Elantra auto insurance, saving time and ensuring you get the most suitable coverage for your vehicle.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Case Studies: Tailored Protection for Your Hyundai Elantra Insurance

The following case studies present fictional scenarios inspired by real-world situations to illustrate the experiences of different individuals with various car insurance companies. Each case highlights how specific insurance providers catered to the needs of their clients, focusing on their unique circumstances and requirements for their Hyundai Elantra.

- Case Study #1 – Smooth Start for a New Graduate: John, a 22-year-old recent graduate, chose Progressive for his new Hyundai Elantra. At $120 per month, his policy included comprehensive insurance coverage and discounts for safe driving. After a minor accident, Progressive’s quick claims process got John back on the road promptly.

- Case Study #2 – Family’s Reliable Choice: Mary and Tom selected State Farm for their family’s Hyundai Elantra due to its excellent customer service. Their $130 per month policy included liability and medical payments. State Farm’s efficient claims process ensured minimal disruption after Tom’s minor accident.

- Case Study #3 – Smart Savings for the Solo Professional: Sarah, a single professional, opted for Geico’s affordable rates starting at $114 per month. Geico’s discounts and user-friendly app made managing her policy easy. When her Elantra was vandalized, Geico’s responsive service handled the repair seamlessly.

These fictional case studies, based on real-world scenarios, provide insight into how different insurance companies can meet the needs of various customers.

Progressive excels in delivering both value and protection, making it a prime contender for the best Hyundai Elantra auto insurance.Daniel Walker Licensed Auto Insurance Agent

Whether it’s a recent graduate, a family, or a solo professional, the right insurance provider can make a significant difference in handling the challenges that arise with car ownership.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors determine the best Hyundai Elantra auto insurance?

The best Hyundai Elantra auto insurance depends on coverage options, premium costs, customer service, discounts, and the insurer’s reputation for handling claims. Comparing these factors across providers will help you find the best insurance for your needs.

How can I find the best Hyundai Elantra auto insurance rates?

To find the best Hyundai Elantra auto insurance rates, compare quotes from multiple companies, look for discounts (e.g., safe driver, multi-policy), and consider coverage limits and deductibles for comprehensive protection at a competitive price.

Explore relevant guide titled “How to Get a Multi-Vehicle Auto Insurance Discount.”

How much is insurance for a Hyundai Elantra?

The cost to insure a Hyundai Elantra depends on the model year and the driver’s profile. For instance, the insurance cost for a 2020 Hyundai Elantra may differ significantly from the insurance rates for a 2023 Hyundai Elantra Hybrid.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

How long will a Hyundai Elantra engine last?

A Hyundai Elantra can easily last 150,000 to 250,000 miles with regular maintenance and good driving practices. If you drive around 15,000 miles per year, it will survive 13 to 17 years before needing costly repairs or breaking down.

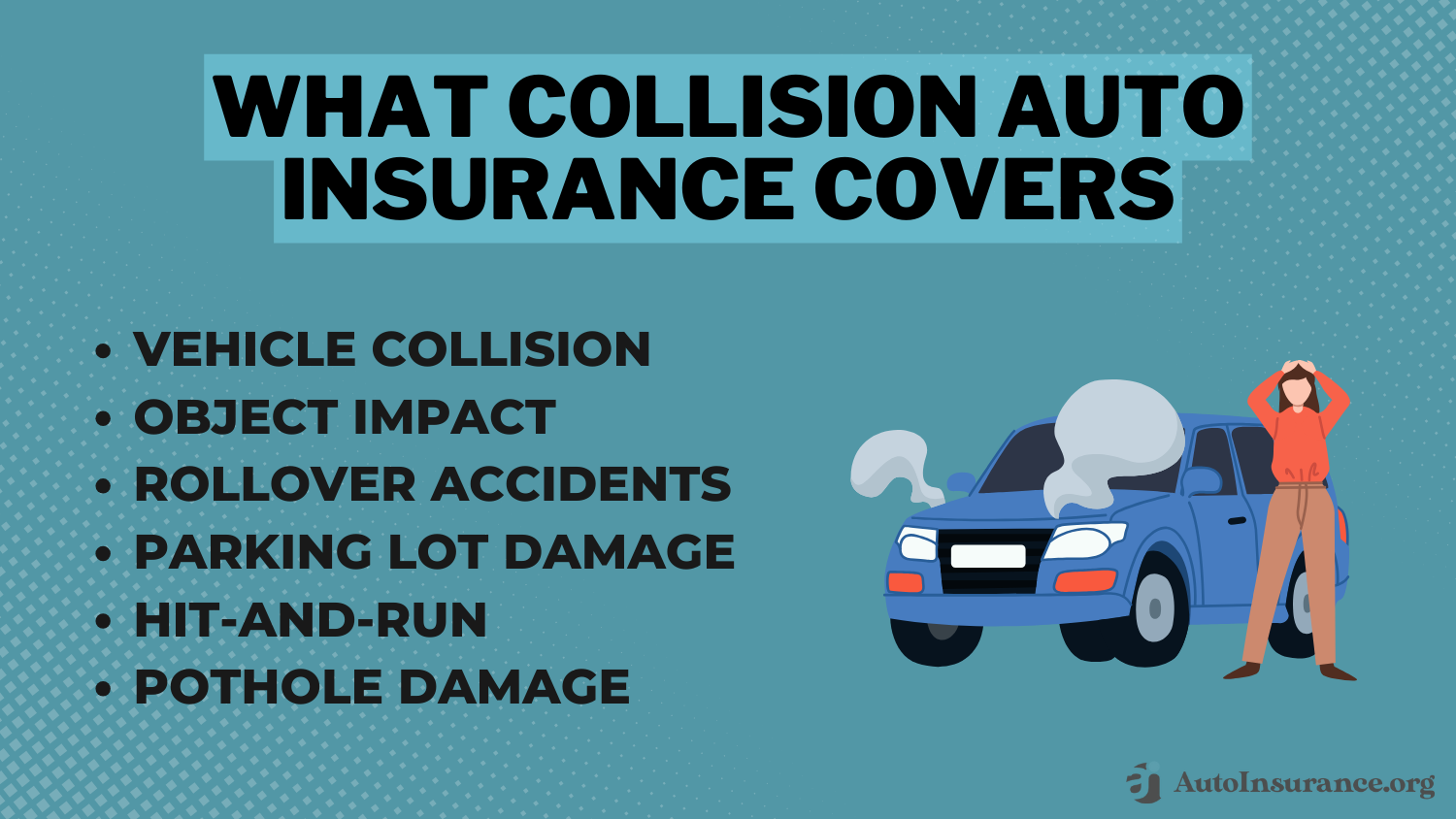

What coverage types are important for the best Hyundai Elantra auto insurance?

For the best Hyundai Elantra auto insurance, consider including coverage types such as collision, comprehensive, liability, and uninsured/underinsured motorist coverage. Additionally, adding roadside assistance and rental car coverage can provide extra peace of mind in case of unexpected events.

Delve into our guide titled ”Types of Auto Insurance.”

What should I do if I’m unhappy with my current Hyundai Elantra auto insurance?

If you’re unhappy with your current Hyundai Elantra auto insurance, contact your provider to discuss concerns and possible adjustments. If that doesn’t help, shop around for quotes from other insurers to find better coverage and rates for the best Hyundai Elantra auto insurance.

How reliable is Hyundai Elantra car?

The 2024 Hyundai Elantra has a predicted reliability score of 81 out of 100. A J.D. Power predicted reliability score of 91-100 is considered the Best, 81-90 is Great, 70-80 is Average and 0-69 is Fair and considered below average.

Which insurance companies are known for offering the best Hyundai Elantra auto insurance?

Geico, State Farm, and Progressive are often recommended for their comprehensive and competitive auto insurance for Hyundai Elantra owners. Review customer feedback and compare quotes to find the best option for you.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Can I save money on the best Hyundai Elantra auto insurance?

Yes, you can save money on the best Hyundai Elantra auto insurance by taking advantage of available discounts, such as those for safe driving, good credit, or bundling multiple policies. Additionally, maintaining a clean driving record and opting for a higher deductible can help reduce your premium costs.

To expand your knowledge, refer to our comprehensive handbook titled “How Auto Insurance Companies Check Driving Records.”

How often should I review my Hyundai Elantra auto insurance policy?

Review your Hyundai Elantra auto insurance annually or when significant changes occur, like driving habit changes or vehicle modifications. This ensures you have the best coverage and benefit from new discounts or updates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.