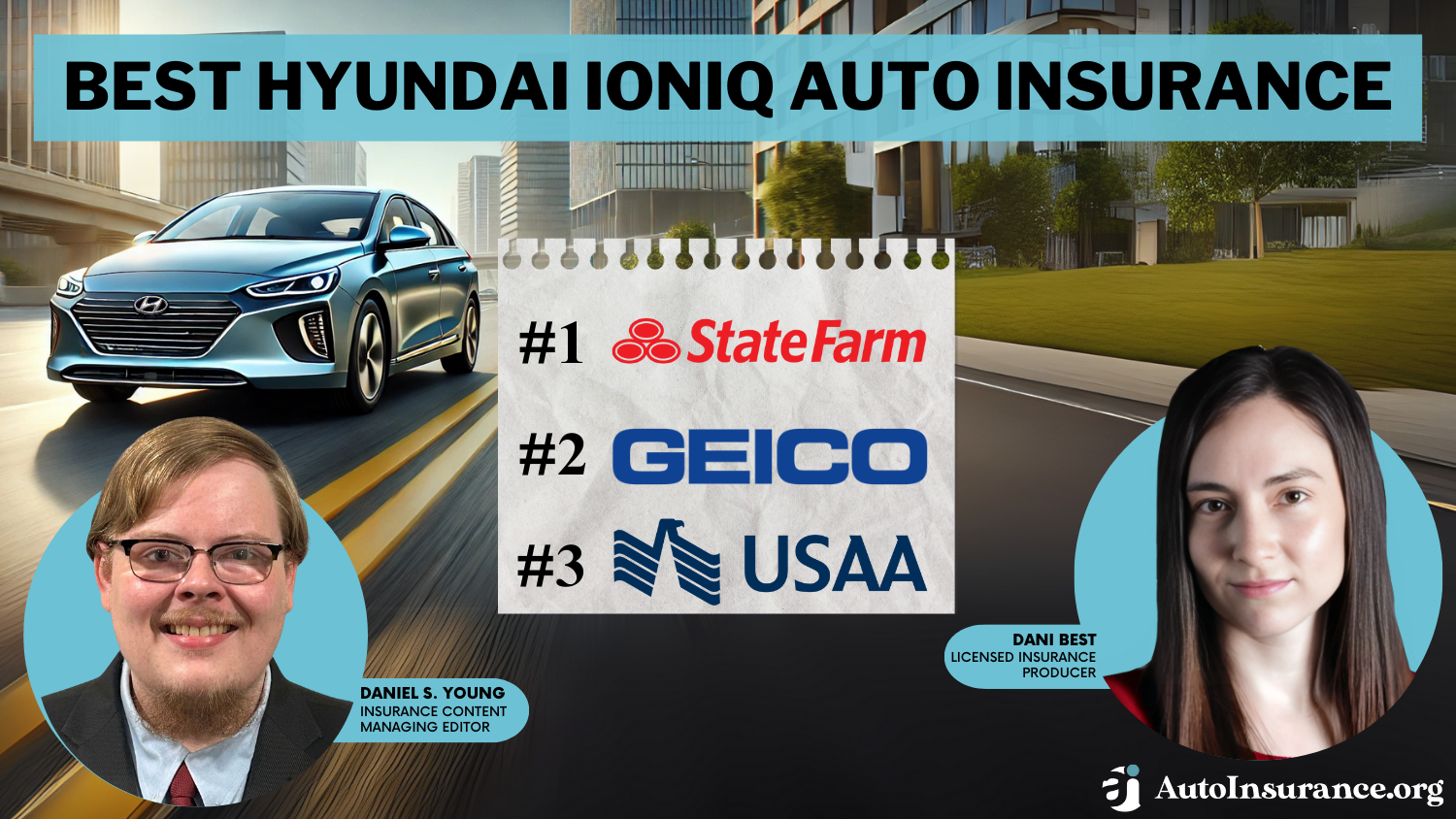

Best Hyundai Ioniq Auto Insurance in 2025 (Check Out the Top 10 Companies)

State Farm, Geico, and USAA are offering the best Hyundai Ioniq auto insurance with rates as low as $33 per month. These companies provide competitive rates, excellent customer service, and robust coverage options. Your driving record and location will affect your rates, so compare quotes now for your Ioniq.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Mar 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Hyundai Ioniq

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hyundai Ioniq

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hyundai Ioniq

A.M. Best Rating

Complaint Level

Pros & Cons

The best Hyundai Ioniq auto insurance providers are State Farm, Geico, and USAA, with rates around $33. These companies offer competitive pricing, excellent coverage, and top-notch customer service.

Factors like your driving record and location can impact your rates, making it crucial to compare quotes. State Farm is particularly notable for its comprehensive auto insurance policies and customer satisfaction.

Our Top 10 Company Picks: Best Hyundai Ioniq Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 12% B Many Discounts State Farm

#2 15% A++ Cheap Rates Geico

#3 20% A+ Military Savings USAA

#4 18% A++ Local Agents Progressive

#5 15% A++ Accident Forgiveness Travelers

#6 10% A Student Savings American Family

#7 12% A Customizable Polices Liberty Mutual

#8 15% A Online Convenience Farmers

#9 10% A+ Add-on Coverages Allstate

#10 15% A+ Usage Discount Nationwide

To compare Hyundai Ioniq Electric auto insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- The cost of insurance for a Hyundai Ioniq Electric depends on the trim level

- Safety features of the Hyundai Ioniq Electric can earn you a car insurance discount

- Crash test ratings have an impact on Hyundai Ioniq Electric auto insurance rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm auto insurance review offers some of the best Hyundai Ioniq auto insurance rates, averaging around $103, making it a top choice for affordability.

- Excellent Customer Service: Known for outstanding customer service, State Farm ensures that Hyundai Ioniq owners receive timely and helpful support for their insurance needs.

- Comprehensive Coverage: State Farm provides extensive coverage options tailored to Hyundai Ioniq vehicles, including collision, comprehensive, and liability coverage.

Cons

- Limited Discounts: State Farm offers fewer discounts specifically for electric vehicles like the Hyundai Ioniq compared to some competitors.

- Inconsistent Rates: Insurance rates for Hyundai Ioniq owners can vary significantly by location, sometimes making it less competitive in certain areas.

#2 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico is among the best Hyundai Ioniq auto insurance providers, offering low rates that average around $103.

- Extensive Discounts: As mentioned in our Geico auto insurance discounts, they offer a wide range of discounts, including those for safe driving, multi-vehicle policies, and specific safety features.

- User-Friendly Tools: Geico’s user-friendly website and mobile app make it easy for Hyundai Ioniq owners to manage their policies and file claims.

Cons

- Average Service: While Geico is affordable, its customer service is often rated as average, which can be a drawback for Hyundai Ioniq owners needing frequent support.

- Few Local Agents: Geico primarily operates online, which means Hyundai Ioniq owners may have limited access to local agents for personalized assistance.

#3 – USAA: Best for Military Savings

Pros

- High Satisfaction: USAA consistently ranks high in customer satisfaction, making it a reliable choice for Hyundai Ioniq owners seeking excellent service.

- Military Discounts: USAA auto insurance review provides special discounts for military personnel, offering additional savings on Hyundai Ioniq auto insurance for eligible members.

- Broad Coverage: USAA offers a range of coverage options tailored to meet the unique needs of Hyundai Ioniq owners, from liability to comprehensive plans.

Cons

- Restricted Eligibility: USAA is only available to military members and their families, limiting access for many Hyundai Ioniq owners.

- Higher Rates: For those eligible but not actively serving, USAA’s rates for Hyundai Ioniq auto insurance can be higher compared to other providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Local Agents

Pros

- Snapshot Program: Progressive’s Snapshot program offers potential discounts for Hyundai Ioniq drivers who demonstrate safe driving habits.

- Competitive Pricing: Progressive is known for its competitive rates, often making it one of the best Hyundai Ioniq auto insurance providers in terms of affordability.

- Customizable Coverage: As outlined in our Progressive auto insurance review, they allow Hyundai Ioniq owners to customize their coverage options, ensuring they only pay for what they need.

Cons

- Mixed Service: Customer service experiences with Progressive can vary, which may affect Hyundai Ioniq owners needing consistent support.

- Rate Increases: Progressive has a reputation for increasing rates significantly after claims, which can be a concern for Hyundai Ioniq owners.

#5 – Travelers: Best for Accident Forgiveness

Pros

- Wide Discounts: Travelers offers various discounts, including for hybrid and electric vehicles like the Hyundai Ioniq, making insurance more affordable.

- Strong Stability: Travelers’ strong financial ratings ensure reliability for Hyundai Ioniq auto insurance policyholders.

- Comprehensive Plans: Travelers auto insurance review provides robust coverage options tailored to meet the specific needs of Hyundai Ioniq owners.

Cons

- High Premiums: Travelers can have higher premiums in some regions, which may deter Hyundai Ioniq owners looking for cost-effective insurance.

- Limited Tools: The online tools and mobile app offered by Travelers are not as advanced as some competitors, potentially frustrating tech-savvy Hyundai Ioniq owners.

#6 – American Family: Best for Student Savings

Pros

- Competitive Rates: American Family auto insurance review offers competitive rates, often making it a top choice for Hyundai Ioniq auto insurance.

- Great Service: American Family is known for excellent customer service, providing Hyundai Ioniq owners with reliable and responsive support.

- Various Discounts: American Family offers numerous discounts, including those for safe driving and bundling policies, which can benefit Hyundai Ioniq owners.

Cons

- Limited Availability: American Family’s services are not available in all states, which can limit access for some Hyundai Ioniq owners.

- Average Digital: The digital experience, including the website and mobile app, is not as user-friendly as some competitors, which may inconvenience Hyundai Ioniq owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Polices

Pros

- Multi-Policy Discounts: Liberty Mutual auto insurance review provides significant discounts for Hyundai Ioniq owners who bundle multiple policies, such as home and auto insurance.

- Customizable Coverage: Liberty Mutual allows Hyundai Ioniq owners to customize their insurance policies to fit their specific needs.

- Strong Stability: Liberty Mutual’s strong financial stability ensures that they can reliably handle claims for Hyundai Ioniq auto insurance.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be higher than average, which might deter Hyundai Ioniq owners looking for budget-friendly options.

- Mixed Service: Customer service ratings for Liberty Mutual are mixed, which can be a concern for Hyundai Ioniq owners needing consistent support.

#8 – Farmers: Best for Online Convenience

Pros

- Extensive Options: Farmers offers a wide range of coverage options tailored to the needs of Hyundai Ioniq owners, from basic to comprehensive plans.

- Strong Service: Farmers is known for strong customer service, providing reliable support for Hyundai Ioniq auto insurance policyholders.

- Unique Discounts: Farmers auto insurance review provides unique discounts, such as for safe driving and vehicle safety features, which can benefit Hyundai Ioniq owners.

Cons

- Higher Rates: Farmers’ rates for comprehensive coverage can be higher, which may not be ideal for all Hyundai Ioniq owners.

- Limited Discounts: Some discounts offered by Farmers are not available in all states, limiting the savings for some Hyundai Ioniq owners.

#9 – Allstate: Best for Add-on Coverages

Pros

- User-Friendly Tools: Allstate offers a highly user-friendly website and mobile app, making it easy for Hyundai Ioniq owners to manage their policies.

- Various Options: Allstate auto insurance review provides a variety of coverage options, allowing Hyundai Ioniq owners to tailor their insurance to their specific needs.

- Strong Ratings: Allstate’s strong financial stability ensures reliability for Hyundai Ioniq auto insurance policyholders.

Cons

- Higher Premiums: Allstate’s premiums can be higher for certain drivers, which may not be ideal for all Hyundai Ioniq owners.

- Mixed Service: Customer service experiences with Allstate can vary, potentially affecting Hyundai Ioniq owners needing consistent support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Usage Discount Usage Discount

Pros

- Competitive Rates: Nationwide offers competitive rates, making it one of the best Hyundai Ioniq auto insurance providers in terms of affordability.

- Comprehensive Discounts: Nationwide auto insurance review provides a range of discounts, including for safe driving and bundling policies, which can benefit Hyundai Ioniq owners.

- Strong Service: Nationwide is known for strong customer service, offering reliable support for Hyundai Ioniq auto insurance policyholders.

Cons

- Limited Discounts: Some of Nationwide’s discounts are not available in all regions, which can limit savings for some Hyundai Ioniq owners.

- Rate Increases: Nationwide has a reputation for increasing rates after claims, which can be a concern for Hyundai Ioniq owners

Hyundai Ioniq Insurance Costs Explained

The best way to get affordable Hyundai Ioniq Electric auto insurance is to shop around and compare. Before you do that, take a look at the details we’ve gathered on what affects Hyundai auto insurance for Ioniq Electric.

Hyundai Ioniq Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $64 $201

American Family $50 $163

Farmers $88 $275

Geico $52 $165

Liberty Mutual $58 $175

Nationwide $49 $156

Progressive $64 $200

State Farm $44 $135

Travelers $60 $181

USAA $33 $103

You can also compare Hyundai Ioniq Electric auto insurance rates to the average cost of insurance for competitors like Nissan Pulsar and Volkswagen Rabbit.

Read more: Nissan Auto Insurance

Take a look at how insurance rates for similar models to the Hyundai Ioniq Electric look. These insurance rates for other hatchbacks like the MINI Hardtop, Volkswagen Rabbit, and Nissan Pulsar give you a good idea of what to expect.

Hyundai Ioniq Auto Insurance Monthly Rates by Coverage Type

| Coverage | Rates |

|---|---|

| Comprehensive | $24 |

| Collision | $44 |

| Minimum Coverage | $35 |

| Full Coverage | $115 |

Understanding these averages can help Hyundai Ioniq Electric owners anticipate their insurance expenses more accurately.

Monthly Auto Insurance Rates for Vehicles Similar to the Hyundai Ioniq

| Vehicle | Rates |

|---|---|

| FIAT 500L | $114 |

| Mazda 2 | $95 |

| Nissan Leaf | $128 |

| Porsche Panamera | $177 |

| Ford C-Max Energi | $120 |

| Toyota Prius | $109 |

| FIAT 500 | $113 |

| Mazda 3 | $117 |

This comparison helps highlight that while the Hyundai Ioniq Electric may have a moderate insurance cost, there are more affordable and more expensive options in the market.

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Dodge Caliber | $16 | $28 | $38 | $96 |

| Ford C-Max Hybrid | $24 | $47 | $33 | $117 |

| Honda CR-Z | $25 | $37 | $36 | $111 |

| Porsche Panamera | $43 | $87 | $33 | $177 |

| Mazda 3 | $26 | $47 | $31 | $117 |

| Toyota Yaris | $21 | $40 | $33 | $108 |

| Nissan Leaf | $27 | $53 | $35 | $128 |

| FIAT 500L | $21 | $40 | $38 | $114 |

The detailed insurance rates breakdown for vehicles similar to the Hyundai Ioniq Electric underscores the variations in comprehensive, collision, and liability costs.

State Farm is particularly notable for its comprehensive policies and customer satisfaction.Jeff Root LICENSED INSURANCE AGENT

Factors Affecting Hyundai Ioniq Electric Insurance Costs

The average annual rate for the Hyundai Ioniq Electric is just that, an average. Your insurance rates for a Hyundai Ioniq Electric can be higher or lower depending upon the trim level and personal factors.

Those factors include your age, home address, driving history, and the model year of your Hyundai Ioniq Electric. To learn more, explore our article titled “Factors That Affect Auto Insurance Rates.”

Hyundai Ioniq Electric Crash Test Ratings

Hyundai Ioniq Electric crash test ratings can impact the cost of your Hyundai Ioniq Electric car insurance. See Hyundai Ioniq Electric crash test results here.

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Hyundai Ioniq Electric 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Hyundai Ioniq Electric 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Hyundai Ioniq Electric 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Hyundai Ioniq Electric 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Hyundai Ioniq Electric 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Hyundai Ioniq Electric 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Hyundai Ioniq Electric 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Hyundai Ioniq Electric 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

The Hyundai Ioniq Electric boasts strong crash test ratings across various models, which positively impacts insurance costs by indicating a high level of safety.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Hyundai Ioniq Electric Insurance

Save more on your Hyundai Ioniq Electric car insurance rates. Take a look at the following five strategies that will get you the best Hyundai Ioniq Electric auto insurance rates possible.

- Check your Hyundai Ioniq Electric policy carefully to ensure all information is correct.

- Check for organization-based discounts, like alumni or employer discounts.

- Ask about Hyundai Ioniq Electric low mileage discounts.

- Compare insurance companies after moving.

- Move to an area with a lower cost of living.

By ensuring accurate policy information, exploring available discounts, and comparing insurance options, you can find the most cost-effective coverage.

For more information, read our article titled “Auto Insurance Rates by State“.

Top Hyundai Ioniq Electric Insurance Companies

What is the best auto insurance company for Hyundai Ioniq Electric insurance rates? Rates you pay will also depend on the type of auto insurance you get, here are some of the top companies offering Hyundai Ioniq Electric auto insurance coverage (ordered by market share).

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 6% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Allstate | $35.6 milllion | 5% |

| #5 | Liberty Mutual | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

You can start comparing quotes for Hyundai Ioniq Electric insurance from some of the top car insurance companies by using our free online tool today.

Frequently Asked Questions

How much does insurance for a Hyundai Ioniq cost?

The cost of insurance for a Hyundai Ioniq can vary depending on several factors, including your location, driving record, age, gender, and the specific model and trim level of the Ioniq. Additionally, insurance rates can vary between insurance companies. It’s best to contact multiple insurance providers and obtain quotes to get an accurate estimate for your situation.

What factors can affect the insurance premium for a Hyundai Ioniq?

Several factors can influence the insurance premium for a Hyundai Ioniq. Some common factors include your driving record, age, gender, location, annual mileage, the model and trim level of the Ioniq, safety features, and the deductible and coverage limits you choose. Additionally, the insurance company’s own criteria and calculations may also impact the premium.

To Learn more, read our article titled “Top 7 Factors That Affect Auto Insurance Rates.”

Are there any specific safety features on the Hyundai Ioniq that can lower insurance costs?

Yes, the Hyundai Ioniq comes equipped with various safety features that can potentially lower insurance costs. These features may include advanced driver-assistance systems (ADAS) such as forward collision warning, automatic emergency braking, lane departure warning, blind-spot monitoring, and adaptive cruise control.

Insurance companies often offer discounts for vehicles with these safety features, as they can help reduce the risk of accidents.

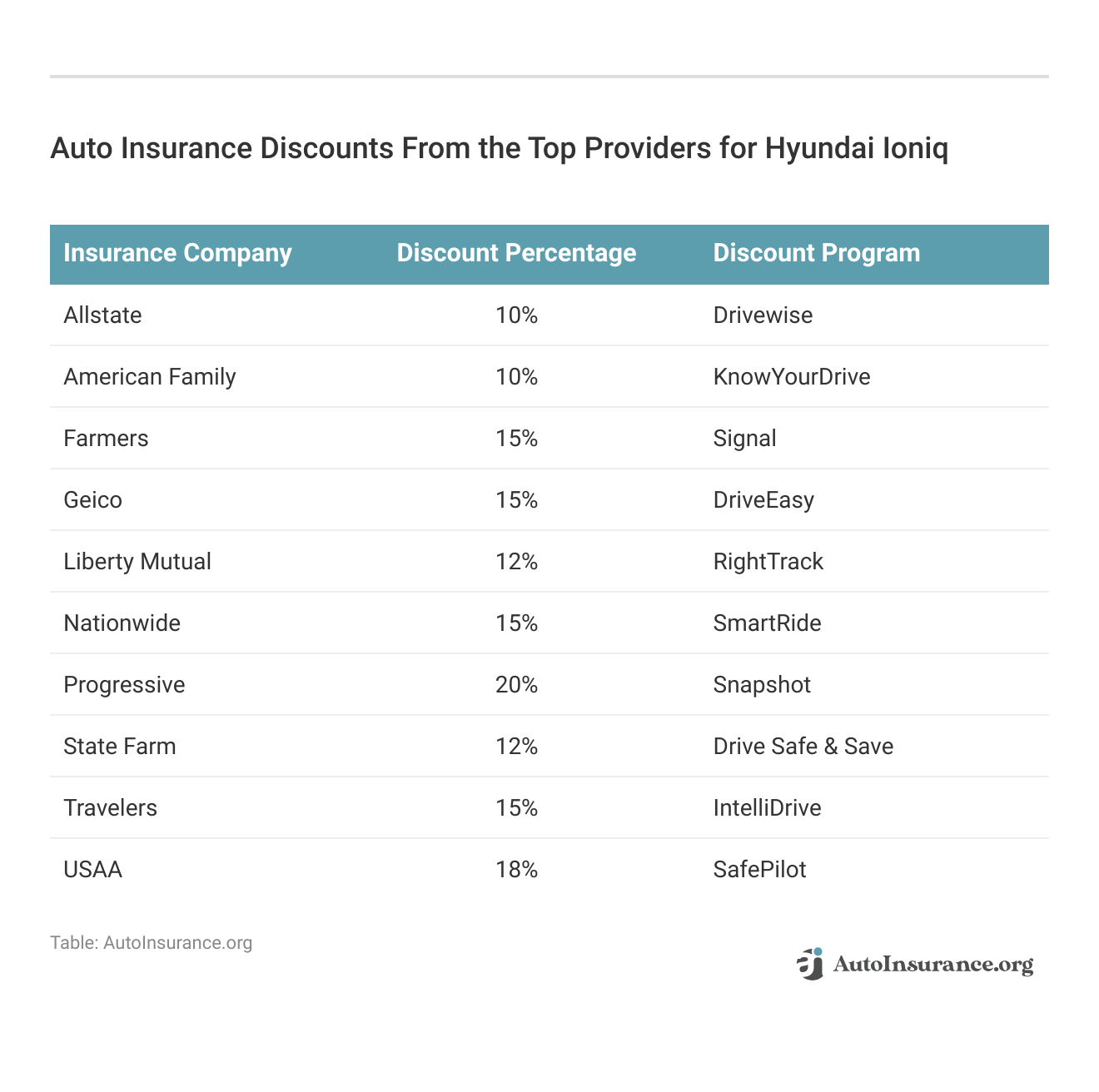

Are there any insurance discounts available for the Hyundai Ioniq?

Insurance discounts for the Hyundai Ioniq may vary depending on the insurance provider and the region. However, common discounts that may be available include discounts for safety features, such as ADAS, anti-lock brakes, and anti-theft devices.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

You may also be eligible for discounts based on your driving history, such as a good driver discount or a low-mileage discount. To know the specific discounts available, it’s recommended to reach out to insurance providers and inquire about their offerings.

Is it necessary to have full coverage insurance for a Hyundai Ioniq?

The need for full coverage insurance on a Hyundai Ioniq depends on several factors, including your personal preferences, financial situation, and any loan or lease requirements. Full coverage typically includes both liability insurance (which is usually required by law) and comprehensive and collision coverage.

Read More: Cheapest Liability-Only Auto Insurance

Comprehensive and collision coverage protects your vehicle in case of damage from events like accidents, theft, vandalism, or natural disasters. If you have a loan or lease on the vehicle, the lender or leasing company may require you to carry full coverage insurance.

What are the best Hyundai Ioniq auto insurance providers?

The best Hyundai Ioniq auto insurance providers include State Farm, Geico, and USAA. These companies offer competitive rates, with premiums as low as $103 per month, and provide excellent customer service along with comprehensive coverage options.

How can I find the cheapest Hyundai Ioniq auto insurance rates?

To find the cheapest Hyundai Ioniq auto insurance rates, compare quotes from multiple providers, check for available discounts, and ensure all policy information is accurate. Rates can vary significantly based on your driving record, location, and other factors. For more information, read our article titled “Cheap Hyundai Auto Insurance.”

Does the Hyundai Ioniq’s crash test rating affect insurance costs?

Yes, the Hyundai Ioniq’s crash test ratings significantly impact insurance costs. Higher safety ratings typically result in lower premiums, as insurers view these vehicles as less risky to cover. The Hyundai Ioniq generally boasts strong crash test ratings, contributing to more favorable insurance rates.

Are there specific discounts available for Hyundai Ioniq auto insurance?

Yes, many insurance companies offer specific discounts for Hyundai Ioniq auto insurance. These can include low mileage discounts, organization-based discounts, and savings for advanced safety features. It’s beneficial to ask your insurer about all available discounts.

What factors should I consider when choosing Hyundai Ioniq auto insurance?

When choosing Hyundai Ioniq auto insurance, consider factors such as coverage options, customer service quality, available discounts, and the overall cost. Comparing quotes from top providers like State Farm, Geico, and USAA can help you find the best policy for your needs.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.