Best Jeep Commander Auto Insurance in 2025 (Top 10 Companies Ranked)

Explore the best Jeep Commander auto insurance from State Farm, Geico, and USAA, with rates as low as $60 per month. These top providers offer comprehensive coverage, ideal for insurance for Jeep owners. Learn why they rank highest for your Jeep Commander and explore factors influencing insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jul 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Jeep Commander

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Jeep Commander

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Jeep Commander

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

When looking for the best Jeep Commander auto insurance, State Farm, Geico, and USAA, are the top choices offering rates as low as $60 per month. These top companies excel in affordability and comprehensive coverage. This article explains why auto insurance rates vary so much and highlights factors influencing your insurance costs.

In addition, this article explores factors affecting Jeep Commander insurance costs, such as vehicle safety ratings, driver demographics, and location.

Our Top 10 Company Picks: Best Jeep Commander Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 20% B Financial Stability State Farm

#2 25% A++ Competitive Rates Geico

#3 10% A++ Exceptional Service USAA

#4 12% A+ Innovative Programs Progressive

#5 25% A+ Comprehensive Coverage Allstate

#6 20% A Customizable Policies Farmers

#7 25% A Good Discounts Liberty Mutual

#8 20% A+ Strong Ratings Nationwide

#9 25% A+ High Satisfaction Amica

#10 10% A+ Affordable Rates Erie

Learn tips for finding the best rates and discover discounts available for Jeep Commander insurance coverage. Get the best auto insurance rates possible by entering your ZIP code above into our free comparison tool today.

- Discounts for safety features can lower premiums

- State Farm offers the top rates for coverage

- Discover how safety and driver factors impact costs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Pricing for Coverage: State Farm offers insurance rates for the Jeep Commander starting at $150 per month, which is reasonably competitive compared to other providers, providing a balance between cost and coverage.

- Comprehensive Coverage Options: State Farm auto insurance review highlights it’s extensive coverage options including collision, comprehensive, and liability, which are essential for maintaining a well-rounded protection plan for your Jeep Commander.

- High Customer Satisfaction: State Farm has a strong reputation for customer service, which can be particularly valuable when handling claims or adjusting coverage for your Jeep Commander.

Cons

- Higher Premiums Compared to Some Competitors: At $150 per month, State Farm’s rates are higher than several competitors, such as USAA and Erie, which may not be ideal if you are looking for the lowest possible premium.

- Limited Discounts for Safety Features: State Farm may not offer as many discounts for advanced safety features on your Jeep Commander compared to some other insurers, potentially leading to higher overall costs.

#2 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: As mentioned in our Geico auto insurance review, Geico offers a lower starting rate of $130 per month for Jeep Commander insurance, making it a cost-effective choice for budget-conscious drivers.

- Discounts for Safe Driving: Geico provides substantial discounts for safe driving records and defensive driving courses, which can be beneficial for reducing premiums for your Jeep Commander.

- User-Friendly Digital Tools: Geico’s app and website offer convenient tools for managing your policy and filing claims, making it easier to handle insurance matters for your Jeep Commander.

Cons

- Less Extensive Coverage Options: While Geico offers competitive pricing, its coverage options may not be as comprehensive as those of some other providers, potentially leaving gaps in protection for your Jeep Commander.

- Potential for Higher Rates for Older Vehicles: Geico’s rates may not be as competitive for older Jeep Commander models, which could result in higher premiums as the vehicle ages.

#3 – USAA: Best for Exceptional Service

Pros

- Best Rates for Military Families: As mentioned in our USAA auto insurance review, USAA offers the lowest rate at $110 per month for Jeep Commander insurance, which is especially advantageous for military families and veterans.

- Excellent Customer Service: Known for its exceptional customer service, USAA provides high-quality support and efficient claims handling, which is crucial for managing insurance for your Jeep Commander.

- Generous Discounts: USAA provides various discounts, including those for safe driving and multiple policy holders, which can further reduce the cost of insurance for your Jeep Commander.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members, veterans, and their families, limiting its availability to the general public who may own a Jeep Commander.

- Less Variety in Coverage Options: USAA may offer fewer optional coverage choices compared to some other insurers, potentially limiting customization for your Jeep Commander insurance needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Innovative Programs

Pros

- Customizable Coverage Plans: Progressive offers flexible coverage options for the Jeep Commander, allowing you to tailor your policy to fit specific needs and preferences. (Read More: Progressive Auto Insurance Discounts).

- Discounts for Bundling Policies: Progressive provides significant discounts if you bundle multiple insurance policies, which can lower the overall cost of insuring your Jeep Commander.

- Snapshot Program for Lower Rates: Progressive’s Snapshot program rewards safe driving habits with lower premiums, which can be beneficial if you have a clean driving record with your Jeep Commander.

Cons

- Higher Rates Compared to Some Insurers: Progressive’s rates start at $145 per month, which may be higher than some competitors, potentially impacting your budget if you’re seeking the lowest premium.

- Complexity of Discounts: The variety of discounts offered by Progressive can be complex to navigate, and not all discounts may apply to your specific Jeep Commander insurance situation.

#5 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Allstate provides a broad range of coverage options for the Jeep Commander, including roadside assistance and accident forgiveness, enhancing overall protection.

- Strong Claims Handling: Known for its efficient claims processing, Allstate ensures that any issues with your Jeep Commander are addressed promptly and effectively.

- Discounts for Multiple Vehicles: Allstate offers substantial discounts if you insure multiple vehicles, which can be advantageous if you own more than one car, including a Jeep Commander. Learn more about their discounts in our Allstate auto insurance review.

Cons

- Higher Monthly Premiums: Allstate’s rates are among the highest at $160 per month, which might not be ideal for those seeking more affordable insurance options for their Jeep Commander.

- Variable Customer Service Quality: Customer service experiences with Allstate can vary, which may impact your satisfaction with handling insurance matters for your Jeep Commander.

#6 – Farmers: Best for Customizable Policies

Pros

- Wide Range of Coverage Options: Farmers offers diverse coverage options, including customizable plans and additional features for the Jeep Commander, ensuring tailored protection.

- Discounts for Safe Driving: Farmers provides discounts for maintaining a clean driving record, which can help reduce the insurance cost for your Jeep Commander. Check out this page Farmers auto insurance review to know more details.

- Strong Local Agent Support: Farmers’ extensive network of local agents provides personalized service and support, which can be beneficial for managing your Jeep Commander insurance needs.

Cons

- Higher Premiums: With rates starting at $170 per month, Farmers’ insurance may be more expensive compared to other providers, impacting overall affordability for your Jeep Commander.

- Less Competitive Pricing for Newer Models: Farmers’ rates may not be as competitive for newer Jeep Commander models, potentially resulting in higher premiums for recent purchases.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Good Discounts

Pros

- Extensive Coverage Choices: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual offers a broad array of coverage options for the Jeep Commander, including various add-ons and customization features.

- Good Discounts for Bundling: Liberty Mutual provides substantial discounts if you bundle auto insurance with other types of coverage, which can reduce the overall cost for your Jeep Commander.

- Accident Forgiveness Program: Liberty Mutual’s accident forgiveness program helps prevent premium increases after your first accident, which can be beneficial for maintaining affordable rates.

Cons

- Highest Monthly Premiums: Liberty Mutual’s insurance rates start at $180 per month, making it one of the most expensive options for Jeep Commander coverage.

- Complex Discount Structure: The discount structure at Liberty Mutual can be intricate, potentially making it challenging to maximize savings on your Jeep Commander insurance.

#8 – Nationwide: Best for Strong Ratings

Pros

- Affordable Rates: Nationwide offers competitive rates starting at $140 per month for Jeep Commander insurance, providing a good balance between cost and coverage. For more information, read our Nationwide auto insurance review.

- Various Discount Opportunities: Nationwide provides multiple discounts, including those for safe driving and bundling, which can help lower your insurance costs for the Jeep Commander.

- Solid Coverage Options: Nationwide offers comprehensive coverage options and additional features like roadside assistance, enhancing overall protection for your Jeep Commander.

Cons

- Higher Rates for Newer Models: Nationwide’s rates might be higher for newer Jeep Commander models, which could impact affordability if you own a recent model.

- Customer Service Variability: Customer service experiences with Nationwide can be inconsistent, which may affect your satisfaction with managing your Jeep Commander insurance.

#9 – Amica: Best for High Satisfaction

Pros

- Competitive Pricing: As outlined in our Amica auto insurance review, Amica offers competitive rates for Jeep Commander insurance starting at $150 per month, providing a good value for the coverage offered.

- Excellent Customer Service: Amica is known for its high-quality customer service, ensuring efficient and effective handling of any insurance issues for your Jeep Commander.

- Discounts for Safe Driving: Amica provides discounts for maintaining a clean driving record, which can help reduce insurance premiums for your Jeep Commander.

Cons

- Limited Discounts for Vehicle Safety Features: Amica may offer fewer discounts for advanced safety features on your Jeep Commander compared to some other insurers, potentially impacting overall savings.

- Higher Rates for Older Vehicles: Amica’s rates might be less competitive for older Jeep Commander models, which could result in higher premiums as the vehicle ages.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Erie: Best for Affordable Rates

Pros

- Lowest Monthly Rate: As mentioned in our Erie auto insurance review, Erie offers the lowest starting rate at $120 per month for Jeep Commander insurance, making it an affordable option for many drivers.

- Comprehensive Coverage: Erie provides a range of coverage options, including comprehensive and collision, which ensures robust protection for your Jeep Commander.

- Discounts for Bundling and Safe Driving: Erie offers discounts for bundling multiple policies and maintaining a clean driving record, which can further reduce your insurance costs.

Cons

- Availability Limited by Location: Erie’s insurance services may not be available in all regions, potentially limiting access for some Jeep Commander owners.

- Customer Service Variability: Erie’s customer service can vary, which may affect your overall experience with handling insurance claims and policy management.

Jeep Commander Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Jeep Commander from various providers.

Jeep Commander Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $90 $160

Amica $87 $150

Erie $73 $120

Farmers $95 $170

Geico $70 $130

Liberty Mutual $100 $180

Nationwide $80 $140

Progressive $75 $145

State Farm $85 $150

USAA $60 $110

Overall, USAA offers the most affordable rates for Jeep Commander insurance, with competitive pricing for both minimum and full coverage. For a balance between cost and comprehensive protection, Erie and Geico are also strong contenders, providing attractive rates across various coverage levels.

Top Jeep Commander Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

For Jeep Commander insurance, opting for high deductibles can significantly lower your rates, while teen drivers and high-risk profiles face considerably higher costs. Overall, choosing a higher deductible and maintaining a clean driving record can help reduce insurance expenses.

Read More: Do points affect auto insurance rates?

Jeep Commander Cost Comparison

The chart below details how Jeep Commander insurance rates compare to other SUVs like the BMW X3, Kia Sorento, and Lexus LX 570.

Jeep Commander Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| BMW X3 | $31 | $55 | $31 | $130 |

| Kia Sorento | $27 | $47 | $31 | $118 |

| Lexus LX 570 | $37 | $70 | $33 | $153 |

| Dodge Journey | $27 | $44 | $31 | $115 |

| Volvo XC60 | $26 | $45 | $28 | $110 |

| Acura RDX | $26 | $44 | $26 | $108 |

When comparing Jeep Commander insurance rates to other SUVs like the BMW X3 and Lexus LX 570, the Commander generally offers more affordable coverage. Its costs are competitive, often lower than those of many similar SUVs.

Read More: Cheap Lexus Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Influencing Jeep Commander Insurance Cost

The cost of insuring a Jeep Commander can be significantly impacted by various factors, including the specific trim and model you select. Higher trims with more advanced features may result in higher insurance premiums due to increased repair costs and higher vehicle values.

Newer models with advanced safety technology might qualify for discounts, while older or less equipped models might offer lower insurance rates.Ty Stewart LICENSED INSURANCE AGENT

Other factors such as your driving history, location, and age can also affect insurance costs. By comparing different trims and models, as well as leveraging available discounts, you can find the most cost-effective insurance solution for your Jeep Commander.

Age of the Vehicle

Insurance rates for the 2010 Jeep Commander are notably lower compared to newer models. The breakdown of costs for comprehensive, collision, and liability coverage shows lower premiums for older models.

Jeep Commander Auto Insurance Monthly Rates by Year & Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Jeep Commander | $30 | $55 | $40 | $125 |

| 2023 Jeep Commander | $29 | $53 | $39 | $123 |

| 2022 Jeep Commander | $28 | $51 | $39 | $121 |

| 2021 Jeep Commander | $27 | $49 | $38 | $119 |

| 2020 Jeep Commander | $26 | $47 | $38 | $117 |

| 2019 Jeep Commander | $25 | $45 | $37 | $115 |

| 2018 Jeep Commander | $24 | $43 | $36 | $113 |

| 2017 Jeep Commander | $23 | $41 | $36 | $110 |

| 2016 Jeep Commander | $22 | $39 | $35 | $108 |

| 2010 Jeep Commander | $20 | $29 | $39 | $100 |

Older Jeep Commander models generally cost less to insure. For example, the insurance costs for a 2010 Jeep Commander are notably lower compared to newer models.

Driver Age

Driver age can have a significant impact on Jeep Commander auto insurance rates. For example, 20-year-old drivers pay approximately $122 more per month for their Jeep Commander auto insurance compared to 30-year-old drivers.

Top Jeep Grand Cherokee Auto Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

Driver age greatly affects Jeep Commander insurance rates, with younger drivers paying significantly more. For instance, teen drivers face much higher premiums compared to those in their 30s or older.

Driver Location

Where you live or changing your address affects auto insurance rates on your Jeep Commander. For example, drivers in Los Angeles may pay $86 more per month than drivers in Indianapolis.

Jeep Commander Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $171 |

| New York, NY | $158 |

| Houston, TX | $157 |

| Jacksonville, FL | $145 |

| Philadelphia, PA | $134 |

| Chicago, IL | $132 |

| Phoenix, AZ | $116 |

| Seattle, WA | $97 |

| Indianapolis, IN | $85 |

| Columbus, OH | $83 |

Driver location significantly impacts Jeep Commander insurance rates, with drivers in cities like Los Angeles facing much higher premiums compared to those in places like Indianapolis. This variation highlights the importance of considering local factors when assessing insurance costs.

Your Driving Record

The chart reveals how driving record violations impact Jeep Commander insurance rates across various age groups. It highlights that younger drivers, especially those with violations, experience the steepest increases in premiums.

Jeep Commander Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $407 | $580 | $640 | $520 |

| Age: 20 | $345 | $490 | $560 | $450 |

| Age: 30 | $111 | $210 | $240 | $190 |

| Age: 40 | $102 | $200 | $220 | $170 |

| Age: 50 | $95 | $180 | $200 | $160 |

| Age: 60 | $90 | $170 | $190 | $150 |

Your driving record significantly affects Jeep Commander insurance rates, with teens and drivers in their 20s facing the highest increases. Violations and accidents can lead to much higher premiums compared to those with clean records.

Jeep Commander Safety Ratings

The chart details how the safety ratings of the Jeep Commander affect its insurance rates. Each test type, from small overlap front to roof strength, contributes to the overall insurance cost.

Jeep Commander Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Marginal |

| Small overlap front: passenger-side | Poor |

| Moderate overlap front | Good |

| Side | Acceptable |

| Roof strength | Good |

| Head restraints and seats | Good |

The Jeep Commander’s safety ratings directly influence insurance costs, with each test impacting premiums. Reviewing these ratings can help you understand potential insurance savings or increases.

Jeep Commander Crash Test Ratings

The Jeep Commander’s crash test ratings play a significant role in determining insurance rates. The breakdown of its performance across various test categories highlights how safety ratings can impact your overall premiums.

Jeep Commander Crash Test Ratings by Model Year

| Model Year | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2023 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2022 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2021 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2020 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2019 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2018 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2017 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

| 2016 Jeep Commander | 4 stars | 5 stars | 3 stars | 3 stars |

The Jeep Commander’s crash test ratings impact insurance costs, with lower ratings potentially leading to higher premiums. Ensuring strong safety ratings can help reduce your overall insurance expenses.

Jeep Commander Safety Features

The more safety features you have on your Jeep Commander, the more likely it is that you can earn a discount. The Jeep Commander’s safety features include:

- Advanced Safety Features: Includes 4-wheel anti-lock disc brakes, traction control, and electronic stability program.

- Comprehensive Airbag System: Equipped with advanced multistage front airbags, side airbags, and front & rear side curtain airbags.

- Child Safety: Features LATCH-ready anchor system, upper tether anchorages, and rear door child safety locks.

- Driver Assistance: ParkSense rear park assist system and tire pressure monitoring warning.

- Enhanced Visibility: Dual note horn for increased alertness.

The extensive safety features of the Jeep Commander not only enhance overall protection but also increase eligibility for potential insurance discounts. Leveraging these features can contribute to both safer driving and lower insurance costs.

Jeep Commander Finance and Insurance Cost

If you are financing a Jeep Commander, you will pay more if you purchase Jeep Commander auto insurance at the dealership, so be sure to shop around and compare Jeep Commander auto insurance quotes from the best auto insurance companies using our free tool below.

5 Ways to Save on Jeep Commander Insurance

Here are some effective ways to lower your Jeep Commander insurance rates. Implement these tips to potentially reduce costs and enhance safety.

- Enroll your teen driver in usage-based insurance.

- Move to the countryside.

- Buy a dashcam for your Jeep Commander.

- Audit your Jeep Commander driving when you move to a new location or start a new job.

- Buy winter tires for your Jeep Commander.

Read More: What are the benefits of a dashcam?

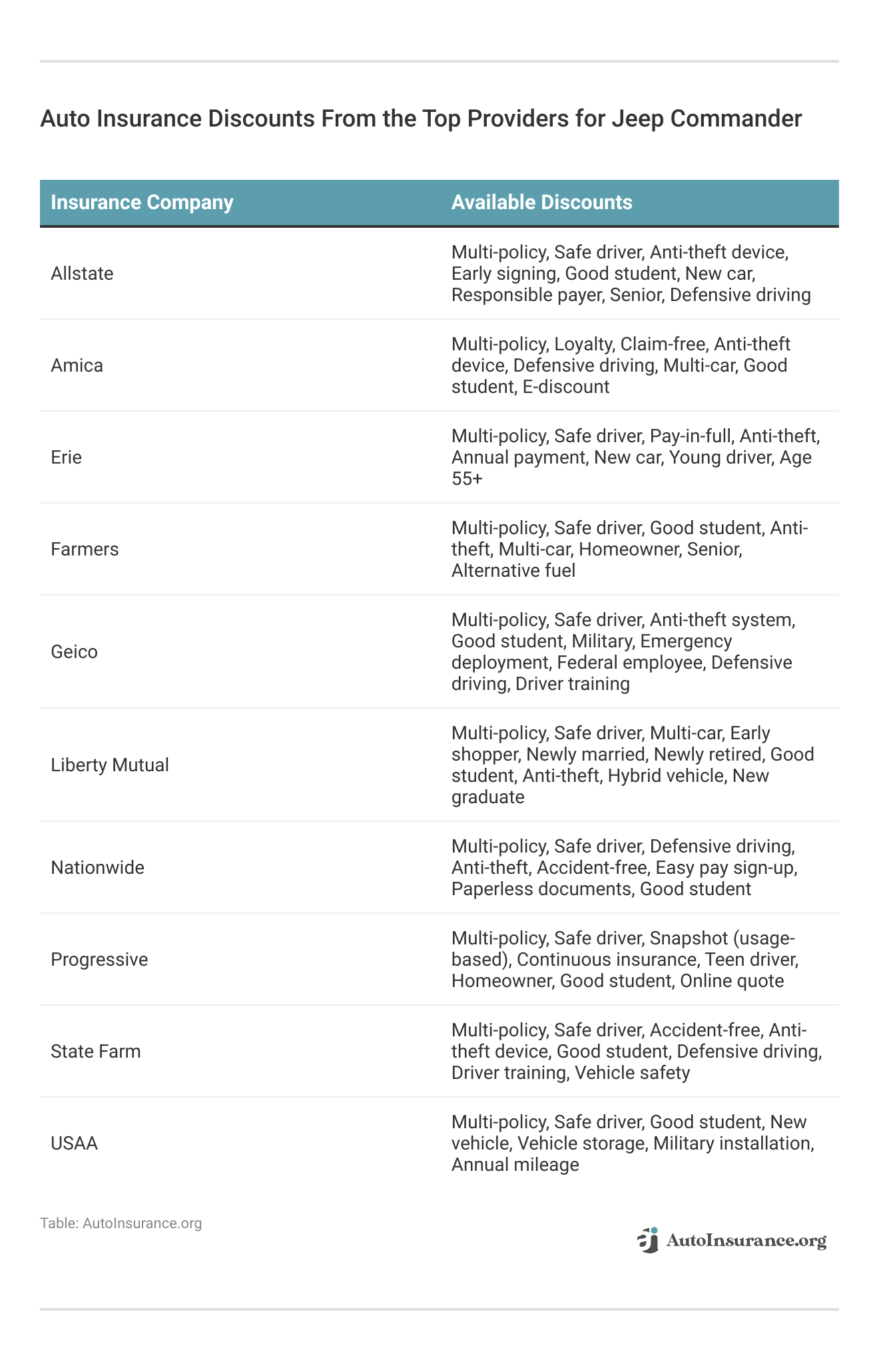

Discover the variety of car insurance discounts offered by top providers for Jeep Commander to help you save on your premiums.

These discounts from top insurance providers for Jeep Commander offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Jeep Commander Insurance Companies

Several insurance companies offer cheap Jeep auto insurance rates based on factors like discounts for safety features. Take a look at these top auto insurance companies that are popular with Jeep Commander drivers organized by market share.

Top Jeep Commander Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

The top insurance companies offer competitive rates for Jeep Commander coverage, influenced by market share and available discounts. Comparing quotes from these leading providers can help you find the best value for your insurance needs.

Compare Free Jeep Commander Insurance Quotes Online

Compare Jeep Commander insurance coverage options and get free online auto insurance quotes to uncover the best rates and potential savings. By evaluating multiple providers, you can identify which companies offer the most competitive rates and the best coverage options tailored to your needs.

Don’t miss out on potential discounts and lower premiums—start comparing today. To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

Why should I consider State Farm for Jeep Commander insurance?

State Farm is often considered the top pick for Jeep Commander insurance due to its competitive rates and comprehensive coverage options, making it a strong choice for affordable and reliable protection.

Read More: State Farm Auto Insurance Discounts

How does my location affect Jeep Commander insurance rates?

Your location impacts Jeep Commander insurance rates due to factors like local crime rates and accident frequency. Urban areas typically have higher premiums compared to rural locations.

Can I find cheap insurance rates for my Jeep Commander?

Yes, if you are a good driver with a mature driving record, you may be able to find cheap insurance rates for your Jeep Commander. Some drivers have reported rates as low as $706 per year.

What are the average insurance costs for a Jeep Commander?

The average insurance costs for a Jeep Commander are $1,202 per year or $100 per month. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Are there discounts available for the Best Jeep Commander Auto Insurance?

Yes, discounts are available for the Best Jeep Commander Auto Insurance. These can include savings for advanced safety features, a good driver auto insurance discount, and bundling multiple policies with the same provider.

How do Jeep Commander insurance rates compare to other SUVs?

Jeep Commander insurance rates are generally cheaper compared to other SUVs. However, the specific rates can vary depending on factors such as the model and trim of your Jeep Commander.

What factors impact the cost of Jeep Commander insurance?

Several factors can impact the cost of Jeep Commander insurance. These include the age of the vehicle, driver age, driver location, driving record, and safety ratings of the Jeep Commander.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

How can I save on Jeep Commander insurance?

To save on Jeep Commander insurance, compare quotes, raise deductibles, and use available discounts. A good driving record and added safety features can also reduce your premiums.

How does choosing a higher deductible affect the cost of Jeep Commander insurance?

Opting for a higher deductible generally lowers your monthly insurance premium. This means you’ll pay more out of pocket if you need to file a claim, but you’ll save on monthly costs

Read More: How to File an Auto Insurance Claim

Is full coverage recommended for a Jeep Commander?

Full coverage is recommended for a Jeep Commander to protect against extensive damages and theft. It includes liability, collision, and comprehensive coverage, offering broader protection.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.