Best Kia Niro Plug-In Hybrid Auto Insurance in 2025 (Check Out These 10 Companies)

State Farm, AAA, and Allstate are the top picks for the best Kia Niro Plug-In Hybrid auto insurance, offering competitive rates starting at $28 a month. These providers are recognized for their comprehensive coverage options, exceptional customer service, and tailored policies for Niro Plug-In Hybrid owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Kia Niro Plug-In Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Kia Niro Plug-In Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews

Company Facts

Full Coverage for Kia Niro Plug-In Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Kia Niro Plug-In Hybrid auto insurance are State Farm, AAA, and Allstate, renowned for their robust coverage options and exceptional service

These companies excel in meeting the specific needs of Kia Niro Plug-In Hybrid owners, offering tailored policies that provide both comprehensive protection and value. Learn more by reading our guide titled, “What are the benefits of auto insurance?“

Our Top 10 Company Picks: Best Kia Niro Plug-In Hybrid Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 12% B Many Discounts State Farm

#2 10% A Online Convenience AAA

#3 15% A+ Cheap Rates Allstate

#4 18% A++ Add-on Coverages Geico

#5 16% A++ Customizable Polices USAA

#6 13% A+ Military Savings Progressive

#7 14% A++ Accident Forgiveness Travelers

#8 11% A Local Agents Farmers

#9 17% A+ Usage Discount Nationwide

#10 19% A Online App Liberty Mutual

When searching for insurance, factors such as location, driving history, and vehicle features play a critical role in determining your premiums. By focusing on these providers, drivers can ensure they receive top-tier insurance support that enhances their driving experience and safety.

To see fast, free Kia Niro Plug-In Hybrid insurance quotes right now, just enter your ZIP code above.

- State Farm is the top pick for Kia Niro Plug-In Hybrid auto insurance

- Insurance for the Kia Niro Plug-In Hybrid factors in hybrid-specific repairs

- Coverage includes benefits tailored to the safety features of the Kia Niro

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Benefits: State Farm offers significant bundling discounts, appealing to Kia Niro Plug-In Hybrid owners looking to insure multiple vehicles or combine different policies.

- Low-Mileage Advantage: Owners of Kia Niro Plug-In Hybrids benefit from State Farm’s substantial low-mileage discounts, ideal for eco-friendly drivers who use their vehicles less frequently.

- Varied Coverage Options: State Farm provides a wide array of coverage options, allowing Kia Niro Plug-In Hybrid owners to customize their insurance based on specific needs. Discover insights in our guide titled, State Farm auto insurance review.

Cons

- Comparatively Lower Multi-Policy Discounts: State Farm’s multi-policy discounts are less competitive than others, which may be a concern for Kia Niro Plug-In Hybrid owners looking for the best savings.

- Higher Premiums for Certain Coverages: Despite the available discounts, premiums for some coverage levels can still be relatively high at State Farm for Kia Niro Plug-In Hybrid owners.

#2 – AAA: Best for Online Convenience

Pros

- Streamlined Online Services: AAA offers easy online services for Kia Niro Plug-In Hybrid insurance, making policy management and claims handling convenient.

- Robust Member Benefits: Owners of the Kia Niro Plug-In Hybrid can enjoy AAA’s range of membership benefits, including travel discounts and roadside assistance.

- Reliable Coverage: With an A.M. Best rating of A, AAA provides dependable coverage options tailored for Kia Niro Plug-In Hybrid owners. See more details in our guide titled, “AAA Auto Insurance Review.”

Cons

- Slightly Lower Multi-Vehicle Discounts: AAA’s multi-vehicle discounts are slightly less than competitors, at 10%, which might not be as attractive for Kia Niro Plug-In Hybrid owners with multiple cars.

- Online Dependency: The heavy reliance on online platforms might disadvantage those Kia Niro Plug-In Hybrid owners who prefer in-person interactions or have limited internet access.

#3 – Allstate: Best for Cheap Rates

Pros

- Competitive Pricing: Allstate offers some of the lowest rates for Kia Niro Plug-In Hybrid insurance, backed by an A.M. Best rating of A+. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Highest Multi-Vehicle Discount: With a 15% discount for multiple vehicles, Allstate is particularly attractive for Kia Niro Plug-In Hybrid owners insuring more than one car.

- Comprehensive Protection: Allstate’s policies provide extensive coverage options that cater to the unique aspects of insuring a hybrid vehicle like the Kia Niro Plug-In Hybrid.

Cons

- Variable Premiums: Despite generally low rates, premiums at Allstate can vary widely based on specific factors like the Kia Niro Plug-In Hybrid’s trim and the owner’s driving history.

- Coverage Limitations: Some specific coverages desired by Kia Niro Plug-In Hybrid owners may not be as comprehensive or flexible compared to those offered by higher-ranked competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Add-on Coverages

Pros

- Extensive Add-on Options: Geico offers a wide range of add-on coverages, which is ideal for Kia Niro Plug-In Hybrid owners looking to tailor their policies with specific protections like mechanical breakdown insurance.

- Highest Multi-Vehicle Discount: At 18%, Geico provides the highest discount for multi-vehicle policies, benefiting Kia Niro Plug-In Hybrid owners with multiple cars.

- Superior Financial Strength: With an A.M. Best rating of A++, Geico ensures reliability and trust in its ability to handle claims for Kia Niro Plug-In Hybrid insurance. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

Cons

- Premium Cost Variability: Despite offering broad coverage options, Geico’s premiums can be inconsistent, with Kia Niro Plug-In Hybrid owners potentially facing higher rates based on their location and driving records.

- Add-on Costs: While extensive, the add-on coverages can become costly, which might deter some Kia Niro Plug-In Hybrid owners from fully customizing their insurance packages.

#5 – USAA: Best for Customizable Policies

Pros

- Tailored Insurance Solutions: USAA offers highly customizable policy options that cater well to the specific needs of Kia Niro Plug-In Hybrid owners, particularly military families.

- Strong Financial Rating: With an A.M. Best rating of A++, USAA guarantees excellent financial stability and dependable claim support for Kia Niro Plug-In Hybrid insurance.

- Competitive Multi-Vehicle Discounts: USAA’s 16% discount on multi-vehicle policies is advantageous for Kia Niro Plug-In Hybrid owners with multiple cars. Unlock details in our guide titled, USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA’s services are only available to military members and their families, which limits accessibility for a broader range of Kia Niro Plug-In Hybrid owners.

- Customization Costs: While policy customization is a significant advantage, it can lead to higher costs as more specific add-ons and coverages are included in the Kia Niro Plug-In Hybrid insurance plan.

#6 – Progressive: Best for Military Savings

Pros

- Dedicated Discounts for Military: Progressive offers special discounts for military personnel, making it a viable option for Kia Niro Plug-In Hybrid owners serving in the armed forces.

- Strong Online Tools: Progressive’s robust online tools facilitate easy management and customization of Kia Niro Plug-In Hybrid insurance policies. Delve into our evaluation of Progressive auto insurance review.

- Generous Multi-Vehicle Discount: The 13% multi-vehicle discount allows significant savings for Kia Niro Plug-In Hybrid owners insuring multiple vehicles.

Cons

- Rate Fluctuations: Progressive’s rates can fluctuate, potentially affecting Kia Niro Plug-In Hybrid owners based on factors like changes in regional legislation or personal driving history.

- Limited Military Discount Availability: While offering military savings, these discounts are not as extensive or widely applicable as those provided by other insurers like USAA, limiting their benefit for some Kia Niro Plug-In Hybrid owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Travelers offers an accident forgiveness feature that can prevent premium increases after your first accident, a valuable benefit for Kia Niro Plug-In Hybrid owners.

- High Multi-Vehicle Discount: With a 14% discount for insuring multiple vehicles, Travelers appeals to Kia Niro Plug-In Hybrid owners looking to insure more than one car. See more details in our guide titled, “Travelers Auto Insurance Review.”

- Extensive Coverage Options: Travelers provides a wide range of coverage options, allowing for comprehensive insurance solutions tailored to the needs of Kia Niro Plug-In Hybrid owners.

Cons

- Higher Base Premiums: Travelers may have higher base premiums compared to some competitors, which could be a downside for cost-conscious Kia Niro Plug-In Hybrid owners.

- Complex Policy Terms: Some Kia Niro Plug-In Hybrid owners might find Travelers’ policy terms and conditions complex, potentially complicating the claims process and coverage understanding.

#8 – Farmers: Best for Local Agents

Pros

- Personalized Service via Local Agents: Farmers utilizes local agents to provide personalized service, making it easier for Kia Niro Plug-In Hybrid owners to get tailored advice and assistance.

- Consistent Coverage: Farmers offers consistent and reliable coverage options that cater specifically to the needs of hybrid vehicle owners like those of the Kia Niro Plug-In Hybrid.

- Good Multi-Vehicle Discount: With an 11% discount for multiple vehicles, Farmers is a competitive choice for Kia Niro Plug-In Hybrid owners insuring more than one car. More information is available about this provider in our Farmers auto insurance review.

Cons

- Limited Availability of Discounts: Compared to other insurers, Farmers may offer fewer overall discounts, which could limit the savings potential for Kia Niro Plug-In Hybrid insurance.

- Premium Costs Can Be Higher: Despite the benefits of local agent support, the premium costs at Farmers can be higher, potentially making it less attractive for budget-conscious Kia Niro Plug-In Hybrid owners.

#9 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Discounts: Nationwide offers significant discounts for Kia Niro Plug-In Hybrid owners who opt for usage-based insurance, perfect for those who drive less.

- High Multi-Vehicle Discount: A 17% discount on multi-vehicle policies makes Nationwide a great option for Kia Niro Plug-In Hybrid owners with multiple cars. Read up on the Nationwide auto insurance review for more information.

- Flexible Coverage Options: Nationwide allows Kia Niro Plug-In Hybrid owners to choose from a variety of flexible coverage options, enabling them to precisely meet their insurance needs.

Cons

- Variable Rate Adjustments: Nationwide’s premiums can vary more than some competitors, potentially affecting Kia Niro Plug-In Hybrid owners with changes in driving habits or personal circumstances.

- Usage Tracking Required: To benefit from usage-based discounts, Kia Niro Plug-In Hybrid owners must agree to track their driving habits, which might not appeal to everyone due to privacy concerns.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Online App

Pros

- Advanced Online App: Liberty Mutual provides an advanced online app that facilitates easy policy management and claims filing for Kia Niro Plug-In Hybrid owners. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Highest Multi-Vehicle Discount: With a 19% discount, Liberty Mutual offers the highest multi-vehicle discount, making it a particularly cost-effective option for those insuring multiple vehicles.

- Tailored Hybrid Vehicle Coverage: Liberty Mutual offers specific coverages that are tailored to the needs of hybrid vehicles like the Kia Niro Plug-In Hybrid, including battery coverage.

Cons

- Premium Variability: While offering competitive discounts, Liberty Mutual’s premiums can vary widely, which may impact Kia Niro Plug-In Hybrid owners depending on factors like their location and driving history.

- Online Dependency: The heavy reliance on digital tools might not suit all Kia Niro Plug-In Hybrid owners, especially those who prefer traditional, face-to-face insurance interactions.

Kia Niro Plug-In Hybrid Insurance Cost Breakdown

When selecting auto insurance for your Kia Niro Plug-In Hybrid, understanding the cost differences between minimum and full coverage options is crucial. Below, you’ll find a detailed table that compares monthly rates from various providers, giving you a clear picture of what you can expect to pay depending on your chosen level of protection.

Kia Niro Plug-In Hybrid Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $45 $143

Allstate $55 $171

Farmers $76 $238

Geico $28 $89

Liberty Mutual $42 $135

Nationwide $55 $174

Progressive $43 $141

State Farm $38 $116

Travelers $49 $151

USAA $52 $156

The table below showcases the monthly rates for both minimum and full coverage across several major insurance companies for the Kia Niro Plug-In Hybrid.

For example, Geico offers the most affordable rates, with minimum coverage starting at just $28 and full coverage at $89 per month. Discover insights in our guide titled, “What is full coverage auto insurance?“

On the higher end, Farmers charges $76 for minimum coverage and $238 for full coverage, reflecting the broader spectrum of pricing available in the market. This variance highlights the importance of comparing rates to find the best fit for your insurance needs and budget.

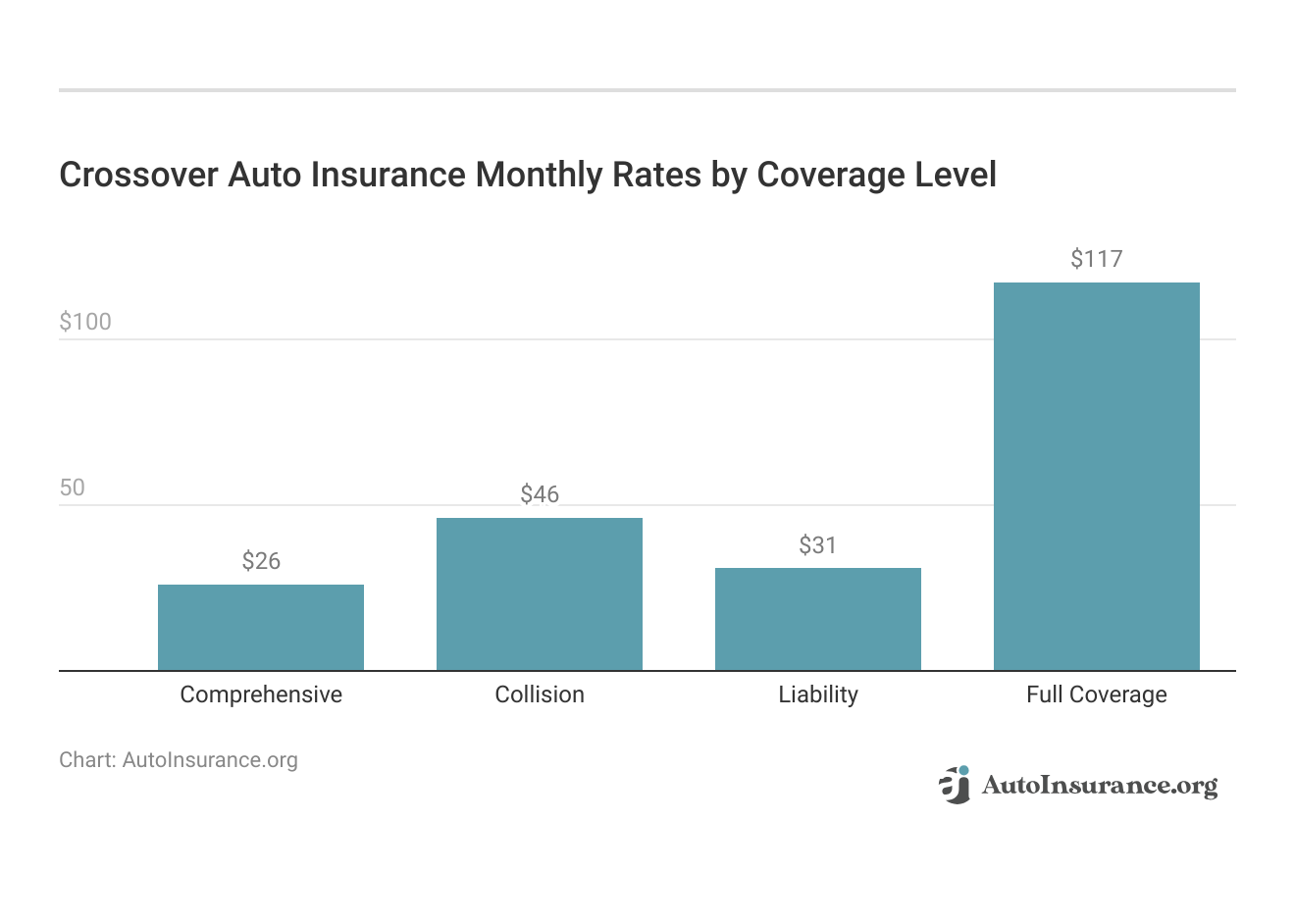

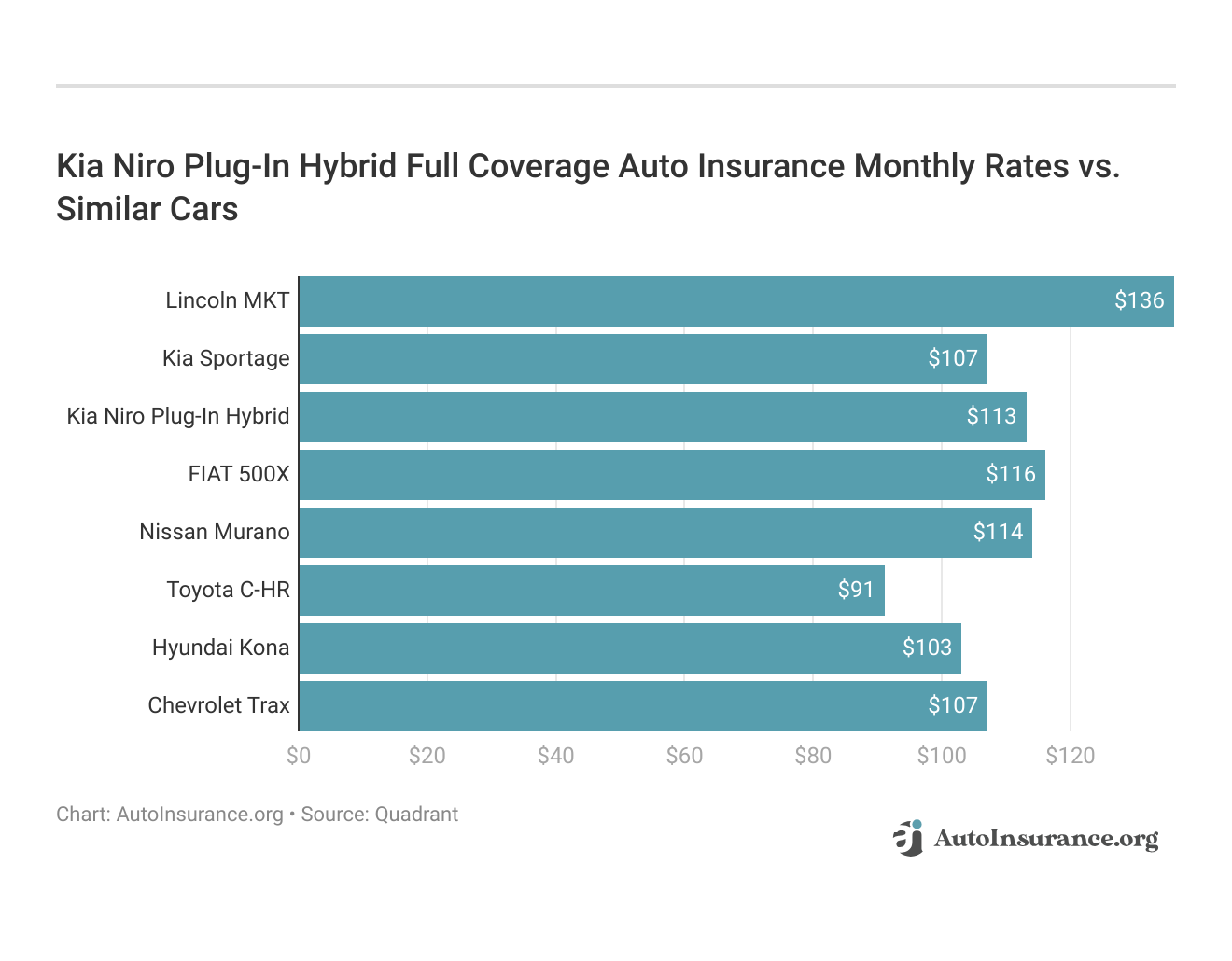

Are Vehicles Like the Kia Niro Plug-In Hybrid Expensive to Insure

When considering the purchase of a hybrid vehicle like the Kia Niro Plug-In Hybrid, potential buyers often wonder about the insurance costs associated with such models. Comparing these costs to other similar crossovers can provide valuable insights.

Understanding the insurance costs for hybrid vehicles like the Kia Niro Plug-In Hybrid helps in making an informed decision.

For Kia Niro Plug-In Hybrid owners, State Farm offers not just insurance, but peace of mind through their comprehensive and tailored policies.Chris Abrams Licensed Insurance Agent

By examining the rates for similar models, one can better anticipate the financial commitment required for insuring such vehicles. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

The data presented demonstrates the variability in insurance costs among vehicles that share similar features with the Kia Niro Plug-In Hybrid. Understanding these comparisons can guide consumers in making informed decisions about which vehicle might offer the most affordable insurance rates.

Insurance Rates for Vehicles Similar to the Kia Niro Plug-In Hybrid

Insurance rates can vary significantly between vehicles, even within the same vehicle category. Below, we compare the comprehensive, collision, and liability costs for vehicles similar to the Kia Niro Plug-In Hybrid to provide a broader context on potential insurance expenses.

Kia Niro Plug-In Hybrid Auto Insurance Monthly Rates vs. Similar Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Kia Niro Plug-In Hybrid | $24 | $38 | $28 | $100 |

| Cadillac SRX | $26 | $51 | $36 | $126 |

| Ford Escape | $23 | $37 | $26 | $98 |

| Hyundai Kona | $23 | $42 | $26 | $103 |

| Lexus RX 450h | $33 | $60 | $35 | $142 |

| Infiniti QX70 | $31 | $63 | $35 | $142 |

| Honda CR-V | $23 | $34 | $26 | $95 |

| Toyota Venza | $22 | $40 | $37 | $112 |

| Honda HR-V | $25 | $44 | $31 | $113 |

Evaluating insurance costs for comparable vehicles, like the Hyundai Kona and Lexus RX 450h, offers insightful perspectives into what one might expect to pay for the Kia Niro Plug-In Hybrid. These comparisons assist in making informed decisions about which vehicle might offer the most cost-effective insurance rates based on individual coverage needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Kia Niro Plug-In Hybrid Insurance

The Kia Niro Plug-In Hybrid trim and model you choose can impact the total price you will pay for Kia Niro Plug-In Hybrid insurance coverage.

You can also expect your Kia Niro Plug-In Hybrid rates to be affected by where you live, your driving history, and in most states your age and gender. To find out more, explore our guide titled, “Top 7 Factors That Affect Auto Insurance Rates.”

How Much Is the Kia Niro Plug-In Hybrid

The MSRP for a Kia Niro Plug-In Hybrid is listed as $24,690. Of course, this cost will vary depending on the trim level of the Kia Niro Plug-In Hybrid you choose and any dealer incentives that might be available to you. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Kia Niro Plug-In Hybrid Crash Test Ratings

Crash test ratings are a crucial factor in determining insurance rates for vehicles, including the Kia Niro Plug-In Hybrid. Below is an overview of the crash test results for recent model years of the Kia Niro Plug-In Hybrid, which can influence the cost of its car insurance.

Kia Niro Plug-In Hybrid Auto Insurance Monthly Rates vs. Similar Cars by Coverage Type

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Kia Niro Plug-In Hybrid SUV FWD | N/R | N/R | N/R | N/R |

| 2023 Kia Niro Plug-In Hybrid SUV FWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Kia Niro Plug-In Hybrid SUV FWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Kia Niro Plug-In Hybrid SUV FWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Kia Niro Plug-In Hybrid SUV FWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Kia Niro Plug-In Hybrid SUV FWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2018 Kia Niro Plug-In Hybrid SUV FWD | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

Understanding the crash test ratings for the Kia Niro Plug-In Hybrid is essential for assessing potential insurance costs. The consistent rating across different years highlights factors that insurers consider when setting premiums, ensuring that buyers are well-informed about their vehicle’s safety performance.

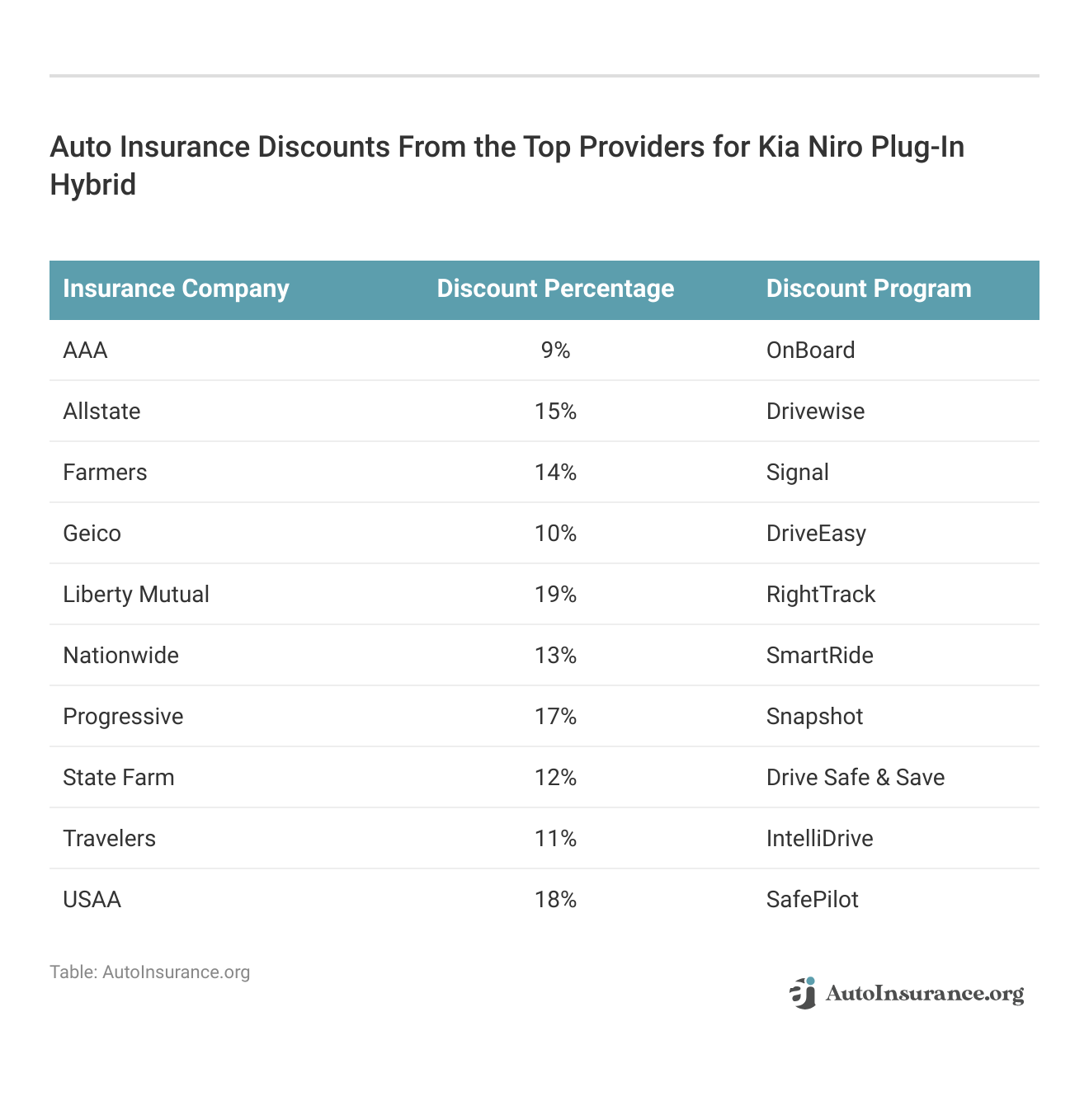

Ways to Save on Kia Niro Plug-In Hybrid Insurance

Save more on your Kia Niro Plug-In Hybrid car insurance rates. Take a look at the following five strategies that will get you the best Kia Niro Plug-In Hybrid auto insurance rates possible.

- Wait six years for accidents to disappear from your record.

- Ask for a higher deductible for your Kia Niro Plug-In Hybrid insurance policy.

- Make sure you use an accredited driver safety program.

- Choose a Kia Niro Plug-In Hybrid with cheaper repair costs.

- Use an accurate job title when requesting Kia Niro Plug-In Hybrid auto insurance.

Implementing these strategies can lead to significant savings on your Kia Niro Plug-In Hybrid insurance. Learn more by reading our guide, “What is the average auto insurance cost per month?“

By proactively managing factors such as deductibles, driving records, and vehicle choice, you can enjoy more affordable insurance rates tailored to your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

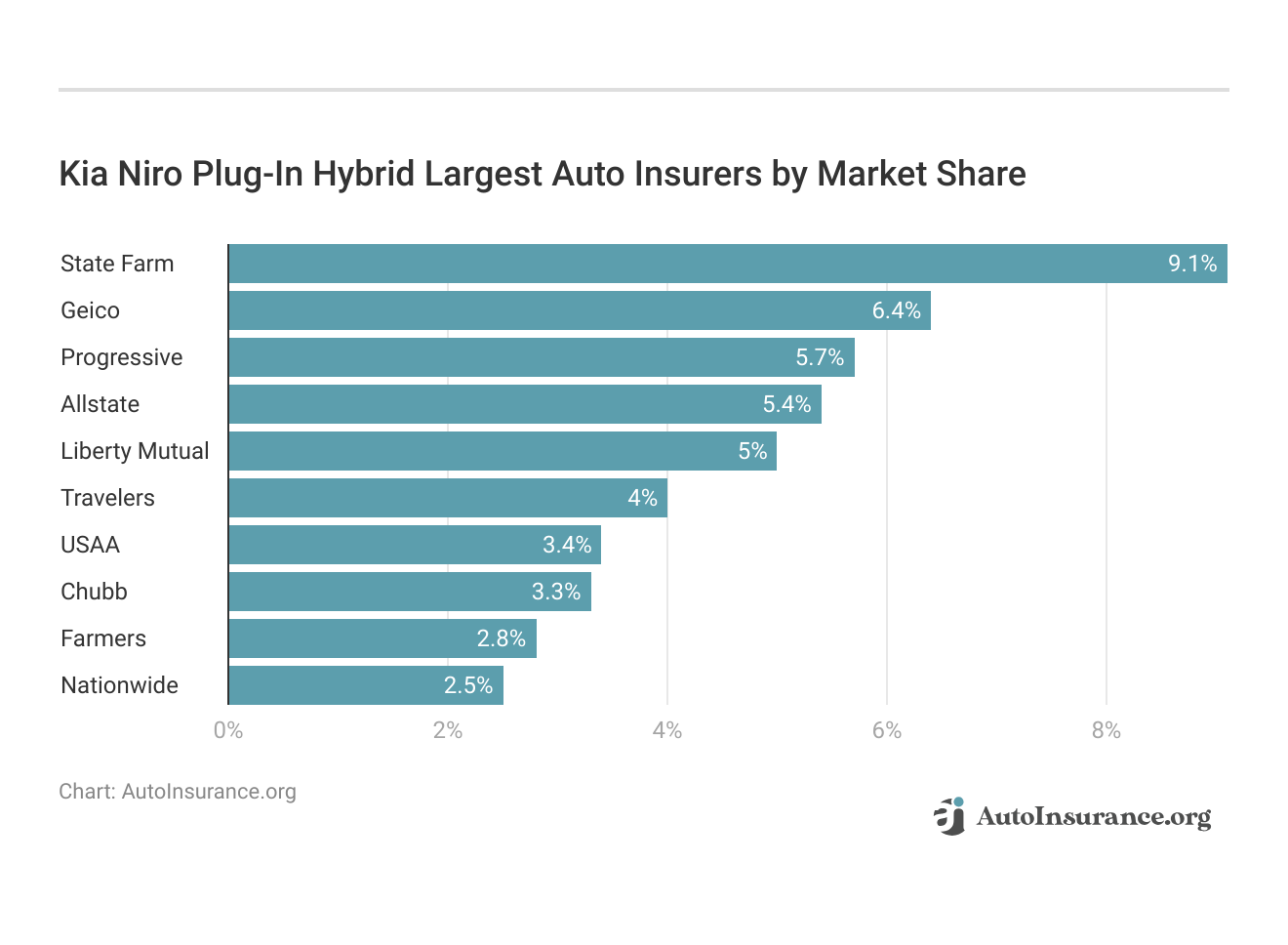

Top Kia Niro Plug-In Hybrid Insurance Companies

Choosing the right auto insurance provider for a Kia Niro Plug-In Hybrid involves understanding which companies offer the most competitive rates and the best coverage. Here’s a look at the largest auto insurers by market share, focusing on those that cater well to Kia Niro Plug-In Hybrid owners.

The market share of insurers like State Farm, Geico, and Progressive highlights their popularity and potential reliability for providing auto insurance for the Kia Niro Plug-In Hybrid.

Choosing State Farm means choosing a provider that understands the unique needs of Kia Niro Plug-In Hybrid drivers.Michelle Robbins Licensed Insurance Agent

Comparing these companies can help you find the most suitable coverage, taking advantage of any available discounts for safety features and security systems specific to the Kia Niro Plug-In Hybrid.

Largest Auto Insurers by Market Share

Understanding the landscape of the auto insurance market is essential for discerning the influence and reach of top insurers. Here, we outline the largest auto insurers by market share, highlighting their dominance and competitive positions within the industry. To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

Kia Niro Plug-In Hybrid Largest Auto Insurers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Allstate | $39.2 million | 5.4% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20.0 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

This ranking of the largest auto insurers by market share illustrates the significant role these companies play in the auto insurance sector. Analyzing their market positions helps consumers and stakeholders gauge the stability and breadth of services offered by these leading firms.

You can compare quotes for Kia Niro Plug-In Hybrid auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

What is Kia Niro Plug-In Hybrid auto insurance?

Kia Niro Plug-In Hybrid auto insurance refers to the insurance coverage specifically designed for the Kia Niro Plug-In Hybrid model. It provides financial protection in case of accidents, damages, theft, or other incidents involving the Kia Niro Plug-In Hybrid.

For additional details, explore our comprehensive resource titled, “Best Auto Insurance for Hybrid Vehicles.”

Is auto insurance mandatory for a Kia Niro Plug-In Hybrid?

Yes, auto insurance is mandatory for all vehicles, including the Kia Niro Plug-In Hybrid. The specific insurance requirements may vary depending on your location and local regulations. It’s important to comply with the legal requirements and have the necessary insurance coverage for your Kia Niro Plug-In Hybrid.

What types of coverage are available for Kia Niro Plug-In Hybrid auto insurance?

Kia Niro Plug-In Hybrid auto insurance typically offers a range of coverage options. These may include liability coverage (which is often required by law), collision coverage (for damages caused by collisions), comprehensive coverage (for non-collision-related damages like theft or vandalism), uninsured/underinsured motorist coverage, and personal injury protection (PIP) coverage.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

How can I find affordable auto insurance for my Kia Niro Plug-In Hybrid?

To find affordable auto insurance for your Kia Niro Plug-In Hybrid, it’s recommended to shop around and obtain quotes from multiple insurance providers. Factors such as your driving record, age, location, and the coverage options you choose can affect the cost of insurance. Comparing quotes, considering available discounts, and maintaining a good driving record can help you find more affordable rates.

Are there any discounts available specifically for Kia Niro Plug-In Hybrid auto insurance?

While specific discounts can vary among insurance providers, many companies offer discounts that may apply to Kia Niro Plug-In Hybrid auto insurance. To find out more, explore our guide titled, “Auto Insurance Discounts.”

These could include discounts for safety features installed in the Kia Niro Plug-In Hybrid, good driver discounts, multi-policy discounts (if you bundle your auto insurance with other policies), or loyalty discounts. It’s recommended to inquire about available discounts when obtaining insurance quotes.

Why is the Kia Niro Plug-In Hybrid so popular for insurance?

The Kia Niro Plug-In Hybrid is popular for insurance due to its safety features and fuel efficiency, which often lead to lower insurance premiums. Its reliability and eco-friendly design also contribute to generally favorable insurance rates, appealing to cost-conscious drivers.

What insurance group is the Kia Niro Hybrid in?

The Kia Niro Hybrid typically falls into insurance groups 12 to 14, depending on the specific model and trim level.

How much does Kia Niro car insurance generally cost?

The cost of Kia Niro car insurance varies, but on average, you can expect monthly rates to range from $100 to $200.

What is the typical insurance cost for a Kia Niro EV?

Kia Niro EV insurance cost generally ranges between $120 and $250 per month, influenced by your location, driving history, and the level of coverage.

To find out more, explore our guide titled, “How Changing Your Address Affects Auto Insurance.”

Can you provide details on Kia Niro insurance affordability?

Kia Niro insurance is considered affordable compared to other vehicles in its class, with average monthly premiums of around $130.

What factors affect the Kia Niro insurance cost?

Factors that affect Kia Niro insurance cost include the driver’s age, driving record, location, and the chosen insurance coverage levels.

What should I consider when looking for Kia Niro Plug-In Hybrid insurance in Seattle?

When searching for Kia Niro Plug-In Hybrid insurance in Seattle, consider local traffic conditions, and potential weather-related risks, and compare quotes from multiple insurers to find the best rate.

What are the leading Niro companies providing auto insurance?

Leading companies providing insurance for the Kia Niro include State Farm, Geico, and Allstate, known for their comprehensive coverage options and competitive rates.

To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

How does the reliability of the Kia Niro Plug-In Hybrid affect its insurance costs?

The Kia Niro Plug-In Hybrid’s reputation for reliability can positively affect its insurance costs, as insurers may view it as a lower risk for breakdowns and expensive repairs, potentially leading to lower premiums.

Does the Kia Niro Plug-In Hybrid’s battery warranty impact its insurance rates?

Yes, the extensive 10-year or 100,000-mile battery warranty of the Kia Niro Plug-In Hybrid can impact its insurance rates by potentially lowering comprehensive coverage costs, as the risk of expensive battery replacements is mitigated.

Are there insurance benefits to the Kia Niro Plug-In Hybrid’s fuel efficiency?

Yes, the fuel efficiency of the Kia Niro Plug-In Hybrid can lead to insurance benefits such as discounts for eco-friendly vehicles, which some insurers offer, recognizing the reduced environmental impact and lower operating costs.

What insurance challenges might owners of the Kia Niro Plug-In Hybrid face?

Owners of the Kia Niro Plug-In Hybrid might face insurance challenges such as higher premiums due to the cost of replacing hybrid-specific parts and technology, which can be more expensive than those in conventional vehicles.

To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

How does the manufacturing origin of the Kia Niro Plug-In Hybrid influence insurance rates?

The manufacturing origin of the Kia Niro Plug-In Hybrid in South Korea may influence insurance rates slightly, as the availability and cost of replacement parts can affect claims costs, potentially impacting premiums.

What is the recommended oil change frequency for a Kia Niro Plug-In Hybrid from an insurance perspective?

From an insurance perspective, adhering to the recommended oil change frequency for the Kia Niro Plug-In Hybrid every 7,500 miles or annually is crucial as regular maintenance can reduce the risk of engine damage and help avoid insurance claims related to mechanical failures.

From an insurance standpoint, which type of hybrid vehicle is most cost-effective to insure?

From an insurance standpoint, plug-in hybrids like the Kia Niro Plug-In Hybrid are often more cost-effective to insure compared to fully electric vehicles due to their ability to use gasoline, reducing dependency on charging infrastructure and possibly lowering the risk profile.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.