Best Lexus IS 300 Auto Insurance in 2025 (Top 10 Companies Ranked)

State Farm, AAA, and Nationwide offer the best Lexus IS 300 auto insurance, starting at just $40 monthly. Explore why these providers lead with competitive rates, reliable coverage, and excellent customer service options for your Lexus IS 300. Optimize your insurance experience with these top choices.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Lexus IS 300

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Lexus IS 300

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Lexus IS 300

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews

The best Lexus IS 300 auto insurance providers are State Farm, AAA, and Nationwide, known for their superior coverage and competitive pricing.

These companies stand out in the market due to their comprehensive policies, excellent customer service, and strong financial stability. Each insurer offers unique advantages that cater to different driver needs, making them top choices for Lexus IS 300 owners.

Our Top 10 Company Picks: Best Lexus IS 300 Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 11% B Many Discounts State Farm

#2 15% A Local Agents AAA

#3 10% A+ Usage Discount Nationwide

#4 12% A+ Add-on Coverages Allstate

#5 18% A++ Military Savings USAA

#6 14% A++ Cheap Rates Geico

#7 9% A Customizable Polices Liberty Mutual

#8 16% A+ Online Convenience Progressive

#9 13% A Online App Farmers

#10 17% A++ Accident Forgiveness Travelers

Understanding these differences is key to selecting the right policy for your vehicle and driving habits. Learn more in our article titled “How Auto Insurance Companies Check Driving Records.”

Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- State Farm leads as the top pick for Lexus IS 300 auto insurance

- Tailored coverage options address the specific needs of Lexus IS 300 owners

- Features and benefits designed to enhance the Lexus IS 300 driving experience

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Discounts: State Farm offers significant discounts for bundling Lexus IS 300 auto insurance with other policies. Read more in our full review on the article titled State Farm’s auto insurance.

- Low-Mileage Savings: Owners of the Lexus IS 300 who drive less can benefit from State Farm’s substantial low-mileage discounts.

- Comprehensive Coverage Options: State Farm provides a variety of coverage options that can be tailored specifically to the needs of Lexus IS 300 owners.

Cons

- Comparatively Lower Multi-Policy Discounts: The discounts for multiple policies with State Farm are less generous than some competitors for Lexus IS 300 insurance.

- Higher Premium Levels: Despite available discounts, State Farm’s premiums can be relatively higher for certain Lexus IS 300 coverage levels.

#2 – AAA: Best for Local Agents

Pros

- Personalized Agent Support: Lexus IS 300 owners benefit from personalized service and local knowledge through AAA’s extensive network of agents.

- Higher Multi-Vehicle Discounts: AAA offers a 15% discount for customers who insure more than one vehicle like the Lexus IS 300.

- Strong Financial Stability: With an A.M. Best rating of A, AAA is a reliable choice for insuring your Lexus IS 300. Learn more about AAA roadside assistance in our review of AAA insurance.

Cons

- Availability May Vary: AAA’s features and discounts for Lexus IS 300 insurance can vary significantly by region.

- Membership Required: Lexus IS 300 owners must purchase a membership to access AAA’s auto insurance services.

#3 – Nationwide: Best for Usage Discount

Pros

- Pay-Per-Mile Discounts: Nationwide offers discounts for Lexus IS 300 owners who opt for a usage-based insurance model, saving money for those who drive less.

- High Financial Ratings: With an A+ rating from A.M. Best, Nationwide is a financially robust insurer for your Lexus IS 300. Find out if Nationwide might have the lowest rates for you in our Nationwide auto insurance review.

- Customizable Policies: Nationwide allows Lexus IS 300 owners to customize their policies extensively to match their driving habits and coverage needs.

Cons

- Lower Multi-Vehicle Discounts: Nationwide’s multi-vehicle discount rate for Lexus IS 300 is lower than some competitors at 10%.

- Premium Cost Variability: Nationwide’s premiums for Lexus IS 300 may vary widely depending on the driver’s profile and vehicle specifics.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-on Coverages

Pros

- Extensive Add-On Options: Allstate offers a variety of add-on coverages that can enhance the protection for your Lexus IS 300, such as accident forgiveness and new car replacement.

- Good Multi-Vehicle Discount: Allstate provides a 12% discount for Lexus IS 300 owners who insure multiple vehicles with them.

- Robust Financial Rating: With an A+ rating from A.M. Best, Allstate is a secure choice for insuring your Lexus IS 300. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Higher Premiums for Add-Ons: While Allstate offers extensive add-ons, the premiums for these enhanced coverages can be relatively high for Lexus IS 300 owners.

- Variable Discounts by State: The availability and amount of discounts can vary significantly depending on the state, affecting Lexus IS 300 insurance costs.

#5 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA offers substantial discounts and benefits for military members and their families, making it an excellent choice for Lexus IS 300 owners who serve.

- Highest Multi-Vehicle Discount: At 18%, USAA provides the highest discount for those who insure more than one vehicle, like a Lexus IS 300. See how USAA’s rates compare to other insurance providers in our article titled USAA auto insurance review.

- Top-Notch Financial Stability: USAA holds an A++ rating from A.M. Best, indicating superior financial health for supporting Lexus IS 300 insurance claims.

Cons

- Limited Eligibility: USAA’s services are only available to military members, veterans, and their families, limiting access for the general Lexus IS 300 owning public.

- Restrictive Coverage Options: Some Lexus IS 300 owners may find USAA’s coverage options less flexible compared to other insurers.

#6 – Geico: Best for Cheap Rates

Pros

- Competitive Pricing: Geico is known for offering some of the most affordable rates for Lexus IS 300 auto insurance, making it a popular choice for budget-conscious drivers.

- High Customer Satisfaction: Geico’s strong customer service ratings ensure a positive experience for Lexus IS 300 insurance policyholders. Learn more about Geico’s rates in our article titled Geico auto insurance company review.

- Efficient Claims Process: Geico provides a fast and efficient claims process, reducing hassle for Lexus IS 300 owners in the event of an accident.

Cons

- Basic Coverage Options: While affordable, Geico’s coverage for Lexus IS 300 can be basic compared to more premium offerings from competitors.

- Less Personalized Service: Due to its size and focus on low-cost insurance, Geico may offer less personalized service than smaller, niche insurers for Lexus IS 300 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Coverage: Liberty Mutual allows Lexus IS 300 owners to tailor their auto insurance policies extensively to suit individual needs and preferences.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness options, preventing your rates from increasing after your first at-fault accident with a Lexus IS 300.

- Strong Financial Rating: An A rating from A.M. Best assures that Liberty Mutual is financially capable of handling claims for Lexus IS 300 insurance. Learn more about this provider in our thorough article titled Liberty Mutual company review.

Cons

- Higher Pricing for Customizations: Customizing your Lexus IS 300 insurance policy with Liberty Mutual can lead to higher costs compared to standard offerings.

- Inconsistent Customer Service: Some Lexus IS 300 owners may experience variability in customer service quality with Liberty Mutual, depending on the region and local agents.

#8 – Progressive: Best for Online Convenience

Pros

- Streamlined Online Services: Progressive offers advanced online tools and services, making it easy for Lexus IS 300 owners to manage their policies and file claims digitally.

- Generous Multi-Vehicle Discount: Progressive offers a 16% discount for Lexus IS 300 owners who insure multiple vehicles, enhancing affordability. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

- Rapid Quote Generation: Progressive’s technology allows for quick and accurate insurance quotes for Lexus IS 300, facilitating comparison and decision-making.

Cons

- Variable Rate Increases: Some Lexus IS 300 owners might experience rate increases at renewal, especially after filing claims.

- Mixed Reviews on Claim Satisfaction: While Progressive is convenient, some users report mixed experiences with the claims process, impacting satisfaction for Lexus IS 300 insurance.

#9 – Farmers: Best for Online App

Pros

- Innovative Mobile App: Farmers’ mobile app offers comprehensive tools for managing Lexus IS 300 insurance policies, filing claims, and accessing digital ID cards.

- Customizable Coverage Levels: Farmers provides several customizable options that allow Lexus IS 300 owners to tailor their coverage to meet specific needs.

- Dedicated Agent Network: Farmers supports its Lexus IS 300 insurance with a dedicated network of agents providing personalized service. Check out our online Farmers review for more information.

Cons

- Higher Premiums for Customizations: Enhanced coverage options for Lexus IS 300 at Farmers can come with higher premiums compared to basic plans.

- App Reliability Issues: Some users report occasional reliability issues with Farmers’ app, which could affect the management of Lexus IS 300 insurance policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Programs: Travelers offers accident forgiveness policies which can prevent premium increases for Lexus IS 300 after the first accident.

- Extensive Coverage Options: Travelers provides a broad range of coverage options, including gap insurance, which is beneficial for Lexus IS 300 owners with newer models.

- Strong Financial Rating: An A++ rating from A.M. Best ensures that Travelers has the financial strength to back Lexus IS 300 claims reliably. Read more about Travelers’ ratings in our Travelers insurance review.

Cons

- Premium Costs Can Be High: While offering extensive coverage, Travelers’ premiums for Lexus IS 300 may be higher, especially for more comprehensive plans.

- Policy Customization May Increase Costs: Customizing policies to include more extensive coverage options for Lexus IS 300 can significantly increase the cost, making it less competitive.

Lexus IS 300 Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $57 $181

Allstate $40 $127

Farmers $72 $219

Geico $59 $177

Liberty Mutual $62 $193

Nationwide $72 $217

Progressive $99 $301

State Farm $50 $147

Travelers $56 $171

USAA $70 $198

The table of monthly auto insurance rates for the Lexus IS 300 shows a significant range in costs, both for minimum and full coverage across various providers. For instance, Allstate offers the most affordable minimum coverage at $40, while Progressive presents the highest rate at $99.

Full coverage rates also vary, with Allstate again being the most cost-effective at $127 and Progressive being the most expensive at $301.

These figures highlight the disparity in pricing strategies among insurers, affecting the overall cost-effectiveness of their policies for Lexus IS 300 owners. Such a detailed breakdown assists policyholders in making informed decisions based on their coverage needs and financial situations.

Lexus IS 300 Insurance Cost

The average car insurance costs for a Lexus IS 300 are $133 a month. Check out insurance savings in our complete article titled “What is the average auto insurance cost per month?”

Lexus IS 300 Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $133 |

| Discount Rate | $78 |

| High Deductibles | $115 |

| High Risk Driver | $284 |

| Low Deductibles | $168 |

| Teen Driver | $487 |

Ultimately, while the average monthly insurance cost for a Lexus IS 300 stands at $133, rates can vary significantly based on factors like deductibles and driver risk profiles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Are Lexus IS 300s Expensive to Insure

The chart below details how Lexus IS 300 insurance rates compare to other luxury cars like the Volvo S90, Mercedes-Benz C300, and Lexus GS 300. Discover more about offerings in our article titled “Best Volvo S90 Auto Insurance.”

Lexus IS 300 Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Lexus IS 300 | $30 | $57 | $33 | $133 |

| Volvo S90 | $30 | $60 | $33 | $136 |

| Mercedes-Benz C300 | $34 | $60 | $31 | $138 |

| Lexus GS 300 | $29 | $55 | $28 | $123 |

| Jaguar XF | $34 | $67 | $33 | $147 |

| Audi A6 | $32 | $62 | $33 | $140 |

| Lexus IS 350 | $29 | $57 | $33 | $132 |

However, there are a few things you can do to find the cheapest Lexus insurance rates online.

Comparing insurance rates, the Lexus IS 300 offers competitive pricing relative to other luxury vehicles, making it a moderately priced option for comprehensive insurance coverage.

What Impacts the Cost of Lexus IS 300 Insurance

The cost of insurance for a Lexus IS 300 can be significantly influenced by the specific trim and model variant you select. Different trims come with varying features and engine specifications, which can affect the vehicle’s risk profile and, consequently, its insurance premiums.

Age of the Vehicle

Older Lexus IS 300 models generally cost less to insure. For example, car insurance for a 2018 Lexus IS 300 costs about $133 a month, while 2016 Lexus IS 300 insurance costs approximately $130 a month, a difference of $3.

Lexus IS 300 Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Lexus IS 300 | $31 | $59 | $34 | $135 |

| 2023 Lexus IS 300 | $31 | $59 | $34 | $135 |

| 2022 Lexus IS 300 | $31 | $58 | $34 | $134 |

| 2021 Lexus IS 300 | $30 | $58 | $34 | $134 |

| 2020 Lexus IS 300 | $30 | $58 | $34 | $134 |

| 2019 Lexus IS 300 | $30 | $57 | $34 | $133 |

| 2018 Lexus IS 300 | $30 | $57 | $33 | $133 |

| 2017 Lexus IS 300 | $29 | $56 | $35 | $132 |

| 2016 Lexus IS 300 | $28 | $53 | $36 | $130 |

As the age of the Lexus IS 300 increases, the cost of insuring it decreases slightly, reflecting lower premiums for older models.

Driver Age

Driver age can have a significant impact on the cost of Lexus IS 300 auto insurance. For example, 20-year-old drivers pay as much as $169 more each month for their Lexus IS 300 auto insurance than 40-year-old drivers.

Lexus IS 3000 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $680 |

| Age: 18 | $487 |

| Age: 20 | $302 |

| Age: 30 | $139 |

| Age: 40 | $133 |

| Age: 45 | $128 |

| Age: 50 | $121 |

| Age: 60 | $119 |

The cost of Lexus IS 300 auto insurance varies significantly with driver age, highlighting the importance of considering age-related factors when assessing potential premiums.

Driver Location

Where you live can have a large impact on Lexus IS 300 insurance rates. For example, drivers in Los Angeles may pay approximately $73 a month more than drivers in Phoenix. Access comprehensive insights into our “Do auto insurance companies check where you live?”

Lexus IS 300 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $228 |

| New York, NY | $210 |

| Houston, TX | $209 |

| Jacksonville, FL | $193 |

| Philadelphia, PA | $178 |

| Chicago, IL | $176 |

| Phoenix, AZ | $155 |

| Seattle, WA | $129 |

| Indianapolis, IN | $113 |

| Columbus, OH | $111 |

Ultimately, your location plays a crucial role in determining the cost of Lexus IS 300 insurance, with rates varying significantly from city to city.

Your Driving Record

Your driving record can have an impact on the cost of Lexus IS 300 car insurance.

State Farm sets the standard with their competitive $50 monthly rate for minimum Lexus IS 300 coverage, making them a top choice for affordability.Daniel Walker Licensed Insurance Agent

Teens and drivers in their 20’s see the highest jump in their Lexus IS 300 auto insurance rates with violations on their driving record. Delve into our evaluation of “Should I add my teenager to my auto insurance policy?”

Lexus IS 300 Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $680 | $1,020 | $1,360 | $850 |

| Age: 18 | $487 | $730 | $973 | $608 |

| Age: 20 | $302 | $453 | $604 | $378 |

| Age: 30 | $139 | $208 | $278 | $174 |

| Age: 40 | $133 | $200 | $267 | $167 |

| Age: 45 | $128 | $192 | $256 | $160 |

| Age: 50 | $121 | $182 | $242 | $151 |

| Age: 60 | $119 | $179 | $238 | $149 |

Maintaining a clean driving record can significantly reduce your Lexus IS 300 insurance costs, especially with State Farm’s competitive rates, while violations or accidents can lead to higher premiums.

Lexus IS 300 Safety Ratings

The Lexus IS 300’s safety ratings will affect your Lexus IS 300 car insurance rates. See the chart below:

Lexus IS 300 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Lexus IS 300’s strong safety ratings, as evaluated by the Insurance Institute for Highway Safety, highlight its reliability and could positively impact your car insurance rates.

Lexus IS 300 Crash Test Ratings

If the Lexus IS 300 crash test ratings are good, you could have lower Lexus IS 300 car insurance rates. See Lexus IS 300 crash test results below:

Lexus IS 300 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Lexus IS 300 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2024 Lexus IS 300 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2023 Lexus IS 300 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2023 Lexus IS 300 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2022 Lexus IS 300 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2022 Lexus IS 300 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2021 Lexus IS 300 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2021 Lexus IS 300 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2020 Lexus IS 300 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2020 Lexus IS 300 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

Strong crash test ratings for the 2020 Lexus IS 300, including a 5-star overall score, can contribute to lower car insurance rates for this model.

Lexus IS 300 Safety Features

The more safety features you have on your Lexus IS 300, the more likely it is that you can earn a discount. The Lexus IS 300’s safety features include:

- Air Bags: Driver, Passenger, Front/Rear Head, Front/Rear Side

- Braking Systems: 4-Wheel ABS, Disc Brakes, Brake Assist

- Safety Features: Electronic Stability Control, Traction Control, Auto-Leveling Headlights

- Driver Assistance: Lane Departure Warning, Lane Keeping Assist, Blind Spot Monitor, Cross-Traffic Alert

- Additional Safety: Daytime Running Lights, Child Safety Locks, Integrated Turn Signal Mirrors

Equipping your Lexus IS 300 with its comprehensive array of safety features not only enhances protection but also significantly increases your eligibility for insurance discounts.

Lexus IS 300 Finance and Insurance Cost

If you are financing a Lexus IS 300, you will pay more if you purchase Lexus IS 300 car insurance at the dealership, so be sure to shop around and compare Lexus IS 300 car insurance quotes from the best companies using our free comparison tool below. Unlock details in our article titled “Where to Compare Auto Insurance Rates.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Lexus IS 300 Insurance

You can save more money on your Lexus IS 300 auto insurance rates by employing any of the following five strategies.

- Move to an area with a lower cost of living.

- Move to the countryside.

- Make sure you’re raising a safe driver.

- Purchase a roadside assistance program for your Lexus IS 300.

- Get cheaper Lexus IS 300 car insurance rates as a full-time parent.

To effectively reduce your Lexus IS 300 auto insurance costs, consider adopting strategies that address both your living situation and specific policy features.

Relocating to a more affordable area or investing in programs that enhance vehicle safety and security can lead to significant savings on your premiums. Discover insights in our guide titled “Auto Insurance Premium Defined.”

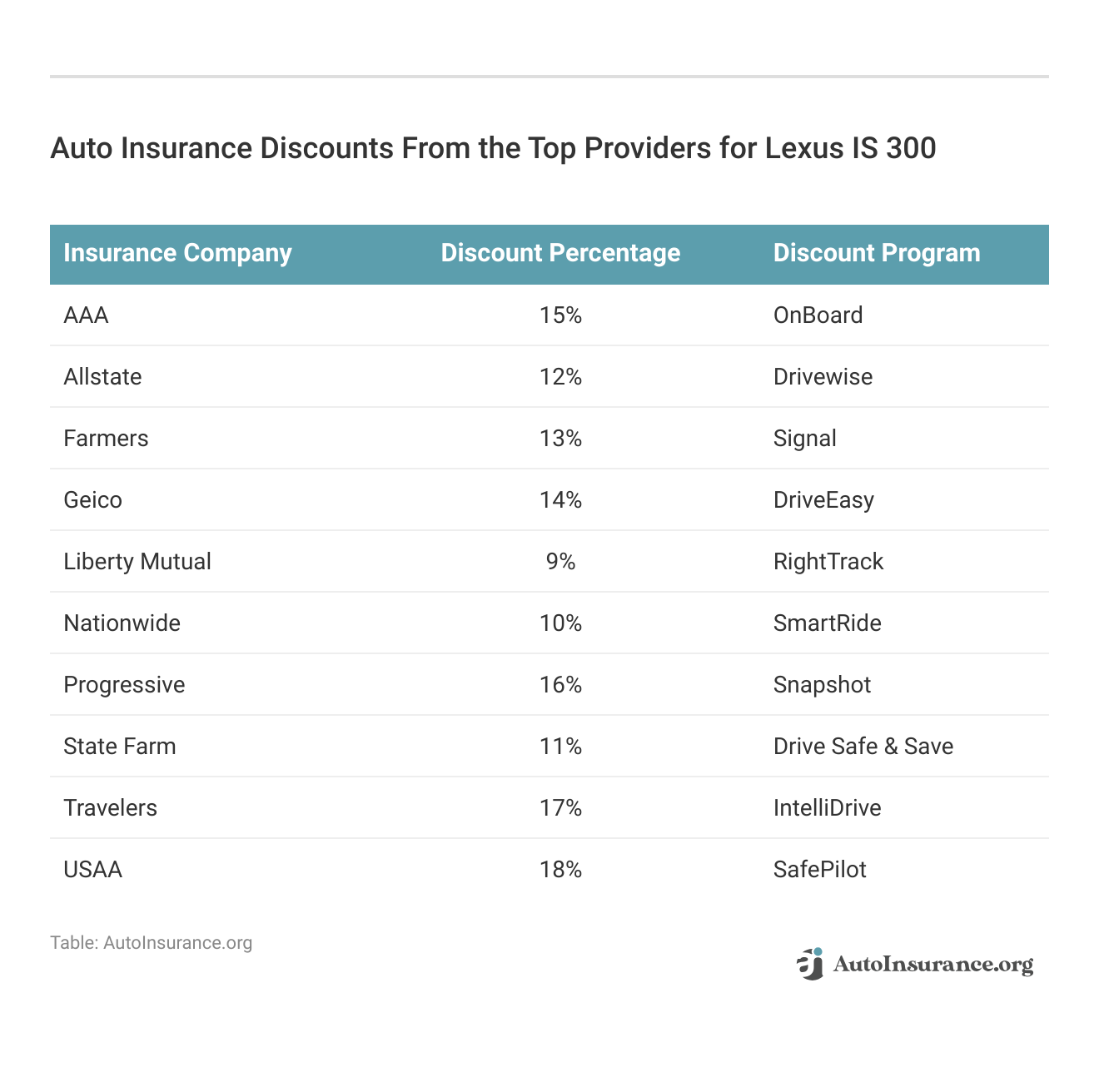

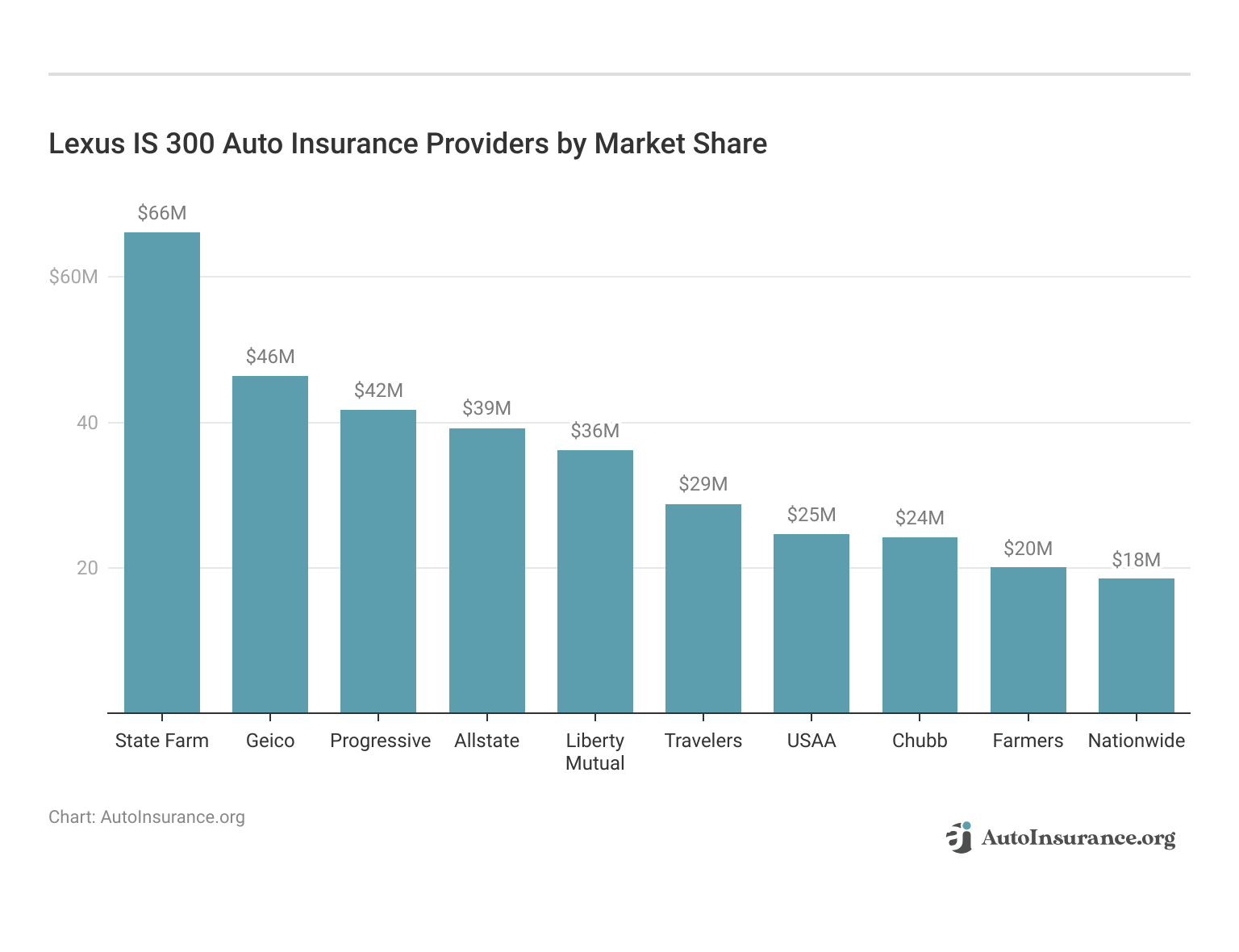

Top Lexus IS 300 Insurance Companies

The best auto insurance companies for Lexus IS 300 car insurance rates will offer competitive rates, discounts, and account for the Lexus IS 300’s safety features. The following list of car insurance companies outlines which companies hold the highest market share.

Lexus IS 300 Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5.0% |

| #6 | Travelers | $28,786,741 | 4.0% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

When choosing insurance for the Lexus IS 300, consider the top companies like State Farm, Geico, and Progressive, which lead the market in terms of volume and share. These insurers not only offer competitive rates and discounts but also take into account the vehicle’s safety features, making them preferred choices for many drivers.

By selecting a leading insurer, you ensure a blend of affordability, comprehensive coverage, and reliable service for your Lexus IS 300.

Compare Free Lexus IS 300 Insurance Quotes Online

Finding the right insurance for your Lexus IS 300 doesn’t have to be a daunting task. With our free online comparison tool, you can quickly and easily compare quotes from top insurance providers.

Start by exploring offers from leading companies like State Farm, AAA, and Nationwide, renowned for their competitive rates and comprehensive coverage options. See more details on our guide titled “State Farm Drive Safe and Save Review.”

This tool simplifies the process, allowing you to find the best policy tailored to your needs directly from the comfort of your home. Take the first step towards securing optimal coverage for your Lexus IS 300 by comparing quotes today.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors can affect the cost of insurance for a Lexus IS 300?

Several factors can influence the cost of insurance for a Lexus IS 300. These factors may include the driver’s age, location, driving history, credit score, the vehicle’s value, safety features, theft rates, and the coverage options selected.

Is the Lexus IS 300 considered an expensive car to insure?

The cost of insurance for a Lexus IS 300 can vary depending on the aforementioned factors. Generally, luxury vehicles like the Lexus IS 300 tend to have higher insurance premiums due to their higher values and potentially higher repair costs. However, it’s best to get quotes from different insurance providers to determine the specific cost for your situation.

Are there any safety features in the Lexus IS 300 that may lower insurance costs?

Yes, the Lexus IS 300 comes equipped with various safety features that may help reduce insurance costs. These features may include advanced driver assistance systems (ADAS) such as lane departure warning, forward collision warning, adaptive cruise control, and anti-lock brakes. Insurance companies often consider vehicles with these safety features to be less risky, which can result in lower premiums.

Access comprehensive insights into our guide titled “How to Get an Anti-Lock Brakes Auto Insurance Discount.”

Can I save money on insurance for a Lexus IS 300 by taking a defensive driving course?

In some cases, completing a defensive driving course may help you save money on insurance for your Lexus IS 300. Many insurance providers offer discounts for drivers who have completed an approved defensive driving course. It’s best to check with your insurance company to see if they offer such discounts and if they apply to the Lexus IS 300.

Should I purchase comprehensive and collision coverage for my Lexus IS 300?

Deciding on comprehensive and collision coverage for your Lexus IS 300 depends on personal circumstances and preferences. Comprehensive coverage shields against damages like theft and vandalism, while collision coverage addresses damages from crashes. If your Lexus IS 300 is financed, your lender will likely require both types of coverage. Otherwise, the choice depends on your risk assessment.

Are there any specific insurance considerations for leased or financed Lexus IS 300?

If you lease or finance a Lexus IS 300, the leasing or financing company may require you to carry specific insurance coverage. This often includes liability insurance, comprehensive coverage, and collision coverage. It’s essential to review the terms of your lease or financing agreement and consult with your insurance provider to ensure you meet the necessary insurance requirements.

Learn more by reading our guide titled “Collision Auto Insurance Defined.”

Can I get insurance discounts for installing anti-theft devices in my Lexus IS 300?

Yes, installing anti-theft devices in your Lexus IS 300 can often lead to insurance discounts. Anti-theft devices such as car alarms, tracking systems, or immobilizers make your vehicle less prone to theft or damage, reducing the insurance company’s risk. Check with your insurance provider to see if they offer discounts for specific anti-theft devices and how much you can save.

How much is insurance for a Lexus IS300?

Insurance for a Lexus IS300 can vary widely based on factors such as your driving history, location, and the level of coverage, but it generally averages $133 per month.

What is the 2001 Lexus IS300 insurance cost?

The insurance cost for a 2001 Lexus IS300 tends to be lower due to the vehicle’s age, potentially costing around $100 to $120 per month.

To learn more, explore our comprehensive resource on “How Vehicle Year Affects Auto Insurance Rates.”

How is the 2021 Lexus IS 300 reliability rated?

The 2021 Lexus IS 300 is highly reliable, often receiving above-average reliability ratings from automotive experts and consumer reports.

Which company offers the best car insurance for Lexus IS300?

State Farm is often considered the best car insurance provider for the Lexus IS300, offering competitive rates and comprehensive coverage.

Where can I find cheap Lexus IS300 insurance?

Cheap Lexus IS300 insurance can be found by comparing quotes from multiple insurers and checking for discounts such as multi-car or safe driver discounts.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Who provides the cheapest insurance for Lexus?

Geico and Progressive often offer the cheapest insurance rates for Lexus models, depending on your location and driving record.

Do Lexus have high insurance?

Yes, Lexus vehicles generally have higher insurance costs due to their luxury status and higher repair costs.

Is $300 a month for car insurance good for a Lexus IS300?

$300 a month is on the higher side for Lexus IS300 insurance, suggesting it includes full coverage or the driver has a less favorable driving history.

To find out more, explore our guide titled “Cheap Full Coverage Auto Insurance.”

Is insurance higher on a Lexus?

Yes, insurance is typically higher on a Lexus compared to non-luxury brands due to their higher value and repair costs.

What are the Lexus IS300 car insurance reviews saying?

Reviews often praise Lexus IS300 car insurance for offering good coverage options and value for money, though it can be pricey depending on the provider.

What insurance group is the Lexus IS300 in?

The Lexus IS300 typically falls into higher insurance groups due to its luxury status and performance characteristics.

For additional details, explore our comprehensive resource titled “Best Auto Insurance for Luxury Cars.”

What do users on Reddit say about Lexus IS300 insurance cost?

Users on Reddit often share that while Lexus IS300 insurance costs can be higher than average, shopping around for quotes can lead to significant savings.

How does Lexus IS300 insurance cost compare to Toyota insurance cost?

Insurance for the Lexus IS300 is generally higher than for Toyota vehicles due to its luxury nature and higher repair costs.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.