Best Nissan Kicks Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, USAA, and Geico are the top picks for the best Nissan Kicks auto insurance, offering unbeatable rates starting at just $41 per month. Each company brings reliable coverage options and competitive pricing specifically tailored for Nissan Kicks owners seeking quality and affordability.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Nissan Kicks

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Full Coverage for Nissan Kicks

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Nissan Kicks

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Nissan Kicks auto insurance are State Farm, USAA, and Geico, renowned for their comprehensive coverage options.

These companies excel in providing tailored insurance policies that cater specifically to the needs of Nissan Kicks owners, ensuring both affordability and reliability. Discover insights in our guide titled, “Auto Insurance Premium Defined.”

Our Top 10 Company Picks: Best Nissan Kicks Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 13% B Many Discounts State Farm

#2 15% A++ Military Savings USAA

#3 18% A++ Custom Plan Geico

#4 10% A+ Online Convenience Progressive

#5 12% A Online App AAA

#6 14% A++ Accident Forgiveness Travelers

#7 11% A+ Usage Discount Nationwide

#8 16% A Local Agents Farmers

#9 9% A Customizable Polices Liberty Mutual

#10 17% A+ Add-on Coverages Allstate

By focusing on customer satisfaction and competitive pricing, they stand out in the crowded market of auto insurance. Exploring these options ensures that you get the most suitable protection for your vehicle without compromising on quality or service.

If you need insurance for a Nissan Kicks right now, we can help. Enter your ZIP code for free Nissan Kicks car insurance quotes from top companies.

- State Farm stands out as the top choice for Nissan Kicks auto insurance

- Nissan Kicks owners benefit from customized insurance options

- Specialized policies cater to the unique needs of Nissan Kicks drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Multiple Policy Savings: State Farm offers robust discounts for Nissan Kicks owners who bundle auto insurance with other policies.

- Low-Mileage Perks: Significant savings for Nissan Kicks owners who drive less, thanks to State Farm’s high low-mileage discounts.

- Extensive Coverage Options: Offers a variety of insurance coverages tailored to meet the specific needs of Nissan Kicks drivers. Discover insights in our guide titled, State Farm auto insurance review.

Cons

- Limited Multi-Policy Discounts: While State Farm provides bundling options, the multi-policy discount is not as substantial as some competitors for Nissan Kicks insurance.

- Higher Premium Costs: Despite the discounts, premiums for certain levels of coverage for Nissan Kicks can still be relatively high at State Farm.

#2 – USAA: Best for Military Savings

Pros

- Exclusive Military Rates: USAA offers exceptionally competitive rates for Nissan Kicks insurance to military members and their families.

- High Multi-Vehicle Discount: A notable 15% discount on Nissan Kicks insurance for customers who insure more than one vehicle. Unlock details in our guide titled, USAA auto insurance review.

- Top-Notch Customer Service: Renowned customer support, backed by an A++ AM Best rating, ensuring reliable service for Nissan Kicks owners.

Cons

- Limited Availability: USAA’s Nissan Kicks insurance is only available to military personnel, veterans, and their immediate family members.

- Fewer Local Agents: Compared to competitors, USAA has fewer physical locations, which might limit face-to-face interactions for Nissan Kicks insurance.

#3 – Geico: Best for Custom Plan

Pros

- Customizable Policies: Geico offers highly customizable Nissan Kicks insurance plans, allowing drivers to tailor their coverage extensively.

- Highest Multi-Vehicle Discount: Offers an 18% discount for Nissan Kicks owners insuring multiple vehicles, the highest among the listed companies.

- Efficient Claims Process: Known for a fast and efficient claims process, making it easier for Nissan Kicks owners to manage their policies. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

Cons

- Variable Customer Service: While Geico is known for customization, its customer service ratings can vary significantly by region for Nissan Kicks insurance.

- Premium Fluctuations: Nissan Kicks insurance premiums at Geico can fluctuate more than some competitors, potentially affecting budgeting for policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Convenience

Pros

- Streamlined Online Tools: Progressive offers advanced online tools that simplify buying and managing Nissan Kicks insurance.

- Competitive Online Discounts: Attractive discounts for Nissan Kicks owners who prefer handling their insurance needs online. Delve into our evaluation of Progressive auto insurance review.

- Flexible Payment Options: Progressive provides various payment plans, making it easier for Nissan Kicks owners to budget their insurance expenses.

Cons

- Higher Rates for High-Risk Drivers: Nissan Kicks owners with less-than-perfect driving records may face higher premiums at Progressive.

- Complex Claims Process: Some Nissan Kicks customers may find the online-focused claims process complex and less personal, which could be challenging for those who prefer direct interaction.

#5 – AAA: Best for Online App

Pros

- User-Friendly Mobile App: AAA’s mobile app enhances the insurance management experience for Nissan Kicks owners, offering easy access to policy information.

- Good Multi-Vehicle Discounts: Nissan Kicks owners benefit from a 12% discount when insuring multiple vehicles with AAA. Learn more in our complete “AAA Auto Insurance Review.”

- Strong Roadside Assistance: Renowned for its exceptional roadside assistance, adding extra value to Nissan Kicks auto insurance.

Cons

- Membership Required: AAA requires membership to access Nissan Kicks insurance, which could be an extra cost for some customers.

- Variable Service Quality: The quality of service and response times can vary regionally, which might affect Nissan Kicks owners depending on their location.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness policies that prevent premium increases after a first accident for Nissan Kicks owners.

- High Customer Satisfaction: Known for high customer satisfaction ratings, ensuring a positive insurance experience for Nissan Kicks owners.

- Generous Coverage Options: Offers a wide range of coverage options, providing comprehensive protection for Nissan Kicks. See more details in our guide titled, “Travelers Auto Insurance Review.”

Cons

- Higher Premiums Without Discounts: Without qualifying for discounts, Nissan Kicks owners might find Travelers’ premiums higher compared to other insurers.

- Selective Accident Forgiveness: The accident forgiveness benefit is not automatic and requires eligibility, which may not be available to all Nissan Kicks owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Savings: Nationwide offers a discount based on the actual usage of the Nissan Kicks, ideal for low-mileage drivers.

- Flexible Coverage Options: Provides a range of coverage choices that can be customized to suit the specific needs of Nissan Kicks owners.

- Strong Financial Stability: Backed by an A+ AM Best rating, ensuring reliable claims support for Nissan Kicks insurance. Read up on the Nationwide auto insurance review for more information.

Cons

- Limited Usage Discount Availability: The usage-based discount is not available in all states, which may limit savings for some Nissan Kicks owners.

- Inconsistent Pricing: Some customers may experience variability in pricing and discounts, affecting the predictability of Nissan Kicks insurance costs.

#8 – Farmers: Best for Local Agents

Pros

- Local Agent Network: Farmers boasts a strong network of local agents providing personalized service to Nissan Kicks owners. More information is available about this provider in our Farmers auto insurance review.

- High Multi-Vehicle Discount: Offers a 16% discount for Nissan Kicks owners who insure multiple vehicles, one of the highest available.

- Customizable Policies: Allows for extensive customization of policies, ensuring that Nissan Kicks owners can tailor their coverage to their specific needs.

Cons

- Higher Base Premiums: Despite discounts, base premiums for Nissan Kicks insurance may be higher than some competitors.

- Varied Agent Quality: The quality of service can vary significantly depending on the local agent, potentially affecting the insurance experience for Nissan Kicks owners.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Coverages: Liberty Mutual offers extensive options for customizing Nissan Kicks insurance policies, accommodating a wide range of needs.

- Discounts for Safety Features: Nissan Kicks owners can receive discounts for vehicles equipped with advanced safety features, enhancing value.

- Strong Online Presence: Efficient online services streamline the process of managing Nissan Kicks insurance, from quotes to claims. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Premium Cost Variability: The cost of premiums can vary widely, depending on the individual’s specifics and the level of customization for the Nissan Kicks.

- Customer Service Inconsistencies: Some customers report inconsistent experiences with customer service, which could impact satisfaction levels for Nissan Kicks insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Add-on Coverages

Pros

- Extensive Add-On Options: Allstate offers a variety of add-on coverages that provide additional protection for Nissan Kicks, such as gap insurance and roadside assistance.

- High Multi-Vehicle Discounts: Nissan Kicks owners can benefit from up to a 17% discount when insuring multiple vehicles, offering significant savings.

- Innovative Tools and Apps: Features advanced tools and apps that enhance the insurance management experience for Nissan Kicks owners. Access comprehensive insights into our guide titled Allstate auto insurance review.

Cons

- Higher Premiums with Add-Ons: While Allstate provides comprehensive coverage options, the cost can escalate quickly with additional protections for Nissan Kicks owners.

- Variable Discount Eligibility: The eligibility for discounts can vary widely, making it harder for some Nissan Kicks owners to predict their insurance costs.

Nissan Kicks Insurance Cost Breakdown

Understanding the monthly rates for different coverage levels can significantly impact your decision when choosing the right auto insurance for your Nissan Kicks. Below, we delve into a comprehensive breakdown of minimum and full coverage rates provided by various insurers.

Nissan Kicks Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $73 $209

Allstate $61 $179

Farmers $99 $314

Geico $75 $228

Liberty Mutual $75 $231

Nationwide $66 $203

Progressive $41 $133

State Farm $52 $151

Travelers $63 $183

USAA $61 $186

The table illustrates monthly auto insurance rates for the Nissan Kicks, categorized by insurance provider and the type of coverage—minimum and full. Progressive offers the most affordable minimum coverage at $41 per month, making it an attractive option for budget-conscious drivers.

On the other hand, Farmers presents the highest minimum coverage rate at $99 per month. When it comes to full coverage, Progressive again provides the best rate at $133 monthly, appealing to those seeking more comprehensive protection without a significant price hike.

In contrast, Farmers’ full coverage is the priciest at $314 per month. This data is crucial for Nissan Kicks owners to compare and identify the insurance plan that not only meets their coverage needs but also aligns with their financial constraints.

Read more: Comprehensive Auto Insurance Defined

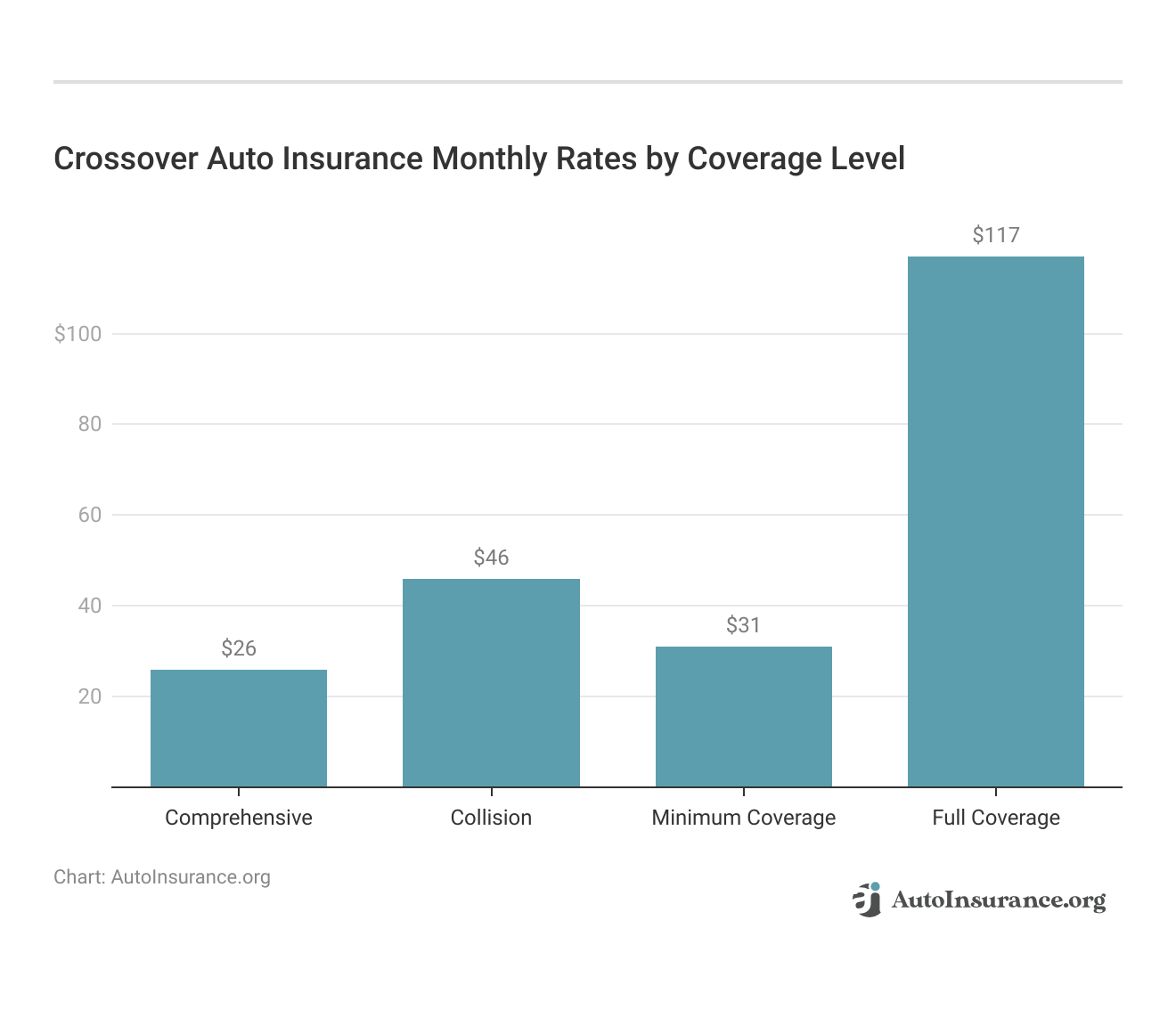

Are Vehicles Like the Nissan Kicks Expensive to Insure

Understanding the cost of insuring vehicles like the Nissan Kicks compared to other crossovers can help you budget more effectively for your auto insurance. By comparing rates from similar models, you gain a clearer insight into the insurance landscape for compact crossovers.

As the data reveals, insurance costs can vary significantly among different crossover models, with the comprehensive, collision, and liability rates culminating in the total full coverage cost. This information underscores the importance of comparing insurance rates to ensure you get the best possible deal tailored to your specific vehicle and coverage needs.

Comparing these insurance rates is essential for prospective car buyers to determine which vehicle offers the best financial value in terms of ongoing ownership costs, including insurance. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

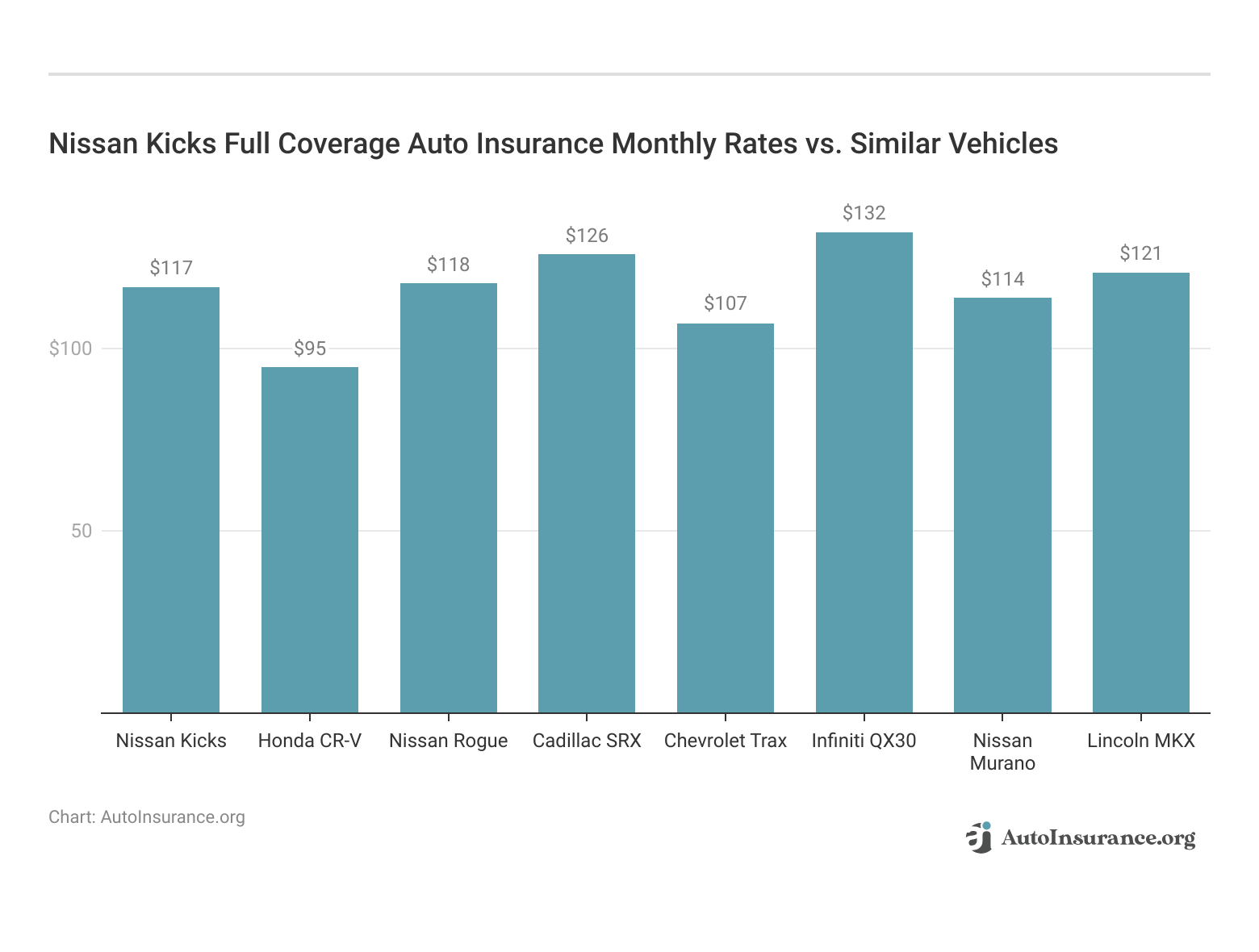

Insurance Rates for Vehicles Similar to the Nissan Kicks

Comparing insurance rates for vehicles similar to the Nissan Kicks can provide a broader perspective on potential costs and coverage options available in the market. Here is a detailed breakdown of comprehensive, collision, and liability costs for various comparable models.

Nissan Kicks Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Nissan Kicks | $25 | $45 | $37 | $120 |

| Toyota C-HR | $22 | $39 | $21 | $91 |

| Nissan Murano | $26 | $44 | $31 | $114 |

| Buick Envision | $27 | $47 | $33 | $120 |

| Hyundai Tucson | $25 | $39 | $31 | $108 |

| Audi Q5 | $30 | $60 | $31 | $134 |

| Cadillac XT4 | $30 | $55 | $26 | $123 |

| Lincoln MKC | $26 | $50 | $33 | $122 |

| Chevrolet Equinox | $26 | $44 | $31 | $114 |

Analyzing these insurance rates highlights the diversity in coverage costs across different vehicle models, helping consumers make informed decisions when selecting an insurance plan that best fits their needs and budget. This comparison ensures that owners of vehicles like the Nissan Kicks understand their potential expenses concerning other similar options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Nissan Kicks Insurance

The average annual rate for the Nissan Kicks is an average. Your insurance rates for a Nissan Kicks can be higher or lower depending on the trim level and personal factors.

Those factors include your age, home address, driving history, and the model year of your Nissan Kicks. Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

How Much Is the Nissan Kicks

The average cost to buy a new Nissan Kicks is $19,600. This cost will be affected by the trim level of your Nissan Kicks and any options you might choose to add. To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

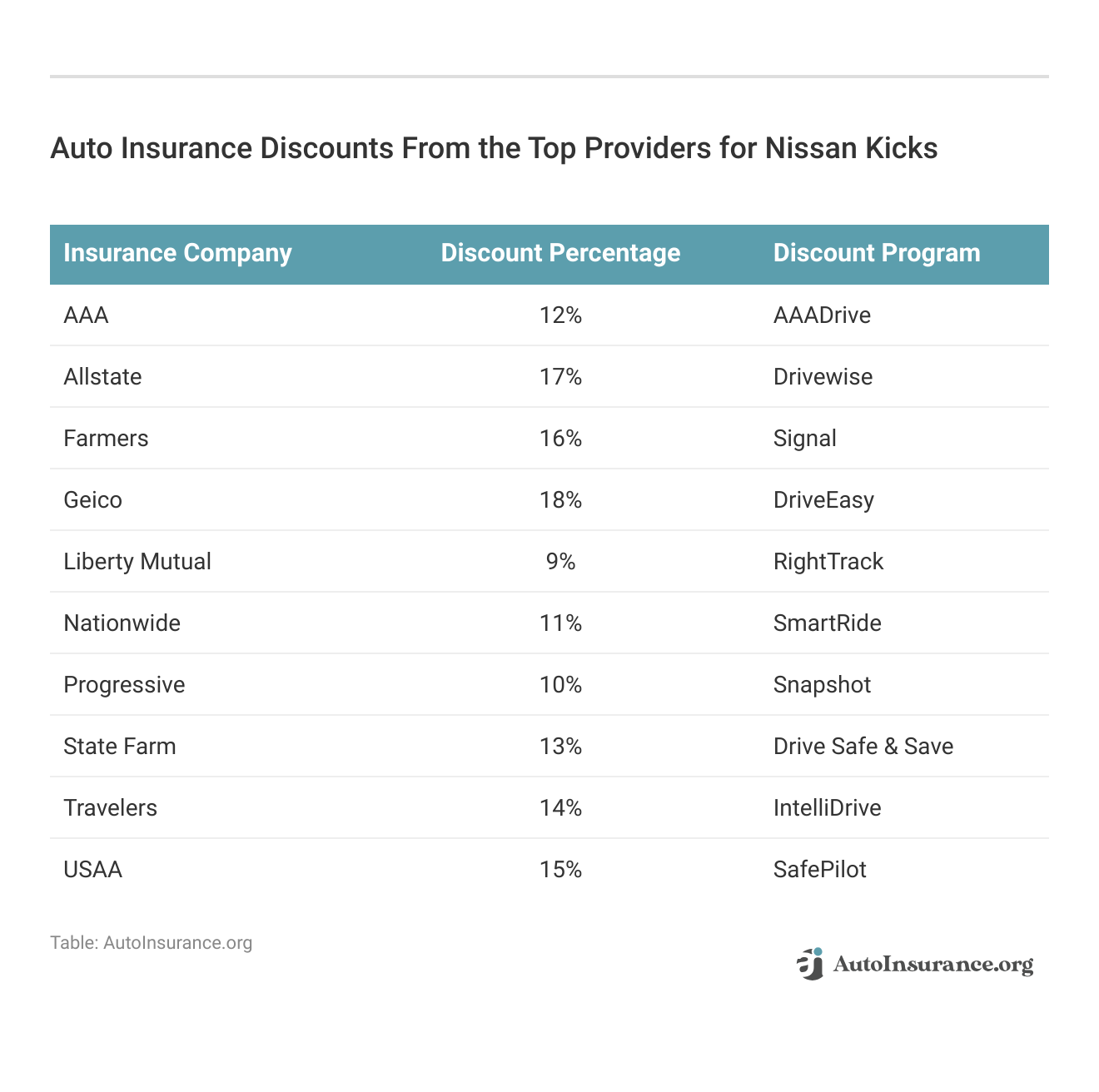

Ways to Save on Nissan Kicks Insurance

Save more on your Nissan Kicks car insurance rates. Look at the following five strategies that will get you the best Nissan Kicks auto insurance rates possible.

- Move to an area with a lower cost of living.

- Ask for a new Nissan Kicks auto insurance rate based on your improved credit score.

- Tell your insurer how you use your Nissan Kicks.

- Get a plan with only liability coverage if you’re driving an older Nissan Kicks.

- Check the odometer on your Nissan Kicks.

Implementing these strategies can lead to substantial savings on your Nissan Kicks insurance costs. By proactively managing factors such as location, credit score, usage, coverage type, and mileage, you can optimize your insurance expenses and enjoy more affordable rates.

Learn more by reading our guide: How to Save on Auto Insurance for Three Vehicles

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Nissan Kicks Insurance Companies

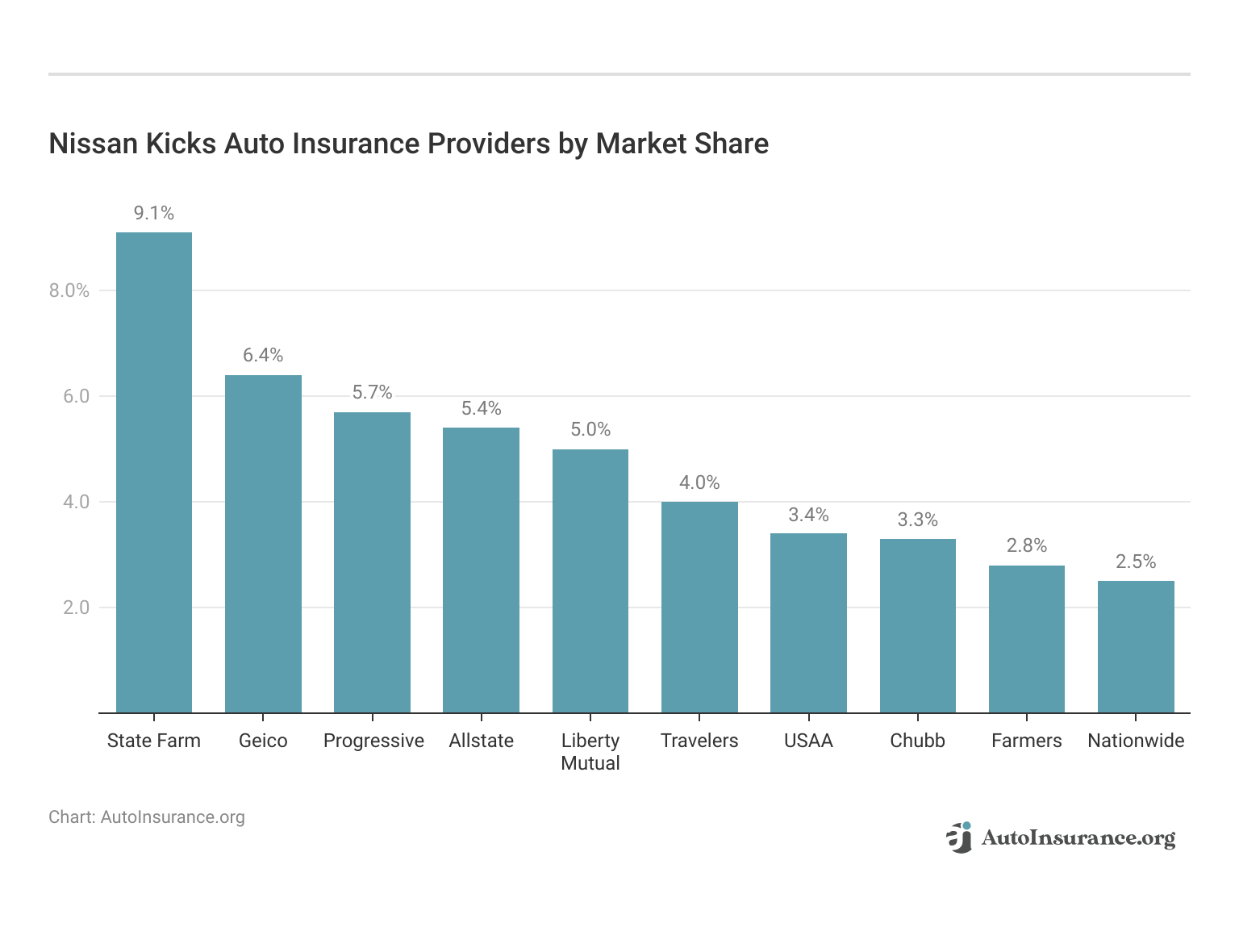

Selecting the right insurance provider for the Nissan Kicks involves understanding which companies offer the most competitive rates and favorable terms. This overview examines the top insurers for the Nissan Kicks, ranked by their market share and popularity among vehicle owners. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

The market share statistics reflect the preferences of Nissan Kicks drivers and indicate which insurers are leading the market.

With State Farm, Nissan Kicks owners can enjoy comprehensive coverage tailored to their specific driving needs.Daniel Walker Licensed Insurance Agent

This information is invaluable for owners looking to choose a provider that not only offers competitive rates but also has a strong presence and reliability in the auto insurance industry.

Largest Auto Insurers by Market Share

Understanding the landscape of the auto insurance market can be crucial for consumers. Here’s a snapshot of the largest auto insurers by market share, highlighting their dominance and influence in the industry.

Top Nissan Kicks Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

This overview of the top auto insurers by market share illustrates the distribution of consumer trust and preference across major companies. Recognizing these market leaders can aid customers in making well-informed choices when selecting their auto insurance provider.

You can compare quotes for Nissan Kicks auto insurance rates from some of the best auto insurance companies by using our free online tool below now.

Frequently Asked Questions

What factors affect the insurance premium for a Nissan Kicks?

Several factors can influence the insurance premium for a Nissan Kicks. These may include the driver’s age, driving record, location, insurance history, coverage limits, deductible amount, and the specific features and safety equipment of the Nissan Kicks itself.

Learn more by reading our guide: What is the average auto insurance cost per month?

Is Nissan Kicks considered an expensive vehicle to insure?

The insurance cost for a Nissan Kicks is typically lower compared to more expensive or high-performance vehicles. However, insurance rates can vary based on several factors, including the driver’s profile, location, and the insurance provider’s assessment of risk.

Are there any specific safety features in the Nissan Kicks that can help reduce insurance premiums?

Yes, the Nissan Kicks comes equipped with several safety features that can potentially help lower insurance premiums. These features may include anti-lock brakes, airbags, electronic stability control, a rearview camera, and collision warning systems. It’s advisable to check with your insurance provider to understand how these safety features may impact your premium.

Should I consider comprehensive and collision coverage for my Nissan Kicks?

The decision to include comprehensive and collision coverage for your Nissan Kicks depends on your circumstances and preferences.

Comprehensive coverage can protect your vehicle against non-collision incidents, such as theft, vandalism, or natural disasters. Collision coverage can help cover repair costs if your vehicle is damaged in an accident. Evaluating your budget, the value of your vehicle, and your risk tolerance can help determine whether these coverages are right for you.

Can I bundle my Nissan Kicks insurance with other policies for potential discounts?

Yes, many insurance providers offer discounts for bundling multiple policies. You can explore bundling your Nissan Kicks insurance with other insurance needs, such as homeowners or renters insurance, to potentially qualify for a discounted rate. It’s recommended to inquire with your insurance provider about the available discounts and savings opportunities.

For additional details, explore our comprehensive resource titled, “Auto Insurance Discounts.”

Why is Nissan Kicks insurance so popular?

Nissan Kicks insurance is popular because it offers affordable monthly rates, making it an economical choice for many drivers seeking comprehensive coverage.

Is insurance for Nissan cheaper than Toyota?

Generally, insurance for the Nissan Kicks tends to be slightly cheaper than comparable Toyota models, thanks to its lower cost of repair and good safety ratings. If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Is Nissan Kicks insurance expensive?

No, insurance for the Nissan Kicks is considered affordable, with lower premiums compared to many other vehicles in its class.

Does Nissan Kicks have a history of insurance claims due to transmission problems?

The Nissan Kicks, equipped with a CVT, does not generally see high insurance claims due to transmission problems, as it is considered reliable based on current data.

To learn more, explore our comprehensive resource on “Does auto insurance cover transmission repair?”

Where is the insurance for Nissan Kicks e-POWER most favorable?

Insurance rates for the Nissan Kicks e-POWER are most favorable in regions where hybrid and electric vehicles are promoted through insurance discounts and incentives.

Is Nissan Kicks 100% electric vehicle insurance more expensive?

No, the Nissan Kicks is not 100% electric, and its e-POWER hybrid model often enjoys similar or slightly higher insurance rates compared to the standard model due to advanced technology.

What are the disadvantages of Nissan Kicks insurance?

The main disadvantages include potentially higher premiums for younger drivers and the possibility of higher deductibles depending on the coverage options chosen.

How long can insurance coverage for Nissan Kicks be extended?

Insurance coverage for the Nissan Kicks can be extended for as long as the owner keeps the vehicle, with renewals typically offered annually.

Access comprehensive insights into our guide titled, “Types of Auto Insurance.”

What are the benefits of insuring a Nissan Kicks?

Insuring a Nissan Kicks comes with benefits such as lower-than-average insurance costs, good coverage options for physical damage, and potential discounts for safety features.

Is Nissan Kicks insurance easy to maintain?

Yes, maintaining insurance for the Nissan Kicks is straightforward, thanks to its low-risk profile and the availability of multiple insurance providers offering competitive rates.

Do Nissan Kicks hold their insurance value?

Yes, the Nissan Kicks holds its insurance value fairly well, thanks to its low cost of ownership and strong safety features, which can mitigate rate increases over time.

Where are Nissan Kicks insurance policies commonly underwritten?

Auto insurance for the Nissan Kicks is commonly underwritten in regions where the vehicle is popular, such as North America and Asia, with tailored policies that reflect local driving conditions and regulations.

Why might insurance for the Nissan Kicks be discontinued by some providers?

Insurance for the Nissan Kicks might be discontinued by some providers if they reassess their risk portfolio or if there’s a high frequency of claims for this model, which is not currently a widespread issue.

What is the insurance impact of the safety rating of the Nissan Kicks?

The safety rating of the Nissan Kicks, once established, will significantly impact insurance rates; higher safety ratings generally lead to lower premiums due to reduced accident risk.

Is insurance cheaper for Nissan Kicks due to its fuel efficiency?

Yes, the fuel efficiency of the Nissan Kicks can contribute to lower insurance premiums, as it is often linked with responsible driving behavior and lower operational costs. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.