Best Nissan Leaf Auto Insurance in 2025 (Compare the Top 10 Companies)

State Farm, AAA, and Geico are the best Nissan Leaf auto insurance companies. At the best Nissan Leaf companies, minimum rates start at $43/mo. All Nissan Leaf drivers must carry at least their state's minimum coverage requirements, though full coverage is recommended for Nissan Leaf cars.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Nissan Leaf

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Nissan Leaf

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Nissan Leaf

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, AAA, and Geico have the best Nissan Leaf auto insurance for the majority of U.S. drivers.

When shopping at the best auto insurance companies for Nissan Leafs, make sure to consider each company’s ratings, coverages, and discounts.

Our Top 10 Company Picks: Best Nissan Leaf Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 13% | B | Many Discounts | State Farm | |

| #2 | 15% | A | Online App | AAA |

| #3 | 10% | A++ | Custom Plan | Geico | |

| #4 | 18% | A++ | Military Savings | USAA | |

| #5 | 12% | A+ | Online Convenience | Progressive | |

| #6 | 14% | A+ | Usage Discount | Nationwide |

| #7 | 9% | A++ | Accident Forgiveness | Travelers | |

| #8 | 17% | A | Local Agents | Farmers | |

| #9 | 11% | A | Customizable Polices | Liberty Mutual |

| #10 | 16% | A+ | Add-on Coverages | Allstate |

Nissan Leaf insurance rates are $123 per month for full coverage, but parents of teen drivers pay $467 per month.

You can save up to $53 per month through earned policy discounts. Continue reading to learn how you can be eligible.

Using our free online tool, you can start comparing quotes for Nissan Leaf auto insurance rates from some of the best Nissan Leaf companies now.

- State Farm has the best Nissan Leaf car insurance policies

- Good drivers can save as much as $53 a month by earning policy discounts

- Nissan Leaf insurance costs slightly more than the average vehicle

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Many Discounts: State Farm has multiple discounts that can be applied to Nissan Leaf policies, which you can check out in our State Farm review.

- Local Support: Customers can reach out to local agents for assistance with their Nissan Leaf insurance.

- Availability: State Farm sells Nissan Leaf car insurance in all states.

Cons

- Financial Stability Rating: A.M. Best downgraded State Farm to a B, which is a lower rating among the top Nissan Leaf companies.

- Online Management: Nissan Leaf owners will find that online tasks are more limited at State Farm.

#2 – AAA: Best for Online App

Pros

- Online App: AAA’s online app is useful for requesting roadside assistance for Nissan Leafs, making policy changes, and more.

- Roadside Assistance Plans: Nissan Leaf customers can choose from different membership tiers for roadside assistance.

- Bundling Discount: AAA also sells home insurance, which can be bundled with Nissan Leaf insurance.

Cons

- Membership Fee: Customers have to pay a membership fee to buy Nissan Leaf insurance.

- Customer Ratings: Nissan Leaf customers should know not all reviews are positive. Learn more in our AAA review.

#3 – Geico: Best for Custom Plan

Pros

- Custom Plan: Nissan Leaf owners can make a custom plan at Geico for their vehicles.

- Affordable Rates: Geico’s average rates for Nissan Leaf Insurance are on the lower end.

- Availability: Geico sells Nissan Leaf policies in all states. Learn more about the company in our Geico review.

Cons

- Coverage Options: Geico doesn’t have as many add-on options for Nissan Leaf cars.

- No Local Agents: Nissan Leaf customers will contact customer service online or over the phone.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Savings

Pros

- Military Savings: Nissan Leaf customers will get some of the lowest rates at USAA. Read our USAA review to learn more.

- Coverage Options: Customers can insure Nissan Leaf vehicles with extras like roadside assistance.

- Availability: Nissan Leaf insurance is available in all states.

Cons

- Exclusive Eligibility: Nissan Leaf insurance is sold exclusively to veterans, military, or veteran/military family members.

- Virtual Assistance: Nissan Leaf customers won’t have access to local agents.

#5 – Progressive: Best for Online Convenience

Pros

- Online Conveneince: Nissan Leaf customers will find that Progressive’s app and website are convenient for online management.

- Snapshot Program: Nissan Leaf insurance rates can be lowered if customers join Snapshot.

- Coverage Options: Nissan Leaf vehicles can be insured with roadside assistance and more. Learn what Progressive sells in our Progressive review.

Cons

- Discount Availability: Progressive’s Nissan Leaf discounts aren’t always available in states such as its Snapshot discount.

- Customer Ratings: Progressive has some negative feedback, which means Nissan Leaf customers could have less than perfect service.

#6 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nissan Leaf customers can join Nationwide’s good driver program for a usage discount.

- Mileage-Based Insurance: SmartMiles offers lower rates by the mile for Nissan Leaf customers who travel less than 10,000 miles annually.

- Accident Forgiveness: Some Nissan Leaf customers will avoid increased rates with accident forgiveness. Read our Nationwide review to learn more.

Cons

- Availability: Nissan Leaf insurance isn’t sold in all states.

- Local Agent Availability: Nationwide doesn’t have as many local agents stationed to help customers with Nissan Leaf insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nissan Leaf customers can avoid increased rates with accident forgiveness at Travelers.

- IntelliDrive Program: Customers can join to lower their Nissan Leaf car insurance rates.

- Coverage Options: Travelers offers extras like roadside assistance to Nissan Leaf customers.

Cons

- IntelliDrive Rate Hikes: Nissan Leaf customers may see increased rates after completing the program if they drive badly.

- Customer Satisfaction: Read how Nissan Leaf customers may find services lacking in our Travelers review.

#8 – Farmers: Best for Local Agents

Pros

- Local Agents: Numerous local agents are stationed around the country, so most Nissan Leaf customers should be able to visit an agent in person.

- New Car Replacement: Owners of new Nissan Leaf vehicles can pay a little extra to add this coverage to their policy.

- Bundling Discount: Nissan Leaf insurance can be bundled with other Farmers insurance.

Cons

- Customer Satisfaction: Read our Farmers review to learn some of the reasons Nissan Leaf customers may be unhappy with services.

- Discount Availability: Some of Farmers’ discounts may be unavailable in some Nissan Leaf customers’ states.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers easy customization of Nissan Leaf policies. Read our Liberty Mutual review to learn more.

- Bundling Discount: Nissan Leaf policies can be combined with other policies.

- 24/7 Claims: Nissan Leaf claims can be filed by customers at any time.

Cons

- Customer Service: Customer service for Nissan Leaf customers can vary based on previous reviews.

- Discount Availability: Nissan Leaf discounts can vary by state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Add-on Coverages

Pros

- Add-On Coverages: Nissan Leaf customers can add coverages to their policies as needed. See what is sold in our Allstate review.

- Mileage-Based Insurance: Infrequent drivers can save on Nissan Leaf insurance by choosing Milewise insurance.

- Bundling Discount: Allstate sells many different types of insurance besides car insurance for Nissan Leaf vehicles.

Cons

- Higher Rates: Nissan Leaf rates are a little pricier at Allstate.

- Customer Complaints: Customer complaints indicated Nissan Leaf customers may have issues with customer service and claims.

Nissan Leaf Insurance Cost

Curious how much Nissan Leaf vehicles cost to insure on average? The average Nissan Leaf auto insurance costs are $128 a month for full coverage (Learn More: Full Coverage Auto Insurance Defined).

Nissan Leaf Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $128 |

| Discount Rate | $75 |

| High Deductibles | $110 |

| High Risk Driver | $272 |

| Low Deductibles | $161 |

| Teen Driver | $467 |

However, rates do vary based on what type of coverage Nissan Leaf customers choose. Drivers can choose between a minimum coverage policy or a full coverage policy.

Nissan Leaf Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Drivers can also choose optional add-ons for their Nissan Leaf if they want specialized car insurance policies for their Nissan Leaf.

Owners of new Nissan Leaf vehicles may want to consider add-ons like gap coverage or new car replacement coverage.Dani Best Licensed Insurance Producer

Old Nissan Leaf vehicles may benefit from extras like roadside assistance in case of breakdowns, as it helps with simple fixes and tows.

Nissan Leaf Rates Compared to Other Vehicle Brands

The chart below details how Nissan Leaf insurance rates compare to other hybrid/electrics like the Buick LaCrosse, Toyota Prius, and Ford C-Max Hybrid.

Nissan Leaf Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Buick LaCrosse | $27 | $47 | $28 | $113 |

| Toyota Prius | $26 | $43 | $28 | $107 |

| Ford C-Max Hybrid | $24 | $47 | $33 | $117 |

| Hyundai Sonata Hybrid | $27 | $52 | $35 | $129 |

| Honda Accord Hybrid | $30 | $60 | $26 | $128 |

| Ford Fusion Hybrid | $27 | $55 | $39 | $137 |

Ford Fusions are more expensive than Nissan Leaf vehicles, while some Buick and Toyota models are cheaper to purchase.

Factors That Affect Nissan Leaf Insurance Rates

There are several factors that affect auto insurance rates, from credit score to age and gender. The Nissan Leaf trim and model you choose can also impact the total price you will pay for Nissan Leaf insurance coverage. Read on to learn about the factors that will change your Nissan Leaf rates.

Age of the Vehicle

Older Nissan Leaf models generally cost less to insure. For example, full coverage auto insurance for a 2024 Nissan Leaf costs $129 monthly, while 2011 Nissan Leaf insurance costs $107 monthly.

Nissan Leaf Auto Insurance Monthly Rates by by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Nissan Leaf | $28 | $56 | $35 | $129 |

| 2023 Nissan Leaf | $28 | $55 | $35 | $129 |

| 2022 Nissan Leaf | $28 | $55 | $35 | $128 |

| 2021 Nissan Leaf | $27 | $55 | $35 | $128 |

| 2020 Nissan Leaf | $27 | $54 | $34 | $128 |

| 2019 Nissan Leaf | $26 | $54 | $34 | $127 |

| 2018 Nissan Leaf | $26 | $53 | $35 | $128 |

| 2017 Nissan Leaf | $26 | $53 | $35 | $128 |

| 2016 Nissan Leaf | $26 | $51 | $36 | $126 |

| 2015 Nissan Leaf | $24 | $49 | $37 | $124 |

| 2014 Nissan Leaf | $24 | $46 | $38 | $120 |

| 2013 Nissan Leaf | $23 | $43 | $38 | $117 |

| 2012 Nissan Leaf | $22 | $39 | $38 | $112 |

| 2011 Nissan Leaf | $20 | $36 | $38 | $107 |

Older vehicles can also opt for just minimum coverage if the cost of full coverage will soon equal the value of the vehicle.

Driver Age

Driver age can have a significant impact on the cost of Nissan Leaf auto insurance. For example, 20-year-old drivers pay as much as $162 more each month for their Nissan Leaf auto insurance than 40-year-old drivers.

Nissan Leaf Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $206 |

| Age: 30 | $191 |

| Age: 40 | $128 |

| Age: 45 | $169 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Younger drivers pay more for the best Nissan Leaf car insurance because of driving inexperience. Statistically, young drivers file more claims at auto insurance companies.

Young drivers can work to lower Nissan Leaf insurance rates by applying for good student discounts and keeping a clean driving record.

Driver Location

Where you live can have a large impact on Nissan Leaf insurance rates. For example, drivers in Phoenix may pay $71 less per month than drivers in Los Angeles.

Nissan Leaf Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $219 |

| New York, NY | $202 |

| Houston, TX | $200 |

| Jacksonville, FL | $185 |

| Philadelphia, PA | $171 |

| Chicago, IL | $169 |

| Phoenix, AZ | $148 |

| Seattle, WA | $124 |

| Indianapolis, IN | $109 |

| Columbus, OH | $106 |

Areas with more crime or accidents will have higher rates than more statistically safe areas. Areas with frequently dangerous weather patterns will also have higher insurance rates.

Your Driving Record

Your driving record can impact the cost of Nissan Leaf auto insurance. The table below shows what incidents affect Nissan Leaf rates.

Nissan Leaf Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $790 | $1,050 | $760 |

| Age: 18 | $467 | $620 | $860 | $520 |

| Age: 20 | $290 | $450 | $680 | $370 |

| Age: 30 | $133 | $200 | $320 | $180 |

| Age: 40 | $128 | $190 | $310 | $175 |

| Age: 45 | $122 | $185 | $300 | $170 |

| Age: 50 | $117 | $175 | $290 | $165 |

| Age: 60 | $114 | $170 | $280 | $160 |

Teens and drivers in their 20’s see the highest jump in their Nissan Leaf auto insurance rates with violations on their driving record.

Nissan Leaf Safety Ratings

Your Nissan Leaf auto insurance rates are influenced by the Nissan Leaf’s safety ratings. See the breakdown below:

Nissan Leaf Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Nissan Leaf hasn’t been tested completely, so its safety isn’t fully rated. However, the few tests that were done were rated as good.

Nissan Leaf Crash Test Ratings

Nissan Leaf crash test ratings will affect your Nissan Leaf auto insurance rates. Take a look at the crash ratings below.

Nissan Leaf Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2023 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2022 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2021 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2020 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2019 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2016 Nissan Leaf 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

The Nissan Leaf crash tests could be better, as the few tests that were done only scored the Nissan Leaf four stars.

Nissan Leaf Safety Features

Most drivers don’t realize that not only do Nissan Leaf safety features play a vital role in keeping passengers safe in crashes, but they can also help lower Nissan Leaf auto insurance rates with a safety feature discount.

The Nissan Leaf vehicles usually have several safety features that qualify for this discount. The Nissan Leaf’s safety features are listed in the table below.

Nissan Leaf Safety Features

| Safety Feature |

|---|

| ABS & Driveline Traction Control |

| Airbag Occupancy Sensor |

| Automatic Emergency Braking (AEB) |

| Curtain 1st & 2nd Row Airbags |

| Dual Stage Driver & Passenger Front Airbags |

| Dual Stage Driver & Passenger Seat-Mounted Side Airbags |

| Electronic Stability Control (ESC) |

| Low Tire Pressure Warning |

| Outboard Front Lap & Shoulder Safety Belts |

| Rear Child Safety Locks |

| Rearview Monitor Back-Up Camera |

| Side Impact Beams |

Most auto insurance companies will automatically apply Nissan Leaf safety feature discounts to your auto insurance policy.

Nissan Leaf Insurance Loss Probability

The Nissan Leaf’s insurance loss ratio varies between different coverage types. Take a look at the different loss ratios below.

Nissan Leaf Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2023 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2022 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2021 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2020 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2019 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2016 Nissan Leaf 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

While some types of insurance loss ratios are higher for the Nissan Leaf, others are more favorable and lead to cheap Nissan Leaf auto insurance rates.

Nissan Leaf Finance and Insurance Cost

If you are financing a Nissan Leaf, most lenders will require you to carry higher Nissan Leaf coverage options, including comprehensive coverage, so be sure to shop around and compare Nissan Leaf auto insurance rates from the best companies using our free tool below.

Nissan Leaf Insurance Companies’ Market Shares

Who is the top auto insurance company for Nissan Leaf insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Nissan Leaf auto insurance coverage (ordered by market share).

Top 10 Nissan Leaf Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

State Farm has the biggest market share in the U.S. Many of these companies offer discounts for security systems and other safety features that the Nissan Leaf offers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Nissan Leaf Insurance

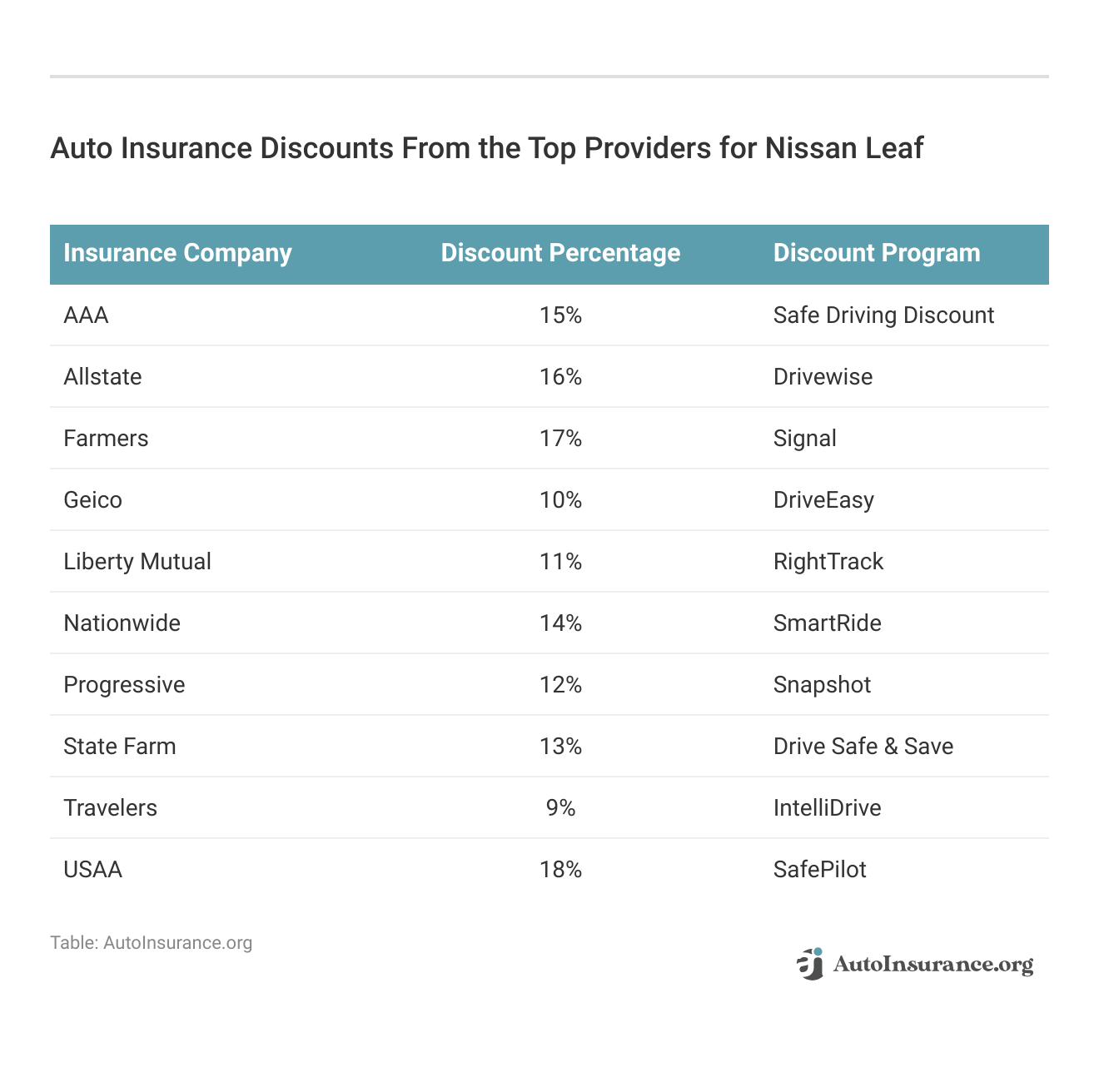

One way to save on Nissan Leaf insurance at the best Nissan Leaf companies is to apply for auto insurance discounts.

Drivers can also end up saving more money on their Nissan Leaf auto insurance rates by employing any one of the following strategies.

- Watch your insurer closely when your Nissan Leaf needs repairs.

- Tell your insurer about different drivers or uses for your Nissan Leaf.

- Remove young drivers from your Nissan Leaf auto insurance policy when they move out or go to school.

- Choose automatic payments or EFT for your Nissan Leaf auto insurance policy.

Following the tips above will help most Nissan Leaf drivers safe on their Nissan auto insurance policies.

Finding the Best Nissan Leaf Insurance For You

State Farm, AAA, and Geico have the best Nissan Leaf insurance for drivers. We recommend comparing quotes from a few of your favorite Nissan Leaf companies to find the best deal for you (Learn More: How to Evaluate Auto Insurance Quotes).

Ready to get Nissan Leaf insurance quotes? Start comparing Nissan Leaf auto insurance quotes for free by using our convenient online comparison tool.

Frequently Asked Questions

Is auto insurance required for a Nissan Leaf?

Yes, auto insurance is required for all vehicles, including the Nissan Leaf. It is a legal requirement in most countries or states to have auto insurance coverage to protect yourself and others in the event of an accident or damage.

What type of coverage should I consider for my Nissan Leaf?

The type of coverage you should consider for your Nissan Leaf depends on your specific needs and preferences. However, common coverage options for auto insurance include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP) or medical payments coverage.

Are there any specific discounts available for insuring a Nissan Leaf?

Some insurance companies offer specific discounts for insuring electric or hybrid vehicles like the Nissan Leaf. These discounts can vary depending on the insurer, so it’s recommended to inquire with different insurance providers to see if they offer any incentives or discounts for electric vehicles (Learn More: Electric Vehicle Auto Insurance Discounts).

Will insuring a Nissan Leaf be more expensive than insuring a traditional gasoline-powered car?

Insurance rates can vary depending on several factors, including the make and model of the vehicle, the driver’s profile, and the location. While the initial purchase price of an electric vehicle like the Nissan Leaf may be higher, insurance rates may not necessarily be significantly more expensive. It’s best to compare quotes from different insurance companies to get an accurate idea of the costs involved.

Are there any specific considerations for insuring the battery of a Nissan Leaf?

The battery is an essential component of the Nissan Leaf, and in the event of damage or malfunction, it can be costly to repair or replace. It’s important to review your insurance policy to understand if it covers battery-related issues. Some insurers offer specific coverage options for electric vehicle batteries, so it’s worth discussing this with your insurance provider.

What should I do if my Nissan Leaf is involved in an accident?

If your Nissan Leaf is involved in an accident, follow the standard procedures for reporting the incident to the police and your insurance company. Take pictures of the damage, gather relevant information from the other party involved, and notify your insurer as soon as possible to initiate the claims process (Read More: How to File an Auto Insurance Claim).

Can I transfer my current auto insurance policy to a Nissan Leaf?

In most cases, you can transfer your current auto insurance policy to cover your Nissan Leaf. However, it’s essential to inform your insurance company about the change in the vehicle’s make and model to ensure proper coverage. Your premiums may be adjusted based on the new vehicle’s characteristics. You can get quotes with our free tool to see how much it will cost to insure your Nissan Leaf.

Why is Nissan more expensive to insure?

Nissan auto insurance is more expensive because Nissan models are more likely to be stolen.

Can I get roadside assistance coverage for my Nissan Leaf?

Yes, many insurance companies offer roadside assistance coverage as an add-on option to your auto insurance policy. This coverage can provide assistance in case of a breakdown, flat tire, or if you run out of charge while driving your Nissan Leaf.

Which Nissan is cheapest to insure?

The Nissan Micra is the cheapest Nissan model for auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.