Best Ohio Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, USAA, and Progressive have the best Ohio auto insurance for residents. At State Farm, minimum coverage in Ohio averages just $37/mo. Because Ohio auto insurance is so affordable for most drivers, carrying more than the state-required minimum is recommended for those with newer Ohio vehicles.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, USAA, and Progressive have the best Ohio auto insurance for most drivers.

Ohio auto insurance costs around $98 monthly for full coverage and $31 monthly for liability. However, you can always get even better car insurance rates in Ohio by comparing quotes from the best auto insurance companies in your area.

Our Top 10 Company Picks: Best Ohio Auto Insurance

Company Rank Multi-Vehicle

DiscountA.M. Best Best For Jump to Pros/Cons

#1 10% B Many Discounts State Farm

#2 12% A++ Military Savings USAA

#3 15% A+ Online Convenience Progressive

#4 10% A++ Safe Drivers Geico

#5 10% A+ Add-on Coverages Allstate

#6 15% A+ Usage Discount Nationwide

#7 10% A++ Accident Forgiveness Travelers

#8 15% A Student Savings American Family

#9 12% A Local Agents Farmers

#10 15% A Customizable Polices Liberty Mutual

This guide will help you learn more about how to buy cheap auto insurance in Ohio, meet the state’s coverage requirements, and evaluate auto insurance quotes from the top companies in OH.

You can also enter your ZIP into our free quote comparison tool to find the best Ohio car insurance quotes.

- Ohio Auto Insurance

- Best Westerville, Ohio Auto Insurance in 2025

- Best Twinsburg, Ohio Auto Insurance in 2025

- Best Toledo, Ohio Auto Insurance in 2025 (Check Out the Top 10 Companies)

- Best Peebles, Ohio Auto Insurance in 2025

- Best North Ridgeville, Ohio Auto Insurance in 2025

- Best Maumee, Ohio Auto Insurance in 2025

- Best Lorain, Ohio Auto Insurance in 2025

- Best Kingston, Ohio Auto Insurance in 2025

- Best Dayton, Ohio Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- State Farm has the best Ohio insurance for residents

- Ohio requires all drivers to have liability coverage

- Save on their Ohio auto insurance rates by applying for discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Many Discounts: State Farm’s discount selection will help most Ohio residents lower rates.

- Local Support: State Farm has multiple agents posted around Ohio. Learn more about the company’s customer service in our State Farm review.

- Coverage Selection: Ohio drivers can carry as much coverage as they need with add-ons from State Farm.

Cons

- Financial Stability: State Farm’s stability could be rated much better.

- Online Tools: Most changes must be completed through an agent, limiting online management at State Farm.

#2 – USAA: Best for Miltary Savings

Pros

- Military Savings: Military and veterans in Ohio will usually find the best deals at USAA.

- Customer Service Reputation: Ratings for USAA’s customer service are excellent. Learn more in our USAA auto insurance review.

- Roadside Assistance: Pay a little more each month to add 24/7 roadside assistance to your USAA policy.

Cons

- Restrictions on Eligibility: Ohio residents can only purchase USAA if they are veterans or military.

- Local Agent Availability: There are very few local agents available from USAA, as most customer service is virtual.

#3 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Ohio customers will find it easy to do most tasks online at Progressive.

- Snapshot Discount: Ohio drivers can participate in Progressive’s optional program to save up to 30%.

- Flexible Plans: Customers can adjust their coverages and deductibles at Progressive. Learn more in our review of Progressive.

Cons

- Snapshot Rate Increases: Potentially, rates could also be raised after participating in Snapshot if drivers score badly.

- Average Reviews: Progressive’s customer service doesn’t have excellent ratings from most customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Safe Drivers

Pros

- Safe Drivers: Ohio drivers with good driving records will get affordable quotes from Geico. Learn more in our review of Geico.

- A.M. Best Rating: The company was awarded the highest financial rating.

- Online Policy Management: One of the perks of Geico is its user-friendly app.

Cons

- Local Agent Availability: Ohio residents probably won’t have access to a local agent, as Geico’s services are mainly virtual.

- New Car Coverage: Geico doesn’t sell gap coverage, which may deter Ohio residents with brand-new cars.

#5 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Ohio customers can buy a full variety of coverages for their vehicles. Read more in our Allstate review.

- Claim Guarantee: Allstate guarantees claim satisfaction and may give some customers lower rates if they aren’t satisfied.

- Pay-Per-Mile Coverage: Allstate’s Milewise coverage is ideal for Ohio customers who travel less than 10,000 miles a year.

Cons

- Customer Reviews: Not all customer reviews are favorable.

- Young Driver Rates: Allstate’s rates are less ideal for young drivers in Ohio.

#6 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers a discount to drivers who participate in its SmartRide program.

- Vanishing Deductible: Ohio customers may be able to reduce their deductibles simply by staying claims-free.

- Multi-Policy Discount: Ohio drivers who purchase home or renters insurance will save on Ohio car insurance rates.

Cons

- Usage Data Tracking: Ohio customers must be okay with their driving data being tracked to get the usage discount.

- Average Customer Ratings: The company doesn’t stand out for its customer service. Learn more by reading our Nationwide review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Ohio drivers with great previous driving records could avoid rate increases after an accident.

- IntelliDrive Discount: Ohio drivers may choose to join IntelliDrive to try and score a discount on their policy.

- A.M. Best Rating: Travelers stands out from its competition for its excellent financial rating.

Cons

- IntelliDrive Rate Increases: Some drivers may potentially have rate increases after participating in the program if they score badly.

- Average Customer Ratings: Most reviews are just average. Learn more in our Travelers’ review.

#8 – American Family: Best for Student Savings

Pros

- Student Savings: Ohio students under 25 can get discounts for having good grades.

- Coverage Selection: Ohio customers can select add-ons as needed for their vehicles. See what’s offered in our American Family review.

- Good Customer Feedback: Reviews left by customers are mostly positive.

Cons

- Online Policy Management: American Family’s online management tools may be limited compared to other companies.

- New Customer Rates: American Family’s loyalty discount doesn’t apply to new customers’ rates, so initial quotes may be higher.

#9 – Farmers: Best for Local Agents

Pros

- Local Agents: Most Ohio customers should have access to a local agent. Learn more in our review of Farmers.

- Multi-Policy Discount: Customers can lower Ohio auto insurance rates by also purchasing home or renters insurance.

- Coverage Selection: Ohio customers can pay a little more to add on protective coverages like roadside assistance.

Cons

- High-Risk Driver Rates: Ohio auto insurance rates are less cheap for bad drivers.

- Average Customer Ratings: Farmers doesn’t stand out for its customer service based on reviews.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Ohio customers can easily customize policies. Read our Liberty Mutual review for more information.

- Multi-Vehicle Discount: Insuring more than one vehicle will lower rates for Ohio customers.

- Claim Assistance: Claim filing and assistance are available 24/7 to Ohio drivers.

Cons

- Average Customer Ratings: Liberty Mutual doesn’t stand out for customer service.

- High-Risk Rates: Ohio rates are less cheap for poor drivers.

Finding the Best Auto Insurance in Ohio

With so many auto insurance companies to choose from, it can be overwhelming to sort through them to find which ones are best for you. We recommend starting with the following ten companies.

Ohio Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $64 | $168 | |

| $33 | $86 | |

| $52 | $135 | |

| $32 | $82 | |

| $57 | $148 |

| $61 | $159 |

| $45 | $119 | |

| $37 | $98 | |

| $34 | $89 | |

| $22 | $57 |

The best way to approach this is to see which few companies are the cheapest based on your driving record factors and then get quotes from these companies. State Farm and other companies offer quotes from their websites, or you can compare rates using a comparison tool.

For example, if you have caused an accident before, you should see which companies offer the cheapest rates for drivers with an at-fault accident. You can also shop for discounts at the best companies to see if your Ohio insurance rates can be further reduced.

Scroll down to see how coverage limits, driving record, and even your age affect how much you pay for auto insurance in Ohio.

Read more: Top 7 Factors That Affect Auto Insurance Rates

Cheapest Ohio Auto Insurance Company for Minimum Coverage

Every driver in Ohio must carry minimum liability insurance coverage to meet Ohio auto insurance requirements. If you cause a car accident, liability insurance will pay for the other drivers’ accident bills. Not carrying Ohio’s required coverage could result in fines, loss of driving privileges, and more.

If the cost of car insurance is more daunting to you than the penalties for not following Ohio auto insurance laws, however, don’t worry. Cheaper rates for minimum liability insurance may be found at a different auto insurance company than the one you are currently with.

Take a look at the table below to see which auto insurance companies have the cheapest Ohio auto insurance rates for minimum liability coverage.

Ohio Minimum Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $64 | |

| $33 | |

| $52 | |

| $32 | |

| $57 |

| $61 |

| $45 | |

| $37 | |

| $34 | |

| $22 | |

| U.S. Average | $44 |

Some of your cheaper options for a basic liability insurance policy will be Geico, American Family, State Farm, and Travelers. Their rates tend to fall below Ohio’s average liability insurance rates, which are $31 per month or $372 per year.

Companies to avoid when looking for cheap car insurance in Ohio include Allstate, Liberty Mutual, and Travelers. You will find that the base rates for liability insurance at these companies are higher than average, making them a more expensive choice for the majority of drivers.

Read more about the most expensive companies in our Allstate auto insurance review and Liberty Mutual auto insurance review.

Cheapest Ohio Auto Insurance Company for Full Coverage

Full coverage car insurance policies are often the better choice for most drivers in Ohio. If you are in an accident, full coverage car insurance will pay for your car repairs, not just the other drivers.

However, the better financial protection that comes with full coverage also means your rates will be higher than if you just purchase minimum liability insurance.

The good news is that the cost of better protection doesn’t have to break the bank. The table below shows how some companies offer significantly cheaper rates for full coverage insurance in Ohio.

Ohio Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $168 | |

| $86 | |

| $135 | |

| $82 | |

| $148 |

| $159 |

| $119 | |

| $98 | |

| $89 | |

| $57 | |

| U.S. Average | $114 |

A few of the insurance companies that offer the cheapest average rates are State Farm, American Family, Geico, and Travelers. Their rates tend to fall below the Ohio state average for full coverage, which is $90 per month or $1,080 per year.

On the other hand, companies with average rates well above Ohio’s average rates are Allstate and Farmers. If you have a clean driving record, you should avoid these companies and get quotes from the cheapest companies instead.

Cheapest Ohio Auto Insurance Company For Young Drivers

Young drivers are inexperienced, which means they are at a greater risk of crashing and filing a claim. Because of this, insurance companies often charge young drivers the highest insurance rates out of all types of drivers.

Auto insurance rates for young drivers in Ohio can often be hundreds of dollars per month. Many young drivers will be unable to afford these extremely high rates, although shopping around and comparing companies may help them find a more affordable policy.

Below, you can see how rates change for young drivers among different insurance companies.

Ohio Full Coverage Auto Insurance Monthly Rates for Teen Drivers by Gender & Provider

| Insurance Company | Female (Age 16) | Male (Age 16) | Female (Age 18) | Male (Age 18) |

|---|---|---|---|---|

| $596 | $426 | $423 | $485 | |

| $292 | $209 | $218 | $237 | |

| $974 | $696 | $762 | $792 | |

| $229 | $164 | $199 | $186 | |

| $986 | $705 | $710 | $802 |

| $734 | $524 | $452 | $597 |

| $1,130 | $807 | $810 | $919 | |

| $431 | $308 | $279 | $350 | |

| $949 | $678 | $492 | $772 | |

| $195 | $139 | $143 | $159 | |

| U.S. Average | $702 | $502 | $449 | $530 |

Farmers, Progressive, and Allstate all have high average rates for young drivers, so these auto insurance companies should be avoided. The best auto insurance for teens and young drivers in Ohio includes Geico and State Farm.

We want to mention that the car insurance rates we show are for young drivers purchasing their own auto insurance policies.

It is often much more cost-effective when young drivers join a parent’s policy as a driver instead of purchasing their own separate coverage. As long as the young driver still lives at home or is merely away at school without a car, they can join a parent’s insurance policy.

There may also be discounts offered at insurance companies for young drivers, such as a discounts for good students or a student away discount, that can help parents find savings when insuring young drivers.

Cheapest Ohio Auto Insurance Company for Drivers With Poor Credit

Poor credit scores may seem to have little to do with your auto insurance rates, especially when the biggest factors that usually affect rates have to do with your driving history.

However, the majority of insurance companies will charge drivers with poor credit scores more than drivers with good credit scores.

Insurance companies upcharge drivers with poor credit because these drivers are more likely to miss payments on their insurance plans. Missed payments result in late fees or cancellations, and a driver whose insurance is going to be canceled also runs the risk of illegally going without insurance coverage.

Ohio Full Coverage Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

If you have a poor credit score, the following insurance companies in Ohio will offer some of the better rates.

Some of the companies that are normally cheaper, such as State Farm, become more expensive for drivers with poor credit scores. These changes in rates among normally cheap companies show the importance of shopping around for auto insurance quotes when you have bad credit.

Learn about the best auto insurance companies for bad credit to see if you can find a cheaper rate.

Cheapest Ohio Auto Insurance Company for Drivers With Speeding Tickets

Traffic tickets are a red flag to insurance companies. Any moving violations, such as speeding or reckless driving, will increase your insurance rates because the company now assumes you are more likely to participate in risky behaviors that can lead to a claim. So, while a parking ticket won’t affect your Ohio auto insurance rates, a failure to yield ticket will.

The table below shows how much insurance companies charge on average for drivers with a traffic ticket on their record.

Ohio Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $188 | $168 | |

| $91 | $86 | |

| $201 | $135 | |

| $113 | $82 | |

| $196 | $148 |

| $185 | $159 |

| $165 | $119 | |

| $107 | $98 | |

| $110 | $89 | |

| $63 | $57 | |

| U.S. Average | $151 | $114 |

Geico, State Farm, and Travelers are some of the best auto insurance companies for drivers with speeding tickets. Some of the more expensive companies will be Allstate, Liberty Mutual, Progressive, and similar companies.

If you have more than one traffic ticket on your record, it is worth shopping around to see if another company will offer a cheaper auto insurance rate for your driving record.

Cheapest Ohio Auto Insurance Company for Drivers With At-Fault Accidents

At-fault accidents are another red flag to insurance companies. Drivers with a history of causing accidents are considered to be at a higher risk of causing another accident in the future.

Insurance rates will stay high for a few years after the at-fault accident at most insurance companies. Therefore, it is beneficial to shop around after an at-fault accident and see if a different auto insurance company in Ohio will offer a cheaper rate.

Take a look at the average insurance rates below for drivers with at-fault accidents.

Ohio Full Coverage Auto Insurance Monthly Rates by Provider: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $223 | $168 | |

| $91 | $86 | |

| $196 | $135 | |

| $119 | $82 | |

| $217 | $148 |

| $234 | $159 |

| $226 | $119 | |

| $116 | $98 | |

| $122 | $89 | |

| $77 | $57 | |

| U.S. Average | $171 | $114 |

Some of the more expensive companies for drivers who caused an accident are Allstate, and Progressive. State Farm is among the companies that offer some of the cheapest rates after an at-fault accident.

We want to note, too, that some insurance companies in Ohio may offer accident forgiveness. This can save you a lot of money after an at-fault accident, as your first accident with the company will be forgiven.

A few Ohio insurance companies that offer these accident forgiveness programs will require drivers to pay an additional fee to join the program. Other companies offer this perk for free if drivers have been accident-free for a few years.

Cheapest Ohio Auto Insurance Company for Drivers With DUIs

A DUI changes Ohio auto insurance rates significantly, often more than an at-fault accident or traffic ticket. If you have a recent DUI conviction, it is important to shop around for insurance quotes to see if a different auto insurance company offers cheaper rates.

Below, you can see the average insurance rates for DUI drivers at different Ohio insurance companies.

Ohio Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $168 | $223 | $231 | $188 | |

| $86 | $91 | $91 | $91 | |

| $135 | $196 | $189 | $201 | |

| $82 | $119 | $175 | $113 | |

| $148 | $217 | $223 | $196 |

| $159 | $234 | $326 | $185 |

| $119 | $226 | $137 | $165 | |

| $98 | $116 | $107 | $107 | |

| $89 | $122 | $197 | $110 | |

| $57 | $77 | $87 | $63 | |

| U.S. Average | $114 | $171 | $186 | $151 |

Nationwide and Allstate have some of the most expensive rates for drivers with DUIs. It is better to start getting quotes from companies with the best auto insurance for drivers with DUIs, such as State Farm, before checking out the most expensive companies for insurance rates.

Cheapest Ohio Cities For Car Insurance

If you move around Ohio, you will likely see a change in your insurance rates, even if you stay with the same auto insurance company you were with before relocating. This is because auto insurance companies use a driver’s home address as part of their pricing process.

Some of the location factors insurance companies will look at include the following:

- Crime: Comprehensive insurance will cost more in areas with higher rates of stolen vehicles and vandalism.

- Crashes: Ohio insurance will cost more in areas that have a history of multiple crashes in the area. For example, there may be more dangerous roads in your area that lead to multiple crashes each year.

- Traffic: If there is heavier traffic in your area, OH insurance companies may charge more as you are more likely to get into accidents with other drivers, even if it’s just a minor denting of someone’s back bumper.

- Weather: Ohio insurance rates will be higher in areas with poor weather conditions that can cause accidents. For instance, if you live in a state with colder weather, there is a higher chance you will be driving on icy roads or in snowy conditions.

As you can see from the examples above, location factors all have an impact on what your insurance company will charge you. For example, one of the more expensive cities in Ohio for auto insurance is Cleveland.

As one of the largest cities in Ohio, Cleveland’s higher insurance rates make sense. More drivers on the road mean a higher likelihood of running into another car and filing a claim.

However, no matter what city you move to, you should always look into different companies’ quotes to see if a cheaper rate can be found in your new city.

Unveiling the Cost of Auto Insurance in Your City

Discover how auto insurance costs vary across different cities in Ohio with our table detailing the cost of auto insurance in your city.

Ohio Auto Insurance Cost by City

From Dayton to Toledo, and Lorain to Westerville, find out how your location impacts your insurance rates.

Ways to Increase Your Ohio Auto Insurance Savings

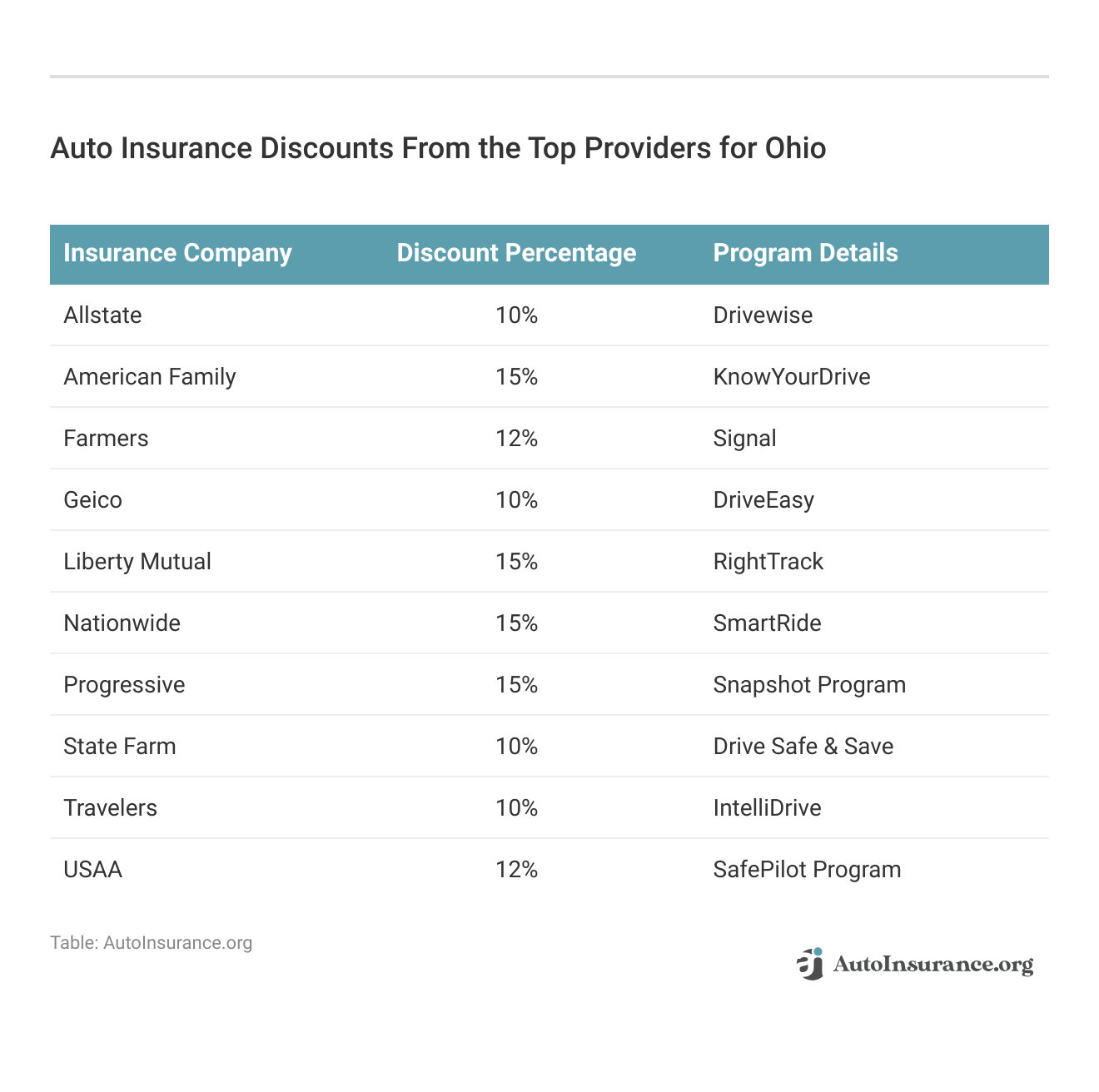

We’ve covered a lot of ground about which companies are the best choices for many different types of drivers. If you have gotten quotes from the cheapest companies but still want to find additional savings, you can try a few other tricks to reduce your Ohio car insurance rates further.

Take a look at our tips below:

- Apply for Discounts: Sometimes auto insurance discounts aren’t automatically applied to your rates, as you have to apply for them. Ohio auto insurance discounts include safe driving program discounts, good student discounts, and more.

- Choose Affordable Cars: Picking a car that is cheaper to insure will save you money in the long run. Look for cars with good safety and crash ratings, as well as inexpensive parts that are easy to find.

- Drive Safely: Being a safe driver will go a long way to reducing your auto insurance costs. Even if you have an accident or ticket on your record, avoiding any more infractions for a few years will help reduce rates.

- Increase Deductibles: Raising your auto insurance deductible will decrease your rates. We caution, however, not to raise it beyond an amount you can pay out of pocket, or you may be stuck without a car until you can afford to pay the deductible for repairs.

- Reduce Coverage: If you have any optional insurance coverages, such as roadside assistance, dropping them will reduce your rates. You can also consider carrying just liability insurance if your car is older and significantly depreciated in value.

Following the tips above, in addition to shopping around for quotes from companies in Ohio, will help you reduce your auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ohio Car Insurance Laws and DUI Penalties

Ohio’s laws and DUI penalties will have an effect on how much you pay for auto insurance and related expenses, so we want to go over both of these factors in detail.

Learn more: Cheap Auto Insurance After a DUI

Minimum Ohio Auto Insurance Coverage

How much you will have to pay for a bare minimum auto insurance policy depends upon what coverages and limits your state requires. In Ohio, all drivers must carry bodily injury liability insurance and property damage liability insurance.

Proof of insurance must be shown at vehicle inspections, traffic stops, and accidents in Ohio. Failure to carry these coverages will lead to fines, loss of driving privileges, and more if caught driving without auto insurance.

In Ohio, drivers must carry the following limits of these two liability insurance coverages:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $25,000 per accident

These limits simply refer to the maximum amount that insurance will pay if you cause an accident that injures other people or damages their property. You will be responsible for any costs that exceed your insurance limits.

This is why we highly recommend carrying a higher limit of liability insurance if you can afford to do so, as you will be better protected financially if you cause an accident.

Optional Auto Insurance Coverages in Ohio

Ohio minimum insurance requirements don’t require any other auto insurance coverages besides bodily injury and property damage liability insurance to drive legally. However, lenders often put in their contracts that you must carry collision and comprehensive insurance on your car with a lease or loan. In those cases, you are legally required to carry those additional coverages for a full coverage insurance policy.

States require liability insurance, but what do you need to cover your car 🚘if you cause an accident🤔? The answer: Collision coverage. https://t.co/27f1xf1ARb specializes in insurance and has the info you need. Check it out here👉: https://t.co/qGCSzimRSO pic.twitter.com/JPjFnXnmct

— AutoInsurance.org (@AutoInsurance) September 19, 2023

Besides those two coverages, however, in most cases, you can choose which of the following auto insurance coverages you want to carry on your vehicle:

- Collision auto insurance

- Comprehensive auto insurance

- Gap insurance

- Medical payments coverage

- Modified car insurance

- New car insurance

- Personal injury protection insurance

- Rental car reimbursement

- Roadside assistance coverage

- Umbrella insurance

While staple insurance coverages like collision and comprehensive insurance will be offered at all insurance companies, other insurance coverages on this list may not be available.

If coverages like roadside assistance insurance or rental reimbursement insurance are important to you, you should shop around to see which insurance companies offer these add-on auto insurance coverages.

DUI Penalties in Ohio

As in any state, DUIs come with a host of penalties in Ohio. The financial cost of paying off fines and following Ohio’s requirements after a DUI can quickly add up to thousands of dollars for drivers.

Penalties vary depending on what number of DUI a driver is being convicted for and if anyone was injured from the DUI, so drivers may face some of all of the following in Ohio after a DUI:

- Drug/Alcohol assessment or treatment

- Driver’s license points

- Fines

- Ignition interlock device (IID)

- Jail time

- Probation

- Restricted license plates

- Suspended license

- SR-22 certificate

- Vehicle forfeiture

In addition to the possible penalties listed above, drivers will also find that they have much higher auto insurance rates than before their DUI. They will also have to pay to fulfill some of the court’s requirements, such as paying to install an ignition interlock device (IID) on their vehicles.

All of these costs can make it difficult for drivers to afford their auto insurance once they can drive again, so it’s imperative to get quotes if drivers have a DUI on their record in Ohio.

SR-22 Auto Insurance Certificates in Ohio

Usually, drivers will need an SR-22 certificate if they are applying to get their license back after a suspension. SR-22 certificates prove that high-risk drivers are abiding by Ohio’s auto insurance laws and carrying minimum liability on their vehicles.

Some of the reasons a driver would need to show proof of insurance would be:

- Too many points amassed on a driving license

- Caught driving under the influence

- Caught driving without insurance

- Caught driving with a suspended or expired license

To get an SR-22 certificate, you will have to reach out to your insurance company to get cheap SR-22 auto insurance. Some insurance companies may charge small fees for filing an SR-22 certificate. They may also choose to drop you as a high-risk driver, although they are required to give you plenty of notice so that you are able to find a new insurance company.

When shopping for a new Ohio auto insurance company, make sure you let companies know you need an SR-22 certificate. Attempting to conceal this information could result in you being dropped as a customer.Brandon Frady Licensed Insurance Agent

We want to note that if you don’t have a car, you will need to purchase non-owner car insurance in order to qualify for an SR-22 certificate. Non-owner car insurance offers liability insurance that meets the amounts required by the state of Ohio, so if you cause an accident, you’ll be covered by your personal liability policy.

Finding the Best Ohio Auto Insurance Today

Car insurance is expensive, but it is a necessary expense. Not carrying it could result in fines, license suspension, and more. Luckily, there are methods drivers can follow to find cheap auto insurance in Ohio, from applying for discounts to choosing a car that is cheaper to insure.

The best way to find affordable Ohio auto insurance is to shop around at the cheapest companies and car insurance quotes in Ohio. If you want to find the cheapest rates in Ohio for you, use our free quote comparison tool to see which companies in your area have the best Ohio auto insurance rates.

Frequently Asked Questions

Who has the cheapest insurance rates in Ohio?

Some Ohio auto insurance companies that consistently have cheaper rates in Ohio are State Farm, Travelers, and Geico. However, the cheapest car insurance company in Ohio depends on a driver’s vehicle, driving record, location, and other important factors.

What is the average cost of auto insurance in Ohio?

In Ohio, the average rate for a minimum liability insurance policy is $31 per month. The average rate for a full coverage insurance policy is higher at $90 per month. The actual rate you pay in Ohio will vary depending on which insurance company you choose and your driving record.

What is Ohio state minimum car insurance?

Ohio car insurance requirements are 25/50/25 of liability coverage. Drivers who are caught driving without insurance face fines, suspended licenses, and more.

Which auto insurance companies offer the cheapest rates for minimum liability coverage in Ohio?

Some of the cheaper options for minimum liability insurance in Ohio include Geico, American Family, State Farm, and Travelers.

Why is car insurance expensive in Ohio?

Car insurance in Ohio is slightly more expensive than the national average cost of car insurance. The increased rates could be due to a number of factors, from the number of uninsured drivers in Ohio to the local wildlife and weather conditions.

What is considered full coverage insurance in Ohio?

Ohio’s full coverage insurance is the state’s minimum coverage combined with comprehensive and collision coverage (learn more: Collision vs. Comprehensive Auto Insurance).

What are the best insurance companies for young drivers in Ohio?

Geico and State Farm are considered the best insurance companies for young drivers in Ohio.

Which insurance companies offer affordable rates for drivers with poor credit scores in Ohio?

Ohio car insurance companies such as Progressive, Geico, and State Farm offer relatively better rates for drivers with poor credit scores in Ohio (learn more: How Credit Scores Affect Auto Insurance Rates).

What are the cheapest insurance companies for drivers with speeding tickets in Ohio?

Geico, State Farm, and Travelers are some of the best insurance companies in Ohio that offer cheaper rates for drivers with speeding tickets in Ohio.

Is Ohio a no-fault state?

No, Ohio is an at-fault state. Make sure you carry the right Ohio auto insurance coverage from auto insurance companies in Ohio to protect you after an accident. Shop for the best coverage today by entering your ZIP into our free tool for Ohio auto insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.