Best Pay-As-You-Go Auto Insurance in Alabama for 2025 (Top 9 Company Ranking)

Nationwide, USAA and Progressive offer the best pay-as-you-go auto insurance in Alabama. If you drive under 833 miles per month, you can find pay-as-you-go auto insurance quotes for $70/month. The top pay-as-you-go car insurance companies help drivers save up to 30%.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best pay-as-you-go auto insurance in Alabama is a great choice for drivers who want to save money by only paying for the miles they drive.

Companies like Metromile and Mile Auto offer flexible plans with low per-mile rates and easy-to-use apps for tracking mileage. If you’re looking for cheap car insurance in Alabama, a pay-as-you-go plan could be a smart option, especially if you don’t drive much.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Alabama

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Flexible Plans | Nationwide |

| #2 | 15% | 15% | Military Benefits | USAA | |

| #3 | 15% | 30% | Coverage Options | Progressive | |

| #4 | 25% | 20% | Safe Drivers | Allstate | |

| #5 | 17% | 10% | Local Support | State Farm | |

| #6 | 25% | 15% | Low Rates | Geico | |

| #7 | 10% | 30% | Customizable Policies | Liberty Mutual |

| #8 | 10% | 10% | Discount Variety | Farmers | |

| #9 | 20% | 10% | Membership Benefits | AAA |

By comparing monthly rates, customer reviews, and policy features, you can find the best insurance in Alabama that fits your budget and gives you the coverage you need. Compare rates with our free quote tool to find cheap auto insurance online.

- Nationwide has the best Alabama pay-per-mile auto insurance

- USAA and Progressive offer great usage-based insurance in Alabama

- Drivers must carry insurance that fulfills Alabama pay-per-mile insurance laws

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Overall Pick

Pros

- Flexible Plans: Choose a regular insurance plan or a pay-per-mile plan at Nationwide.

- Coverage Options: Nationwide offers great add-ons for Alabama drivers, such as 24/7 breakdown assistance.

- Discount Variety: Nationwide offers young drive discounts, bundling discounts, and many more.

Cons

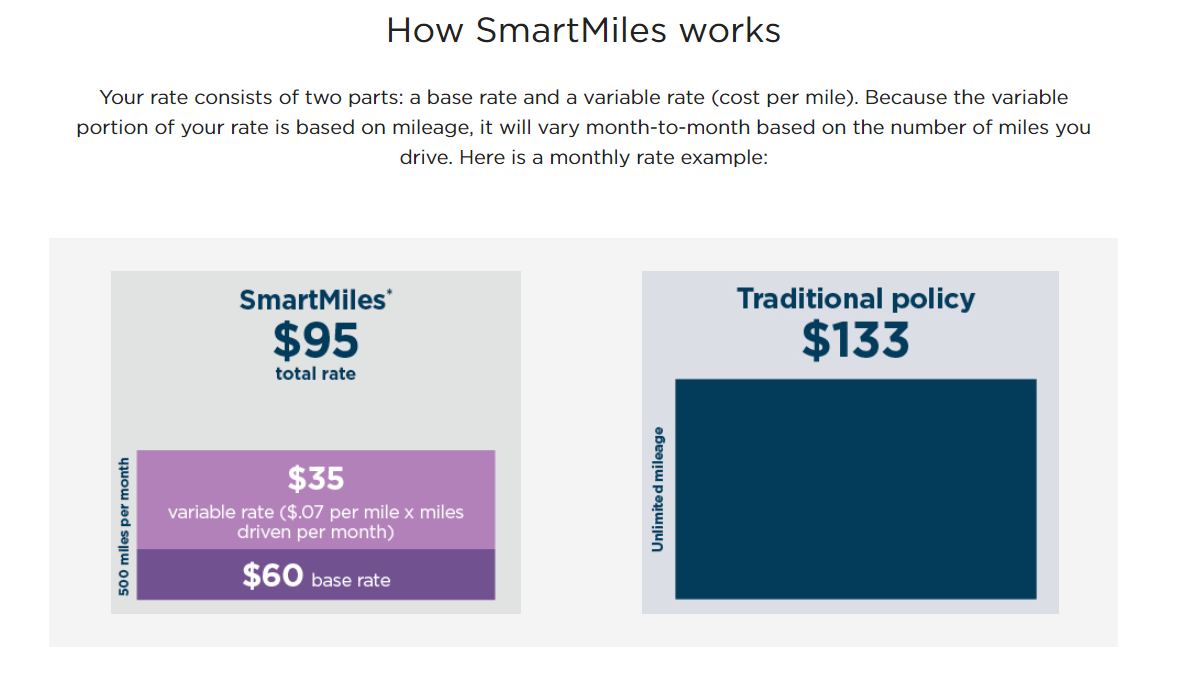

- High-Mileage Rates: You shouldn’t opt for a Nationwide pay-per-mile plan if you have high annual mileage. Learn more in our Nationwide SmartMiles review.

- Telematics Tracking: Nationwide tracks driving data for its pay-per-mile insurance and usage-based discount.

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA members can get discounts on items other than auto insurance.

- Customer Service: USAA’s service in Alabama is highly rated. Find out more in our USAA auto insurance review.

- Discount Options: Although USAA already offers cheap rates, it offers plenty of discounts for additional savings.

Cons

- Eligibility: Only Alabama drivers who are veterans or service members can purchase insurance.

- Telematics Tracking: If you want to get a usage-based discount, USAA will track your driving data.

#3 – Progressive: Best for Coverage Variety

Pros

- Tight Budgets: If you have budget constraints, use the free Name Your Price tool offered by Progressive.

- Snapshot Program: Alabama drivers can participate in a usage-based discount program.

- Coverage Options: Alabama drivers have numerous coverages to add to their plans. Read more in our review of Progressive auto insurance.

Cons

- Snapshot Rate Increases: Alabama drivers may have rates raised in the Snapshot program. Learn more in our Progressive Snapshot review.

- Customer Reviews: Claims handling in Alabama has some mixed reviews.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Safe Drivers

Pros

- Safe Drivers: Allstate’s rates in Alabama are cost-effective for safe drivers. Learn more about rates in our Allstate auto insurance review.

- Pay-Per-Mile Insurance: Allstate offers Milewise pay-per-mile insurance. Read our Allstate Milewise review for more information on Allstate pay-per-mile insurance.

- Coverage Variety: Alabama drivers can choose several add-ons or carry bare minimum coverage.

Cons

- Customer Reviews: Alabama drivers aren’t always satisfied with claims processing at Allstate.

- High-Mileage Drivers: Alabama drivers shouldn’t choose Milewise insurance if they have high annual mileage.

#5 – State Farm: Best for Local Support

Pros

- Local Support: Alabama agents are available throughout the state to offer assistance.

- Usage-Based Discount: State Farm offers a discount based on usage in Alabama. Learn more in our State Farm Drive and Safe review.

- Young Driver Discounts: Families in Alabama can save with good student discounts, student-away discounts, and more.

Cons

- Telematics Tracking: State Farm tracks driving data for its UBI discount in Alabama.

- DUI Rates: Alabama drivers with DUIs will find rates more expensive. Find out more in our State Farm auto insurance review.

#6 – Geico: Best for Low Rates

Pros

- Low Rates: Geico’s rates are consistently low for the majority of Alabama drivers. Read our Geico auto insurance review for more rate information.

- Usage-Based Discount: Alabama drivers can join Geico’s DriveEasy Program to save. Learn more in our Geico DriveEasy review.

- Coverage Options: Alabama auto insurance plans include options to add roadside assistance, gap insurance, and more.

Cons

- Local Agent Availability: Most services are conducted virtually, limiting in-person assistance.

- Telematics Tracking: Alabama drivers must let Geico track driving data for a UBI discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Alabama drivers can customize their policy plans at Liberty Mutual. See what is offered in our Liberty Mutual auto insurance review.

- Usage-Based Discount: Liberty Mutual offers RightTrack to Alabama drivers. Read more in our Liberty Mutual Right Track review.

- Roadside Assistance: Available around the clock to Alabama drivers who add it to their policy plan.

Cons

- Telematics Tracking: Alabama drivers must let Liberty Mutual track data with the RightTrack app.

- High-Risk Rates: DUIs, at-fault accidents, and other incidents will raise Alabama drivers’ rates past the average.

#8 – Farmers: Best for Discount Variety

Pros

- Discount Variety: Learn about the various discounts offered in our Farmers auto insurance review.

- Usage-Based Discount: Alabama drivers can save with the Signal program. See how in our Farmers Signal review.

- Vehicle Safety Discounts: Alabama drivers with safe cars will have lower rates.

Cons

- Telematics Tracking: Alabama drivers will have their data tracked for the UBI discount.

- Customer Satisfaction: Alabama drivers don’t always rate Farmers highly.

#9 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: AAA members can use their member ID to get discounts on some items when shopping.

- Roadside Assistance: Alabama drivers can choose from several different plan options.

- Good Driver Discount: Participate in AAA’s good driver program for a discount. See what other discounts AAA offers in our AAA auto insurance review.

Cons

- Additional Fee: Alabama drivers must pay a small membership fee each year.

- Telematics Tracking: AAA tracks driving data before issuing a good driver discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Alabama Pay-As-You-Go Auto Insurance Works

Most of the best pay-as-you-go auto insurance companies work the same way, whether you’re getting auto insurance in Alabama for a motorcycle or a car. Traditional pay-as-you-go auto insurance plans have a base monthly fee plus a per-mile rate unless you go with non-traditional options like Hugo.

Some companies don’t offer pay-per-mile plans but instead give discounts based on your driving habits. Getting car insurance quotes in Alabama can help you find the best deal. While some people look for cheap pay-as-you-go car insurance, just having the minimum coverage might not be enough to fully protect you in an accident.

Pay-As-You-Go Auto Insurance in Alabama: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $33 | $95 |

| $51 | $143 | |

| $63 | $177 | |

| $42 | $118 | |

| $77 | $215 |

| $46 | $128 |

| $53 | $149 | |

| $51 | $144 | |

| $27 | $74 |

If you do have an accident, filing a pay-as-you-go auto insurance claim in Alabama is usually the same as with regular insurance, but coverage may be limited.

In addition, when exploring Liberty Mutual pay-per-mile insurance in Alabama, drivers should review its pricing structure to ensure it meets their budget and coverage needs. Likewise, Geico pay-per-mile insurance rewards low-mileage drivers with potential savings.

When You Need Pay-As-You-Go Auto Insurance in Alabama

You might need pay-as-you-go auto insurance online if you don’t drive much but still have to meet Alabama’s minimum auto insurance requirements. This type of insurance is a good option for low-mileage drivers who want to save money while staying covered.

Alabama Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $215 | $255 | $280 | $310 |

| 16-Year-Old Male | $230 | $265 | $295 | $320 |

| 20-Year-Old Female | $200 | $235 | $255 | $280 |

| 20-Year-Old Male | $220 | $250 | $270 | $300 |

| 30-Year-Old Female | $170 | $195 | $215 | $235 |

| 30-Year-Old Male | $180 | $205 | $225 | $245 |

| 40-Year-Old Female | $160 | $180 | $200 | $220 |

| 40-Year-Old Male | $170 | $190 | $210 | $230 |

| 50-Year-Old Female | $150 | $170 | $190 | $210 |

| 50-Year-Old Male | $160 | $180 | $200 | $220 |

| 60-Year-Old Female | $140 | $155 | $175 | $195 |

| 60-Year-Old Male | $150 | $165 | $185 | $205 |

| 70-Year-Old Female | $130 | $140 | $155 | $175 |

| 70-Year-Old Male | $140 | $150 | $165 | $185 |

If you live in one of Alabama’s expensive cities, where insurance costs more due to heavy traffic and accident rates, choosing low-income car insurance in Alabama or a pay-as-you-go plan can help lower your costs.

Many people search for cheap Alabama car insurance to find an affordable option that fits their driving habits. If you’re wondering how much car insurance in Alabama is, the price depends on things like where you live, your driving record, and the coverage you choose.

Alabama Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Birmingham | Huntsville | Mobile | Montgomery | Tuscaloosa |

|---|---|---|---|---|---|

| 16-Year-Old Female | $180 | $170 | $190 | $175 | $185 |

| 16-Year-Old Male | $190 | $180 | $200 | $185 | $195 |

| 20-Year-Old Female | $160 | $150 | $170 | $155 | $165 |

| 20-Year-Old Male | $170 | $160 | $180 | $165 | $175 |

| 30-Year-Old Female | $140 | $130 | $150 | $135 | $145 |

| 30-Year-Old Male | $150 | $140 | $160 | $145 | $155 |

| 40-Year-Old Female | $130 | $120 | $140 | $125 | $135 |

| 40-Year-Old Male | $140 | $130 | $150 | $135 | $145 |

| 50-Year-Old Female | $120 | $110 | $130 | $115 | $125 |

| 50-Year-Old Male | $130 | $120 | $140 | $125 | $135 |

| 60-Year-Old Female | $110 | $100 | $120 | $105 | $115 |

| 60-Year-Old Male | $120 | $110 | $130 | $115 | $125 |

| 70-Year-Old Female | $100 | $90 | $110 | $95 | $105 |

| 70-Year-Old Male | $110 | $100 | $120 | $105 | $115 |

Using a comparison service like Go auto insurance payment options can help you find the best deal. Choosing cheap Alabama auto insurance with a pay-as-you-go option helps you stay insured without overspending.

Alabama Auto Insurance Requirements And Laws

In Alabama, drivers must have the right insurance and follow traffic laws. Liability insurance is required, but it only covers damages to others, not your own car.

Alabama mandates 25/50/25 liability insurance: $25,000 per person, $50,000 per accident for injuries, and $25,000 for property damage.Dani Best Licensed Insurance Producer

If you want better protection, choosing cheap full coverage car insurance in Alabama can help pay for your own repairs too. Many people compare Alabama auto insurance quotes to find affordable options that meet state requirements. Teen drivers can save money by joining a family policy instead of buying their own.

Alabama Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $255 | $797 |

| 16-Year-Old Male | $287 | $600 |

| 20-Year-Old Female | $213 | $511 |

| 20-Year-Old Male | $246 | $607 |

| 30-Year-Old Female | $54 | $93 |

| 30-Year-Old Male | $58 | $163 |

| 40-Year-Old Female | $115 | $275 |

| 40-Year-Old Male | $130 | $292 |

| 50-Year-Old Female | $50 | $139 |

| 50-Year-Old Male | $50 | $216 |

| 60-Year-Old Female | $44 | $64 |

| 60-Year-Old Male | $46 | $63 |

| 70-Year-Old Female | $49 | $143 |

| 70-Year-Old Male | $49 | $143 |

This can lower costs with the best car insurance in Alabama providers. If you’re asking who has the cheapest car insurance in Alabama, shopping around and comparing rates is the best way to find a good deal.

Some companies also offer pay-as-you-go full coverage insurance, which lets you pay based on how much you drive while still following Alabama’s auto insurance laws.

Learn more: Cheapest Teen Driver Auto Insurance in Alabama

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Low-Mileage Drivers in Alabama Save Money on Auto Insurance

Low-mileage drivers in Alabama can save money with special discounts from insurance companies. Even if a company doesn’t offer pay-per-mile coverage, you can still get a pay-as-you-go auto insurance quote to lower costs.

Many providers offer Alabama auto insurance discounts for drivers who don’t drive much, which can save up to 30% on a policy. Other ways to save include bundling policies, signing up for paperless billing, and maintaining a good driving record. Comparing car insurance rates in Alabama is a great way to find the best deal.

Some cheap Alabama car insurance companies offer extra savings for safe drivers and low-mileage drivers. If you ever need to file a claim, Go Auto Insurance claims can help.

Companies like Good-to-Go Auto Insurance also offer affordable options for low-mileage drivers. To find the cheapest Alabama car insurance, shop around and take advantage of every available discount. Read more about low-mileage auto insurance discounts.

Key Factors to Consider When Comparing Pay-As-You-Go Auto Insurance

When you are comparing pay-as-you-go car insurance, it’s important for you to look at the pricing, coverage, and how claims are handled. Some pay-as-you-go car insurance companies base rates on miles driven, while others track driving habits.

Knowing how pay-as-you-go auto insurance claims work helps you avoid surprises when filing a claim. If you’re searching for cheap auto insurance in Alabama, check how each company sets auto insurance premiums and what discounts they offer, like safe driving or bundling. Getting multiple Alabama car insurance quotes is a smart way to compare costs and coverage.

Checking auto insurance quotes in Alabama also helps you find a policy that matches your driving needs. If you want short-term or flexible coverage, on-the-go auto insurance is a good option without long-term commitments. Always review the policy details to make sure it follows U.S. insurance laws and meets state requirements before making a decision.

Choosing the Best Pay-As-You-Go Auto Insurance in Alabama

Finding the best pay-as-you-go car insurance in Alabama is important for drivers who want affordable coverage without paying for miles they don’t drive. Many people look for cheap insurance in Alabama, but it’s also important to check coverage details and read auto insurance reviews to find a reliable company.

Every driver must carry car insurance in Alabama, so choosing a policy that meets the state’s legal requirements is a must. The Alabama automobile insurance plan helps high-risk drivers get coverage, but those with a clean record can find cheaper options. Good pay-as-you-go auto insurance customer service is also important, making it easier to manage your policy and file claims when needed.

Since insurance costs vary based on driving history and location, getting multiple quotes can help you find the best deal. Always compare policies to make sure you get affordable and legal coverage in Alabama.

Read more: How to Check if an Auto Insurance Company is Legitimate

Ready to shop for Alabama car insurance today? Enter your ZIP code into our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What does pay-as-you-go auto insurance mean?

Pay-as-you-go auto insurance charges based on mileage or usage, ideal for low-mileage drivers. Checking Alabama pay-per-mile car insurance reviews from providers like Nationwide or Hugo auto insurance helps compare rates. Knowing the average cost of car insurance in Alabama ensures you make the best choice.

What is the maximum mileage for pay-as-you-go insurance?

The maximum mileage for Alabama pay-per-mile insurance coverage depends on the company. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Is pay-as-you-go car insurance worth it?

Pay-as-you-go auto insurance is worth it for drivers with low annual mileage (Learn more: How Annual Mileage Affects Your Auto Insurance Rates).

How do Alabama pay-as-you-go insurance companies verify mileage?

The best pay-per-mile insurance companies typically track mileage through an app or odometer device. Other companies may only require a picture of the odometer each month.

What is the minimum auto insurance coverage in Alabama?

Minimum auto insurance consists of liability insurance for bodily injuries and property damage. The Alabama pay-per-mile insurance statute has the same requirements as a normal auto insurance policy.

Who has the cheapest full-coverage insurance in Alabama?

USAA and Geico have the cheapest Alabama auto insurance rates for full coverage.

Why is Alabama auto insurance so expensive?

Alabama auto insurance costs can be expensive if drivers have poor driving records or shop at expensive companies. We recommend using an Alabama car payment calculator to determine rates.

Which pay-as-you-go company has the highest customer satisfaction in Alabama?

USAA has some of the highest Alabama usage-based car insurance reviews.

What happens if you drive without insurance in Alabama?

Alabama auto insurance requirements require all drivers to have auto insurance. If caught driving without auto insurance, you face fines, license suspensions, and more.

Does credit score affect pay-as-you-go car insurance in Alabama?

Yes, credit scores can impact the cheapest pay-per-mile insurance rates (Read more: How Credit Scores Affect Auto Insurance Rates).

How much is auto insurance in Alabama per month?

Minimum coverage in Alabama is an average of $40 per month, though rates vary drastically based on driving record. Use our free quote tool to find the best rates for your vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.