Best Pay-As-You-Go Auto Insurance in California (Top 10 Companies for 2025)

Metromile, AAA, and Allstate have the best pay-as-you-go auto insurance in California. Drivers save up to 40% with low-mileage discounts from Allstate. Base rates start at just $29/mo with Metromile, but you'll get the cheapest pay-per-mile insurance policy if you drive less than 10,000 miles annually.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

150 reviews

150 reviewsCompany Facts

PAYG Full Coverage in CA

A.M. Best Rating

Complaint Level

Pros & Cons

150 reviews

150 reviews 3,027 reviews

3,027 reviewsCompany Facts

PAYG Full Coverage in CA

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 11,638 reviews

11,638 reviewsCompany Facts

PAYG Full Coverage in CA

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsMetromile, AAA, and Allstate have the best pay-as-you-go auto insurance in California.

Whereas most major companies offer a telematics discount for low-mileage drivers, Metromile is one of the few genuine pay-per-mile insurance companies.

It’s not a good pick for California auto insurance if you drive 10,000 or more miles per year, but low-mileage drivers can find significant savings with Metromile.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in California

| Company | Rank | Safe Driving Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 22% | A | Mileage Tracking | Metromile | |

| #2 | 17% | A | Additional Discounts | AAA |

| #3 | 19% | A++ | DriveSense Program | Allstate | |

| #4 | 18% | A | Distance Traveled | Safeco | |

| #5 | 20% | A | Behavior-Based | American Family | |

| #6 | 19% | A+ | Usage Monitoring | Progressive | |

| #7 | 21% | A+ | On-Demand Coverage | Nationwide |

| #8 | 23% | A++ | Behavior Monitoring | Travelers | |

| #9 | 20% | A | Trip Tracking | Liberty Mutual |

| #10 | 20% | A+ | Mileage Monitoring | Mercury |

Learn more about the best pay-as-you-go auto insurance companies in California below. Then, enter your ZIP code into our free tool above to find the lowest-costing insurance today.

- Pay-as-you-go insurance charges you for the miles you drive instead of a flat fee

- Pay-as-you-go companies sell minimum and full coverage plans

- Metromile and AAA have the best pay-per-mile insurance in California

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Metromile: Top Pick Overall

Pros

- Customizable Pay-Per-Mile Coverage: Metromile offers a variety of ways for drivers to customize their pay-as-you-go coverage, including their deductible amount, level of coverage, and add-ons.

- Easy-to-Use App: The Metromile app – which you’ll use to track your daily mileage – receives excellent reviews for its ease of use.

- Additional Benefits: Using the Metromile app is not just for tracking miles. It also gives you benefits like smart driving insights and vehicle diagnostics through the plug-in device.

Cons

- Higher Rates: Metromile tops our list of pay-as-you-go insurance companies, but it’s not the cheapest. Metromile has higher per-mile rates compared with other companies.

- Limited Coverage Options: You can purchase pay-as-you-go full coverage insurance from Metromile, but there aren’t many add-on options to increase your coverage. See what you can add to your policy in our Metromile auto insurance review.

#2 – AAA: Best Roadside Assistance Plans

Pros

- Safe Driving Discounts: AAA offers 17 discounts, which include savings for safe drivers. See all your discount options in our AAA auto insurance review.

- Roadside Assistance: As a company famous for its roadside assistance, it should come as no surprise that drivers love it. Choose from three roadside assistance plans to find the perfect coverage.

- AAADrive: AAADrive is the company’s usage-based insurance (UBI) program. Low-mileage drivers can save up to 30% with AAADrive.

Cons

- Membership Fees: You need to be an AAA member before you can purchase car insurance. The annual fee is usually no more than $115 per year, but it does add to the overall price of insurance.

- Coverage Varies: AAA auto insurance varies by region. California drivers should check with a representative to see coverage and discount options in their area.

#3 – Allstate: Best for Full Coverage Policies

Pros

- Milewise: Milewise is one of the options for the best car insurance for low-mileage drivers because it offers affordable per-mile rates and a great mobile app.

- Coverage Options: Allstate offers a variety of add-ons so you can get the coverage you want, even if you’re a low-mileage driver. Explore all your options in our Allstate auto insurance review.

- Daily Cap for Road Trips: Milewise caps the number of miles you can be charged for in a single day so you can still take road trips. In California, the daily cap is 250 miles.

Cons

- App Issues and Fees: If the Milewise app fails to report your daily mileage, Allstate will add 40 daily miles to your fees until the issue is resolved.

- Higher Rates: Allstate offers quality California pay-per-mile car insurance, but it comes at a price. Typically speaking, Allstate is one of the most expensive coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Safeco: Best for Flexible Payment Options

Pros

- Flexible Payment Options: Safeco makes it easy to manage your insurance needs by offering flexible payment options.

- Wide Range of Coverage: You can purchase a variety of coverage from Safeco, including SR-22, non-owner, and gap insurance.

- Generous Discounts: Safeco’s generous discounts earn it a spot as one of the top California auto insurance companies.

Cons

- Usage-Based Mile Tracking: Safeco’s low-mileage option is technically a telematics plan. It not only tracks your mileage but also your driving behaviors like braking and speeding.

- Weak Claims Reviews: Drivers frequently report problems with the Safeco claims handling process. Read more about Safeco’s claims process in our Safeco auto insurance review.

#5 – American Family: Best for Costco Members

Pros

- KnowYourDrive: KnowYourDrive offers savings of up to 20% for low-mileage drivers who consistently practice safe habits on the road.

- Costco Policies: American Family writes auto insurance policies for Costco, which helps warehouse members save.

- Ample Discount Opportunities: American Family has 18 discounts to help drivers find the lowest rates possible. See how many you qualify for in our American Family auto insurance review.

Cons

- Limited Availability: American Family only sells auto insurance in 19 states, and California is not included. However, you can buy American Family insurance through CONNECT, which writes Costco policies for American Family.

- Less Competitive Rates: While it offers excellent coverage, American Family’s pay-as-you-go insurance rates are not the lowest on the market.

#6 – Progressive: Best for Budgeting Tools

Pros

- Name Your Price Tool: Use Progressive’s Name Your Price tool to see coverage options that match your monthly insurance budget.

- Snapshot: While you can’t get direct pay-as-you-go insurance quotes from Progressive, you can sign up for Snapshot. Snapshot rewards drivers for having low mileage with a discount of up to 30%.

- Loyalty Discounts: Progressive automatically applies many of its 13 discounts directly to your account, including savings for being a loyal customer after your first year of coverage.

Cons

- Mixed Customer Reviews: Despite efforts to improve, Progressive struggles to keep customers. See what Progressive is doing to improve in our Progressive auto insurance review.

- Unexpected Rate Increases: Many Progressive drivers report unexpected rate increases when their policy is renewed, even though nothing has changed about their situation.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for UBI Savings

Pros

- SmartMiles Program: Nationwide’s SmartMiles is an excellent option for pay-as-you-go insurance for young drivers, especially if they want just enough coverage to meet California auto insurance limits.

- Safe Driving Discount: Drivers who sign up for SmartMiles may receive a 10% discount on their first policy renewal for being a safe driver.

- SmartRide Program: If California pay-per-mile auto insurance doesn’t sound like a perfect fit, you can still save for being a low-mileage driver with SmartRide. Learn more in our Nationwide auto insurance review.

Cons

- SmartRide Can Increase Rates: SmartRide is one of the few UBI programs that doesn’t guarantee your rates won’t increase.

- Can be Expensive: Nationwide is usually an affordable option, but it’s not the cheapest option for drivers with a DUI on their record.

#8 – Travelers: Best Customer Service

Pros

- IntelliDrive: Low-mileage drivers can save up to 30% with IntelliDrive.

- Responsible Driver Plan: Travelers’ Responsible Driver Plan bundles accident forgiveness, minor violation forgiveness, vanishing deductible, and a deductible waiver into one convenient package.

- Excellent Customer Service: Travelers has a reputation for offering superb customer service. See what customers say in our review of Travelers auto insurance.

Cons

- Limited Digital Options: Travelers focus on an agent-to-customer approach for managing policies, so it doesn’t have some of the digital options other companies offer.

- Higher Rates for Bad Credit: If your credit score is on the low side, you’ll find cheaper coverage at another company.

#9 – Liberty Mutual: Best for Unique Coverage Options

Pros

- Unique Coverage Options: Liberty Mutual offers an excellent selection of coverage options, including original parts replacement coverage and gap insurance.

- RightTrack Program: Low-mileage drivers can save up to 30% with Liberty Mutual’s RightTrack program.

- Educator Discounts: In an effort to support California educators, Liberty Mutual offers special discounts to teachers. See what Liberty Mutual does for teachers in our Liberty Mutual car insurance review.

Cons

- Higher-than-Average Complaints: Liberty Mutual receives more complaints than expected for a company its size.

- Reduced RightTrack Discount: California low-mileage insurance reviews show that RightTrack discounts drop if not all drivers join the UBI program.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Mercury: Best for Cheap California Rates

Pros

- Low Rates: Mercury may not be the largest insurance provider, but it offers low rates in California, especially for young drivers. Learn how Mercury keeps its rates low in our Mercury auto insurance review.

- MercuryGo: Mercury’s UBI program MercuryGo offers a staggering 50% off your insurance if you practice safe driving habits. One of the behaviors MercuryGo tracks is your total driving mileage.

- Coverage Options: Although minimum insurance is the cheapest option, Mercury offers plenty of ways to increase coverage. Popular choices include rideshare insurance and roadside assistance.

Cons

- Lack of Many Coverage Options: Mercury gives customers a few good add-on choices, but it currently lacks the variety that many of its competitors have. These missing choices include accident forgiveness and a vanishing deductible.

- Some Drivers Pay Higher Rates: Although most drivers see affordable rates in California, some high-risk individuals will see much higher Mercury quotes.

What You Need to Know About California Pay-As-You-Go Insurance

Pay-as-you-go auto insurance is similar to a standard policy with one major exception – your rates are determined by the miles you drive.

Instead of paying a flat auto insurance rate every month, you’ll only be charged for the miles you drive.Benjamin Carr Former State Farm Insurance Agent

Companies like Metromile determine your rates in two parts. The first is a flat fee that you’ll pay per month, no matter what. Then, they’ll decide how much to charge you per mile, usually just a few cents.

Pay-as-you-go policies are a great way to find cheap auto insurance for infrequent drivers, but it’s not for everyone. If you’re not a low-mileage driver or you have periods where you’re driving increases, a traditional policy might be better.

The Benefits of Pay-As-You-Go Auto Insurance in California

Low-mileage drivers typically see lower insurance rates than drivers who spend more time behind the wheel. First, you can compare average insurance rates from our best pay-as-you-go insurance companies below.

CA Pay-As-You-Go Auto Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $545 |

| $102 | $312 | |

| $71 | $216 | |

| $110 | $338 |

| $87 | $227 | |

| $29 | $115 | |

| $73 | $223 |

| $68 | $207 | |

| $54 | $150 | |

| $63 | $192 |

Insurance rates are also impacted by your annual mileage. Check below to see how much variation there can be between car insurance quotes based on annual mileage.

California Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $93 | $169 | $210 | $249 |

| 16-Year-Old Male | $111 | $190 | $226 | $284 |

| 20-Year-Old Female | $122 | $198 | $226 | $268 |

| 20-Year-Old Male | $131 | $224 | $252 | $315 |

| 30-Year-Old Female | $126 | $196 | $223 | $280 |

| 30-Year-Old Male | $146 | $227 | $242 | $303 |

| 40-Year-Old Female | $126 | $201 | $215 | $268 |

| 40-Year-Old Male | $131 | $227 | $235 | $288 |

| 50-Year-Old Female | $122 | $201 | $212 | $265 |

| 50-Year-Old Male | $128 | $208 | $226 | $275 |

| 60-Year-Old Female | $75 | $134 | $166 | $214 |

| 60-Year-Old Male | $103 | $175 | $210 | $264 |

| 70-Year-Old Female | $70 | $120 | $134 | $201 |

| 70-Year-Old Male | $90 | $170 | $200 | $248 |

Of course, your annual mileage isn’t the only factor that affects your auto insurance rates. A driver’s age and the level of coverage they need are also important factors, as you can see below.

California Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $346 | $1,196 |

| 16-Year-Old Male | $395 | $764 |

| 20-Year-Old Female | $301 | $762 |

| 20-Year-Old Male | $338 | $915 |

| 30-Year-Old Female | $78 | $146 |

| 30-Year-Old Male | $83 | $157 |

| 40-Year-Old Female | $72 | $220 |

| 40-Year-Old Male | $72 | $404 |

| 50-Year-Old Female | $72 | $220 |

| 50-Year-Old Male | $71 | $116 |

| 60-Year-Old Female | $65 | $104 |

| 60-Year-Old Male | $67 | $104 |

| 70-Year-Old Female | $71 | $226 |

| 70-Year-Old Male | $70 | $226 |

Getting cheap full coverage auto insurance is more difficult, especially for young drivers. However, choosing a pay-as-you-go option from the California auto insurance companies listed above can help you save.

Other benefits from pay-as-you-go insurance aside from lower rates vary by company, but often include personalized driving advice.

Our customer Danielle recently had her car stolen, but thanks to the Metromile app and Pulse device, she recovered her vehicle in only a matter of hours!

Read Danielle’s full story on our blog:

— Metromile (@Metromile) June 10, 2022

While there are some great benefits to low-mileage programs, drivers should make sure they’re fine with being tracked. Some drivers are uncomfortable sharing information with their insurance companies and will have to find a company that offers a more private way of tracking miles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pay-As-You-Go Insurance vs. California Auto Insurance Requirements

Unless you live in one of the few states that don’t mandate coverage, all drivers need to meet the minimum auto insurance requirements in their state. In the state of California, it’s illegal to drive without coverage.

California's minimum auto insurance requires only a 15/30/5 liability plan. Uninsured motorist coverage is optional but must be offered.Heidi Mertlich Licensed Insurance Agent

Check below to see how much the average driver pays for coverage in some of California’s biggest cities.

California Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Fresno | Long Beach | Los Angeles | Sacramento | San Diego |

|---|---|---|---|---|---|

| 16-Year-Old Female | $1,436 | $1,316 | $1,556 | $1,276 | $1,316 |

| 16-Year-Old Male | $916 | $839 | $993 | $814 | $839 |

| 20-Year-Old Female | $308 | $282 | $334 | $274 | $282 |

| 20-Year-Old Male | $339 | $310 | $368 | $302 | $310 |

| 30-Year-Old Female | $220 | $202 | $240 | $197 | $202 |

| 30-Year-Old Male | $242 | $223 | $265 | $217 | $223 |

| 40-Year-Old Female | $264 | $243 | $289 | $236 | $243 |

| 40-Year-Old Male | $485 | $447 | $532 | $434 | $447 |

| 50-Year-Old Female | $263 | $242 | $287 | $235 | $242 |

| 50-Year-Old Male | $263 | $242 | $287 | $235 | $242 |

| 60-Year-Old Female | $179 | $164 | $195 | $160 | $164 |

| 60-Year-Old Male | $179 | $164 | $195 | $160 | $164 |

| 70-Year-Old Female | $271 | $249 | $296 | $242 | $249 |

| 70-Year-Old Male | $271 | $249 | $296 | $242 | $249 |

There are significant variations between cities when it comes to car insurance rates. Regardless of whether you want the bare minimum to satisfy California auto insurance laws or full coverage with all the bells and whistles, you should always compare rates. If you don’t, you likely won’t pick the most affordable company in your city.

More Ways to Get Cheaper California Auto Insurance Rates

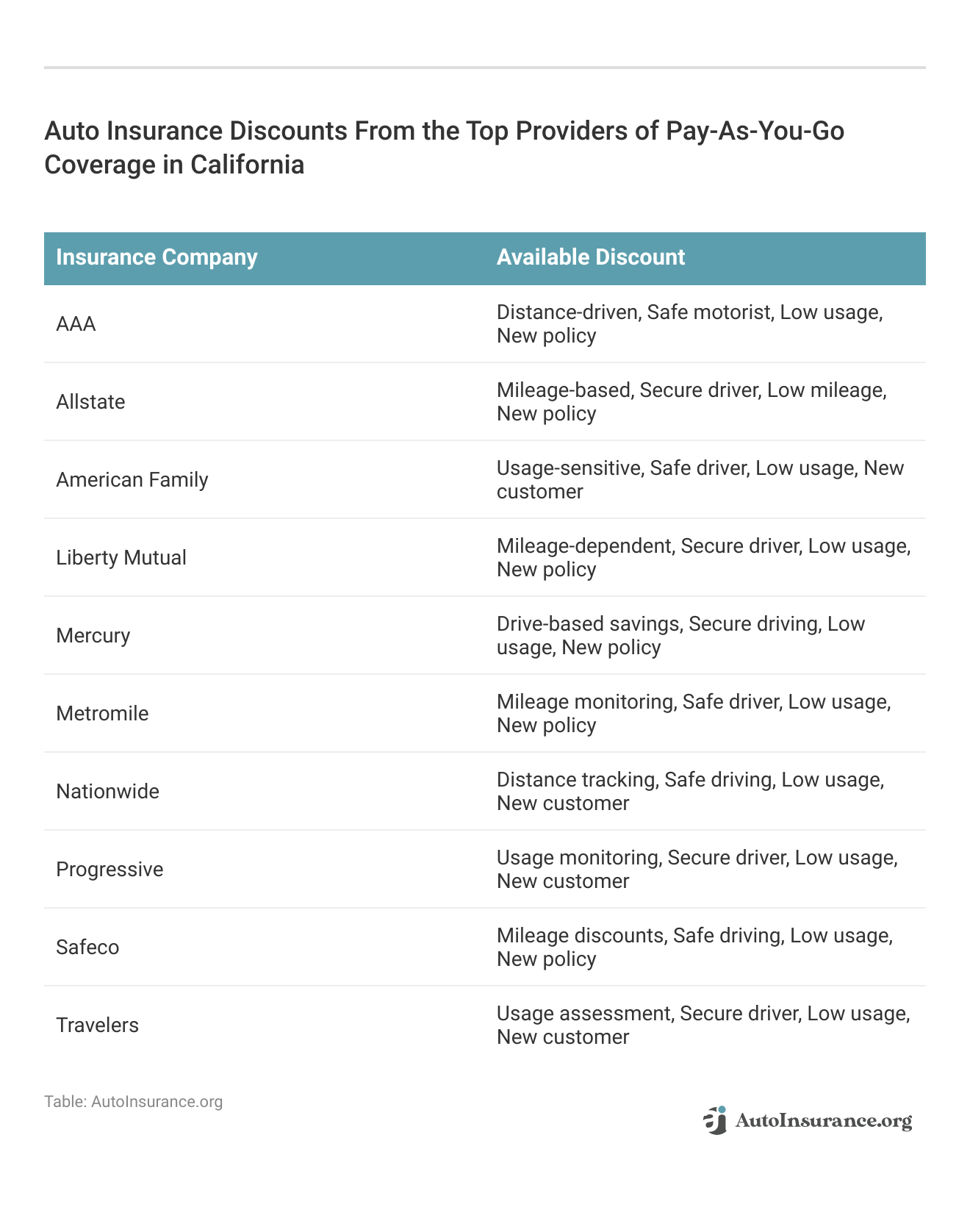

There are plenty of ways to find affordable coverage besides learning how to get a low-mileage auto insurance discount. For starters, you can find other discounts that offer similar savings.

Available Discounts for Best Pay-As-You-Go Auto Insurance in California

| Insurance Company | Low-Mileage | Student-Away-at-School | Usage-Based |

|---|---|---|---|

| 6% | 12% | 18% |

| 5% | 10% | 17% | |

| 7% | 13% | 19% | |

| 8% | 14% | 20% |

| 6% | 11% | 16% | |

| 10% | 15% | 25% | |

| 7% | 12% | 18% |

| 5% | 9% | 15% | |

| 8% | 13% | 21% | |

| 6% | 11% | 17% |

You can also find other discounts for things like being a claims-free driver or getting good grades. Check below to see what our top companies offer for low-mileage drivers.

Other ways to save on your insurance include steps like lowering your coverage, raising your deductible, and keeping your driving record clean. Of course, one of the most crucial steps is to compare your options with multiple companies.

Save With California’s Best Pay-As-You-Go Car Insurance

Finding affordable coverage as a low-mileage driver can be easy if you shop at the best pay-as-you-go auto insurance companies. Metromile is our top pick in California, but you may find a different company has better coverage options and rates for you.

If you’re ready to find the cheapest low-mileage coverage, enter your ZIP code into our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Who has the best pay-as-you-go auto insurance in California?

Our top pick for pay-as-you-go car insurance in California is Metromile, which offers a pay-per-mile insurance model. If you prefer a traditional policy with a usage-based program, AAA and Allstate are better choices.

What is considered low mileage in California?

There’s no set amount, but drivers are generally considered low mileage if they drive fewer than 7,500 or 625 miles per year. However, to qualify for a California low-mileage exemption, the vehicle must be driven fewer than 1,000 miles annually. Pay-per-mile car insurance in California can be a cost-effective option for those who drive less. Many consider it the best pay-as-you-go car insurance since rates are based on actual mileage, helping low-mileage drivers save on premiums.

Does Metromile auto insurance work in California?

Yes, you can get a Metromile auto insurance policy in California. Metromile is an excellent California option, particularly for young people. Metromile has some of the best auto insurance for drivers under 25 because it can offer much lower rates.

One thing to note is that Metromile car insurance in California may have a longer waiting period than traditional insurers that offer instant coverage. The setup process might take longer since it operates as pay-as-you-go car insurance. Checking a Metromile insurance review can help you understand the process and any potential delays.

What auto insurance companies are leaving California?

Most auto insurance companies still operate in California, but some have limited new policies. State Farm and Allstate no longer offer homeowners insurance in the state. Pay-as-you-go auto insurance and the cheapest auto insurance in California remain options for drivers.

What is the recommended auto insurance coverage in California?

California’s state minimum auto insurance is 15/30/5. Meeting this allows legal driving, but uninsured motorist coverage adds protection. Car insurance pay-per-mile plans can lower costs. Go Auto Insurance allows online payment, and the Go Auto customer service number provides support.

What is full coverage auto insurance in California?

Full coverage in California consists of liability, collision, comprehensive, uninsured motorist, and sometimes medical payments insurance. Full coverage costs more but offers much better protection for your vehicle. To keep rates down, make sure to look for savings opportunities. For example, hybrid car owners should consider cheap auto insurance vs. fuel efficiency savings to find the lowest rates.

What is the largest auto insurance company in California?

State Farm is the largest insurance company in California, followed by Geico and Progressive. Many providers offer low-cost California auto insurance to meet different budget needs. Drivers looking for flexible coverage can consider pay-as-you-go insurance options. For low-mileage drivers, pay-per-mile insurance in California can be a cost-effective choice.

Which California auto insurance company has the most complaints?

The insurance company with the most complaints in California is Ocean Harbor Insurance. This company receives nearly 20 times the number of complaints compared to other similarly-sized companies.

How much is the average auto insurance premium per month in California?

The average auto insurance premium in California costs $47 for minimum insurance and $115 per month for full coverage. Low-mileage drivers will likely find much cheaper rates, but you should compare your options to ensure you get the best deal. Enter your ZIP code into our free tool to get started.

How does Metromile accident forgiveness work?

Metromile does not offer traditional accident forgiveness. However, its pay-as-you-go insurance with no deposit model ensures that customers are not penalized based on driving habits alone, though any at-fault accident could still impact rates. Additionally, Metromile roadside assistance is available as an optional add-on. For those looking for low-income car insurance in California, Metromile’s pricing structure may be a cost-effective option, especially for low-mileage drivers.

How does Metromile vs Geico compare in coverage and cost?

Metromile offers pay-per-mile insurance, ideal for low-mileage drivers, while Geico provides traditional policies with discounts. Metromile can be cheaper for those driving under 10,000 miles annually, but Geico offers broader nationwide availability and bundling options.

Who typically has the cheapest California car insurance?

While it depends on the types of auto insurance you want to buy, Geico, USAA, and Liberty Mutual have the cheapest overall California car insurance.

How does Metromile vs Progressive differ in terms of pay-per-mile insurance?

Metromile specializes in pay-per-mile young driver insurance, charging a base rate plus a per-mile fee. Progressive offers pay-per-mile through its Snapshot program, which provides pay-as-you-go auto insurance options based on driving habits rather than a strict per-mile pricing model.

What should be considered when comparing pay-per-mile auto insurance plans?

Key factors include base rate, per-mile charge, mileage tracking method, coverage options, availability by state, and potential savings for low-mileage drivers. Car insurance by the mile in California is a flexible option that bases costs on actual mileage, making it ideal for infrequent drivers. Keeping your auto policy number accessible ensures smooth policy management and quick claim processing.

Which city has the cheapest auto insurance in California?

The city of Chula Vista has the overall lowest average auto insurance rates in California. However, you should learn how annual mileage affects auto insurance rates to find the cheapest coverage in your city.

Does Go Auto’s full coverage insurance include comprehensive and collision?

Yes, Go Auto Insurance offers full coverage, including comprehensive and collision, but availability and specifics depend on state regulations and policyholder selections.

Find the cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Is Metromile a good insurance company based on reviews and coverage?

Metromile receives positive reviews for affordability among low-mileage drivers but mixed feedback on claims handling. Although coverage options are standard, they lack extensive bundling options.

Where can drivers find low-cost insurance options in San Diego?

The best San Diego, California auto insurance is available from providers like Geico, Progressive, Mercury, and Wawanesa, as well as local agencies offering discounts for good driving records and bundling policies.

What companies offer pay-per-mile car insurance in Florida?

Florida has limited pay-per-mile options, but companies like Mile Auto and SmartMiles by Nationwide may offer coverage, depending on eligibility.

Which pay-per-mile car insurance companies are best for low-mileage drivers?

Metromile, Mile Auto, and Nationwide’s SmartMiles are top choices for low-mileage drivers. They offer competitive per-mile rates and flexible coverage.

What are the options for pay-by-mile car insurance in Texas?

You can find the best pay-as-you-go auto insurance in Texas with Metromile (if available), Mile Auto, or Nationwide’s SmartMiles.

What is the best cheap car insurance in the Sacramento area with bad credit?

Mercury, Geico, and Progressive typically offer lower rates for Sacramento drivers with bad credit. Local insurers like Wawanesa may also offer competitive pricing.

How does pay-per-mile car insurance work?

Pay-per-mile insurance charges a fixed monthly base rate plus a per-mile fee, making it cost-effective for low-mileage drivers. Mileage is tracked through a device or app.

What is the AAADrive program, and how does it affect rates?

The AAADrive program is a usage-based insurance discount that tracks driving habits via an app. Safe driving can lower premiums, while risky behaviors may reduce discounts. Explore the best AAA auto insurance discounts.

How does Allstate pay-per-mile car insurance compare to other options?

Allstate’s pay-per-mile option, Milewise, offers a base rate plus a per-mile charge, similar to Metromile but with broader availability and bundling discounts.

What are the options for auto insurance in Lincoln, CA?

Auto insurance options in Lincoln, CA, include major providers like State Farm, Geico, Progressive, and Allstate and local insurers such as Wawanesa and California Casualty. Coverage options range from minimum liability to full coverage, with add-ons like roadside assistance and uninsured motorist protection.

What are the top ten car insurance companies in California?

Top insurers in California include Geico, State Farm, Progressive, Allstate, Mercury, Farmers, AAA, Wawanesa, USAA (for military), and Nationwide. Read more: Cheap Auto Insurance for High-Risk Drivers in California

How does Metromile vs Root car insurance compare in price and benefits?

Metromile offers pay-per-mile pricing, making it ideal for low-mileage drivers, while Root bases rates on driving behavior using a mobile app. Metromile provides better savings for those who drive less, while Root rewards safe drivers with lower premiums. Both offer standard coverages, but Root includes more discounts based on driving habits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.