Best Pay-As-You-Go Auto Insurance in Indiana (Your Guide to the Top 10 Companies for 2025)

Geico, AAA, and USAA have the best pay-as-you-go auto insurance in Indiana. Safe drivers get the cheapest usage-based car insurance in Indiana, with Geico offering coverage for $99 monthly. AAA provides free roadside assistance as part of IN pay-as-you-go insurance, but you must be a member to buy coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Melanie Musson

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Published Insurance Expert

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

PAYG Full Coverage in IN

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

PAYG Full Coverage in IN

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 6,589 reviews

6,589 reviewsCompany Facts

PAYG Full Coverage in IN

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsGeico, AAA, and USAA offer the best pay-as-you-go auto insurance in Indiana. Geico has the cheapest rates, starting at $99 monthly.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Indiana

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Extensive Discounts | Geico | |

| #2 | 15% | A | Roadside Assistance | AAA |

| #3 | 10% | A++ | Military Savings | USAA | |

| #4 | 20% | A | Claims Service | American Family | |

| #5 | 12% | A+ | Coverage Options | Progressive | |

| #6 | 25% | A+ | High-Mileage Drivers | Allstate | |

| #7 | 20% | A+ | Multi-Policy Discounts | Nationwide |

| #8 | 10% | A | Accident Forgiveness | Liberty Mutual |

| #9 | 17% | B | Customer Service | State Farm | |

| #10 | 10% | A | Great Add-ons | Farmers |

Check out the best pay-as-you-go auto insurance companies in Indiana and compare discounts for bundling policies, which can help lower Indiana insurance rates even more.

Scroll down to learn how to find the best pay-as-you-go auto insurance in Indiana that fits your needs and budget. Start saving on Indiana auto insurance today by entering your ZIP code and comparing quotes.

- Geico, AAA, and USAA offer the best pay-as-you-go auto insurance in Indiana

- Geico offers the lowest rates starting at $99 per month

- USAA’s pay-as-you-go insurance in Indiana is only available to military members

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Consistently low rates for pay-as-you-go auto insurance in Indiana, starting at $99 monthly. Learn more in our Geico DriveEasy review.

- Digital Tools: Advanced online tools and mobile app for easy policy management and pay-as-you-go claims filing for Indiana drivers.

- Multiple Discounts: Offers a variety of discounts on pay-as-you-go car insurance in Indiana, including good driver and multi-vehicle.

Cons

- No Gap Coverage: Indiana drivers cannot get gap coverage for new or leased vehicles with pay-as-you-go policies.

- Claims Process: Some Indiana customers report delays in the pay-as-you-go insurance claims process.

#2 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA provides free roadside assistance services for Indiana drivers with pay-as-you-go insurance. Learn more in our review of AAA insurance.

- Accident-Free Discounts: Substantial discounts for accident-free drivers, a key feature for pay-as-you-go auto insurance in Indiana.

- Membership Discounts: Indiana drivers who are AAA members get additional discounts on pay-as-you-go insurance, vacation packages, hotels, and more.

Cons

- Membership Fees: Requires AAA membership, adding to the cost of Indiana pay-as-you-go auto insurance.

- Limited Availability: Services and discounts may vary by city, impacting Indiana pay-as-you-go availability.

#3 – USAA: Best for Military Drivers

Pros

- Military-Friendly: USAA has specialized coverage and discounts on IN pay-as-you-go insurance for military members who are sent overseas, store their vehicles, or use their cars for work.

- Top-Rated Service: USAA pay-as-you-go insurance in Indiana consistently receives high marks for customer satisfaction and claims handling.

- Low Rates: Competitive pricing for IN pay-as-you-go auto insurance starts at $67 monthly. See the rates compared in our USAA auto insurance review.

Cons

- Membership Restrictions: USAA pay-as-you-go insurance in Indiana is only available to military members and their families.

- Partnership Program: USAA provides pay-as-you-go insurance through a partnership with Noblr, which could impact customer service in Indiana.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Claims Service

Pros

- High Claims Satisfaction: American Family ranks in the top two for customer and claims satisfaction in the Indiana region for pay-as-you-go auto insurance.

- Loyalty Discounts: Offers discounts for long-term customers in Indiana with pay-as-you-go auto insurance. Learn more in our American Family review.

- Flexible Payment Options: Indiana has Multiple payment plans for pay-as-you-go auto insurance.

Cons

- Digital Tools: Online tools may not be as advanced as other pay-as-you-go auto insurance companies in IN.

- Premium Rates: American Family’s pay-as-you-go insurance rates, starting at $167 monthly, can be higher than those of other providers in Indiana.

#5 – Progressive: Best for Coverage Options

Pros

- Online Tools: User-friendly online tools and mobile app for easy pay-as-you-go management for IN drivers. Our complete Progressive Snapshot review goes over this in more detail.

- Flexible Coverage: Progressive offers a wide range of customizable pay-as-you-go coverage options in Indiana.

- Snapshot Program: Progressive’s Snapshot program allows Indiana drivers to potentially lower their pay-as-you-go insurance rates based on safe driving habits.

Cons

- Higher Rates: Progressive’s pay-as-you-go auto insurance rates in Indiana start at $107 per month, which may be higher than some competitors’ rates.

- Claims Process: Some Indiana customers report a complicated claims process for pay-as-you-go insurance.

#6 – Allstate: Best for High-Mileage Drivers

Pros

- Mileage Discounts: Allstate Milewise and Milewise Unlimited allows high-mileage drivers to get a discount on pay-as-you-go car insurance in Indiana. Learn how in our Allstate Milewise review.

- Financial Stability: A.M. Best gives Allstate a superior A+ financial rating, which is good news if you need to file a pay-as-you-go insurance claim in Indiana.

- Customer Support: Allstate customer support is available 24/7 for Indiana drivers with pay-as-you-go insurance,

Cons

- Expensive Premiums: Allstate has higher IN pay-as-you-go premiums than other providers. Find more information in our review of Allstate insurance.

- Mobile App: Some Indiana pay-as-you-go users report issues with the mobile app functionality.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Nationwide offers significant discounts for bundling multiple policies, making it an attractive option for pay-as-you-go auto insurance in Indiana.

- SmartRide Program: Indiana drivers can save money on pay-as-you-go insurance with safe driving rewards. Learn how in our Nationwide SmartRide app review.

- Financial Strength: Nationwide’s strong financial rating ensures reliable pay-as-you-go insurance coverage in Indiana.

Cons

- Can be Expensive: Pay-as-you-go auto insurance rates with Nationwide in Indiana start at $151 per month, which may be higher than some competitors’ rates.

- Availability: Some pay-as-you-go discounts and services may not be available in all areas of Indiana.

#8 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness for pay-as-you-go auto insurance in Indiana, preventing rate increases after the first accident.

- RightTrack Program: The RightTrack program can help Indiana drivers save on pay-as-you-go insurance by monitoring driving habits.

- Flexible Coverage Options: Liberty Mutual provides various coverage options for pay-as-you-go auto insurance in Indiana.

Cons

- Premium Rates: Liberty Mutual’s pay-as-you-go insurance rates in Indiana start at $285 monthly, which can be higher than some other providers. Read our Liberty Mutual auto insurance review to compare monthly premiums.

- Customer Service: Some Indiana customers report mixed experiences with Liberty Mutual pay-as-you-go customer service.

#9 – State Farm: Best Customer Service

Pros

- Customer Service: State Farm is known for its excellent customer service for Indiana pay-as-you-go insurance. Read our State Farm auto insurance review for full rankings.

- Drive Safe & Save: The Drive Safe & Save program monitors driving behavior to help Indiana drivers reduce pay-as-you-go insurance costs.

- Discounts: State Farm offers various discounts for good driving and multiple vehicles for pay-as-you-go auto insurance in Indiana.

Cons

- Premium Costs: Despite discounts, State Farm’s pay-as-you-go premiums might still be relatively higher for certain coverage levels in Indiana.

- Digital Tools: Some Indiana customers feel that State Farm’s online tools and mobile app could be improved for pay-as-you-go insurance management.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best Policy Add-Ons

Pros

- Policy Add-Ons: Farmers offers a wide range of add-ons for pay-as-you-go auto insurance in Indiana, including rideshare coverage and new car replacement.

- Discounts: Various discounts, such as good driver and multi-policy discounts, are available for Indiana drivers, enhancing the value of pay-as-you-go insurance.

- Financial Stability: Farmers have a strong financial rating, ensuring reliable pay-as-you-go insurance coverage in Indiana.

Cons

- Rates: Farmers’ pay-as-you-go auto insurance rates in Indiana start at $123 monthly, which can be higher than some competitors. Compare free quotes in our Farmers Insurance review.

- Claims Process: Some Indiana customers report a lengthy claims process for pay-as-you-go insurance with Farmers.

The Best Pay-As-You-Go Auto Insurance Rates in Indiana

Choosing the best pay-as-you-go auto insurance in Indiana involves weighing these monthly rates against the coverage levels provided, ensuring you get the protection you need at a price that fits your budget.

Indiana Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $53 | $154 |

| $75 | $217 | |

| $57 | $167 | |

| $42 | $123 | |

| $34 | $99 | |

| $98 | $285 |

| $52 | $151 |

| $37 | $107 | |

| $38 | $110 | |

| $23 | $67 |

Geico offers the most affordable minimum coverage rates of $34 monthly, followed by American Family and State Farm. These three companies are also the cheapest for full coverage auto insurance.

Minimum coverage types include liability, which covers damages and injuries to others if you’re at fault in an accident. Full coverage includes comprehensive and collision coverage, which protects your own vehicle in case of accidents or non-collision incidents like theft or vandalism.

When selecting pay-as-you-go auto insurance, understanding the various coverage options is essential to ensure you choose the best protection for your needs. Most pay-as-you-go policies offer a range of coverage options that can be tailored to fit your driving habits and budget.

Best Car Insurance Companies for Indiana Drivers

Indiana motorists searching for an affordable car insurance company must consider affordability, coverage levels, and customer support. Geico is a good option for those wanting low premiums, while AAA offers great roadside assistance features. USAA has reasonable prices and high-quality customer support for military families.

Indiana drivers what’s a good car insurance company to look into?

byu/CurrentlyNa inIndiana

State Farm is highly respected for its excellent customer service and many discount plans. Progressive is unique in offering flexible coverage plans and usage-based discounts. Drivers in Indiana can compare quotes, look for deals, and examine customer reviews to identify the optimal policy to help them select a provider that will serve their interests.

Read More: Indiana Minimum Auto Insurance Requirements

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

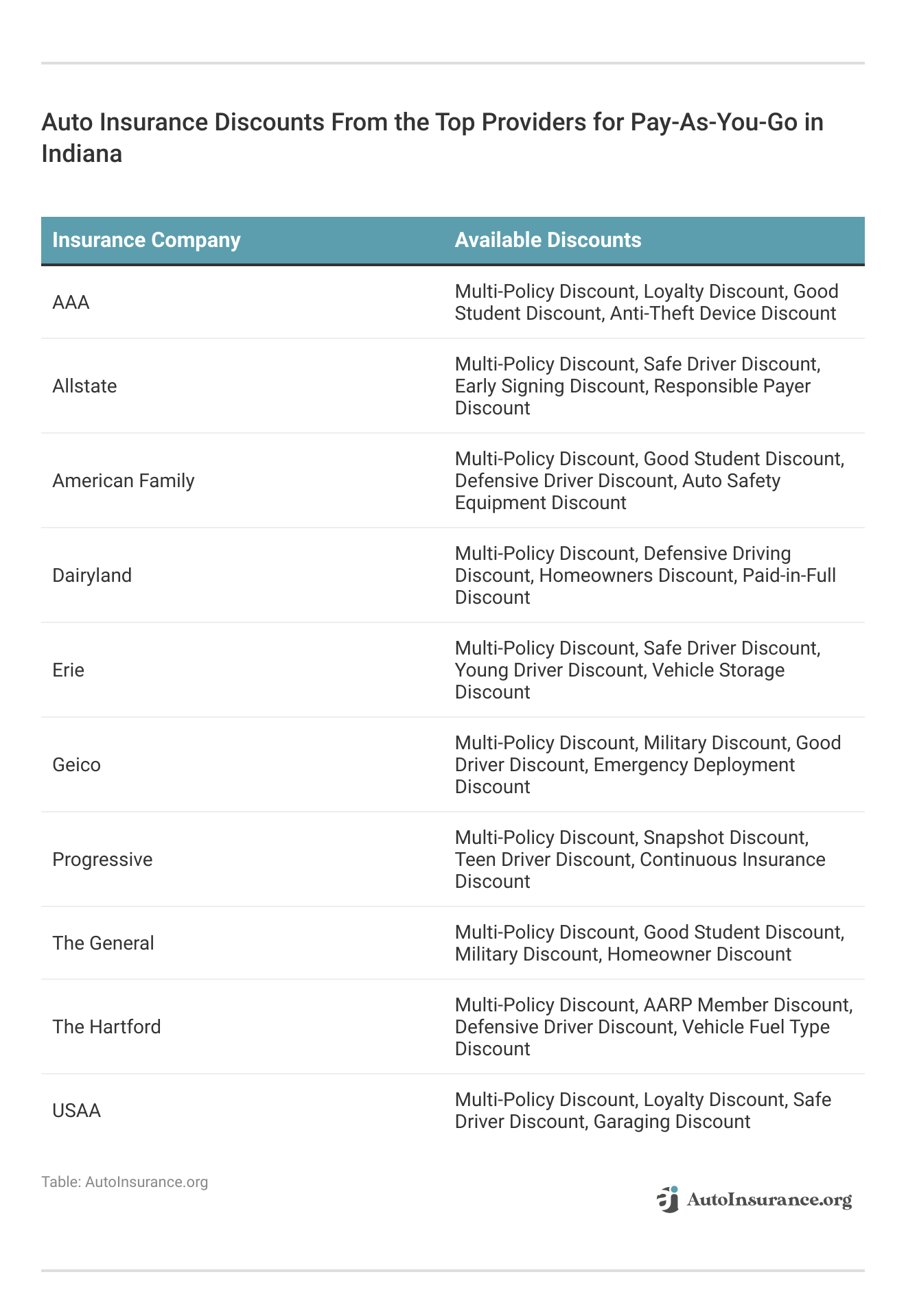

Discounts on Pay-As-You-Go Auto Insurance in Indiana

Indiana insurance companies provide various auto insurance discounts based on factors such as your driving history, vehicle safety features, and overall driving behavior.

For instance, maintaining a clean driving record may qualify you for a safe driver discount, while having advanced safety features in your car could earn you additional savings.

Additionally, Indiana drivers can save money by bundling insurance policies, like auto and home insurance, or for driving fewer miles, which aligns well with pay-as-you-go models.

Case Studies: Pay-As-You-Go Auto Insurance Success in Indiana

To illustrate the benefits of pay-as-you-go auto insurance, here are a few real-life case studies highlighting how different individuals have saved on their Indiana car insurance with safe driving habits and vehicle safety features:

- Case Study #1—The Savvy City Commuter: Jane, who lives in Indianapolis and only uses her car on weekends, switched to Geico DriveEasy, a pay-as-you-go insurance plan. By tracking her mileage and driving habits, she saved 30% on Indiana auto insurance.

- Case Study #3 – The Vehicle Safety Seeker: Emily, who drives a newer model with advanced safety features, chose AAA pay-as-you-go insurance that offered discounts for these features. Her Indiana insurance costs were reduced by 25%, and she enjoys peace of mind with free roadside assistance.

- Case Study #4 – The Multi-Policy Beneficiary: Mark, a retired veteran, bundled his USAA pay-as-you-go policy with his home insurance, taking advantage of a 15% multi-policy discount on his Indiana car insurance.

These case studies highlight how pay-as-you-go auto insurance in Indiana can offer significant savings based on individual circumstances.

You can save on pay-as-you-go auto insurance in Indiana through low mileage, a clean driving record, safety features, or policy bundling.Travis Thompson Licensed Insurance Agent

Indiana pay-as-you-go car insurance works best for drivers who practice safe driving habits and aren’t on the road that often. You’ll get the lowest pay-as-you-go insurance rates if you drive less than 11,000 miles per year and avoid driving at night.

How to Get Affordable Pay-As-You-Go Auto Insurance in Indiana

Selecting the right pay-as-you-go plan requires comparing the best Indiana auto insurance companies to find the one that suits your needs. Geico, AAA, and USAA have the best pay-as-you-go auto insurance in Indiana, with competitive rates and great policy add-ons like roadside assistance.

Your unique factors as a driver might align better with a different company. Be sure to use our free quote tool to compare personalized rates from various insurers. Whether you’re looking for auto insurance discounts in Indiana, searching for cheap car insurance in Indiana, or needing cheap liability car insurance in Indiana, exploring multiple options can help you find the best deal.

You can also check Go Auto Insurance near me for local coverage and take advantage of Indiana auto insurance discounts. Comparing car insurance companies in Indiana and reviewing car insurance rates in Indiana will help you find the most affordable and suitable policy for your needs.

Enter your ZIP code using our free quote tool to find the best auto insurance company near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is car insurance monthly in Indiana?

The average monthly cost of full coverage car insurance in Indiana is approximately $111 per month, based on a 35-year-old driver with good credit and a clean record.

Low-income car insurance in Indiana is available through state programs and budget-friendly insurers like Good To Go Auto Insurance. The Indiana auto insurance guide provides details on coverage options, while the Indiana auto insurance plan helps drivers who struggle to obtain standard coverage.

What is the best full coverage insurance?

Some of the most affordable options for full coverage car insurance include Amica at $190 per month, Auto-Owners at $118, Geico at $109, and NJM at $124. Shelter offers coverage for $131 per month, while State Farm is $167. Travelers charge $117 monthly, and USAA is the most affordable at $105.

What is the basic vehicle insurance coverage in Indiana?

The minimum required coverage is $25,000 for bodily injury or death of one person per accident, $50,000 for bodily injury auto insurance or death of two or more people per accident, and $25,000 for property damage per accident.

What are the five types of car insurance?

The five main types of car insurance are liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Who typically has the cheapest car insurance?

USAA, Nationwide, Travelers, Erie, Geico, and Progressive are the most affordable car insurance companies nationwide. Enter your ZIP code to find out if you can get a better deal.

Is Indiana car insurance high?

Car insurance in Indiana is generally more affordable than in many other states, making it a good option for those seeking affordable car insurance in Indiana. The average cost for full coverage with a $1,000 deductible is about $71 per month, lower than the national average of $108 per month.

Providers like Go Auto Insurance offer competitive rates, and checking Go Auto Insurance reviews can help assess reliability. With various options for cheap auto insurance in Indiana or low-cost auto insurance in Indiana, drivers can find budget-friendly coverage.

What is the cheapest cover for insurance?

Third-party only is the minimum legal requirement and usually the least expensive option. Third-party, fire, and theft cover third-party damage plus protection against fire and theft. Comprehensive offers the most extensive coverage, including protection for your vehicle and third-party damage.

What insurance is required in Indiana?

Driving without insurance in Indiana is illegal, so it’s essential to ensure your policy meets the state’s minimum requirements. If you’re searching for affordable auto insurance in Indiana, comparing different providers can help you find the best rates.

For those needing cheap full coverage car insurance in Indiana, exploring various options can provide better protection at a lower cost. Getting a Go Auto Insurance quote is also a good way to find budget-friendly coverage that meets your needs.

What happens if you drive without insurance in Indiana?

Without insurance, your driver’s license will be suspended for at least 90 days for a first driving offense. Additionally, you’ll need to pay a $250 reinstatement fee. You must provide proof of future financial responsibility during this period, typically through an SR-22 certificate, for 180 days.

How much is the monthly payment for Geico car insurance?

Geico’s monthly payment varies based on location, vehicle type, and driving record but typically ranges from $50 to $150 per month for full coverage.

How much is renters insurance in Indiana?

The typical cost of renters insurance in Indiana is approximately $15 each month. State Farm is worth considering for those seeking the most cost-effective and extensive coverage options. Get cheap auto insurance coverage today with our quote comparison tool.

What is the cost of an AAA SR-22 policy?

The cost of an AAA SR-22 policy depends on the state, driving record, and coverage level but typically ranges from $15 to $50 for the SR-22 filing fee, plus higher premiums due to the high-risk status.

What is the Go Auto Insurance phone number?

The Go Auto Insurance phone number varies by state, but the leading customer service number is 1-833-700-0000.

At what age is car insurance cheapest?

Experienced drivers generally have fewer accident claims, which translates to lower insurance costs. At Progressive, the average monthly premium typically decreases significantly between the ages of 19 and 34, then levels off or decreases slightly between the ages of 34 and 75. Learn more information on the best auto insurance by age.

Which are the top-rated insurance companies in Indiana?

Top-rated car insurance companies in Indiana include State Farm, Geico, Progressive, Allstate, and USAA (for military families).

What are the coverage options provided by GoAuto Insurance in Louisiana?

GoAuto Insurance in Louisiana offers liability coverage, comprehensive coverage for collisions, uninsured/underinsured motorist coverage, and medical payments coverage.

How does AAA car insurance compare to Geico?

AAA typically offers better member benefits, including roadside assistance, while Geico is known for lower rates and easy online management. Coverage and pricing vary by location and driving history. Read our “AAA vs. Geico Car Insurance Comparison” for more details.

Where can I find Go Auto Insurance in Louisiana?

Go Auto Insurance has multiple locations in Louisiana, including Baton Rouge, New Orleans, and Shreveport. Their website provides office locations and contact details.

How much does Geico auto insurance cost?

Geico auto insurance costs vary, but the national average is around $1,200 per year ($100 per month) for full coverage, depending on personal factors.

What does NJM roadside assistance cover?

NJM roadside assistance covers towing, battery jump-starts, lockout services, fuel delivery, and flat tire changes for policyholders who add the coverage. Read this NJM car insurance review to learn more about this coverage.

What is the Indiana Automobile Insurance Plan, and who qualifies for it?

The Indiana Automobile Insurance Plan (IN AIP) covers high-risk drivers who cannot obtain insurance through standard insurers. Drivers must first be denied coverage by multiple insurers.

How can I contact The General Insurance customer service?

The General Insurance customer service number is 1-800-280-1466 for policy assistance and claims support.

What does “pays AAA” refer to in insurance or roadside assistance?

“Pays AAA” likely refers to AAA membership dues or an insurance policy that covers AAA roadside assistance costs, depending on the context. Some policies may offer eligible members the best AAA auto insurance discounts.

Additionally, drivers looking for flexible coverage might consider pay-as-you-go auto insurance options. For Go Auto policyholders, managing payments is easy through the Go Auto Insurance payment online system.

Does USAA allow a payable-on-death beneficiary?

USAA allows a payable-on-death (POD) beneficiary for certain accounts, including life insurance policies and bank accounts.

What is the basic vehicle insurance coverage in Indiana?

Indiana’s basic vehicle insurance coverage requires 25/50/25 liability limits, meaning $25,000 per person, $50,000 per accident for bodily injury, and $25,000 for property damage. For drivers seeking flexible payment options, pay-as-you-go car insurance for new drivers can be cost-effective based on usage.

Those insured with Go Auto can conveniently manage their policies through the Go Auto Insurance app, file Go Auto Insurance claims easily, and pay Go Auto online for their premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Melanie Musson

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Published Insurance Expert

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.