Best Pay-As-You-Go Auto Insurance in Louisiana for 2025 (Top 10 Companies Ranked)

Allstate, Travelers, and Geico are the top picks for the best pay-as-you-go auto insurance in Louisiana. These providers offer flexible options for low-mileage drivers starting at $20/month. Safe driving and policy customization can lower costs, as noted in this pay-as-you-go auto insurance review.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Apr 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full PAYG Coverage in LA

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full PAYG Coverage in LA

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full PAYG Coverage in LA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsAllstate, Travelers, and Geico are leading providers of the best pay-as-you-go auto insurance in Louisiana, with rates starting at $239 monthly. Louisana auto insurance is expensive, but these companies help drivers save with excellent discounts.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Louisiana

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Claims Satisfaction | Allstate | |

| #2 | 18% | A++ | Customizable Policies | Travelers | |

| #3 | 12% | A++ | Various Discounts | Geico | |

| #4 | 20% | A++ | Safe Drivers | USAA | |

| #5 | 40% | A+ | Usage-Based Discounts | Nationwide |

| #6 | 17% | B | Safety Discounts | State Farm | |

| #7 | 16% | A+ | Family Plans | Progressive | |

| #8 | 25% | B+ | Short-Term Coverage | Hugo | |

| #9 | 19% | A | Affordable Rates | Liberty Mutual |

| #10 | 40% | A- | Mobile App | Metromile |

Safe drivers save the most money on pay-as-you-go car insurance in Louisiana with discounts of up to 25%. Nationwide has the biggest safe driving discount of 40%.

- Allstate is the best pay-as-you-go auto insurance for low-mileage drivers

- USAA has the cheapest PAYG insurance for military drivers at $26/mo

- The best pay-as-you-go auto insurance in Louisiana includes customizable options

Learn how safe driving and annual mileage affect your auto insurance rates and see which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Flexible PAYG Options: Allstate offers a range of flexible pay-as-you-go auto insurance options in Louisiana, catering to different driving habits and mileage. Learn more in our Allstate review.

- Variety of Discounts: Benefits from various discounts on pay-as-you-go auto insurance in Louisiana for safe driving, bundling, and vehicle safety features.

- Wide Availability: Allstate pay-as-you-go auto insurance is widely available across Louisiana, making it accessible to many drivers.

Cons

- Higher Rates: The cost of pay-as-you-go auto insurance with Allstate in Louisiana might be higher compared to some competitors, especially for drivers with higher mileage.

- Low Mileage Restrictions: While discounts are available, Allstate pay-as-you-go auto insurance in Louisiana for low-mileage drivers has strict requirements to qualify.

#2 – Travelers: Best for Customizable Policies

Pros

- Flexible Coverage: Travelers pay-as-you-go auto insurance in Louisiana offers cost-effective coverage tailored to individual driving habits. Read our Travelers IntelliDrive review for a full list.

- Convenient Adjustments: Policyholders can easily adjust their coverage as their driving needs change, making Travelers a practical choice for pay-as-you-go auto insurance in Louisiana.

- Industry Experience: Travelers has been around for 150 years and is equipped to pay Louisiana car insurance claims with a superior A++ financial rating from A.M. Best.

Cons

- Smaller Discounts: Other Louisiana pay-as-you-go insurance companies have bigger discounts than Travelers for things like insuring multiple vehicles or bundling policies.

- Higher Base Rates: Travelers rates for pay-as-you-go auto insurance in Louisiana may be higher compared to other companies, which could impact overall affordability.

#3 – Geico: Best for First-Responder Discount

Pros

- First-Responder Discounts: Geico offers special discounts on pay-as-you-go auto insurance in Louisiana for first responders and federal employees.

- Economical PAYG Plans: Geico DriveEasy lets safe drivers track driving habits for a chance to lower Louisiana auto insurance rates. Learn more in our DriveEasy review.

- Efficient Online Management: The Geico insurance app simplifies managing Louisiana PAYG auto insurance policies and keeping track of discounts.

Cons

- Service Variability: Customer service quality for pay-as-you-go auto insurance in Louisiana can vary, leading to inconsistent experiences for some policyholders.

- Higher Rates: Geico DriveEasy base rates are higher than those of other Louisiana PAYG insurance companies, and the app will raise rates for bad driving habits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Safe Drivers

Pros

- Competitive Rates: USAA offers excellent pay-as-you-go auto insurance rates in Louisiana for drivers with clean records. Read our USAA review to learn what else is offered.

- Top-Tier Customer Support: USAA customer service is renowned for its high quality, ensuring a smooth experience with pay-as-you-go auto insurance in Louisiana.

- Additional Perks for Safe Drivers: Drivers with a safe driving history can enjoy added perks and benefits under USAA’s pay-as-you-go auto insurance in Louisiana.

Cons

- Eligibility Restrictions: USAA pay-as-you-go auto insurance in Louisiana is only available to military members and their families, limiting its accessibility.

- Corporate Partner: USAA doesn’t sell PAYG coverage in Louisiana but partners with Noblr to offer policies to USAA customers. Learn more in our Noblr auto insurance review.

#5 – Nationwide: Best for Usage-Based Discounts

Pros

- Biggest Policy Discounts: Nationwide offers excellent pay-as-you-go auto insurance discounts in Louisiana of up to 40%.

- Flexible Plans: Provides flexible usage-based auto insurance plans in Louisiana based on mileage (SmartMiles) or driving habits (SmartRide). Discover additional details in our Nationwide review.

- Wide Range of Coverage Options: Nationwide’s pay-as-you-go auto insurance in Louisiana includes a broad array of coverage choices.

Cons

- Higher Deductibles: Pay-as-you-go auto insurance plans in Louisiana might come with higher deductibles, impacting out-of-pocket expenses.

- Varied Customer Experience: The quality of customer experience with Nationwide’s pay-as-you-go auto insurance in Louisiana can vary by location and individual agent.

#6 – State Farm: Best for Safety Discounts

Pros

- Savings for Safe Driving: State Farm pay-as-you-go auto insurance in Louisiana provides considerable discounts of 30% to safe drivers.

- Defensive Driving Discounts: Young drivers earn an additional 15% off Louisana auto insurance when they sign up for an approved course.

- Extensive Network of Agents: State Farm’s excellent customer service comes from a broad network of local agents for personalized assistance with pay-as-you-go auto insurance in Louisiana.

Cons

- Discount Decreases: State Farm usage-based insurance will drop your discount amount for bad driving habits. Learn more in our State Farm Drive Safe and Save review.

- Complex Discount Application: The process for applying and receiving safety discounts might be intricate, potentially complicating savings on pay-as-you-go auto insurance in Louisiana.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Family Plans

Pros

- Affordable Family Plans: Progressive offers pay-as-you-go auto insurance in Louisiana with affordable family plans, allowing for cost savings across multiple vehicles and policies.

- Customizable Family Coverage: Snapshot usage-based insurance provides flexible Louisiana coverage options that can be customized for family needs. Read more in our review of Progressive Snapshot.

- Safe Driver Discounts: Progressive Snapshot can save drivers 30%, and discounts are applied to the whole policy even if no other drivers participate in the program.

Cons

- Potentially Complex Policy Structure: Some customers might find the extensive range of family plan options for pay-as-you-go auto insurance in Louisiana complex to navigate.

- Variable Discount Availability: The availability and extent of discounts for family plans may differ, potentially affecting the overall affordability of pay-as-you-go auto insurance in Louisiana.

#8 – Hugo: Best for Short-Term Auto Insurance

Pros

- Short-Term Insurance: Hugo offers flexible short-term pay-as-you-go auto insurance options in Louisiana, ideal for temporary needs.

- Cost-Effective: Provides affordable pay-as-you-go auto insurance plans in Louisiana, particularly for short-term coverage.

- Easy Enrollment: Simple enrollment process for pay-as-you-go auto insurance in Louisiana. Find out more in our Hugo review.

Cons

- Limited Coverage: The short-term nature of Hugo’s pay-as-you-go auto insurance in Louisiana might not address all coverage needs or offer extensive coverage options.

- Availability: The availability of pay-as-you-go auto insurance in Louisiana could be restricted in some regions, affecting how accessible it is.

#9 – Liberty Mutual: Best for Affordable Rates

Pros

- Affordable Pay-As-You-Go Insurance: Liberty Mutual RightTrack provides competitive rates for pay-as-you-go auto insurance in Louisiana. Learn more in our Liberty Mutual RightTrack review.

- Customizable Coverage Features: Customize pay-as-you-go auto insurance in Louisiana with policy add-ons for new cars and accident forgiveness.

- Additional Savings Opportunities: Liberty Mutual provides substantial discounts on Lousiana auto insurance for bundling policies and installing anti-theft devices.

Cons

- Potential for Elevated Premiums: Liberty Mutual RightTrack could increase Louisiana auto insurance rates for bad driving.

- Customer Service Inconsistencies: The quality of customer service for pay-as-you-go auto insurance in Louisiana may vary, leading to inconsistent experiences for policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Metromile: Best for Mobile App

Pros

- Advanced Mobile App: Metromile’s app provides excellent tools for tracking and managing pay-as-you-go auto insurance in Louisiana.

- Pay-Per-Mile Savings: Ideal for low-mileage drivers, offering significant savings with pay-as-you-go auto insurance in Louisiana.

- Transparent Pricing: Offers clear and transparent pricing for pay-as-you-go auto insurance in Louisiana, which you can learn about in our Metromile review.

Cons

- Limited Coverage Areas: Metromile’s pay-as-you-go auto insurance might not be available in all areas of Louisiana.

- Mileage Cap: There may be mileage limits that could affect drivers who sometimes exceed the lower mileage thresholds for pay-as-you-go auto insurance in Louisiana.

Pay-As-You-Go Auto Insurance Explained

Pay-as-you-go auto insurance is a flexible option whose rate is based on how much you drive. This is a good choice for people who don’t drive because it can be cheaper than a regular policy. Finding the cheapest auto insurance in Louisiana, where insurance rates can be high, is important.

Companies like GoAuto insurance in Louisiana make it easy to manage your policy with tools like the GoAuto insurance app, where you can check your coverage and make payments. If you’re in New Orleans, pay-as-you-go auto insurance offers coverage that fits your needs.

Some companies also have pay-as-you-go auto insurance by phone, so you can track your driving and update your plan anytime. If you’re looking for the best auto insurance in Louisiana, check out pay-as-you-go auto insurance, which can help you save money while staying covered under state laws.

How Pay-As-You-Go Auto Insurance Works in Louisiana

When choosing a pay-as-you-go auto insurance plan in Louisiana, understanding how usage-based auto insurance works can help you get the best monthly rates. Insurance rates are based on mileage, driving habits, and coverage level. Take a look at the monthly rates for minimum and full coverage from the best Louisiana insurance providers:

Louisiana Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $64 | $239 | |

| $44 | $163 | |

| $60 | $120 |

| $85 | $319 |

| $41 | $104 | |

| $56 | $211 |

| $50 | $187 | |

| $39 | $144 | |

| $48 | $181 | |

| $30 | $114 |

Hugo, Metromile, and USAA offer the most affordable pay-as-you-go auto insurance in Louisiana, but eligibility is limited, and only a few drivers may qualify.

Allstate is more expensive but offers flexible PAYG auto insurance for different types of drivers. These insurers mostly serve military members or low-mileage drivers, so not everyone can get coverage. While insurers offer affordable options, some drivers may not qualify.

Additionally, when looking at a pay-as-you-go auto insurance review, it helps to compare different options to find what works best for you. Some drivers want cheap pay-as-you-go insurance, while others need more coverage.

Pay-as-you-go auto insurance in Baton Rouge offers local coverage, making GoAuto insurance a convenient choice. No matter if you need low-cost or full-coverage auto insurance in Louisiana, checking different companies can help you find the right plan.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

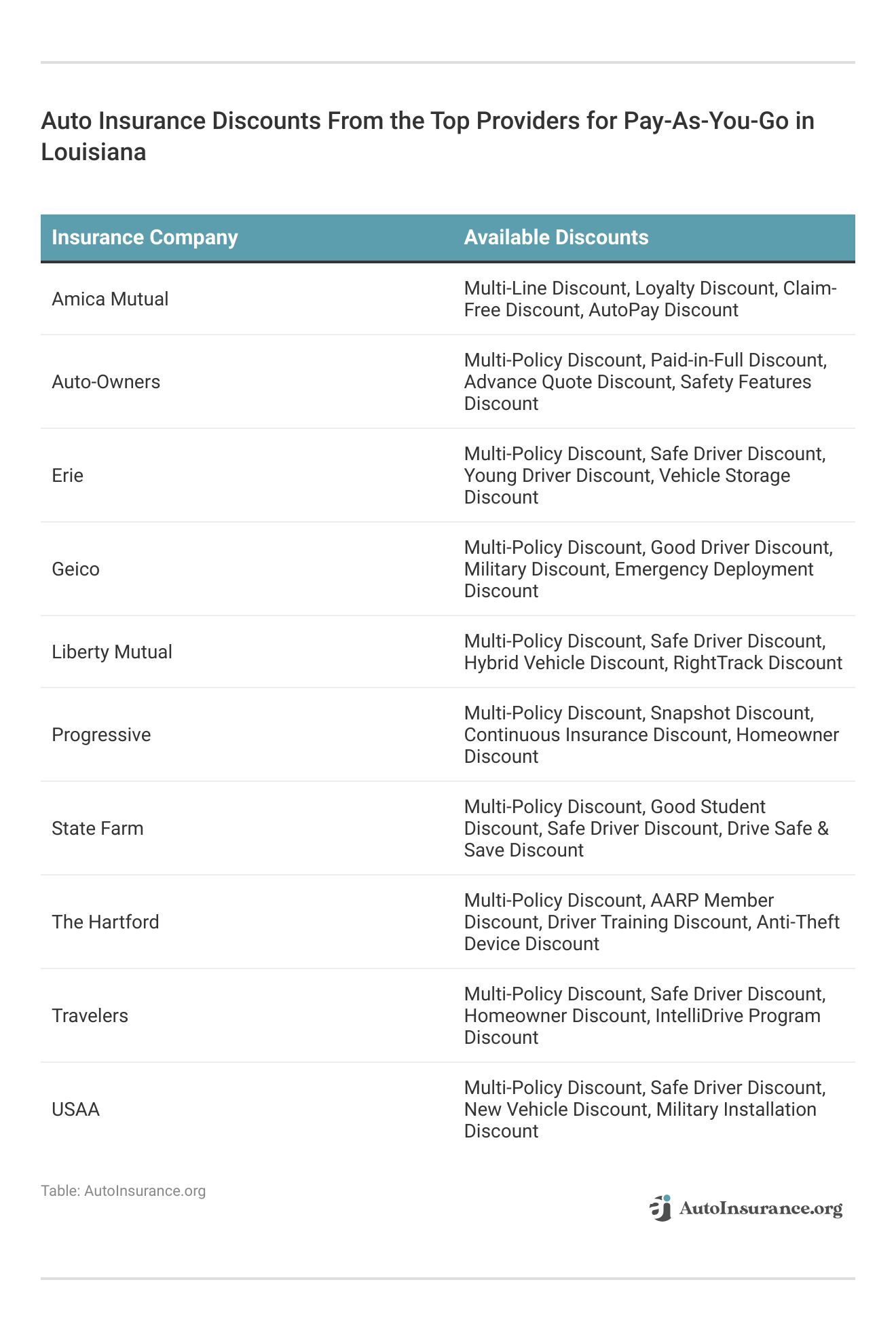

Lowering Your Pay-As-You-Go Auto Insurance Costs in Louisiana

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How does pay-as-you-go auto insurance work in Louisiana?

In Louisiana, pay-as-you-go auto insurance works by using telematics devices or mobile apps to track your driving habits, such as mileage, speed, and braking patterns. Insurance providers then use this data to calculate your premiums, often offering discounts for safe driving and low mileage.

Which companies offer the best pay-as-you-go auto insurance in Louisiana?

The top companies offering pay-as-you-go auto insurance in Louisiana include Allstate, Travelers, and Geico.

What factors affect pay-as-you-go auto insurance rates in Louisiana?

Several factors affect pay-as-you-go auto insurance rates in Louisiana, such as driving behavior, coverage levels, vehicle type and age, driving environment, and discount eligibility. (Read More: Do I have to declare speeding points on my insurance?)

Who has the cheapest auto insurance in Louisiana?

USAA and State Farm have the cheapest Louisiana auto insurance rates on average.

Who is the most popular auto insurance company in Louisiana?

State Farm is the largest car insurance company in Louisiana, insuring more than 30% of drivers in the state.

How can I lower my pay-as-you-go auto insurance costs in Louisiana?

To lower your pay-as-you-go auto insurance costs in Louisiana, improve your driving habits, reduce your mileage, opt for a higher deductible, take advantage of available discounts, regularly review and adjust your coverage, shop around for quotes, and maintain a good credit score.

Check out our ranking of the best pay-as-you-go auto insurance companies.

Is Louisiana a no-fault insurance state?

No, Louisiana is not a no-fault insurance state. It operates under a “fault” system, meaning the at-fault driver is responsible for paying for damages and injuries, either through their insurance or out of pocket, if the costs exceed coverage limits.

Which type of auto insurance coverage is most important?

The most important auto insurance coverage varies by need, but liability coverage is crucial for covering injuries and damages to others.

Collision and comprehensive coverage are also important, protecting your vehicle from accidents, theft, and natural disasters. Adequate coverage beyond state minimums offers better financial protection.

Who has the best auto insurance in Louisiana?

The best auto insurance companies in Louisiana include State Farm, Allstate, and Progressive.

What is the minimum auto insurance in Louisiana?

The Louisiana minimum auto insurance requirements are $15,000 for bodily injury liability per person, $30,000 per accident, and $25,000 for property damage liability per accident. These minimum coverage amounts ensure that drivers have a basic level of protection in the event of an accident.

Are you looking for more affordable premiums? Enter your ZIP code to find the right PAYG provider for your budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.